What are Composition Scheme Rules under GST?

BOOK A FREE DEMO

The composition scheme was introduced in order to simplify compliance with GST laws for small taxpayers, with an annual turnover of less than ₹1.5 crores (earlier it was ₹1 crore). The composition scheme rules under GST outline procedural compliance with respect to the intimation for the composition scheme, the date of levy, conditions, restrictions and validity on the levy, and tax rate.

Intimation of Composition Levy

For existing registrants under the pre-GST era

Individuals who possess provisional registration under VAT Act, Service Tax, Central Excise laws, etc. and have chosen composition levy must file an electronic intimation in GST CMP-01 form with a signature before or within 30 days from the appointed date. If they fail to file the intimation within the timeframe, they won’t be able to collect taxes.

Additionally, a bill of supply (GST CMP-03 form) must also be filed within 60 days of filing the intimation. The following details must be provided in this form:

- Stock information

- Inward supply of goods received from unregistered individuals held on the day before the option is exercised.

Also Know – Differences Between Regular and Composite Schemes

People who are new registrants under GST

Individuals applying for a new registration under the scheme must file an intimation in FORM GST REG-01.

For registered individuals switching to the Composition Scheme

Individuals who are already registered under GST but opt to pay taxes under the Composition Scheme must follow these steps:

- File an intimation in FORM GST CMP-02 for exercising the option

- Submit a statement in FORM GST ITC-3 with information on input tax credits related to inputs in stock and inputs contained in semi-finished or finished goods within 60 days of the relevant financial year’s commencement.

Effective Date for Composition Levy

The option to pay taxes under the Composition Scheme will become effective as follows:

- For existing registrants under the pre-GST regime: On the appointed day

- For individuals switching to the Composition Scheme: Upon the filing of the Intimation in FORM GST CMP-02.

- For new registrants under GST: The option to pay taxes under the Composition Scheme will be effective from the date of grant of registration if the application for registration is submitted within 30 days from the date the individual becomes liable for registration.

Composition Levy Requirements and Limitations

- A non-resident or casual taxable person is not permitted to avail the composition scheme.

- He may not purchase the items he has in store on the designated day from a location outside his state. Therefore, the items shouldn’t be categorised as:

- Interstate purchase

- Imported goods

- Branch located outside the state

- Either the Agent or the Principal is located outside the state

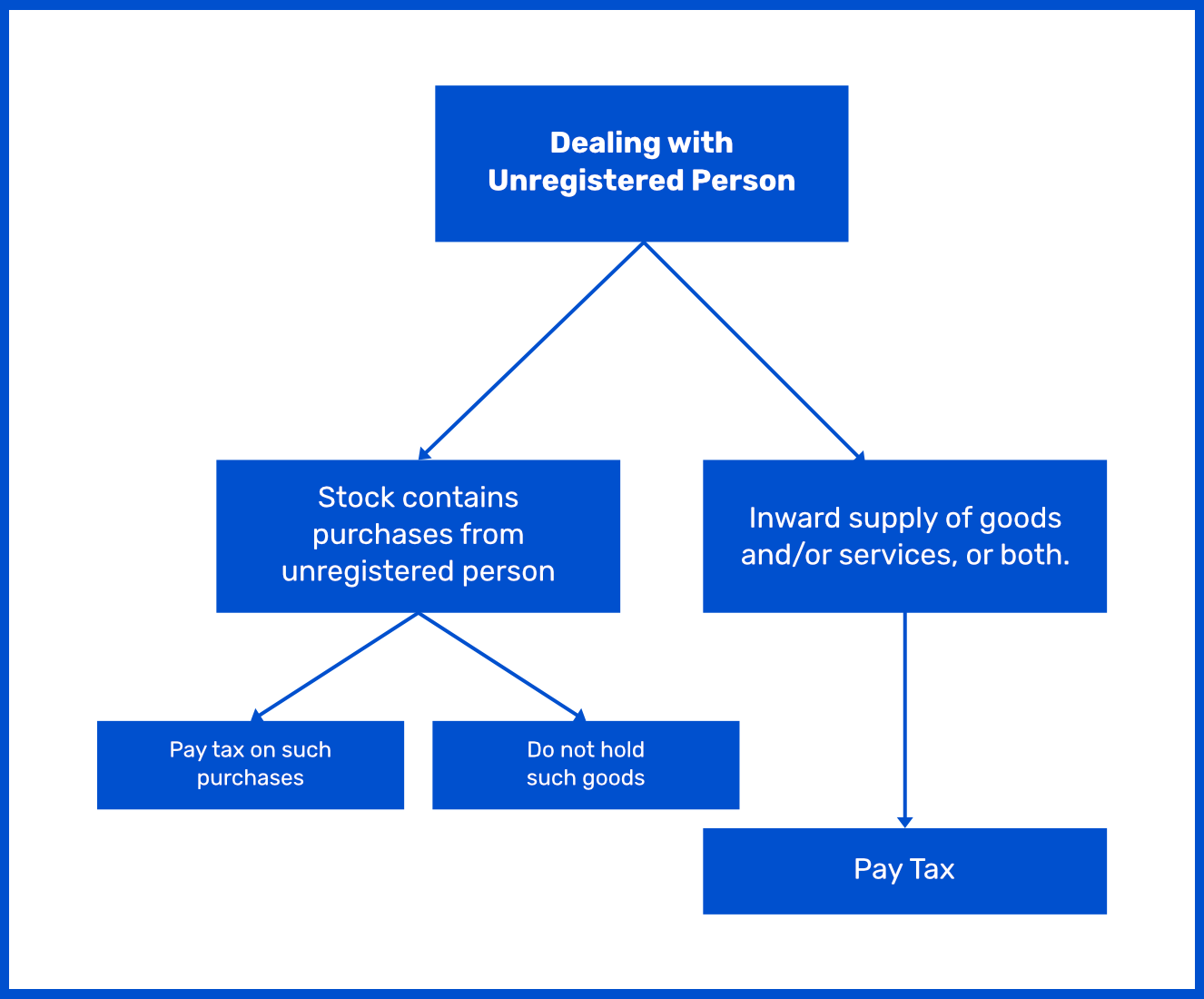

- Tax must be paid, or no stock can be held when taxpayers deal with unregistered individuals.

- Invoices must display the phrase “Composition Taxable Person, not eligible to collect tax on supplies.”

- The words “Composition Taxable Person” must be prominently displayed on all notices and signboards.

- The individual is not a manufacturer of goods that the government has notified during the preceding fiscal year.

Validity of Composition levy

The validity of the composition levy depends on the following:

- As long as a registered person meets all of the requirements outlined in section 10 and by these regulations, their choice to pay tax under that section will remain valid.

- The person referred to in sub-rule (1) shall be liable to pay taxes under sub-section (1) of section 9 as of the day he fails to satisfy any of the conditions mentioned in section 10 or the provisions of this Chapter. He shall issue a tax invoice for any taxable supplies made after that date, and he shall also file an intimation for withdrawal from the scheme in FORM GST CMP-04 within 7 days of such event.

- Before the withdrawal date, the registered person who wishes to leave the composition scheme must submit an application in Form GST CMP-04, signed or verified electronically with a verification number.

- If the authorised officer has reason to suspect that the registered person was ineligible to pay tax under section 10 or has violated the Act’s or this Chapter’s rules, he may send that person a notice in the form GST CMP-05 asking them to explain their actions within fifteen days of receiving the notice as to why the option to pay tax under section 10 should not be rejected.

- The authorised officer must issue an order in FORM GST CMP-07 within 30 days of receiving the registered person’s FORM GST CMP-06 reply to the show cause notice issued under sub-rule (4), either acknowledging the reply or rejecting the option to pay tax under section 10 from the date of the option or from the date of the event concerning such contravention, as the case may be.

- A person who has provided notification under sub-rule (2), filed a withdrawal application under sub-rule (3), or received an order to withdraw the option in FORM GST CMP-07 under sub-rule (5) may file a statement in FORM GST ITC-01 electronically at the common portal or through a Commissioner-notified Facilitation Centre. The statement should include information about the input and semi-finished/finished goods stock held on the day the option is withdrawn or rejected. The filing must be completed within 30 days of the date of option withdrawal or order issued in FORM GST CMP-07.

- An intimation or withdrawal application under sub-rule (2) or (3), or denial of the option to pay tax under section 10 as per sub-rule (5) for any place of business in a state or union territory, will be considered as an intimation for all other places of business registered under the same Permanent Account Number.

Tax Rate

| Type of business | CGST | SGST | Total |

| Manufacturers and Traders | 0.5% | 0.5% | 1% |

| Restaurant not Serving alcohol | 2.5% | 2.5% | 5% |

| Other service provider | 3.0% | 3.0% | 6% |

Compliance with Composition Scheme Rules under GST

Following the due date for submitting such forms, the Composition Scheme Rules under GST require the submission of various forms intended for various purposes.

| Form Required | Purpose | Due Date |

| Form GST CMP-01 | To enrol in the scheme as a holder of a provisional GST registration (from VAT regime) | Before the scheduled date or within 30 days after that date |

| Form GST CMP-02 | intimation of intent to participate in the scheme for regular taxpayers who are GST registered | Before the start of the financial year |

| Form GST CMP-03 | Information about the stock and incoming shipments from both registered and unregistered sources | 90 days after the option was exercised |

| Form GST CMP-04 | Notification of withdrawing the scheme | 7 days after the event had occurred |

| Form GST CMP-05 | A proper official has given a show cause notice for a rule or act violation. | Regarding any infraction |

| Form GST CMP-06 | Answering the show-cause notice | Within 15 days |

| Form GST CMP-07 | Issue of Order | Within 15 days |

| Form GST REG-01 | enrollment in the composition scheme | Before the designated date |

| Form GST ITC-01 | Details on stock inputs, semi-finished goods, and finished goods | Option to withdraw after 30 days |

| Form GST ITC-03 | Intimation of ITC available | within 60 days of the financial year’s beginning |

All of the above documents must be properly filled out, signed, and submitted electronically via Common Portal, either directly or through a Facilitation Center that has been informed by the Commissioner.

Conclusion

The composition scheme is only for small taxpayers whose annual turnover is less than ₹1.5 crores. However, the scheme does not apply automatically to such taxpayers. Instead, they must voluntarily opt for this scheme.

Even though the aim of the scheme is to simplify compliance for such businesses, the composition scheme rules are nevertheless very strict and clear in terms of what is and what is not allowed.

Any taxpayer who opts for the composition scheme is assumed to have opted for the scheme for all their business locations that have the same registered PAN. As a result, taxpayers cannot select only one business location to register under the scheme.Make GST compliance easy for your business with BUSY GST Software.