ORDER BEST MONEY GOLD JEWELLERY LIMITED, 20B, KALIAMMAN KOIL STREET, SAI NAGAR, VIRUGAMBAKKAM, CHENNAI-600092 (hereinafter called the Applicant) are registered under GST with GSTIN 33AAGCB1247B1ZD. The applicant has sought Advance Ruling on the following question:

In case the applicant has purchased used/second hand gold jewellery or ornaments from persons who are not registered under GST and that at the time of sale of such goods there is no change in the form/nature of such goods and ITC will also not be availed on such purchase, if so the case, whether GST is to be paid only on the difference between the selling price and purchase price as stipulated under Rule 32(5) of CGST Rules, 2017?

The Applicant has submitted the copy of application in Form GST ARA – 01 and also submitted a copy of Challan evidencing payment of application fees of ₹ 5,000/- each under sub-rule (1) of Rule 104 of CGST rules 2017 and SGST Rules 2017.

2.1 The applicant has stated that they are engaged in the business of buying and selling of old/used/second hand gold jewellery/ornament from the unregistered person, who are all general public and will be sold ‘as such’ to the end consumers. They are also having branches across Tamil Nadu. They have stated that the used/second hand gold ornaments are sold in the same form in which they are purchased to another registered or unregistered person, except for some minor processing in the form of cleaning and polishing but without altering the nature of such ornament/jewellery. They have stated that as they have purchased old/used/second hand gold jewellery/ornament from the unregistered persons there is no scope for availment of Input tax credit as per Section 16 of the CGST Act for them as such unregistered person will not charge GST. They have stated that presently they are charging GST at 3% [CGST-1.50% ; TNGST -1.50%] on the entire consideration received from the customers on account of sale of such old/used/second hand gold jewellery/ornament. In view of the above facts, the applicant is seeking the authority to determine the value of supply as per Section 15 (5) of CGST act read with Rule 32(5) of CGST Rules, 2017.

2.2 On interpretation of law the applicant has stated that Section 15 of CGST Act deals with the value of Supply of goods or services. But in case of used / secondhand goods, the value of supply will be determined as per Section 15 (5) of the CGST Act, in the manner prescribed by the Government on the recommendation of the Council through a Notification. Thus, Rule 32(5) of CGST Rules prescribes the manner of determination of Value of such second-hand goods. As such, Rule 32(5) provides that where a taxable supply is provided by a person dealing in buying and selling of second-hand goods Le., used goods as such or after such minor processing which does not change the nature of the goods and where no input tax credit has been availed on the purchase of such goods, the value of supply shall be the difference between the selling price and the purchase price and where the value of such supply is negative, it shall be ignored. The applicant has stated that the term “second hand goods” specified in Rule 32 (5) is being interpreted to mean the goods which are used as such or after minor processing, the nature of such goods should not alter and where no input tax credit has been availed on purchase of such goods. The term ‘second hand goods’ or ‘used goods’ are not defined in either CGST Act or CGST Rules. Similarly, the term ‘second hand goods’ or used goods’ is also not defined in General Clauses Act. Since there is no statutory definition for ‘second-hand goods’ as well as ‘used goods’ they have referred to the dictionary meaning or trade parlance meaning of ‘Second-hand goods’ or used goods’ for interpretation in Rule 32(5), which are as below:

A. Second Hand Goods:

i. Second-hand things are not new and have been owned by someone else (Collins Dictionary)

ii. having had a previous owner; not new (English Oxford Dictionary)

iii. not new; having been used in the past by someone else (Cambridge English Dictionary)

iv. acquired after being used by another (Merriam Webster)

v. previously used or owned (Dictionary.com)

B. Used Goods:

i. already owned or put to a purpose by someone else; not new (Cambridge Dictionary)

ii. that has endured use (Merriam Webster)

2.3 The applicant has further stated that it is settled jurisprudence that when the words of a statute is clear, plain and unambiguous, i.e. they are reasonable susceptible to only one meaning, the courts are bound to give effect to that meaning irrespective of consequences. Moreover, if the words of the statute are in themselves precise and unambiguous, then no more can be necessary than to explicate those words in their natural and ordinary sense. The applicant has referred to the following case laws where the above rule of interpretation has been followed:

- Nelson Motisv. Union of India (AIR 1992 SC 1981) = 1992 (9) TMI 355 -SUPREME COURT

- Gurudevantt VKSSS Maryadit v. State of Maharashtra (AIR 2001 SC 1980) =2001 (3) TMI 976 – SUPREME COURT

- Swedish Match AB v. Securities and Exchange Board of India (AIR 2004 SC 4219) = 2004 (8) TMI 389 – SUPREME COURT

- Government of Andhra Pradesh v. Road Rollers Owners Welfare Association [2004 (6) SCC 210) – 2004 (4) TMI 602 – SUPREME COURT

Hence, the applicant has submitted that, since they are engaged in the business of buying and selling of old/used/second-hand ornaments / jewellery under HSN Code 7113, they are very much eligible to avail the benefit of Margin Scheme for determination of value of supply as per Rule 32 (5) of CGST Rules read with Notification No. 10/2017- Central Tax (Rate) dated 28.06.2017.

2.4 The applicant has also submitted that they have complied with all the conditions specified in Rule 32(5) of CGST Rules which are discussed as below:

i. Input Tax Credit not claimed:

The Applicant is predominantly purchasing the old / used / second-hand ornaments / jewellery only from the unregistered persons and hence there is no clear-cut scope for availing Input Tax Credit in this aspect, as such suppliers will not charge GST on their bills.

ii. Goods sold either ‘as such’ or ‘with minor modifications’:

The Applicant is buying the old / used Gold Ornaments viz., Necklace, Oram, Ring, Bangles, etc from the unregistered persons and may sell some time as such to their customers or if the Customers prefer, they may clean or polish such Gold Ornaments without changing its nature. As such, the Applicant is selling those used Gold Ornaments as a Second-Hand goods without melting, altering or changing its form, instead the goods bought will be sold as such’. The Gold Necklace bought will be sold only as Gold Necklace. Similarly, the Gold Ring bought will be sold only as Gold Ring, just polishing or cleaning will alone be done. Thus, it is submitted by the Applicant that they are selling the old / used / second-hand Gold Ornaments / Jewellery only ‘as such’.

iii. Applicant is a dealer in Secondary Market dealing in Second-hand goods:

Generally, the Jewellery market is divided into two segments (i.e.) i.e. primary market and secondary market. A primary market means market where goods come for the first time at a retail shop or any other way for reaching ultimate consumers. This is the time when the price for the goods is established for the first time. Once the goods are purchased from the primary market and when such purchaser or consumer decides to sell it, such goods enter the secondary market either as used goods or as second-hand goods. The Applicant is one such dealer in the secondary market procuring second-hand or used Jewellery or Gold Ornament from unregistered persons or end users.

2.5 Further they have submitted that if Rule 32(5) is being interpreted to take a view that Rule 32(5) applies only to sale of goods, which are purchased on payment of GST and where credit of such tax is not availed. This interpretation will make Rule 32 (5) redundant in majority of transactions as such second hand or used goods are normally purchased from individuals not liable to tax as such goods are not sold by them in course or furtherance of business. If this interpretation is taken, most of the dealers in second hand goods will not be entitled to take valuation as prescribed under Rule 32(5) of the CGST Rules. Moreover, the second-hand goods when it is purchased for the first time from primary market it would suffer the levy of indirect tax i.e. VAT, GST, etc. It therefore means that when the tax is paid on margin on sale of second-hand goods, these goods have suffered full tax. The question may arise in which circumstances the phrase used in Rule 32(5) “where no input tax credit has been availed on the purchase of such goods” shall apply. The purpose of this phrase used in Rule 32(5) seems to prevent the dealer purchasing second hand goods or used goods from registered person on payment of GST and availing dual benefit of paying the tax on margin and claiming input tax credit simultaneously.

2.6 The applicant has stated that the GST is a value added tax and each person in the value addition chain is expected to pay tax on the value addition made by him in the transaction. The intention of promulgating Rule 32(5) is to ensure that a dealer operating in unorganized sector (buying second hand or used goods from unregistered persons or non-business entities) is not burdened with tax liability disproportionate to value addition done by him in the supply chain. In majority of the cases, the margin of such second-hand goods dealer is less than the tax leviable on such goods under normal scheme of taxation and hence need for such provision. They have also stated that it is settled principle of interpretation that if a statutory provision is open to more than one interpretations, one has to choose that interpretation which represents the true intention of the legislature. A statute is to be construed according to the intent of them that make it and the duty of judicature is to act upon the true intent of the legislature i.e. mens or sententia legis (Salmond: “Jurisprudence’ 11th Edition). The applicant has relied upon the following judicial pronouncements where the principle of interpretation has been enshrined:

- Venkataswami Naidu, R vs Narasram Naraindas (AIR 1966 SC 361) = 1965 (4) TMI 122 – SUPREME COURT

- District Mining Officer vs Tata Iron and steel co. (AIR 2001 SC 3134) = 2001 (7) TMI 1277 – SUPREME COURT

- Bhatia International vs. Bulk Trading SA (AIR 2002 SC 1432) = 2002 (3) TMI 824 – SUPREME COURT

- South Asia Industries (Pvt) Ltd vs. Sarup Singh (AIR 1966 SC 346) = 1965 (4) TMI 112 – SUPREME COURT

- Kartar Singh vs. State of Punjab [JT(1994) 2 SC 423] = 1994 (3) TMI 379 -SUPREME COURT

- Narayanaswami vs. G. Panneerseviam (AIR 1972 SC 2284) = 1972 (4) TMI 95 – SUPREME COURT Rule 32(5)

2.7 They have stated that such presumptive schemes are promulgated for trade facilitation or for convenience of tax administration. Once such valuation scheme is on the statue book, it is mandatory for Assessee as well as tax authorities to follow it in letter and spirit, irrespective of revenue considerations. Once the goods are second hand or used goods, Rule 32(5) is applicable irrespective of value of such goods and irrespective of nature of such goods.

2.8 In view of the above facts, the applicant has stated that they have fulfilled all the conditions specified in Rule 32(5) of the CGST Rules and they are eligible to adopt the Margin Scheme for determination of value of supply of such Old / Used / Second hand Jewellery and thereby they can arrive at the value of such goods as the difference between the value at which the goods are supplied and the price at which the goods arc purchased. If there is no margin, no GST is charged for such supply. They have referred to the following case laws to substantiate their contentions for the instant case.

- M/s. Attica Gold Private Limited -[2020 (4) TMI 690 -AAR, Karnataka/KAR ADRG 15/2020

- M/ s. Aadhya Gold Private Limited – (2021 (7) TMI 548 – AAR, Karnataka)-KAR ADRG 35/2021

- M/s. Safset Agencies Private Limited – (2019 (6) TMI 822 – AAR, Maharashtra) – GST-ARA-86/2018-19/B-07

- M/s. Safset Agencies Private Limited – (2020 (6) TMI 678 – AAAR, Maharashtra) – GST-AAAR-SS-RJ/08/2019-20

3.1 Due to the prevailing PANDEMIC situation and in order not to delay the proceedings, the applicant was addressed through the Email Address mentioned in the application to seek their willingness to participate in a virtual Personal Hearing in Digital media. The applicant consented and the hearing was held on 20.01.2022. The Authorised Representative CA. Balasubramanian appeared for the hearing and reiterated the submissions in detail. He explained the relevance of the rulings of AAAR/AAR relied upon by them. He stated that the old gold will be purchased through a voucher, polishing and cleaning of the goods will be undertaken in the branches of the applicant without involving any goldsmith activity and thereafter will be sold through retail outlets/dealers. He was asked to furnish a detailed write-up on the process undertaken from purchase of the old gold to the end sale with the documents/ trail of accounts at each stage along with the details of whether the goods are sold as second-hand sale and the accounting of the same in case they are sold along with new ornaments.

3.2 The applicant vide their letter dated 28.02.2022 (received on 14.03.2022) submitted the following facts/documents:

- Detailed process involved in purchase of old gold/jewels:

List of documents collected from the customers at the time of buying the old gold from sellers, who are normally unregistered persons:

i. KYC of the supplier will be verified after collecting the Address proof, Seller Photo, Jewel photo, Signature / Thumb Impression, copy of Bank pass Book, proof of witness, contact Number of the seller, Employment / occupation proof, etc.

ii. Application for acceptance of sale of old Gold / Jewels

iii. Declaration of the seller that the old Gold / ornaments offered for sale is used by them for a longer period and also not stolen goods. Further the seller will also give a declaration that jewels which are being offered for sale is free from encumbrances. In case of any legal issue, all the remedies will be borne by the seller alone.

iv. Detailed sale Agreement / promissory Note containing various terms and conditions applicable for sale duly signed by the seller.

v. Declaration to Police Station and to the Best Money Gold Jewellery Limited by the Seller regarding the sale of Old Gold/ jewels.

-

- Authentication of the seller is being verified by the designated Department in detail along with the above documents.

- old Gold / Jewels purchased will be subject to the detailed technical evaluation by the technical team of the company and will estimate the weight and quality of the old Gold / Jewels for valuation.

- Details of the list of jewels of ornaments viz., Bangles, Necklace, Ring, etc is specifically mentioned in the sale agreement along with the Weight, Wastage, etc.

- After valuation, the sale amount will be paid to the sellers either through ‘cash / cheque / NEFT / RTGS, etc after issuing the purchase receipt.

- once old Gold/Jewels in the form of the Bangles, Necklace, Ring, etc. are purchased after completing the above formalities the same will be subject to the processing of cleaning which involves the process of manually cleaning the Old Gold / Jewels with Soap Oil and polishing with Brush Puffing. But in no case the process will alter / change the form of the Old Gold / Jewel Ornaments, the activity involves only the simple cleaning activity and Bangle will remain the same Bangle and Ring remains the same ring and so on. The above cleaning activities are being undergone in regional office at Chennai, Madurai, Coimbatore, Theni, Trichy, Salem, Erode, Villupuram, Cuddalore, Sivagangai, Tanjore etc., and also we got melting centres in Chennai, Coimbatore and Trichy for conversion of old gold in to bullion. The old ornaments purchased in different locations send to the various regional headquarters as above, and there it will be graded for second sales and the balance which will not fit for second sales will be sent to melting centres for conversion of bullion

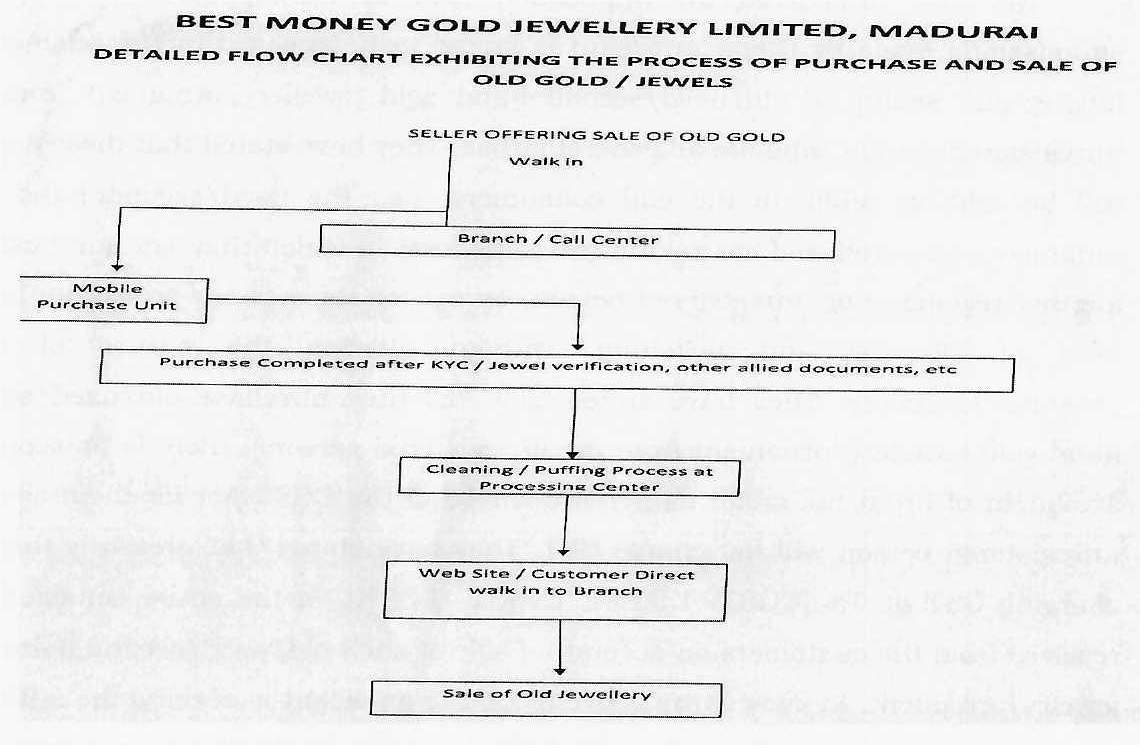

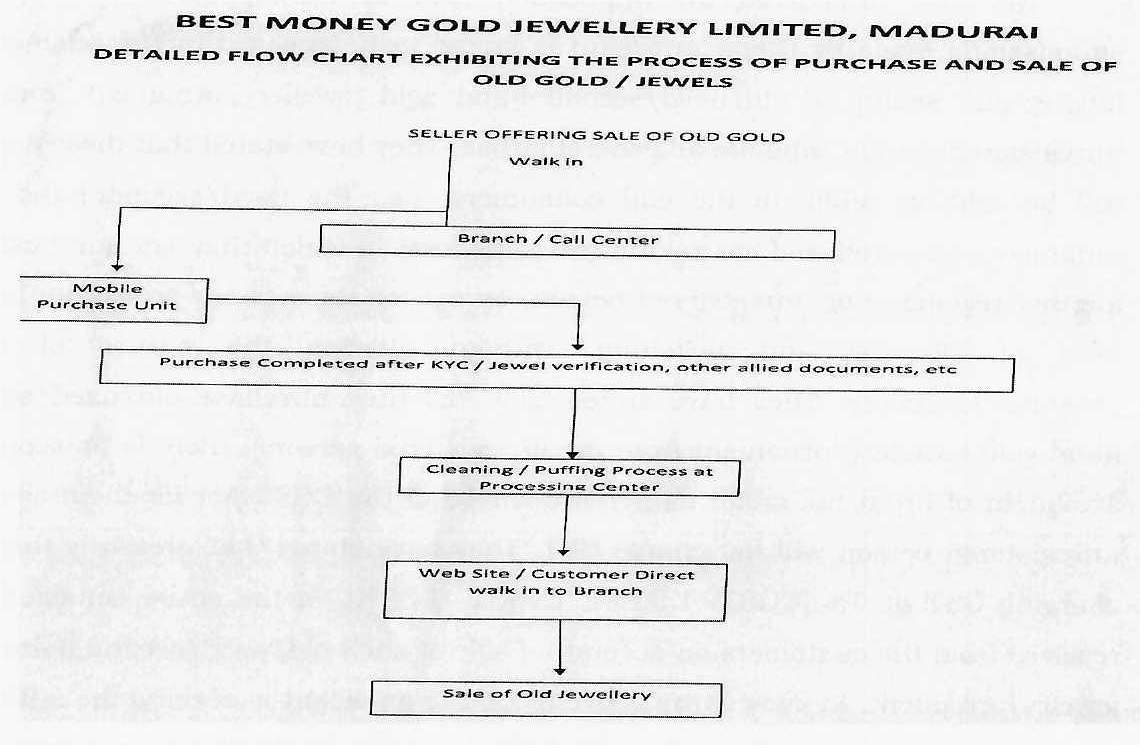

- The flow chart showing the process commencing from purchase of old gold to sale of old gold is given below:

-

- The applicant has also submitted the following documents:

i. Application for acceptance of sale of old gold

ii. Sale agreement

iii. Declaration to police station and the applicant

iv. purchase receipt

v. seller declaration

vi. tax invoice for sale

4. The Centre Jurisdictional authority, Chennai South Commissionerate, who has administrative control over the applicant was addressed vide this office letter dt.17.11.2021 requiring to furnish the comments on the issue raised by the applicant and to report whether any proceedings are pending in respect of the applicant. The said authority has not furnished the report on pending proceedings and the comments on the issues raised in reply to the letter, in spite of reminders dt.19.01.22 and 23.03.2022. Hence it is construed that no proceedings are pending in respect of the applicant.

5. The State Jurisdictional authority has submitted that there are no pending proceedings in the applicant’s case in their jurisdiction.

6. We have considered the application filed by the applicant and various submissions made by them. Applicant is stated to be engaged in the business of buying and selling of old/used/second hand gold jewellery/ornament from the unregistered person, who are all general public. They have stated that these articles will be sold ‘as such’ to the end consumers, i.e., the used/second hand gold ornaments so purchased are sold in the same form in which they are purchased to another registered or unregistered person, except for some minor processing in the form of cleaning and polishing, without altering the nature of such ornament/jewellery. They have stated that as they purchase old/used/second hand gold jewellery/ornament from the unregistered persons, there is no scope for availment of Input tax credit as per Section 16 of the CGST Act for them as such unregistered person will not charge GST. They have stated that presently they are charging GST at 3% [CGST-1.50% ; TNGST -1.50%] on the entire consideration received from the customers on account of sale of such old/used/second hand gold jewelry/ornament. In view of the above facts, the applicant is seeking the authority to determine the value of supply as per Section 15(5) of CGST act read with Rule 32 (5) of CGST Rules, 2017 and has applied for ruling on the following question:

In case the applicant has purchased used/second hand gold jewellery or ornaments from persons who are not registered under GST and that at the time of sale of such goods there is no change in the form/nature of such goods and ITC will also not be availed on such purchase, if so the case, whether GST is to be paid only on the difference between the selling price and purchase price as stipulated under Rule 32(5) of CGST Rules, 2017?

The question pertains to determination of value of the goods supplied and the liability to pay tax on such goods sold by the applicant. As the question is falling under the purview of Section 97 (2) of the CGST ACT, 2017 same is admitted and is taken up for consideration on merits.

7.1 The question for ruling is whether the applicant is eligible to avail Rule 32(5) of the CGST Rules 2017 in as much as they are involved in selling the used/second hand gold jewelry and ornaments. The relevant rule is reproduced below:-

“Rule 32. Determination of value in respect of certain supplies.-

(1) Notwithstanding anything contained in the provisions of this Chapter, the value in respect of supplies specified below shall, at the option of the supplier, be determined in the manner provided hereinafter.

(2)………………..

(3)……………….

(4)………………

(5) Where a taxable supply is provided by a person dealing in buying and selling of second hand goods i.e., used good as such or after such minor processing which does not change the nature of the goods and where no input tax credit has been availed on the purchase of such goods, the value of supply shall be the difference between the selling price and the purchase price and where the value of such supply is negative, it shall be ignored:”

7.2 The rule 32(5) above, stipulates the method of working of the taxable value of a supply and is applicable if the following conditions are satisfied:

(a) The supply made by the supplier must be a taxable supply

(b) The supplier shall be a person dealing in buying and selling of second-hand goods, that means

- Used goods as such or after such minor processing which does not change the nature of the goods and

- Where no input tax credit has been availed on the purchase of such goods.

7.3 In the instant case, the applicant is effecting the supply of jewellery which is taxable under the GST Act as it is covered under entry no.13 of Schedule V to the Notification No.01/2017-Central Tax (Rate) dated 28th June, 2017 which is taxable at 1.5% under the CGST Act and similarly taxable under the SGST Act, 2017 also at 1.5%. Hence, the supplier satisfies the condition that the supply made by him must be a taxable supply.

7.4 The second condition is that the supplier shall be a person dealing in buying and selling of second-hand goods i.e., used goods as such or after such minor processing which does not change the nature of goods. In this respect the applicant has submitted that the old/used gold jewels in the form of say Bangles, Ring, Necklace etc are purchased and after completing certain formalities such as

(i) Verification of KYC of the seller, the Occupation and address proof

(ii) Application for acceptance of sale of old gold

(iii) Declaration of the seller that the old gold/ornaments offered are not stolen goods and have been used for a long time, that they are without any encumbrance

(iv) Entering into sale agreement

(v) Declaration to Police station and to the applicant regarding sale of old gold by the seller

(vi) Authentication of seller being verified by the applicant with the documents provided

(vii) Technical evaluation of old gold and estimation of weight and quality

(viii) Payment of consideration through Cash/ cheque/ NEFT/ RTGs etc after issuing the purchase receipt.

They have stated that the purchased jewellery will be subject to the process of cleaning which involves the process of manual cleaning with soap oil and polishing with brush puffing (not substantiated with documentary proof). Applicant has stated that in no case the process will alter/change the form of old gold/Jewel/ornaments and the ornaments/jewels so purchased say as bangle will remain as bangle and ring will remain as ring and so on. Thus the applicant has submitted that the processing undertaken does not change the nature of goods, though not substantiated with documentary evidences.

7.5 The third condition mentioned in the rule is that no input tax credit should have been availed on such goods. In this respect, applicant has furnished that they predominantly buy such old/used gold jewel /ornaments only from unregistered individuals and hence there is no scope for availing Input Tax Credit as such suppliers will not charge GST on their bills. From the copy of purchase receipt dt.16.12.2021, issued to Mr. Ogalvi Micheal Sigamoney, submitted by the applicant it is seen that the used jewel/ornaments have been purchased from an individual and a declaration that such jewels are his personal assets is certified in the receipt itself by the seller of such ornaments.

8.1 From the above discussions, it is seen that the applicant is engaged in taxable supply of jewellery. They are dealing in buying the jewellery from the individuals as seen from the document furnished. To substantiate that the so purchased jewellery was subjected to only minor process which do not change the nature of the goods, the applicant has not furnished any documentary evidence, though the same was specifically called for during the hearing. The applicant has submitted a sample invoice no. ARA/07/2021-2022 dt. 01.12.2021 mentioning `sale of Used Gold Ornament’ issued to Mrs. Aarthi Abinaya, for the gold ornaments namely stud with jimikki and ring. However, Purchase receipt number/grammage for such purchase is not indicated in the said sale invoice. Also, in the purchase invoice submitted the ornaments said to have purchased do not include the ‘Stud with Jimikki’ and ‘ring’ and hence from the furnished documents, we are constrained to verify the claim of the applicant that he undertakes sale of used goods.

8.2 During the hearing held on 20.01.2022, the applicant was specifically asked to furnish ‘write-up on the process undertaken from Purchase of the Old Gold to the end sale with the documents/trail of accounts at each stage along with accounting for sale as second-hand’. The applicant did not furnish the details and notice was sent to him on 09.02.2022 and on 02.03.2022 requiring him to furnish such details. The applicant has furnished the detailed flow chart exhibiting the process of purchase and sale of old gold/jewels, but the same is not substantiated with Purchase to end stage documents & the accounting of the purchase, process undertaken and sale of such goods as required by this Authority. Advance ruling is a facility extended and the person seeking the same has to furnish the details as required by this authority to verify and pronounce the ruling. In the instant case, from the documents furnished, there is no clear cut link between purchase & sale, and the applicant do not furnish the purchase details and grammage in the sale invoice. Thus the applicant has not furnished with the documentary proof that he satisfies the conditions provided under Rule 32 (5) enabling him to adopt the differential value as prescribed in the said rule. Hence, No ruling is extended.

9. In view of the above, we rule as under:-

RULING

The applicant has failed to furnish the substantiating documents as required by this authority and therefore, no ruling is extended on the question sought

Prices of BUSY Increasing from 1st June, 2024. Click Here

Prices of BUSY Increasing from 1st June, 2024. Click Here