Omsai Professional Detective And Security Services Pvt. Ltd. vs. Na

(Faa (First Appellate Authority), Andhra Pradesh)

1. This appeal is filed by M/s. Omsai Professional Detective and Security Services Private Limited, D. No. 57-3-4, Sri Rama Nilayam, Yadavula Bazar, Patamata, Vijayawada (hereinafter referred to as ‘Appellant’) against the tax assessment orders passed by the Assistant Commissioner of State Tax, Patamata Circle, No-n Division, Vijayawada, (hereinafter referred to as ‘Assessing Authority’/for short ‘AA.’) for the tax periods from January, 2019 to February, 2019 under CGST/APGST Act, 2017 in GSTIN : 37AAAC02542G1ZO vide his orders dated 23-4-2019, disputing the levy of tax of ₹ 6,96,22,979/-.

2. The case is posted for personal hearing. The details thereof are as under:

| Sl. No. | Date of notice issued | Posted for hearing on | Status of hearing |

| 1. | 29-8-2019 | 20-9-2019 | Not Attended |

| 2. | 14-10-2019 | 15-11-2019 | Not Attended |

| 3. | 28-11-2019 | 21-12-2019 | Not Attended |

| 4. | 31-12-2019 | 2-1-2020 | Not Attended |

| 5. | 10-2-2020 | 4-3-2020 | Not Attended |

3. This office has issued notices for appeal hearings to appear and argue the case, but neither the appellant nor their authorized representative has appeared for the hearings except filing adjournments. From the above, it can be concluded that the appellant has failed to respond to the above notices issued and failed to avail the opportunities of personal hearing provided to them in the present appeal. In the circumstances, there is no other alternative except to dispose off the appeal on merits considering the material/information available in the appeal file.

Statement of facts:-

4. The appellant is an assessee on the rolls of the AA and doing the business of supplying the security services.

5. The A.A stated in his assessment orders (GST assessment 13), which were passed separately for each month from January, 2019 to February, 2019, that the appellant has been filing the returns in Form GSTR-1 by declaring the outward taxable supplies under the GST Act, but not filed the returns in Form GSTR-3B for the above tax periods, and not paid liable tax on its outward supplies as declared in the returns in Form GSTR-1.

The A.A stated that he has issued notices for filing of the returns in Form GSTR-3B, but the appellant failed to file the same. As per the A. A’s remarks, he is left with no other option, but to resorted to pass the best judgment assessment orders under Section 62 of CGST/SGST Act, 2017. The AA has estimated the appellant’s outward taxable supplies, by enhancing the returned outward taxable supplies in the returns in Form GSTR-1 by 50% towards probable supplies. Thus, the A.A has best judged the turnovers of the appellant @ 150% of the returned outward supplies and levied tax thereon @ 18%. The AA also invoked Section 50 and computed the interest liability of the appellant.

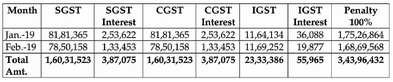

6. Besides, the A.A also levied penalty @ 100% under Section 122 holding that the appellant has willfully suppressed such 150% of the returned turnovers in Form GSTR-1, in such default. The details of such total tax, interest and penalty levied are given below in the table.

7. Thus, the A.A has levied the tax, penalty and interest as detailed hereunder:

Tax : ₹ 3,43,96,432/-

Penalty : ₹ 3,43,96,432/-

Interest : ₹ 8,30,115/-

Total : ₹ 6,96,22,979/-

8. Aggrieved by the above orders passed by the assessing authority, the appellant has preferred the present appeal and disputed the levy of tax, penalty and interest totaling to an amount of ₹ 6,96,22,979/-.

Grounds of Appeal;-

9. The grounds of appeal filed by appellant in the appeal are extracted hereunder;

(1) Appellant submits that the impugned order is ex facie illegal and untenable in law since the same is contrary to facts and judicial decisions.

(2) As stated in the background facts, and as an elaboration to the same, the appellant would like to explain the practical difficulty faced at the time of committing default of non-filing of return, which had occurred purely as a. result of helplessness and was undoubtedly without any malicious intention of evading taxes.

(3) Appellant submits that the main reason for delayed/Non-payment of GST is due to huge delay in the realisation of the amounts due from the clients. The ideal average time taken for the realisation is 90 days from the date of raising the invoice. Whereas, the appellant has to pay the salaries to the security personnel on monthly basis and certain clients allow raising invoice only after the payment of salaries to them. The interest/finance cost on the overheads (mainly salaries to the security personnel) is almost shelling out the margins of the appellant. Adding to the above difficulties, the GST at the rate of 18% has to be paid immediately on raising of the invoice which is becoming an added burden to the appellant. All these led to huge working capital crisis, ultimately leading to cash crunch in the hands of the appellant. Further, the main reason of bringing the security services under reverse charge (w.e.f. 1-1-2019) is relieve the suppliers of ‘security services’ from the above mentioned difficulties. Further, the bank accounts were frozen which had further added to the difficulties of the appellant in remitting the salaries to the security personnel affecting the livelihood of the 20,000 employees of the appellant.

(4) Though the client was facing cash crunch, it prioritized the revenue of the government over business needs and started depositing cash into the electronic cash ledger as and when the collections were made from the debtors. The same can be evidenced from the Electronic cash ledger which is enclosed herewith as Annexure-

(5) Therefore, the alleged delayed payment of GST is arisen mainly because of huge cash crunch, and as soon as even a part of receivables were being realized, efforts were being made to accumulate the same in the electronic cash ledger until accumulated amount was enough to offset the liability for the respective month.

(6) Without prejudice to the above, Appellant submits that the impugned orders raised the demand under section 62 of CGST Act, 2017, which read as under:

“62.(1) Notwithstanding anything to the contrary contained in section 73 or section 74, where a registered person fails to furnish the return under section 39 or section 45, even after the service of notice under section 46, the proper officer may proceed to assess the tax liability of the said person to the best of his judgement taking into account all the relevant material which is available or which he has gathered and issue an assessment order within a period of five years from the date specified under section 44 for furnishing of the annual return for the financial year to which the tax not paid relates.”

(7) As seen from the above, the proper officer may assess the tax liability only inter alia if the

(a) registered person failed to furnish the returns under section 39 of CGST Act, 2017.

(b) Notice under section 46 of CGBT Act, 2017 is served;

The above-mentioned pre-requisites are not fulfilled in the present set of factual matrix as explained hereinbelow.

In Re : No failure in furnishing of the returns u/s. 39, ibid

(8) Appellant submits that GST was introduced w.e.f. 1-7-2017. According to the original scheme of GST, a person was required to file details and returns monthly as explained below:

(a) FORM GSTR-1 – As per Section 37 of the CGST Act, 2017 read with Rule 59 of CGST Rules, 2017, a person is required to file FORM GSTR-1 mentioning details of the outward supply effected during a tax period. Accordingly, the entire outward supply (that is sales, including inter-state supply and other forms of supply) was required to be disclosed on or before the 10th day of the month succeeding the tax period.

(b) Form GSTR-2 – As per Section 38 of CGST Act, 2017, read with Rule 60 of the CGST Rules, 2017, every person is required to file a FORM GSTR-2 mentioning details of the inward supplies including the debit and credit notes, relating to such supplies before the 15th day of the month succeeding the tax period.

(c) Form GSTR-3 – As per Section 39 of the CGST Act, 2017, read with Rule 61 of the CGST Rules, 2017, a person has to file a return in Form GSTR-3 mentioning details of inward and outward supplies of goods and services mentioning details about input tax credit availed, tax payable and tax paid on or before the 20th day of the month succeeding the tax period.

(9) Due to the difficulty in the implementation of GST, returns which were designed to be implemented as per the scheme explained supra were not implemented by the Government and a new form called FORM GSTR-3B was prescribed in lieu of return in FORM GSTR-3 under rule 61(5) of CGST Rules, 2017. The extract of the rule is given below:

“Where the time limit for furnishing of details in FORM GSTR-1 under Section 37 and in FORM GSTR-2 under Section 38 has been extended and the circumstances so warrant, return in FORM GSTR-3B, in lieu of FORM GSTR-02 may be furnished in such manner and subject to such conditions as may be notified by the Commissioner.”

(10) From the above, it can be substantiated that FORM GSTR-3B can be considered as a return filed in lieu of FORM GSTR-3 and accordingly it can be said that FORM GSTR-3B is a return filed under Section 39 of the CGST Act, 2017.

(11) However, subsequently, the aforesaid sub-rule was amended vide Notification No. 17/2017-Central Tax : dated 27-7-2017 w.e.f. 1-7-2017 by way substitution. The substituted sub-rule read as under:

“Where the time-limit for furnishing of details in FORM GSTR-1 under Section 37 and in FORM GSTR-2 under Section 38 has been extended and the circumstances so warrant, the Commissioner may, by notification, specify the manner and conditions subject to which the return shall be furnished in FORM GSTR-3B electronically through the common portal, either directly or through a Facilitation Centre notified by the Commissioner.”

Thus, from the above retrospective amendment (i.e. w.e.f. 1-7-2017), it can be construed that FORM GSTR-3B is a return which will be notified by the Commissioner of GST and it has no nexus with FORM GSTR-3 the way it had before this amendment and accordingly, it can be construed that FORM GSTR-3B is not a return prescribed under Section 39 of CGST Act, 2017 as the very foundation of the parity clause between two returns has been amended so as to partake either of the returns colour in isolation.

(12) Also the fact that Rule 61(1) states, “Every registered person other than a person referred to in section 14………shall furnish a returns specified under sub-section (1) of section 39 in FORM GSTR-3 electronically……….”. Thereby drawing no relevance to GSTR-3B with GSTR-3 and leaving no room for doubt regarding the distinct identity of both the returns. In other words, the GSTR-3 and GSTR-3B are two different returns while the GSTR-3 is return prescribed u/s. 39, ibid read with rule 61(1) of CGST Rules, 2017 and the GSTR-3B is not so.

(13) In this regard, Appellant wishes to rely on the Hon’ble Gujarat High Court in the case of AAP and Co., Chartered Accounts v. UOI 2019-TTOL-1422-HC-AHM-GST held that GSTR-3B is not a return u/s. 39. The relevant extract from the case is produced as under : “it would be apposite to state that initially it was decided to have three returns in a month, i.e. return for outward supplies i.e. GSTR-1 in terms of Section 37, return for inward supplies in terms of GSTR-2 and a combined return in Form GSTR-3. However, considering technical glitches in the GSTN portal as well as difficulty faced by the taxpayers it was decided to keep filing of GSTR-2 and GSTR-3 in abeyance. Therefore, in order to ease the burden of the taxpayers for some time, it was decided in the 18th GST Council meeting to allow filing of a shorter return in Form GSTR-3B for initial period. It was not introduced as a return in lieu of return required to be filed in Form GSTR-3. The return in Form GSTR-3B is only a temporary stop gap arrangement till due date of filing the return in Form GSTR-3 is notified. Notifications are being issued from time to time extending the due date of filing of the return in Form GSTR-3 i.e., return required to be filed under Section 39 of CGST Act. It was notified vide Notification No. 44/2018-Central Tax dated 10th September, 2018 that the due date of filing the return under Section 39 of the Act, for the months of July, 2017 to March, 2019 shall be subsequently notified in the Official Gazette.

31. It would also be apposite to point out that the Notification No. 10/2017-Central Tax dated 28th June, 2017 which introduced mandatory filing of the return in Form GSTR-3B stated that it is a return in lieu of Form GSTR-3. However, the Government, on realising its mistake that the return in Form GSTR-03B is not intended to be in lieu of FORM GSTR-3, RECTIFIED ITS MISTAKE RETROSPECTIVELY VIDE notification No. 17/2017-Central Tax dated 27th July, 2017 and omitted the reference to return in GSTR-3B being return in lieu of Form GSTR-3.”

(14) Appellant submits that undisputedly the filing of the GSTR-3 is deferred now vide Notification No. 12/2019 dated 7-3-2019 consequently the jurisdiction to make the assessment u/s. 62, ibid is also deferred. Further, the failure in filing of the GSTR-3B returns do not give jurisdiction to make the assessment u/s. 62, ibid as the GSTR-3B is not a return u/s. 39, ibid. Hence, the assessment made u/s. 62, ibid fails and requires to be set aside.

(15) Appellant submits that the assessment u/s. 62, ibid shall be made after serving of a valid notice u/s. 46, ibid in form GSTR-3A. Similar to the Section 62 of CGST Act, 2017, the Section 46, ibid also refers to the returns to be filed u/s. 39, ibid i.e. GSTR-3 and not the GSTR-3B returns thereby there is no jurisdiction to serve the notice u/s. 46, ibid for failure in filing of the GSTR-3B returns. The submissions made supra as to what constitutes the return u/s. 39 would equally apply here and Appellant would like to reiterate the same.

In Re : Notice in GSTR-3A (u/s. 46, ibid) was not issued prior to the assessment u/s. 62, ibid:

(16) Without prejudice to the above, Appellant submits the Ld. Adjudicating authority has made the assessment u/s. 62, ibid without first serving the notice u/s. 46, ibid. Hence, the impugned assessment fails on this count also.

In Re : Penalty u/s. 122 is not imposable:

(17) Appellant submits the penalty is not imposable as there was no offense committed that attracts penal action u/s. 122, CGST Act, 2017. The fact that Appellant has been filing the GSTR-1 returns regularly and also remitting the tax dues wherever possible despite of the huge cash crunch in the business.

(18) Appellant craves leave to alter, add to and/or amend the aforesaid grounds.

(19) Appellant wish to be personally heard before any decision is taken in this matter.

Discussion:

10. Perused the grounds of appeal Vis-a-Vis the impugned orders passed by the assessing authority i.e. Assistant Commissioner (ST), Patamata Circle, No. II Division.

11. The fundamental objection of it against the orders is that the non-filing of the returns in Form GSTR-3B is actually due to the financial crunch and inability to discharge the tax liability by it, and no suppression of outward supplies of services is involved. The appellant further explained that the main reason for the delayed/Non-payment of the admitted GST is due to huge delay in the realisation of the proceeds of its supply of services due from the clients. The ideal average time taken for the realisation is 90 days from the date of raising the invoice, whereas the appellant has to pay the salaries to the security personnel on monthly basis and certain clients allow raising invoice only after the payment of salaries to them. The interest/finance cost on the overheads (mainly salaries to the security personnel) is almost shelling out the margins of it. Adding to the above difficulties, the GST at the rate of 18% has to be paid immediately on raising of the invoices, which is becoming an added burden to it. All these led to huge working capital crisis, ultimately leading to cash crunch in its hands.

12. The appellant further put forth that in spite of the above stated cash crunch, it has always prioritized the discharging the tax liability over business needs and frequently deposited cash into its electronic cash ledger as and when the consideration is received from its recipients. Detailing about the above circumstances, the appellant strongly contended that there is no reason except cash crunch for its failure to file the returns in Form GSTR-3B. Hence, argued that holding/alleging suppression of tax and passing the best judgment orders is not justifiable and not lawful.

13. The appellant further points out that it has filed the returns in Form GSTR-1, that means actually scored outward taxable supplies are disclosed to the Department, and as such there are no circumstances or logic to estimate the outward supplies turnovers. The appellant also advanced two more objections. Firstly, the A.A has added 50% to its actually scored turnover, while estimating the total turnover for all the months. But, arbitrarily added 50% more turnover without any basis or evidence. Secondly, the appellant also pointed out that as per the contents of Section 62 a notice under Section 46 ought to have been issued before passing the best judgment assessment orders as per Section 46, but the A.A has not issued any such notices for the tax periods from January, 2019 to February, 2019, and hence such orders are unlawful and liable to be set aside.

14. The appellant further contends that it has already submitted the returns in Form GSTR-3B for the months of January, 2019 to February, 2019, which shall be seen as a genuine effort by it to discharge its tax due. The appellant in its submissions has attempted to interpret Section 39 in an interesting and relevant point of dispute. The appellant contends that as per Section 39 of the Act, the returns in Forms GSTR-1, GSTR-2 and GSTR-3 have been prescribed, but due to the difficulty in the implementation of the relevant returns under the Act, which were designed to be implemented as per the scheme explained supra were not implemented by the Government of India and a new return in FORM GSTR-3B is prescribed in lieu of the return in FORM GSTR-3 under Rule 61(5) of the CGST Rules, 2017 (‘Rules’ for short). The extract of the said rule is given below:

“Where the time limit for furnishing of details in FORM GSTR-1 under Section 37 and in FORM GSTR-2 under Section 38 has been extended and the circumstances so warrant, return in FORM GSTK-3B. in lieu of FORM GSTR-3, may be furnished in such manner and subject to such conditions as may be notified by the Commissioner.”

15. From the above, it can be substantiated that the returns in FORM GSTR-3B can be considered as a return filed in lieu of FORM GSTR-3 and accordingly it can be said that FORM GSTR-3B is a return filed under Section 39 of the CGST Act, 2017.

16. However, subsequently, the aforesaid sub-rule is amended vide Notification No. 17/2017-Central Tax dated 27-7-2017 w.e.f. 1-7-2017, by way of substitution. The substituted sub-rule reads as under:

“Where the time limit for furnishing of details in FORM GSTR-1 under Section 37 and in FORM GSTR-2 under Section 38 has been extended and the circumstances so warrant, the Commissioner may, by notification, specify the manner and conditions subject to which the return shall be furnished in FORM GSTR-3B electronically through the common portal, either directly or through a Facilitation Centre notified by the Commissioner.”

17. Thus, from the above retrospective amendment (i.e. w.e.f. 1-7-2017), it can be construed that FORM GSTR-3B is a return which will be notified by the Commissioner of GST and it has no nexus with FORM GSTR-3 the way it had before this amendment and accordingly, it can be construed that FORM GSTR-3B is not a return prescribed under Section 39 of CGST Act, 2017 as the very foundation of the parity clause between two returns has been amended so as to partake either of the returns colour in isolation.

18. Thus, interpreting Section 39 in its point of view as discussed above, the appellant contemplated that since GSTR-3 is deferred now vide Notification No.12/2019 dated 7-3-2019, consequently the jurisdiction to make the assessment under Section 62, ibid is also deferred. Further, the failure to file the returns in Form GSTR-3B do not give jurisdiction to make the assessment under Section 62, ibid as the GSTR-3B is not a return for the purpose of Section 39 of the Act, ibid. Hence, the assessment made under Section 62, ibid fails and requires to be set aside.

19. The appellant further contends that the assessment under Section 62, ibid shall be made after serving a valid notice under Section 46, ibid in form GSTR-3A. Similar to the Section 62 of CGST Act, 2017, the Section 46, ibid also refers to the returns to be filed under Section 39, ibid i.e. GSTR-3 and not the GSTR-3B returns and hence there is no jurisdiction to serve the notice under Section 46, ibid for failure to file the returns in Form GSTR-3B.

20. Without prejudice to the above objections, the appellant also questioned that the AA has not served notice under Section 46 for certain months, and hence orders basing on such action cannot be held as legitimate.

21. Regarding, the estimation of turnover by A.A, the appellant objected that since the outward taxable supplies turnover is available through the returns in Form GSTR-1 filed by it, the A.A ought to have raised demand based on the actually scored disclosed turnovers instead of estimating the same that too without any basis. The appellant averred that the A.A has not gathered any additional material or information to contradict with the disclosed turnovers, as such the estimated turnovers by AA lacks authenticity/legitimacy. The appellant also raised an interesting point on this aspect, stating that the same A.A has raised the demand basing on actual turnovers for the subsequent periods, following a different analogy which is not followed for the present impugned tax periods, for the reasons not known.

22. Regarding the penalty levied, the appellant strongly contended that since it has already disclosed the outward taxable supplies turnover through the returns in Form GSTR-1, charging it with wilfulness/mala fades is not logical and lacking justifiability. Hence, the penalty under Section 122 of the Act, does not arise and such levy of penalty treating it as willful suppression of the outward supplies is erroneous.

Issues for adjudication;

(1) Whether the best judgment orders through estimating the outward taxable supplies by A.A, are based on any dependable and authentic evidence/basis or not?

(2) Whether the appellant’s contention that Section 62 cannot be invoked as GSTR-3B is not any return prescribed under Section 39 of the Act, hence these orders are legal or not?

(3) Whether the willful suppression aspect and resultant levy of 100% penalty, is found to be having any basis and such willfulness, has been established by A.A or not?

(4) Whether the interest levied by A.A, is in tune with the provisions of the GST Act or not?

Analysis:

23. Perused the grounds of appeal along with the assessment orders passed by the A.A., and after thorough verification of records, the following findings are recorded;

(1) Regarding the levy of tax of ₹ 3,43,96,432/-:

A basic perusal of A A’s order reveals that the findings on the turnovers are not based on analytical and exhaustive scrutiny. The palpably pointing out certain anomalies, which are discussed hereunder:-

Firstly, the A. A has chosen to determine the turnovers on his best judgment and presumes the suppression of outward taxable supplies by the appellant on mere guess work. He has not conducted any worthy verifications or elaborate enquiries. We have to read and comprehend that Section 62 thoroughly before analyzing the present issue. Hence Section 62(1) of the Act, is abstracted hereunder:-

Section 62. (1)

“Notwithstanding anything to the contrary contained in section 73 or section 74, where a registered person fails to furnish the return under section 39 or section 45, even after the service of a notice under section 46, the proper officer may proceed to assess the tax liability of the said person to the best of his judgement taking into account all the relevant material which is available or which he has gathered and issue an assessment order within a period of five years from the date specified under section 44 for furnishing of the annual return for the financial year to which the tax not paid relates”.

A fundamental comprehension of above Section obviously makes it perceivable that the best judgment assessment to be passed by any authority shall be based on taking into account of all the relevant material, which is available or which may be gathered by such assessing authority. But, the impugned finding does not speak of any material collected by the A.A, nor mentions any enquiries which establish the assumed turnover by the AA. In such circumstances, it is to be held that the AA has not followed basic instructions read between in the contents of Section 62(1), hence not qualifies to be upheld as bona fide..

In this connection, the following case laws are to be taken into consideration before commenting on the AA’s best judgment orders.

(i) State of Orissa v. B.P. Singh Deo (1970) 76 ITR 690 -AIR SC 670) (SC).

In this case, the Hon’ble Supreme Court held that the power to levy assessment on the best of judgment basis is not an arbitrary power, but such assessment must be based on best judgment or on relevant material. It is not a power that can be exercised on the sweet will and pleasure of the concerned authorities.

(ii) State of A.P. v. Ravuri Narasimhulu (1965) (16 STC 54) (APHC)

“The Legislature has confined the power of the department under this sub-section to assessing such turnover as is shown to have escaped assessment and has not extended it to estimate depending upon inferences to be drawn by the department from certain circumstances. It does not clothe the department with power to make a best judgment assessment.”

(iii) The Privy Council in the case of Commissioner of Income Tax, Central and United Provisions v. Laxminarain Badridas (1937) (5 ITR 170, 180) observed that the Assessing Authority must not act dishonestly, or vindictively or capriciously because he must exercise judgment in the matter.

(iv) Honorable STAT in the case of M/s. Sri Krishna Timber Depot, jammalamadugu v. State of A.P. (14 APSTJ 238), wherein it was held that “A presumption without basis, on mere suspicion cannot be sustained. Suspicion can only lead to investigation and unearthing material on which any conclusion can be based, but on mere suspicion without further investigation no inference can be drawn and no conclusion can be arrived at”.

(v) Hon’ble Delhi High Court vide its order dated 27-5-1998 in the case of Deepak Industries v. STO & Others (Delhi High Court) 38 DSTC J-79; 73 (1998) DLT 718; 1998 (46) DRJ 208 held as follows:-

To sum up, the principles governing a best judgment assessment are:

1. A best judgment assessment is not a wild assessment. Exclusion of arbitrariness and caprice is an obligation implicit in the power to assess to the best of judgment.

2. Assessment to the best of judgment must be founded upon some rational basis, relevant material and logic so that nexus between such basis or material and the figure of assessment arrived at can be objectively seen though some amount of guess work or estimation is to be allowed like a play in the joint.

Though, the above case laws are pertaining to Sales Tax/Income Tax Acts, but the principles and concepts regarding the best judgment assessment formulated by the earlier judicial pronouncements would be squarely applicable to the GST disputes also.

The essential principle emerges from the above judgments is that presumption of sale or purchase turnover is not any substitute for the proof of sale/purchase. Any presumption shall always linked to some sort of material like bills, vouchers or payment consideration evidence, etc. If the estimation is not based on any evidences, such factual presumptions are always rebuttable. That’s why in the instant case also, the A.A has not brought on record any evidence of such kind. That means, without any incriminating material to establish the assumed suppressions of taxable supply of services, best judgment orders cannot be upheld as de jure.

It is further reasonable here to note that the main principle emanates from the decisions on the best judgment assessment is that any levy basing on mere presumptions, but not substantiated by any sort of incriminating material to establish the suppression indubitably, shall be seen as bad in law and in violation to the principles of natural justice.

Any best judgment assessment must be supplemented by reason, because reason is the heart beat of any conclusion and fetches clarity in conclusion of any order, as such, without the reason best judgment orders becomes lifeless and amounts to denial of fundamental justice. The reason/evidence would act as live link between the mind of assessing authority and the resultant conclusion arrived at.

In the impugned orders, it is an apparent failure on the part of the AA that he has not recorded any reason or basis in estimating the quantum of the outward taxable supplies. It is also clear from the findings that the A.A has not discussed anything about the appellant’s contentions and not recorded any reasons. In this connection, it needs to be emphasized that every litigant, who approaches the A.A for relief is entitled to know the reason for acceptance or rejection of his prayer, particularly when either of the parties to the list has a right of further appeal. Unless the litigant is made aware of the reasons which weighed with the A.A in denying him the relief prayed for, the remedy of appeal will not be meaningful. It is that reasoning, which can be subjected to examination at the higher forums.

The appellant also averred before me that except presuming sales suppression basing on routine wild guess work, the A.A has never attempted to verify transactions/payments of anyone connected with the determined sales suppressions in issue, the same clearly points towards a conclusion that the estimates of sales suppression are pure guess work, and not based on any authenticate/dependable evidence and/details.

The appellant has submitted a detailed statement and copies of the returns in Form GSTR-1 filed by it and asserted that the turnovers and taxes shown in this statement are actually scored outward supplies. Since, the returns in Form GSTR-1 filed by it are found to be not respectable due to lack of any additional contra evidence, hence the turnover & tax liability disclosed through these GSTR-1 returns, is to be confirmed as the real turnovers of the appellant.

It is also an anomaly in the A.A’s determination, wherein the A.A stated that he has added 50% to the declared turnover of the appellant. But, the thorough examination of the said GSTR-1 returns of the appellant, it is revealed that the A.A’s computations on this aspect even after adding 50% are observed to be erroneous.

The common best judgment assessment, penalty and interest orders are passed in a single order called Form GST ASMT-13 under Section 62 of the APGST Act, 1917 read with Rule 61(1) and Rule 100(1) of the APGST Rules, 2017. The turnovers of the dealer are estimated under Section 62 of the Act only on the ground that the dealer has not filed the return in Form. GSTR-3B. The said estimates of the turnovers are based either on the return in Form GSTR-3B for the previous tax periods or the details of the outward supplies made by the dealer reported in Form GSTR-1 for the same month/tax periods (mostly of the previous months). For such non-filing of the Form GSTR-3B for the particular tax periods, the turnovers declared by the dealer for the previous periods of turnovers declared towards its outwards supplies of goods and/or services in Form GSTR-001 for that tax period is adopted, besides adding 50% of such returned outward supplies/turnovers towards probable suppressions uniformly in all the tax periods and the best judgment assessments are made accordingly in the same document of common orders in Form GST ASMT-13, levying the tax, penalty and interest therein.

Thus, the short issue herein is whether the best judgment assessment under Section 62(1) can be made in respect of the non-filers of the returns in Form GSTR-3B? To answer this question, it is appropriate to extract the Section 62(1) of the Act and Rules 61(1) of the Rules hereunder.

“Section 62. Assessment of non-filers of returns. – (1) Notwithstanding anything to the contrary contained in Section 73 or Section 74, where a registered person fails to furnish the return under Section 39 or Section 45, even after the service of a notice under Section 46, the proper officer may proceed to assess the tax liability of the said person to the best of his judgment taking into account all the relevant material which is available or which he has gathered and issue an assessment order within a period of five years from the date specified under Section 44 for furnishing of the annual return for the financial year to which the tax not paid relates.

(2) Where the registered person furnishes a valid return within thirty days of the service of the assessment order under sub-section (1), the said assessment order shall be deemed to have been withdrawn but the liability for payment of interest under sub-section (1) of section 50 or for payment of late fee under section 47 shall continue.”

“Rule 61(1). Form and manner of submission of monthly return. – (1) Every registered person other than a person referred to in section 14 of the Integrated Goods and Services Tax Act, 2017 or an Input Service Distributor or a non-resident taxable person or a person paying tax under Section 10 or Section 51 or, as the case may be, under Section 52 shall furnish a return specified under sub-section (1) of section 39 in FORM GSTR-3 electronically through the common portal either directly or through a Facilitation Centre notified by the Chief Commissioner.”

Thus, it is very clear that the best judgment assessment under Section 62 can be made only when the dealer fails to file the return specified in Section 39(1) of the Act, read with Rule 61(1) of the Rules, that is the return in Form GSTR-3. Nothing else. Thus, the next question to answer is whether the return in Form GSTR-3B can be treated as return in Form GSTR-3 within the meaning of Section 39(1) of the Act read with Rule 61(1) of the Rules. But, my enquiry is made easy by the judgment and orders of the Hon’ble High Court of Judicature of Gujarat at Ahmadabad in R/Special Civil Application No. : 18962 of 2018, dated 24-6-2019 – 2019-VIL-314-GUJ : 2019 (26) G.S.T.L. 481 (Guj.). Thus, the issue is no more a res Integra. Their lordships at para 28 and 30 of the said judgment and orders held as under:-

Para 28.– “Therefore, the moot question is, whether the return, in Form GSTR-3B is a return required to be filed under Section 39 of the CGST Act/GGST Act. The aforesaid press release is valid and in consonance with Section 16(4) of the CGST Act/GGST Act only if Form GSTR-3B is a return required to be filed under Section 39 of the CGST Act/GGST Act.”

Para 30:- “It would be apposite to state that initially it was decided to have three returns in a month, i.e. return for outward supplies i.e. GSTR-1 in terms of Section 37, return for inward supplies in terms of Section 38, i.e. GSTR-2 and a combined return in Form GSTR-3. However, considering technical glitches in the GSTN portal as well as difficulty faced by the taxpayers it was decided to keep filing of GSTR-2 and GSTR-3 in abeyance. Therefore, in order to ease the burden of the taxpayer for some time, it was decided in the 18th GST Council meeting to allow filing of a shorter return in Form GSTR-3B for initial period. It was not introduced as a return in lieu of return required to be filed in Form GSTR-3. The return in Form GSTR-3B is only a temporary stop gap arrangement till due date of filing the return in Form GSTR-3 is notified. Notifications are being issued from time to time extending the due date of filing of the return in Form GSTR-3, i.e. return required to be filed under Section 39 of the CGST Act/GGST Act. It was notified vide Notification No. 44/2018-Central Tax dated 10th September, 2018 that the due date of filing the return under Section 39 of the Act, for the months of July, 2017 to March, 2019 shall be subsequently notified in the Official Gazette.”

Their lordships of the High Court of Gujarat were examining the legality or otherwise/validity or otherwise of the said press release which considered both GSTR-3B and GSTR-3 as one the same. The question is framed in para 28 of the said judgment and the same is answered in negative at para 33 therein. Thereby their lordships declared that for the purpose Section 39, the return means the return in Form GSTR-3 only, but not Form GSTR-3B during the relevant period. It is held therein that the Return in Form GSTR-3B is not even the return in Eeu of the return in Form GSTR-3 (para 31). Holding so, the clarification given in the said press release dated 18-10-2018 of the Government of India is held to be illegal for the disputed period. Thus, the very Jurisdictional factor to exercise the power of the best judgment assessment under Section 62 is conspicuously absent herein. Thus, I have no hesitation to declare that the best judgment common assessment, penalty and interest orders impugned herein are without the jurisdiction and hence, I declare them as non est void.

(2) For another reason also, these best judgment orders cannot be sustained in law. The best judgment assessment under Section 62 can be made by taking into account all the relevant material which are already available and/or the material available which is gathered from the other sources. It is also clear from the settled judicial principles on best judgment assessment that the estimations involved in the best judgment assessment should not be based on mere surmises and/or conjectures. Though estimations are involved in the best judgment assessment, the same cannot be without any basis or with some basis. In the instant case, uniformly the suppressed turnovers for a particular month are estimated either mostly on the basis of returns of the outward supplies of the dealer in Form GSTR-1 of that month or on the basis of the return in Form GSTR-3B for the preceding month. The quantum of the outward supplies declared by the dealer in such return is held to be incorrect and incomplete and the same is inflated to 150% of the declared outward supplies to arrive at the probable suppressed outward supplies for that month @ 50% (150% -100%).

This cannot be treated as the correct basis for the estimation. No attempt is made by the CTO to gather any material to at least indicate, not to talk of establish, that the quantum of the outward supplies declared by the dealer/supplier in Form GSTR-1 for that month is incorrect and incomplete. It is not even rejected by the AA. But, still the best judgment of the quantum of the outward supplies is made declaring uniformly for all the months that the dealer has suppressed 50% of its declared outward supplies in the relevant months. Thus, the estimations involved in the best judgment assessment herein are not sustainable. They are whimsical. They have no basis. It is declared accordingly. The same are deleted.

Besides, it is judicially settled law that the estimations fall foul of law if they are smacked off factors like wildness, vindictiveness, arbitrariness, capriciousness, etc., The best judgment orders in issue cannot be sustained even on these touch stones laid down by the Apex Court in the catena of cases starting from the case of Commissioner of Sales Tax, M.P. v. H.M. Esuf Ali Abdulla (way back in 1973) 32 STC 77 SC.

Conclusion:

Therefore, in view of the above emerged anomalies involving invoking of Section 62 unlawfully, because the relevant Section 39 does not speak of GSTR-3B in the listed returns for the disputed period, as clarified in the above discussed judgment and in view of the erroneous method adopted by A.A for estimating outward taxable supplies through best judgment without mentioning reasons/evidence, hence the tax so levied by the A.A of ₹ 3,43,96,432/- is annulled and modified as per actual tax liability of the appellant for the period from January, 2019 to February, 2019. In the result, the appeal is modified by fixing the actual tax liability from ₹ 3,43,96,432/- (annulled) (to be determined as per GSTR-1 returns of the appellant for the period from January, 2019 to February, 2019.

(2) Regarding levy of penalty of ₹ 3,43,96,432/-:

As already discussed the A.A has not recorded exhaustive reasons, while determining the tax as well as the penalty and passed tax/penalty orders through a single order, which is not legitimate. In this connection, the following case law is relevant and essential to explore, before analyzing the penalty justifiability aspect.

THE HON’BLE SRI JUSTICE RAMESH RANGANATHAN

AND

THE HON’BLE SMT. JUSTICE KONGARA VIJAYA LAKSHMI

WRIT PETITION NO. 33777 OF 2018

Dated 26-9-2018

ORDER: (Per the Hon’ble Sri Justice Ramesh Ranganathan) Heard Sri P. Balaji Varma, Learned Counsel for the petitioner and Sri Shaik Jeelani Basha, Learned Special Standing Counsel for Commercial Taxes and, with their consent, the Writ Petition is disposed of at the stage of admission.

The proceedings under challenge in this Writ Petition is the order passed by the second respondent on 20-8-2018, for the tax period March, 2018, directing the petitioner to pay tax and penal interest without issuing an assessment order under Section 61 of the Andhra Pradesh Goods and Services Tax Act, 2017 (“the APGST Act” for brevity), and without issuing a show cause notice, as illegal, arbitrary and without jurisdiction. By the order, impugned in the Writ Petition, dated 20-8-2018 the Assistant Commissioner directed payment of penalty at 15% along with interest under Section 50 read with Section 79(5) of the APGST Act and Rule 143 of the APGST Rules, failing which recovery proceedings would be initiated under Section 79 of the said Act.

While fairly admitting that the petitioner is liable to pay tax and penal interest, Sri P. Balaji Varma, Learned Counsel for the petitioner, would, however, question the validity of the assessment order in so far as the petitioner was called upon to pay penalty at 15%, contending that any proceedings for recovery of penalty must be preceded by a show cause notice which, admittedly, was not issued in the present case.

Section 74(5) of the APGST Act stipulates that a person, chargeable with tax, may, before service of notice under sub-section (1), pay the amount of tax along with interest payable under Section 50 and a penalty equivalent to 15% of such tax on the basis of his own ascertainment of such tax or the tax as ascertained by the proper officer, and inform the proper officer in writing of such payment. Section 74(1) of the APGST Act stipulates that, where it appears to the proper officer that any tax has not been paid or short paid or erroneously refunded or where input tax credit has been wrongly availed or utilised by reason of fraud, or any wilful-misstatement or suppression of facts to evade tax, he shall serve notice on the person chargeable with tax which has not been so paid or which has been short paid or to whom refund has erroneously been made, or who has wrongly availed or utilised input tax credit requiring him to show cause as to why he should not pay the amount specified in the notice along with interest payable thereon under Section 50, and a penalty equivalent to the tax specified in the notice.

While a show cause notice is required to be issued under Section 74(1) of the APGST Act for recovery of penalty equivalent to the tax specified in the notice, Section 74(5) of the said Act enables the dealer to pay 15% penalty on his own accord before receipt of a notice under Section 74(1) of the Act. Section 74(5) of the APGST Act enables the dealer to avoid payment of penalty beyond 15%, if penalty at 15% is paid before receipt of a show cause notice. That does not mean that, even without a show cause notice being issued, the dealer is obligated to pay penalty at 15% under Section 74(5) of the Act. Section 74(5) of the Act merely enables the petitioner to pay penalty at 15% on his own accord, in which event the assessing authority cannot thereafter issue a notice seeking recovery of the balance 85% penalty (i.e. penalty equivalent to the tax specified in the notice). Whether penalty at 15% should be paid or not is for the assessee to decide. While he would, undoubtedly, run the risk of being subjected to penalty at 100% of the tax specified, the power conferred on the assessing authority to recover penalty, equivalent to the tax specified in the notice, is only after a notice is issued calling upon the petitioner to show cause why penalty should not be imposed on him.

The impugned order, to the limited extent the petitioner was called upon to pay penalty at 15%, is set aside. As the validity of the order is not subjected to challenge in this Writ Petition on any other ground, it is wholly unnecessary for us to examine the said order on its merits.

Suffice it, therefore, to set aside the impugned order to the limited extent the petitioner was called upon to pay penalty at 15%. The Writ Petition stands disposed of accordingly. Needless to state that this order shall not disable the respondent from issuing a penalty notice and recover the penalty payable in terms of Section 74(1) of the APGST Act. There shall be no order as to costs. Miscellaneous petitions, if any, pending shall stand closed.

The Hon’ble High Court of Andhra Pradesh has discretely thrown light on the penalty orders discussed above, where in penalty levied in the same orders of assessment, and struck down such orders mandating that a separate notice for passing penalty orders shall always be issued before levy. In the instant case, the A.A has not followed such procedure and arbitrarily clubbed the tax & penalty orders without putting a notice to appellant, thus making it liable for setting aside.

Before embarking on adjudication of this issue, it is very much essential to have a comprehensive understanding of Section 122(1 & 2) of GST Act, 2017, which are abstracted below:

Section 122.

(1) Where a taxable person who-

(i) supplies any goods or services or both without issue of any invoice or issues an incorrect or false invoice with regard to any such supply;

(ii) issues any invoice or bill without supply of goods or services or both in violation of the provisions of this Act or the rules made thereunder;

(iii) collects any amount as tax but fails to pay the same to the Government beyond a period of three months from the date on which such payment becomes due;

(iv) collects any tax in contravention of the provisions of this Act but fails to pay the same to the Government beyond a period of three months from the date on which such payment becomes due;

(v) fails to deduct the tax in accordance with the provisions of sub-section (1) of section 51, or deducts an amount which is less than the amount required to be deducted under the said sub-section, or where he fails to pay to the Government under sub-section (2) thereof, the amount deducted as tax;

(vi) fails to collect tax in accordance with the provisions of sub-section (1) of section 52, or collects an amount which is less than the amount required to be collected under the said sub-section or where he fails to pay to the Government the amount collected as tax under sub-section (3) of section 52;

(vii) takes or utilises input tax credit without actual receipt of goods or services or both either fully or partially, in contravention of the provisions of this Act or the rules made thereunder;

(viii) fraudulently obtains refund of tax under this Act; (ix) takes or distributes input tax credit in contravention of section 20, or the rules made thereunder;

(x) falsifies or substitutes financial records or produces fake accounts or documents or furnishes any false information or return with an intention to evade payment of tax due under this Act; Non-appealable decisions and orders. Penalty for certain offences.

(xi) is liable to be registered under this Act but fails to obtain registration;

(xii) furnishes any false information with regard to registration particulars, either at the time of applying for registration, or subsequently;

(xiii) obstructs or prevents any officer in discharge of his duties under this Act;

(xiv) transports any taxable goods without the cover of documents as may be specified in this behalf;

(xv) suppresses his turnover leading to evasion of tax under this Act;

(xvi) fails to keep, maintain or retain books of account and other documents in accordance with the provisions of this Act or the rules made thereunder;

(xvii) fails to furnish information or documents called for by an officer in accordance with the provisions of this Act or the rules made thereunder or furnishes false information or documents during any proceedings under this Act;

(xviii) supplies, transports or stores any goods which he has reasons to believe are liable to confiscation under this Act;

(xix) issues any invoice or document by using the registration number of another registered person;

(xx) tampers with, or destroys any material evidence or document;

(xxi) disposes off or tampers with any goods that have been detained, seized, or attached under this Act, he shall be liable to pay a penalty of ten thousand rupees or an amount equivalent to the tax evaded or the tax not deducted under section 51 or short deducted or deducted but not paid to the Government or tax not collected under section 52 or short collected or collected but not paid to the Government or input tax credit availed of or passed on or distributed irregularly, or the refund claimed fraudulently, whichever is higher.

(2) Any registered person who supplies any goods or services or both on which any tax has not been paid or short-paid or erroneously refunded, or where the input tax credit has been wrongly availed or utilised,-

(a) for any reason, other than the reason of fraud or any willful misstatement or suppression of facts to evade tax, shall be liable to a penalty of ten thousand rupees or ten per cent, of the tax due from such person, whichever is higher;

(b) for reason of fraud or any willful misstatement or suppression of facts to evade tax, shall be liable to a penalty equal to ten thousand rupees or the tax due from such person, whichever is higher.

The A.A has invoked Section 122, on which he has supposedly relied and treated the appellant non-submission of GSTR-3B as a means for fraudulent and willful attempt for suppression of liable tax and levied 100% penalty. The basic discrepancy in the A.A’s interpretation is that it cannot be said that the appellant has acted deliberately to suppress the outward taxable supplies, because the appellant has filed GSTR-1 returns declaring the actual turnovers, hence prima facie no ground can be made for willful suppression attribution. That means, though the A.A has assigned appellant’s action with a motive of willful attempt for suppression of facts, but it is beyond any doubt and the A.A also admitted that the appellant has filed GSTR-1 returns declaring the outward taxable supplies, hence attribution of willful suppression by the appellant does not hold legit. To levy of penalty under Section 122, basically there must be suppression of facts, but in the instant case the appellant has not attempted for suppression of facts and duly declared his outward taxable supplies turnovers thorough GSTR-1 returns filed by them.

Though, non-tiling of GSTR-3B returns, is certainly an omission on the part of the appellant, but such non-filing shall not lead to penalty under Section 122, because there is no prima facie suppression by the appellant regarding his outward taxable supplies.

The additions made by the AA towards the probable suppressions that formed the basis for the levy of penalty should also fall to the ground. It is trite to say that when the tax is set aside the corresponding penalty should also be set aside. Hence, the penalty which is proportionate to the tax additions made towards the probable suppression is also set aside.

Besides, there is not even an iota of evidence established by the AA pointing out the willfulness in the omission to file the return in Form GSTR-3B and/or in the determined suppression of outward tax. None of the facts that could give rise to the inferences of the ‘willfulness’ are specified in the very brief pre-common assessment Show-Cause Notice and also in the common assessment orders in Form GST ASMT-13. Hence, the levy of penalty @ 100% of determined turnovers are also to be deleted. It is ordered accordingly.

Conclusion:

For the above anomalies discussed, a case is made in favour of the appellant to struck down the penalty as the levy is not justifiable. Hence, the total penalty of ₹ 3,43,96,432/- annulled and appeal allowed on this aspect in favour of the appellant.

(3) Regarding, levy of interest of ₹ 8,30,115/-:

Before embarking on adjudication of this issue, it is very much essential to have a comprehensive understanding of Section 50 of GST Act, 2017, which are abstracted below:

Section 50.

(1) Every person who is liable to pay tax in accordance with the provisions of this Act or the rules made thereunder, but fails to pay the tax or any part thereof to the Government within the period prescribed, shall for the period for which the tax or any part thereof remains unpaid, pay, on his own, interest at such rate, not exceeding eighteen per cent, as may be notified by the Government on the recommendations of the Council. Interest on delayed payment of tax.

(2) The interest under sub-section (1) shall be calculated, in such manner as may be prescribed, from the day succeeding the day on which such tax was due to be paid.

(3) A taxable person who makes an undue or excess claim of input tax credit under sub-section (10) of section 42 or undue or excess reduction in output tax liability under sub-section (10) of section 43, shall pay interest on such undue or excess claim or on such undue or excess reduction, as the case may be, at such rate not exceeding twenty-four per cent, as may be notified by the Government on the recommendations of the Council.

A plain understanding of the above section clearly envisages that, whenever any dealer failed to discharge applicable tax in time, is liable to pay interest @ 18% for the delayed period.

Conclusion:

Therefore, the levy of interest is upheld, but the A.A is directed to compute leviable interest as on date against the actual tax to be paid by the appellant as discussed at above paras. In the end, appeal on this aspect is confirmed. The appellant also not advanced any objections on this aspect.

Result of the appeal:

24. In the end, the assessment is partly modified, partly annulled and partly confirmed on the levy made by the assessing authority