ORDER Tvl. Chennai Water Desalination Plant Limited, No.30A, South Phase, 6th cross, Guindy, Chennai-600032 (hereinafter called the Applicant) are registered under GST with GSTIN 33AACCC6640F1Z1. The applicant has sought Advance Ruling on the following questions:

1. Whether GST is applicable on supply of safe drinking water for public purpose by Chennai Water Desalination Plant Limited (CWDL) to Chennai Metropolitan Water Supply and Sewerage Board(CMWSSB) a Government Authority;

2. Ruling is sought for applicability of SI.No.99 of Notification 02/2017 for supply of water

or/and

3. SI.No. 3 of Notification 12/2017 for transaction of supply of safe drinking water for public purpose by Chennai Water Desalination Plant Limited (CWDL) to Chennai Metro Water Supply and Sewerage Board, a Government Authority

The Applicant has submitted the copy of application in Form GST ARA – 01 and also submitted a copy of Challan evidencing payment of application fees of ₹ 5,000/- each under sub-rule (1) of Rule 104 of CGST rules 2017 and SGST Rules 2017.

2.1 The applicant has stated that they are processing sea water in to potable water through desalination and they supply to Chennai Metropolitan Water Supply and Sewerage Board for distribution to General Public.

2.2 On interpretation of law, the applicant has submitted that Sl.no.99 of Notification no.2/2017 dated 28.06.2017 exempts HSN 2201- Water [other that aerated, mineral, purified, distilled, medicinal, ionic battery, de-mineralised and water sold in sealer container]. Further, the applicant has stated that the clarifications issued vide Circular No.52/26/2018-GST specifically addresses the issue on Supply of safe drinking water for public purpose. The applicant has also stated that they have sought the Chennai South Commissionerate to provide clarification on the Applicability of GST on supply of “Desalinated Water”. In response, the jurisdictional Assistant Commissioner, Chennai South has brought in the clarification circular cited above and applied “drinking water for public purpose” and ignored the general wording “water” which falls under HSN 2201 and stands exempted as per Notification 02/2017. They have also stated that water whether supplied at a price or not are exempted as per Notification 02/2017 irrespective of whether supplied to different categories like domestic, industrial, institutions and commercial.

2.3 The applicant has also referred to Notification 12/2017 to substantiate their contention that CMWSSB is a Government Authority. They have also placed reliance on the Order No.22/AAR/2018 dated 28.11.2018 of Tamilnadu AAR, wherein it has been confirmed that CMWSSB is a Government Authority. They have also referred to Sl.No.3 of Notification 12/2017 which exempts supply of pure services provided to Government Authority. In view of the above facts, the applicant is seeking the authority to clarify on the questions raised in para supra.

3.1 Due to the prevailing PANDEMIC situation and in order not to delay the proceedings, the applicant was addressed through the Email Address mentioned in the application to seek their willingness to participate in a virtual Personal Hearing in Digital media. The applicant consented and the hearing was held on 22.10.2021. The Authorised Representatives Shri L.Raghu Rami Reddy, CFO, CA. V. Swaminathan, Consultant, M. Murali Mohan, AGM, Hari Venkataramana, DGM, F&A appeared for the hearing and reiterated their submissions. They stated that sea water does not belong to them and they do not pay any royalty/license fees; that the pipelines through which they supply the de-salinated water to CMWSSB for public supply also do not belong to them; that they undertake only the de-salination process. They were asked to furnish the copy of the agreement entered into with CMWSSB for such de-salination and supply; invoices raised on CMWSSB for such supply; and a write upon the entire process undertaken by them.

3.2 The applicant vide their letter dated 01.11.2021 (received on 12.11.2021) submitted that they supply desalinated water in bulk form to M/s. CMWSSB under Bulk Water purchase agreement and such water supplied in bulk form is exempted in earlier law by virtue of Notification no,12/2012-CE dt. 17.03.2012. With the introduction of GST, effective from 01.07.2017, they approached CMWSSB for the applicability of GST on supply of desalinated water, wherein CMWSSB responded to the applicant vide their letter ref: CIVIWSSB/Fin (Cont & supp)/2017-18/Spl dt. 22.01,2018, stating that as per SI.No.99 of Notification no.2/2017CT-(R) dt.28.06.2017, water falling under Tariff item 2201 is exempt from GST; that the entry is an exclusion based entry and the items not mentioned therein are exempt; that desalination process has not been included in the entry and hence is exempted; that the process of desalination is different from demineralization; that water is treated/desalinated exclusively for the purpose of human consumption, whereas the demineralized water cannot be used for human consumption because of its hazardous effects on human health and it is used exclusively for scientific purposes. Therefore applicant approached jurisdictional commissionerate for clarification and they were intimated that GST was applicable on desalinated water. Hence they started billing the invoice with GST which was not intended to be paid by their recipient namely CMWSSB. Hence they have filed this application for ruling.

3.3 They have also mentioned that their registered office has been shifted to the following address:

Tvl. Chennai Water Desalination Plant Limited,

Registered Office,

100 Mid Sea Water Desalination Plant,330/1, Kattupalli village, Ponneri Taluk, Tiruvallur Dist

Tamilnadu-601203

3.4 They had enclosed the following documents:

- Write up on Desalination Process

- Bulk Water Purchase Agreement dt. 13.09.2005

- Copy of invoice No. CWDL/ CMWSB / INV/ SEP-2021/ 135 dt. 05.10.2021 issued to CMWSSB.

The applicant has submitted the following facts in their write-up:

- The applicant is a Special Purpose Vehicle(SPV) promoted and incorporated by a consortium of M/s IVRCL Infrastructures & Projects Limited (now M/s IVRCL Limited), Befesa Agua, Spain. The applicant has been awarded with detailed design, engineering, financing, procurement, construction, operation, maintenance and transfer of the seawater desalination plant on 25 years on DBOOT basis the client being CMWSSB.

- The applicant & CMWSSB have entered in to a Bulk water purchase agreement for implementation of the project, which is located in Minjur, Chennai. The SPV supplies the ‘desalinated water’ to CMWSSB in bulk form arising out of the activities undertaken by the applicant and as such, under the. earlier law, the same being cleared as an exempted by virtue of Notification 12/2012 CE dated 17.03.2012.

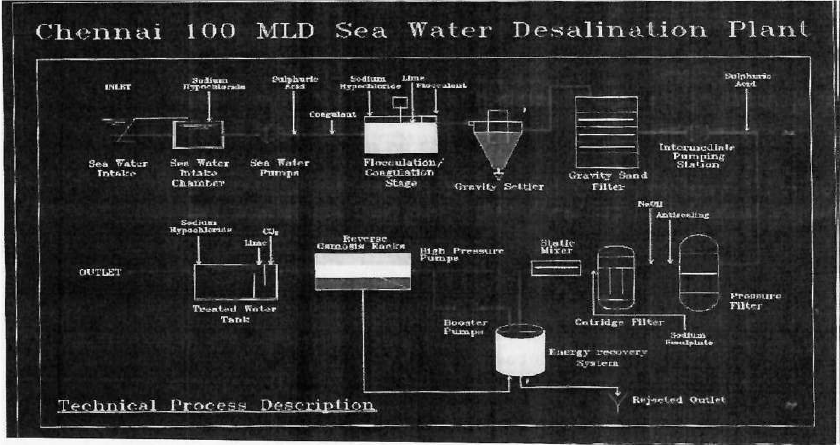

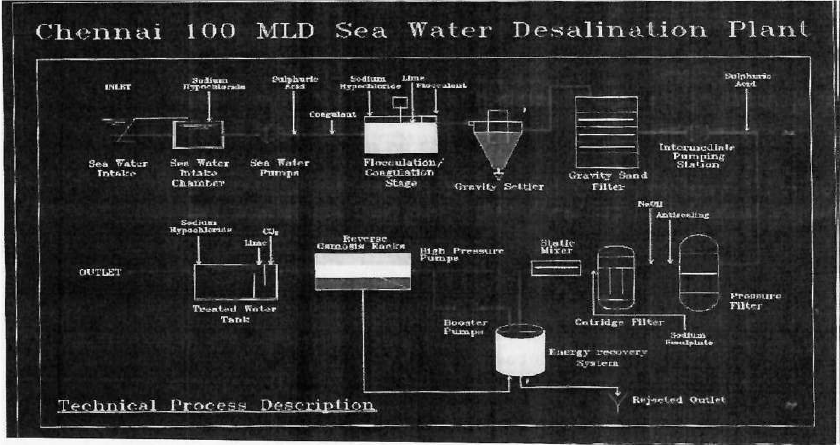

- The process of desalination of sea water by the applicant is as follows:

i. Drawing of water from the sea and intake pump house to pump pre-treatment process

ii. Pre-treatment

(a) Flocculation & clarifier settling

(b) 1st stage dual media gravity filters

(c) Intermediate pumping and pressure sand filters

(d) Cartridge Filtration

iii. Desalination-Reverse osmosis process

iv. Post treatment in product water tank –

v. Brine discharge

- The sea water after undergoing the above mentioned processes, would become ‘desalinated water’ or any other nomenclature that can be assigned to sea water which has undergone such processes as listed above. Hence, as per the notification 02/2017 CT(Rate) water is exempted from levy of GST.

4.1 On perusal of the submissions made by the applicant the following details were called for vide notice issued on 02.12.2021.

- From the conditions of the Bulk Water Purchase Agreement (BWPA), it was observed that the applicant abstracts sea water from the abstraction area on their own accord. Therefore, reasons for claiming the applicability of Sl.No.3 of Notification 12/2017 along with documentary evidences regarding the approval for drawl of water from the appropriate authority and such others were required to be furnished.

- Clarifications regarding whether the ownership of the plant constructed under the DBOOT has been transferred to CMWSSB or vests with the applicant as on date.

4.2 The applicant vide their letter dated 16.12.2021 received on 20.12.2021 submitted the following:

- They have entered into an agreement with CMWSSB on 13.09.2005 to set up 100MLD Desalination Plant at Minjur, Chennai on DBOOT basis and a Copy of Master Agreement dated 05.01.2007 between CWDL, U.T.E Construction Desaladora Chennai and BEFESA Infrastructure India(P) Ltd has been attached.

- CWDL draws raw water from sea unconditionally without paying any amount towards royalty; that they pay a licence fee for using the coastal land on annual basis to the Tamilnadu Maritime Board, Chennai. Copy of Form 26A Licence for the Allotment of Coastal lands has been enclosed.

- They have also stated that the ownership of plant constructed under DBOT vests with them as on date and will be transferred to CMWSSB on completion of the concession period.

5.1. The Centre Jurisdictional authority who has administrative control over the applicant has stated that there are no pending proceedings on the issue raised by the applicant in the Advance Ruling application and has furnished the following comments.

- The activity carried out by CWDL is supply of desalinated water through pipeline to CMWSSB, who in turn supply water to different categories of consumers like domestic, industrial, institutional and commercial which cannot be construed as public. Hence, CWDL do not qualify for the exemption under Sl.No.99 of Notification 02/2017 CT (Rate) as they do not supply drinking water for public purpose.

- On applicability of SI.No 3 of Notification 12/2017 CT(Rate), it is seen that in Order No. AAAR 17 & 18 issued by the Tamilnadu Appellate Authority for Advance Ruling in the case of M/s New Tirupur Area Development Corporation Ltd, it was ruled that the activity of appellant viz, supply of potable water to purchasers is only supply of goods not services. Hence, applying the same in the instant case supply of desalinated water is supply of goods and not supply of services. Hence, the applicant do not qualify for exemption under the said notification.

5.2 The State Jurisdictional authority has stated that there are no pending proceedings in the applicant’s case.

6.1 We have considered the application filed by the applicant and various submissions made by them as well as the comments of the State and Central Tax officers. The issues raised before us is regarding the taxability of GST on the desalinated water supplied by the applicant to M/s. CMWSSB, a government authority for distribution of water to general public and applicability of notification 02/2017 and/ or Notification no.12/2017 cited supra. Applicant is a Special Purpose vehicle (SPV) promoted and incorporated by a consortium consisting of M/s.IVRCL Infrastructures &Projects Ltd, Befesa Agua, Spain. They have been awarded with detailed design, engineering, financing, procurement, construction, operation, maintenance and transfer of the seawater desalination plant on 25 years DBOOT basis, the client being M/s.CMWSSB. The applicant and CMWSSB have entered into a Bulk Water Purchase Agreement (BWPA) for the implementation of the project, located at Minjur, Chennai with Reverse osmosis process. The SPV supplies ‘desalinated water’ to CMWSSB in bulk form for which a consideration in the form of yearly water capacity charges and water variable charges per Kilo litre of water supplied is paid. They have sought Advance Ruling on the following questions:

1. Whether GST is applicable on supply of safe drinking water for public purpose by Tvl. Chennai Water Desalination Plant Limited (CWDL) to Chennai Metropolitan Water Supply and Sewerage Board (CMWSSB) a Government Authority;

2. Ruling is sought for applicability of Sl.No.99 of Notification 02/2017 for supply of water

or/and

3. Sl.No. 3 of Notification 12/2017 for transaction of supply of safe drinking water for public purpose by Tvl. Chennai Water Desalination Plant Limited (CWDL) to Tvl. Chennai Metro Water Supply and Sewerage Board, a Government Authority

The above questions being on the applicability of notification and on determination of liability to pay tax on the activities carried on by the applicant were found admissible under Section 97(2)(b&e)/95A of the GST Act,2017 and are taken up for consideration on merits.

7.1 Applicant has furnished copies of Bulk water purchase agreement, Invoices raised for supply water, License of the allotment of Coastal lands by the Tamilnadu Maritime Board, Chennai, Master agreement entered between CWDL, U.T.E. Construction Desaladora Chennai and BEFESA Infrastructure India (P) Ltd for design, supply, erection and commissioning of the Sea water desalination plant. From the documents submitted the following salient points are noted:

1. Applicant has obtained license for the allotment of coastal lands belonging to Tamilnadu Maritime Board situated in Kattupalli village, near Minjur for the purpose of laying submarine pipelines, intake structure, diffuser ports and allied structure to draw seawater from the sea and to discharge the brine water into the sea for the 100 MLD Desalination plant for an annual license fee of ₹ 7,50,000/- to be -paid initially and subsequent such payments be made annually for the succeeding years. Applicant has thus been allowed to abstract sea water on an annual payment made by them to the coastal authorities.

2. The agreement to procure desalinated water is entered into by CMWSSB to bridge the gap between the demand and supply of safe drinking water and the scope of this agreement for implementation of the DBOOT project envisages supply of Product water to CMWSSB. Product water means the sea water that has been processed through a desalination treatment plant i.e., desalinated water.

3. Section3.2.1 of the BWPA, stipulates that the agreement to purchase bulk water shall have a term of ,from the effective date until the 25th anniversary of the COD (Agreement Period) when it shall automatically terminate and the facility shall get transferred to CMWSSB,

4. Section 8.2 of the BWPA, stipulates that the applicant company undertakes to sell Desalinated water to CMWSSB on payment of aggregate of water capacity charges(WCC) and water variable charges (WVC) including energy charges to the applicant by CMWSSB. WCC is the amount of money determined, levied, demanded, charged collected, retained and appropriated by the applicant from CMWSSB for setting up and making available at all tinies the facility to CMWSSB, which would go towards covering all fixed costs which will not have any escalation. WVC shall be payable by CMWSSB on the basis of water units supplied which will be the product of water units supplied and the rate of per unit charged. Invoices are raised monthly for such charges by the applicant which shall be paid by CMWSSB within 30 days of the date of invoice.

5. Section 9.1 of the BWPA stipulates that the applicant shall procure state of the art meter and install them at Product Water Dispatch point to measure the volume of Product water dispatched to CMWSSB on a monthly basis. The cost for ownership, maintenance, calibration and replacement of the meters shall be borne by the applicant.

6. The invoice No. CWDL/CMWSB/INV/SEP-2021/ 135 dt. 05.10.2021 issued by the applicant to CMWSSB contains the charge both Water capacity and water variable. WVC has been calculated based on the quantity of product water supplied.

7. The State Support Agreement between the applicant, CMWSSB and the Governor of State of Tamilnadu through the Secretary, Municipal Administration and Water Supply Department of Government of Tamilnadu spells out the scope of the implementation of the subject DBOOT plant as supply of potable water to CMWSSB for domestic and non-domestic purpose.

From the above, it is observed that,

• CWDL is a SPV promoted to design, engineer, finance, construct, operate and transfer the seawater desalination plant on 25 years DBOOT basis for CMWSSB.

• CWDL has been abstracting sea water on payment of annual license fee to the authorities concerned and after desalinating the same, been selling the desalinated potable water to CMWSSB at a price agreed upon. Thus the sea water abstracted becomes the property of CWDL which is being acted upon by Reverse osmosis process to remove salinity and make the water safe for drinking.

• The purpose of such purchase of desalinated water by CMWSSB is to bridge the gap between the demand and supply of safe drinking water.

• The product water dispatched is monitored via the meters of the applicant and the charges are calculated based on the monthly dispatch of water as shown in the meters installed at the water dispatch point.

• Invoice issued based on the quantity of water dispatched is a proof of sale of water.

• The agreement entered into by the applicant and CMWSSB is supported by the Government of Tamilnadu through the Municipal administration and Water supply department to augment potable water for distribution by CMWSSB for domestic and non-domestic purposes. Thus it is seen that the distribution vests with CMWSSB and the applicant supplies the desalinated water to CMWSSB only.

7.2. The question whether the transaction of supply of desalinated water for public purpose by the applicant to CMWSSB is Pure services as stipulated in the SI.No.3 of Notification no.12/2017 is first taken up for consideration. The entry Sl.No. 3 of the said notification is as under:

| 3 | Chapter 99 | Pure services (excluding works contract service or other composite supplies involving supply of any aoods) provided to the Central Government, State Government or Union territory or local authority or a Governmental authority by way of any activity in relation to any function entrusted to a Panchayat under article 243G of the Constitution or in relation to any function entrusted to a Municipality under article 243W of the Constitution. | Nil | Nil |

The above entry exempts pure services provided to a local authority in relation to functions entrusted to a Panchayat/Municipality under Article 243 G/ 243W of the Constitution.

7.3 The eligibility to ‘Supply of Water’ under this Notification is examined first. Providing ‘Water Supply for Domestic, Industrial and Commercial Purpose’ is listed as Item 5 of 12th Schedule (Article 243W) of the Constitution. The applicant claims exemption under this entry for the activity of sale of water to the purchaser namely CMWSSB. It is evident that the entry exempts only services. The applicant abstracts water from sea, treats the same in the facility owned, managed, operated, maintained by them and sells the ‘treated water’ to the Purchasers’ and charge them for such supply. The applicant is not involved in the distribution of the water supply. to the common public and sale of water to CMWSSB is done at the ‘Off-take points’ at the underground storage tank of the applicant company as agreed in Schedule XVII of the BWPA therein. Invoices issued for sale of product water has been furnished. Thus in our opinion, this activity of treatment of water on own account and supply of water is sale simpliciter and therefore this notification which provides exemption to services do not have any application with regard to supply of water.

8.1 Now we take up the question of whether the applicant is eligible to avail exemption under Entry no.99 of Notification no.2/2017 dt. 28.06.2017 read with clarification in Circular No.52/26/2018-GST dt. 09.08.2018 The relevant entry of the Notification is as follows:

| 99. | 2201 | Water [other than aerated, mineral, purified, distilled. medicinal, ionic, battery, de-mineralized and water sold in sealed container] |

The above entry exempts Water which is not

1. Aerated water,

2. Mineral water,

3. Purified water,

4. Distilled water,

5. Medicinal water,

6. Ionic water,

7. Battery water,

8. De-mineralized water and

9. Water sold in sealed container.

Also, the Circular No. 52/26/2018-GST, dated 9-8-2018 issued from F. No. 354/255/2018-TRU, in para 6 has clarified as below :

“6.1 Applicability of GST on supply of safe drinking water for public purpose :

Representations have been received seeking clarification regarding applicability of GST on supply of safe drinking water for public purpose.

6.2 Attention is drawn to the entry at S. No. 99 of notification No. 2/2017- Central Tax (Rate), dated 28-6-2017, by virtue of which water /other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container] falling under HS code 2207 attracts NIL rate of GST.

6.3 Accordingly, supply of water, other than those excluded from Sr. No. 99 of notification No. 2/2017-Central Tax (Rate), dated 28-6-2017, would attract GST at “NIL” rate. Therefore, it is clarified that supply of drinking water for public purposes, if it is not supplied in a sealed container, is exempt from GST.”

8.2 The clarification in para 6 of circular no 52/26/2018-GST, dated 09.08.2018 issued from F.No. 354/255/2018 TRU states that supply of drinking water for public purpose when not sold in sealed container is exempted. The notification is unambiguous in as much as it clearly states the type of waters which is not exempted. On a joint reading of the Notification and the Clarification, the waters mentioned at sl.no. 1 to 8 and drinking water for public purpose sold in sealed container are not exempted. In the case at hand the applicant sells the water to CMWSSB after the process of desalination which is as under:-

i. Drawing of water from the sea and intake pump house to pump pre-treatment process

ii. Pre-treatment

(a) Flocculation & clarifier settling

(b) 1st stage dual media gravity filters

(c) Intermediate pumping and pressure sand filters

(d) Cartridge Filtration

iii. Desalination-Reverse osmosis process

iv. Post treatment in product water tank

v. Brine Discharge

Thus it is seen that the desalination is carried out by Reverse osmosis process. Reverse osmosis is a process where water from the ocean is forced through thousands of tightly-wrapped, semi permeable membranes under very high pressure. The membranes allow the smaller water molecules to pass through, leaving salt and other impurities behind. Thus in this process water molecules are separated from sea water. From the documents furnished it is observed that the desalinated water is supplied to CMWSSB for distribution as safe drinking water to domestic and non-domestic purposes. The process of desalination has also been differentiated from that of demineralization by CMWSSB vide its letter dt. 22.01.2018 addressed to the applicant wherein it has been clarified that in the process of desalination, the water is treated/desalinated exclusively for the purpose of human consumption and it is different from demineralization. Therefore, they have stated that the desalinated water not being mentioned in the excluded list of water namely, aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container would fall under HS code 2201. Further in the State Support Agreement too, it has been stated that the desalnation plant is commissioned and the water procured by CMWSSB from the applicant to bridge the gap between the demand and supply of safe drinking water. Thus from the scope, language and the terms and conditions of the agreement, it is clearly seen that the applicant has been awarded a contract for the sole purpose of supply of potable water to CMWSSB, after treating the sea water abstracted from the coastal area. From these, it is clear that the sea water which is desalinated is used for drinking purpose and hence it is potable water only. Thus the desalinated water does not fall under the excluded categories of water stipulated in the Entry No.99 as seen above. Therefore we find that the desalinated water is potable water supplied to CMWSSB for distribution as safe drinking water and so we find the same falling under HSN2201- water [other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container] . As stipulated in the circular cited supra, the product water sold in this case is potable water and is not sold in sealed container. Hence we find the desalinated water eligible to be classified under HSN-2201 attracting NIL rate of GST.

9.1 The centre jurisdictional authority has stated that the applicant is supplying to CMWSSB and not to consumers directly and hence are not eligible to avail concession under Entry 99. Also it has been stated that the activities carried out by the applicant cannot be termed as ‘Pure services’ as laid down in Order-in-Appeal no.178G18/2021 dt.30.06.2021 passed by the TN State Authority for Advance Ruling in the case of M/s. New Tiruppur Area Development Corporation Ltd. However in the order cited, it has been held that the raw water abstracted from river cauvery is purified and supplied as potable water which is eligible to be classified under Entry no.99 cited supra attracting NIL rate of GST. The relevant portion of the order is as extracted below:

“7.5 There is no dispute regarding the classification of water as such under 2201. However, the main question raised by the appellant and also the point of reference made by the members of AAR is whether the water supplied by the appellant is exempted under sl. No. 99 of notfn. No.02/2017-CT(R) and its equivalent SGST notification published vide TamilNadu GO Ms. No. 63 dated 29/6/2017. Since purified water is excluded from the exemption entry, the point of contention appears to be that since the raw water is treated to various processes to make it potable, whether these processes make the raw water as a ‘purified water’ or it remains as ‘water treated’ to make it fit as potable water. As discussed supra in para 7.3, not only the term used in the agreement for the supply denotes it is only ‘potable water’ which is supplied, but the treatment processes specified elsewhere in the agreement and the intent and the purpose of the whole arrangement is only ensuring sustainable supply of potable water. Potable water is never to be equated to ‘purified water’. In fact, the meaning of ‘purified water’ depends on what use of it people have in mind, like whether it is for washing, pharma use, industrial use or even to swim. In chemical terms, purified water is pure H2O and only contains Hydrogen and Oxygen and no minerals. Distilled water is the most common form of pure water. However, potable water has only one meaning, water fit for human and animal consumption and has dissolved minerals. In fact, from the performance standards spelt out in Schedule C of the agreement, the quality of potable water would itself indicate that it does not attain the nature and quality of a `purified water’ on any count. Therefore, it can be safely concluded that the supply of the appellant is of raw water, treated to become ‘potable water’ and nothing more.. Once it is distinctly clear that the supply is of ‘water’ only, and NOT purified water, the same falling under the entry 99 of the notification no. 02/2017-CT (R) is qualified for the exemption.”

Thus it has been held that the intent and purpose of the supply determines the nature of supply. Here the agreement has been specifically entered into for the setting up of 100MLD sea water Desalination plant on DBOOT basis for supply of desalinated water to CMWSSB for distribution to public as safe drinking water. Hence going by the agreement and following the judicial discipline of adhering to the decision of the Appellate authority cited supra, we conclude that the desalinated water supplied by the applicant to CMWSSB for distribution as safe drinking water is not liable to tax under the entry at Sl.no.99of Notification no.02/2017- Central Tax dated 28t.06.2017 based on the discussions above.

10. To sum up, we hold that the activity of the applicant is not services and is only sale simpliciter i.e., sale of potable water, obtained after the process of desalination of sea water. We find the product water to be falling under water [other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container] falling under HS code 2201 attracts NIL rate of GST.

11. In view of the above, we rule as under:

RULING

1. Supply of desalinated water by the applicant to CMWSSB for distribution as safe drinking water to public falls under the entry at Sl.No.99 of Notification no.02/2017- Central Tax dated 28.06.2017 and attracts ‘NIL’ rate of GST.

2. Transaction of supply of safe drinking water by applicant to CMWSSB does not merit to be classified as ‘services’ and hence are not eligible for exemption under Sl.No.3 Of the Notification no.12/2017 dt. 28.06.2017.

Prices of BUSY Increasing from 1st June, 2024. Click Here

Prices of BUSY Increasing from 1st June, 2024. Click Here