Hussain Shoaib Kothalia And Others vs. Subwest Restaurant Llp (Franchise Of M/S. Subway Systems India Pvt. Ltd.)

(Naa (National Anti Profiteering Authority), )

1. The present Report dated 27.12.2019 had been received from the Applicant No. 2, i.e. the Director General of Anti-Profiteering (DGAP), after a detailed investigation under Rule 129 (6) of the Central Goods and Service Tax (CGST) Rules, 2017. The brief facts of the case are that an application was filed by the Applicant No. 1 with the Maharashtra State Screening Committee on Antiprofiteering alleging profiteering in respect of restaurant service supplied by the Respondent despite the reduction in the rate of GST from 18% to 5% w.e.f. 15.11.2017 vide Notification No. 46/2017-Central Tax (Rate) dated 14.11.2017 by way of not making a commensurate reduction in price, in terms of Section 171 of the CGST Act, 2017.

2. The aforesaid issue was examined by the Maharashtra State Screening Committee on Anti-profiteering which observed that the Respondent had not passed on the benefit to his customers on account of reduction in tax rate and forwarded the complaint to the Standing Committee on Anti-profiteering for further action.

3. The Standing Committee on Anti-profiteering examined the reference received from the Maharashtra State Screening Committee in its meeting held on 15.05.2019 and it was decided to refer the matter to the DGAP to initiate an investigation and collect the evidence necessary to determine whether the benefit of reduction in the rate of GST on the supply of “restaurant service” had been passed on by the Respondent to the recipients. The Assistant Commissioner of Sales Tax (D-819), Nodal Division-II, Mazgaon, Mumbai-10, had prepared a summary of the profiteered amount computed on the basis of ratio of ITC available to the taxable turnover of the Respondent which was also enclosed with the reference of the Standing Committee on Anti-profiteering.

4. On receipt of the aforesaid reference from the Standing Committee on Anti-profiteering on 28.06.2019, a Notice under Rule 129 of the CGST Rules, 2017 was issued by the DGAP on 09.07.2019, calling upon the Respondent to reply as to whether he admitted that the benefit of reduction in GST rate w.e.f. 15.11.2017, had not been passed on to his recipients by way of commensurate reduction in prices and if so, to suo moto determine the quantum thereof and indicate the same in his reply to the Notice as well as to furnish all the documents in support of his reply. Further, the Respondent was given an opportunity by the DGAP to inspect the non-confidential evidence/information which formed the basis of the said Notice, during the period 17.07.2019 to 19.07.2019. However, the Respondent did not avail of the said opportunity. The period covered by the DGAP during the current investigation was from 15.11.2017 to 30.06.2019.

5. The Respondent replied to the above said Notice of the DGAP vide various letters but did not furnish the complete and relevant documents. Hence, Summons under Section 70 of the CGST Act, 2017 read with Rule 132 of the CGST Rules, 2017 were issued by the DGAP on 19.09.2019 to Shri Chetan Arora (Designated Partner) and Shri Mitul Trivedi (Authorized Representative of the Respondent), asking them to appear in the office of DGAP on 26.09.2019 and produce the relevant documents. In response to the Summons dated 19.09.2019, the Respondent neither appeared nor submitted the complete required documents and instead vide letter dated 24.09.2019 requested extension of time for a period of 3 weeks.

6. Accordingly, the DGAP issued another Summons dated 27.09.2019 to Shri Chetan Arora (Designated Partner) and Shri Mitul Trivedi (Authorized Representative of the Respondent). However, the Respondent neither appeared nor submitted the requisite documents and vide letter dated 09.10.2019, requested further extension for a period of one week. Vide e-mail dated 19.10.2019, the Respondent submitted partial documents. Accordingly, a final reminder dated 31.10.2019 was sent by the DGAP to the Respondent requesting him to submit the remaining documents but vide his letter dated 04.11.2019 he informed that his system had crashed in the month of January, 2018 and the data was lost completely from the Subway system and even the headquarters of M/s. Subway Systems India Pvt. Ltd. was not able to fetch the details and expressed his inability to submit the requisite documents/information.

7. Vide Letters/e-mails dated 10.12.2019 and 16.12.2019, the DGAP requested the Respondent to submit a letter of undertaking /affidavit with regard to non-availability/recovery of data up to January, 2018 and to furnish a copy of the correspondence and e-mails exchanged with Subway headquarters and with service providers to recover the lost data to ascertain the veracity of the claims made by him. However, the Respondent failed to respond to the above communications.

8. In response to the Notice dated 09.07.2019 and subsequent reminders vide letter/e-mails dated 23.07.2019, 02.08.2019, 20.08.2019, 02.09.2019, 31.10.2019, 10.12.2019, 16.12.2019 and summons dated 19.09.2019 and 27.09.2019, the Respondent submitted his replies vide e-mails/letters dated 22.07.2019, 19.08.2019, 26.08.2019, 30.08.2019, 12.09.2019, 24.09.2019, 25.09.2019, 09.10.2019, 19.10.2019 and 06.11.2019. The submissions of the Respondent were summed up by the DGAP as follows:

a. That he had increased the base prices of the menu items by 10.80% post 15.11.2017, as the Central Government had disallowed ITC vide Notification No. 46/2017- Central Tax (Rate) dated 14.11.2017 with effect from 15.11.2017 and as per ITC working during the period from July, 2017 to 14.11.2017, ITC amounting to ₹ 5,26,236/- was available which came to approx. 10% of the total turnover. Further, the price increase affected by him was commensurate with the loss/denial of ITC which was earlier permitted in terms of capital nature/assets and other purchases and expenses during the year along with regular purchase bills.

b. That upon reduction of the rate of tax from 18% to 5% without ITC with effect from 15.11.2017, he had passed on the benefit on the pricing of other popular selling items to the extent which could offset the loss due to the withdrawal of ITC.

c. That his system had crashed in January, 2018 due to which he had lost the data completely from his subway system and even the headquarters of M/s. Subway Systems India Pvt. Ltd., the franchisor, were not able to fetch the details from the cloud and expressed his inability to submit the requisite sale register from July, 2017 to January, 2018.

9. The DGAP has stated that vide the aforementioned e-mails/letters, the Respondent has submitted the following documents/information:

(a) Copies of GSTR-1 Returns for the period July 2017 to June 2019.

(b) Copies of GSTR-3B Returns for the period July 2017 to June 2019.

(c) Ledger of ITC maintained in Tally.

(d) Copies of Sales invoices for the period 20.09.2017 to 31.01.2018 (Approx. 4,800 pages in PDF format)

(e) Sales details for the period from February, 2018 to June, 2019 in excel format.

(f) Reconciliation of ITC Ledgers and GSTR-3B for the period July, 2017 to Nov, 2017

(g) Price lists of the products. (Pre and Post 15.11.2017) along with the percentage increase in prices post 15.11.2017.

(h) Sample Sale Invoices pre and post-tax rate reduction period.

(i) Month-wise summary of ITC lost during the FY 2018-19.

10. The DGAP has stated that the Respondent had submitted the documents in a piecemeal manner and he had not co-operated with the investigation. The DGAP has further submitted that the Respondent had tried to delay the investigation by not submitting the requisite documents and by requesting for repeated extensions of time for submitting his data in each of his replies; further the Respondent had not submitted the invoice-wise details of his outward taxable supply during the period from 01.07.2017 to 31.01.2018, in the absence of which, the DGAP had requested the Respondent to map the Menu product names in the Sale register to determine the number of units of each of the products sold by him; further, the Respondent neither responded to the DGAP on this issue nor did he submit the desired information/documents.

11. The DGAP has also reported that the reference received from the Standing Committee on Anti-profiteering, the various replies of the Respondent and the documents/evidence on record were carefully scrutinized. The main issues to be examined in the investigation were whether the rate of GST on the service supplied by the Respondent was reduced from 18% to 5% w.e.f. 15.11.2017 and if so, whether the benefit of such reduction in the rate of GST had been passed on by the Respondent to his recipients/ customers in terms of Section 171 of the CGST Act, 2017.

12. The DGAP has stated that the Central Government, on the recommendation of the GST Council, had reduced the GST rate on the restaurant service from 18% to 5% w.e.f. 15.11.2017 with the condition that the ITC on the goods and services used in supplying the service was not taken vide Notification No. 46/2017-Central Tax (Rate) dated 14.11.2017.

13. The DGAP has further reported that it was important to examine Section 171 of CGST Act, 2017 which governed the antiprofiteering provisions under GST. Section 171 (1) reads as “Any reduction in rate of tax on any supply of goods or services or the benefit of ITC shall be passed on to the recipient by way of commensurate reduction in prices.” Thus, the legal requirement was abundantly clear that in the event of benefit of ITC or reduction in the rate of tax, there must be a commensurate reduction in prices of the goods or services. Such reduction could obviously only be in absolute terms such that the final price payable by a consumer must get reduced. This was the legally prescribed mechanism for passing on the benefit of ITC or reduction in the rate of tax under the GST regime to the consumers. Moreover, it was clear that the said Section 171 simply did not provide a supplier of the goods or services any other means of passing on the benefit of ITC or reduction in the rate of tax to the consumers. Thus, the legal position was unambiguous and has been summed up by the DGAP as follows:

(a) A supplier of goods or services must pass on the benefit of ITC or reduction in the rate of tax to the recipients by way of reducing the prices thereof paid by the recipients; and

(b) The law did not offer a supplier of goods and services any flexibility to suo moto decide on any other modality to pass on the benefit of ITC or reduction in the rate of tax to the recipients.

The DGAP has added that the law did not offer a supplier of goods and services, flexibility to pass on the benefit of ITC or reduction in the rate of tax on one product, say ‘X’ by reducing the prices of any other product, say ‘Y’.

14. The DGAP has further stated that it was clear from the Menu Price List and the invoice-wise sale register for the part period that the Respondent had been dealing with a total of 137 items while supplying restaurant services before and after 15.11.2017. As per the details submitted by the Respondent for the period before 14.11.2017, the increase in base prices after the reduction in GST rate w.e.f. 15.11.2017 was evident in respect of 133 items (97.08% of 137 items) supplied by him. This increase in the base price was mentioned in the report by the DGAP. The lower GST rate of 5% had been charged on the increased base price of these 133 items, which confirmed that the tax amount was computed @ 18% before 15.11.2017 and @ 5% w.e.f. 15.11.2017. However, the fact was that because of the increase in base prices the cum-tax price paid by the consumers was not reduced commensurately for all the items supplied by the Respondent. Therefore, the issue to be investigated was whether the increase in base prices was solely on account of the denial of ITC or not.

15. The DGAP has also reported that the assessment of the impact of denial of input tax credit which was an uncontested fact required determination of the ITC in respect of “restaurant service” as a percentage of the taxable turnover from the outward supply of “products” during the pre-GST rate reduction period. To illustrate, if the ITC in respect of restaurant service was 10% of the taxable turnover of the Respondent till 14.11.2017 (which became unavailable w.e.f. 15.11.2017) and the increase in the pre-GST rate reduction base price w.e.f. 15.11.2017, was upt010%, one could conclude that there was no profiteering. However, if the increase in the pre-GST rate reduction base price w.e.f. 15.11.2017, was by 14%, the extent of profiteering would be 14% – 10% = 4% of the turnover. Therefore, this exercise to work out the ITC in respect of restaurant service as a percentage of the taxable turnover of the products during the pre-GST rate reduction period had to be carried out, though by taking into consideration the period from 01.07.2017 to 31.10.2017 and not up to 14.11.2017. This had been done by the DGAP for the following reasons:

(a) In terms of the provisions of Section 17 of the CGST Act, 2017 read with Rule 42 and 43 of the Rules, Respondent was required to reverse the ITC on the closing stock of inputs and capital goods held on 14.11.2017. However, the Respondent had not reversed any amount of ITC on account of closing stock of inputs and capital goods held on 14.11.2017.

(b) The invoice-wise outward taxable turnover for November 2017 was not provided by the Respondent to compute taxable turnover for the period 01.11.2017 to 14.11.2017.

(c) The ITC ledger submitted by the Respondent for the month of November 2017 revealed that in some cases, credit was taken by the Respondent without fulfilling the prescribed conditions, and also some discrepancies were noticed in ITC availed. For instance, the Respondent availed ITC of ₹ 27,000/- in November 2017 on the invoice for the monthly rental charges for the period 01.11.2017 to 30.11.2017, which the Respondent had not received on the date of availing input tax credit, in violation of provisions of Section 16(2) (b) of the CGST Act, 2017.

16. The DGAP has reported that the ratio of ITC to the net taxable turnover had been taken for determining the impact of denial of ITC, which was available to the Respondent till 14.11.2017 but not thereafter. On this basis, the findings of the DGAP were that ITC amounting to ₹ 4,54,734/- was available to the Respondent during the period from July, 2017 to October, 2017 which was approximately 9.64% of the net taxable turnover of restaurant service amounting to ₹ 47,18,983/- supplied during the same period. With effect from 15.11.2017, when the GST rate on restaurant service was reduced from 18% to 5%, the said ITC was not available to the Respondent. A summary of the computation of the ratio of ITC to the taxable turnover of the Respondent was furnished by the DGAP as is given in Table below:

Table

(Amount in Rs.)

| Particulars | July 2017 | August 2017 | September 2017 | October 2017 | Total |

| ITC Availed as per GSTR-3B(A)* | 1,18,312 | 1,27,319 | 1,07,139 | 1,01,964 | 4,54,734 |

| Total Outward Taxable Turnover as per GSTR-3B (B) | 11,45,395 | 11,43,249 | 12,90,075 | 11,40,264 | 47,18,983 |

| The ratio of ITC to Net Outward Taxable Turnover (C)= (A/B) 9.64% |

| 9.64% |

17. The DGAP has further mentioned that the analysis of the details of item-wise outward taxable supplies during the period from 15.11.2017 to 30.06.2019 revealed that the Respondent had increased the base prices of different items supplied as a part of restaurant service to make up for the denial of ITC post GST rate reduction. The pre and post GST rate reduction prices of the items sold as a part of restaurant service during the period 15.11.2017 to 30.06.2019 were compared and it was established that the Respondent had increased the base prices by more than 9.64% (i.e., by more than what was required to offset the impact of denial of the input tax credit) in respect of 115 items (out of a total of 137 items) sold during the same period. Thus, the conclusion was that in respect of these items the commensurate benefit of reduction in the rate of tax from 18% to 5% had not been passed on. It was also clear that there was no profiteering regarding the remaining items on which there was either no increase in the base prices or the increase in base prices was less than or equal to the denial of the input tax credit.

18. The DGAP has further stated that the Respondent had not submitted invoice wise outward taxable supplies for the period from 01.07.2017 to 31.01.2018 and even the details submitted for the period from 01.02.2018 to 30.06.2019 suffered from multiple product descriptions for a single product. Therefore, the usual method of comparing the average base price after discount (obtained on dividing the total taxable value by total quantity in pre-tax rate reduction period) of each item with the actual selling price of the item sold during post-GST rate reduction i.e. on or after 15.11.2017 could not be applied in the present case. Therefore, the DGAP has proceeded to quantify the amount of profiteering by taking into consideration the Menu Price List (verified from copies of sale invoices on a sample basis) and the number of units of each product sold during the period from 15.11.2017 to 30.06.2019.

19. The DGAP has also stated that the methodology adopted in this case could be explained by illustrating calculation in respect of a specific item i.e., “6 Inch Western Egg and Cheese” sold by the Respondent. In this regard, the denial of ITC @ 9.64% was added to the pre-GST rate reduction base price obtained from the Menu Price List and then the commensurate cum-tax selling price was arrived at by adding the reduced GST rate of 5% on this base price. The commensurate cum-tax selling price of this item was compared with the actual cum-tax selling price of this item as per Menu Price List during post- GST rate reduction i.e. on or after 15.11.2017 as has been illustrated by the DGAP in the Table below:

Table

(Amount in Rupees)

| Sl.No. | Description | Factors | Pre Rate Reduction (up to 14.11.2017 | Post-tax rate Reduction (From 15.11.2017) |

| 1. | Item Description and Category | A | Western Egg and Cheese (6 INCH) | |

| 2. | Base price as per Menu Price List | B | 110/- |

|

| 3. | C=B*18% | 19.80/- |

| |

| 4. | Selling price (including GST) | D=B+C | 129.80/- |

|

| 5. | GST Rate | E | 18% | 5% |

| 6. | Denial of ITC of 9.64% as per table- ‘B’ above | F=B*9.64% |

| 10.60/- |

| 7. | Commensurate Base price (post Rate reduction) (Excluding GST) | G=B+F |

| 120.60/- |

| 8. | Commensurate Selling price (post Rate reduction) (including GST) | H=105% of G |

| 126.63/- |

| 9. | Selling price (including GST) as per Menu Price List | I |

| 130.20/- |

| 10. | The excess amount charged or Profiteering per unit | J=I-G |

| 3.57/- |

| 11. | Total quantity Sold in Post reduction illustrative month of Feb.-2018 | K |

| 26 |

| 12. | Total Profiteering | L=J*K | 92.82/- |

20. Citing the above Table, the DGAP has stated that the Respondent did not reduce the selling price commensurately of the “6 Inch Western Egg and Cheese” when the GST rate was reduced from 18% to 5% w.e.f. 15.11.2017, vide Notification No. 46/2017 Central Tax (Rate) dated 14.11.2017 and hence he profiteered by an amount of ₹ 92.82 in respect of the said product. Hence, the benefit of reduction in GST rate was not passed on to the recipients by way of commensurate reduction in the price, in terms of Section 171 of the CGST Act, 2017. Based on the above calculation as illustrated in the Table above, profiteering in the case of all the products supplied by the Respondent was worked out by the DGAP.

21. The DGAP has submitted that while computing the total profiteering, only those items where the increase in the base prices was more than what was required to offset the impact of denial of the ITC, were considered. Based on the aforesaid pre and post-reduction in GST rates, the impact of denial of ITC and the details of outward supplies based on Menu Price List along with quantity sold during the period 15.11.2017 to 30 06.2019, the amount of net higher sale realization due to increase in the base price of the service, despite the reduction in GST rate from 18% to 5% (with denial of the input tax credit) or in other words, the profiteered amount came to ₹ 6,85,531/- (including GST on the base profiteered amount). The detailed computation of the above amount was given in the Annexure-15 of the Report.

22. Based on the details of outward supplies of the restaurant service submitted by the Respondent, the DGAP has observed that the said service had been supplied by the Respondent in the State of Maharashtra only.

23. The DGAP has further stated that the allegation of profiteering by way of either increasing the base prices of the products or by way of not fixing the selling prices of the products commensurately, despite the reduction in GST rate from 18% to 5% w.e.f. 15.11.2017 stood established against the Respondent. On this account, the Respondent had realized an additional amount to the tune of ₹ 6,85,531/- from the recipients which included both the profiteered amount and GST on the said profiteered amount.

24. The DGAP has also reported that Section 171 (1) of the CGST Act, 2017 requiring that “any reduction in rate of tax on any supply of goods or services or the benefit of ITC shall be passed on to the recipient by way of commensurate reduction in prices” had been contravened by the Respondent in the present case.

25. The above Report was considered by this Authority in its meeting held on 31.12.2019 and it was decided that the Applicants and the Respondent be asked to appear before this Authority on 16.01.2020. The Respondent was issued a notice on 31.12.2019 to explain why the above Report of the DGAP should not be accepted and his liability for violating the provisions of Section 171 of the CGST Act, 2017 should not be fixed. The Respondent had requested for an adjournment of the hearing scheduled on 16.01.2020 which was allowed by this Authority. Accordingly, the first hearing in the matter was held on 10.02.2020 wherein none appeared for either of the Applicants while Sh. Rakesh Kumar, Authorised Representative, Sh. Aneesh Mittal, Advocate, and Ms. Nikita Singh, Intern, appeared for the Respondent. During the course of the proceedings before this Authority, the Respondent has filed written submissions on 31.01.2020, 16.03.2020, 02.07.2020, and 29.07.2020. Vide his above-mentioned submissions, the Respondent has interalia submitted:

a. That the DGAP has incorrectly computed the ratio of ITC availed to the taxable turnover as 9.64% instead of 9.86%; that the formula adopted by the DGAP, for quantifying the impact of the withdrawal of ITC on the product- prices, was based on certain assumptions which might not be always correct; that in this case, reduction in the rate of tax from 18% to 5% was accompanied by the withdrawal of ITC; that since the withdrawal of ITC has increased the cost of inputs, increase in the base price of the products to neutralize the effect of the withdrawal of ITC benefit was justified; that no computational methodology or formula for the calculation of the quantum of profiteering was prescribed either in Chapter XV of the CGST Rules, 2017 (that contain the anti-profiteering provisions) or in the Procedure and Methodology’ for anti-profiteering proceedings notified by the NAA under Rule 126 of the CGST Rules; that the methodology adopted by the DGAP in his case for computing the effect of the withdrawal of ITC was based on a comparison of the ratio of ITC availment to taxable turnover for the pre-tax rate reduction period and the post-tax rate reduction period; that this methodology for calculating the impact of the withdrawal of ITC benefit on the base prices of the products was incorrect as it rested on the assumption that the ITC to taxable turnover ratio for the pre-tax rate reduction period would be the same as the ITC to taxable turnover ratio for the post-tax rate reduction period; that the DGAP has erroneously considered the ITC availed instead of the ITC utilized for the computation of the ratio of ITC to the taxable turnover for pre-tax rate reduction period; that the DGAP should have taken utilized ITC up to 14.11.2017 as the Respondent could utilize the ITC only up to 14.11.2017 for the payment of ax on outward supplies. Therefore, the period from 01.11.2017 to 14.11.2017 should have not been excluded from the calculation of ITC to the taxable turnover ratio.

b. That the DGAP has not taken into account the ITC and the taxable turnover for the period from 01.11.2017 to 14.11.2017; that the total ITC availed by him during the period from 01.07.2017 to 14.11.2017 was ₹ 5,26,236/- and his taxable turnover for this period as per GSTR-3B return was ₹ 53,37,603.77/-; that thus the correct ITC availed to taxable turnover ratio for the pre-tax rate reduction in his case worked out to 9.86% [(5,26,236/53,37,603.77*100] and not 9.64% as calculated by the DGAP; that he has been made to understand that the period from 01.11.2017 to 14.11.2017 has been excluded from the computation by the DGAP because:-

i. He had not reversed the ITC on the closing stock of inputs and capital goods held by him as of 14.11.2017;

ii. The invoice-wise outward taxable turnover for 01.11.2017 to 14.11.2017 period was not provided by him to the DGAP; and

iii. ITC amounting to ₹ 27,000/- was wrongly taken by him in November 2017 based on an invoice for his rent for the period from 01.11.2017 to 30.11.2017 since it was a period in which the services covered by the invoice had not been received.

c. In this context, the Respondent has contended that none of the aforesaid reasons advanced by the DGAP for excluding the ITC and the turnover for the period from 01.11.2017 14.11.2017 for the computation were correct; that the said exclusion was frivolous because:-

i. Since the unutilized ITC as of 14.11.2017 could not be utilized for payment of GST on outward supplies w.e.f. 15.11.2017, its reversal or non-reversal was immaterial,

ii. The invoice-wise details of the outward supplies for the 01.11.2017 to 14.11.2017 period were submitted by him and the same has been acknowledged in para 13(d) of the DGAP’s report,

and

iii. When the service covered by the landlord/ service supplier’s invoice has actually been received by him, the ITC based on the said invoice could be denied just because, as per his Agreement with his landlord, the rent for a particular month was required to be paid in advance at the beginning of the month, more so, when no objection in this regard has been raised by the concerned jurisdictional assessing officer.

d. That he was a franchisee of M/s. Subway Systems India Pvt. Ltd. (SSIPL); that it was the SSIPL, the franchisor, which determined the revised recommendatory rates for various items of food and beverages and circulated the same; that since the withdrawal of ITC had increased the input costs, there was no option but to revise the base prices of his products upwards; that as a franchisee, he had revised the base prices w.e.f. 15.11.2017; that while according to the DGAP the impact of the withdrawal of ITC should have increased his input cost by 9.64%, and on this basis, the base prices of his products should have been increased by 9.64%, as per the assessment of his franchisor (SSIPL), the average impact of the withdrawal of ITC was about 11%.

e. That he had increased the base prices of the items supplied as “sub of the day” (SOTD items) by only 8.22% and this was well within the permissible increase of the 9.64% calculated by the DGAP; that in the case of the item supplied as “classy combo” the base price had been reduced by him by 4.76%; that thus, in respect of items sold as SOTD and the item “clay combo”, there was no profiteering; that in the case of other items, except the item supplies as “wraps”, the base prices were increased by him and the said increase was ranging from 10.70% to 14.69%; that in the case of the item “wraps”, which was supplied in small quantities, the increase in the base price ranged from 17.39% to 20.34%; that thus the average increase in his base prices was 10.80%; that hence he had not profiteered since he had not retained the benefit of the reduction in the rate of tax.

f. That during the financial year 2018-19, the rise in the cost of some of his major inputs, viz. salary & staff welfare, rent, electricity and material cost was 9.32%, 28.46%, 5.42%, and 5%, respectively, which he had himself absorbed till 29.01.2019 since his franchisor had advised him to revise the product prices upward only with effect from 30.01.2019; that the obligation under Section 171 of the CGST Act 2017, to pass on the benefit of reduction in the rate of tax by way of a commensurate reduction in prices did not mean that the Respondent could not increase the base prices of his products even if there has been an increase in his cost of inputs; that the price of a product – depended not only upon the rate of tax, but also on the cost of inputs, fixed cost, availability or otherwise of ITC, the position of supply and demand, the degree of competition, etc.; that he placed his reliance on the case of Kumar Gandharv v. KRBL Ltd. 2018-TIOL-2-NAA GST, wherein this Authority has held that an increase in the MRP of packed and branded rice, on account of increase in the purchase price of the loose rice, was justified

g. That any increase in the base prices during the post-tax rate reduction period on account of denial of ITC benefit or genuine commercial reasons could not be termed as profiteering and treating the same as profiteering amounted to unreasonable price control or price regulation which violated the freedom of trade and commerce granted to a citizen under Article 19 (1) (g) of the Constitution of India.

h. That the methodology adopted by the DGAP for determining whether or not a registered person has passed on the benefit of reduction in the rate of tax to his customers by way of commensurate reduction in prices was neither prescribed in the CGST Act, 2017/ SGST Acts nor in the Rules made thereunder and that the notification issued by this Authority under Rule 126 of the CGST Rules, 2017 could not be applied like a statutory provision; that merely based on such computational methodology or formula, a registered person could not be accused of profiteering; that he placed his reliance on the case of Commissioner of Income Tax Bangalore v. B. C. Srinivas Shetty (1981) 2 SCC 460 and Eternit Everest Ltd. v. UOI 1997 (89) ELT 28 (Mad) decided by the Hon’ble Madras High Court; that he reiterated that neither in the Act nor in the Rules nor in ‘Methodology and Procedure’ prescribed by this Authority under Rule 126 of the CGST Rules 2017 was there any provision prescribing the following:-

(i) How to determine that a supplier had not passed on the benefit of reduction in the rate of tax or ITC by way of commensurate reduction in prices and how would it be determined that an increase in the base price after a reduction in the rate of tax or a non- reduction of the base price on account of higher ITC benefit was not due to genuine and bona fide reasons like increase in the cost of inputs, etc;

(ii) In case if the reduction in the rate of tax was accompanied by a withdrawal of ITC, how would the impact of the withdrawal of ITC benefit on prices during the post-tax rate reduction period be calculated;

and

(iii) In case if profiteering has been established, what should be the period of investigation and how long would be the period after which the price could be reduced; whether it would be considered if the effect of reduction in the rate of tax was neutralized by other factors affecting the price, such as an increase in the cost of inputs, spurt in the demand, etc.

i. That the DGAP has not provided any specific reason for adopting an arbitrary and long period of investigation; further that even if the DGAP had concluded that there was profiteering in the case, reasons ought to have been spelled out for having adopted a particular period of investigation without considering the impact of factors such as cost of inputs, fixed costs, supply and demand position, etc.; that during 2018-19, the increase in his expenditure on account of salaries and staff welfare, rent, electricity and material cost contributed 9.32%, 28% and 5.42% respectively in the total cost but the same has not been considered by the DGAP; that he had increased the prices of his menu items with effect from 30.01.2019 on account of increase in the cost of inputs and hence the period from 01.02.2019 to 30.06.2019 should be excluded from the computation of the profiteered amount; that if the period from February 2019 to June 2019 was excluded from the purview of the investigation, the amount of profiteering would be ₹ 4,72,421/-.

j. That the profiteered amount computed by the DGAP also included the element of GST unjustifiably, since the entire amount representing CGST and SGST recovered by the Respondent from his customers has been paid by him to the Governments as CGST and SGST per the provisions of Section 76(1) of the CGST Act, 2017 and the identical provisions under the Maharashtra GST Act, 2017; that thus there was no question of including the element of GST on the base profiteered amount; that if the element of GST was removed, the profiteered amount for the period from 15.11.2017 to 30.01.2019 would be ₹ 4,48,972/-.

k. That Section 125 of the CGST Act 2017 provided that “any person” who contravenes any of the provisions of this Act or any Rules made thereunder, for which no penalty has been separately provided for in this Act, would be liable to a penalty which may extend to Twenty Five Thousand Rupees; that in the currency of the period of this investigation, i.e. from 15.11.2017 to 30.06.2019, for which profiteering has been alleged, no specific penalty was prescribed under the CGST Act 2017 for contravention of the provisions of Section 171(1) of the Act, ibid. Therefore, even if the allegation of profiteering in his case was upheld, only the penal provisions of Section 125 of the CGST Act 2017 could be invoked against him for which the maximum penalty which could be imposed is ₹ 25,000/-.

26. The above submissions of the Respondent were forwarded to the DGAP vide this Authority’s Order dated 10.02.2020 asking him to file clarifications thereon under Rule 133 (2A) of the CGST Rules, 2017. Accordingly, the DGAP has filed clarifications vide his communications dated 28.02.2020, 29.05.2020, and 17.07.2020, which have been summed up as follows:-

a. On the contention of the Respondent that the DGAP’s calculation of the ratio of ITC availed to the taxable turnover for the pre-tax rate reduction period was incorrect and the connected contention related to the non-consideration of the ITC and taxable turnover for the 01.11.2017 to 14.11.2017 period by the DGAP, the DGAP has reported that the Ratio of Input Tax Credit to Net Outward Taxable Turnover was 9.64% in the pre-tax rate reduction period and hence the Respondent could have increased the base price by 9.64% in the post-tax rate reduction period, i.e. after 15.11.2017 to negate the impact of the denial of ITC. However, it was clear that the Respondent has increased the base prices of his 115 impacted items by more than what was required to offset the impact of denial if ITC. Thus, the total profiteered amount worked out to ₹ 6,85,531/- for the period of investigation.

b. The DGAP has also reported that the contention of the Respondent that the ITC to taxable turnover ratio should be 9.86% was not correct since the Respondent has included the ITC availed by him for the whole of the month of November 2017 for making this calculation whereas he could have availed ITC only till 14.11.2017 and not through the entire month; that in the calculation proposed by the Respondent, he has also incorrectly included the element of ITC of the compensation cess availed by him in his GSTR3B return, which could not have been lawfully taken and used for payment/ discharge of any taxes in the pre-GST period other than for discharging the output liability of compensation cess and hence the said ITC of compensation cess could not be included in the computation of profiteering in this case;

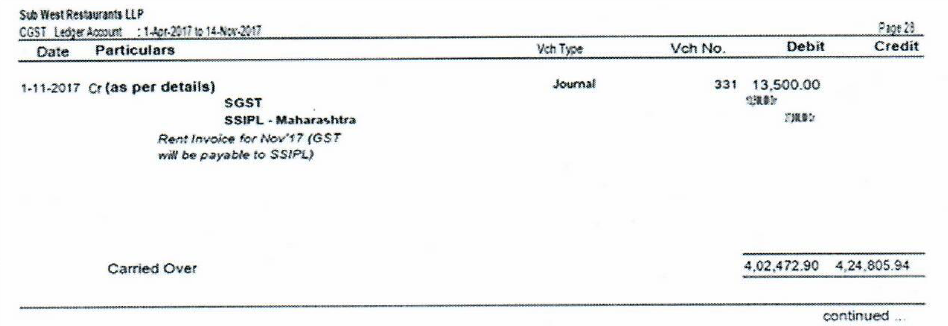

c. Further, the Respondent’s submission related to his not having availed ITC in the post-tax rate reduction period, i.e. after 15.11.2017, was factually incorrect as his own books of account, more specifically his General ledger of CGST Account confirmed that he has availed ITC amounting to ₹ 27,000/- in the month of November 2017 on the strength of an invoice for the monthly rental charges paid by him for the period 01.11.2017 to 30.11.2017, the extract of which is as below:-

d. The DGAP had also reported that in terms of the provisions of Section 17 of the CGST Act 2017 read with Rule 42 and 43 of the CGST Rules 2017, the Respondent was required to reverse the ITC on the closing stock of inputs and capital goods held by him on 14.11.2017, which has not been complied with by the Respondent.

e. Further, the DGAP has reported that while the Respondent has not submitted the details of his invoice-wise outward taxable turnover for the period from 01.11.2017 to 14.11.2017 despite repeated reminders of the DGAP, he had now submitted invoices of that period in printable PDF format running into thousands of pages and not in the format supplied to him by the DGAP; that the said raw data could not be used for the purpose of investigation and hence the period from 1.11.2017 to 14.11.2017 has been excluded while calculating the ITC and taxable turnover in the pre-tax rate reduction period.

f. On the contention of the Respondent that he was only a franchisee of M/s. SSIPL and it was the SSIPL, i.e. the franchisor, who determined the price and that thus he had not contravened the provisions of Section 171(1) of the CGST Act, 2017, the DGAP has stated that the said contention of the Respondent was bereft of factual grounds since he was an independent GST registrant, having a separate GSTIN registration, and he had been availing ITC as an independent entity before and after 15.11.2017; that in terms of Section 171 of CGST Act, 2017, the legal requirement was that in the event of a benefit of input tax credit or reduction in the rate of tax, there must be commensurate reduction in prices of the goods or service and that such a reduction could only be in absolute/ monetary terms so that the final price payable by any consumer in respect of each supply got reduced. The DGAP has added that this was the only legally prescribed mechanism for passing on the benefit of input tax credit or reduction in the rate of tax under the GST regime to the consumers since Section 171 of the ACT simply did not provide a supplier of the goods or services any other means of passing on the benefit of ITC or reduction in the rate of tax to the consumers. The DGAP has also added that therefore the computation of marginal gain/loss as per financial statements could not be considered for computation of the quantum of profiteering in the light of the above statutory provisions. The DGAP has also stated that the implementation of the provisions of Section 171 of the CGST Act 2017 was not in conflict with the right to carry any trade or business guaranteed under Article 19(1) (g) of the Constitution and as such there was no violation of the Article.

g. On the issue of the methodology adopted by the DGAP for the computation of profiteering, the DGAP has reported that it had consistently adopted the period of investigation as one that started from the event of a reduction in the rate of tax or availability of input tax credit (i.e. 15.11.2017 in the present case) till the latest month of receipt of a reference from the Standing Committee (i.e. June 2019 in the present case) in all the cases. Hence there was no arbitrariness in respect of the same.

h. On the contention of the Respondent that every increase in the base prices of the products should not be presumed to be profiteering, the DGAP has stated that he had not attempted to examine or question the base prices as Section 171 did not mandate control over the prices of the goods or services as they were to be determined by the supplier. Section 171 only mandated that any reduction in the rate of tax or the benefit of ITC which accrued to a supplier must be passed on to the consumers as both were the concessions given by the Government and the suppliers were not entitled to appropriate them. Such benefits must go to the consumers and in case they were not identifiable, the amount so collected by the suppliers was required to be deposited in the Consumer Welfare Fund. The DGAP has further reported that the investigation has not examined the cost component included in the base price. It has only added the denial of ITC to the pre rate reduction base price. Therefore, there was no violation of Article 19 (1) (g) of the Constitution. Further, the increase in the cost of inputs and other fixed costs, etc. were factors in the determination of price but these factors were independent of the output GST rate. Therefore, it could not be asserted that elements of cost unrelated to GST were affected by the change in the output GST rates. Further, the case of Kumar Gandharv v. KRBL Ltd. 2018-TIOL-2-NAA GST. cited by the Respondent was different from the instant case as in the case of M/s. KRBL the pre-GST rate was nil and for the first time, a tax rate of 5% was imposed on the impugned product.

i. On the contention of the Respondent that the element of GST has been added to the base profiteered amount in the computation incorrectly since the same has already b n deposited as CGST and SGST, the DGAP has clarified that Section 171 of the CGST Act, 2017 and Chapter XV of the CGST Rules, 2017 required the supplier of goods or services to pass on the benefit of the tax rate reduction to the recipients by way of a commensurate reduction in the price. Price included both, the base price and the tax paid on it. If any supplier has charged more tax from the recipients, the aforesaid statutory provisions would require that such amount be refunded to the eligible recipients or deposited in the Consumer Welfare Fund, regardless of whether such extra tax collected from the recipient has been deposited in the Government account or not. Besides, any extra tax returned to the recipients by the supplier by issuing a credit note could be declared in the return filed by such supplier, and his tax liability would stand adjusted to that extent in terms of Section 34 of the CGST Act, 2017. Therefore, the option was always open to the Respondent to return the tax amount to the recipients by issuing credit notes and adjusting his tax liability for the subsequent period to that extent.

j. On the contention of the Respondent that he had reversed the ITC on his closing stock as of 14.11.2017 and has not availed any ITC post 14.11.2017, the DGAP has clarified that on perusal of the Respondent’s GSTR-3B returns for the month of November 2017 and afterward, it is evident that the Respondent had not reversed any amount of input tax credit on account of closing stock of input and capital goods held by him as of 14.11.2017. The DGAP has reported that, therefore, the aforesaid claim of the Respondent was incorrect, frivolous, misleading, and was thus liable to be rejected.

27. We have carefully considered the case record, the Reports furnished by the DGAP, the submissions made by the Respondent, and the other material placed on record. On examining the various submissions we find that the following issues need to be addressed:-

a. Whether the Respondent has passed on the commensurate benefit of reduction in the rate of tax to his customers?

b. Whether there was any violation of the provisions of Section 171 of the CGST Act, 2017 committed by the Respondent?

28. It is revealed from the record that the Respondent is running a restaurant as a franchisee of M/S Subway Systems India Private Limited in Maharashtra and is supplying various food products to customers. It is also revealed from the plain reading of Section 171 (1) of the CGST Act, 2017 that it deals with two situations, one relating to the passing on the benefit of reduction in the rate of tax and the second about the passing on the benefit of the ITC. On the issue of reduction in the tax rate, it is apparent from the record that there has been a reduction in the rate of tax from 18% to 5% w.e.f. 15.11.2017, on the restaurant service being supplied by the Respondent, vide Notification No. 46/2017-Central Tax (Rate) dated 14.11.2017 without the benefit of ITC. Therefore, the Respondent is liable to pass on the benefit of tax reduction to his customers in terms of Section 171 (1) of the above Act. It is also apparent that the present investigation has been carried out w.e.f. 15.11 .2017 to 30.06.2019.

29. It is also evident that the Respondent has been dealing with a total of 137 items during the period from 15.11.2017 to 30.06.2019. The DGAP has reported that the GST rate of 5% has been charged w.e.f. 15.11.2017 however the base prices of 133 products have been increased more than their commensurate prices w.e.f. 15.11.2017 which establishes that because of the increase in the base prices the cum-tax prices paid by the consumers were not fixed commensurately, despite the reduction in the GST rate.

30. It is pertinent to mention that the method of computation of profiteering on the basis of comparison of item-wise average pre-rate reduction base prices with the actual post-rate reduction base prices for determination of profiteered amount as approved by this Authority in the cases of tax reduction cannot be applied in this case because of the following reasons:

a. That despite repeated requests and reminders issued by the DGAP, the Respondent had not submitted the invoice wise details of his outward taxable supplies for the period from 01.07.2017 to 31.01.2018 and had instead submitted that his software system had crashed in January 2018 and all the invoice data was lost. When asked to provide the invoice wise details from the franchisor M/S Subway Systems India Pvt. Ltd. he had submitted that the franchisor was also not able to fetch the required data, therefore, he was not in a position to submit the requisite information. This submission of the Respondent is not correct and appears to be a deliberate attempt to mislead because of the fact that when the DGAP, vide his letters/e-mails dated 10.12.2019 and 16.12.2019, had asked the Respondent to submit affidavit/undertaking in respect of non-availability of information and to furnish evidence/copies of his correspondence made with the franchisor M/S Subway Systems India Pvt. Ltd., the Respondent never responded on the above issue to the DGAP nor he submitted affidavit/undertaking. It is thus clear to us that the Respondent has deliberately not submitted the requisite data to the DGAP to avoid his liability for profiteering.

b. That from the record, it is also evident that the details of taxable supplies submitted by the Respondent for the period from 01.02.2018 to 30.06.2019 mentioned multiple product descriptions for a single product rendering the data unusable for the purpose of any meaningful examination and computation of profiteered amount. Therefore, the DGAP had no option but to ask the Respondent to map the product descriptions appearing in the Menu Price List with his Sales Register to enable determination of the number of units of each product (as per the Menu Price List) supplied by him. However, the Respondent neither responded to the above direction of the DGAP nor submitted the requisite information to the DGAP. Hence, it is apparent that the Respondent has intentionally not submitted the complete information to the DGAP and has deliberately tried to derail the investigation.

c. That the Respondent had submitted the invoices for the period from 01.11.2017 to 14.11.2017 in non-editable pdf format which ran into thousands of pages, hence, the DGAP could not extract the relevant information from these printed invoices as they were not comprehensible. In this regard, it is pertinent to mention that the Respondent had desisted from furnishing the said invoices during the investigation on one pretext or the other despite numerous reminders issued by the DGAP. We also find that the failure of the Respondent to provide the relevant information in the prescribed format to the DGAP which formed the basis of computation of product-wise base prices for the period from 01.11.2017 to 14.11.2017, was also a reason for consideration of the Menu Price List for computation of the profiteered amount.

Since the invoice wise details of the supplies for the pre-rate reduction period w.e.f. 01.11.2017 to 14.11.2017 and the post-rate reduction period w.e.f. 15.11.2017 to 30.06.2019 were not supplied due to the malafide intentions of the Respondent therefore, the average pre-rate reduction base prices could not be computed and compared with the actual post-rate reduction base prices, especially when there was clear evidence that the Respondent had contravened the provisions of Section 171 by increasing the base prices of his products on the intervening night of 14.11.2017, when the rate reduction took place, the DGAP had no other option but to compare the Menu Price Lists of the pre-rate reduction and post-rate reduction periods for computation of profiteered amount. It is further clear to us that this deliberate action of the Respondent to withhold the requisite data cannot be allowed to go scot-free and hence this is a fit case for computation of profiteered amount based on the available records, i.e. on the basis of the product-wise Menu Price Lists of the pre-rate reduction and post-rate reduction periods, in view of the peculiar circumstances of this case. Accordingly, the methodology adopted by the DGAP for computation of profiteered amount is appropriate, reasonable and correct in these circumstances.

31. While comparing the pre rate reduction cum-tax selling prices with the post-tax rate reduction selling prices as per the Menu Price Lists the DGAP has duly taken in to account the impact of denial of ITC in respect of the “restaurant service” being supplied by the Respondent as a percentage of the taxable turnover from the outward supply of the products made during the pre-GST rate reduction period by taking into consideration the period from 01.07.2017 to 31.10.2017 and not up to 14.11.2017. This has been done because there was no reversal of ITC on the closing stock of inputs/input services and capital goods as of 14.11.2017 made by the Respondent as per the provisions of Section 17 of the CGST Act, 2017 read with Rule 42 and 43 of the above Rules. Further, the Respondent has not submitted the required data/information for computing the taxable turnover for the period from 01.11.2017 to 14.11.2017 in the requisite format to the DGAP therefore, the turnover for the period from 01.11.2017 to 14.11.2017 could not be considered. Accordingly, the ratio of ITC to the net taxable turnover has been taken for determining the impact of denial of ITC which was available to the Respondent till 31.10.2017. As per the case record, ITC amounting to ₹ 4,54,734/- was available to the Respondent during the period from July 2017 to October 2017 which was approximately 9.64% of ₹ 47,18,983/- of the turnover during the same period, as has been shown in Table-A supra. For computation of commensurate cum-tax selling price the DGAP has considered the selling price as per the Menu Price List of every item and added 9.64% to it in lieu of denial of ITC w.e.f. 15.11.2017, when the GST rate on restaurant service was reduced from 18% to 5% and the said ITC was not available to the Respondent. The DGAP has then compared the pre-rate reduction cum-tax selling price to the post rate change selling price as per Menu Price List and the difference between pre-rate change cum-tax selling price and post-rate change selling price has been established as profiteered amount.

32. It is further revealed from the analysis of the details of item-wise outward taxable supplies made during the period from 15.11.2017 to 30.06.2019 that the Respondent had increased the base prices of different items supplied as a part of restaurant service to make up for the denial of ITC post GST rate reduction. The pre and post GST rate reduction prices of the items, as per Menu Price Lists, have been compared and it has been found that the Respondent has increased the base prices by more than 9.64% i.e. by more than what was required to offset the impact of denial of ITC in respect of 115 items sold during the above period. Thus, it is apparent that the Respondent has resorted to profiteering as the commensurate benefit of reduction in the rate of tax from 18% to 5% has not been passed on by him. However, there was no profiteering in respect of the remaining items on which there was either no increase in the base prices or the increase in base prices was less or equal to the denial of ITC or these were new products launched post-GST rate reduction.

33. Based on the aforesaid change in the tax rate, the impact of denial of ITC and the details of outward supplies (other than zero-rated, nil rated, and exempted supplies) during the period from 15.11.2017 to 30.06.2019, the amount of net higher sale realization due to increase in the base prices of the products, despite the reduction in the GST rate from 18% to 5% with denial of ITC or the profiteered amount has come to ₹6,85,531/- as per Annexure-15 of the Report of the DGAP including the GST on the base profiteered amount. The details of the computation have been given by the DGAP in his Report.

34. The Respondent has argued that the DGAP has wrongly computed ITC/Turnover ratio as 9.64% instead of 9.86%. In this regard, it is observed that the total ITC availed by the Respondent during the period from July 2017 to October 2017, as per GSTR-3B Returns filed by him, was ₹ 4,54,734/- and the total outward taxable turnover for the same period, as per GSTR-3B Returns, was Rs. Therefore, the ITC to taxable turnover ratio for the pre rate reduction period comes out to 9.64%{(4,54,734/47,18,983) * 100} which has been correctly computed by the DGAP as mentioned in Table-A above. Hence, the claim of the Respondent that the DGAP has wrongly computed the ITC to taxable turnover ratio for the pre-tax rate reduction period is not tenable and cannot be accepted.

35. Further, the Respondent has contended that the DGAP has not considered the ITC and Turnover for the period from 01.11.2017 to 14.11.2017 while computing the ratio of ITC to taxable turnover for the pre rate reduction period. In this regard, it was noticed that as required according to the provisions of Section 171 of the CGST Act, 2017 read with Rules 42 and 43 of the CGST Rules, 2017, the Respondent had not reversed the ITC on the closing stock of inputs and capital goods as of 14.11.2017. Further, the case records have revealed that the Respondent had incorrectly availed ITC on the strength of certain invoices relating to the whole month of November 2017 (as in the case of ITC on rent paid by him for the whole month of November 2017) and had not limited the availment of ITC only till 14.11.2017. Since the ITC was no longer available to him with effect from 14.11.2017, he could not have claimed it after the above date. Further, it has been found that the Respondent has submitted invoices for the period from 01.11.2017 to 14.11.2017 during the currency of present proceedings before this Authority in ‘pdf format which ran into thousands of pages, from which relevant information could not be extracted for determination of profiteered amount. In this regard, it is pertinent to mention that the Respondent had desisted from furnishing the said invoices during the investigation on one pretext or the other despite numerous reminders issued by the DGAP. We also find it pertinent to mention that the failure of the Respondent to provide the relevant information in the prescribed format to the DGAP that allowed computation of product-wise base prices for the period from 01.11.2017 to 14.11.2017 was also a reason for the exclusion of the month of November 2017. The Respondent had also not reversed the balance ITC that he ought to have done in line with the existing statutory provisions. It is also pertinent that the DGAP or this Authority cannot be forced to reconcile each entry made in the invoices in the pdf format and then ascertain the amount of taxable supply of the Respondent for the period 01.11.2017 to 14.11.2017. Therefore, we agree with the view of the DGAP that there was no option but to exclude the period from 01.11.2017 to 14.11.2017 from the computation of ITC to taxable turnover ratio for the pre-rate reduction period. Hence, the claim of the Respondent that DGAP has not considered the ITC and Turnover for the period from 01.11.2017 to 14.11.2017 while computing the ratio of ITC to turnover for the pre rate reduction period is not tenable and cannot be accepted.

36. The Respondent has also claimed that the DGAP ought to have considered ‘utilized’ ITC instead of ‘availed’ ITC while computing the ratio of ITC to turnover for the pre-tax rate reduction period. In this regard, it is pertinent to mention that as per the provisions of Section 16 of the CGST Act, 2017, every registered person is legally bound to keep record of the ITC availed by him on inputs and input services which are used in the furtherance of his outward supplies. Therefore, the quantum of ITC availed is directly proportional to the quantum of inputs/ input services utilized and thus to the outward supplies of a registered person. On the other hand, utilization of ITC depends upon the will of the registered person since every registered person has an option to pay his tax liability either in the form of cash or by utilizing the available ITC/ credit as per his convenience. Therefore, it is clear to us that the utilization of ITC has no direct relationship with the outward supplies of the registered person. Given the above facts, the factoring of the ITC ‘availed’ instead of the ITC ‘Utilized’ in the computation is the more reasonable, accurate and appropriate approach. Therefore, we take the view that the DGAP has rightly considered the ITC ‘availed’ while computing ITC to taxable turnover ratio for the pre-tax rate reduction period. Therefore the said contention of the Respondent cannot be accepted.

37. The Respondent has also averred that he was operating his outlet as a franchisee and the franchisor, i.e. M/S Subway Systems India Pvt. Ltd., was the vital authority that controlled the product prices as also the POS system used for billing and took all the decisions related to revision in the product-prices, and that he (the Respondent) has no real control over the prices of the products being sold and thus profiteering was only at the end of the franchisor i.e. M/s. Subway Systems India Pvt. Ltd. In this regard, we find that the Respondent has not submitted any cogent evidence to prove that the prices of the products supplied by him are controlled by M/s. Subway Systems India Pvt. Ltd. and that he, was not free to fix the prices of his products. In this context, we also note that the provisions of Section 171 of the CGST Act, 2017 require a registered person to pass on the benefit of additional ITC or reduction in the rate of tax by way of a commensurate reduction in the prices of the goods or services supplied by him. It is also pertinent that it was the Respondent who had been availing ITC and not the franchisor. Hence, in the present case, it was clearly the responsibility of the Respondent to comply with the provisions of Section 171 of the CGST Act, 2017 and the said responsibility could not be shifted to any other person, including the Franchisor. Therefore, the contention made by the Respondent is not correct and hence dismissed.

38. The Respondent has further contended that the right to trade was a fundamental right guaranteed under Article 19 (1) (g) of the Constitution of India and the right to trade incorporated the right to determine prices which could not be taken away without any explicit authority under the law. Therefore, this form of price control was a violation of Article 19 (1) (g) of the Constitution of India. In this connection, it would be relevant to mention that the Respondent has full right to fix his prices under Article 19 (1) (g) of the Constitution but he has no right to appropriate the benefit of tax reduction under the garb of the above right. The DGAP has not acted in any way as a price controlling authority as he does not have the mandate to do so. Under Section 171 read with Rule 129 of the above Rules, the DGAP has only been mandated to investigate whether both the benefits of tax reduction and ITC which are the sacrifices of precious tax revenue made from the kitty of the Central and the State Governments have been passed on to the end consumers who bear the burden of the tax. The intent of this provision is the welfare of the consumers who are voiceless, unorganized and vulnerable. It is also pertinent that the DGAP has nowhere interfered with the pricing decisions of the Respondent and therefore, there is no violation of Article 19 (1) (g) of the Constitution.

39. The Respondent has also pleaded that the DGAP while arriving at profiteering has failed to appreciate that different factors at different points in time affect the costing and pricing of a product and therefore, no straight jacket formula could be used for calculating profiteering. The pricing of products was dependent on various factors like increase in expenses and increase in cost due to GST implementation, marketing costs, operating cost, cost of inputs, and the rental cost which should be considered while arriving at the profiteering. In this connection, it would be pertinent to mention that the provisions of Section 171 (1) and (2) of the above Act require the Respondent to pass on the benefit of tax reduction to the consumers only and have no mandate to look into fixing of prices of the products which the Respondent was free to fix. If there was an increase in his costs the Respondent should have increased his prices before 15.11.2017, however, it cannot be accepted that his costs had increased exactly on the intervening night of 14.11.2017/15.11.2017 when the rate reduction had happened which had forced him to increase his prices exactly equal to the reduction in the rate of such tax or more. We thus opine that the Respondent has increased the prices of his supplies only for appropriating the benefit of tax reduction to deny the above benefit to the consumers.

40. The Respondent has also relied upon the decision of this Authority given in the case of Kumar Gandharv v. M/S KRBL Limited (Case Number 03/2018 dated 04.05.2018 to support his case. In this context, it is pertinent to mention that in the above case no benefit of the increase in the cost was given. Instead, the rate of tax had been increased from 0% to 5% on the product under consideration and hence the provisions of Section 171 (1) were not applicable as there was no tax reduction. Therefore, the facts of the above case are different from this case and hence, they cannot help the Respondent.

41. One of the contentions made by the Respondent is that the CGST Act and the Rules made thereunder did not prescribe any procedure or mechanism for calculation of profiteering due to which the DGAP had arbitrarily adopted a methodology that best suited his motives. In terms of Section 171 (3) of the above Act, this Authority could discharge only such function and exercise such powers as were specifically mentioned in the CGST Rules, 2017. However, the Methodology and Procedure, 2018 notified by this Authority in terms of Rule 126 of the CGST Rules did not prescribe any specific methodology to be adopted in the computation of profiteering. Therefore, in the absence of any methodology in the Rules, the entire approach adopted by the DGAP, and this Authority was without jurisdiction. The above contention of the Respondent is not correct. In this regard, it is submitted that the ‘Procedure and Methodology’ for passing on the benefits of reduction in the rate of tax and ITC has been mentioned in Section 171 (1) of the CGST Act, 2017 itself which states that “Any reduction in rate of tax on any supply of goods or services or the benefit of input tax credit shall be passed on to the recipient by way of commensurate reduction in prices.” It is clear from the perusal of the above provision that it mentions “reduction in the rate of tax or benefit of ITC” which means that the benefit of tax reduction or ITC has to be passed on by a registered dealer to his customers since it is a concession which has been granted from the public exchequer which cannot be misappropriated by a supplier. It also means that the above benefits are to be passed on each Stock Keeping Unit (SKU) or unit of construction to each buyer and in case they are not passed on, the profiteered amount has to be calculated for which investigation has to be conducted on all impacted SKUs/units. These benefits can also not be passed on at the entity/organization/branch level as the benefits have to be passed on to each recipient at each SKU/unit level. Further, the above Section mentions “any supply” which connotes each taxable supply made to each recipient thereby clearly indicating that a supplier cannot claim that he has passed on more benefit to one customer, therefore, he would pass less benefit to another customer than the benefit which is actually due to that customer. Each customer is entitled to receive the benefit of tax reduction or ITC on each SKU or unit purchased by him. The word “commensurate” mentioned in the above Section gives the extent of benefit to be passed on by way of reduction in the prices which has to be computed in respect of each SKU or unit based on the tax reduction as well as the existing base price of the SKU or the additional ITC available. The computation of commensurate reduction in prices is purely a mathematical exercise which is based upon the above parameters and hence it would vary from SKU to SKU or unit to unit and hence no fixed methodology can be prescribed to determine the amount of benefit which a supplier is required to pass on to a recipient or for computation of the profiteered amount. However, to give further elaborate upon this legislative intent behind the law, this Authority has been empowered to determine the ‘Procedure and Methodology’ which has been done by this Authority vide its Notification dated 28.03.2018 under Rule 126 of the CGST Rules, 2017. However, no fixed formula which fits all the cases of profiteering can be set while determining such a “Methodology and Procedure” as the facts of each case are different. In one real estate project, date of start and completion of the project, price of the house/commercial unit, mode of payment of the price, stage of completion of the project, rates of taxes, amount of ITC availed, total saleable area, area sold and the taxable turnover realized before and after the GST implementation would always be different from the other project and hence the amount of benefit of additional ITC to be passed on in respect of one project would not be similar to another project. Therefore, no set parameters can be fixed for determining methodology to compute the benefit of additional ITC which would be required to be passed on to the buyers of such units. Moreover, this Authority under Rule 126 has the power to ‘determine’ Methodology and Procedure and not to ‘prescribe’ it. However, fixation of the commensurate price is purely a mathematical exercise that can be easily done by a supplier keeping in view the reduction in the rate of tax and his price before such reduction or the availability of additional ITC post implementation of GST. Further, the facts of the cases relating to the Fast Moving Consumer Goods (FMCGs), restaurants, construction, and cinema houses are completely different and therefore, the mathematical methodology employed in the case of one sector cannot be applied in the other sector otherwise it would result in denial of the benefit to the eligible recipients. Moreover, both the above benefits have been granted by the Central as well as the State Governments by sacrificing their tax revenue in the public interest and hence the suppliers are not required to pay even a single penny from their pocket and hence they have to pass on the above benefits as per the provisions of Section 171 (1) of the CGST Act 2017 which are abundantly clear, unambiguous and mandatory which truly reflect the intent of the Central and State legislatures. Therefore, the above contention of the Respondent is frivolous and hence the same cannot be accepted. The Respondent cannot deny the benefit of tax reduction to his customers on the above untenable ground as Section 171 of the CGST Act 2017 provides a clear cut methodology to compute both the above benefits. Further, in the present case, the methodology adopted by the DGAP for calculation of the quantum of profiteering has been furnished as is given in the below table:-

| Sl.No. | Description | Factors | Pre Rate Reduction (up to 14.11.2017 | Post-tax rate Reduction (From 15.11.2017) |

| 1. | Item Description and Category | A | Western Egg and Cheese (6 INCH) | |

| 2. | Base price as per Menu Price List | B | 110/- |

|

| 3. | C=B*18% | 19.80/- |

| |

| 4. | Selling price (including GST) | D=B+C | 129.80/- |

|

| 5. | GST Rate | E | 18% | 5% |

| 6. | Denial of ITC of 9.64% as per table- ‘B’ above | F=B*9.64% |

| 10.60/- |

| 7. | Commensurate Base price (post Rate reduction) (Excluding GST) | G=B+F |

| 120.60/- |

| 8. | Commensurate Selling price (post Rate reduction) (including GST) | H=105% of G |

| 126.63/- |

| 9. | Selling price (including GST) as per Menu Price List | I |

| 130.20/- |

| 10. | The excess amount charged or Profiteering per unit | J=I-G |

| 3.57/- |

| 11. | Total quantity Sold in Post reduction illustrative month of Feb.-2018 | K |

| 26 |

| 12. | Total Profiteering | L=J*K | 92.82/- |

A perusal of the above Table shows that the Respondent had increased the base price of the item i.e. 6 Inch Western Egg and Cheese supplied by him as a part of restaurant service to make up for the denial of ITC post GST rate reduction. The pre and post GST rate reduction prices of the item sold during the period 15.11.2017 to 30.06.2019 were compared and it is established that the Respondent had increased the base prices by more than 9.64% i.e., by more than what was required to offset the impact of denial of ITC in respect of the product. A similar methodology has been adopted while computing the profiteered amount in respect of the other impacted products and it is established that in respect of the items sold by the Respondent post-rate reduction, the commensurate benefit of reduction in the rate of tax from 18% to 5% has not been passed on. Therefore, the above claim of the Respondent cannot be accepted.

42. The Respondent has relied upon the judgements passed by the Hon’ble Supreme Court in the cases of Commissioner of Income Tax Bangalore v. B. C. Srinivas Shetty 460 and Eternit Everest Ltd. v. UOI 1997 (89) ELT 28 (Mad) and stated that there was no machinery provision in the anti-profiteering measures and hence they could not be enforced. On this aspect, it is to be noted that no tax has been imposed under the above measures and hence the law settled in the above cases is not applicable. However, it would be relevant to mention here that Section 171 (2) of the CGST Act, 2017 and Rules 122, 123 129, and 136 of the CGST Rules, 2017 have provided elaborate machinery in the form of this Authority, the Standing and Screening Committees, the DGAP and a large number of field officers of the Central and the State Taxes to implement the anti-profiteering provisions. Therefore, the Respondent cannot allege that no machinery has been provided to implement the above measures.

43. The Respondent has also cited the extract from the minutes of the 17th GST Council Meeting wherein the Advisor to the Chief Minister, Punjab as well as the Chief Economic Advisor raised the issue of the requirement of having a mechanism to compute profiteering with proper checks and balances. However, the issues raised by the above officers are incorrect as the methodology to compute the profiteering is itself contained in Section 171 of the CGST Act, 2017 as has been explained above. The Respondent has also pointed out that the Malaysian Government has introduced the Price Control and Anti-Profiteering (Mechanism To Determine Unreasonably High Profits for Goods) Regulations, 2018, and under the said Regulations, any profit earned over and above the determined ‘Net Profit Margin’ was considered as an unreasonably high profit rendering the supplier liable for penal action under the law. The anti-profiteering measures in Australia revolved around the ‘Net Dollar Margin Rule’ serving as the fundamental principle for the determination of price variances and changes as its guideline. In this regard, it would be appropriate to mention that the above Act has been repealed by Malaysia as it was not found to be working properly. Moreover, this Act was promulgated to control prices after the introduction of GST in the above Country whereas no provision for controlling prices has been made in the CGST Act, 2017. Similarly, the ‘Net Dollar Margin Rule’ applicable in Australia also provides a mechanism for price control which is not the intent of Section 171. This Authority has also not been mandated to work as a price controller or regulator and it is only empowered to ensure that the benefits of tax reduction and ITC are passed to the consumers as per the specific provisions of Section 171 (1) of the CGST Act, 2017. Strangely, the Respondent is advocating the implementation of the price control measures under the CGST Act, 2017. The above claim of the Respondent also runs contrary to the argument of the Respondent which claims that no fetters can be placed on his power to fix the prices of his products in violation of the provisions of Article 19 (1) (g) of the Constitution. Therefore, the above contention of the Respondent is untenable and hence it cannot be accepted.

44. The Respondent has further contended that the CGST Act, 2017, the CGST Rules, 2017, and the Methodology and Procedure notified by this Authority did not prescribe the period up to which the profiteered amount is to be calculated. Therefore, keeping in mind the perishable nature of the items and various other factors the profiteered amount should be restricted up to January 2019. In this context, we observe that while the rate of GST was reduced from 18% to 5% w.e.f. 15.11.2017, the Respondent had increased the base prices of his products immediately w.e.f. 15.11.2017 and had taken no steps to pass on the resultant benefit of tax reduction by way of commensurate fixation of the prices of his supplies at any point of time till 30.06.2019. In other words, the violation of the provisions of Section 171 of the CGST Act 2017 has continued unabated in this case and the offence continues to date. The Respondent has not produced any evidence to prove from which date the benefit was passed on by him. The fact that the Respondent has not complied with the law till 30.06.2019 requires that the profiteering is computed till the above period and hence we do not see any reason to accept this contention of the Respondent. We further observe that had the Respondent passed on the benefit before 30.06.2019, he would have been investigated only till that date. Therefore, the period of investigation from 15.11.2017 to 30.06.2019 has been rightly taken by the DGAP for computation of the profiteered amount.

45. The Respondent has also claimed that the DGAP while calculating the profiteered amount has erroneously added a 5% additional amount on account of GST which has been collected from the customers and deposited with the Government of India with the monthly GST returns. This contention of the Respondent is not correct because the provisions of Section 171 (1) and (2) of the CGST Act, 2017 require that the benefit of reduction in the tax rate is to be passed on to the recipients/ customers by way of commensurate reduction in price, which includes both the base price and the tax. The Respondent has not only collected excess base prices from the customers which they were not required to pay due to the reduction in the rate of tax but he has also compelled them to pay additional GST on these excess base prices which they should not have paid. By doing so, the Respondent has defeated the very objective of both the Central as well as the State Government which aimed to provide the benefit of rate reduction to the general public. The Respondent was legally not required to collect the excess GST and therefore, he has not only violated the provisions of the CGST Act, 2017 but has also acted in contravention of the provisions of Section 171 (1) of the above Act as he has denied the benefit of tax reduction to his customers by charging excess GST. Had he not charged the excess GST, the customers would have paid a lesser item-wise price while purchasing food items from the Respondent, and hence the above amount has rightly been included in the profiteered amount as it denotes the amount of benefit denied by the Respondent. Therefore, the above amount has been correctly included in the profiteered amount by the DGAP, hence, the above contention of the Respondent is untenable which cannot be accepted.