Om Trading Company vs. Deputy Commissioner Of State Tax & Others

(Madhya Pradesh High Court, Madhya Pradesh)

Petitioner, a dealer registered under the Central Goods and Services Tax Act, 2017, allegedly purchased 8100Kg Clarified Butter (Ghee) through bill No. 53 on 31/07/2018 amounting to ₹ 23,49,000/- and 1000 Tin of Clarified Butter through bill No. 54 amounting to ₹ 40,50,000/- from one M/s Marco International, Kachari Ghat, Agra, who allegedly issued e-way bill, was issued show cause notice on 05/10/2018 as it was found that the bill was without supply of goods in violation of stipulations contained in the Act of 2017. The notice was purportedly under Rule 21(b) of the Central Goods & Services Tax Rules 2017 which mandates that the Registration granted to the person is liable to be cancelled, if the person issued invoice or bill without supply of goods or services in violation of the provisions of the Act, or the rules made thereunder.

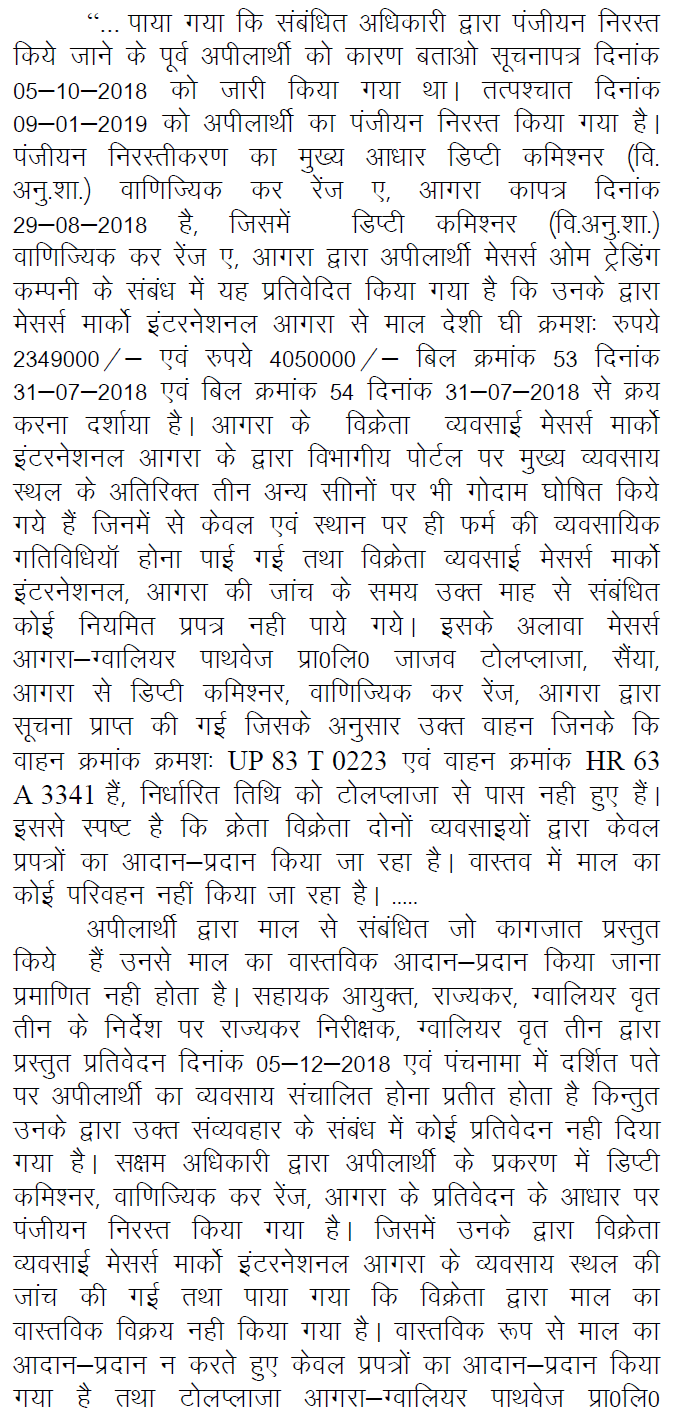

As the petitioner failed to prove his e-way bill transaction details, his registration has been cancelled by order dated 09/01/2019; where against, the petitioner preferred an appeal under Section 107 of the Act of 2017. The Appellate Authority taking into consideration the entire facts on record affirm the order passed by the Deputy Commissioner of State Tax, holding:-

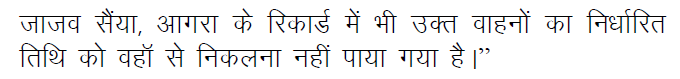

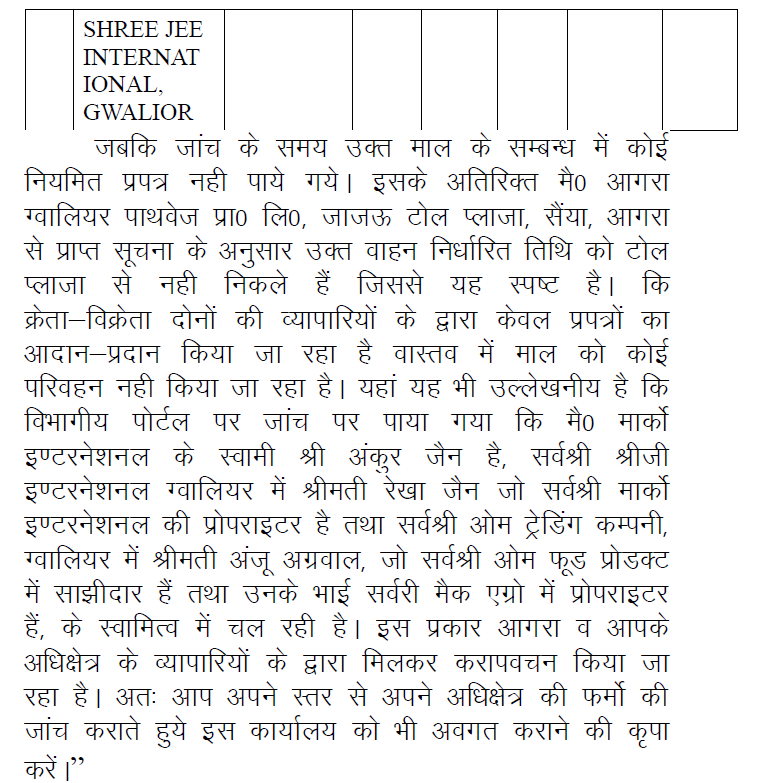

Pertinent it is to note at this stage that before initiating proceeding against the petitioner, an information was received from the Deputy Commissioner, Commercial Tax, Range- A, Agra, whereby following information was sent to Joint Commissioner, Sales Tax, Gwalior:-

It is this information which led the Competent Authority to initiate proceeding for cancellation of registration and passing an order of cancellation after affording opportunity of hearing to the petitioner.

When the impugned order is tested on the anvil of material on record and in absence of any cogent documentary evidence to prove that the bills in question were physically transferred from Agra to Gwalior, this Court does not find any error in the judgment rendered by the Deputy Commissioner as well as Appellate Authority, as would warrant any indulgence.

Consequently, petition fails and is dismissed. No costs.