Guitar Head Publishing Llp vs. Na

(AAR (Authority For Advance Ruling), Karnataka)

ORDER UNDER SECTION 98(4) OF THE CGST ACT, 2017 & UNDER SECTION 98(4) OF THE KGST ACT, 2017

M/s. Guitar Head Publishing LLP, # 306/A, Ground Floor, 13th Cross, Near LCA Ramesh Nagar, Marathahalli, Bengaluru-560037 having GSTIN number(29AAVFG2223Q1ZN), have filed an application for Advance Ruling under Section 97 of CGST Act,2017, KGST Act, 2017 & IGST Act, 2017 read with Rule 104 of CGST Rules 2017 & KGST Rules 2017, in form GST ARA-01 discharging the fee of ₹ 5,000/- each under the CGST Act and the KGST Act.

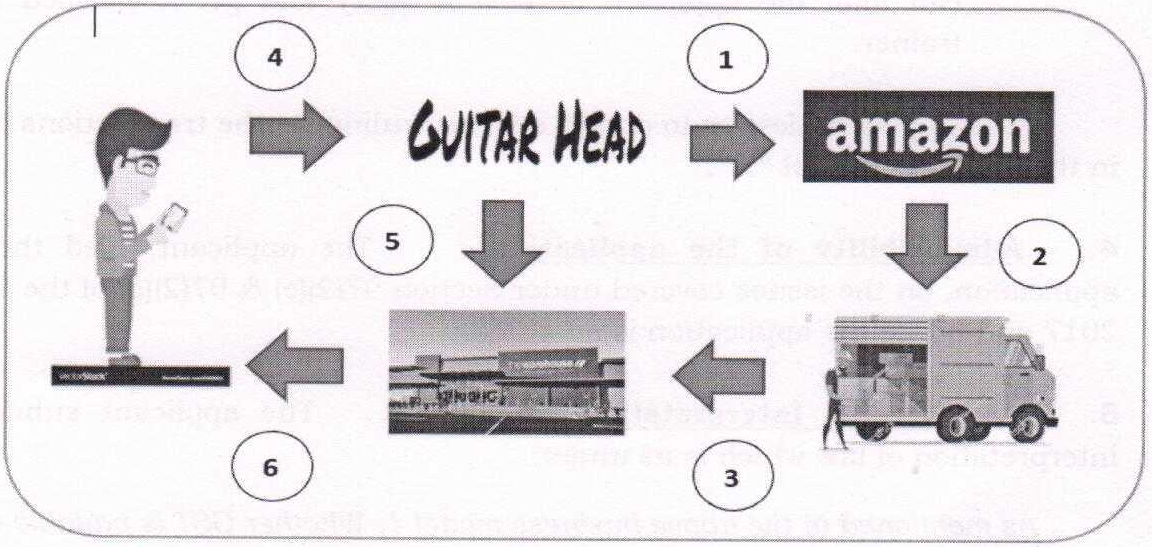

2. The Applicant is engaged in business of selling guitar training books in United States of America, United Kingdom & Canada through their Website. Applicant sends soft copy of the book to the printer located in USA, who in turn prints it and Ships to the customer located in USA, UK and Canada. Further, in another business model Applicant is having an agreement with Amazon Inc. Who through their website “amazon.com” based on the choice of the customers either prints the books and sells it to the consumers on their own account or will share the link to download the e-books material in an of the electronic devices & pays royalty to Applicant as agreed between the 2 parties.

In view of the above, the Applicant sought advance ruling in respect of the following question.-

i. Whether GST is payable on Guitar Head Books purchased from Amazon Inc.-USA (located outside India) in a context where the Guitar Head Books so purchased are not brought into India?

3. Statements of relevant facts having a bearing on the question(s) raised:

3.1 The Applicant is in the business of selling guitar training books in United States of America, United Kingdom & Canada through their Website. Applicant sends soft copy of the book to the printer located in USA, who in-turn prints it and Ships it to the customer located in USA, UK and Canada. Further, in another business model Applicant is having an agreement with Amazon Inc. who through their through their website “amazon.com” based on the choice of the customers either prints the books and sells it to the consumers on their own account or will share the link to download the e-books material in any of the electronic devices & pays royalty to Applicant as agreed between the 2 parties.

3.2 Applicant is a Limited Liability Partnership registered under the LLP Act 2008. Applicant’s vision is to make available the guitar training books to every individual in the countries of USA, UK & Canada either the paperback books or e-books and also reach entire global market at the earliest. The main intention for guitar training books is that, in learning music from musician – there are few limitations like: long duration, physical attendance for training. But, with the applicant’s guitar training books, every individual can learn at their leisure time.

3.3 Business model:

Applicant has three 3 models:-

a) Sales through Own website

b) Sales through Amazon platform

c) Online Guitar training Courses through the website of Guitar Head

Sales through own website:

In this transaction, Applicant places the order with Amazon Inc to supply Guitar Head Books. Amazon Inc supplies the Guitar Head Books by billing it to Guitar Head Bangalore and Ships the Guitar Head Books to the warehouse located outside India. The books are stored in the warehouse for quick delivery to the customer.

Customer in USA, UK and Canada places an order through Applicant’s website by making payment in Foreign Currency. Applicant shares the order detail to the warehouse service provider, who in turn ships the books to customer. Applicant pays warehouse charges & Shipping charges to the respective service provider. Applicant collects with the price of book along with shipping charges.

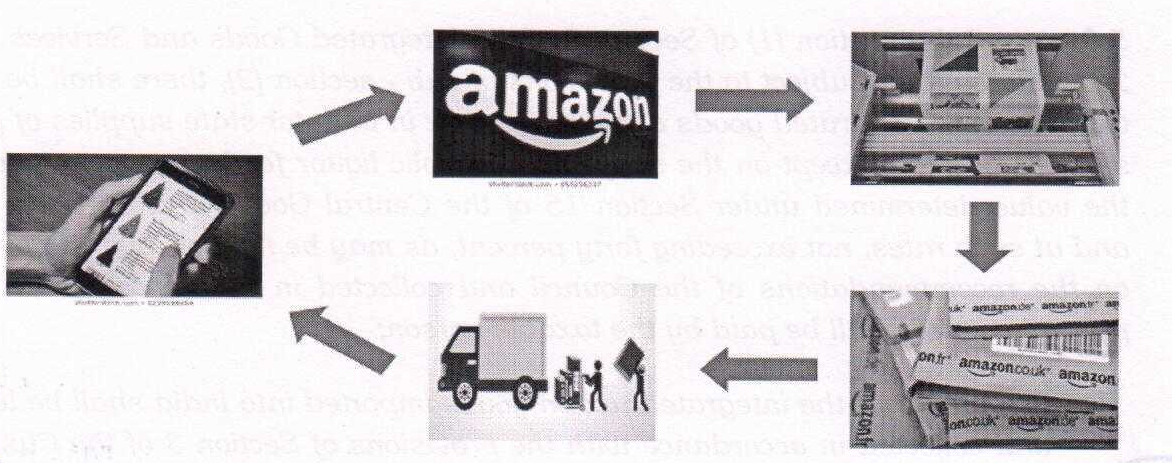

Sales through Amazon platform:

Customer places an order through Amazon web portal by making payment either for physical book or e-book. Amazon collates all the orders, print the books & ships to customers located outside India and in case of e-books, Amazon will share the link to download the material in any of the electronic devices. Amazon will pay royalty to Applicant at agreed rates.

Online Guitar training courses through the Applicant website:

In this transaction, the applicant is proposed to start Online guitar courses through its own website. Customers can purchase the course on the website. They will be provided with a User ID and grant access to the course platform. The customer is required to login with the user ID and Password to view the course. The sessions are pre-recorded and require continuous availability of internet to access the course. In case the students need any clarification regarding the content of the course, they can mail the applicant or post a query and get it clarified from the trainer.

The applicant desires to obtain advance ruling for the transactions occurring in the business Model “A”.

4. Admissibility of the application : The applicant, filed the instant application, on the issues covered under Section 97(2)(e) & 97(2)(g) of the CGST Act 2017 and hence the application is admitted.

5. Applicant’s interpretation of law : The applicant submits their interpretation of law which is as under:

As mentioned in the above business model 1, Whether GST is payable on Guitar Head Books purchased from Amazon Inc – USA (located outside India) in a context where the Guitar Head Books so purchased are not brought into India?

5.1 As per Section 2(10) of the Integrated Goods and Services Tax Act, 2017, “import of goods” with its grammatical variations and cognate expressions, means bringing goods into India from a place outside India.

5.2 As per sub-section (2) of Section 7 of the Integrated Goods and Services Tax Act, 2017, supply of goods imported into the territory of India, till they cross the customs frontiers of India, shall be treated to be a supply of goods in the course of inter-state trade or commerce.

5.3 Sub – section (1) of Section 5 of the Integrated Goods and Services Tax Act, 2017 states that, subject to the provisions of sub – section (2), there shall be levied a tax called the integrated goods and services tax in all inter-state supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under Section 15 of the Central Goods and Services Tax Act, and at such rates, not exceeding forty percent, as may be notified by the Government on the recommendations of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person;

Provided that the integrated tax on goods imported into India shall be levied and collected in accordance with the provisions of Section 3 of the Customs Tariff Act, 1975, on the value determined under the said Act at the point of when duties of customs are levied on the said goods under Section 12 of the Customs Act, 1962.

5.4 The Customs Tariff Act, 1975 was amended by The Taxation Laws Amendment Act, 2017 by introducing sub-section (7) in Section 3 of the Customs Tariff Act, 1975 with effect from 01.07.2017 to enable collection of integrated tcuc on the goods imported. The relevant provisions of the amended Section 3 of the Customs Tariff Act, 1975 reads as follows.-

(7) Any article which is imported into India shall, in addition, be liable to integrated tax at such rate, not exceeding forty per cent as is leviable under section 5 of the Integrated Goods and Services Tax Act, 2017 on a like article on its supply in India, on the value of the imported article as determined under sub-section (8) or sub-section (8A), as the case may be.

(8) For the purposes of calculating the integrated tax under sub-section (7) on any imported article where such tax is leviable at any percentage of its value, the value of the imported article shall, notwithstanding anything contained in section 14 of the Customs Act, 1962, be the aggregate of-

(a) the value of the imported article determined under sub-section (1) of section 14 of the Customs Act, 1962(52 of 1962) or the tariff value of such article fixed under sub-section (2) of that section, as the case may be; and.

(b) any duty of customs chargeable on that article under section 12 of the Customs Act, 1962 (52 of 1962), and any sum chargeable on that article under any law for the time being in force as an addition to, and in the same manner as, a duty of customs, but does not include the tax referred to in sub-section (7) or the cess referred to in sub-section (9).

(12) The provisions of the Customs Act, 1962(52 of 1962) and the rules and regulations made there under, including those relating to drawbacks, refunds and exemption from duties shall, so far as may be, apply to the duty or tax or cess, as the case may be, chargeable under this section as they apply in relation to the duties leviable under that Act.

5.5 The relevant provisions of the Customs Act 1962are reproduced below.

SECTION 12: Dutiable goods,-

i. Except as otherwise provided in this Act, or any other law for the time being in force, duties of customs shall be levied at such rates as may be specified under the Customs Tariff Act, 1975(51 of 1975), or any other law for the time being in force, on goods imported into, or exported from, India.

ii. The provisions of sub-section (1) shall apply in respect of all goods belonging to Government as they apply in respect of goods not belonging to Government.

SECTION 15: Date for determination of rate of duty and tariff valuation of imported goods.

(1) Rate of duty and tariff valuation, if any, applicable to any imported goods, shall be the rate and valuation in force, –

i. in the case of goods entered for home consumption under section 46, on the date on which a billof entry in respect of such goods is presented under that section.

ii. in the case of goods cleared from a warehouse under section 68, on the date on which a bill of entry for home consumption in respect of such goods is presented under that section.

iii. in the case of any the goods, on the date of payment of duty:

Provided that if a bill of entry has been presented before the date of entry inwards of the vessel or the arrival of the aircraft or the vehicle by which the goods-are imported, the bill of entry shall be deemed to have been presented on the date of such entry inwards or the arrival, as the case may be.

(2) The provisions of this section shall not apply to baggage and goods imported by post.

5.6 From a combined reading of the above provisions of the IGST Act, 2017, the Customs Tariff Act, 1975, and the Customs Act, 1962, it is evident that the integrated tax on goods imported into India shall be levied and collected at the point when duties of customs are levied on the said goods under Section 12of the Customs Act, 1962 i.e. on the date determined as per provisions of Section 15 of the Customs Act, 1962.

5.7 Reference has been received in the Central Board of Excise and Customs regarding clarity on Leviability of Integrated Goods and Services Tax (IGST) on High Sea Sales of imported goods. The CBEC by Circular No. 33/2017-Customs dated 01.0B.2017had clarified as follows;

2. The issue has been examined in the Board. ‘High Sea Sales’ is a common trade practice whereby the original importer sells the goods to a third person before the goods are entered for customs clearance. After the High sea sale of the goods, the Customs declarations i.e. Bill of Entry etc is filed by the person who buys the goods from the original importer during the said sale. In the past, CBEC has issued various instructions regarding high sea sales appropriating the contract price paid by the last high sea sales buyer into the Customs valuation [Circular No. 32/2004-Cus., dated 11-5-2004 refers].

3. As mentioned earlier, all inter-state transactions are subject to IGST. High sea sales of imported goods are akin to inter-state transactions. Owing to this, it was presented to the Board as to whether the high sea sales of imported goods would be chargeable to IGST twice i.e. at the time of Customs clearance under sub-section (7) of section 3 of Customs Tariff Act, 1975 and also separately under Section 5 of The Integrated Goods and Services Tax Act, 2017.

4. GST council has deliberated the levy of Integrated Goods and Services Tax on high sea sales in the case of imported goods. The council has decided that IGST on high sea sale (s) transactions of imported goods, whether one or multiple, shall be levied and collected only at the time of importation i.e. when the import declarations are filed before the Customs authorities for the customs clearance purposes for the first time. Further, value addition accruing in each such high sea sale shall form part of the value on which IGST is collected at the time of clearance.

5. The above decision of the GST council is already envisioned in the provisions of sub-section (12) of section 3 of Customs Tariff Act, 1975 inasmuch as in respect of imported goods, all duties, taxes, cessess etc shall be collected at the time of importation i. e. when the import declarations are filed before the customs authorities for the customs clearance purposes. The importer (last buyer in the chain) would be required to furnish the entire chain of documents, such as original Invoice, high-seas-sales-contract, details of service charges/commission paid etc, to establish a link between the first contracted price of the goods and the last transaction. In case of a doubt regarding the truth or accuracy of the declared value, the department may reject the declared transaction value and determination the price of the imported goods as provided in the Customs Valuation rules.

5.8 The above circular is applicable in the present case. Similarly, we find that, where, Bill of Entry/import declarations are not being filed with respect to the goods so procured, GST would not be leviable.

5.9 The issue has been decided by Authority for Advance Ruling, Kerala vide ORDER No. CT/12275/18-C3 DATED 26/03/2018 in the case of M/s Synthite Industries Ltd., Kerala. It was held that,-

“The applicant is neither liable to GST on the sale of goods procured from China and directly supplied to USA nor on the sale of goods stored in the warehouse in Netherlands, after being procured from China, to customers, in and around Netherlands as the goods are not imported into India at any point.”

5.10 The issue has been decided by Authority for Advance Ruling, Gujarat vide ORDER No. GUJ/GAAR/R/04/2020 DATED 17/03/2020 in the case of M/s Sterlite Technologies Ltd., Gujarat. It was held that GST is not payable on goods procured from vendor located outside India, where the goods so purchased are not brought into India.

PERSONAL HEARING: / PROCEEDINGS HELD ON 15-12-2020

6. Sri. Veeresh S Kandgol, CA & Authorized Representative appeared for personal hearing proceedings held on 15-12-2020 before this authority.

FINDINGS & DISCUSSION

7. At the outset we would like to make it clear that the provisions of CGST, Act 2017 and KGST, Act 2017 are in pari materia and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act would also mean reference to the corresponding similar provisions in the KGST Act.

8 We have considered the submissions made by the applicant in their application for advance ruling as well as the submissions made by Sri. Veeresh S Kandgol, C A & Authorized Representative during the personal hearing. We also considered the issues involved, on which advance rulings are sought by the applicant, relevant facts & the applicant’s interpretation of law.

9. The applicant, in relation to one of their business models, i.e. model ‘A’, sought advance ruling in respect of the question mentioned at para 2 supra. In the said model the applicant places the order with Amazon Inc to supply Guitar Head Books. Amazon Inc supplies the Guitar Head Books by billing it to Guitar Head Bangalore and Ships the Guitar Head Books to the warehouse located outside India. The books are stored in the warehouse for quick delivery to the customer.

The Customer in USA, UK and Canada places an order through Applicant’s website by making payment in Foreign Currency. Applicant shares the order detail to the warehouse service provider, who in turn ships the books to customer. Applicant pays warehouse charges & Shipping charges to the respective service provider. Applicant collects with the price of book along with shipping charges.

10. The question before us to decide is whether the GST is payable on Guitar Head books purchased from Amazon Inc.-USA (outside India) and sold to customers outside India, when the said books are not brought into India. The applicant quoting the Customs Act 1962 and relevant circular contends that their transaction does not amount to import of goods; even it does not satisfy the high sea sale as the books not crossed the Indian boarders and no bill of entry if filed for such clearance and hence no GST is payable. Further they also referred the ruling of the Advance Ruling Authority, Kerala, in the case of M/s Synthetic Industries Limited.

11. We invite reference to Schedule III relevant to Section 7 of CGST Act 2017, which specifies certain activities or transactions that shall be treated neither as a supply of goods nor a supply of services. Para 7 of the said schedule stipulates that Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India as neither supply of goods nor supply of services. In the instant case the applicant is involved in supply of books, purchased from Amazon who owned the books, from a place outside India, a non-taxable territory, to another place outside India, a non-taxable territory, without the said goods entering into India. Thus the impugned supply of books by the applicant is neither supply of goods nor supply of services, in terms of schedule II to Section 7 of the CGST Act 2017.

12. In view of the foregoing, we pass the following

RULING

The Guitar Head Books purchased from Amazon Inc.-USA (located outside India) and supplied to the customers located outside India, without bringing into India do not attract any GST, in terms of Schedule III to Section 7 of the CGST Act 2017.