E-Invoice Registration on IRP – Who Should Register, Steps for Registration

BOOK A FREE DEMO

To facilitate taxpayers in their GST Compliance efforts, the GST Network (GSTN) has set up dedicated portals to manage various compliance tasks, such as e-way bill management on the e-way bill portal, and likewise, the e-invoice portal for managing e-invoices. The E-Invoicing Portal continually sees surges in the user base numbers, owing to e-invoicing becoming applicable to more businesses with each new phase of implementation. Currently, 5 phases of e-invoicing have been implemented, and it is currently applicable to businesses that have generated a turnover of more than ₹10 crores in any financial year since GST was implemented in FY 2017-18.

In this article, we will provide a complete overview of the E-Invoice Portal, India’s first invoice registration portal.

What is the E-Invoice Portal?

Businesses to whom e-invoicing is applicable need to get their B2B invoices authenticated. The E-Invoice Portal, also known as the Invoice Registration Portal (IRP) is the website where such businesses need to login and upload the invoices of their B2B transactions. These invoices are then digitally authenticated by the IRP, and an e-invoice is generated automatically for these invoices.

Facilities Available on E-Invoice Portal

The e-invoice portal provides the following facilities for taxpayers:

- Register taxpayers in the e-invoicing system

- Generate unique Invoice Reference Numbers (IRN) through the bulk upload feature

- Track and verify e-invoice details using the IRN

- Search for taxpayers, Pincode, goods or services, signed e-invoices, or master codes

- Cancel the IRN

- Print e-invoices

- Generate Management Information System (MIS) reports

- Authorise sub-users to generate, cancel IRN or generate reports related to IRN.

Contents of the E-Invoice Portal

This section is divided into two parts:

- Contents Before Logging into the Portal

- Contents After Logging into the Portal

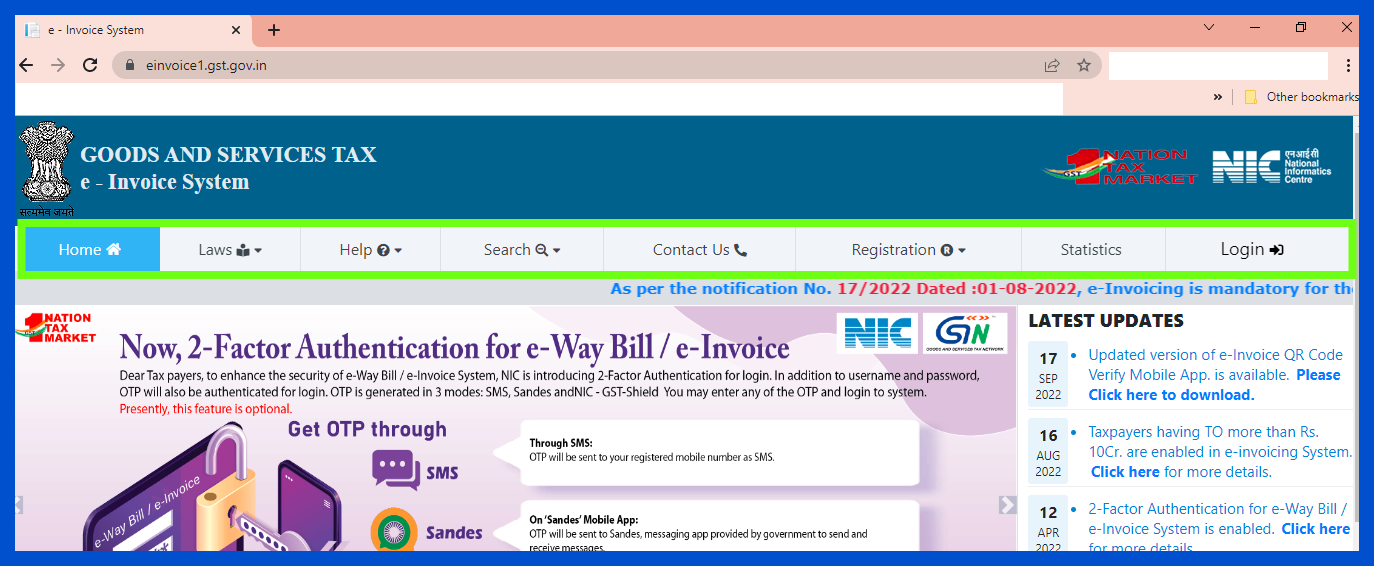

Contents Before Logging into the Portal

The Top Menu shows the following sections:

- The homepage of the e-invoice website displays a section on the right-hand side called ‘Latest Updates’. This section shows the latest developments in the implementation and new features launched on the e-invoice portal.

- The ‘Laws’ section on the website includes various rules, forms, a list of GST notifications, and circulars related to GST laws pertaining to e-invoicing.

- The ‘Help’ section provides access to user manuals for managing IRN, FAQs on the same, as well as tools for bulk generation of IRN.

- The ‘Search’ section allows users to lookup the following information:

- A Taxpayer’s details through their GSTIN.

- Pincode search to find the name of the state.

- Details of products and services through HSN/SAC Code.

- Authentication of the signature and invoice details

- Check whether a taxpayer has e-invoice enabled or not by entering their GSTIN.

- List of GST Suvidha Providers.

- Master codes for states, HSN, countries, ports, currency, and UQC.

- The ‘Downloads’ section of the e-invoice website provides the following facilities:

- A ‘QR code verify’ app (yet to be provided).

- Sample signed e-invoice JSON.

- A brief document explaining QR codes (yet to be provided).

- FAQs on QR codes (yet to be provided).

- Public key for e-invoices for respective periods of generation of IRN.

- ‘Contact Us’ section which provides contact information for support.

- ‘Registration’ section for first-time registration to use the e-invoicing system. This facility is available for different types of users, such as SMS-based, mobile-based, GSP-based, API-based, etc. The mode of e-invoice generation varies depending on the user’s selection during registration.

- ‘Login’ section, where registered users can access the additional features of the portal, only available to logged in users.

Contents After Logging into the Portal

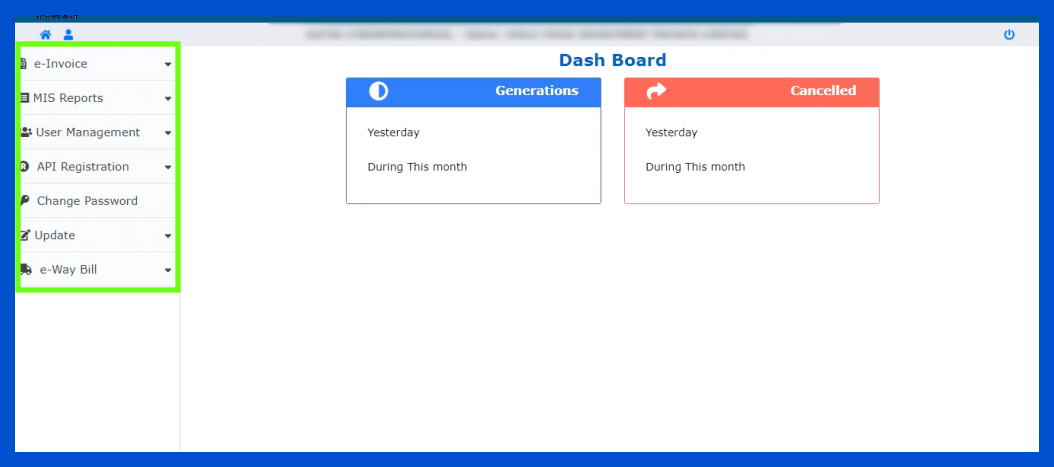

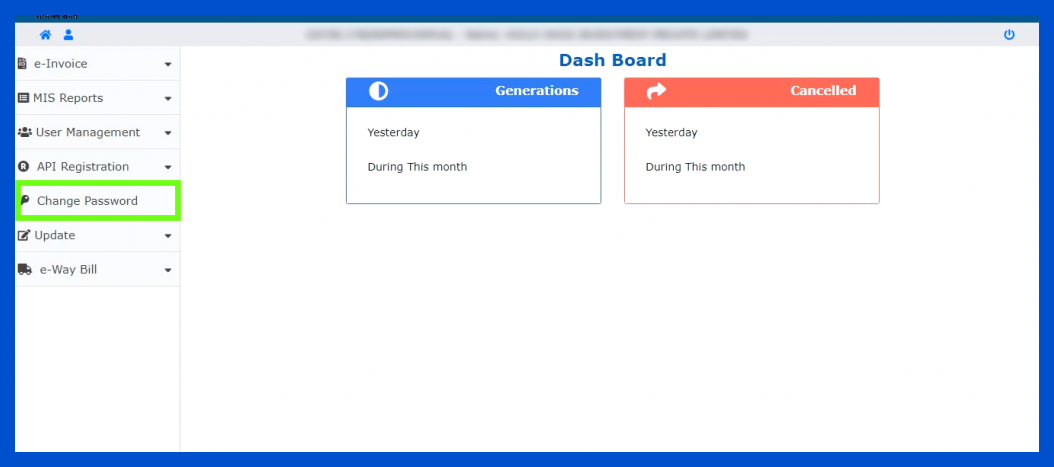

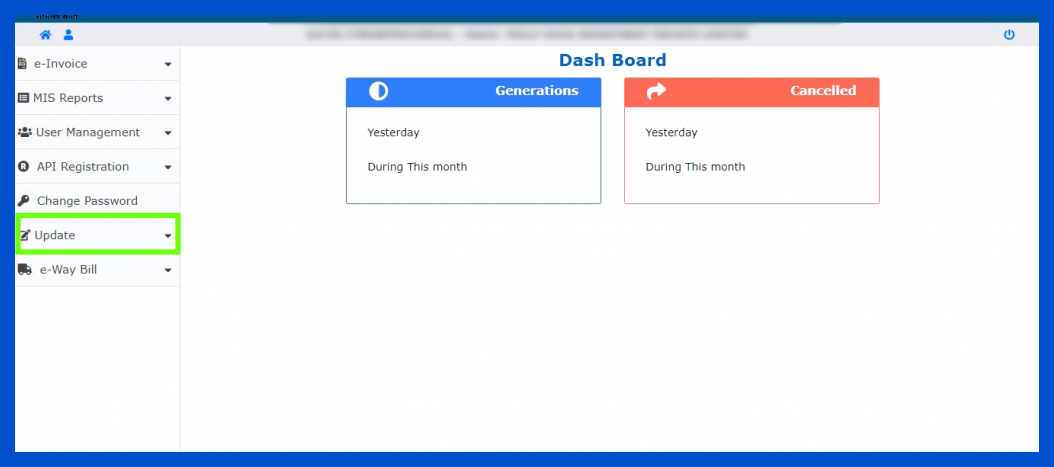

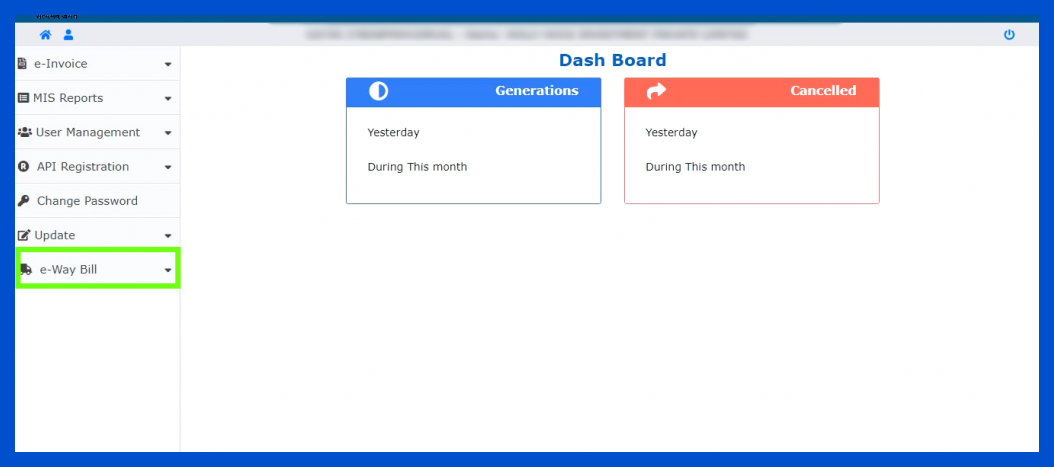

Below is a screenshot of the main screen that logged in users will see on the portal:

As you can see in the screenshot above, there are seven main categories of features available to logged in users:

- E-invoice

- MIS Reports

- User Management

- API Registration

- Change Password

- Update

- E-Way Bill

We will discuss each of these features in detail

E-invoice

The E-Invoice menu provides the following features:

- Bulk Upload: This feature comes in handy when multiple invoices need to be uploaded together. Users can generate a JSON file with all the invoice details through the bulk generator tool provided by the portal.

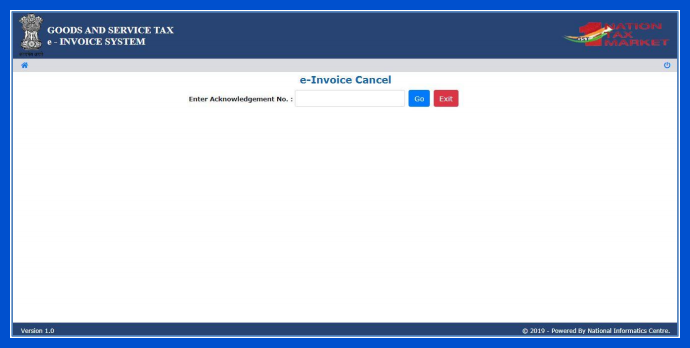

- Cancel IRN: The IRN for an invoice that is incorrect can be cancelled. However, when the corrected invoice is uploaded, it must use a different unique IRN, not the same one as the cancelled invoice.

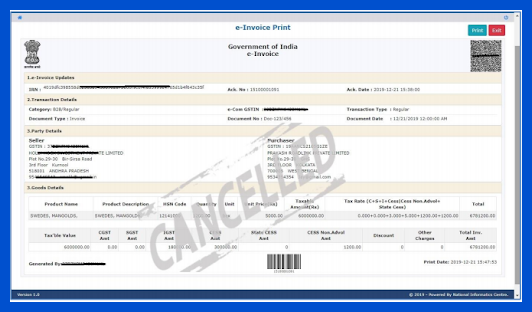

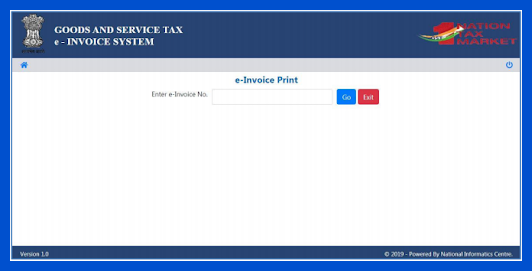

- Print e-invoice: Users can print an e-invoice by entering the e-invoice number.

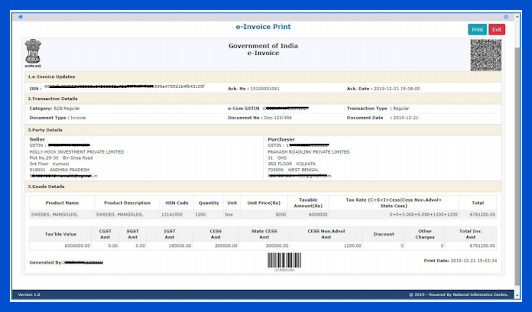

A printed e-invoice looks like the image shown below:

MIS Reports

You can use this option to generate MIS reports showing the list of invoices uploaded based on selected parameters and dates. You can also export this list in Excel format by clicking the ‘Export to Excel’ tab.

User Management

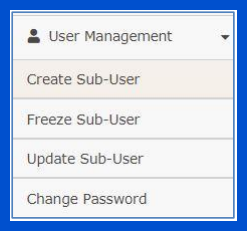

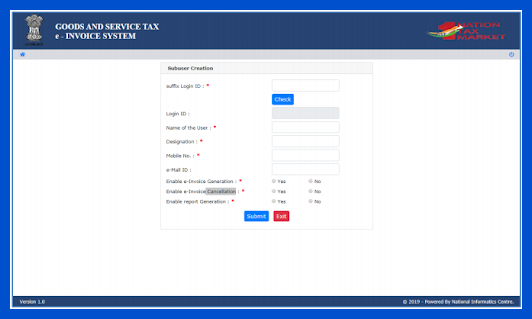

Large businesses may not depend only on a single person to create the e-invoices. For better efficiency, they can create and manage sub-users on the E-Invoice Portal, as shown below:

The main user can set permissions levels for the sub-users, as follows:

- Sub-users can generate IRNs

- Sub-users can cancel IRNs

- Sub-users can generate reports of the IRNs

API Registration

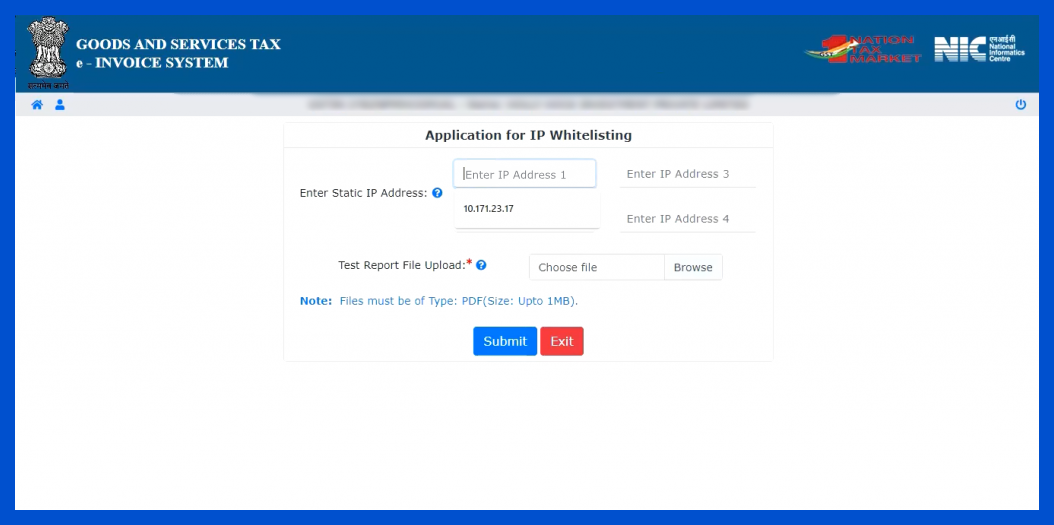

This feature allows taxpayers to integrate their ERP with the E-Invoice Portal, either directly or through a GST Suvidha Provider (GSP). To do this, go to ‘API Registration’ > IP Whitelisting and register your IP address on the portal.

To register your GSTIN for the API interface and set login credentials, go to the ‘User Credentials’ option and select ‘Create API User’. If a sister concern of your GSTIN has already registered for the API interface, their details will be displayed. To set login credentials for your concern, enter the client ID and client secret.

Change Password

This one is self explanatory

Update

This feature lets you auto-populate your business details by pulling the information from the common portal while generating e-invoices.

E-Way Bill

Use this feature to auto-populate Part A of E-Way Bills while generating them. Only Part B remains to be filled once this is done.

Frequently Asked Questions

- If I am registered on the common portal, do I need to register again on the e-invoice portal?You will need to register again on the e-invoice portal. However, if you have already registered on the e-way bill portal, then the same credentials can be used to login to the e-invoice portal too.

- Is it compulsory to generate e-invoices?If your business falls under the applicability of e-invoicing, then yes, it is compulsory to generate e-invoices for all your B2B transactions.

- Can I partially cancel an e-invoice?No, you cannot partially cancel an e-invoice. If, for any reason, you need to cancel an e-invoice, you need to completely cancel the IRN associated with that e-invoice.

- How many sub-users am I allowed to have?You can have a maximum of 10 sub-users for a single place of business. If you have multiple places of business, you can have up to 10 sub-users for each.

- Is it necessary to have sub-users?No, it is not necessary to have sub-users. It is purely dependent on the needs of your business.

- I am unable to generate reports for the selected period. What should I do?For smooth performance, currently the portal does not provide the facility to download reports for multiple days. You will need to download the reports for one day at a time.

- Can I make amendments to an e-invoice?Yes, you can make amendments to an e-invoice, but not on the e-invoice portal itself. You will need to go to the GST Portal to make the required amendments.