Input Tax Credit on Capital Goods

BOOK A FREE DEMO

Rules Apply To Calculate Input Tax Credit Reversals

Different rules apply to calculate input tax credit reversals, availability, non-availability, and tax credits in respect of capital goods under GST. In this article, we will dive into the concept of ITC for capital goods. Claiming the correct ITC can be challenging since you need to follow many rules and regulations. Use reliable GST Accounting Software to claim Input Tax Credits and comply with rules easily.

What are Capital Goods in Input Tax Credit?

Businesses require capital goods and raw materials to produce the goods and services they sell. Capital goods refer to the machinery, equipment and assets used to produce goods and services. The manufacturing process converts raw materials into finished products, which are the primary products. For example, let’s say ‘Company A’ manufactures wooden furniture. They will require machines to cut, shape and polish the wood.

The use of these machines will not end with the production of one piece of furniture. They will use them for many years. Thus, these are long-term capital goods. On the other hand, wood is a raw material used to make furniture. Machinery transforms wood into furniture.

Once manufacturers make capital goods, they do not change. Manufacturing transforms raw materials and cannot return them to their original state. According to the GST Act, “capital goods” are goods recorded as assets in the books of accounts. A person claims these goods for an Input Tax Credit.

ITC on Capital Goods Under GST

You must pay the applicable GST rate when purchasing goods or services. However, you can claim back the GST Input Tax Credit on capital goods if you are a GST-registered taxpayer. The same applies when you purchase capital goods for business purposes. However, capital goods are subject to elimination over time, as per rates prescribed under the Income Tax Act. They also have a predetermined useful life as per the same Act.

To claim ITC, only claim depreciation on the value of the capital goods purchased without including the GST paid. You cannot claim an Input Tax Credit if you deduct depreciation on the total amount spent on capital goods. This total amount consists of the GST paid.

For example, you purchased a new computer for business use. They will classify that computer as capital goods. The taxable value of the computer is ₹50,000, and the applicable rate of GST is 18%, which is ₹9,000. Hence, the total amount you have paid for the computer is ₹59,000.

The Income Tax Act allows the depreciation of computers by 40% over five years, which is their useful life. To be eligible for ITC, you must claim depreciation only on the value before GST, i.e. ₹50,000. If you claim depreciation on the entire amount of ₹59,000, then you cannot claim ITC.

Applicable ITC on Common Credit

Taxpayers can claim an Input Tax Credit for capital goods for business and personal use. However, they can only claim this credit if they use the goods solely for business purposes. Let’s say you are a freelancer selling copywriting services to clients. You purchased a computer for your copywriting job but also enjoy using it for gaming and watching movies. You can get a refund for the GST you paid on the computer if you use it for your copywriting business.

Let’s say you purchased a subscription to a software that helps you do your copywriting work better and faster. If you use the software for business, you can claim the full tax credit on the monthly subscription price. If you buy a computer game or movie streaming service for yourself, you can’t get any tax credits for them. To know more, read our guide to ITC on Common Credit.

Conditions for Claiming Input Tax Credit on Capital Goods

The Conditions for claiming ITC on Capital goods are as follows:

- Businesses should utilise capital goods professionally.

- If you sell capital goods, you must pay tax on the sale price and cannot use input tax credit from a previous period.

- Capital assets are those of the company, not of an employee. This ensures that employees use the items solely for company purposes and do not use them as staff perks.

- We received an input tax credit for the purchase in the previous fiscal year.

- You cannot claim ITC for capital goods imported before. This rule does not apply if you bring the equipment into India, use it, and then sell it after fixing it up.

- You can also claim credit for Central Sales Tax under GST for capital goods used to make more supplies.

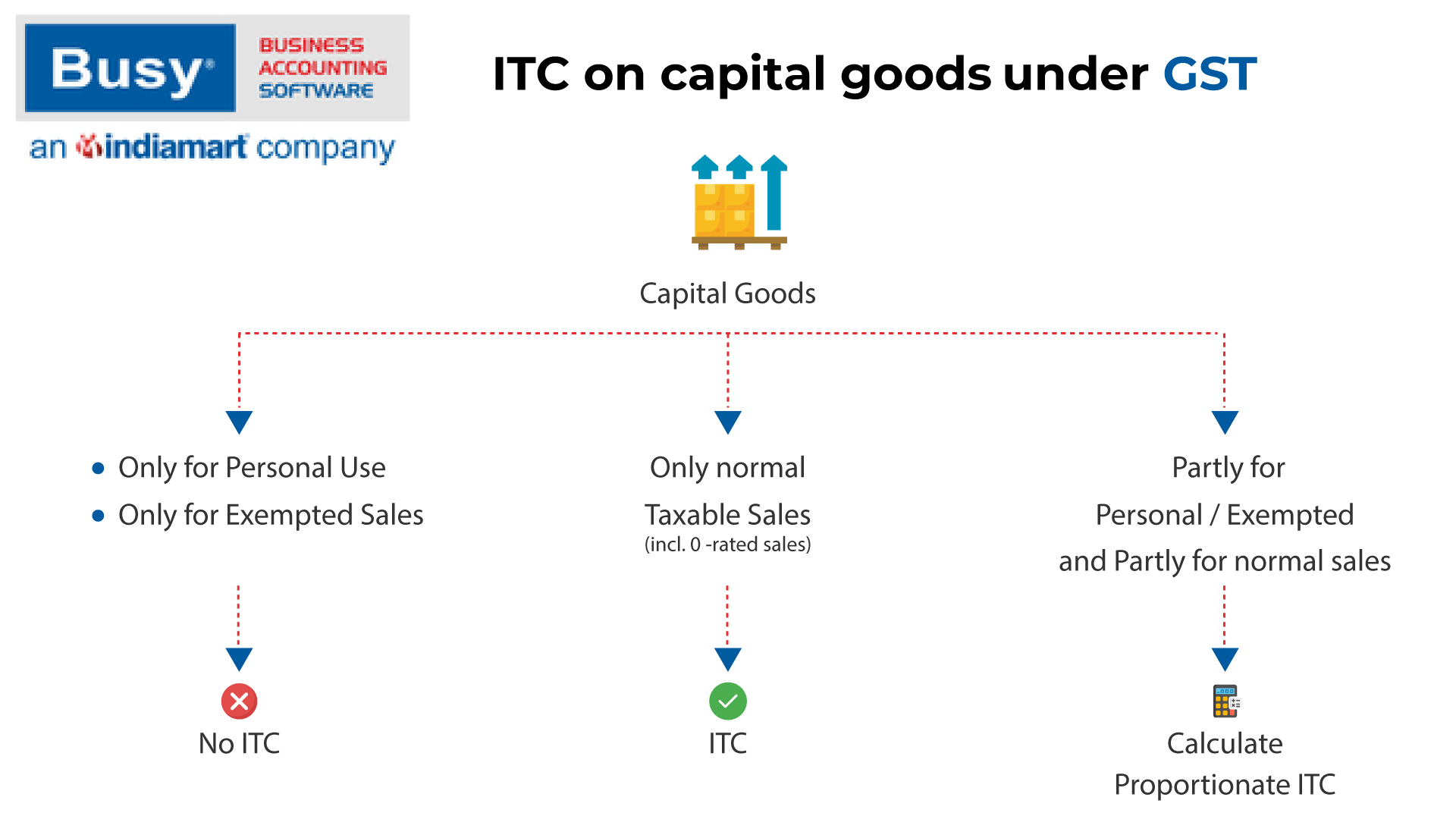

Types of ITC for Capital Goods

Types Of ITC For Capital Goods. These are:

- Capital goods used for personal or exempted sales

- Capital goods used for average taxable sales

- Businesses use capital goods for both personal or exempted and average taxable sales.

- Capital Goods Used for Personal or Exempted Sales.

- The input tax credit is not available for personal or exempted sales of capital goods.

He can avoid paying GST if he buys a small flour mill for his store and produces unbranded flour. However, he won’t be able to claim a tax credit for the flour. This means he can’t get a tax credit for it.

Capital Goods Used for Personal or Exempted Sales

The input tax credit is not available for personal or exempted sales of capital goods. For instance, if Mr Kapoor buys a fridge for his house, it is a personal purchase; hence, ITC cannot be claimed. Similarly, if he purchases a small flour mill for his grocery shop, he is producing unbranded flour, which is exempted from GST, and thus he cannot claim an ITC for the same.

Capital Goods Used for Normal Taxable Sales

Mr. Manoj bought machinery to make shoes. Because the machinery is a regular taxable supply, he can claim the GST he paid on it as an Input Tax Credit.

- Businesses use capital goods for personal or exempted and average taxable sales.

- You can claim an Input Tax Credit on capital goods used for both personal/exempt sales and taxable sales.

Capital Goods are Used Partly for Personal or Exempted and Normal Taxable Sales

Capital goods used partly for personal or exempted sales and partly for normal taxable sales are eligible for claiming ITC.

The ITC that is paid for the capital goods is transacted through the e-ledger. The shelf life of such assets will be marked as five years from the date of purchase. The e-ledger will distribute the total input tax transacted over the marked shelf life. To calculate the monthly ITC, use this formula: Shelf life of 5 years and pay GST monthly.

Considering five years as the shelf life and the GST is paid monthly, the following formula can be used to calculate the ITC per month:

ITC per month= Input tax credited to the e-ledger divided by 60 (5×12)

The amount of ITC from common capital credit that can be attributed to exempt supplies is:

Credit attributed to exempted supply= (Value of exempted supplies divided by the total sales) multiplied by Common Credit for a tax period

After subtracting credit for exempt materials, the remaining sum will be eligible for ITC. These calculations should be carried out separately for CGST, SGST, IGST, and UTGST.

What Happens if a Person Uses an Asset for Taxable and Exempt Goods?

The system will credit 5% of the input tax for every quarter or part from the invoice date subtracted from the input tax.

- Cases When ITC Will not be Applicable on Capital Goods.

- Cases when ITC will not apply to Capital Goods are:

A Transaction with Consideration:

- In this case, GST will be due at the corresponding rate.

- You must prepare tax invoices.

- You must record the transaction on the GSTR 1 Form.

If someone loses, steals, destroys, writes off, or disposes of items, it constitutes a transaction without consideration. This is similar to what happened before. In such circumstances, people will not consider it the supply of goods and will not charge any GST.

Also Know About: Busywin

Reversal of ITC on Capital Goods

The following circumstances require businesses to reverse input tax credits obtained on capital items.

- When a taxpayer chooses the composition plan for tax payment.

- Taxpayers who provide products or services are no longer subject to tax.

- Businesses claim an input tax credit when they receive capital items.

If we cancel a taxpayer’s registration early, we will credit them for the remaining value of their assets. This credit assumes a five-year useful life.

Capital Goods Sent on Job Work

Suppose the employer has given an employee a capital asset to use during business. If the manufacturer returns the item to the employee within three years, the employee may get a tax credit. If you do not return the assets within three years, we will consider them supplied. You will owe tax plus interest for late payments.

Conclusion

Thus, capital goods that aid a company’s expansion are eligible for the input tax credit (ITC). ITC reduces the expense of corporate development, which benefits the economy as a whole. Comprehending and calculating ITC can be challenging. Utilising fully automated software that can handle time-consuming tasks on your behalf helps you save time and effort.

Busy Accounting Software offers automated and scalable solutions for various GST-related tasks. These tasks include calculating the input tax credits and joint credits. The software streamlines business processes related to GST. Fill out the form below for a free trial to assist you with a seamless procedure.

Frequently Asked Questions

-

What is ITC on capital goods under GST?Businesses can claim a tax credit for the tax paid on purchasing capital goods used for business purposes under GST. This is known as Input Tax Credit (ITC). It helps businesses reduce their tax liability. By claiming ITC, companies can save money on their taxes. It helps reduce the overall tax liability.

-

How does input tax credit on capital goods differ from other inputs?The input tax credit for capital goods is unique because it applies to long-term assets used in production. In contrast, other inputs include consumables and raw materials used in manufacturing.

-

What is the GST rate on capital goods?The GST on capital goods is usually 12%, 18%, or 28%, depending on the type of capital good.

-

Can you provide an example of ITC on capital goods under GST?Sure! A manufacturer purchases machinery for ₹1,00,000 with 18% GST (₹18,000). They can claim the ₹18,000 as an Input Tax Credit (ITC) on capital goods under GST, reducing their total GST payment.

-

What are tax credits in respect of capital goods?Tax credits for capital goods reduce the GST businesses pay when buying these goods. This encourages firms to invest in long-term assets.

-

How is the GST input on capital goods recorded in accounts?The business records the GST input on capital goods in the ITC ledger under the capital goods ledger. Businesses then use it to offset GST liabilities.

-

In which ledger is the input tax credit on capital goods created?The GST portal stores the input tax credit for capital goods in a section called the “Electronic Credit Ledger.” This section is separate from other sections on the portal. It helps businesses keep track of their input tax credits for capital goods. Businesses can easily access and manage their input tax credits through this section.

-

Can ITC be claimed on capital goods used for personal purposes?You cannot claim ITC on capital goods if you use them for personal or non-business-related purposes.

-

What is the capital goods scheme under GST?The capital goods scheme in GST lets businesses claim ITC on capital goods. However, you must make adjustments if you use the goods for exempt supplies or non-business purposes.

-

How does the GST credit on capital goods benefit businesses?The GST credit on capital goods reduces the cost of capital investments. This helps businesses invest more in growth and development and repay the GST they paid.