Sadashiv Anajee Shete vs. Na

(AAR (Authority For Advance Ruling), Maharashtra)

PROCEEDINGS

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

The present application has been filed under section 97 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and MGST Act”] by Sadashiv Anajee Shete, the applicant, seeking an advance ruling in respect of the following questions.

1. Whether exemption under Sr. No. 13 of Notification No. 12/2017 – Central Tax (Rate) dated 28th June 2017 is applicable to the Applicant?

2. Whether the Applicant is liable to get registered under section 22/24 of CGST Act, 2017?

3. If the Applicant is liable to pay GST, then on what value GST liability needs to be discharged, whether on the commission which the Applicant receives from pundits/website users or on the booking value received from website users?

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the MGST Act. Further to the earlier, henceforth for the purposes of this Advance Ruling, a reference to such a similar provision under the CGST Act / MGST Act would be mentioned as being under the “GST Act”.

FACTS AND CONTENTION – AS PER THE APPLICANT

The submissions, as reproduced verbatim, could be seen thus-

STATEMENT OF THE RELEVANT FACTS HAVING A BEARING ON THE QUESTIONS :

Mr. Sadashiv Anajee Shete(hereinafter referred to as “Applicant”) is engaged into the business of assisting believers, followers and devotees to book pundit/Brahmins online for their religious ceremonies like pujas, abhisheks etc. The said service is being provided through applicant’s own website.

Applicant hires various expert Pundits in order to provide services of religious ceremony like pujas, abhisheks etc.

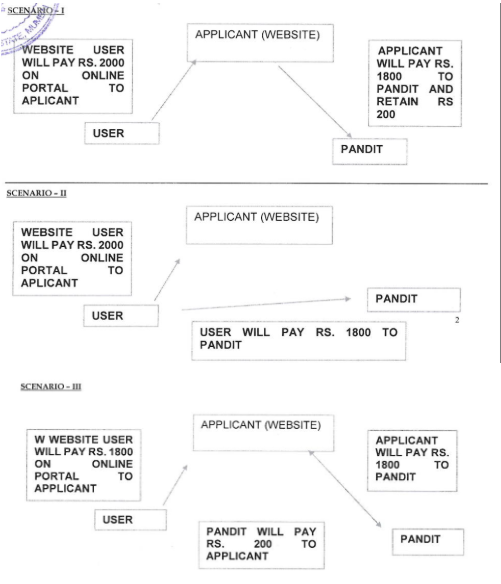

Applicant has three types of business models which are given as below:

| Scenario-I | Scenario-II | Scenario-III |

| Website user will pay ₹ 2000 on online portal to applicant | Website user will pays ₹ 200 on Online portal to applicant | Website user will Pay ₹ 1800 on online portal to Applicant |

| Applicant will Pay ₹ 1800 to Pandit ji and retains ₹ 200 | Website user will pay ₹ 1800 to Panditji | Applicant will Pay ₹ 1800 to Pandit ji |

|

| Panditji will pay ₹ 200 to Applicant |

STATEMENT CONTAINING APPLICANTS INTERPRETATION OF LAW IN RESPECT OF THE QUESTIONS RAISED –

1. Whether exemption under Sr. No. 13 of Notification No. 12/2017 Central Tax (Rate) dated 28th June 2017 is applicable to the Applicant?

Applicant’s Submission:

Applicant submits that his services would fall under Sr. No. 13 of Notification No. 12/2017-Central Tax (Rate) dated 28th June 2017, since it is providing services by way of conducting religious ceremonies by hiring various Pundits / Brahmins for the welfare of the people through its own website. Hence, Applicant is not liable to pay GST on the said services.

2. Whether the Applicant is liable to get registered under section 22/24 of CGST Act, 2017?

Applicant’s Submission:

Applicant is expecting a turnover of ₹ 1 lakh in Financial Year 2018-19 which is much below the threshold limit of ₹ 20 Lakhs. Hence, Applicant is not liable to get register under CGST Act, 2017.

Further, Applicant submits that he is not falling into any of the categories as specified under section 24 of CGST Act, 2017.

3. If the Applicant is liable to pay GST, then on what value GST liability needs to be discharged, whether on the commission which the Applicant receives from pundits/website users or on the booking value received from website users?

Applicant’s Submission:

As per above submissions, Applicant is not liable to pay GST. However, without prejudice to above submissions, even if we assume that Applicant is liable to pay GST then, GST liability needs to be discharged on the value of amount which the Applicant receives from Pundits/ website users.

03. CONTENTION – AS PER THE CONCERNED OFFICER SUBMITTED-

The submission, as reproduced verbatim, could be seen thus-

In continuation to the same it is to submit that a copy of application filed by the applicant was called for on email and copy of the same is enclosed herewith for ready reference and further report called for is as under:

1. Whether exemption under S. No. 13 of Notification No. 12/2017 Central Tax (Rate) dated 28th June 2017 is applicable to the Applicant?

The exemption under the said Notification is available to the person by way of

a) Conduct of any religious ceremony;

b) renting of precincts of a religious place meant for general public, owned or managed by an entity registered as a charitable or religious trust under section 12AA of the Income Tax Act, 1961 or a trust or an institution registered under sub clause (v) of clause (23C) of Section 10 of the Income-tax Act or a body or an authority covered under clause (23BBA) of Section 10 of the Income-tax Act:

The Applicant unit is not a charitable trust; they are conducting religious ceremonies by hiring various Pundits/ Brahmins for the welfare of the people through its own website. Hence it is felt that the exemption under the Notification is not available to the Applicant.

2. Whether the Applicant is liable to get registered under Section 22/24 of CGST Act 2017? The Applicant is liable to get registered after crossing the threshold limit of 20 Lakhs.

3. If the Applicant is liable to pay GST, then on what value GST liability needs to be discharged, whether on the commission which the Applicant receives from pundit Websites users or on the booking value received from website users?

The Applicant is liable to pay GST on the booking value received from website users.

04. HEARING

The case was taken up for Preliminary hearing on dt. 04.07.2018 when Sh. Anuj A Chordiya, Cost Accountant along with Sh. Sadashiv A. Shete, Applicant appeared and requested for admission of application. The applicant was informed to reframe their application and give full facts with respect to each question that he intends to raise in his application latest by 12.07.2018. Jurisdictional Officer, Ms. N.R. Jhangiani, Superintendent, Central Tax appeared and made written submissions.

The application was admitted and called for final hearing on 31.07.2018, Sh. Anuj A Chordiya, Cost Accountant appeared and made oral and written submissions. Jurisdictional Officer, Ms. N. R. Jhangiani Superintendent, Central Tax appeared and made written submissions.

05 OBSERVATIONS

We have gone through the facts of the case and submission made by the applicant and concerned officer. We were heard from both side .The details are as below,

1.The Applicant is Mr. Sadashiv Anajee Shete(hereinafter referred to as “Applicant”) is Unregistered person (URD) under GST ACT and is claiming to be engaged in the business of assisting believers, followers and devotees to book pundits/ Brahmins online for their religious ceremonies like pujas, abhisheks etc. The said service is being provided through applicant’s own website by charging the money.

2. Applicant submitted that he hires various expert Pundits in order to provide services of religious ceremony like pujas, abhisheks etc. to the interested persons. Applicant have three types of business models as stated above in scenario which are available on their own website to the concerned public for the service fees and terms and conditions. The service recipient can choose as per their own option.

3. Applicant submits that his impugned services would fall under Sr. No. 13 of Notification No. 12/2017 – Central Tax (Rate) dated 28th June 2017, since they are providing services by way of conducting religious ceremonies by hiring various Pundits / Brahmins for the welfare of the people through their own website.

Hence, Applicant is not liable to pay GST on the said services. Therefore, applicant has raised the questions in his application for the clarity as under:-

1. Whether exemption under Sr. No. 13 of Notification No. 12/2017 – Central Tax (Rate) dated 28th June 2017 is applicable to the Applicant?

2. Whether the Applicant is liable to get registered under section 22/24 of CGST Act, 2017?

3. If the Applicant is liable to pay GST, then on what value GST liability needs to be discharged, whether on the commission which the Applicant receives from pundits/website users or on the booking value received from website users?

4. Considering the facts of the case and business activity carried out by the applicant,

In respect of Question No.-1,

4.1. We find that applicant is mainly providing the services to the interested persons through hiring of pundits and Brahmans for religious ceremony like puja, abhishek etc.it needs to be examined as to whether the Sr. No .13 of Exemption Notification No. 12/2017 – Central Tax (Rate) dated 28th June 2017 is applicable to the Applicant? The entry No. 13 of said notification is reproduced as under:-

| Sr. no | Chapter, Section, Heading, group of Service Code (Tariff) | Description of Services | Rate % | Condition |

| 1 | 2 | 3 | 4 | 5 |

| 13 | Heading 9963 or Heading 9972 or Heading 9995 or any other Heading of Section 9 | Services by a person by way of- (a) Conduct of any religious ceremony; (b) Renting of precincts of a religious place meant for general public, owned or managed by an entity registered as a charitable or religious trust under section 12AA of the Income-tax Act, 1961 (hereinafter referred to as the Income tax Act) or a trust or an institution registered under sub clause (v) of clause (23C) of section 10 of the Income-tax Act or a body of or an authority covered under clause (23BBA) of section 10 of the said Income-tax Act: | Nil | Nil |

4.2 From the above notification, we find that the entry No.13 (heading-9963) covers the services by a person by way of “Conduct of any religious ceremony”. Thus it would cover services provided by a person who is conducting the religious ceremony

We find that as per web star dictionary meaning of condust is,

transitive verb-

1a: to direct or take part in the operation or management of

conduct an experiment,

conduct a business,

conduct an investigation.

b: to direct the performance of,

conduct an orchestra,

conduct an opera.

c: to lead from a position of command,

conduct a siege,

conduct a class.

4.3 In the present case applicant is facilitating in making available Pundits/Brahmins for the conduct of puja or abhishek through such Pundits/ Brahmins those who are in his touch and are ready to be available at his request. The puja or Abhishek are actually performed by the pundits/ Brahmins on the desired location of customers. All the religious functions are carried out by Pundits on their own once he informs the details of the person and place where it is to be conducted. The applicant is not a person who actually perform the services like puja / abhishek or makes an other arrangement in this respect except as discussed above. He is facilitator between the pundits and customers. He is acting as an agent to coordinate between the person who wants services of conduct of religious ceremony like puja, abhishek from the pundits who are actually performing. We find that the pundits are not a employee of the applicant. In the present case Pundits are the person who are actually performing the services of puja and abhishek.

In terms, as per the GST law, applicant is acting as an “Intermediately” person. The applicant is taking booking of services online on his own web site from the customers and intimates the names of pundits/ Brahmins who would perform the job to the customers also on online. For that purpose he is charging to the customers as per the models submitted.

Therefore, the Applicant is not covered under the scope of exemption notification entry No .13.

4.3. In the present case Punditji’s are the person who are actually performing the services like puja, abhishek to the customers and therefore they are eligible for exemption from GST for their supply of services.

Hence the applicant is not covered under the entry No. 13 of exemption notification No. 14/2017-Central Tax (Rate) dated 28th June 2017 and therefore his services are not exempt. Hence it is not applicable to the Applicant.

5. Question -2, Whether the Applicant is liable to get registered under section 22/24 of CGST Act, 2017?

5.1 We find from the above discussion, the applicant is providing the services to the public. The supply of impugned services are not exempted from the GST law to the applicant. Therefore it is transaction of supply of taxable services. The section 22/24 are related to the person liable for registration. The section 22 (1) provides the threshold limit for the registration under GST ACT which is reproduced as under,

Section 22(1)- Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees:

Provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees.

Section 24 is related to compulsory registration in certain cases, the section is produce as below,

24-Notwithstanding anything contained in sub-section (1) of section 22, the following categories of persons shall be required to be registered under this Act,––

(i) persons making any inter-State taxable supply;

(ii) casual taxable persons making taxable supply;

(iii) persons who are required to pay tax under reverse charge;

(iv) person who are required to pay tax under sub-section (5) of section 9;

(v) non-resident taxable persons making taxable supply;

(vi) persons who are required to deduct tax under section 51, whether or not separately registered under this Act;

(vii) persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise;

(viii) Input Service Distributor, whether or not separately registered under this Act;

(ix) persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under section 52;

(x) every electronic commerce operator;

(xi) every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person; and

(xii) such other person or class of persons as may be notified by the Government on the recommendations of the Council.

5.2 Thus in view of there above provisions we find that the applicant is in state of Maharashtra and is doing the business from this state and therefore, Applicant would be liable to get registered considering the provisions of law and nature of business activity. We find that applicant is providing the services and doing the activities through electronic network of owns website. The business compliance is also made through electronic network media to the customers. He operates or manages digital or electronic facility is giving to the customers. He has facilitate one of the platform to the recipient of services on electronic basis through their internet website and operate his business .it is business of e commerce. Therefore we find that applicant is covered under section 2 (44) and 2(45) of CGST/MGST ACT as a “Electronic commerce” and “Electronic commerce operator”. The definition of 2(44) and 2 (45) are reproduced as below for the clarity purposes,

2(44) “electronic commerce” means the supply of goods or services or both, including digital products over digital or electronic network;

2(45) “electronic commerce operator” means any person who owns, operates or manages digital or electronic facility or platform for electronic commerce;

5.3. We have seen that the as per the definitions as above, applicant is squarely covered under the “Electronic commerce operator Considering the section 24-and the categories of persons mentioned therein, shall be required to be registered under this Act, the category No (x) is related to “every electronic commerce operator;”. Therefore, as per discussion above we are in opinion that, the applicant is covered under Electronic commerce operator and shall be required to be registered under this Act without fulfilling of threshold limit. So that he is liable to get registration under the GST ACT.

6. Question no.3- If the Applicant is liable to pay GST, then on what value GST liability needs to be discharged, whether on the commission which the Applicant receives from pundits/website users or on the booking value received from website users?

6.1 We find that applicant’s supply of services are the taxable services . The commission received from the person is also taxable service under the GST Law. The GST is leviable on value of taxable supply. The relevant section of 15 of CGST/MGST ACT 2017 is reproduce herein below for deciding the value of transactions discharging the liability.

15. (1) The value of a supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.

(2) The value of supply shall include–––

(a) any taxes, duties, cesses, fees and charges levied under any law for the time being in force other than this Act, the State Goods and Services Tax Act, the Union Territory Goods and Services Tax Act and the Goods and Services Tax (Compensation to States) Act, if charged separately by the supplier;

(b) any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both;

(c) incidental expenses, including commission and packing, charged by the supplier to the recipient of a supply and any amount charged for anything done by the supplier in respect of the supply of goods or services or both at the time of, or before delivery of goods or supply of services;

(d) interest or late fee or penalty for delayed payment———-,

(e) subsidies directly linked——-,

Explanation.––For the purposes of this sub-section, the amount of subsidy shall be included in the value of supply of the supplier who receives the subsidy.

6.2 Considering the facts of the transaction referred by the applicant, as per section 15 (1) the value of supply of services shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply. In the present case we find that applicant and recipient are not related persons and price received is sole consideration. We further see that these services are given by the applicant in his business models to choose the type of model. In all the three business models we find that consideration is first received by him on online as a whole and thereafter major part of it, is given to Pundits who are having an agreement with the applicant to provide their services as and when it is requisitioned but they are not the applicant’s employees but are providing their services independently. The actual basic services like puja, abheshek etc are performed by the pundits or Brahmins which are exempted by nature of notification issued under GST ACT. The commission portion is received to the applicant out of total consideration received online from the service recipient. As per the provisions of law the commission is the supply of service and it would be the value on which he would be liable for GST and thus the Applicant would be liable to pay GST on the value of commission received from website users not for on total amount received.

05. In view of the extensive deliberations as held hereinabove, we pass an order as follows:

ORDER

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

NO.GST-ARA-32/2018-19/B-131

Mumbai, dt. 23.10.2018

For reasons as discussed in the body of the order, the questions are answered thus –

Question :- 1. Whether exemption under Sr. No. 13 of Notification No. 12/2017 – Central Tax (Rate) dated 28th June 2017 is applicable to the Applicant?

Answer:- Answered is in Negative.

Question :-2. Whether the Applicant is liable to get registered under section 22/24 of CGST Act, 2017?

Answer :- Answered is in affirmative. As per the provisions of section 24 of CGST/MGST ACT, the applicant, is covered under “Electronic commerce operator Hence, he is liable to get registered.

Question :- 3. If the Applicant is liable to pay GST, then on what value GST liability needs to be discharged, whether on the commission which the Applicant receives from pundits/ website users or on the booking value received from website users?

Answer:- As discussed above in para 6.2, the Applicant is liable to pay GST on the on the value of commission received from website users/ Pundits , not for on total amount received.