Kernex Tcas Jv vs. Na

(AAR (Authority For Advance Ruling), Telangana)

1. M/s. Kernex TCAS JV, Plot No 38 TO 41, Hardware Technology Park, TSIIC Layout, Maheswaram Mandalam, Ranga Reddy, Telangana – 501510 (36AAUFK6458J1ZI) has filed an application in FORM GST ARA-01 under Section 97(1) of TGST Act, 2017 read with Rule 104 of CGST/TGST Rules.

2. At the outset, it is made clear that the provisions of both the CGST Act and the TGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to any dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the TGST Act. Further, for the purposes of this Advance Ruling, the expression ‘GST Act’ would be a common reference to both CGST Act and TGST Act.

3. It is observed that the queries raised by the applicant fall within the ambit of Section 97 of the GST ACT. The Applicant enclosed copies of challans as proof of payment of ₹ 5,000/- for SGST and ₹ 5,000/- for CGST towards the fee for Advance Ruling. The concerned jurisdictional officer also raised no objection to the admission of the application. The application is therefore, admitted

4. Brief facts of the case:

M/s. Kernex TCAS JV is executing a contract for South Central Railways for design, supply, installation, testing and commissioning of onboard train collision avoidance system (TCAS). The applicant is desirous of ascertaining the liability to tax under GST law on the execution of this contract on various counts including place of supply. Hence this application.

5. Questions raised:

1. (A) Whether the subject work falls under Works Contract?

(B) What is the applicable rate of GST for this contract?

2. Whether AMC services fall under the same category of principal supply i.e., setting up of TCAS since both are under one work order?

3. (A) If this contract is not to be considered as works contract then what should be the rate of GST for supply of goods under TCAS and supply of goods and services under AMC as the quantity and prices are provided in the work order separately?

(B) What is the rate of GST for services (erection and commissioning) under TCAS and AMC involving civil works as the prices for the same are provided in the work order separately.

4. Whether is there a requirement for separate registration in other states?

5. Whether CGST & SGST or IGST to be charged on the supply of goods like components, parts, spares etc., to SCR, Secunderabad, Telangana as a part of whole contract of supply, installation & commissioning in Maharashtra and Karnataka State?

6. What is the applicable rate of GST to sub-contractors and sub-suppliers of goods?

6. Personal Hearing:

The Authorized representatives of the unit namely C V Suryam, CA and Mahesh Kumar, Admin officer attended the personal hearing held on 05-01-2022. The authorized representatives reiterated their averments in the application submitted and requested the AAR to dispose the case on merits based on their detailed submissions.

7. Discussion & Findings:

The applicant is seeking clarification regarding the classification and tariff on TCAS equipment in Railways.

As seen from the counter offer issued by south central railway dated: 13.11.2019 the contract is for design, supply, installation, testing and commissioning of onboard TCAS equipment in locomotives and track side. The counter offer also contains schedule of description mentioning various items to be utilized quantity and value wise in it. There is also a payment schedule for the contract. There is a specific clause 7 regarding GST which mentions that the contractee i.e., South Central Railway shall reimburse the GST if a higher rate is determined even after completion of the contract.

Further the definition of works contract under the CGST Act at Section 2(119) is restricted to supplies of goods & services pertaining to immovable property only. This contract being an agreement for installation of equipment onboard the locomotives which are movable property, the said supply does not qualify to be a works contract under the GST law.

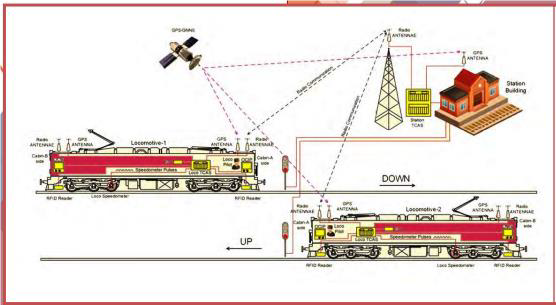

To ascertain the exact nature of the supply involved in this contract, it is pertinent to refer to the publications of Ministry of Railways, Government of India who have published a handbook on Train Collision Avoidance System (TCAS) in Apr’2021 wherein the composition and working of the TCAS system has been given in detail. It is expressively stated that this system has been designed and implemented to prevent ‘Signal Passing at Danger (SPAD) cases, unsafe situations arising due to over speed and train collisions in station as well as block sections’. It is mentioned in the introduction to overview that this includes automatic break application and display of information like speed, location, distance to signal ahead, signal aspects etc., in the loco pilots cabin and generation of auto & manual SOS messages from LOCO in case of emergency situation.

In the system overview of this handbook, it is seen that the entire system is based on signaling equipment and RFID tags. The principal goods in the system is electrical signaling equipment enumerated as HSN 8530 i.e., ‘Electrical signaling, safety or traffic control equipment for railways, tramways, roads, inland waterways, parking facilities, port installations or airfields’.

The illustration of the working of the system based on signals is available in this handbook in the following diagram:

As seen from the description and illustration, supply of this system is a naturally bundled supply of various goods working in unison to achieve a single purpose of railway safety through signaling etc., Therefore the supply of this system to south central railway under a contract has all the attributes to make it a composite supply.

Composite supply is defined in the CGST Act in Section 2(30) as follows:

“Composite supply” means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply.

Illustration: Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply.

As seen from the above definitions a composite supply is essentially a naturally bundled supply where two or more different supplies invariably exist along with each other. As against this a mixed supply is a bundled supply is not a bundled supply where the goods / services though supplied together are distinct and separately identifiable. However a supply can be a mixed supply only if it is a single price.

The Hon’ble High Court of Kerala in the case of Abott Health Care Pvt. Ltd., (2020) 74 GSTR 37 (Kerala) held that a composite supply must take into account supplies as affected at a given point in time on “as is where is” basis.

Therefore a naturally bundled supply should possess the following attributes (as mentioned in Education Guide on Taxation of Services published by CBE & C on 20.06.2012 at Para 9.2.4):

a. There is a single price or the customer pays the same amount, no matter how much of the package they actually receive or use.

b. The elements are normally advertised as a package.

c. The different elements are not available separately

d. The different elements are integral to one overall supply – if one or more is removed, the nature of supply would be affected.

Further the illustration in the definition clarifies the context of composite supply. As seen from the illustration the supply of service i.e., insurance and goods go alongside each other. As against this the illustration given in the context of mixed supply clearly indicates that each of the items therein can be supplied separately and are not dependant of any other.

The Hon’ble Supreme court of India in a catena of case law has ruled that illustrations in a statute are part of the statute and help to elucidate the principle of the Section (Dr. Mahesh Chandra Sharma Vs Smt. Raj Kumari Sharma – AIR 1996 SC 869). Therefore a composite supply should be similar to a supply mentioned in the illustration to the definition in Section 2(30), where two or more taxable goods or services are supplied along with each other to constitute a composite supply.

Further Para 6 of the Schedule II to the CGST Act, 2017 states that composite supply involving works contract as defined under clause 119 of Section 2 of CGST Act and supply of food, drink etc., shall be treated as services. Therefore a composite supply involving goods and services other than the above will be assessed as a naturally bundled supply and will be taxed at the rate applicable to the principal supply therein.

Therefore in view of the above discussions the supply made by the applicant against the counter offer of the South Central Railway is a composite supply and the rate of tax applicable is the rate at which the principal supply has to be taxed i.e., Electrical signalling equipment with HSN code ‘8530’

This commodity was made taxable at the rate of 9% under CGST & SGST respectively vide Notification No. 1/2017 dated: 28.06.2017 as amended by Notification No. 41/2017 dated: 14.11.2017. Therefore the supply of Train Collision Avoidance System (TCAS) is taxable at the rate of 9% under CGST & SGST respectively.

Further the contract has performance guaranteed clauses at clause 9 followed by warranty AMC details at clause 10. Under clause 10, the applicant shall enter into AMC (Annual Maintenance Contract) after the expiry of warranty period for a period of one year separately for onboard and track side systems with respective Sr.DEE/Sr.DME of loco sheds for onboard system and Sr.DSTEs of Division for track side system. Thus AMC is clearly a different contract and will be enforced separately so that the failure to perform the promises under AMC will not put the promises under main contract in breach, more so because the main contract would have been completed by the time AMCs are separately entered with the authorities indicated. Therefore mere mentioning of a future AMC in the original contract will not make such future AMC contracts a part of the original contract. Further the details of Annual Maintenance Contract are not provided by the applicant, however the applicant submitted that the AMC involves the same services and goods for the maintenance of the TCAS system.

Therefore, in view of the submissions, AMC is also a composite contract and GST payable will be the GST applicable to the principal supply i.e., 9% under CGST & SGST respectively on Maintenance service of Electrical signalling equipment.

Further the tax payer is executing these supplies in other States also. The GST statute requires that they need to take registration under CGST & local SGST in the respective states where they make supplies and are liable to pay tax under CGST/SGST as per the place of supply rules enumerated under Section 10 & 12 of the IGST Act.

It is also informed by the applicant the South Central Railway has awarded the supply contract to their joint venture firm and that one of the partners of the Joint venture M/s. Kernex Microsystems (I) ltd will execute the contract for the Joint venture. In this connection it is observed that if the entire contract is executed all the attributes of the contract discussed above will remain the same for the executing partner. Therefore the liability of the executing partner will also remain the same as discussed.

8. The ruling is given as below:

In view of the above discussion, the questions raised by the applicant are clarified as below:

| Questions | Ruling |

| 1. (A) Whether the subject work falls under Works Contract? | The subject work is a composite supply and not works contract under GST |

| (B) What is the applicable rate of GST for this contract? | Being a composite supply, the rate applicable to principal supply is the rate applicable to the entire contract i.e., 9% CGST and also SGST as discussed above. |

| 2. Whether AMC services fall under the same category of principal supply i.e., setting up of TCAS since both are under one work order? | The AMC contract is a separate contract from the original contract as discussed above. |

| 3 (A) If this contract is not to be considered as works contract then what should be the rate of GST for supply of goods under TCAS and supply of goods and services under AMC as the quantity and prices are provided in the work order separately? | As discussed above, this contract is a composite contract and the rate of tax applicable to principal supply is the rate applicable to the entire contract i.e., 9% CGST and also SGST as discussed above. |

| (B) What is the rate of GST for services (erection and commissioning) under TCAS and AMC involving civil works as the prices for the same are provided in the work order separately. | As discussed above, this contract is a composite contract and the rate of tax applicable to principal supply is the rate applicable to the entire contract i.e., 9% CGST and also SGST as discussed above. |

| 4) Whether is there a requirement for separate registration in other states? | Yes. As the applicant makes supplies in other States and is liable to pay CGST & SGST in those states as he is required to take separate registration in other States. |

| 5) Whether CGST & SGST or IGST to be charged on the supply of goods like components, parts, spares etc., to SCR, Secunderabad, Telangana as a part of whole contract of supply, installation & commissioning in Maharashtra and Karnataka State? | The applicant is making a composite supply other than supply of works contract or food and beverage. Therefore it is a naturally bundled supply where in the liability to pay tax on the entire consideration will be the liability relatable to the principal supply. In this case the principal supply is Electrical signalling equipment with HSN code ‘8530’ i.e., goods and as per Section 10 of IGST Act the place of supply of goods is the place where goods are delivered by the supplier i.e., the applicant. If the applicant is delivering goods to the recipient in other State that State will be the place of supply and the liability to pay tax will arise in such State where the delivery is made. |

| 6) What is the applicable rate of GST to sub-contractors and sub-suppliers of goods? | In the context of facts submitted, the executing partner of Joint Venture will have the same liability as the Joint Venture firm which was allotted the contract by South Central Railways. |