Nes Global Specialist Engineering Services Private Limited vs. Na

(AAR (Authority For Advance Ruling), Maharashtra)

PROCEEDINGS

(under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

The present application has been filed under section 97 of the Central Goods and services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and MGST Act”] by NES GLOBAL SPECIALIST ENGINEERING SERVICES PRIVATE LIMITED, the applicant, seeking an advance ruling in respect of the following questions.-

(i) Whether the transaction in question is a Zero Rated Supply or a Normal Supply under the GST ACT?

(ii) If the said supply is a Zero Rated Supply, then can the same be considered as an export of service under the GST Act?

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the MGST Act. Further to the earlier, henceforth for the purposes of this Advance Ruling, a reference to such a similar provision under the CGST Act / MGST Act would be mentioned as being under the “GST Act”.

02. FACTS AND CONTENTION – AS PER THE APPLICANT

The submissions, as reproduced verbatim, could be seen thus-

I. STATEMENT OF FACTS :

Brief of Indian Company

NES Global Specialist Engineering Services Private Limited (NES India) has its registered office is situated at office no 24 & 28, Red Bricks – Level 1, HDIL Kaledonia, Sahar Road, Andheri East, Mumbai -400069, Maharashtra, India.

The Company is engaged in providing supply of man-power services to highly technical industries such as Oil and Gas, Power, etc. GST Regn number:- 27AACCN9033F1ZI & C1N :- U72200MH2008FTC288230

Brief of Abu Dhabi Company

NES Global Talent Recruitment Services (NES Abu Dhabi) whose registered office is situated at Unit 104, Business Avenue Tower, A1 Salaam Street, P.O. Box no 63107, Abu Dhabi. Foreign Tax Identification number:-100069908000003

Brief of Parent Company in UK

Both tine above mentioned companies i.e. NES India and NES Abu Dhabi are subsidiary companies of the parent company named NES Global Limited (NES UK) , which is a registered company in the United kingdom.

Unique Tax Reference number :- 4008011199.

Brief of transaction

NES India & NES Abu Dhabi have proposed to enter into a service agreement through which NES India will provide support service in respect of the foreign business carried on by NES Abu Dhabi.

Every service provided by NES India will form part of the Master Services Agreement (“MSA”) & its Schedules in detail. The services provided by NES India would be as following, for example:-

Accounting, Sales Invoicing, Purchase Invoicing, Cash receipt posting, Bank Payment entries, Other receipt entries, Credit Control work, Support Assignment work, Payroll assistance, storing and scanning of data to the data storage disk and any other work would be required by you as per your requirements. (Refer Separate Service Schedule for total list of services – Copy of MSA enclosed).

– Valuation of transaction

As per the agreement, NES India is not allowed to outsource or sub contract the work to any other person and hence, in order to provide the above mentioned services, NES India will have to use its current place of business, which is on rent along with current employees and will also incur other related expenses, in order to carry out the desired work for NES Abu Dhabi.

In view of the above and as per the MSA, NES India will Charge NES Abu Dhabi the cost incurred in India for providing the desired services, as identified and allocated with a margin of 10% plus taxes as applicable during the period.

Written Submission, being the Part and Parcel of the Application for Advance Ruling submitted with the Advance Ruling Authority on 06.07.2018.

Justification for considering the transaction as export of service.

1. We understand that Learned CGST Officer had informed in last hearing dated 12.12.2018 that the copy of Master Service Agreement (MSA) had not been produced for verification. The Service Provider, NES Global Specialist Engineering Services Private Limited (NES India) and the Service receiver, NES Global Talent Recruitment Services (NES Abu Dhabi are associate concerns, had made an “INTER COMPANY SERVICE AGREEMENT” and the same had furnished with you, already and the same be considered as MSA, for all purposes, and request to waive the variation in Nomenclature, if any.

2. Further we are enclosing copy of Invoices – (Exb- 1) & Bank Statement – Supporting for realisation, (Exb- 2) and Advice of Foreign Inward Remittance- HSBC (Advice), (Exhibit- 3).

3. Further we submit that the above proceeds are received in fully convertible foreign exchange and the fact had been confirmed by the Bank in the Advice, as reproduced below for the sake of brevity.-

“* In case where foreign currency amount has been mentioned as “INR” in the advice, it is being confirmed that the bank has received the funds in “INR” to the debit of Vostro account and that such proceeds are received in fully convertible foreign exchange”.

Based on the above fact, we reiterate that the above transaction to be considered as Export of Service, as the following conditions fulfilled.-

(i) the supplier, (NES India), of service is located in India;

(ii) the recipient, (NES Abu Dhabi), of service is located outside India;

(iii) the place of supply of service is outside India, (Location of the recipient);

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; (as mentioned supra) and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8.

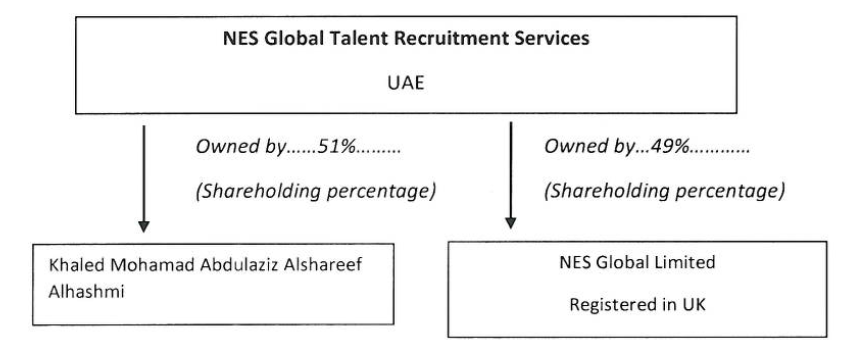

Sample of Organizational Chart for Opening of Account & Account Servicing

II. STATEMENT OF INTERPRETATION OF LAW AND/OR FACTS:

The applicant is on the view that above transaction will fall under Export of Service, on considering the fulfilment of the conditions as per the GST Act and provisions.

Export of Services conditions under GST as summarised below:

Under the provisions of the IGST Act, if a transaction of service provision meets all the conditions of “export of services” as defined in Section 2(6) of the said act, then such transaction will be treated as an export of service and qualify as a Zero Rated Supply as per section 16(1) of the Act.

Section 2(6) of the IGST Act defines “Export of Services”, as follows:

“Export of Services” means the supply of any service when,-

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8

Section 16(1) of the IGST Act defines “zero rated supply”, as follows

16. (2) “zero rated supply” means any of the following supplies of goods or services or both, namely:-

(a) export of goods or services or both; or

(b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

In view of the above, the transaction that NES India and NES Abu Dhabi are proposing to enter into is squarely covered by the definition of export of service, as it satisfies all the conditions as listed in section 2(6) of the IGST Act, as follows:-

(i) the supplier of service i.e. NES India is located in India and is reregistered under the GST Act in the State of Maharashtra ;

NES India will provide services to NES Abu Dhabi as per MSA and for doing so, NES India will employ persons in India and also take office space on rent in its own name, which indicates that provider of services is located in India.

(ii) the recipient of service i.e. NES Abu Dhabi is located outside India and is registered at Abu Dhabi;

As per MSA, NES Abu Dhabi will list of services (example given above) that it needs NES India to provide in respect of its office and business in Abu Dhabi, which indicates that recipient of services is located in Abu Dhabi.

(iii) the place of supply of service is outside India in terms of Section 13(2) of the IGST Act;

Section 13(1) of the IGST Act is to be referred to, to determine the Place of supply of services provided, in a situation where the location of the supplier of services or the location of the recipient of services is outside India.

Hence, as the location of recipient of service i.e. NES Abu Dhabi, is outside India, the place of supply will be determined based on Section 13 of the IGST Act.

In view of the above and as per section 13(2) of the IGST Act, the Place of supply for services provided by NES India is the location of the recipient of services i.e. in Abu Dhabi and the services provided by NES India is not covered by the specific situations covered by sections 13(3) to (13) of the IGST Act 2017.

Section 13(1) and 13(2) reads as under:-

13. (1) The provisions of this section shall apply to determine the place of supply of services where the location of the supplier of services or the location of the recipient of services is outside India

(2) The place of supply of services except the services specified in sub-sections (3) to (13) shall be the location of the recipient of services:

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange; and

NES Abu Dhabi will remunerate NES India for the services provided by it from India, in convertible foreign exchange, hence meeting the said condition.

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8

NES India and NES Abu Dhabi are not establishments of the same person, even though they are group companies.

The Shareholding pattern of both the companies proves that the Key management personal and Board of Directors are different and neither of them holds shares of each other and thus they do not control one another. (Related documents proving the same have been attached).

NES India is not a branch or an agency or a representational office of NES Abu Dhabi and both the companies are independent of each other.

It is important to draw attention to the fact that, even the MSA states that this transaction will not create any partnership or relation between the 2 companies and both the companies will act independently. The relevant clause of the MSA has been reproduced below

8.4 Nature of Relationship.- In performing services pursuant to this Agreement, the Party providing such services will be an independent contractor of the Party for whom such services are performed, and this Agreement will not be deemed to create a partnership, joint venture or other arrangement between the Parties.

The Applicant relied on the similar issue, in which HON. HIGH COURT OF DELHI had taken the view that such transaction will fall under export of service. (Verizon Communication India Pvt. v/s Assistant Commissioner, Service .. on 12 September, 2017, Delhi High Court).

03. CONTENTION – AS PER THE CONCERNED OFFICER

The submission, as reproduced verbatim, could be seen thus-

M/s. NES Global Specialist Engineering Services Pvt. Ltd., 1st floor, Redbrick, Kaledonia Sahar Road, Andheri (East), Mumbai 400069 (GSTIN: 27AACCN9033F1ZI) (here in after referred to as ‘the applicant’) has filed above application under Section 98 of the Central Goods and Service Tax Act, 2017 read with Rule 104 (1) of the CGST Rules, 2017 seeking advance ruling on:-

(i) Whether the transaction in question is a Zero Rated Supply or a Normal Supply under the GST Act?

(ii) if the said supply is a Zero Rated Supply, then can the same be considered as an export of service under the GS T Act?

2. In point No.15 of the application regarding statement of relevant facts having a bearing on the question(s) raised, the applicant has stated the following are as under:

NES Global Specialist Engineering Services Private Limited (NES India) has its registered office is situated at office no 24 & 28, Red Bricks – Level 1, HDIL Kaledonia, Sahar Road, Andheri East, Mumbai -400069, Maharashtra, India.

The Company is engaged in providing supply of man-power services to highly technical industries such as Oil and Gas Power, etc. GST Registration number: 27AACCN9033F1ZI. CIN :- U72200MH2008FTC288230.

Brief of Abu Dhabi Company

NES Global Talent Recruitment Services (NES Abu Dhabi) whose registered office is situated at Unit 104, Business Avenue Tower, A1 Salaam Street, P.O. Box no 63107, Abu Dhabi. Foreign Tax Identification number:- 100069908000003.

Brief of Parent Company in UK

Both the above mentioned companies i.e. NES India and NES Abu Dhabi are subsidiary companies of the parent company named NES Global Limited (NES UK), which is a . registered company in the United kingdom.

Brief of transaction

NES India and NES. Abu Dhabi have proposed to enter into a service agreement through which NES India will provide support service in respect of the foreign business carried on by NES Abu Dhabi.

Every service provided by NES India will form part of the Master Services Agreement (“MSA”) and its Schedules in detail, The services provided by NES India would be as following, for example:

Accounting, Sales Invoicing, Purchase invoicing, Cash receipt posting, Bank Payment entries, Other receipt entries, Credit Control work, Support Assignment work, Payroll assistance, Storing and scanning of data to the data storage disk and any other work would be required by you as per your requirements. The applicant has mentioned that copy of the Master Services Agreement (MSA) is enclosed.

However the applicant has not submitted the Master Services Agreement (“MSA”) and its Schedules in detail.

3. The applicant has provided vide their letter dated 5.07.2018, as Exhibit-1, a draft Intercompany Services Agreement (“ISA”) with NES Global Talent Recruitment Services (NES Abu Dhabi) whose registered office is situated at Unit 104, Business Avenue Tower, AI Salaam Street, P.O. Box No.63107, Abu Dhabi.

The above mentioned draft agreement is only “Draft” and not final. Hence, this also is not a authentic document:-

4. In point No.16 of the application regarding statement containing the applicant’s interpretation of law and/or facts, as the case may be, i,e, applicant’s view point and submissions on issues on which the advance ruling is sought,, the applicant has stated the following are as under:

The applicant is on the view that above transaction will fall under Export of Service, on considering the fulfilment of the conditions as per the GST Act and provisions.

Export of Services conditions under GST as summarized below:

under the provisions of the IGST Act, if a transaction of service provision meets all the conditions of “export of services” as defined in Section 2(6) of the said act, then such a transaction will be treated as an export of service and qualify as a Zero Rated Supply as per section 16(1) of the Act.

Section 2(6) of the IGST Act defines “Export of Services”, as follows

“Export of Services” means the supply of any service when:-

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange, and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8

The applicant mentioned that they fulfil all the conditions.

FINDINGS

5. The basic issue to be decided in the application is to:-

(i) Whether the transaction in question is a Zero Rated Supply or a Normal Supply under the GST Act?

(ii) If the said supply is a Zero Rated Supply, then can the same be considered as an export of service under the GST Act?

6. The applicant in Point No.15 of the application have stated that NES India and NES Abu Dhabi have proposed to enter into a service agreement through which NES India will provide support service in respect of the foreign business carried on by NES Abu Dhabi. Every service provided by NES India will form part of the Master Services Agreement (“MSA”) and its Schedules in detail. The services provided by NES India would be as following, for example, Accounting, Sales Invoicing, Purchase Invoicing, Cash receipt posting, Bank Payment entries, other receipt entries, Credit Control work, Support Assignment work; Payroll assistance, storing and scanning of data to the data storage disk and any other work would be required by them as per their requirements.

The applicant had mentioned that they have enclosed the copy of Master Services Agreement (“MSA”), but the same was not enclosed and they were asked to submit the same but not submitted.

Further, the applicant has provided vide their letter dated 5.07.2018, as Exhibit – 1; a draft Intercompany Services Agreement (“ISA”) with NES. Global Talent Recruitment Services (NES Abu Dhabi) whose registered office is situated at Unit 104, Business Avenue Tower, A1 Salaam Street, P.O. Box No.63107, Abu Dhabi. The above mentioned draft agreement is only “Draft” and not final. Hence, this also is not a authentic document.

7. To consider the transaction between NES India and NES Abu Dhabi as “Export of Service” following conditions as per provisions of Section 2(6) of GST Act are to be fulfilled,-

i) the supplier of service is located in India;

ii) the recipient of service is located outside India;

iii) the place of supply of service is outside India;

iv) the payment for such service has been received by the supplier of service inconvertible foreign exchange; and

v) the supplier of service and the recipient of service are not merely establishments of a distinct person.

In order to comply with the above conditions, the

1. copy of Master Services Agreement (“MSA”),

2. copy of Intercompany Services Agreement (“ISA”).

3. Shareholding Patterns & Management personnel of NES India

4. Shareholding Patterns & Management Personnel of NES Abu Dhabi are required.

5. The end to end details of transactions, nature of services, mode of payment, currency of payment, the place of provision of service, the place of recipient of service, the place of provider of services, the relationship of NES India and NES Abu Dhabi as to why they are not merely establishment of distinct persons etc.

The Annexure-A to draft Intercompany Services Agreement (“ISA”) mentions the following Services:-

1. Purchases, Invoice Bookings for various Costs such as Visa, Immigration, labour cancellation charges, Medical expenses of various contractors of NES Abu Dhabi.

2. Invoices booking for all overheads.

3. Creating Invoices to various clients.

4. Booking Expenses of Contractors.

5. Bank-Reconciliation of all Bank accounts.

6. Vendor Reconciliation for all Vendors.

7. Cash Receipt entries posting.

8. Bank Payment entries posting,

9. AR reporting:

10. Payroll Assistance.

11. Support Assignment work.

12. Scanning and storing the data in the shared folder of NES Abu Dhabi.

13. General Consultancy Services provided for Accounting, Payroll, Taxation etc., and any other work which would require to do as per the request.

The above details does not mention how each services will be provided, and what are the end to end transactions or details of each services, mode of payment, currency of payment, the place of provision of service, the place of recipient of service, the place of provider of services, the relationship of NES India and NES Abu Dhabi as to why they are not merely establishment of distinct persons etc.

Since, the above mentioned agreement and details are not provided, this office is not in a position to reply to above questions of the applicant.

In view of the above, it appears that transaction between NES India and NES Abu Dhabi cannot be consider as Export of Service at this stage.

PRAYER

Considering the facts discussed in foregoing paragraphs, the question framed by the applicant in Point No. 14,

(i) Whether the transaction in question is a Zero Rated Supply or a Normal Supply under the GST Act? the answer is since the applicant failed to provide the Master Services Agreement (“MSA”’) and also the original Intercompany Services Agreement (“ISA”), it is prayed that the application may be rejected at this stage. The applicant has also failed the complete details as to how they fulfil the requirements of Section 2(6).

(ii) If the said supply is a Zero Rated Supply, then can the same be considered as an export of service under the GST Act? the answer is since the applicant failed to provide the Master Services Agreement (“MSA”), also the original Intercompany. Services Agreement (“ISA”) and relevant details in terms of Section 2(6). It is prayed that the application may be rejected at this stage:

Further submission of the officer –Please refer to the first written submission dated 11.09.2018

Submitted to Advance Ruling Authority.

2) In Para 7 of the above written submission dated 11.09.2018 to Advance Ruling Authority, it was mentioned that the following details were not submitted by the applicant.-

1. copy of Master Services Agreement (“MSA”),

2. copy of Intercompany Services Agreement (“ISA”).

3. Shareholding Patterns & Management personnel of NES India

4. Shareholding Patterns & Management Personnel of NES Abu Dhabi are required.

5. The end to end details of transactions, nature of services, mode of payment, currency of payment, the place of provision of service, the place of recipient of service, the place of provider of services, the relationship of NES India and NES. Abu Dhabi as to why they are not merely establishment of distinct persons etc.

2.1) The above information is insufficient to understand as to how each services will be provided, and what are the end to end transactions or details of each services, mode of payment, currency of payment, the place of provision of service, the place of recipient of service, the place of provider of services, the relationship of NES India and NES Abu Dhabi as to why they are not merely establishment of distinct persons etc.

3) During the previous personal hearing the Bench had asked the applicant to provide the details of end to end transactions and to handover supportive documents to the department. However, the applicant has submitted only a copy of intercompany service agreement, Month wise, cost sheet of invoice amount for the period 2017-18, offer letter of employees issued by NES Global Talent for working in Mumbai of office, details of Directors (Key personnel), and sharing pattern of NES India Abu Dhabi. Registration Certificate of NES Global Talent Abu Dhabi and citation of Delhi High Court decision in respect of W.P.(C) No. 11569/2016, W.P.(C)11572/2016, W.P.(C) No.11575/2016 and C.M. No. 45598/2016, W.P.(c) No. 11577/2016 1.r.o. M/s. Verizon Communication India Pvt. Ltd.

3.1) It may be seen that applicant has not provided the information about end to end transactions as detailed at para No.2.1 above.

4) Further the details of share holding pattern and Key Personnel of NES India shows that 9,999 share are with NES Global Ltd. UK and one share is with NES International Ltd., UK. There are four Directors in The company viz. Stephen William Buckley, Coleman Lee Fraser, Coton Simon Francis, Babu Sebastin. In case of NES Abu Dhabi 51% share are hold by Mr.Khaled Mohmmad Abdulaziz Alshareef Alhashmi and 49% are hold by NES Globle Ltd, UK. They have 6 Directors viz. Mr.Darren Grainger Managing Director Middle East, Mr.Vikram Nanda Regional Director Operation, Mr.Ronan Kelly Regional Finance Director – Middle East, Mr Sultan Mohamed Operation Manager, Mr. Narayan Devadiga, Regional Finance Manager & Mr. Ashish Poduval, Regional Payroll Manager. It shows that both companies have different Key Management Personnel, and Board of Directors and neither the company hold shares of each other and hence both the companies are independent of each other. Regarding citation mentioned above, all the citations are before the implementation of GST. Hence it appears that the same is not applicable in this case. Further, the applicant has not provided the copy of Master Service Agreement(MSA).

4.1) Further, in the copy of the Intercompany Services Agreement submitted by the applicant, it is observed/appears that the agreement is not registered in India, in Annexure-A to the agreement, the service schedule is attached, in which the following services are mentioned: it is found that activities are same as mentioned in earlier submission in para 5 cited above . Hence it is not repeated again here.

4.2) It may be seen that we cannot presume anything including the place of provision of service merely on the basis of nomenclature of the services. This is a question of fact and only the applicant is in possession of relevant detailed information which he has opted not to part with. The applicant has not submitted, how each of the above services will be provided, and what are the end to end transactions or details of each services, mode of payment, currency of payment, the place of provision of service, the place of recipient of service, the place of provider of services, in spite of Advance Ruling Authority directing the applicant to handover supporting documents.

5) We can neither presume or conjuncture nor can we commit anything merely on the basis of nomenclature of the services. In absence of full disclosure/information, if we indicate it is an export of services, ITC benefits, refund and other unknown implications may wrongly arise.

Since, the above mentioned details/information are not provided, this office is not in a position to reply to below questions of the applicant.

QUESTION & PRAYER

Considering the facts discussed in foregoing paragraphs, the question framed by the applicant in

Point No.14,

(i) Whether the transaction in question is a Zero Rated Supply or a Normal Supply under the GST Act? the answer is since the applicant failed to provide the Master Services Agreement (“MSA”) and not specifying how each of the services mentioned in the Intercompany Services Agreement (“ISA”), will be provided, and what are the end to end transactions or details of each services, mode of payment, currency of payment, the place of provision of service, the place of recipient of service, the place of provider of services, it is prayed that the application may be rejected at this stage. The applicant has also failed submit the complete details as to how they fulfil the requirements of Section 2(6).

(ii) If the said supply is a Zero Rated Supply, then can the same be considered as an export of service under the GST Act? the answer is since the applicant failed to provide the Master Services Agreement (“MSA”’) and not specifying how each of the services mentioned in the Intercompany Services Agreement (“ISA”), will be provided, and what are the end to end transactions or details of each services, mode of payment, currency of payment, the place of provision of service, the place of recipient of service, the place of provider of services, it is prayed that the application may be rejected at this stage.

Therefore, the applicant may be directed to provide complete information as stated in foregoing paras above.

04. HEARING

The Preliminary hearing in the matter was held on 07.08.2018, as nobody was present from applicant’s side. Jurisdictional Officer Ms. Shobha Parde, Division – VI, Range – IV, Mumbai East Commissionerate appeared and stated that they would making submissions at the time of final hearing. Next Preliminary hearing in the matter was held on 12.09.2018 Sh. Ravidram. P .M. C.A. appeared and requested for admission of application as per contentions in their application. Jurisdictional Officer Ms. Rashmi Nakashe, Suptt., Division – VI, Range – IV, Mumbai East Commissionerate appeared and stated that they will make submissions in due course in addition to submissions made today.

The application was admitted and called for final hearing on 12.12.2018, Sh. Ravidram P.M. C.A. appeared made oral and written submissions. The Jurisdictional Officer Ms. Rashmi Nakashe, Suptt., Division – VI, Range – IV, Mumbai East Commissionerate appeared and made written submissions. We were heard from both the parties.

05. OBSERVATIONS

We have gone through the facts of the case and submissions made before us by both, the applicant and the department. The applicant, located in India have submitted that they and M/s NES situated in Abu Dhabi (hereinafter referred to as the client) have proposed to enter into a service agreement through which the applicant will provide support service in respect of the foreign business carried on by the client as per the Master Services Agreement (“MSA”) and its Schedules in detail. However even though they have mentioned that they have proposed to enter into a service agreement, it is seen that they have submitted a copy of the agreement which they have already entered into as on 30th April, 2017. The services to be provided by the applicant to the client as per the MSA would be as under:-

1. Purchase Invoice Bookings for various Costs such as Visa, Immigration, labour cancellation charges, Medical expenses of various contractors of NES Abu Dhabi.

2. Invoices Booking for all overheads.

3. Creating Invoices to various clients.

4. Booking Expenses of Contractors.

5. Bank Reconciliation of all Bank accounts.

6. Vendor Reconciliation for all Vendors.

7. Cash Receipt entries posting.

8. Bank Payment entries posting,

9. AR reporting:

10. Payroll Assistance.

11. Support Assignment work.

12. Scanning and storing the data in the shared folder of NES Abu Dhabi.

13. General Consultancy Services provided for Accounting, Payroll, Taxation etc., and any other work which would require to do as per the request.

2). The relevant portion of the agreement is reproduced as below for the sake of clarity of activities & transactions undertaken by the applicant whether it comes under term “EXPORT” and “Zero rated supply” of GST Act to answer the questions asked in this application.

1. This Intercompany Services Agreement (this “Agreement”) together with various Annexures is entered in to as of 30 April 2017 (“Commencement Date’) between NES Global Specialist Engineering Services Private Limited (NES India) whose registered office is situated in …………. India and NES Global talent Recruitment Services (NES Abu Dhabi) whose registered office is situated in ………….. Abu Dhabi.

3. Services to be provided:

3.2. NES India will provide to NES Abu Dhabi Administrative and Support Services which includes:

Accounting which includes Sales Invoicing, Purchase Invoicing, Cash receipt posting, Bank Payment entries, Other receipt entries, Credit Control work, Support Assignment work, Payroll assistance, Storing and scanning of data to the data storage disk and any other work would be required by NES Abu Dhabi as per its requirements – Refer to Annexure A for detailed Service Schedule.

3.3. NES India will provide general advice and assistance in relation to the Services, as required, from time to time. These will be charged on a time and costs basis, according to NES India’s standard rates. Such consultancy services will be provided with NES India’s prior consent and at mutually agreeable dates and times,

5.1. NES India will charge to NES Abu Dhabi the cost incurred for providing the Service with a margin of 10% plus taxes applicable during the period.

3). We find from the agreement that the services being provided to their client is in the form of Administrative and support services. It is further seen from the clause no.3.3 that NES India will provide general advice and assistance in relation to the Services, as required, from time to time and such services will be charged on a time and costs basis.

Considering the facts and various documents produced before us, we find that the applicant’s transaction is in the nature of supply of services. The applicant has submitted that such services are exported by them and therefore it is required to examine whether it is covered under term “Export of services “outside India” and ultimate covered under zero rated supply.

Export of service is defined under Section 2(6) of IGST ACT, which is reproduced as below,-

“Export of Services” means the supply of any service when

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange, and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 2 in section 8.

In the present matter, we find from the agreement that applicant located in India is supplying to their client located abroad. The applicant submitted that the payment for such service has been received by the supplier of service in convertible foreign exchange, and for that copies of invoices, BRC and Bank statements are submitted on record which proves that the payment received is in convertible foreign exchange. We further find from the information submitted on record that both the Applicant and their client are not establishments of the same person, even though they are group companies. The Shareholding pattern of both the companies proves that the Key management personal and Board of Directors are different and neither of them holds shares of each other and thus they do not control one another. The applicant is not a branch or an agency or a representational office of the client and both the companies are independent of each other. Thus from the foregoing we find that the clause no. (i),(ii), (iv),and ( v) of Section 2(6) of the IGST Act, are fulfilled by the applicant.

Now we will discuss whether condition no. (iii), related to the ‘place of supply’ is satisfied in the present case and therefore refer to Section 13 of the IGST Act which deals with the place of supply in various cases where the location of the supplier of services or the location of the recipient of services is outside India. The relevant provisions of Section 13 of IGST is reproduced as under:-

Section 13.

(1) The provisions of this section shall apply to determine the place of supply of services where the location of the supplier of services or the location of the recipient of services is outside India.

(2) The place of supply of services except the services specified in sub-sections (3) to (13) shall be the location of the recipient of services:

3) The place of supply of the following services shall be the location where the services are actually performed, namely: –

………………………………….

We find from the scrutiny of the MSA that that the relationship between the parties is that of independent contractors meaning that the agreement does not intend to create relationship of principal and agent. Thus we find that applicant is not a person who arranges or facilitate supply of services between two or more persons and therefore the proposed service would not fall to be classified as ‘intermediary service’.

We find from the details as given in the application and submissions before us, record, that supplier of service i.e. applicant is located in India, the recipient of service i.e. AM is located outside India -Abu Dhabi; payment is received in convertible foreign exchange, the supplier of service and the recipient of service are not merely establishment of a distinct person and applicant not being an intermediary and services are not specified in sub-section (3) to (13) of section 13, the place of supply of service would be the location of the recipient of services i.e.

NES Abu Dhabi, which is outside India. As the applicant satisfies all the ingredients of ‘export of services’ the service provided by the ‘Marketing Services Agreement’ would qualify as an export of Taxable service.

The relevant provisions of section 16 of IGST Act is reproduced here as below,

16. (1) “zero rated supply” means any of the following supplies of goods or services or both, namely:-

(a) export of goods or services or both; or

……………………………………….

From the above provision we find that the “zero rated supply” means (a) the export of goods or services or both, and

(b) ……………………………..

In the present case, we are of the opinion that the applicant is an exporter of services under GST Act and the supply of services in the subject case as covered by the MSA agreement submitted it is very clear that the said transactions are covered under “Zero rated supply

05. In view of the extensive deliberations as held hereinabove, we pass an order as follows :

ORDER

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

NO.GST-ARA- 52/2018-19/B-160,

Mumbai, dt. 19.12.2018

For reasons as discussed in the body of the order, the questions are answered thus-

Question:- Whether the transaction in question is a Zero Rated Supply or a Normal Supply under the GST ACT?

Answer:- In view of the discussions we hold that the transaction covered under the MSA dated between the applicant and NES Abu Dhabi is a Zero rated supply.

Question:- If the said supply is a Zero Rated Supply, then can the same be considered as an export of service under the GST Act?

Answer:- Answered is in the positive in lieu of our answer to Q. No. 1 above