Claiming ITC on Transfer of Business

Claiming an Input Tax Credit (ITC) on a business transfer is crucial for businesses that undergo mergers, acquisitions, or any other transfer form. When a business transfers, it needs to transfer its assets and liabilities, including its tax credits.

BOOK A FREE DEMO

A registered taxpayer may transfer the input tax credit accessible and excess in his electronic credit ledger to another business in case of a business transfer by way of sale, merger, or demerger by filing a declaration in GST Form ITC-02. The new business entity must register for Goods and Services Tax (GST) and provide the necessary documentation, including a transfer agreement, to the GST authorities to claim ITC on business transfer.

Transfer of ITC by Filing Form GST ITC-02

The ITC-02 form facilitates the transfer of the Input Tax Credit (ITC) balance from one GSTIN to another GSTIN as a result of mergers and acquisitions. The transferor must file it, and the transferee must take action. However, there is no time restriction for doing so.

After the introduction of GST, numerous combinations, mergers, and demergers have occurred. In certain situations, a business transferor will have unused ITC in the electronic credit ledger. Only by submitting GST ITC-02 can they transfer this ITC to the new company. The transferor’s unused credit will be transferred to the transferee’s electronic credit ledger upon filing GST ITC-02.

Download here –Busy Software Trial Version For 15 Days

Preconditions for Filing ITC-02

To be qualified to submit the FORM GST ITC-02, the following requirements must be satisfied:

- If a registered organisation is sold, merged, demerged, combined, leased, or transferred, it must fill out a form called GST ITC-02 to transfer the input tax credit.

- The organisation being acquired or transferred must have input tax credit available in its electronic credit ledger from the date of merger, acquisition, combination, lease, or transfer.

- Both the transferee and the transferor must be registered under GST.

- The transferor must have filed all GST returns in the past.

- All pending transactions related to the merger must be accepted, rejected, or modified, and all liabilities of the transferor’s filed returns must be paid.

- The transfer of business must include the transfer of liabilities, including any unpaid taxes, litigation, or recovery cases. This transfer must be accompanied by a Chartered or Cost Accountant’s certificate.

How to File Form GST ITC-02

Here are the steps to follow while filing Form GST ITC-02:

Step 1: Go to the GST Portal

The transferor or the acquiring entity should go to the official GST Portal, and the GST Home page will appear.

Step 2: Enter your Credentials

Enter your login details, and the taxpayer’s dashboard will appear

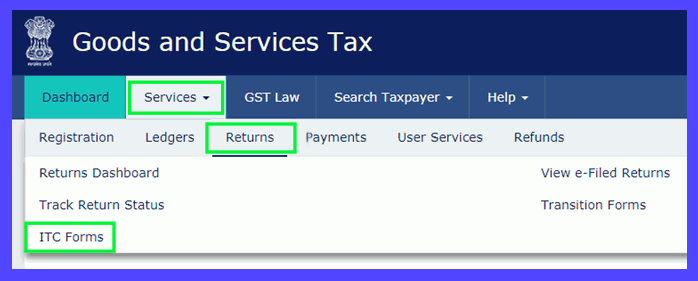

Step 3: Click on ITC Forms

Go to the Services tab and click on the Return option. Then select ‘ITC Forms’ and the GST ITC forms page will appear.

Step 4: Click on Prepare Online

Click on the Prepare Online option under the GST ITC-02 tile. Choose whether to transfer all or partial ITC and fill in the matched ITC needed.

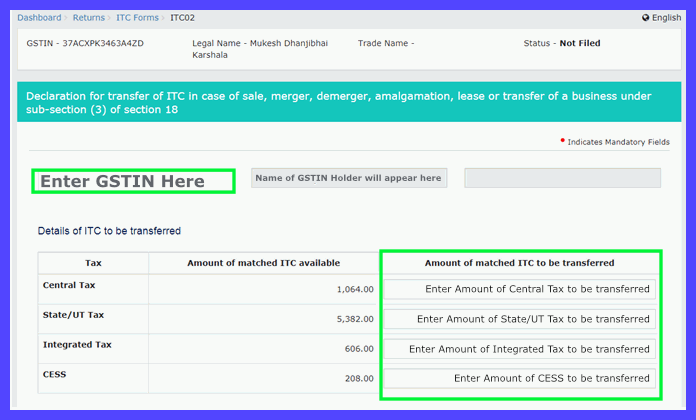

Step 5: Enter the GSTIN

Enter the GSTIN of the transferee. Then, enter the amount of the matched Input Tax Credit to be transferred under each significant heading in the ‘Details of ITC to be transferred’ section.

Step 6: Enter the Details

Enter the required details for the Certifying Chartered Accountant or Cost Accountant in the certifying firm.

Step 7: Attach the Certificate

Attach the Certificate—Please attach a copy of the certificate in JPEG or PDF format, but the file size should not exceed 500 KB.

Step 8: Save and Upload

Click ‘Save’ to upload the data and the attachment to the GST Portal. Check the statement box to confirm that the furnished information is accurate and correct.

Step 9: Select the Authorised Signatory

Select the authorised signatory from the drop-down list.

Step 10: File Form GST ITC-02

File the form using the DSC or EVC option. If DSC has been selected, ensure it is signed using the Digital Signature of the designated authorised signatory. On the other hand, if EVC is selected, an OTP will be sent to the authorised signatory’s registered mobile number, which needs to be entered.

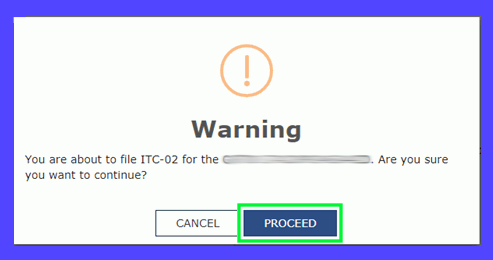

Step 11: Click on Proceed

Click the Proceed option on the warning pop-up message.

Step 12: Enter the OTP

Enter the OTP sent and click on Verify. Once verified, a confirmation message will appear on the successful filing of Form GST ITC-02. This message will also contain the system-generated ARN; a copy of the form can be downloaded by clicking the Downloads button.

Acceptance of ITC Transfer by Transferee

Step 1: Login to the GST Portal with your credentials

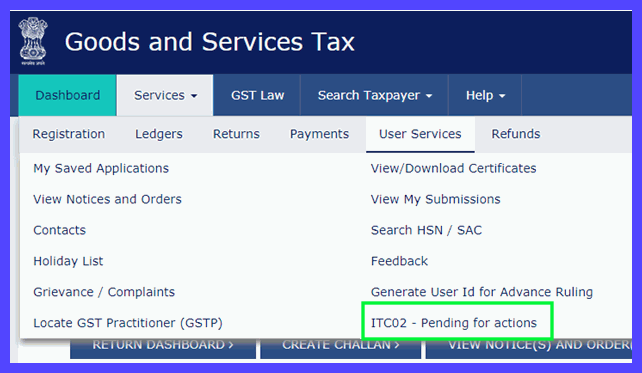

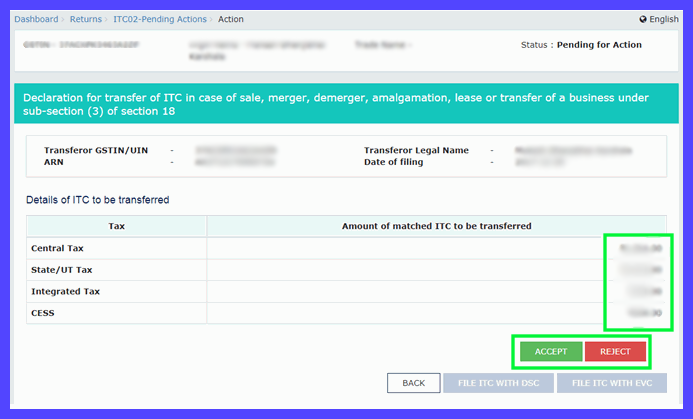

Step 2: Click on ‘ITC-02 – Pending for actions’

Click ‘ User Services ‘ from the ‘Services’ tab and select the ‘ITC 02 – Pending for actions’ option.

Step 3: Click on the ARN link

Click on the ARN link displayed on the new page.

Step 4: Accept or Reject Request

Review the details of all the matched ITC and accept or reject the transfer request.

Step 5: Confirmation message

If you accept the request, a confirmation message will be displayed, and you will be prompted to file a response.

Step 6: Verify the declaration statement

Check the declaration statement and select the authorised signatory from the drop-down list.

Step 7: File the form

File the form using the DSC or EVC option. If EVC is selected, enter the OTP sent to the authorised signatory’s registered mobile number.

Step 8: Click on ‘Proceed’

Click the ‘Proceed’ option on the warning pop-up message.

Step 9: Enter OTP

Enter the OTP sent and click the ‘Verify’ option. Once verified, the system displays a confirmation message with the system-generated ARN.

Step 10: Click on the ‘Back’ option

This will take you back to the ITC-02 Pending for actions screen. You can now view the changed status as ‘Accepted’.

Different Aspects in Transfer of Business

The transfer of a business involves a range of legal and financial aspects that need to be carefully considered and addressed to ensure a smooth and successful transfer. Some critical elements that companies consider include transferring assets and liabilities, employee transfer, tax implications, intellectual property rights transfer, customer and vendor contract transfer, and compliance with regulatory requirements. Each aspect requires a thorough understanding of the legal and financial implications and the proper procedures to avoid disputes or penalties.

Registration under GST

Under section 22 (3) of the CGST Act 2017, a person purchasing another company must claim a new ownership document and a new registration under GST. Nevertheless, under section 22(4), if a transfer is made as part of a merger, combination, or demerger scheme, the transferee will be required to register, and the registration’s commencement date will be the day the incorporation certificate is received.

ITC on Transfer of Business

The input tax credit is one of the essential aspects of GST as it helps lower the outward GST liability. According to section 18(3) of the CGST Act, if a business is transferred, the transferor may offer the transferee a credit for any unused ITC as long as the transferee is responsible for all of the transferred business’s liabilities. Additionally, ITC-02 is the mandatory form for claiming unused ITC on business transfer, according to Rule 41 of the CGST Rules.

Itemised Transactions

When a business is transferred, itemised transactions are those in which a value is allocated to each asset and liability. The transferee must pay GST on each transaction because each item has a separate value.

Slump or Crash sale

According to section 2 (42C) of the Income Tax Act, a slump sale transfers one or more businesses in exchange for a lump-sum payment; assets and liabilities are not given separate values. The transferee in a slump sale is exempt from GST.

Accountability of Business

Before the court’s final ruling approving the transfer of business, two or more companies that are merging or amalgamating engage in specific transactions, including the exchange of products and services, the CGST Act will be applied in this situation, and the companies must pay taxes on the supply transactions between them.

Trading of Securities

Another method of obtaining business is trading or buying the majority of a firm’s stock. The transferor company’s shareholders can exchange their shares for shares in the transferee company.

Taxation on Different Types of Transfer

When a company is described as a part of a going concern, it signifies that it is running or operating, either entirely or independently. If a business is transferred as a going concern, or if a whole or independent portion of the company is transferred, then GST will not apply.

Procedure of Transfer

The process of transfer of business includes two steps:

- The transferor must submit Form ITC-02 with all necessary information, including the total amount of unused ITC that will be transferred. The form needs to be submitted on the GST portal.

- The transferee will receive the form and must decide whether to accept or reject it.

Reversal of ITC on Transfer of Business

A business transfer treated as a going concern is not subject to GST and is, therefore, referred to as an exempt supply. According to section 17 and Rule 42 of the CGST Rules, the ITC on exempted supplies will be proportionately reversed if a taxpayer makes any.

Conclusion

The transfer of Input Tax Credit (ITC) is an essential process for businesses in India that change ownership. Companies must use Form GST ITC-02 for this purpose and follow a step-by-step process to transfer the ITC successfully. Using a robust GST Accounting Software like BUSY is beneficial in claiming ITC correctly, as it takes care of a lot of the compliance work required for ITC.

Frequently Asked Questions

-

What is the transfer of the ITC form?Form GST ITC-02 moves tax credits from one business to another during a transfer, such as a merger, sale, or combination.

-

How can one claim ITC on the transfer of business?To get an ITC for a business transfer, the person transferring must fill out Form GST ITC-02 on the GST website. This form contains details about the transferred ITC and the recipient’s information. The transferee must acknowledge the ITC claim in their GST account.

-

What are the steps for claiming ITC on the transfer of business?To receive a tax credit for a business transfer, the person transferring the business must complete Form GST ITC-02. This form needs information about the transfer and the amount of transferred credit. The business recipient must then approve the credit in their online account. The person receiving the business must then accept the credit in their online account.

-

Can ITC be transferred if only a part of the business is sold?ITC can be transferred even if only part of the business is sold. The ITC claim of business transfer should be proportionate to the value of the transferred business assets and liabilities.

-

Is there a specific format for the transfer of the ITC form?To accept the ITC transfer, the recipient can log into their GST portal account, navigate to the “ITC-02” section, and accept the ITC added to their electronic credit ledger.

-

What documents are required for the transfer of the ITC claim?To transfer the ITC claim, you need the transferor’s and transferee’s GSTIN. You also need details of the transferred business and a copy of the business transfer agreement. Additionally, you must fill out Form GST ITC-02.

-

How does the transferee accept the ITC transfer?To accept the ITC transfer, the recipient can log into their GST portal account, navigate to the “ITC-02” section, and accept the ITC added to their electronic credit ledger.

-

What happens if the transferee does not accept the ITC claim on business transfer?If the transferee does not accept the ITC claim on business transfer, they will not transfer the ITC, and the claim will remain pending. The transferee must accept the claim for the ITC and credit it to their account.

-

Are there any time limits for filing the transfer of the ITC form?The transferor must submit the ITC transfer form within 30 days of the business transfer. It ensures that the ITC is transferred to the transferee on time.

-

Can ITC be transferred in the case of a merger or amalgamation?Yes, companies can transfer ITC in the case of a merger or amalgamation. To merge or amalgamate, the transferor needs to submit Form GST ITC-02. The transferee then needs to approve the ITC claim in their GST account.