GST EWB-01 Form

BOOK A FREE DEMO

Transporters must carry an e-way bill with themselves when they are moving goods inter or intra state, when the value of the goods they are carrying is greater than ₹50,000.

In this article, we will take a close look at the format of the e-way bill, or Form GST-EWB 01.

What is an EWB-01 Form?

Form GST EWB-01 is the prescribed format in which the e-way bill is generated. It is this form, commonly referred to as just EWB-01 or the e-way bill itself, that needs to be carried by any transporter who is moving goods that are worth more than ₹50,000, whether inter or intra state. This value is inclusive of GST, but exclusive of the value of any exempted goods being carried. Transporters can choose to carry this form voluntarily even if the value of the goods is not greater than ₹50,000, though it is not mandatory.

Form GST EWB-01 mentions details about the sender or supplier of the goods, the recipient or consignee, and the transporter (if the transporter is a third party).

When goods are being transported by road, it is the responsibility of either the consignor or the consignee to generate Form GST EWB-01. However, if neither of them does so, the transporter needs to generate it. He should generate the e-way bill based on the information provided by the consignor, either in Part A of Form GST EWB-01, or in the invoice details.

However, when the transporter is either the supplier or the recipient themselves , then the party moving the goods (i.e either the supplier or the recipient) is responsible for generating and carrying the e-way bill, regardless of whether the mode of transporting the goods is by road, air, ship or rail.

Exceptional Cases When Form EWB-01 is Required

It is mandatory to carry an e-way bill in the following cases, even if the value of the goods is not more than ₹50,000:

- When there is interstate movement of goods for the purpose of Job Work

- When a dealer who is exempted from GST Registration is transporting handicraft goods inter-state.

Cases When an E-way Bill is not Required

In the following circumstances, the bill is not necessary:

- Transport Mode: In the case of any non-motor vehicle, a GST EWB-01 bill is not required.

- Excise goods are shipments delivered to a freight station or a container depot for customs clearance.

- No Supply Goods: Products are expressly marked on schedule III of the CGST Act as “no supply.”

- All goods included in the GGST Act are CGST Listed Goods.

- Excluded Goods: In the case of items covered by the SGST Act or products like alcoholic beverages intended for consumption, crude oil, diesel, gasoline, natural gas, and aviation fuel.

Modes of Generating E-way Bills

Before generating an E-way bill, the user needs to register on the common E-way bill portal. GSTN has provided access to three modes of transport:

- Online: Depending on the situation, anyone can sign in as a user or sub-user via the e-way bill portal. Then select the “Generate new” option found in the “e-way bill” main menu that appears on the dashboard’s left side.

- SMS: Under GST, a highly convenient on-the-go alternative for creating e-way bills has been provided. In an emergency, one can employ this mode.

- Bulk generation offline tool: Create many e-way bills from a single JSON file upload. Businesses with many shipments to deliver are eligible to use this facility.

- Auto-generate E-Way Bills through BUSY. This is the most convenient way to generate e-way bills.

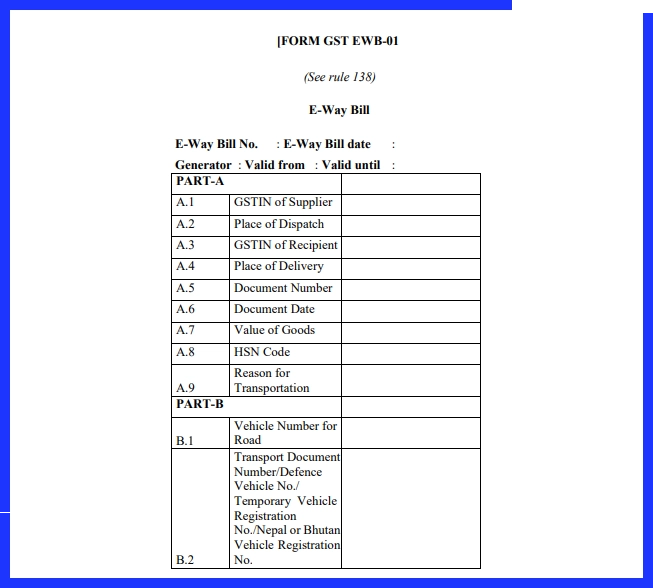

Format of EWB-01

The EWB-01 is generated online through the E-way bill portal. The form of EWB-01 consists of the 12-digit E-way bill number, generation date, the generator’s name, and the E-way bill’s validity period. The Form is divided into two parts, Part A and Part B. These parts include the following:

| PART A | PART B |

|---|---|

| GSTIN of Supplier and/or Recipient | Transporter document number/ registration number |

| Place of dispatch-Pin code | Document number provided by the transporter |

| Place of delivery- Pin code | Vehicle number in which the goods are to be transported |

| Invoice/Challan number, date and value of goods | – |

| HSN Code- minimum two digits | – |

| Reason for transport- supply, export, import, job work, sales return, personal use, etc. | – |

The two parts of the EWB-01 Form have to be filled under different circumstances, such as

The Part A of the form must be filled while generating the E-way bill by

- The supplier, or

- The recipient if the supplier is unregistered, or

- The e-commerce operator if the goods are supplied through an online platform,

- The transporter if the E-way bill was not generated for the respective invoice/challan by the supplier or the receiver.

Part B and the conveyance or vehicle details must be filled in if the supplier is transporting goods through their own or hired conveyance. The supplier can send the transporter information regarding Part-A of the e-way bill when using the transporter services. The transporter then creates an e-way bill by filling out Part B and only following supplier authorisation.

However, you don’t need to fill out Part-B if both the following conditions are met:

- Distance to be covered is less than 50 kms

- The movement is intrastate i.e place of dispatch and place of delivery are both in the same state.

How to Save an E-way bill in PDF format?

An E-way bill can be saved in PDF format through the following steps:

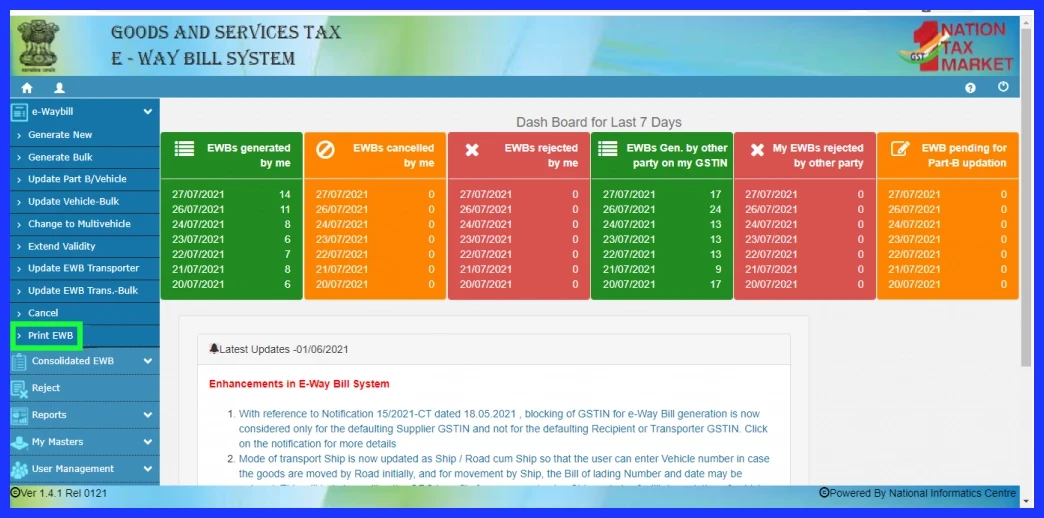

Step 1: Log in to the E-way bill portal and click on Print EWB under the E-way bill tab.

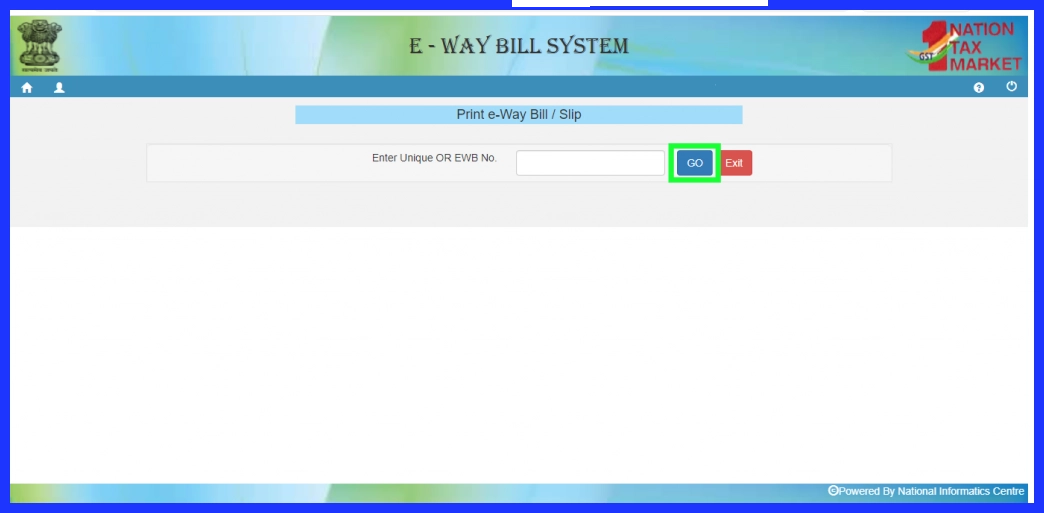

Step 2: Enter the E-way bill number and click on Go.

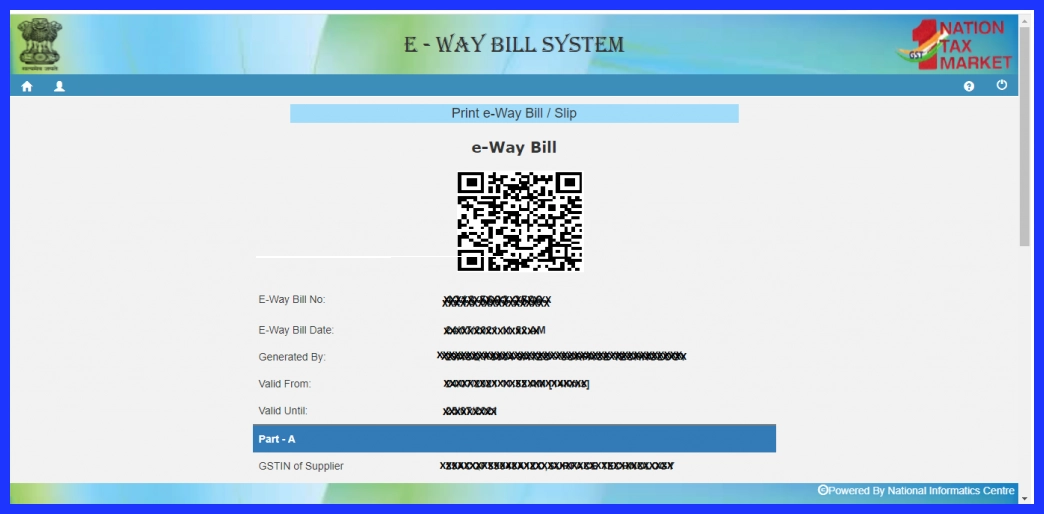

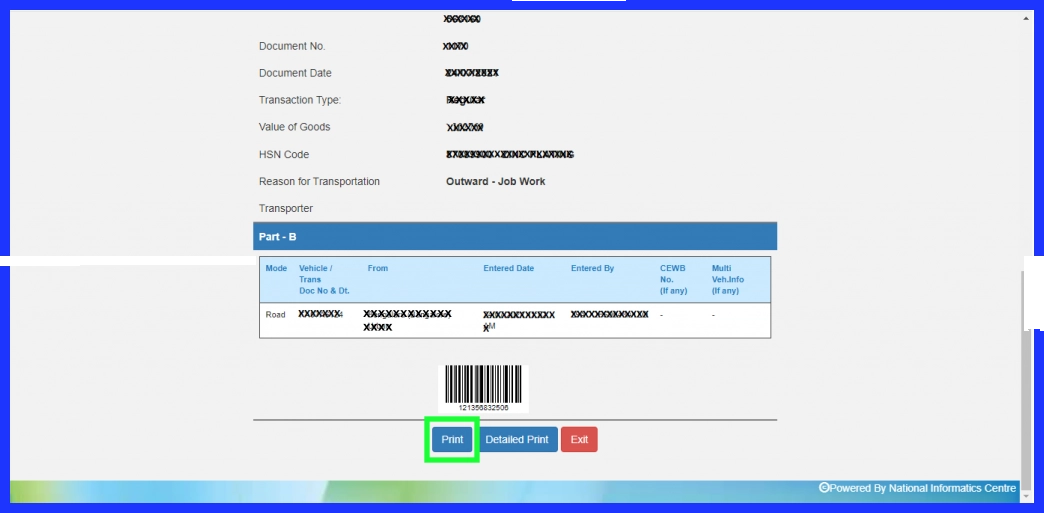

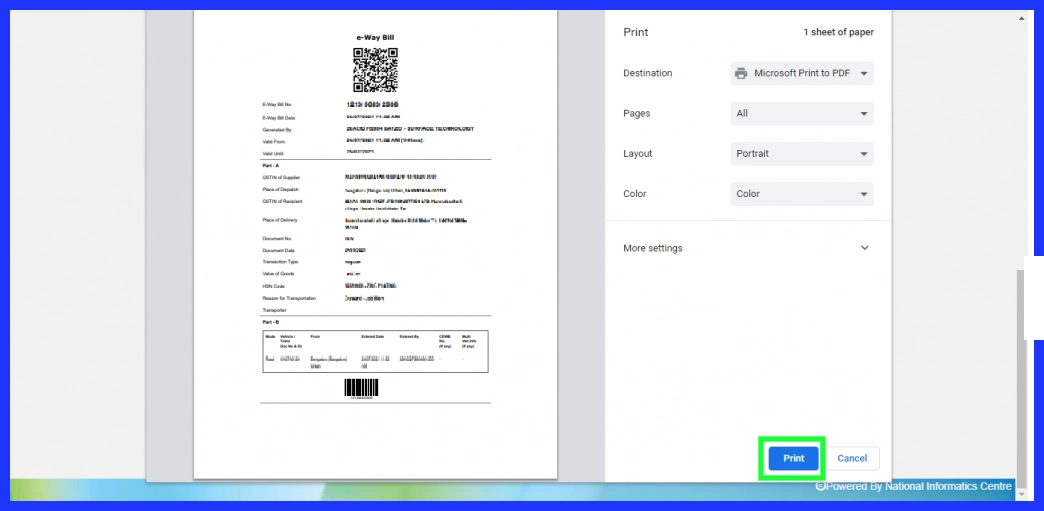

Step 3: The details of the E-way bill will be displayed, and then click on the Print button.

Step 4: Choose the print destination as Microsoft Print to PDF or Save as PDF. Select the desired location to save the PDF.

Conclusion

The GST EWB-01 form is a critical document for the generation of e-way bills under the GST regime in India. It contains essential details related to the movement of goods and is mandatory for the transportation of goods worth more than Rs. 50,000.

By understanding the format, mandatory fields, and other important considerations of the EWB-01 form, businesses can ensure accurate and compliant generation of e-way bills, thereby avoiding penalties and seizure of goods. For a much easier and faster process of generating e-way bills, you can try BUSY Accounting Software’s auto e-way bill generation feature.