ORDER BRIEF FACTS

The applicant M/s.Wago Private Limited is in the process of establishing their new factory at Vadodara, Gujarat and are procuring various assets to install and commission them in their factory and therefore, the applicant sought Ruling on the admissibility of input tax credit on the same in terms of the provisions of Section 16 and 17 of the CGST Act, 2017. They have submitted the brief description of the assets to be procured along with its main function/usage as follows:

Air-conditioning and cooling system:

| Sr.No. | Description | Brief Description | Remarks |

| 1. | Equipments | Chiller-Provides cooling water-which indirectly cools atmosphere for machines and working area | Plant Area-Movable |

| 2. | Equipments-AC Pumping | Pumping System-Pumps coupled with motor-provides water flow from chiller to AHU and other heat exchange equipment. | Plant Area-Movable |

| 3. | Piping works | Piping with insulation-supported on fabrication. | Plant Area-Non Movable |

| 4. | Ducting & Insulation work | Supported from ceiling or on fabrication structure-so there is no vibration. | Plant Area-Non Movable |

| 5. | HVAC related ELE-work | Cables on cable trays and control panel are fixed at location. | Plant Area-Movable |

| 6. | Process Water System | Chiller+Pumping system for cooling process equipment-so that it can provide better efficiency. | Plant Area-Movable |

| 7. | Moulding Area Exhaust System | Supported from ceiling or on fabrication structure-so that there is no vibration. | Plant Area-Movable |

| 8. | GF-Assembly Area Exhaust System | Supported from ceiling or on fabrication structure-so that there is no vibration. | Plant Area-Movable |

| 9. | HVAC BMS | Only controller and PC. | Plant Area-Movable |

| 10. | Tool Room Process Water System | Chiller + Pumping system for cooling process equipment-so that it can provide better efficiency. | Plant Area-Movable |

| 11. | Tool Room Process Water System-Sensor & Controller | Only controller. | Plant Area-Movable |

| 12. | Moulding M/c.Process Water System-Sensor & Controller. | Only controller. | Plant Area-Movable |

| 13. | Tool Room AC System | For maintaining oxygen level. | Plant Area-Movable |

| 14. | Tool Room Process Water HVAC BMS. | For maintaining oxygen level. | Plant Area-Movable |

| 15. | VRF Work-Admin Building | Both indoor and outdoor units with copper pipes for cooling of particular area. | Administration facility-Non Movable |

| 16. | VRF Work-Canteen Building | Both indoor and outdoor units with copper pipes for cooling of particular area. | Administration facility-Non Movable |

Ventilation System-Plant & Admin:

| Sr.No. | Description | Brief Description | Remarks |

| 1. | Factory Toilet & Plant Room Ventilation. | Supported from ceiling or on fabrication structure-so that there is no vibration. | Plant Area-Non Movable |

| 2. | Admin area Toilet & Kitchen Ventilation Work. | Supported from ceiling or on fabrication structure-so that there is no vibration. | Administration facility-Non Movable |

| 3. | Canteen area Toilet & Kitchen Ventilation Work. | Supported from ceiling or on fabrication structure-so that there is no vibration. | Administration facility-Non Movable |

| 4. | Factory office Fresh Air System. | For maintaining Oxygen level. | Plant Area-Non Movable |

| 5. | Canteen Area Fresh Air System | For maintaining Temperature. | Administration facility-Non Movable |

| 6. | Admin Area Fresh Air System | Only controller and PC. | Administration facility-Non Movable |

2. The applicant seeks Ruling on admissibility of input tax credit of GST paid on the procurement of the above including the service of installation and commissioning of the same, in terms of the provisions of Section 16 and 17 of the CGST Act, 2017.

3. The applicant submitted as follows:

(i) General provisions of ITC under GST: Section 16(1) of the CGST Act, 2017 provides for the eligibility of input tax credit on supply of goods or services used or intended to be used in the course or furtherance of business. However, as per Section 16(2), this eligibility of input tax credit is subject to certain restrictions and conditions like payment of tax by supplier, filing of returns etc. Relevant extract of Sections 16(1) and 16(2) of the CGST Act read as under:

“16. (1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

(2) Notwithstanding anything contained in this section, no registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless,––

(a) he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or such other tax paying documents as may be prescribed;

(b) he has received the goods or services or both.

Explanation.-For the purposes of this clause, it shall be deemed that the registered person has received the goods where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

(c) subject to the provisions of section 41, the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilization of input tax credit admissible in respect of the said supply; and

(d) he has furnished the return under section 39:”

Further, Section 17(5) of the CGST Act, 2017 has overriding effect to Section 16(1) of the CGST Act, 2017.

(ii) Legal provisions related to Blocked Credit under GST: Section 17(5) of the CGST Act, 2017, blocks the input tax credit on certain goods or services even though these goods or services are used or intended to be used in the course or furtherance of business. Clause(c) and (d) of the said section restricts input tax credit on the following:

Clause(c): Works contract services when supplied for construction of an immovable property (other than plant and machinery)except where it is an input service for further supply of works contract service;

Clause (d): Goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.

Thus, it may be inferred that tax paid on goods or services used in the course or furtherance of business is eligible for ITC except if they are procured for construction of immovable property. However, the above exception is not applicable in case of plant or machinery. The term ‘construction’ has been defined in Explanation to clause(d) to Section 17(5) in an inclusive manner and states that “for the purposes of clauses(c) and (d), the expression ‘construction’ includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalisation to the said immovable property.”

(iii) Applicability of Clauses(c) and (d) of Section 17(5) on Plant and Machinery: The term ‘plant and machinery’ has been defined in Explanation to Section 17(5) in an exhaustive manner and states that:

The term ‘plant and machinery’ means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes-

i. Land, building or any other civil structures;

ii. Telecommunication towers, and

iii. Pipelines laid outside the factory premises.

GST law defines ‘plant & machinery’ which means

• apparatus, equipment and machinery.

• Fixed to earth by foundation or structural support.

• That are used for making outward supply of goods or services or both and

• Includes such foundation and structural supports.

(iv) Section 17(5)(c)/(d) attracted only in case of Immovable Property: On combined reading of Section 17(5)(c)(d), it can be inferred that clause(c) and (d) of Section 17(5) shall be applicable only in case of immovable property i.e. if something is movable then blockage of input tax credit is not attracted under the said clauses and that in case of movable property, the entitlement to input tax credit shall be governed by Section 16(1) of the CGST Act. As per Section16(1), every registered person shall be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business. Thus, in case of movable property, full input tax credit shall be eligible as per Section 16(1) of the CGST Act.

(v) Section 17(5)(c)(d) not attracted in case of movable plant and machinery: Based on the above discussions, it can be inferred that the blockage of input tax credit under section 17(5)(c)/(d) is not attracted in case of movable plant and machinery.

(vi) Section 17(5)(c)(d) not attracted in case of immovable plant and machinery: Further, since clauses (c) and (d) of Section 17(5) specifically excludes immovable plant and machinery from its ambit, the blockage of input tax credit as envisaged under Section 17(5)(c) and (d) shall not apply in case of immovable plant and machinery. Thus, even if the plant and machinery is immovable, full input tax credit shall be eligible as per Section 16(1) of the CGST Act.

(vii) Definitions of Movable and Immovable Property:

Movable property has not been defined under the GST Act. However, Section3(36) of General Clauses Act, 1837, defines it as:

‘movable property’ shall mean property of every description, except immovable property.’

Similarly, the term ‘immovable property’ has not been defined under the GSTAct. Section 3(26) of General Clauses Act, 1837, defines it as:

‘immovable property’ shall include land, benefits to arise out of land, and things attached to the earth, or permanently fastened to anything attached to the earth;

‘Things attached to earth’ is defined under Section 3 of Transfer of Property Act, 1882 as under:

It means-

(a) Rooted in the earth, as in the case of trees and shrubs;

(b) Imbedded in the earth, as in the case of walls or buildings; or

(c) Attached to what is so embedded for the permanent beneficial enjoyment of that to which it is attached.

(viii) Judicial Precedents: There are a plethora of judgements of the Hon’ble Supreme Court and High Courts which help understand the term ‘immovable property’. Few of them are mentioned hereunder:

(a) In CCE, Ahmedabad vs. Solid & Correct Engineering Work s[2010 (4) TMI 15-SC, 2010(252) ELT.481 (SC), 2010 (4) SCR 476, 2010 (5) SCC 122, 2010 (3) JT 575, 2010 (3) SCALE 598, the Hon’ble Supreme Court observed and held that in the instant case all that has been said by the assessee is that the machine is fixed by nuts and bolts to a foundation not because the intention was to permanently attach it to the earth but because a foundation was necessary to provide a wobble free operation to the machine. An attachment of this kind without the necessary intent of making the same permanent cannot, in our opinion, constitute permanent fixing, embedding or attachment in the sense that would make the machine a part and parcel of the earth permanently. In that view of the matter we see no difficulty in holding that the plants in question were not immovable property so as to be immune from the levy or excise duty. The activity is amount to manufacture.

(b) In CCE, Chennai vs. Kone Elevators India ltd.[2001 (6) TMI 142-CEGAT, Chennai-2001 (138) ELT 635 (Tri-Chennai)], it was observed and held that the assessee’s activity of entering into contracts with the customers for supply of lifts by installation and commissioning of the same at buyer’s site with warranty of certain period would not be goods classifiable under Chapter 84.28. The tribunal has gone through various stages of installation of the lift in the building and has come to the conclusion that erection brings into existence as immovable property and is not goods.

(c) In Sirpur Paper Mills ltd. vs. Collector of Central Excise, Hyderabad[1998 (97) ELT.3 (SC)-1998 (1) SCC 400] the question was whether paper-making machine which was assembled and erected by the appellant using duty paid components and by fabricating certain parts in their factory, was liable to excise duty. The CEGAT recorded the finding that the whole purpose behind attaching the machine to a concrete base was to prevent wobbling of the machine and to secure maximum operational efficiency and also for safety. The SC held that in view of those it is not possible to hold that the machinery assembled and erected by the appellant at its factory site was immovable property as something attached to earth like a building or a tree. The test, it was noted, would be whether the paper-making machine could be sold in the market and as the Tribunal had found as a fact that it could be sold, so the machine was held to be not a part of immovable property of the company.

(d) In municipal Corporation of Greater Bombay & Ors. Vs. India Oil Corporation ltd.[1991 Suppl.(2) SCC 18], one of the questions Hon’ble Supreme Court considered was whether a petrol tank, resting on earth on its own weight without being fixed with nuts and bolts, had been erected permanently without being shifted from place to place. It was pointed out that the test was one of permanency; if the chattel was movable to another place of use in the same position or liable to be dismantled and re-erected at the later place, if the answer to the former is in the positive it must be a movable property but if the answer to the latter part is in the positive then it would be treated as permanently attached to the earth.

(e) In Quality Steel Tubes(P) ltd. vs. Collector of Central Excise, U.P. [1995 (75) ELT.17 (SC)-1995 (2) SCC 372], Hon’ble Supreme Court had to consider the question whether the tube mill and wielding head erected and installed by the appellant for the manufacture of tubes and pipes out of duty paid raw material were assessable to duty under residuary Tariff Item No.68 of the Schedule, being excisable goods within the meaning of Central Excise Act. While re-stating the test, namely, first the article must be goods and secondly that it should be marketable or capable of being brought to market, it was held that goods which are attached to the earth and thus become immovable did not satisfy the test of being goods within the meaning of the Central Excise Act nor can be said to be capable of being brought to the market for being sold. It was found that both the tests were not satisfied and, therefore, the tube mill and welding head erected by the appellant were not exigible to excise duty. It was held that erection and installation of a plant could not be held to be excisable goods and if such wide meaning was assigned, it would result in bringing in its ambit structures, erections and installations which would surely not be in consonance with accepted meaning of excisable goods and its eligibility to duty.

(f) In Mittal Engineering Works(P)ltd. vs. Collector of Central Excise, Meerut[1996 (88) ELT.622 (SC)-1997 (1) SCC 203], Mono vertical crystallisers are used in sugar factories to exhaust molasses of sugar. The component parts of mono vertical crystallisers were cleared on payment of excise duty from the premises of the appellants therein and they were then assembled, erected and attached to the earth at the site of the customers’ sugar factory. The process involved welding and gas cutting. The CEGAT held that the mono vertical crystalliser was complete when it left the factory and upheld the demand of excise duty on clearance thereof. The SC pointed out that the mono vertical crystalliser, had to be assembled, erected and attached to the earth by a foundation at the site of the sugar factory and it was not capable of being sold as it is, without anything more. Bharucha J., speaking for the Court, observed ‘The erection and installation of a plant is not excisable and to so hold would, impermissibly, bring into the net of excise duty all manner of plants and installations.”

(g) In Triveni Engg. & Industries ltd. vs. CCE [(2000) 7 SCC 29; (2000) 120 ELT 273]-2000 (8) TMI 86-Supreme Court– a question arose regarding excisability of turbo alternator. In the facts of that case, it was held that installation or erection of turbo alternator on a concrete base specially constructed on the land cannot be treated as a common base and, therefore, it follows that installation or erection of turbo alternator on the platform constructed on the land would be immovable property, as such it cannot be an excisable goods falling within the meaning of Heading 85.02. In reaching this conclusion this Court considered the earlier judgements of this Court in Municipal Corporation of Greater Bombay vs. Indian Oil Corporation ltd. [1991 Supp (2) SCC 18]-1990 (11) TMI 407-SUPREME COURT, Quality Steel Tubes [(1995)2 SCC 372:(1995) 75 ELT 17]-1994 (12) TMI 75-SUPREME COURT OF INDIA and Mittal Engg. Works(P)ltd.[(1997)1SCC203:(1996) 88 ELT 622]-1996(11) TMI 66-SUPREME COURT OF INDIA as also the earlier judgement of this Court in Sirpur Paper Mills ltd. vs. CCE [(1998) 1 SCC 400 (1998) 97 ELT 3]-1997 (12) TMI 109 109-SUPREME COURT OF INDIA.

In this case the Apex Court clearly laid down that after assembly, when the item continues to be goods, only then it can be held to be excisable goods. However, on completion of process of erection, if the item becomes immovable property, then it is not excisable.

The observations made in above judgements are very useful in determining when a property can be considered as immovable property.

(ix) Further, CBIC has issued Order No.58/1/2002-CX dated 15.01.2002 under Section 37B of the Central Excise Act in order to clarify the term immovable property. The para 5 of the order is reproduced below:

5. Keeping the above factors in mind the position is clarified further in respect of specific instances which have been brought to the notice of the Board.

(i)………..

(ii)……….

(iii) Refrigeration/Air conditioning plants. These are basically systems comprising of compressors, ducting, pipings, insulators and sometimes cooling towers etc. They are in the nature of systems and are not machines as a whole. They came into existence only by assembly and connection of various components and parts. Though each component is dutiable, the refrigeration/air conditioning system as a whole cannot be considered to be excisable goods. Air conditioning units, however, would continue to remain dutiable as per the Central Excise Tariff.

Thus, centralised air conditioning unit is a combination of various components comprising of compressors, ducting, pipings, insulators and cooling towers etc. which results into immovable plant and machinery.

4. The applicant has stated that on the basis of the above discussions, it can very well be concluded that the basic premise whether to claim ITC on goods and/or services which are procured by applicant company will depend on the fact that whether such Capital goods/Plant and Machinery is movable or not.

- If Capital goods/Plant & Machinery is movable then full ITC shall be eligible as per Section 16(1) of the CGST Act, 2017.

- If Capital goods/Plant & Machinery is immovable then also blockage of ITC under Section 17(5) of clause (c) and (d) is not attracted. Thus, ITC should be eligible in this case also.

5. The applicant vide additional submission dated 8-7-21 has submitted the following details in respect of the Air Conditioning and Cooling System as well as the Ventilation System:

(a) Write up and photographs.(Pages 1 to 40).

(b) Annexures-1 to 5 (List of invoices and copies) (Pages 41 to 186)

(c) Contract documents:-

1. Letter of award and purchase orders(Pages 187 to 204).

2. Bill of Quantities (BOQ) (Pages 205 to 307).

3. Tender documents (Pages 308 to 367).

5.1 The applicant has submitted as follows:

(1) The Air conditioning and cooling system consists of chiller, pumping system, piping with insulation, ducting and insulation work, HVAC related electric work, HVAC BMS and Tool room AC system. The objective is to cool the atmosphere.

(2) The Process water system consists of the Chiller and pumping system for cooling machines. It includes process water system, tool room process water system, tool room process water system-sensor & controller, moulding m/s. Process water system-sensor & controller and Tool room process water HVAC BMS. Photographs of the same are submitted. The applicant has stated that it is used in plant as a part of production process in injection moulding machine; that plastic granules used in the machines is being melted and put in the mould to make the plastic part; that this plastic part is very hot and can’t be taken out of the machines unless the temperature of the machine/ part is brought down. The process water system is used to bring down the temperature so that the part can be cooled down and can be taken out.

(3) The Exhaust system is used in the plant so that sufficient ventilation is maintained and it includes moulding area exhaust system and GF-Assembly area exhaust system.

(4) As regards VRF work, it is just like split AC with the exception that multiple indoor units are connected with single outdoor unit and it is installed at admin/plant. It includes VRF work-Admin and VRF work-plant building.

(5) The Ventilation system is used to provide sufficient ventilation/fresh air to plant/admin area and includes factory toilet & plant room ventilation, admin area toilet & kitchen ventilation work, utility building ventilation work, factory office fresh air system, utility building fresh air system and admin area fresh air system.

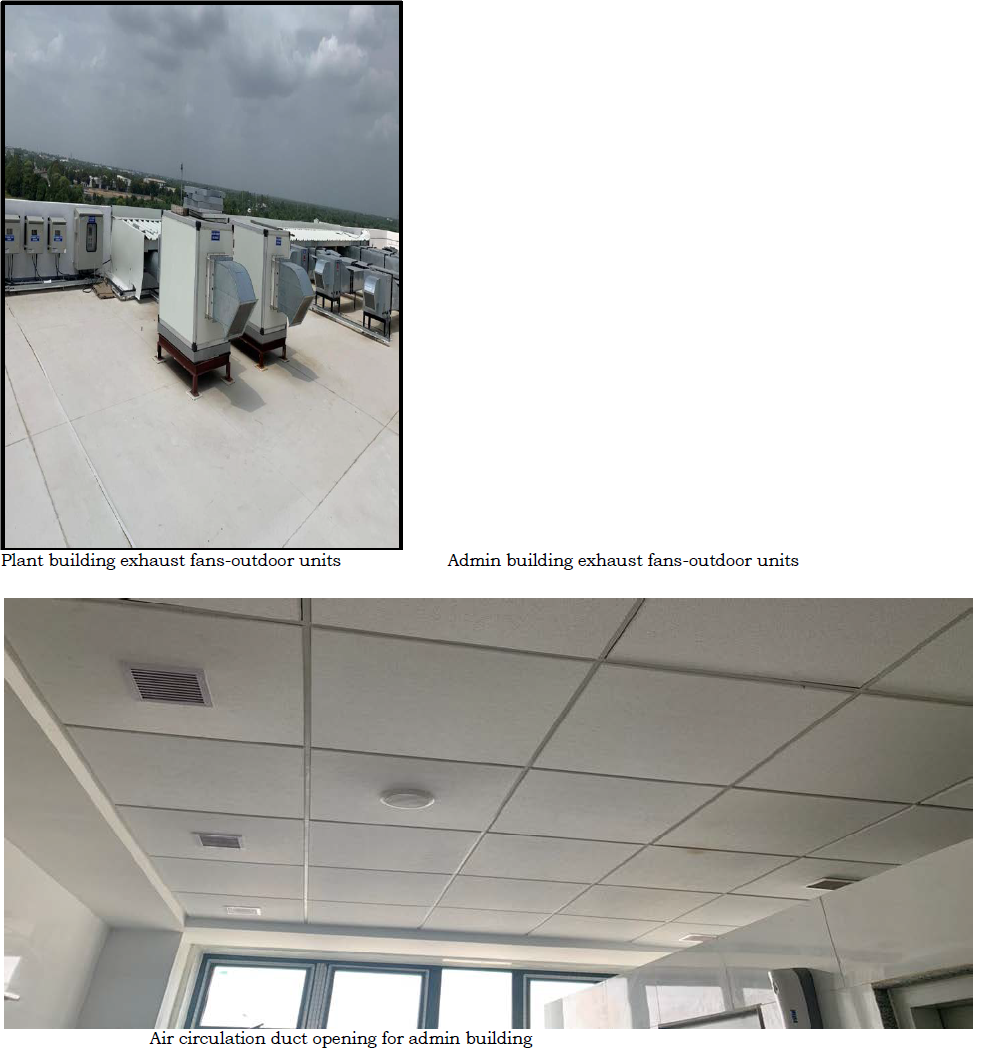

Photographs submitted pertaining to Air conditioning and cooling system are as follows:

Photographs submitted pertaining to Ventilation systems:

Question on which Advance Ruling sought:

6. The applicant has sought Advance Ruling as follows:

“The applicant wishes to know the admissibility of input tax credit of GST paid on the procurement of plant and machines (mentioned in para-3 above) including the service of installation and commissioning the same in terms of the provisions of Section 16 and 17 of the CGST Act, 2017.”

Personal hearing:

7. Shri Chitresh Gupta, CA appeared for hearing (video conferencing) on 17-6-21. Further, as requested by the applicant another hearing was granted on 30-6-21, wherein Shri Chitresh Gupta, C.A. and Shri Anil Kumar appeared for the hearing and reiterated the contents of the application.

FINDINGS:

8. At the outset we would like to make it clear that the provisions of CGST Act, 2017 and GGST Act, 2017 are in parimateria and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act would also mean reference to the corresponding similar provisions in the GGST Act.

9. We have carefully considered all the submissions made by the applicant. We observe that the issue boils down to whether: i. AC & Cooling system and ii. Ventilation system of the applicant are admissible for ITC.

Gist of the single Work Order to understand the scope of Supply:

10. We find that the applicant has awarded a singleWork Order dated 1-9-20 to M/s Skai Air Control pvt.ltd., to supply, install and commission HVAC worksfor proposed Factory building, Assembly building, Admin Building, Staff facility(existing) & associated works. We understand that HVAC acronym stands for Heating, Ventilation and Air Conditioning system. We find that the said Work order covers the scope of supply, installation, testing and commissioning( SITC) and maintenance and warranty of subject Airconditioning& Cooling system and the Ventilation system of the applicant and of its performance guarantee at site. The total contract value of the subject supply is inclusive of cost of materials, labour, machineries etc. and that GST will be payable extra at actual as per the statutory norm at the time of billing. The contract value is for the entire scope of supply.The work order also contains, inter alia, the following terms:

(1) SKAI Air will provide free of charge 1 or 2 operators depending on load-at Wago site for initial 12 months(after commissioning), who will operate chiller/train wago people.

(2) During the entire 18 months of warranty-Mitsubishi shall send their Technical person twice a month for check up of chillers and VRF system.

(3) Wago will provide BMS Controller to SKAI Air and SKAI Air will not charge any margin and bill-back to back on same cost. Wago will provide service and technical back up for this controller as and when required to SKAI air.

(4) Comprehensive Maintenance contract charges of entire plant and office (chillers, VRF units, AHU, DHU, Pumps) will be 148 lacs for entire 10 years after 18 months of warranty.

Further, an Advance Bank Guarantee and Contract Performance Bank Guarantee is required to be executed by the SKAI along with one year maintenance service. It has also been specified in the tender that the work of erection of equipment/system/ancillary work can be considered to be complete only if the following activities have been satisfactorily completed:

System/equipment:

a. Levelling, alignment of the base-frame, tightening of mounting bolts, alignment of drives.

b. Installation of all accessories and instruments, which form a part of the equipment.

c. Cleaning and charging of lubricant.

Ducting:

a. Assembly of a complete section of duct from one end point to another, including all dampers, flexible connections, access doors, frames, bracing etc.

b. Levelling and alignment, fixing of all supports.

c. Cleaning the duct from inside and blanking off open ends temporarily to prevent entry of dust and dirt, if necessary.

Electric Panels and Cabling:

a. Permanent supporting and clamping of cables in position.

b. Fixing of glands and lugs and terminating the cables on the terminals of equipment/panel.

c. Levelling, alignment and assembly of sections of the panel in its final location and fastening the same to foundation. Cleaning the panel from inside and outside and verification of all components.

10.1 In the Tender, the system description and basis of design in the factory area, admin building and canteen building are described as follows:

a. Factory area: AC requirement in factory AC area shall be air-conditioned by chilled water system. Chilled water pumping system shall comprise of chilled water pump to circulate chilled water.

b. Admin & Canteen Building: AC requirement shall be air conditioned by VRV/VRF type air-conditioning system. Various capacities of indoor units will be used for air conditioning of the AC areas. Each outdoor unit of VRF system shall consist of air-cooled condenser, compressor, condenser coil, condenser coil, condenser fans etc. and shall be located on the terrace floor. Each of such outdoor unit shall be connected to a number of various capacity indoor units located on each floor. Each indoor AC unit of VRF system shall have cord less remote/Centralize controller for operating each indoor unit independently and at the desired inside conditions.

10.2 Further, we have perused the copies of invoices submitted by SKAI. We notice two types of invoices, one for materials and other for labour charges. The invoices for goods include items such as air cooled scroll chiller, spring isolator, air handling unit, compact cassette unit, expension tank, hydraulic separator, valves, pressure gauge, pumps, M.S. structure, expension bellow, MS/SS/PVC pipes, SS elbow, flanges, sockets, end caps, clips, GI ducting and insulation works, anchor fastener, threaded rod, temperature gauge, strainer, drain pipe, electrical panel, AHU panel, cables, GI cable tray, control panel, air cooled condensing unit, refrigerant piping, drain pipe, flot switch, hydraulic separator etc. for their air conditioning system whereas the items/goods obtained for their ventilation system comprises of fresh air fans, exhaust fans, electrical panel, GI ducting, threaded rod with PU coating, beam clamp, piping support for copper pipe and drain pipe, drain pipe U clamp, brid screen and cowls, grill, MS structure, regulators, suitable PU coated GI perforated cable trays with cover with necessary structural supports, Anchor Fastener, insulated PVC pipe, SITC of sheet metal ducts(factory fabricated ducts) with accessories like veins, flanges, guide vens as per technical specification, flexible duct for equivalent connecting fresh air ducting and cassette ac indoor units fresh air connection, fabrication and erecting structure steel for support etc.

10.3 The invoices in respect of supply of services include:

(1) Invoice No.943/2020-21 dated 31-3-2021 pertaining to labour charges for MS C Class pipes, Butterfly valves, BF with motorised Actuators, Balancing valves, Y-strainers, pressure gauges, temperature gauges, Auto purge valves, drain valves, flexible connection, structure, steel, manifolds, etc. valued at ₹ 24,45,781/-.

(2) Invoice No.694/2020-21 dated 28-1-2021 pertaining to labour charges for ducting work, grill with VCD, swirl defuser with fixed deflectors, Thick thermal insulations valued at ₹ 17,53,182/-

(3) Invoice No.944/2020-21 dated 31-3-2021 pertaining to labour charges for ducting work, grill with VCD, swirl defuser with fixed deflectors, , swirl defuser with fixed deflectors, structure steel for support, Thkammasound, Thk insulation, Anchor Fasteners, Threaded rods, GI PU coatee channel, Special clamp purlin valued at ₹ 20,48,099/-

(4) Invoice No.152/2020-21 dated 31-5-2021 pertaining to labour charges for ducting work, Grill with VCD, Canvas Flexible connections, diffusers, insulation Anchor fastener, threaded rod, Sp. Round clamp valued at ₹ 26,26,120/-.

It is noticed that invoices do not describe the nature of supply but the description used is either of goods or labour charges.

10.4 The applicant vide:

(i) purchase order No.7471066 dated 30-12-2020 issued to M/s. SKAI has requested for supply of one unit of compressed air piping for plant area and separate purchase order No.74710667 dated 30-12-2020 for installation, commissioning and testing of compressed air piping.

(ii) 2 purchase orders No.7471080 and 7471081 both dated 15-1-2021 issued to the above entity requesting for supply of 1 unit of BMS cabinet and for components of the BMS cabinet.

(iii) purchase order No.7500195 dated 10-5-2021 issued to the above entity requesting for supply of various items like SS pipes, SS Elbow, SS Tee, PN valves, UPVC pipes for cover etc.

(iv) purchase order No.7500196 dated 10-5-2021 for installation of drinking water piping.

11. We detail our findings:

(i) Air-conditioning and cooling system:

The applicant has entered into a work order for supply, installation, erection and commissioning (SITC), maintenance and warranty of HVAC worksin the Building comprising the Factory building, assembly building, the Admin Building and Canteen Building.

We note that the applicant in his additional submission has divided the Air conditioning and cooling system into 4 sub categories as follows: Air conditioning and cooling system, Process water system, the Exhaust system and VRF work. On examination of the work order, invoices raised and also all the pictures submitted in respect of the above, we find that they are invariably part and parcel of the air conditioning and cooling system as such and the single work order has been awarded for the installation and commissioning of HVAC system. In the work order no separate clauses has been mentioned for all the 4 categories as applicant bifurcated. The copies of Invoices raised are for the parts and components for the HVAC system and for labour work of such system. Even the Invoice do not contain the description of different systems. The applicant in the personal hearing has stated that the process water system is attached to the moulding machine. However, we find no specification of moulding machine to be fitted with any further system/ sub system to function as a moulding machine. We find that all the parts of Air conditioning and cooling system get assembled at the site and fitted on the wall and roof and the floor of the building. All the different parts of ‘Air conditioning and cooling system’ after being fitted in the building loose their identity as machines or parts of machines and become a system, namely Air conditioning and cooling system. This AC System is in nature of a system and not machine as a whole. It come into existence only by assembly and connection of various components and parts. Though each component is dutiable to GST, the air conditioning plant as such is not a good under HSN (customs Tariff Heading). We note that Air conditioning unit, however, is dutiable as per HSN but not Air conditioning plant. We find no merit to assume the central air conditioning system as a machine.

We find it apt to refer to CBEC Order No. 58/1/2002-Cx dated 15-1-2002 issued for the purpose of uniformity in connection with classification of goods erected and installed at site. This said CBEC order was issued in wake of plethora of judgments appear to have created some confusion with the assessing officers, the matter was examined by the Board (CBEC) in consultation with the Solicitor General of India and the matter was clarified vide said Order and the relevant extract is reproduced as follows and we hold that its rationale and concept are relevant under GST scheme of law also.

“5 (iii) Refrigeration/ Air Conditioning Plant :These are basically systems comprising of compressors, ducting, pipings, insulators and sometimes cooling towers etc. They are in the nature of systems and are not machines as a whole. They come into existence only by assembly and connection of various components and parts. Though each component is dutiable, the refrigeration/air conditioning system as a whole cannot be considered to be excisable goods. Air conditioning units, however, would continue to remain dutiable as per the Central Excise Tariff”

ii. Now we have the issue before us whether the air conditioning plant is a movable or immovable property. We find it apt to refer to case law: Municipal Corporation of Greater Bombay & ors. V. Indian Oil Corporation Ltd. [199 Suppl. SCC 18], wherein one of the questions Hon’ble Supreme Court considered was whether a petrol tank, resting on earth on its own weight without being fixed with nuts and bolts, had been erected permanently without being shifted from place to place. It was pointed out that the test was one of permanency; if the chattel was movable to another place of use in the same position or liable to be dismantled and re-erected at the later place, if the answer to the former is in the positive it must be a movable property but if the answer to the later part is in the positive then it would be treated as permanently attached to the earth. We note the applicants submission that only after the system is dismantled and individual parts of the air conditioning system are removed they can be transported. AC system as a whole cannot be transported from one place to another. We find the test of permanency laid down by the Apex Court has been answered in subject case as the System cannot be taken as such to the market for sale and cannot be shifted from one place to another as such. It can be shifted only after dismantling the plant which cannot be called ‘Air conditioning system’ after it is dismantled. Further, Air Conditioning system once installed and commissioned in the building is transferred to the building owner and this involves transfer of property. We thus find no merit to treat an entire Central Air conditioning system a movable property. We find that our view is in compliance to Judicial Discipline as laid down vide the following case laws:

1. Commissioner of C. Ex., Indore Vs. Virdi Brothrs 2007 (207) ELT 321 (S.C.) [ Para 2,6,7]

2. Commissioner of C. Ex., Indore Vs. Globus Stores (P) Ltd. 2011 (267) ELT (435) (S.C.) [ Para 3]

3. Voltas Ltd. Vs. Commissioner of Centralised, Mumbai –VII 2011 (270) ELT 541 (Tri- Mumbai) [Para 5,8]

iv. Further, we note that the supply and erection of subject immovable property- Central Air conditioning system merit its classification under works contract service.

iv. When Hon’ble Supreme Court [2011 (267) ELT (435) (S.C.)] has termed Air conditional Plant as an immovable property, we find no reason to dwell on this issue further. We refer to Article 141 of our Constitution,

“141. Law declared by Supreme Court to be binding on all courts: The law declared by the Supreme Court shall be binding on all courts within the territory of India”.

v. We rest on the foundation laid down by the Supreme Court with respect to test of permanency and with respect to terming air conditioning system an immovable property. We are bound by the law of the land, as per Article 141 of our Constitution. We note that is supply of works contract. We find supply of centralised air conditioning plant covered at Section 17(5)(c) CGST Act. We note that section 17(5) CGST Act is a Non obstante sub section, overriding the provisions of section 16(1) and Section 18(1) CGST Act.

(ii) Ventilation system

We find that the work order awarded to Skai Air Control pvt.ltd. isfor HVAC works and this covers the ‘Ventilation system’ too. However, since the applicant has raised the ‘Ventilation system’ separately, the same is taken up for discussion. The ventilation system comprises of fresh air fans, exhaust fans, electrical panel, GI ducting, threaded rod with PU coating, beam clamp, piping support for copper pipe and drain pipe, drain pipe U clamp, brid screen and cowls, grill, MS structure, regulators, suitable PU coated GI perforated cable trays with cover with necessary structural supports, Anchor Fastener, insulated PVC pipe, SITC of sheet metal ducts(factory fabricated ducts) with accessories like veins, flanges, guide vens as per technical specification, flexible duct for equivalent connecting fresh air ducting and cassette ac indoor units fresh air connection, fabrication and erecting structure steel for support etc. All the different parts of ‘Ventilation system’ after being fitted in the building loose their identity as individual goods and become “Ventilation system”. We find that the ‘Ventilation system’ fitted in the building cannot be taken as such to the market for sale and cannot be shifted from oneplace to another as such to erect at another site. It can be shifted only after dismantling the said system which cannot be called ‘Ventilation system’ after it is. The ‘Ventilation system’ once installed and commissioned in the building is transferred to the building owner and this involves the element of transfer of property, thereby ‘Ventilation system’ supply merits to be classified as work contract supply as the system per se is an immovable property. Further as per cited Govt. of India Order No. 58/1/2002-Cx dated 15-1-2002, the relevant extract is reproduced as follows and we hold that its rationale and concept is relevant under GST scheme of law also:

“(vi) The If the goods are incapable of being sold, shifted and marketed without first being dismantled into component parts, the goods would be considered as immovable and therefore not excisable to duty.”

Thus, ‘Ventilation system’ is a combination of various components and partsresulted into an immovable property. Further as per the Hon’ble Supreme Court’s ‘ test of permanency’ laid down in Municipal Corporation of Greater Bombay &ors. V. Indian Oil Corporation Ltd. [199 Suppl. SCC 18], we find the Ventilation System passed the test of permanency.

12. We find that the cited CBEC Order No. 58/1/2002-Cx dated 15-1-2002 was issued for the purpose of uniformity in connection with classification of goods erected and installed at site,as plethora of judgments appear to have created some confusion with the assessing officers, the matter was been examined by the Board (CBEC) in consultation with the Solicitor General of India. For issuance of this said CBEC Order, a number of Apex Court judgments delivered on this issue in the recent past was considered by CBEC and some of the important ones were mentioned in the said CBEC order dated 15-1-2002 which are reproduced a follows:

“Para 3(i) Quality Steel TubesPvt. Ltd. v. CCE [1995 (75) E.L.T. 17 (S.C.)]

(ii) Mittal Engineering Works Pvt. Ltd. v. CCE, Meerut [1996 (88) E.L.T. 622(S.C.)]

(iii) Sirpur Paper Mills Limited v. CCE, Hyderabad [1998 (97) E.L.T. 3 (S.C.)]

(iv) Silica Metallurgical Ltd. v. CCE, Cochin [1999 (106) E.L.T. 439(Tribunal)] as confirmed by the Supreme Court vide their order dated 22-2-99 [1999 (108) E.L.T. A58 (S.C.)]

(v) Duncan Industries Ltd. v. CCE, Mumbai [2000(88) ECR 19 (S.C.)]

(vi) Triveni Engineering & Industries Ltd. v. CCE [2000 (120) E.L.T. 273 (S.C.)]

(vii) CCE, Jaipur v. Man Structurals Ltd. [2001 (130) E.L.T. 401 (S.C.)]

13. We also find that the applicant has referred to various decisions of the Supreme Court to support their contention. The decisions of Quality Steel tubes(P) ltd. vs. Collector of Central Excise, U.P. [1995 (75) ELT.17 (SC)-1995 (2) SCC 372] and Mittal Engineering Works(P)ltd. vs. Collector of Central Excise, Meerut[1996 (88) ELT.622 (SC)-1997 (1) SCC 203] are not applicable in the instant case as in both the cases, the excisability of the goods in question has been discussed by the Supreme Court. Further, the decisions of CCE, Ahmedabad vs. Solid & Correct Engineering Works as well as that of Sirpur Paper mills ltd. vs. Collector of Central Excise, Hyderabad are also not applicable since it pertains to machines fixed by nuts and bolts to a foundation or attaching of the machine to a concrete base for preventing wobbling whereas the issue in the present case pertains to installation of air conditioning & cooling system and ventilation system and not machines. The decision in the case of CCE, Chennai vs. Kone Elevators India ltd. [2006 (6) TMI 142-CEGAT, Chennai-2001 (138) ELT. 638(Tri-Chennai) is also not applicable as it pertains to installation of lifts in the building which is an issue different from the present case. We find that the decisions in the case of Triveni Engg. & Industries ltd. vs. CCE, Municipal Corporation of Great Bombay & Ors. Vs. Indian Oil Corporation ltd. as well as CBEC’s order No.58/1/2002-CX dated 15-1-2002 referred to by the applicant are squarely applicable in the present case.

14. In Conspectus of aforementioned findings, we issue the Ruling:

RULING

Input tax credit is not admissible on Air-conditioning and Cooling System and Ventilation System, as this is blocked credit falling under Section 17(5)(c) CGST Act.

Prices of BUSY Increasing from 1st June, 2024. Click Here

Prices of BUSY Increasing from 1st June, 2024. Click Here