Path Finder India vs. Assistant Commissioner

(Madras High Court, Tamilnadu)

ORDER

In the captioned writ petition, which is in the Admission Board, Mr.M.Abdul Razack, learned counsel on record for writ petitioner is before this writ Court.

2. Learned counsel submits that the writ petitioner is a dealer qua ‘Tamil Nadu Goods and Services Tax Act, 2017’ [hereinafter ‘TN-G&ST Act’ for the sake of convenience and clarity]; that the writ petitioner was visited with a notice dated 24.03.2022 inter alia under Rule 142(1A) of ‘Tamil Nadu Goods and Services Tax Rules 2017’ [hereinafter ‘TN-G&ST Rules’ for the sake of convenience and clarity]; that the writ petitioner sent a reply dated 25.04.2022; that notwithstanding the reply i.e., pending reply, an ‘order dated 30.09.2022 bearing reference RC.No.33AAIFP0890R1ZN/A3/2022’ [hereinafter ‘impugned order’ for the sake of convenience and clarity] has been made by the first respondent [hereinafter ‘impugned order’ for the sake of convenience and clarity] which inter alia cripples the writ petitioner’s bank account with the second respondent bank.

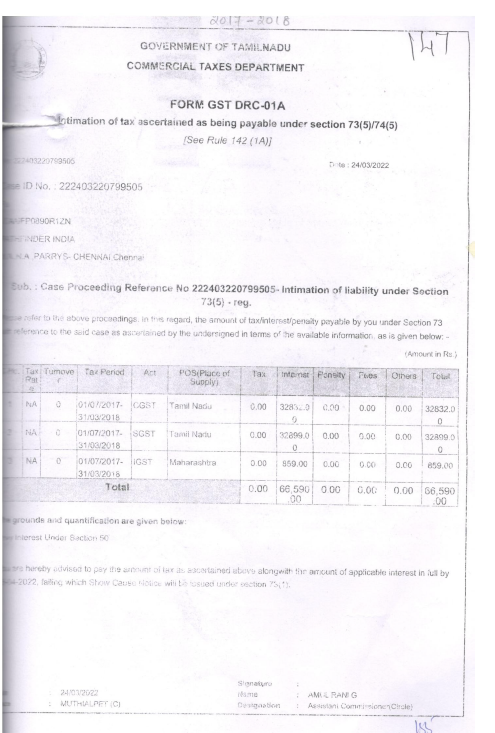

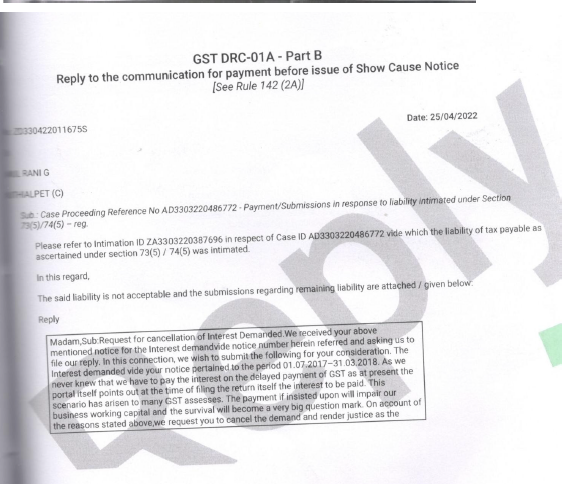

3. Owing to the narrow compass on which the captioned writ petition turns, this writ Court directed Mr.C.Harsha Raj, learned Additional Government Pleader to accept notice on behalf of the first respondent and with the consent of both sides, main writ petition was taken up. To be noted, the second respondent Bank is only a formal party and it has no stake in the lis. Suffice to say that the second respondent Bank will only remain bound by any orders made by this Court or by the first respondent. Before proceeding further, this writ Court deems it appropriate to scan and reproduce the aforementioned 24.03.2022 notice given to the writ petitioner and 25.04.2022 reply of the writ petitioner and the same are as follows:

4. Notwithstanding very many averments in the writ affidavit, short point which the learned counsel on record for writ petitioner makes in his campaign against the impugned order is, the writ petitioner having sent a reply the same should have culminated in some proceedings under Section 73 or Section 74 of TN-G&ST Act. To be noted, this is the lone point that falls for consideration in the captioned writ petition.

5. Learned Revenue counsel submits that the impugned order has been made under Section 79(1)(c) of TN-G&ST Act. In the days to come, it is desirable that the authorities mention the provision of law under which a notice is issued or an order is made so that there is clarity and specificity qua Revenue as well as assessee / dealer. Be that as it may, the impugned notice makes it clear that the writ petitioner has been treated as a defaulter under sub-section (12) of Section 75 of TN-G&ST Act. A careful perusal of the aforementioned 24.03.2022 notice also makes it clear that the claim pertains only to interest which turns on Section 50(1) of TN-G&ST Act. In this regard also 24.03.2022 notice appears to be a template and it talks about tax while it is actually interest, which is evident from the tabulation. Likewise, the impugned notice also talks about defaulter of tax whereas the tabulation makes it clear that it is only the interest.

6. Be that as it may, the clincher in the whole issue is the language in which sub-section (12) of Section 75 of TN-G&ST Act is couched. To be noted, sub-section (12) of Section 75 of TN-G&ST Act reads as follows:

’75. General Provisions relating to determination of tax.-

(1) ……………………

(2) ……………………

(3) ……………………

(4) ……………………

(5) ……………………

(6) ……………………

(7) ……………………

(8) ……………………

(9) ……………………

(10) ……………………

(11) ……………………

(12) Notwithstanding anything contained in section 73 or section 74, where any amount of self-assessed tax in accordance with a return furnished under section 39 remains unpaid, either wholly or party, or any amount of interest payable on such tax remains unpaid, the same shall be recovered under the provisions of section 79.’

7. It is clear that sub-section (12) of Section 75 of TN-G&ST Act opens with a non obstante expression and is notwithstanding Section 73 and Section 74 of TN-G&ST Act. Therefore, as regards the interest component qua Section 50(1) of TN-G&ST Act, the argument that the notice dated 24.03.2022 should have culminated in proceedings under Sections 73 or 74 is a non-starter. This by itself draws the curtains on the captioned writ petition.

8. However, this Court deems it appropriate to provide one window to the writ petitioner and that is to say that the first respondent shall consider the reply of the writ petitioner dated 25.04.2022 (scanned and reproduced supra) and take a call on the same as expeditiously as the official business of the first respondent would permit and in any event, within three weeks from today i.e., on or before 24.01.2023. To be noted, as regards the reply, the learned Revenue counsel points out that the only point raised is that the writ petitioner was not aware of the interest component and he was not aware that he had to pay interest while the portal itself points out the same. However, as this writ Court has left it to the first respondent to deal with 25.04.2022 reply, this writ Court refrains itself from expressing any view or opinion on this submission.

9. Captioned Writ Petition disposed of as closed with a limited directive to the first respondent as set out supra. As already alluded to supra, the second respondent will remain bound by this order and any other order that may be made from time to time by the first respondent in exercise of powers under Section 79 of TN-G&ST Act.

10. Captioned Writ Petition is disposed of. There shall be no order as to costs.