ORDER IDMC Limited, hereafter referred to as IDMC for the sake of brevity, supplies cattle feed plant involving supply of various equipment and machineries. IDMC supplies complete cattle feed plant involving equipment receiving raw-material till packaging of finished goods with erection, installation& commissioning service, with or without civil work, as per the requirement of the customer. IDMC submits that these activities of installation, commissioning, whether, with civil or without civil, forms part of bundle only and is as per industry practice.

2. IDMC submits that the contract prescribes separate pricing for individual machineries and equipment so as to have clarity on material used for plant. Also, the mechanism is just pricing mechanism based on which the value of plant would be decided.

3. Supplies by IDMC involves the following scenarios:

i. Contract involving supply of cattle feed plant including equipment & machinery as well as erection & installation service thereof without civil work.

ii. Contract involving supply of cattle feed plant including equipment & machinery as well as erection & installation services thereof with civil work.

Part A – Supply of cattle feed plant involving supply of installation, testing and commissioning services without civil work

4. IDMC has submitted that one of the purchase order placed by Barauni Dairy vide reference # DRMU/PUR/CFP-Khag/18-19/278 dated January 16, 2019 for design, supply, installation, testing & commissioning of cattle feed plant & allied equipment at Maheshkhunt, Khagaria. The copy of purchase order is enclosed herewith as Exhibit B.

5. The applicant has received the order for design, installation, testing and commissioning of cattle feed plant (‘plant’). They have quoted and agreed separate prices for supply of equipment and installation & commissioning of equipment. The bill of material / bill of quantity specify number of equipment required for cattle feed plant including accessories thereof and all the goods are offered to customers at their respective rate even if there is one contract for supply of cattle feed plant. Furthermore, the Applicant submits that it would issue separate invoices for supply of goods and supply of services. Moreover, submits that all equipment is vital for operation of cattle feed plant and the plant would not work in absence of any of the equipment.

6. IDMC submitted that the price is agreed for entire work with relevant bifurcation of goods and services. It has following responsibilities with respect to plant execution.

- Supply of cattle feed equipment such as pellet mill, hammer mill etc.

- Supply of other ancillary equipment/ goods such as MS Structural, MS chequered plates, Conveyors for transporting raw material in the plant, Electrical switch boards and cables etc.

- Services relating to commission, installation & erection of equipment.

- Undertaking trial runs on the machinery installed and testing of output received.

6.1 IDMC submits that the intention of agreement is supply and install cattle feed plant and this arrangement does not include any civil work / services.

6.2 IDMC submits that as per their understanding the present case qualifies to be composite supplies.

6.3 The applicant further submits that the present supply would not qualify as ‘works contract’ service. The definition of ‘works contract’ has been provided in the CGST Act which has been reproduced hereunder for easy reference:

“(119) “works contract” means a contract for building, construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning of any immovable property wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract;”

6.4 Accordingly, one of the essential conditions to qualify as works contract supply is that the erection, fitting out is carried out for an immovable property. The term ‘immovable property’ has not been defined in the CGST or IGST Act and accordingly, recourse can be taken from other relevant acts to understand the meaning of the term ‘immovable property’. As per General Clauses Act, 1897, the term ‘immovable property’ has been defined as under:

“(26) “immovable property” shall include land, benefits to arise out of land, and things attached to the earth, or permanently fastened to anything attached to the earth;”

6.5 As the expression ‘attached to the earth’ has not been defined in the General Clause Act, reference can be drawn from Section 3 of Transfer Property Act which gives the following meaning to the expression “attached to the earth”:

“(a) rooted in the earth, as in the case of trees and shrubs,

(b) embedded in the earth, as in the case of walls or buildings, and

(c) attached to what is so embedded for permanent beneficial enjoyment of that to which it is attached.”

6.6 From above, IDMC submits that immovable property would mean anything that is permanently fastened to the earth. Considering this, it would be important to discuss whether the supplies in present case result into ‘immovable property’.

7. IDMC submit that in their own case having similar facts, Gujarat Advance Ruling Authority vide reference order #GUJ/GAAR/REFERENCE/2017-18/1 has upheld that same would not be contemplated as works contract. The copy of ruling is enclosed herewith as Exhibit C. Relevant extract of the ruling is reproduced hereunder.

“8.2…

We observed that if the equipments or components assembled or installed at site and attached by foundation to earth can be dismantled without substantial damage to its equipments or components and thus can be reassembled, the item would be considered as moveable. Further, just because plant and machinery are fixed in the earth for better functioning or efficient operations, it does not automatically becomes an immovable property.”

8. IDMC submits that the supply of cattle feed plant in the present case does not create any immovable property. Moreover, in present case, the plant is not rooted to earth but same is fixed with the help of nut & bolt. Further, even if same is embedded to earth, it is just to ensure efficient operation of plant. Considering above discussion, IDMC believes that present supply does not qualify to be works contract supply.

9. IDMC has submitted that since the project involves supply of various machineries and equipment and various services, it is necessary to look into the type of supply in order to determine appropriate classification and applicable tax rate.

10. IDMC submits that under the GST regime, the concepts of composite supply have been newly introduced. The definition of the term is provided in Section 2 of the CGST Act which is reproduced as follows:

(30) “composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply;

10.1 IDMC submits that in view of the above definition the bundle of supplies for cattle feed plant involving supply of various machineries, equipment and services to qualify as a composite supply, needs to satisfy following conditions which is summarized as follows:

(i) Supplies to be made by a taxable person

(ii) Supply should consist of two or more taxable supplies of goods or services

(iii) The various components of such supply should be naturally bundled and in conjunction with each other

(iv) One of supply is principal supply

10.2 IDMC submits that it is taxable person and supplies two or more taxable supplies in the present case, the first two conditions are satisfied.

10.3 IDMC has referred an e-flyer issued by the CBIC on ‘Composite supply and mixed supply’. IDMC submits that the above flyer has relied upon the Service Tax – Education Guide issued in erstwhile regime of Service Tax wherein the clarification was provided with respect to services bundled in the ordinary course of business.

10.4 IDMC submits that this bundle of various machinery and equipment and services are essential for each other and are naturally bundled for operation of cattle feed plant even though there is separate value allocated. It is important to note that need of customer would not be satisfied if IDMC does not supply all the goods and services required for functioning of the cattle feed plant and the obligation of IDMC would not be completed. Moreover, it is worthy to note that IDMC provides the entire bundle service as per the requirements of the customer and IDMC does not have an option to pick and choose the supplies. IDMC is required to provide all the necessary machinery and services required for a functioning cattle feed plant and hence, IDMC submits that the separate line items with separate consideration does not mean they are separate supplies but are a part of a single supply i.e. cattle feed plant.

10.5 In this regard, IDMC relied upon the case of M.O.H. Uduman And Ors Vs. M.O.H. Aslum dated November 13, 1990 [1991 AIR 1020] wherein it has been observed that the contract must be read in a whole and the intention of the parties must be gathered from the language used in the Contract by adopting harmonious construction of all the clauses contained therein. Accordingly, the Applicant submits that the contract in the present case is agreed by the customer to receive cattle feed plant and not individual machineries or equipment and services. Accordingly, the contract in the present case cannot be construed to receive individual services or machineries or equipment. It ought to be construed to receive a functional cattle feed plant.

11. IDMC submits that various machineries and services would support the cattle feed plant and are ancillary to the plant. IDMC places reliance on T.I. Miller Ltd. Vs Union of India and Another [1987 (31) ELT 344)] that a thing is a part of the other only if the other is incomplete without it. In present case, it is submitted that all the machinery / equipment and services, though ancillary, are required for completing and operationlised plant. The aim of the customer is to procure cattle feed plant and not the individual machinery. Thus, the machineries and services are ancillary supplies supporting an operational cattle feed plant.

12. Further, IDMC place reliance on the Gujarat AAR in the case of Silcher Technologies Ltd. (GUJ/GAAR/R/07/2021) wherein the Authority had occasion to deal with the question whether Design, Engineering, Manufacture, Assembly and Testing at Works, Packing / Dispatch, Transportation to Site with Transit Insurance, Supervision of Erection, Testing& Commissioning of Inverter Duty Transformers for SPGS system would merit classification of supply of transformer or not. The Authority upheld that the arrangement would qualify as composite supply.

13. IDMC place reliance on few of the decisions of European Court of Justice, as follows:

• In the case of Card Protection Plan v. Customs and Excise Commissioners, [1998] EUECJ C-349/96, the ECJ held that a service must be regarded as ancillary to a principal service if it does not constitute for customers an aim in itself, but a means of better enjoying the principal service supplied.

• In the case of Levob Verzekeringen BV, OV Bank NV v. Staatssecretaris van Financiën, [2005] EUECJ C-41/04, the ECJ held that where two or more elements or acts supplied by a taxable person to a customer are so closely linked that they form objectively, from an economic point of view, a whole transaction, which it would be artificial to split, all those elements or acts constitute a single supply for the purposes of application of VAT.

14. IDMC submits that in order to qualify various supplies as naturally bundled, it is essential to have following ingredients in any transaction and same are present in the arrangement at hand.

| Ingredients | Whether present in this case |

| The perception of customer is to obtain all equipment and machinery and services as a package | Yes |

| Whether trade & industry has similar practice to supply cattle feed plant including all goods and services | Yes |

| The nature of bundle should be such that they are bundled in ordinary course of business | Yes |

| There is single price for package and advertised in the same manner | The price is agreed for entire work with relevant bifurcation of goods and services. |

| Different products / goods and services are integral part of overall system | Yes |

15. IDMC submits that the supply of cattle feed plant involving various machineries, equipment and services is naturally bundled and in conjunction with each other and therefore, third condition is also satisfied. IDMC submits that the supply of cattle feed plant would be contemplated as composite supply.

16. IDMC has submitted that to determine the classification and taxability, it is important to refer Section 8 of the CGST Act which is reproduced hereunder:

8. The tax liability on a composite or a mixed supply shall be determined in the following manner, namely:-

(a) a composite supply comprising two or more supplies, one of which is a principal supply, shall be treated as a supply of such principal supply; and

17. Further, the term ‘principal supply’ is defined to mean the supply of goods or services which constitutes the predominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary. IDMC submits that supply of cattle feed plant is the principal supply in the present case because the ultimate intention of the customer is to get a fully functional cattle feed plant.

18. IDMC has referred ruling of Gujarat AAR in the case of Air Control and Chemical Engineering Company Ltd. [2021-TIOL-85-AAR-GST] wherein supply, Testing and Commissioning of 160 TR Chilled Water Plant to Naval Dockyard was observed to be a composite supply with the principal supply being of goods viz. ‘160 TR Chilled Water Plant’/ ‘Chiller’. The AAR in the present set of facts observed that the Purchase Order is for composite supply entailing, goods (i.e. Compressor, Fan Condenser, Evaporator, Centrifugal Pump with motor, Electrical Panel, Chilled Water piping/Hoses and mobile trolley) and services (i.e. installation, testing & commissioning). The relevant extract of the ruling is as below:

“15. From the discussion made above, we find that in the proposed activity, the major part is supply of goods viz. Compressor, Fan Condenser, Evaporator, Centrifugal Pump with motor, Electrical Panel, Chilled Water piping/Hoses and mobile trolley etc. These goods are to be delivered to the applicant to provide services of installation, testing & commissioning of the “Trailer Mounted 160TR Chilled Water Plant” at the Naval Dockyard (Vishakhapatnam). Without these goods, the services cannot be supplied by the applicant and, therefore, we find that the goods and services are supplied as a combination and in conjunction and in the course of their business where the principal supply is supply of goods. Thus, we find that there is a composite supply with supply of goods being the principal supply i.e. ‘Chilled Water Plant’/ ‘Chiller’ in the subject case.”

19. IDMC has place reliance on the Advance Ruling of NEC Technologies India Pvt. Ltd. vide Advance Ruling No. GUJ/GAAR/R/ 2020/07 dated May 19, 2020. The Gujarat Advance Ruling Authority had occasion to analyze whether design, development and supply of automatic fare collection (AFC) system would be considered as works contract or composite supply. In this case, after analyzing the facts, it was upheld that the contract for supply of the AFC system to the local authority does not qualify as a ‘Works contract’ under Section 2(119) of the CGST Act, 2017, since the installed AFC system cannot be said to result in the emergence of an immovable property. The relevant extract of the decision is reproduced hereunder, for your ready reference.

“25. As per the applicant, apart from the flap gates and manual swing gates, which can arguable to be said to be fixed/ annexed to immovable property, rest all hardware to be supplied under said contracts are movable property. The flap gates, POS machines and manual swing gates are attached with screws and bolts at the entry gates of the bus station. These flap gates can be easily removed without damaging such gates and re-attached to some other locations. Hence, it cannot be said that such gates are permanently embedded to the bus stations and, hence, should be considered as an immovable property. Further, the flap gates are just a part of the AFC system and is not the main equipment of the AFC system. Even if, it is argued that the flap gates are permanently fastened to the earth and form part of the immovable property, it cannot be construed that the whole AFC system would form part of the immovable property.

26. The applicant further submitted that in case of city buses, hand held ETM machines with electronic payment integration are provided for the AFC system. In certain cases, Pole Validators with the AFC system are installed on the buses. Considering that the buses are movable properties, such equipment would not be construed as immovable property. Further, the purpose and function of the AFC system installed on the city buses and BRTS bus stations is the same i.e. fare collection and providing seamless travel with a single smart card/ticket. Hence, it can be seen that the fixation/ attachment of the hardware to bus station/ terminal is not mandatory for the whole system to operate.

27. In view of the above, we agree with the applicant’s contention that the contract for supply of the AFC system to the local authority does not qualify as a ‘Works contract’ under Section 2(119) of the CGST Act, 2017, since the installed AFC system cannot be said to result in the emergence of an immovable property.”

20. Further, considering the facts in above ruling, it was upheld that the supply of AFC system would be composite supply and AFC system is the principal supply.

21. IDMC has further submitted that in the case of United Engineering Works [2019-TIOL-250-AAR-GST], the Karnataka AAR observed that manufacture and supply of submersible pump sets and accessories with installation, electrification and energization would qualify to be composite supply. The relevant extract of the ruling is as below:

“10.8 In the instant case, the Applicant’s supply involves goods i.e. submersible pump sets and the installation etc, of the same as service. Therefore, the Applicant supplies goods as well as services which are taxable supplies, The contractual agreement between the applicant and the said Corporation requires the applicant to supply the pumps and also install and energise the same. The applicant is, therefore, engaged in two taxable supplies, that of goods and also the service of installation. The service of installation is possible only when the goods (submersible pump sets) are supplied and hence the pre-dominant supply is that of “Submersible Pump Sets” and hence the principal supply in this case is supply of goods i.e. under the definition of Composite Supply.

22. IDMC submits that all conditions for composite supply is fulfilled in present case. IDMC submits that this is the practice followed by trade wherein as per requirement of customer, the supplier would provide cattle feed plant along with installation services. Therefore, IDMC believe that the present case would qualify to be composite supply wherein the supply of cattle feed plant is the principal supply which provides essential character to the entire bundle of supply of goods as well as installation service.

23. IDMC submits that Heading 8436 of Customs Tariff Act, specifically covers machinery for preparing animal feeding stuffs. The relevant extract of the Customs Tariff has been reproduced hereunder:

| Tariff Item | Description of goods |

| 8436 | OTHER AGRICULTURAL, HORTICULTURAL, FORESTRY, POULTRY-KEEPING OR BEE-KEEPING MACHINERY, INCLUDING GERMINATION PLANT FITTED WITH MECHANICAL OR THERMAL EQUIPMENT; POULTRY INCUBATORS AND BROODERS |

| 8436 10 00 | – Machinery for preparing animal feeding stuffs |

24. Moreover, notes to Section XVI provides that composite machines consisting of two or more machines fitted together to form a whole machine designed for the purpose of performing two or more complementary or alternative functions are to be classified as if consisting only of that component or as being that machine which performs the principal function. The relevant extract has been provided hereunder for your ready reference.

3. Unless the context otherwise requires, composite machines consisting of two or more machines fitted together to form a whole and other machines designed for the purpose of performing two or more complementary or alternative functions are to be classified as if consisting only of that component or as being that machine which performs the principal function.

25. Apart from above, IDMC submits that where a machine including combination of machine intended to contribute together to a clearly defined function covered by one of the headings in Chapter 84, whole falls to be classified in the heading appropriate to that function. The relevant extract is reproduced hereunder, for ready reference.

4. Where a machine (including a combination of machines) consists of individual components (whether separate or interconnected by piping, by transmission devices, by electric cables or by other devices) intended to contribute together to a clearly defined function covered by one of the headings in Chapter 84 or Chapter 85, then the whole falls to be classified in the heading appropriate to that function.

5. For the purposes of these Notes, the expression “machine” means any machine, machinery, plant, equipment, apparatus or appliance cited in the headings of Chapter 84 or 85.”

26. IDMC submits that all machinery / equipment and services contribute towards principal functions that work as cattle feed plant. Hence, entire plant should merit classification under Chapter Heading 8436.

27. IDMC has referred to Schedule II of CGST Notification No. 01/2017 – Central Tax (Rate) that prescribes GST rate of 12% for product falling under Chapter Heading 8436. The relevant extract has been provided hereunder for your easy reference:

| S.No. | Chapter /Heading /Sub-heading / Tariff item | Description of goods |

| 199 | 8436 | Other agricultural, horticultural, forestry, poultry keeping or bee-keeping machinery, including germination plant fitted with mechanical or thermal equipment; poultry incubators and brooders |

28. IDMC submits that as the Chapter Heading is included in the CGST Notification, the sub-heading falling under the Heading would also be covered within such line item. On conjoint reading of above, IDMC believes that the supply of cattle feed plant involving supply of various machines and equipment merit classification under Heading 8436 10 00 and be taxed at GST at the rate of 12%. Part B – Discussion on Classification of supply of cattle feed plant involving supply of installation, testing and commissioning services with civil work.

29. IDMC submits that in this case they receives order for design, installation, testing and commissioning of cattle feed plant (‘plant’). They quote and agree separate prices for supply of equipment and installation & commissioning of equipment. The Applicant further submit that the bill of material / bill of quantity specifies number of equipment required for cattle feed plant including accessories thereof and all the goods are offered to customers at their respective rate even if there is one contract for supply of cattle feed plant. Furthermore, it issues separate invoices for supply of goods and supply of services. It is submitted that all equipment are vital for operation of cattle feed plant and the plant would not work in absence of any of the equipment. Further this project involves civil work.

30. IDMC submits that they want to understand whether the present case qualifies to be works contract or not. If the supply would qualify as works contract, then what would be HSN classification & applicable rate thereon.

31. IDMC submits that one of the essential conditions to qualify as works contract supply is that the erection, installation or commissioning should result into an immovable property. IDMC further submits that immovable property would mean anything that is permanently fastened to the earth. Considering this, it would be important to discuss whether the supplies in present case result into ‘immovable property’.

32. IDMC submits that in present case, civil work is involved and the Applicant believes that the present supply would result into immovable property and can be contemplated as ‘works contract’. The relevant extract of the reference order # GUJ / GAAR / REFERENCE/2017-18/1 has been reproduced hereunder:

We observed that if the equipments or components assembled or installed at site and attached by foundation to earth can be dismantled without substantial damage to its equipments or components and thus can be reassembled, the item would be considered as moveable. Further, just because plant and machinery are fixed in the earth for better functioning or efficient operations, it does not automatically becomes an immovable property.”

33. IDMC submits that the supply of cattle feed plant involving civil work would result into an immovable property and hence, the present case would be treated as composite supply of works contract service.

34. Question on which Advance Ruling sought.

1. Whether contract involving supply of equipment / machinery & erection, installation& commissioning services without civil work thereof would be contemplated as composite supply of cattle feed plant under GST regime? If the supplies would qualify as composite supply, what would be the classification of this bundle and applicable tax rate thereon in accordance with Notification No. 01/2017 – CT (Rate) dated June 28, 2017 (as amended).

2. Whether contract involving supply of equipment / machinery & erection, installation& commissioning services with civil work thereof would be contemplated as works contract service or not. If the supplies would qualify as composite supply of works contract, what would be the classification and applicable tax rate thereon in accordance with Notification No. 11/2017 – CT (Rate) dated June 28, 2017 (as amended).

Personal Hearing

35. Personal hearing granted on 18-2-22 was attended by Shri Hardik Shah, CA and Shri Kumar Parikh, CAand they reiterated the submission.

Additional Submission:

36. IDMC vide letter dated 4-3-22 has submitted as follows:

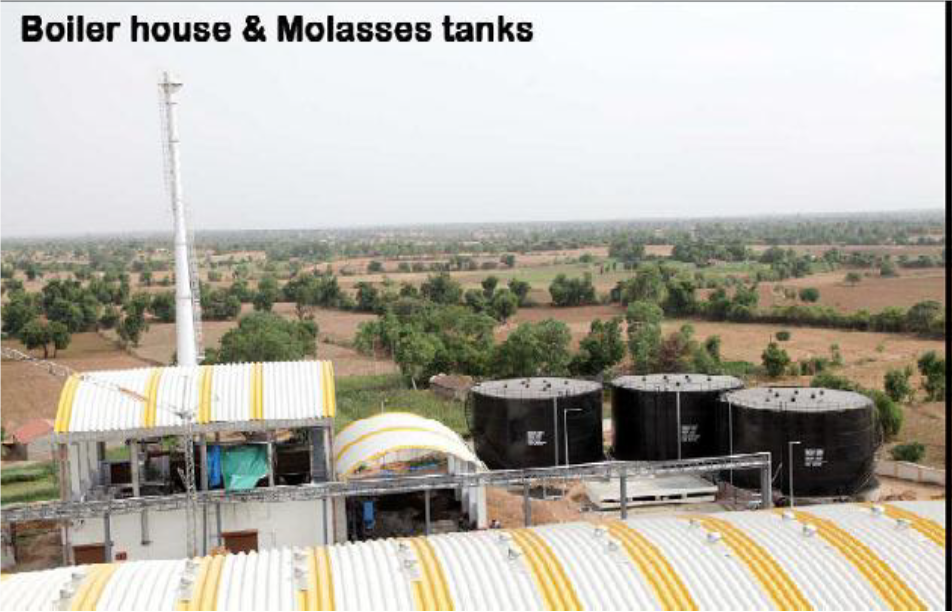

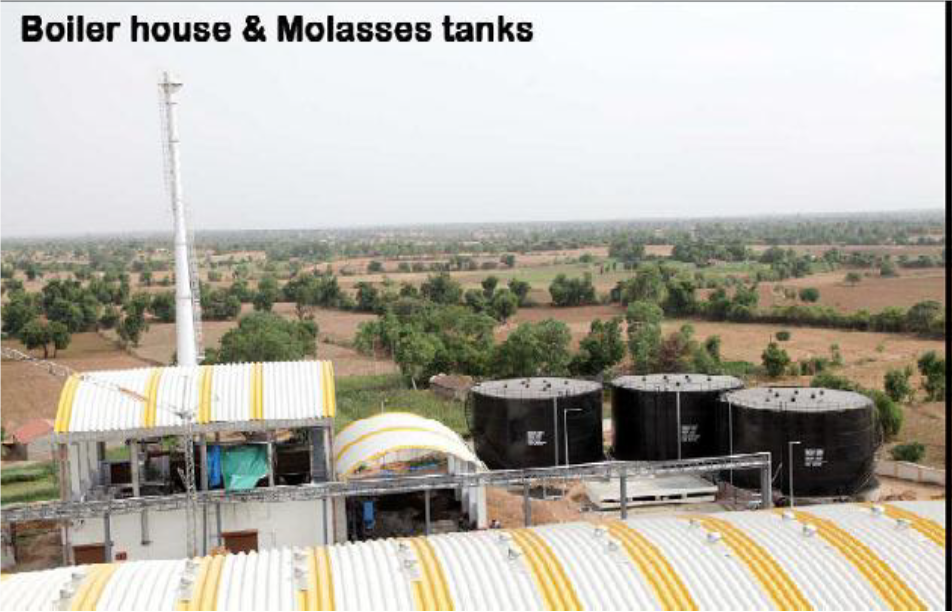

‘During the course of hearing, your good office has sought Photographs of cattle feed plant in order to determine ruling on questions asked in the application. In this regard, we are enclosing herewith sample photographs showing various parts & equipment of cattle feed plant in respect of question raised for Part A of application. We would like to inform that we have highlighted the portion of plant which is supplied by IDMC and same is movable in nature. Further, as seen from photographs, all the equipment are fastened to earth by nut-bolts to ensure wobble free and efficient operation of plant. We would also like to submit that the foundation/ civil work on which plant is fastened would be outside the scope of the IDMC and our responsibility is limited to supply, erection, installation & commissioning of cattle feed plant (i.e. machinery) only. Considering above, we would request your good office to kindly consider the photographs on record & oblige.

Following photographs are pasted as follows :

Revenue’s submission:

37. Revenue has neither submitted its comments nor appeared for hearing.

FINDINGS

38. At the outset we make it clear that the provisions of CGST Act, 2017 and GGST Act, 2017 are in parimateria and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act would also mean reference to the corresponding similar provisions in the GGST Act.

39. We have carefully considered the submissions made by IDMC.

40. We find that in light of the Section Notes 2, 3, 4 and 5 to Tariff Section XVI, a Cattle Feed Plant, as such, falls under the Category: ‘Machinery for preparing animal feeding stuffs’. In subject matter before us, We note that the issue hinges on the ‘test of permanency’ to determine the nature of subject supply of an installed, functional and operational plant. In simple and precise words, the ‘test of permanency’ has been enunciated vide the H’ble Apex Court in the case of Municipal Corporation of Greater Bombay & ors. V. Indian Oil Corporation Ltd. [199 Suppl. SCC 18], wherein one of the questions H’ble Court considered was whether a petrol tank, resting on earth on its own weight without being fixed with nuts and bolts, had been erected permanently without being shifted from place to place. It was pointed out that the test was one of permanency; if the chattel was movable to another place of use in the same position or liable to be dismantled and re-erected at the later place, if the answer to the former is in the positive it must be a movable property but if the answer to the later part is in the positive then it would be treated as permanently attached to the earth.

41. On careful reading of the submissions before us, we find the following facts emerging:

i. All the machines, apparatus, equipment are vital and requisite for the Cattle Feed Plants Operation and the Plant cannot function in their absence.

ii. The Plant includes equipment receiving raw materials till packaging of finished goods.

iii. The supply includes Installation and Erection at Customers premises. This involves equipment drawings and their layout for main feed plant, storage silo plant and steam generation plant.

iv. The supply involves cable trench layout; electrical drawings, ETP drawings including civil construction work, including drawings of civil structure.

v. The mechanical installation comprises supply and installation of structural platforms and tables.

vi. The supply comprises final adjustment of the foundations including alignment and dressing of foundation surface, embedding and grouting of anchor bolts and bedplates.

vii. IDMC shall only after the alignment has been checked by it and witnessed by the Purchaser, then afterwards only, permanently bolt down the equipment to foundations/ structure.

viii. IDMC shall supply, fix and maintain, at its own cost, during the erection work, all the necessary centering, scaffolding, staging required not only for proper execution and protection of the said work but also for protection of the surrounding plant and equipment. ix. IDMC shall supply box type platforms, pipe support bridges/ gantry.

x. IDMC shall install all pipes, valves and specialities being procured from other sources.

xi. The supply includes Testing and Commissioning of the Plant.

xii. Supply comprises Installation and Commissioning of Electrical System.

xiii. The supply includes trial runs of the Plant.

42. We find that the equipment are assembled by IDMC at customers premises and are either fitted with foundations/ structures or fitted on foundations/ structures. We hold that the functional and operational Cattle Feed Plant in its knocked down, either semi knocked down/ completely knocked down condition loses its identity. Further, it is fact on record that an erected Cattle Feed Plant as such cannot be shifted from one place to another, i.e., to say that all the different equipment, machines parts and accessories, electrical systems are required to be dismantled and then only the equipment can be shifted. We have also examined the illustrative photos submitted by IDMC for Supply with respect to Question no 1. We note the equipments are erected and installed and have passed the test of permanency, as discussed in paragraph 40. On reading the facts, we find the test of permanency laid down by the H’ble Apex Court for treating cattle plant as an immovable property has been answered positive in subject case and we hold that subject Plant is an immovable property. The Cattle Feed Plant once installed and commissioned in the premises is transferred to the customer, thereby involving transfer of property. We find that the Plant installation comprises cabling and fastening to earth/ foundation and all the equipment/parts are interlinked to constitute a functioning Plant that it cannot be moved as such without dismantling/ dismembering. We find no force in IDMC’s submission that supply of Operational Plant without civil work is different in its essence from supply of Operation Plant with civil works for reasons of test of permanency, laid down by H’ble Apex Court, answered positive and for the associated civil works and fastening of Plant to earth, irrespective of terminology of contract. We find that though IDMC categorises a supply without civil work, is these cases also all equipment, ancillary equipment, MS Structurals, MS chequered plates, conveyors, electrical boards, cabling is involved and Plant is invariably fitted on foundation/ structures prior to its commissioning. The supply hinges on providing a functional and operational cattle feed plant which has passed the test of permanency and thereby an immovable property. The supply interalia involves transfer of property to the customer and the subject supply merits consideration under works contract service.

43. In this regard, we find it apt to refer to CBEC Order No. 58/1/2002-Cx dated 15-1-2002 issued for the purpose of uniformity in connection with classification of goods erected and installed at site. We find this CBEC order’s rationale applies to our subject matter. This said CBEC order was issued in wake of plethora of judgments appear to have created some confusion with the assessing officers, the matter was examined by the Board (CBEC) in consultation with the Solicitor General of India and the matter was clarified vide said Order and the relevant extract is reproduced as follows and we hold that its rationale and concept are relevant under GST scheme of law also. CBIC in Para (e) has clarified that,

(e) If items assembled, or erected at site and attached by foundation to earth cannot be dismantled without substantial damage to its components and thus cannot be reassembled, then the items would not be considered as moveable and will, therefore, not be excisable goods.

44. We find that our view is in compliance to Judicial Discipline as laid down vide the following case laws:

4.5 In Triveni Engineering & Industries Ltd. [2000 (120) E.L.T. 273 (S.C.)] the Apex Court observes that while determining whether an article is permanently fastened to anything attached to the earth both the intention as well as the factum of fastening has to be ascertained from the facts and circumstances of each case.

In S/S Triveni N.L. Ltd. [RN – 910, 911 & 912 of 2001 (All)] Allahabad High Court observes that ‘permanently fastened to anything attached to the earth’ has to be read in the context for the reason that nothing can be fastened to the earth permanently so that it can never be removed. If the article cannot be used without fastening or attaching it to the earth and is not removed under ordinary circumstances, it may be considered permanently fastened to anything attached to the earth.

4.6 In the case of Solid & Correct Engineering Works,[2010 (252) E.L.T. 481 (S.C.)), the Apex Court when examining whether a machine, fixed with nuts and bolts to a foundation, with no intent to permanently attach it to the earth, is an immovable property or not, has held that such an attachment without necessary intent to making it permanent cannot be an immovable property. The emphasis is on the intention of the party. The Apex Court observes that the specific machine in question can be moved and has indeed been moved after the road construction and repair project, for which it was installed, is completed. However, if a machine is intended to be fixed permanently to a structure embedded in the earth, the moveable character of the machine, according to the Supreme Court, becomes extinct.

45. We rest on the foundation laid down by the Supreme Court with respect to test of permanency and bound by the law of the land, as per Article 141 of our Constitution. We refer to Article 141 of our Constitution, “141. Law declared by Supreme Court to be binding on all courts: The law declared by the Supreme Court shall be binding on all courts within the territory of India”. Further, We find that our views is in compliance to the Hon’ble Apex Court decision in case of M/s. Kone Elevator India Pvt. Ltd. Vs State of Tamil Nadu and others [2014 (5) TMI 265-Supreme Court] wherein the issue before the Larger Bench of the Hon’ble Apex Court was to decide correctness of the Judgement in case of State of Andhra Pradesh vs. Kone Elevators [2005 (2) TMI 519- Supreme Court] wherein a three judges bench held that contract of manufacture, supply and installation of lifts is to be treated as sale of goods, as opposed to a works contract. However, the Larger Bench of the Hon’ble Supreme Court overruled the said decision of three judges bench and held that the said contract in question is not merely a sale of goods since the same does not involve chattel (lift) sold for chattel. The Larger Bench of the Supreme Court upheld that the contract in question as a works contract since the same did not involve sale of chattel simpliciter but involved installation of chattel at site amounting to chattel being attached to another chattel. In this context, it was remarked that:

“64. ……..It is necessary to state here that if there are two contracts, namely, purchase of the components of the lift from a dealer, it would be a contract for sale and similarly, if separate contract is entered into for installation, that would be a contract for labour and service. But, a pregnant one, once there is a composite contract for supply and installation, it has to be treated as a works contract, for it is not a sale of goods/chattel simpliciter. It is not chattel sold as chattel or, for that matter, a chattel being attached to another chattel. Therefore, it would not be appropriate to term it as a contract for sale on the bedrock that the components are brought to the site, i.e., building, and prepared for delivery. The conclusion, as has been reached in Kone Elevators (supra), is based on the bedrock of incidental service for delivery. It would not be legally correct to make such a distinction in respect of lift, for the contract itself profoundly speaks of obligation to supply goods and materials as well as installation of the lift which obviously conveys performance of labour and service. Hence, the fundamental characteristics of works contract are satisfied. Thus analysed, we conclude and hold that the decision rendered in Kone Elevators (supra) does not correctly lay down the law and it is, accordingly, overruled.”

46. We find our views in compliance to judicial discipline laid down vide the judgement of the Hon’ble Bombay High Court in case of Otis Elevator Company (India) Ltd. Vs Superintendent of Central Excise, Range-I [2003 (151) ELT 499 (BOM)] wherein the Court held that elevator does not come into existence until it is installed in building and once the same is installed it becomes integral part of the immovable property. The relevant extract of the said judgment is as under:

“9. Having heard the rival contentions and having examined all the citations referred to hereinabove, we are clearly of the opinion that the same shall apply to the facts of this case in full force and item in question being immovable property cannot be subjected to excise under the tariff heading claimed by the Revenue. The case sought to be made out by the petitioner is also covered by the decision of the Government of India in reference, OTIS Elevator Company (India) Ltd. – 1981 (8) E.L.T. 720 (G.O.I.), wherein, it was clearly held that if an article does not come into existence until it is fully erected or installed, adjusted, tested and commissioned in a building, and on complete erection and installation of such article when it becomes part of immovable property, it cannot be described as goods attracting levy of any excise duty. Thus, applying the ratio of all the above judgments including the order of the Government of India referred to hereinabove, the case sought to be made out by the petitioner has to be upheld. The contention sought to be advanced by the petitioner has a lot of merits in their submission and the issue is squarely covered against the Revenue that once the item has been held to be an immovable property, then, for the purpose of valuation the cost of construction and proportionate escalation charges cannot be added in the assessable value, as such, the impugned communication dated 20th August, 1987 of the respondent No. 1 is quashed and set aside and it is declared that the erection of lift is not excisable under Tariff Item No. 68 of the First Schedule to the said Act.”

46.1 We note our views in compliance to ratio decidenci laid down vide the Hon’ble Tribunal in the matter of Blue Star Limited Vs Commissioner of Central Excise, Jaipur [2002 (143) ELT 391 (Tri. -Del.)] wherein the Hon’ble tribunal while examining the excisability of Central Air-conditioning Plant (‘CAP’), held that CAPs cannot be taken as such to the market for sale. In order to take it to the market, the same would require to be dismantled in components and parts, and which will not remain as a complete CAP. Hence, the Hon’ble Tribunal held that the CAP is an immovable property and hence, not marketable. The relevant extract of the said judgement is as follows:

“In the instant case, the factual position is analogous to that of Triveni Engg. & Industries. Even the Revenue has no case that the CAP was capable of being taken as such to the market for sale. It required to be disassembled or dismantled into its components for the purpose of removal from its site, but then, certain parts would be damaged beyond repair and what could be taken to the market would be only the remaining parts, which would not make a CAP. The marketability test laid down by the Apex Court in Triveni Engg. & Industries is, therefore, not satisfied in the instant case.”

46.2 We note that such similar view was upheld by the Hon’ble Supreme Court in the case of Commissioner of Central Excise, Indore vs. Virdi Brothers [2007 (207) ELT 321(SC)].

47. We note that IDMC relied upon an Advance Ruling Reference GUJ/GAAR/REFERENCE/2017-18/1 wherein an issue was referred by the Advance Ruling Authority, in case of IDMC for supply of Dairy plants, milk processing plant and milk packing and allied service plant, to the Appellate Advance Ruling as the Members of Advance Ruling could not finalise their Ruling and had referred issue of Classification and nature of supply to Appellate Authority of Advance Ruling for decision. We find no merit for relying on a reference issue which has not been answered.

48. Further, IDMC referred to certain Advance Rulings pertaining to supply of Chilled Water plant; supply of AFC System; supply of Submersible Pumpset. Besides, that these supplies are different from the subject supply in present case, we refer to Section 103 CGST Act, wherein any Advance Ruling is binding on the Applicant who has sought it and on the concerned jurisdictional officer in respect of the Applicant.

49. In conspectus of aforementioned Findings and Discussions, we pass the Ruling:

RULING

Supply of a functional Cattle Feed Plant, inclusive of its Erection, Installation and Commissioning and related works involved for both the question 1&2, is Works Contract Service Supply, falling at SAC998732 attracting GST leviability at 18%.

Prices of BUSY Increasing from 1st June, 2024. Click Here

Prices of BUSY Increasing from 1st June, 2024. Click Here