Palsana Enviro Protection Ltd vs. Na

(AAR (Authority For Advance Ruling), Gujrat)

BRIEF FACTS:

M/s Palsana Enviro Protection Limited (for the sake of brevity referred as ‘the applicant’), is a company promoted by cluster of textile processing industries for setting up of Common Effluent Treatment Plant (CETP) to treat and recycled the effluent for Conveyance, Treatment & Disposal of waste water generated from the industries.

2. The applicant recycled its treated water to its member units to use it in their process activities. The treated water can be used in non-potable activity. The waste water is converted into treated water by treating the waste water through various processes to make it suitable for industrial use. As the water is not purified, it is not fit for human consumption.

3. It is submitted by the applicant that as per Sr. No. 99 of Notification No. 2/2017-Central tax (rate) (as amended), Water [other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and -water sold in sealed container] are exempt from GST. The water obtained from CETP is not “purified water”, and is thus, eligible for exemption from GST under SI. No. 99 of Notification 02/2017 – Integrated Tax (Rate) dated 28.06.2017.

4. The applicant has submitted that the treated water is water other than aerated, mineral, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container, the only question remain is whether the treated water can be said as purified water.

5. It is submitted by the applicant that the term “purified” is not defined under the CGST Act, 2017, accordingly, referred the dictionary meaning of the term “purified”.

As per the website Dictionary.com, the term “purify” means:-

1. to make pure; free from anything that debases, pollutes, adulterates, or contaminates;

2. to free from foreign, extraneous, or objectionable elements;

As per the Cambridge Dictionary, the term “purify” means:-

1. to remove bad substances from something to make it pure

5.1 Thus, as per the dictionary meaning, the term ‘purify’ means “to make pure”, or “to free from foreign, extraneous, or objectionable elements”. Accordingly, the “purified water” means such water which is free from foreign, extraneous, or objectionable elements.

6. It is submitted further that the impugned product, i.e. CETP treated water, is obtained after carrying out various processes on the waste water. By carrying out the said processes on the waste water, the waste water is made free from various impurities substances, such as suspended particles, grit, clays, pollutants like nitrogen, phosphorus, etc. However, even after carrying out the said physical and biological processes, water coming out from the CETP still not pure Water and hence cannot be termed as purified water.

7. The applicant submits that the aforesaid notion is also supported by the Tamil Nadu AAAR order in the case of M/s New Tripura Area Development Corporation Limited (ORDER-in-Appeal No. AAAR/17& 18/2021 (AR), wherein the Appellate Authority inter alia held that “in chemical terms, purified water is pure H20 and only contains Hydrogen and Oxygen and no minerals; Distilled water is the most common form of pure water”.

8. It is submitted by the applicant that the water containing anything apart from the Hydrogen and Oxygen will not be construed as pure water. It is further submitted that even potable water, which is fit for human consumption, will not be treated as pure water due to the presence of various minerals and other elements like chlorine, which are added to it to kill the harmful micro-organisms that causes diseases.

9. The applicant is of the view that on application of the legal construction of “noscitur a sociis “or “a doctrine or rule of construction” to derive the meaning of the expression “purified”, which has not been defined under the GST law, it is seen that all the expressions of the exclusion clause of the relevant entry surrounding the word “purified” have got certain specific characteristics and usage. That is, this water at their respective places of their usage cannot be replaced or substituted by any other water.

10. The applicant submits that the CETP treated water supplied to its members for their industrial use, does not have any specific characteristics and usages as those of the other specific water, such as “aerated, mineral, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container’ mentioned in the exclusion clause of the entry under consideration as the said CETP treated water can be readily replaced by municipal water.

11. The applicant submits that all these groups of specific water mentioned under the exclusion clause of the relevant entry are supplied in the packaged form, i.e., in the sealed container, in order to preserve their characteristics and specificity, while the same is not the case with the impugned product, i.e., CETP treated water, which are supplied through pipelines without any such concerns. Thus, the term “purified”, mentioned under the exemption clause of the relevant entry, will definitely not include the CETP treated water. Hence, applicant is of the view that the impugned product, i.e., CETP treated water, is rightfully eligible for exemption under entry at SI. No. 99 of the exemption notification no. 02/2017-C.T. (Rate) dated 28.06.2017.

12. The applicant submits that it has never been the intention of the Government, i.e., either Central Government or State Government, to levy any indirect tax on water of general purposes. Even under the erstwhile indirect tax regime, no tax, whether in the nature of Central Excise or in the nature of VAT, was leviable on the water of general purposes, hence the supply of CETP treated water was not subject to any indirect tax under the erstwhile tax regimes.

13. The applicant further submits that even under the GST regime, Government has clarified its intention of not levying GST on the supply of general-purpose water by way of issuance of the CBIC Circular No. 52/26/2018 dated 9th August 2018, wherein it has been clarified that supply of drinking water, for public purposes, if not supplied in sealed containers, is exempted from GST. Thus, by applying the canon of “purposive construction”, which gives effect to the legislative purpose/intendment, inclined to hold that the impugned product, which can aptly be construed as water of general purpose as discussed earlier, is eligible for exemption under the relevant entry at SI. No. 99 of the exemption notification no. 02/2017-C.T. (Rate) dated 28.06.2017.

14. The applicant vide letter dated 15-9-2022 has submitted that vide notification No. 7/2022-Central Tax (Rate) dtd. 13.07.2022, the word “purified” has been deleted from Sr. No. 99 of Not. No. 12/2017-CT (Rate) dated 28-6-2017 of exempt good list. Hence, the revised list of exempt good is as under :

| Sr.No. | Chapter / Heading / Subheading / Tariff item | Description of Goods |

| 99 | 2201 | Water other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and water sold in scaled container |

15. The applicant has submitted that the intention of Government is not to tax the treated water and intention is to cover the same under exemption and in this regard have referred para 5 of the circular No. 179/11/2022-GST dtd. 03.08.2022, which is reproduced as under:-

5. Treated sewage water attracts Nil rate of GST:

5.1 Representations have been received seeking clarification regarding the applicable GST rate on treated sewage water. Treated sewage water was not meant to be construed as falling under “purified” water for the purpose of levy of GST.

5.2 In general, Water, falling under heading 2201, with certain specified exclusions, is exempt from GST vide entry at S. No. 99 of notification No. 2/2017-Central Tax (Rate), dated the 28th June, 2017.

5.3 Accordingly, it is hereby clarified that supply of treated sewage water, falling under heading 2201, is exempt under GST. Further, to clarify the issue, the word ‘purified’ is being omitted from the above-mentioned entry vide notification No. 7/2022-Central Tax (Rate), dated the 13th of July, 2022.

16. The applicant submits that in their opinion the supply made by them is covered under exemption and is not liable to tax.

17. Question on which Advance Ruling sought:

1. Whether ‘Treated Water’ obtained from CETP (classifiable under Chapter 2201) will be eligible for exemption from GST by virtue of SI. No. 99 of the Exemption Notification No. 02/2017- Integrated Tax (Rate), dated 28-6-2017 (as amended) as ‘Water (other than aerated, mineral, purified, distilled, medical, ionic, battery, demineralized and water sold in sealed container)’? or

2. Whether ‘Treated Water’ obtained from CETP (classifiable under Chapter 2201) is taxable at 18 per cent by virtue of SI. No. 24 of Schedule – III of Notification No. 01/2017- Integrated Tax (Rate), dated 28-6-2017 (as amended) as ‘Waters, including natural or artificial mineral waters, and aerated waters, not containing added sugar or other sweetening matter nor flavoured (other than Drinking water packed in 20 liters bottles)’

Personal Hearing:

18. Personal hearing granted on 26-09-22 was attended by Shri Mihir D. Gandhi (C.A.) and he reiterated the submission. The representative of the applicant during the course of Personal Hearing was asked to submit the detail and comparison of process of Sewage Treatment Plant and Common Effluent Treatment Plant to decide the nature and nomenclature of the treated water. Also it was specifically asked to submit the Chemical Analysis report of the treated water i.e. water extracted after the due process from ETP of the recognized lab. The applicant has submitted the function of Sewage Treatment Plant and Effluent Treatment Plant. Also it was specifically asked to submit the Chemical Analysis report of the treated water i.e. water extracted after the due process from ETP of the recognized laboratory but instead of submitted the letter of Sr. Env. Eng. Dated 2-112022 wherein mentioned the Comparison of Characteristics of Industrial waste water i.e. Effluent received from Textile Units at CETP for treatment.

Revenue’s Submission:

19. Revenue has neither submitted its comments nor appeared for hearing.

Additional Submission

20. The applicant has submitted the function of Sewage Treatment Plant and Effluent Treatment Plant Also submitted the letter of Sr. Env. Eng. Dated 2-11-2022 wherein mentioned the Comparison of Characteristics of Industrial waste water received at CETP for treatment. The same is reproduced as follows :

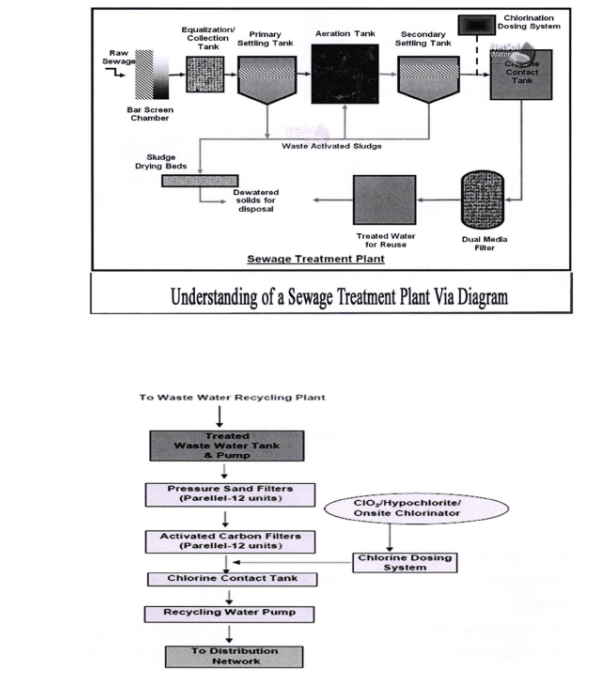

Function of Sewage treatment plants (STP)

20.1 Sewage treatment plants work by separating waste from the sewage and turning it into safe water. This water is purified to a level that is safe to release into the environment. Sewage treatment plants break down the organic waste present in the sewage and turn it into clean water. These plants are built to deal with a large amount of sewage in municipalities.

20.2 In the first stage of cleaning in a sewage treatment plant, the sewage is kept in a tank for an extended period. At this time, the solids present in the sewage sink to the bottom of the tank. Grease, excreta, etc travel to the top and settle there. From this stage, the liquid waste water gets separated and moves on to the next stage to be cleaned further.

20.3 In the second stage, sewage treatment plants put the water in a tank and allow ample airflow. This airflow encourages the growth of bacteria that is capable of quickly breaking down the waste in the water.

20.4 In this stage, most of the waste in the water is separated by the bacteria and the water is nearly safe enough to release into the environment.

20.5 In the last stage of a sewage treatment plant, the wastewater is screened, so the remaining solid in the wastewater can be separated. After this stage, the water is safe to be released into water bodies.

20.6 If all the stages work perfectly, this treated sewage will not burden the environment and clog our water bodies.

Function of Effluent treatment plants (ETP)

21. Effluent treatment plants work in several stages to remove all sorts of impurities from industrial waste water. They can screen out solid waste and dust, disinfect the water and purify it on a molecular level.

21.1 This treated water is safe to be released into water bodies without disrupting the ecological balance.

21.2 In the primary stage of an effluent treatment plant, mostly solid and visible waste is removed. Dust and debris are also removed in the first stage. Screenings are done to separate solid waste from the effluent.

21.3 Coagulants are used to have the contaminants clump together and sink to the bottom of the tank. From there, they can be separated easily. Wastewater is also put in a tank where the growth of bacteria is abundant. The contaminants get broken down by bacteria in that stage.

21.4 The secondary stage of an effluent treatment plant finely cleanses the water. Activated carbons arc used in this stage to capture chemicals and heavy metals.

21.5 Chlorine and ultraviolet rays are frequently used to disinfect the wastewater. Many industry owners prefer to use ultraviolet rays to reduce the use of chlorine.

21.6 If chlorine is used, the wastewater should be pushed through carbon filters to pull out excess amounts from the water.

21.7 After the secondary stage, the water is safe enough to be released into the environment. Reverse osmosis filters might be used to get rid of any molecules that are larger than a water molecule and turn the water into its purest form.

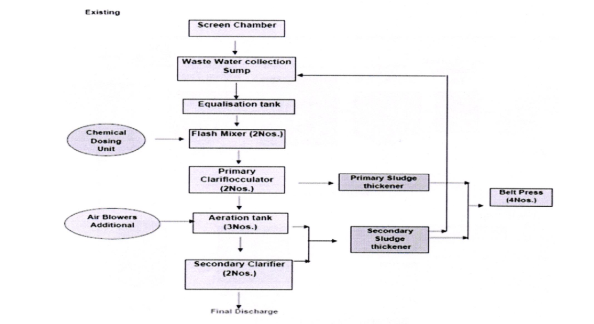

22. The applicant has summarized the function of both STP and ETP as follows:

22.1 An ETP is a plant where the treatment of industrial effluents and waste waters is done. The ETP plants arc used widely in industrial sector, for example, pharmaceutical industry, chemical industry to remove the effluents from the bulk drugs while Sewage treatment is the process of removing contaminants from wastewater and household sewage, both runoff (effluents) and domestic. It includes physical, chemical, and biological processes to remove physical, chemical and biological contaminants.

22.2 ETP may be a system that removes toxic and non-toxic material from water and making it usable for various purposes. STP unit removes contaminants from municipal wastewater or household sewage.

22.3 ETP is employed in industrial areas whereas STP cleanses household water. Pharmaceuticals, chemicals, and leather industries generally make use of Effluent Plants whereas Sewage plants are utilized in residential areas like societies and apartments.

22.4 Both STP and ETP remove contaminants from wastewater or sewage and convert it into an effluent that can be returned to the water cycle with minimum impact on the environment or directly reused. Both of these plants are important to maintain an ecological balance and keep safe water available for everyone.

22.5 The only reasons given by various AAR for taxing the treated water was that the same may be classified as purified water. Vide the notification, the word “Purified” has been deleted. Also the STP and ETP both are plant for removing impurities from the polluted water.

23. The applicant has submitted letter dated 2-11-22 of Sr. Envr. Engineer wherein following details have been mentioned and same are reproduced as under :

Table : Comparison

| Parameter | Unit | Industrial Waste water at CETP | Domestic Sewage at STP |

| PH |

| 6.5-8.0 | 7-7.5 |

| Total Dissolved Solids | Mg/1 | 2000-400 | 500-1000 |

| Total Suspended Solids | Mg/1 | 300-500 | 300-500 |

| COD | Mg/1 | 900-1500 | 40-600 |

| BOD3 | Mg/1 | 350-450 | 250-300 |

| Chloride | Mg/1 | 700-800 | 150-200 |

| Ammonical Nitrogen | Mg/1 | 20-50 | <20 |

| Oil & Grease | Mg/1 | 30-50 | 10-30 |

FINDINGS:

24. We have considered the submissions made by the Applicant in their application for advance ruling as well as the additional submissions made by the applicant before this authority. We also considered the issue involved, on which advance ruling is sought by the applicant, relevant facts & the applicant’s interpretation of law.

25. At the outset we would like to make it clear that the provisions of CGST Act and GGST Act are in pari-materia and have the same provisions in like matter and differ from each other only on a few specific provisions. Therefore, unless a mention is particularly made to such dissimilar provisions, a reference to the CGST Act would also mean reference to the corresponding similar provisions in the GGST Act.

26. The main issue here is to decide whether the treated water obtained from CETP is eligible for exemption from GST under entry at Sr. No. 99 of Notification No. 12/2017-CT (Rate) dated 28-6-2017 as amended.

27. We find that the applicant is a company promoted by cluster of textile processing industries for setting up of Common Effluent Treatment Plant to treat and recycled the effluent for Conveyance, Treatment & Disposal of waste water generated from the industries. The applicant received the effluent from such textile units for treatment and supply treated water obtained from ETP to the industries which required for their various processes.

28. We find that effluent received from industries is passed through various processed in CETP and after carrying out due process treated water obtained from CETP which is suitable for Industrial use as per their requirements. The applicant has argued that this water is not “purified”, therefore is eligible for exemption under Sr. No. 99 of Not. No. 2/2017-CT (Rate) dated 28-6-2017 as amended. To decide the eligibility of such treated water we refer to entry No. 99 of Not. No. 2/2017-CT (Rate) dated 28-6-2017 and is reproduces as under:

| Sr.No. | Chapter / Heading / Subheading / Tariff item | Description of Goods |

| 99 | 2201 | Water (other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container) |

28.1 The said entry was amended vide Notification No. 7/2022-Central Tax (Rate) dtd. 13.07.2022, wherein the word “purified” has been deleted from the types of water mentioned as exception for exemption from payment of GST at Sr. No. 99 and amended entry is as follows :

| Sr.No. | Chapter / Heading / Subheading 1 Tariff item | Description of Goods |

| 99 | 2201 | Water (other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container) |

28.2 We have observed from the above entry that specifically ‘Water’ is eligible for exemption from payment of GST and other types of water i.e. aerated, mineral, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container are not covered under entry no. 99 and liable to payment of applicable GST.

28.3 We find that the intention of the legislature to exempt the water was very clear that any type of water which is usually consumed/drink by the public at large of this country should not be taxed. To meet such objective GST Council has provided exemption under the Entry No.99 of Not. No. 2/2017-CT (Rate) to Water which is free from all types of impurities supplied in cities and villages across the country either through tap or tanker, water cooler and water tap installed at various places across the country. Whereas aerated, mineral, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container is not eligible for exemption from payment of GST under the said entry. This clearly shows the intention of the legislature that any type of water which are being sold in terms of commercial purpose have been kept out of the purview of exemption as provided under entry No. 99 of the Notification.

28.4 The legislature has clarified its intention of not levying GST on the supply of drinking water by way of issuance of the CBIC Circular No. 52/26/2018 dated 9th August 2018, wherein it has been clarified that supply of drinking water, for public purposes, if not supplied in sealed containers, is exempted from GST. The relevant para is reproduces as under:-

6.1 Applicability of GST on supply of safe drinking water for public purpose: Representations have been received seeking clarification regarding applicability of GST on supply of safe drinking water for public purpose.

6.2 Attention is drawn to the entry at S. No. 99 of notification No. 2/2017-Central Tax (Rate) dated 28.06.2017, by virtue of which water [other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralized and water sold in sealed container] falling under HS code 2201attracts NIL rate of GST.

6.3 Accordingly, supply of water, other than those excluded from S. No. 99 of notification No. 2/2017-Central Tax (Rate) dated 28.06.2017, would attract GST at “NIL” rate. Therefore, it is clarified that supply of drinking water for public purposes, if it is not supplied in a sealed container, is exempt from GST.

28.5 We find that the applicant has submitted his own that treated water obtained from CETP is not purified water and cannot be used in drinking by the public but supplied to the Industry and can be used by the industries for their process.

28.6 The treated water obtained from CETP do not cover under the category of ‘purified water’ then what type of treated water would be i.e. whether cover under the category of aerated, mineral, distilled, medicinal, ionic, battery, de-mineralized water. To decide the category of such treated water, we discuss the types of water mentioned in the entry No. 99 one by one. All such types of water have not been defined under CGST/ SGST Act, therefore we take recourse to the definitions provided in various dictionary and wikipedia.-

(i) Aerated water: As per Wikipedia, water to which air is added and this term is applied to carbonated water. As per the definition by Merriam-webster, any water artificially impregnated with a large amount of gas (as carbon dioxide) is called aerated water.

(ii) Mineral water: As the name suggest such types of water contains minerals and in day to day life we prefer to drink or use mineral water because it is useful for the health of man- kind. Even in market Mineral water is sold in bottle and public at large prefer to drink such mineral water if potable water is not available. In general mineral water does not undergo chemical processing and it contains high quantities of minerals, especially magnesium, calcium and sodium.

(iii) Distilled water: Dictionary.com has defined the terms as water from which . impurities, as dissolved salts and colloidal particles, have been removed by one or more process of distillation; chemically pure water. As per Wikipedia, this type of water is water that has been boiled into vapor and condensed back into liquid in a separate container. Impurities in the original water that do not boil below or near the boiling point of water remain in the original container. Thus distilled water is a type of purified water.

(iv) Medicinal water: Medicinal waters are natural mineral waters with proven therapeutical effect. Their therapeutical application in treating certain diseases has been identified using strict medical tests and thus officially these waters are allowed to be called ‘medicinal waters’.

(v) Ionic water: Ionized water is natural water that has been run through an ionizer machine’s platinum and titanium plates to exchange some of the titanium and platinum ions with the water, thereby increasing its alkaline nature and the pH level of natural water. This process also helps remove impurities from the water.

(vi) Battery water : Battery water, is the clean water used to refill the electrolyte when its levels run low. The water used in battery water is usually distilled water or deionized water. It’s never tap water, as tap water may contain impurities.

(vii) De-mineralized water : De-mineralized water is virtually free from minerals and related substances, there can be very tiny amounts of dissolved minerals that will always remain. This water is also called soft water because all the hardness is removed by the demineralization process. De-mineralized water is water completely free (or almost) of dissolved minerals as a result of one of the following processes: distillation. Deionization, membrane filtration (reverse osmosis or nanofiltration)

28.7 We have discussed various types of water at (i) to (vii) above and observed that the applicant impugned treated water do not falls under the category of aerated water, mineral water, distilled water, medicinal water, ionic water and battery water. Now, we discuss the applicant impugned product i.e. treated water as under.

28.8 The applicant has submitted that in CETP they screen out solid waste, dust, disinfect the water and purify it on a molecular level. Various Coagulants are used to have the contaminants clumps together and sink it to the bottom of the tank. Further, Waste water is put in a tank where the growth of bacteria is abundant and contaminants get broken down by bacteria. The activated carbons are used to capture chemicals and heavy metals. Chlorine and ultraviolet rays are frequently used to disinfect the waste water. Reverse Osmosis Membranes are used to get rid of any molecules that are larger than a water molecule and turn the water into its purest form. CETP purify the water on molecular level. Activated carbons are used to capture heavy metals and chemicals.

Further, chlorine is used to clean the water and by Reverse Osmosis process water is made purify up to a molecular level. Thus, by undergoing the treatment of effluent through all such process in CETP de-mineralized water is obtained.

28.9 It can be concluded that after undergoing out all the process treated water obtained from CETP have micro amount of dissolved minerals and chemical and virtually free from all types of toxic materials. This treated water is used in the various industries viz. Pharmaceuticals, chemicals and leather industries for their manufacturing related process. Looking to the presence of small amount of metal and water obtained after treatment from CETP is covered under ‘de-mineralize water’. Hence, we are of the view that the treated water obtained from CETP is not eligible for exemption under Sr. No. 99 of Notification No. 12/2017-CT (Rate) dated 28-6-2017.

28.10 We hold that the ‘Treated Water’ obtained from CETP (classifiable under Chapter 2201) is taxable at 18 per cent by virtue of SI. No. 24 of Schedule – III of Notification No. 01/2017- Integrated Tax (Rate), dated 28-6-2017 (as amended) as ‘Waters, including natural or artificial mineral waters, and aerated waters, not containing added sugar or other sweetening matter nor flavoured (other than Drinking water packed in 20 liters bottles)’

28.11 The applicant has relied upon the following Circulars:-

(i) Circular No. 52/26/2018 dated 9th August 2018 issued by CBIC in relation to supply of drinking water is not applicable as such applicant water is not a drinking water but it is used in the various industry.

(ii) Circular No. 179/11/2022-GST dtd. 03.08.2022 issued by CBIC in relation to purified water obtain from Sewage Treatment Plant. This circular is not tenable in the present case as the applicant treated water is de-mineralised water and obtained from Common Effluent Treatment Plant where as circular has clarified the ‘purified water’ obtained from Sewage Treatment Plant. Both type of water are different as such treated water obtained from CETP is used in Industry for the process whereas treated water obtained from Sewage water is water is nearly safe enough to release into the environment.

29. The applicant has referred the Ruling pronounced by the Appellate Authority in case of M/s New Tripura Area Development Corporation Limited (ORDER-in-Appeal No. AAAR/17& 18/2021 (AR), wherein the Appellate Authority inter alia held that “In chemical terms, purified water is pure H20 and only contains Hydrogen and Oxygen and no minerals; Distilled water is the most common form of pure water”. The facts of the case and issue are not similar to the applicant case and cannot be applied.

30. We find that Authority for Advance Ruling, Tamilnadu in the case of M/s Kasipalayam Common Effluent Treatment Plant (P.) Ltd. has given the Ruling as, Classification of goods – Tamil Nadu Goods and Services Tax Act, 2017 – Demineralized Water – Heading No. 2201 – Applicant is a Common Effluent Treatment Plant engaged in collecting, conveying, treating and disposing of effluents from its member dyeing/bleaching units – Applicant proposes to purchase raw effluent from member units, treat same and sell treated water, extracted salts, etc. – By process of reverse osmosis reusable water is obtained, which is partly de-mineralized in nature and is sold for industrial process utilization – Whether description of product do not fall into ‘Water (other than aerated, mineral, purified, distilled, medicinal, ionic, battery, de-mineralised and water sold in sealed container)’ given under SL No. 99 of Notification No. 02/2017-Central Tax (Rate), dated 28-6-2017 – Held, yes – Whether water recovered, which is demineralized water for industrial use is classifiable under Heading No. 2201 as waters described under SI. No. 24 of Annexure-III of Notification No. 01/2017- Central Tax (Rate), dated 28-6-2017 and is taxable at 18 per cent GST – Held, yes [Paras 9.2 and 10]

30.1 The fact and issue of the above Advance Ruling are similar to the present applicant, as such the applicant in the instant case is also Common Effluent Treatment Plant engaged in collecting, conveying, treating and disposing of effluents from its member dyeing/bleaching units and obtaining water by process of reverse osmosis. This treated water is not use in drinking purpose by public at large but supplied to Industries for their use.

31. We, hereby pass the Ruling:

RULING

1. ‘Treated Water’ obtained from CETP (classifiable under Chapter 2201) is not eligible for exemption from payment of Tax by virtue of SI. No. 99 of the Exemption Notification No. 02/2017- CT (Rate) dated 28-6-2017 (as amended) and SI. No. 99 of the Exemption Notification No. 02/2017- Integrated Tax (Rate), dated 28-6-2017 (as amended).

2. ‘Treated Water’ obtained from CETP (classifiable under Chapter 2201) is taxable at 18 per cent by virtue of SI. No. 24 of Schedule – III of Notification No. 01/2017-CT (Rate) (as amended) and SI. No. 24 of Schedule – III of Notification No. 01/2017- Integrated Tax (Rate), dated 28-6-2017 (as amended).