Jai Jawan Kastha Bhandar And Others vs. The State Of Jharkhand

(Jharkhand High Court, Jharkhand)

Heard learned counsel for the petitioners Mr. Sumeet Gadodia assisted by Mr. Ranjeet Kushwaha, Mr. Sachin Kumar, learned A.A.G.-II appearing for the State in all these writ petitions and Mr. Ashish Kr. Shekhar learned counsel appearing for the CGST in W.P.(T) Nos. 3153 of 2020, 3154 of 2020 and 3179 of 2020. Since common issues are involved in all these writ petitions, therefore they have been tagged together and are being decided by this common judgment.

2. Writ petitioners have prayed for quashing of the summary of show-cause notice issued in Form GST DRC-01 by the respondent State Tax Officer on the ground that the summary of show-cause notice has pre-judged and pre-decided the entire issue and has in fact fastened the liability towards tax, interest and penalty upon the individual petitioners. The petitioners in their individual writ petitions have also sought for quashing of the adjudication order passed under Section 74(9) of the Jharkhand Goods and Services Tax Act, 2017 (hereinafter referred to as ‘JGST Act’ for short) on the ground that without granting any opportunity of hearing, tax, interest and penalty has been fastened upon the petitioners in a pre-judged and pre-decided manner. Petitioners have also challenged the consequential Demand Notices dated 25.02.2020 issued in Form GST DRC-07 wherein the demand of tax, interest and penalty has been levied.

3. Petitioners contend that no proper show-cause notice has been issued in terms of Section 74(1) of the JGST Act read with Rule 142 of the JGST Rules, 2017. The petitioners allege that the show-cause notices do not even indicate any date of hearing. Reference is made to Section 75 Subsection (4) which provides that when a request is received in writing from the person chargeable with tax or penalty or where any adverse decision is contemplated against such person opportunity of hearing is to be granted. Under Section 75(5) the proper officer is obliged to grant time on sufficient cause shown by the person chargeable with tax for reason to be recorded in writing provided that no adjournment shall be granted for more than three times to a person during the proceedings.

4. Learned counsel for the petitioners submits that none of the relied upon documents in the intelligence note have been supplied to the petitioners. As such, the adjudication order is in violation of principles of natural justice. It is submitted that the entire proceedings up to the adjudication order is in violation of Section 74 read with Section 75 of the JGST Act, 2017.

5. Each of these writ petitioners are registered under the GST Act. The impugned proceedings have been initiated in case of each of the individual writ petitioners on the basis of inspection carried out in terms of Section 67 of the JGST Act, 2017 on different dates by the jurisdictional authority wherein allegedly irregularities were noticed. The relevant inspection reports are enclosed to the individual writ petitions which refer to the prima-facie observation of the inspecting team that the individual petitioners are involved in paper transaction of purchase and sale of goods. Certain irregularities relating to short payment of tax were also noticed. Learned counsel for the petitioners has also submitted that individual petitioners were directed to appear in the office of the Deputy Commissioner of State Tax of the concerned circles with books of accounts including sale invoices, stock register, transportation details, etc. by a particular date asking individual petitioners to satisfy as to why appropriate proceedings either under Section 73 or 74 of the JGST Act be not initiated. It is the case of the individual petitioners that despite appearance of their representatives before the respondent Deputy Commissioner of State Tax, concerned circles, no documents were examined nor any inquiry was undertaken. None of the petitioners have received any summon whatsoever in terms of Section 70 of the Act for giving evidence. Individual petitioners therefore were under a bonafide belief that the authority was satisfied with the documents and such accounts produced at the time of inspection and no further proceedings would be undertaken. However, to their surprise, a summary of show-cause notice was issued bearing separate reference number of the same date or of different date in case of some of the petitioners. A perusal of this summary of show cause notice issued in Form GST DRC-01 under Rule 142(1) of the JGST Rules would show that the respondent State Tax Officer has, in fact, come to a finding that input tax credit has been wrongly availed or utilized by reason or fraud or any willful misstatement or suppression of fact and therefore individual petitioners are liable for tax, interest under Section 50 of the Act and penalty as well furnished in the form of a chart. None of the show-cause notices bore any date of hearing. Petitioners did not get any opportunity to file their reply nor was any proper show-cause notice issued under Section 74(1) of the Act. The respondent Deputy Commissioner of State Tax of concerned circle has straightaway passed the adjudication order under Section 74(9) in the case of individual petitioners adjudging the same amount of tax, interest and penalty upon individual petitioners on the ground that they had wrongly availed input tax credit or utilized it by reason or fraud or any wilful misstatement or suppression of fact. A summary of the order was also issued in Form GST DRC 07 in case of each of the petitioners quantifying the details of the demand as indicated in the adjudication order. Petitioners have approached this Court individually in the respective writ petitions, though all the writ petitions involved common issues of facts and law. It is submitted that the impugned proceedings without initiation of a proper show-cause notice under Section 74(1) of the JGST Act, 2017 is bad in law in view of the decision rendered by this Court in W.P.(T) No.2444 of 2021 (M/s Nkas Services Private Limited Vs. The State of Jharkhand & Ors.) reported in 2021 VIL 732 JHR (Para-12 to 19). Learned counsel for the petitioners has also relied upon the judgment rendered by this Court in W.P.(T) No.3908 of 2020 along with W.P.(T) No.3909 of 2020 (M/s Godavari Commodities Limited Vs. The State of Jharkhand & Ors.) wherein the application of Section 75(4) and (5) of the Act regarding opportunity of hearing has also been discussed. Learned counsel for the petitioners submits that the writ petitions are maintainable under Article 226 of the Constitution of India as the impugned adjudication order has been passed in violation of principles of natural justice. Reliance has been placed on the judgment rendered in the case of Maharashtra Chess Association Vrs. Union of India, reported in 2019 SCC Online SC 932, paragraphs 25 and 26. Learned counsel for the petitioners has also relied upon the judgment rendered in the case of Ayaaubkhan Noorkhan Pathan Vrs. State of Maharashtra & Ors., reported in (2013) 4 SCC 465 to support the proposition that in such a case where the respondents have relied upon the documents obtained during the inspection in the premises of the petitioners on the basis of intelligence note such documents should have been given to the petitioners to enable them to properly answer the charges based thereupon. The petitioners have also been denied the principles of natural justice by denying opportunity to crossexamine such witnesses who support the inspection report and the intelligence note. He has also placed reliance on the case of Jharkhand Ispat Pvt. Ltd. Vrs. Union of India & Ors. [W.P.(T) No.4241 of 2018] judgment dated 16th April 2019 in support of the same proposition. Learned counsel for the petitioners submits that in terms of Section 74 Sub-section (2) and Subsection (10), any fresh proceedings shall not be barred by limitation even in some of the present cases where the tax period relates to 2017-18. The cut-off date for initiation of proceeding i.e., 5 years would expire six months prior to the time limit specified in Sub-section 10 for issuance of an order i.e. 31st December 2023. Learned counsel for the petitioners has also placed Section 75(3) of the Act which provides that if an order is required to be issued in pursuance of the direction of the appellate authority or appellate tribunal or a court, such order shall be issued within two years from the date of communication of the said direction. Thus, it is submitted that the initiation of fresh proceedings with a proper show-cause notice would not be barred in time if the matter is remanded to the respondent authorities. Learned counsel for the petitioners has submitted that in terms of the previous order passed by this Court, the State has produced the compilation of records of proceedings as certified to be true from the original records in individual cases starting from the inspection till the adjudication order and issuance of DRC-07 which substantiate the plea raised on facts by the petitioner. The respondents have not been able to show that any proper show-cause notice was issued in terms of Section 74(1) of the Act or any opportunity to file reply or hearing was granted to individual petitioners before the adjudication order was passed under Section 74(9) of the Act.

6. While summarizing the above proposition of law in the facts of the present cases, learned counsel for the petitioners has prayed that the impugned summary of show-cause notice, adjudication order and the demand issued in DRC-07 deserve to be quashed. The matter may be remanded to the Adjudication Officer to take a fresh decision in accordance with law.

7. Mr. Sachin Kumar, learned A.A.G.-II appearing for the respondent State in all the writ petitions has inter-alia relied upon the contents of the counter affidavit filed in each of the writ petitions to defend the impugned proceedings and the adjudication order. He has referred to the provisions of Sections 67, 71 and 74 of the JGST Act and also Rule 142(1) whereunder a summary of show-cause notice was issued upon each of the individual petitioners in Form GST DRC-01 specifying the contraventions and the details of the amount of tax, penalty and interest to which the individual petitioners were liable to pay. It is submitted that in each of these cases, upon intelligence notes received from the headquarters of the State Tax Department to the District Circles/Division offices, it was detected that many tax payers under GST are though physically non-existent but have filed GSTR-1 and allowed the other dealers to utilize the said ITC. Based on these intelligence notes in individual cases investigation was carried out in the business premises of the dealer/person in accordance with law. The intelligence note also indicated that the transaction of the petitioners like M/s. Mahaveer Steel Industries, M/s Nisha Enterprises and others appeared to be a case of bill trading/circular trading. Based on such inspection carried out at the business premises of the individual dealers/petitioners upon proper authorization, inspection report was prepared and copy whereof was handed over to the representative of the petitioner firm which was duly received by him. The inspection report made out a prima-facie case of bill trading / circular transaction in case of the individual petitioners who were asked to produce the documents in this regard. It appeared from the documents made available by the petitioners that the transactions were not supported by proper e-way bills. There were apparent discrepancies in the returns filed by the petitioners in Form GSTR- 2A, GSTR-1 and GSTR-3B which showed sham/circular transactions with few dealers. The inward supply and outward supply were shown to have been made with the same dealer/person. Time was granted to the individual petitioners on their request to produce the documents with intimation as to why proceedings under Section 73/74 of the JGST Act be not initiated. On the basis of the facts determined in course of inspection, a summary of show-cause notice was issued to individual petitioners under Section 74(1) of the JGST Act, 2017 relating to the relevant tax periods specifying the amount of tax, interest and penalty payable by the petitioners. Section 74(1) of the JGST Act, 2017 empowers the proper officer to issue show-cause notice in the case of fraud or any kind of willful misstatement or suppression of facts with intent to evade the payment of tax. No satisfactory response was provided by the petitioners neither the amount specified in the notice under Section 74(1) was deposited nor did they submit any representation in the prescribed form. It has been stated in the counter affidavit that after giving opportunity to the petitioners, the order under Section 74(9) of the JGST Act was passed in case of individual petitioners. It was found that the petitioners have made transaction on paper involving circular trading between the same dealer showing inward as well as outward supplies. Since these transactions were suspicious and were sham between these petitioners’ firms without actually receiving the goods or supplying the goods, the ITC claimed by them were in violation of the conditions under Section 16 of the JGST Act which provides for eligibility and conditions for availing input tax credit. The determination of tax, liability, penalty and interest has therefore been made after thorough evaluation of documents produced by the petitioners, intelligence notes and inspection reports. As such, the order was proper in the eyes of law. The consequent demand notice in Form GST DRC-07 in individual cases are also legally valid.

8. Learned A.A.G.-II has, however, on being specifically confronted not been able to show that any proper show-cause notice was issued to the individual petitioners under Section 74(1) of the JGST Act. Learned counsel for the State has also not been able to show that any date for filing any reply to the summary of show-cause notice issued in Form GST DRC-01 was indicated to any of the petitioners. Learned counsel for the State has also not been able to overcome the lacunae pointed out on the part of the petitioners that the summary of show-cause notice in Form GST DRC-01 does not even seek a reply from the petitioners to show-cause as to why the proposed tax, penalty and interest be not imposed upon him. The language of the impugned show-cause notice are in the nature of a pre-judged and predetermined liability of tax, penalty and interest. The compilation of the records certified to be true from the original records produced by learned State Counsel in respect of each of the writ petitioners pursuant to the order dated th May 2022 do not disprove the specific lacunae pointed out by the petitioners in initiation and conduct of the proceedings leading up to the adjudication order which has confirmed the tax, penalty and interest indicated in each of the show-cause notice in its totality without any variation. Learned A.A.G.-II however submits that in case the impugned show-cause notice and adjudication order and the demand notices are set aside, the matter may be remanded to the competent State Tax Officer to initiate fresh proceeding for the relevant tax period in accordance with law and take a fresh decision. Learned counsel for the State also agrees to the contentions of the petitioners that any initiation of fresh proceeding upon remand would not be hit by limitation in view of the specific provisions of Section 74(2) read with Section 74(10) and 75(3) of the JGST Act, 2017. Learned counsel for the State is not in a position to refute the maintainability of the writ petitions on the grounds of violation of principles of natural justice and the procedure prescribed in law under the JGST Act in conduct of the impugned proceedings.

9. Learned counsel for the CGST has filed counter affidavit in W.P.(T) Nos. 3153 of 2020, 3154 of 2020 and 3179 of 2020. In substance, it is their stand that the impugned proceedings relate to the State tax authorities. However, as a proposition of law emerging on the application of relevant provisions of Sections 74 and 75 of the JGST Act, it is stated that at least 3 opportunities are required to be granted to a dealer/person to reply to the show-cause notice.

10. We have considered the submissions of learned counsel for the parties, taken note of the materials relied upon from the pleadings on record including the summary of show-cause notice issued in Form GST DRC – 01, the adjudication order and the demand notices issued in Form GST DRC – 07 in case of individual petitioners. For convenience sake, the relevant details relating to the tax period, the date of inspection, the date of issuance of summary show-cause notice in DRC-01, date of adjudication order and the date of demand notice issued in DRC-07 along with the relevant annexures relating to the individual writ petitioners are being indicated in the form of tabular chart hereunder:

| Case No. | Party Name | Period | Date of Inspection | Date of DRC-01A/ ASMT | Date of DRC-01 | Date of adjudication order | Date of DRC-07 |

| WPT No. 3153/2020 | M/s Jai Jawan Kastha Bhandar | 2018-19 | 9.7.2019 (An-2, Pg. 30 to 34) |

| 25.10.2019 (An-3, Pg35) | 25.2.2020 (An-4, Pg-36) | 25.2.2020 (An-4/1, pg 39) |

| WPT No. 3154/2020 | M/s Jai Jawan Kastha Bhanda | 2019-20 | Common (An-2, Pg. 30 to 34) |

| 25.10.2019 (An-3, Pg35) | 25.2.2020 (An-4, Pg-36) | 25.2.2020 (An-4/1, pg 39) |

| WPT No. 3179/2020 | M/s Jai Jawan Kastha Bhandar | 2017-18 | Common (An-2, Pg. 30 to 34) |

| 25.10.2019 (An-3, Pg35) | 25.2.2020 (An-4, Pg-36) | 25.2.2020 (An-4/1, pg 39) |

| WPT No. 3210/2020 | M/s Priti Enterprises | 2018-19 | 28.6.2019 (An-2, Pg. 34 to 38) |

| 25.10.2019 (An-3, Pg39) | 25.2.2020 (An-5, Pg-41) | 25.2.2020 (An-5/1, pg 44) |

| WPT No. 3211/2020 | M/s Priti Enterprises | 2017-18 | Common (An-2, Pg. 34 to 38) |

| 25.10.2019 (An-3, Pg39) | 25.2.2020 (An-5, Pg-41) | 25.2.2020 (An-5/1, pg 44) |

| WPT No. 3262/2020 | Nisha Enterprises | 2017-18 | 1.7.2019 (An-2, Pg.36) |

| 25.10.2019 (An-3, Pg41) | 25.2.2020 (An-5, Pg-44) | 25.2.2020 (An-5/1, pg 47) |

| WPT No. 3278/2020 | Nisha Enterprises | 2018-19 | Common (An-2, Pg.36) |

| 25.10.2019 (An-3, Pg41) | 25.2.2020 (An-5, Pg-44) | 25.2.2020 (An-5/1, pg 47) |

| WPT No. 1051/2021 | M/s Mahaveer Steel Industries | 2018-19 (related to M/s Sri Sai Enterprises | 8.9.2018 (An-6, Pg.59) | ASMT-10 issued on 28.1.2020 (An-2, Pg45) | 1.9.2020 (An-3, Pg46) | 16.09.2020/20 .10.2020 (Part of An-5, Pg-52 to 57) | 20.10.2020 (An-5/1, pg 58) |

| WPT No. 1067/2021 | M/s Mahaveer Steel Industries | 2018-19 (related to M/s SG Enterprises | Common (An-6, Pg.57) | ASMT-10 issued on 11.3.2020 (An-2, Pg45) | 1.9.2020 (An-3, Pg47) | 16.09.2020/20 .10.2020 (Part of An-5, Pg-54 to 55) | 20.10.2020 (An-5/1, Pg 56) |

| WPT No. 1082/2021 | M/s Mahaveer Steel Industries | 2019-20 (related to M/s SG Enterprises | Common (An-6, Pg.52) | ASMT-10 issued on 11.3.2020 (An-2, Pg42) | 1.9.2020 (An-3, Pg-43) | 16.09.2020/ 02.12.2020 (Part of An-5, Pg-49 to 50) | 02.12.2020 (An-5/1, Pg 51) |

| WPT No. 1083/2021 | M/s Mahaveer Steel Industries | 2017-18 (related to M/s SG Enterprises | Common (An-6, Pg.54) | ASMT-10 dated 11.3.2020 (An-2, Pg44) | 1.9.2020 (An-3, Pg-45) | 16.09.2020/ 20.10.2020 (Part of An-5, Pg- 50 to 52) | 20.10.2020 (An-5/1, Pg 53) |

11. The pleadings in the case of individual writ petitioners and the documents enclosed thereto, as referred to above, show that the adjudication proceedings in each case were based upon inspection undertaken on the basis of the intelligence inputs provided to the concerned circles by the headquarters of the State Tax Department. It is also evident from the records and the stand taken by the respondents in the counter affidavit that no relied upon documents in the inspection report were supplied to the petitioners. Respondents have now after producing the compilation of records of the proceedings in individual cases, not been able to dispute that no proper showcause notice was issued in terms of Section 74(1) of the JGST Act to the individual petitioners.

Section 74(1) reads as under :-

“(1) Where it appears to the proper officer that any tax has not been paid or short paid or erroneously refunded or where input tax credit has been wrongly availed or utilised by reason of fraud, or any wilful-misstatement or suppression of facts to evade tax, he shall serve notice on the person chargeable with tax which has not been so paid or which has been so short paid or to whom the refund has erroneously been made, or who has wrongly availed or utilised input tax credit, requiring him to show cause as to why he should not pay the amount specified in the notice along with interest payable thereon under Section 50 and a penalty equivalent to the tax specified in the notice.”

12. It provides that if any tax has not been paid or short paid or erroneously refunded or where input tax credit has been wrongly availed or utilised by reason of fraud, or any wilful-misstatement or suppression of facts to evade tax, the proper officer shall serve notice on the person chargeable with tax requiring him to show cause as to why he should not pay the amount specified in the notice along with interest payable thereon under Section 50 and a penalty equivalent to the tax specified in the notice. Under Subsection (2) thereof such notice is to be issued at least six months prior to the time limit specified in sub-section (10) for issuance of an order. Sub-section (10) provides that the order under sub-section (9) shall be issued within a period of five years from the due date for furnishing of annual return for the financial year to which the tax is not paid or short paid or input tax credit has been wrongly availed or utilised within five years from the date of erroneous refund. The requirement of issuance of a proper show-cause has been held to be a sine qua non while initiating such proceeding in the case of M/s Nkas Services Private Limited (supra). The opinion of this Court contained in paragraphs 14 to 18 are being extracted hereunder :-

“14. A bare perusal of the impugned show-case notice creates a clear impression that it is a notice issued in a format without even striking out any irrelevant portions and without stating the contraventions committed by the petitioner whether actuated by reason of fraud or any willful misstatement or suppression of facts in order to evade tax. Needless to say that the proceedings under Section 74 have a serious connotation as they allege punitive consequences on account of fraud or any willful misstatement or suppression of facts employed by the person chargeable with tax. In absence of clear charges which the person so alleged is required to answer, the noticee is bound to be denied proper opportunity to defend itself. This would entail violation of principles of natural justice which is a well-recognized exception for invocation of writ jurisdiction despite availability of alternative remedy. In this regard, it is profitable to quote the opinion of the Apex Court in the case of Oryx Fisheries P. Ltd. (supra) at para 24 to 27 wherein the opinion of the Constitution Bench of the Apex Court in the case of Khem Chand versus Union of India [AIR 1958 SC 300] has been relied upon as well :

“24. This Court finds that there is a lot of substance in the aforesaid contention. It is well settled that a quasi-judicial authority, while acting in exercise of its statutory power must act fairly and must act with an open mind while initiating a show-cause proceeding. A show-cause proceeding is meant to give the person proceeded against a reasonable opportunity of making his objection against the proposed charges indicated in the notice.

25. Expressions like “a reasonable opportunity of making objection” or “a reasonable opportunity of defence” have come up for consideration before this Court in the context of several statutes. A Constitution Bench of this Court in Khem Chand v. Union of India, of course in the context of service jurisprudence, reiterated certain principles which are applicable in the present case also.

26. S.R. Das, C.J. speaking for the unanimous Constitution Bench in Khem Chand held that the concept of “reasonable opportunity” includes various safeguards and one of them, in the words of the learned Chief Justice, is: (AIR p. 307, para 19)

“(a) An opportunity to deny his guilt and establish his innocence, which he can only do if he is told what the charges levelled against him are and the allegations on which such charges are based;”

27. It is no doubt true that at the stage of show cause, the person proceeded against must be told the charges against him so that he can take his defence and prove his innocence. It is obvious that at that stage the authority issuing the chargesheet, cannot, instead of telling him the charges, confront him with definite conclusions of his alleged guilt. If that is done, as has been done in this instant case, the entire proceeding initiated by the show-cause notice gets vitiated by unfairness and bias and the subsequent proceedings become an idle ceremony.”

15. The Apex Court has held that the concept of reasonable opportunity includes various safeguards and one of them is to afford opportunity to the person to deny his guilt and establish his innocence, which he can only do if he is told what the charges leveled against him are and the allegations on which such charges are based.

16. It is also true that acts of fraud or suppression are to be specifically pleaded so that it is clear and explicit to the noticee to reply thereto effectively [See Larsen & Toubro Ltd. Vs. CCE, (2007) 9 SCC 617 (para 14)]. Further in the case of CCE Vs. Brindavan Beverages (P) Ltd. reported in (2007) 5 SCC 388 relied upon by the petitioner, the Apex Court at para-14 of the judgment has held that if the allegations in the show-cause notice are not specific and are on the contrary, vague, lack details and/or unintelligible i.e. sufficient to hold that the noticee was not given proper opportunity to meet the allegations indicated in the showcause notice. We do not agree with the contention of the respondent that the notice ought not to be struck down if in substance it contains the matters which a notice must contain. In order to proceed under the provisions of Section 74 of the Act, the specific ingredients enumerated thereunder have to be clearly asserted in the notice so that the noticee has an opportunity to explain and defend himself.

17. As observed herein above, the impugned notice completely lacks in fulfilling the ingredients of a proper showcause notice under Section 74 of the Act. Proceedings under Section 74 of the Act have to be preceded by a proper show-cause notice. A summary of show-cause notice as issued in Form GST DRC-01 in terms of Rule 142(1) of the JGST Rules, 2017 (Annexure-2 impugned herein) cannot substitute the requirement of a proper show-cause notice. This court, however, is not inclined to be drawn into the issue whether the requirement of issuance of Form GST ASMT-10 is a condition precedent through invocation of Section 73 or 74 of the JGST Act for the purposes of deciding the instant case. This Court finds that upon perusal of Annexure-2 which is the statutory form GST DRC-01 issued to the petitioner, although it has been mentioned that there is mismatch between GSTR-3B and 2A, but that is not sufficient as the foundational allegation for issuance of notice under Section 74 is totally missing and the notice continues to be vague.

18. Since we are of the considered view that the impugned show-cause notice as contained in Annexure-1 does not fulfill the ingredients of a proper show-cause notice and thus amounts to violation of principles of natural justice, the challenge is entertainable in exercise of writ jurisdiction of this Court. Accordingly, the impugned notice at Annexure-1 and the summary of show-cause notice at Annexure-2 in Form GST DRC-01 are quashed. However, since this Court has not gone into the merits of the challenge, respondents are at liberty to initiate fresh proceedings from the same stage in accordance with law within a period of four weeks from today.”

13. In the absence of a proper show-cause notice the petitioners herein have been denied proper opportunity to defend themselves of the charges. The requirement of affording opportunity of hearing as contemplated in Section 75(4) of the JGST Act has also been denied. Section 75(5) provides that in case sufficient show-cause is shown by the person chargeable with tax, the proper officer shall grant time to the said person and adjourn the hearing for reasons to be recorded in writing provided that no such adjournment shall be granted for more than three times to a person during the proceedings.

14. This issue has attracted the attention of this Court in the case of (M/s Godavari Commodities Limited (supra) wherein at paragraphs-21 to 23 it has been held as under :-

“21. At this stage, we deem it appropriate to quote the provisions of Section 75(4) and 75(5) of the CGST/JGST Act:-

“75. General provisions relating to determination of tax (4) An opportunity of hearing shall be granted where a request is received in writing from the person chargeable with tax or penalty, or where any adverse decision is contemplated against such person. (5) The proper officer shall, if sufficient cause is shown by the person chargeable with tax, grant time to the said person and adjourn the hearing for reasons to be recorded in writing: PROVIDED that no such adjournment shall be granted for more than three times to a person during the proceedings.”

22. A conjoint reading of the provisions of Sections 75(4) and 75(5) would reveal as under:- (i) Opportunity of hearing’ shall be granted on request. (ii) Opportunity of hearing shall be granted where any adverse decision is contemplated. (iv) If sufficient cause is shown, the proper officer can adjourn the hearing for reasons to be recorded in writing. (v) However, no such adjournment shall be granted for more than three times during the proceedings.

23. From the facts of the present proceedings, it would transpire that on 14th March, 2020, Form GST DRC 01 was issued without specifying any date of hearing and, thereafter, straightaway, an Adjudication Order was allegedly passed on 13th August, 2020 fastening liability of tax, interest and penalty upon the Petitioner. From the order sheet, it is evident that no opportunity of personal 13 hearing was granted to the petitioner and the purported Adjudication Order was passed on 13.08.2020 i.e. on the first date itself after issuance of the summary of show cause notice. This itself clearly reveals that the entire adjudication proceedings have been carried out in stark disregard to the mandatory provisions of the GST Act and in violation of the principles of natural justice and, thus, the Adjudication Orders, allegedly dated 13.08.2020, are liable to be quashed and set aside on this ground also.”

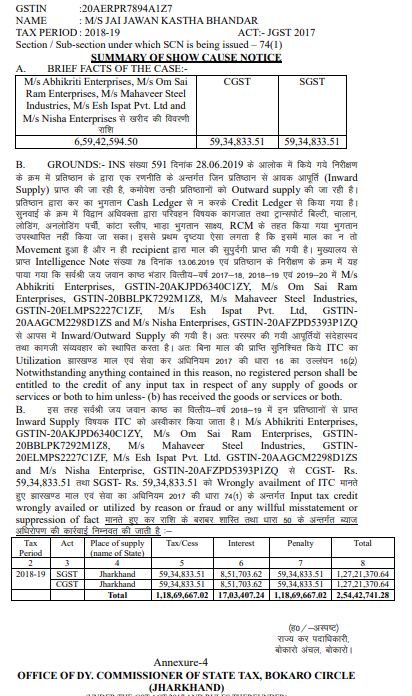

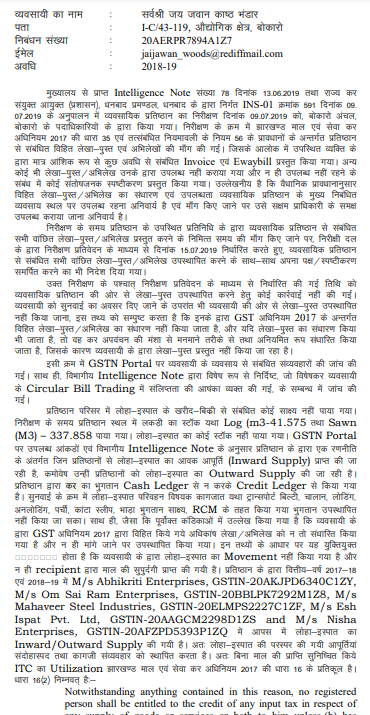

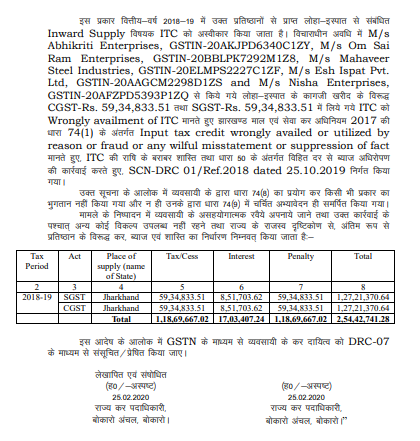

15. We may usefully point out at this stage that the summary of show-cause notice in case of each of the writ petitioners is in the same format and language. It does not indicate any date for filing reply. The language employed also creates a clear impression that the liability towards tax, penalty and interest has been already pre-determined. None of the petitioners got any opportunity to reply to the summary of the show-cause notice either as no date or time was indicated therein. The adjudication order has been passed thereafter confirming this liability towards tax, penalty and interest indicated in the summary of show-cause notice in case of each of the writ petitioners. The extract of one of the summary of show-cause notice and the adjudication order passed in the case of one of the petitioners M/s. Jai Jawan Kastha Bhandar in relation to the tax period 2018-19 relating to W.P.(T) No.3153 of 2020 is being extracted hereunder which shows that the impugned summary of show-cause notice neither did specify any date or time for furnishing of reply nor was in the nature of a proper show-cause notice as the liability towards tax, penalty and interest were already determined. Learned counsel for the State has not been able to dispute that the summary of show-cause notice in Form GST DRC-01 in case of individual petitioners and the adjudication order also in case of individual petitioners are in the same language and format and that no opportunity whatsoever was given to the individual petitioners to furnish reply to the summary of show-cause notice.

16. Annexure-3 being summary of show-cause notice in Form GST DRC-01 bearing Ref. No.2018 dated 25th October 2019 relating to tax period 2018-19 and the adjudication order at Annexure-4 under Section 74(9) of the Act bearing Ref. No.46 dated 25th February 2020 in the case of the petitioner M/s Jai Jawan Kastha Bhandar i.e. W.P.(T) No.3153 of 2020 are reproduced hereunder :-

“Annexure-3

Office of the Deputy Commissioner of State Tax, Bokaro Circle, Bokaro

From GST DRC-01

[See Rule 142(1)]

Ref. …2018

Date. …25.10.2019

17. The summary of the order in Form GST DRC 07 has been issued in individual cases conveying the assessment of liability towards tax, interest and penalty adjudged by the State Tax Officer on wrongful availment of ITC without receipt of goods in contravention of Section 16(2) using fraudulent methods in case of individual petitioners in like manner. It is evident that without proper opportunity of furnishing reply to the show-cause notice and without supplying the relied upon documents referred to in the inspection report, the petitioners have been prejudiced in defending themselves. The petitioners may have also lost the opportunity to cross-examine such persons as are relied upon by the tax authorities to support the impugned proceedings. Since the impugned proceedings are clearly in violation of principles of natural justice and the procedure prescribed under the JGST Act, the petitioners are justified in approaching this Court in writ jurisdiction. The writ petitions are held to be maintainable in view of the principles laid down by the Apex Court in the case of Magadh Sugar & Energy Ltd. Vs. State of Bihar & Ors. reported in 2021 SCC Online SC 801, para-25 to 27. We have also taken note of the provisions of Section 74(2) read with Section 74(10) and Section 75(3) of the JGST Act whereunder initiation of fresh proceedings in respect of the tax periods in question would not be time-barred. The earliest tax period in case of some of the petitioners like W.P.(T) Nos.3179 of 2020, 3262 of 2020 and 1083 of 2021 relates to 2017-18. Initiation of proceedings would be permissible within a period of 6 months prior to expiry of 5 years from the date of filing of the annual returns i.e. 31st December 2018.

18. As an upshot of the discussions made herein above and for the reasons recorded, the impugned show-cause notice, the adjudication orders and the summary of the order/demand notice in DRC-07 in the case of the individual petitioners cannot be sustained in the eyes of law and on facts. They are accordingly set aside. The respondents State Tax authorities are at liberty to initiate fresh proceedings by issuing a proper show-cause notice in respect of the individual writ petitioners relating to the relevant tax periods and take a decision thereupon in accordance with law. It is abundantly made clear that this Court has not gone into the merits of the case of any of the petitioners herein. The Adjudicating Officer shall be entitled to take a fresh decision without being prejudiced by any observation made hereinabove whatsoever.

19. The writ petitions are allowed in the manner and to the extent indicated herein above.