Natco Pharma Limited vs. Assistant Commissioner & Other

(Madras High Court, Tamilnadu)

ORDER

This order will now dispose of the captioned writ petition and captioned ‘writ miscellaneous petition’ (‘WMP’ for the sake of brevity).

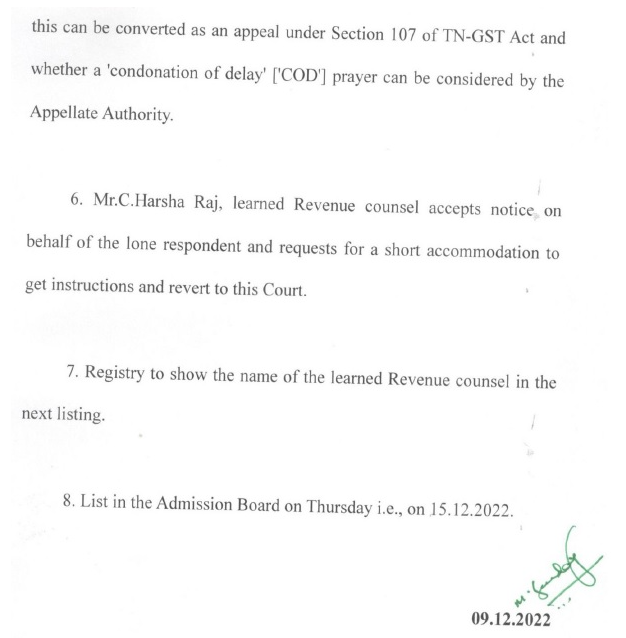

2.This order has to be read in conjunction with and in continuation of earlier proceedings made in the listing on 09.12.2022. A scanned reproduction of the same is as follows:

W.P.No.33043 of 2022

and

W.M.P.No.32451 of 2022

M.SUNDAR, J.,

Ms.N.V.Lakshmi, learned counsel on record for writ petitioner is before this Court.

2. Subject matter Of the captioned writ petition pertains to ‘an order dated 06.04.2022 bearing order No.ZB3304222253181’ [hereinafter ‘impugned order’ for the sake of convenience and clarity] vide which the respondent has rejected a refund claim made by the writ petitioner on the ground that supplies have been made to 100% ‘EOU’ [‘Export Oriented Unit’] and is therefore deemed report.

3. In and by the impugned Order, the refund prayer was rejected. As against the refund order rejection, writ petitioner has a remedy’ of an appeal under Section 107 Of ‘Tamil Nadu Goods and Services Tax Act, 2017 (Tamil Nadu Act 19 of 201 7)’ [hereinafter ‘TN-GST Act’ for the sake of convenience and clarity] but the prescribed time is three months and the condonable time limit is one month, which elapsed on 06.012022 and 06.08.2022 respectively. In the interregnum, the writ petitioner has filed a second refund application on 12.07.2022 which falls within the condonable period.

4. Two questions fall for consideration, one is whether the period of the limitation can be extended/expanded at all in the light of Glaxo Smith case law [Assistant Commissioner (CT) LTV, Kakinada and Others Vs. Glaxo Smith Kline Consumer Health Care Limitedl reported in 2020 SCC OnLine SC 440 and also a line of case laws/orders of this Court following G.Rukmani Ganesan’s case law [Ganesan, Rep. by power agent G.Rukmuni Ganesan Vs. The Commissioner, The Tamil Nadu Hindu Religious and Charitable Endowments Board and Others] reported in (2019) 7SCC 108.

5. The unique facet of the case on hand i.e, the facts and circumstances of the case is the second refund application which has been erroneously filed during the condonable period, the question as to whether

3.The aforesaid earlier proceedings is tell-tale and it also captures the crux and gravamen of the issue before this Court.

4.As the earlier proceedings dated 09.12.2022 has to be read as an integral part and parcel of this order, the short forms, abbreviations and other short references used in the earlier order will continue to be used in the instant order also for the sake of convenience and clarity.

5.Today Ms.N.V.Lakshmi, learned counsel on record for the writ petitioner and Mr.C.Harsha Raj, Additional Government Pleader (Taxes) [Revenue Counsel] for the sole respondent are before this Court.

6.Adverting to the earlier proceedings, learned revenue counsel submits that as regards a statutory appeal under Section 107 of TN-GST Act, the sole respondent is not the appellate authority and the appellate authority is ‘Deputy Commissioner (ST), GST Appeal-II, Annexe Building, 3rd Floor, Greams Road, Chennai – 600 006‘.

7.This Court considering the bonafides on the part of the writ petitioner and also taking into account the facts and circumstances of the case including the obtaining factual position that the refund amount claimed in barely Rs.9.42 lakhs, treats this case as a one off matter, making it clear that it will not serve as precedent in all and every such case is inclined to treat 12.07.2022 as the date of appeal.

8.For the aforesaid purpose, ‘Deputy Commissioner (ST), GST Appeal-II, Annexe Building, 3rd Floor, Greams Road, Chennai – 600 006‘ is suo motu impleaded as second respondent and Mr.C.Harsha Raj, Additional Government Pleader (Taxes) accepts notice on behalf of the second respondent also. Registry to carry out necessary and consequential amendments before issuing certified copy/uploading the instant order.

9.It is to be noted that the case of the writ petitioner qua refund of a little over 9.42 lakhs is they have made deemed export as supply has been made to a 100% EOU but the refund order dated 06.04.2022 made by the [first respondent now] proceeds on the basis that it is a wrong ITC claim. This Court refrains itself from expressing any opinion or view on this aspect of the matter as it would now be in the hands of the second respondent/Appellate Authority to decide the matter on its own merits and in accordance with law.

10.In the light of the narrative thus far, the following order is passed:

(a) The writ petitioner shall refile the second refund application (already filed) as appeal (in appeal format) before second respondent;

(b) The second respondent/Appellate Authority shall construe the appeal to have been presented on 12.07.2022 which is the date of second refund application and proceed with the appeal on its own merits and in accordance with law;

(c) This order or the observations made in this order will neither impede nor serve as an impetus qua the appeal for either the Revenue or the writ petitioner/dealer. In other words, the observations made in this order will not come in the way of Appellate Authority making an order on merits and in accordance with law;

(d) The Appellate Authority shall deal with the appeal as expeditiously as his official business would permit and in any event dispose of the appeal within six weeks from today i.e., on or before 01.02.2023.

11.Captioned Writ Petition disposed of with the aforesaid directives and observations. There shall be no order as to costs.