GST Number Search Tool – GSTIN Verification Online

BOOK A FREE DEMO

The GST Identification Number or GSTIN is a unique 15-digit identification number provided to registered individuals under the GST system. This number is generated based on the registered person’s PAN. As a GST registered dealer, one must be GST verified using the GST number check tool before submitting GST returns.

It’s worth noting that even a single individual with a PAN who is an assessee under the Income Tax Act may have several GSTINs, depending on the number of states or union territories they operate in. Obtaining a GSTIN is mandatory for anyone who crosses the threshold limit for GST registration.

Unlike the previous indirect tax regime, where separate registration numbers were required for Excise, Service Tax, and VAT, GSTIN is a single registration number that applies to all. This simplifies the process and makes compliance easier for registered individuals.

Requirements to apply for GSTIN?

The following are the details required to apply for GSTIN:

- Valid PAN number

- Valid Mobile number

- Valid email address

- Prescribed documents and information on all mandatory fields of the registration application

- Place of business

- Jurisdiction details

- Valid bank account number from India

- IFSC code of same bank and branch

- At least one proprietor/partner/director/trustee/member with corresponding PAN details

- An authorised signatory who is a resident of India with valid details, including PAN number.

Why is a GSTIN Verification or GST Search Required?

Having a GST Number or Goods and Service Tax Identification Number (GSTIN) is essential to verify the authenticity of a taxpayer registered under GST. Some individuals may manipulate their GST numbers (GSTIN) to evade taxes. Every company interacting with GST-registered taxpayers must perform a GST search by name to verify the legitimacy of the seller and the GSTIN or GST number used in the invoice.

If the vendor’s PAN number matches the digits between 3 and 10 in the GSTIN, you can partially verify the GSTIN or GST number at a glance.

To prevent generating incorrect invoices and e-invoices, claim a valid input tax credit, and transfer the tax credits to the proper customers, to name a few, it is also required to conduct a thorough assessment of the GSTIN authenticity.

As a result, technology now allows you to quickly and easily validate your GSTIN from any location at any time. By performing a GST Number Check, one can ensure that the Goods and Service Tax taxes go to the correct pockets, contributing to nation-building and promoting a transparent tax mechanism.

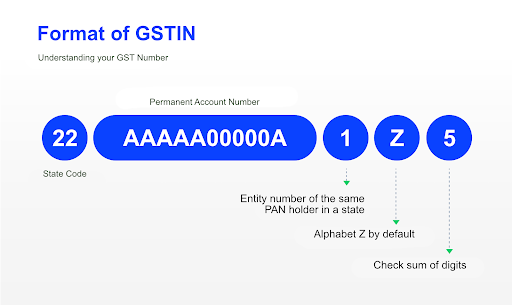

Format of GST Identification Number

Verify that the GSTIN is formatted as shown below, even before the GST check. A GST number is only legitimate if it follows the format listed below.

GSTIN structure includes:

- The first two numbers are the state code for the registered person.

- The registered person’s PAN is the next 10 characters.

- The next number is the entity number of the same PAN.

- The next character is automatically the letter Z.

- Check for alpha or digit codes to identify mistakes for the last number.

What are the Benefits of Using a GSTIN Verification Tool or Online Search and Verification Tool?

Using the online GST Search tool to verify a GST number has the following advantages:

- Verifies the validity of any GSTIN

- If a GSTIN is ambiguous on a handwritten invoice, it can be easily validated.

- By employing false GSTINs, you can avoid collaborating with sellers.

- Help vendors fix any potential GSTIN reporting errors to prevent GSTIN fraud at the point of sale.

How to use Busy’s GSTIN Verification and GST Search Tool?

Businesses can use Busy’s GSTIN Validator and GST Search Tool to perform a single-click GSTIN search to validate any GSTIN.

You must verify the GST number to avoid transacting with any fake GSTINs that may be available on the market. At such times, our GST number search tool is helpful. Thus, there won’t be any interruptions, delays, or vendor follow-up, allowing you and your team to focus on running your business.

We have a detailed explanation of how to use Busy’s GSTIN validation tool. You can Click Here to watch the video.