Inverted Duty Structure Under GST

BOOK A FREE DEMO

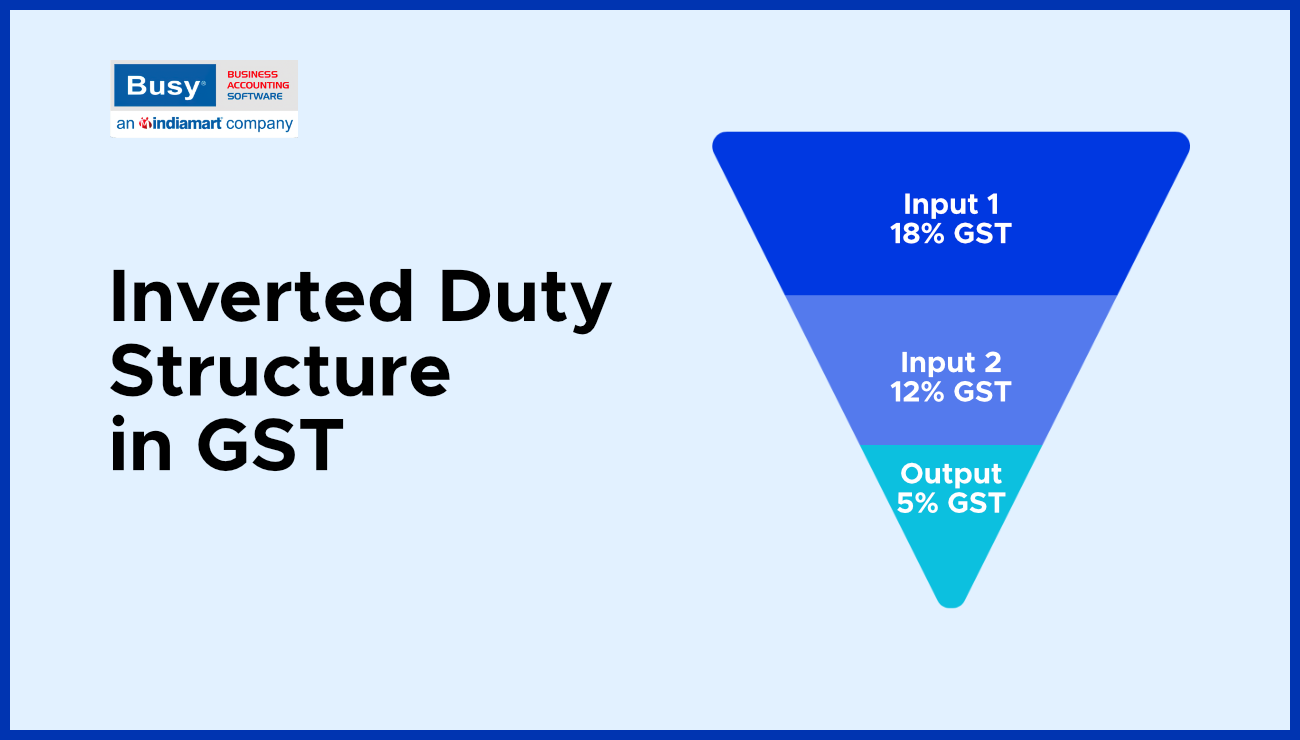

When the input tax credit available on inputs is greater than the GST rate applied to the final product, it leads to an inverted duty structure. This raises the manufacturer’s tax burden, as he is buying inputs at a higher tax rate than what he is charging customers for the final product. The higher tax burden on the manufacturer could ultimately result in higher customer pricing.

For example, in the textile industry, the second largest employer in India, the tax rate on inputs ranges from 12 to 18%, however most finished products are taxed at 5%. This means sellers have less scope to offset the cost of taxes paid on inputs.

Refund Mechanism in Case of Inverted Tax Structure Under GST

Registered individuals are entitled to get a reimbursement for unused input tax credit (ITC). Any tax period in which the credit has accrued due to the tax rate on inputs being greater than the tax rate on output supply may be used to claim the ITC due to an inverted tax structure. A tax period is a time frame during which GST returns must be filed.

The following are some exceptions where the return of the unused input tax credit cannot be claimed:

- Output supplies (i.e. final products) are nil-rated or exempt from GST, except for the supply of goods, services, or both that the government may announce based on the GST Council’s recommendations

- Whether export duty applies to the products exported from India.

- If the supplier files claims for a refund of the output tax paid under the IGST Act.

- If the supplier chooses to avail a duty drawback or an IGST refund on such supplies.

Apart from this, suppliers cannot claim an ITC refund for input services, capital goods or compensation cess.

Formula to Calculate The Maximum Amount of Refund

The maximum amount of Refund = (Turnover of Inverted rate on supply of goods and services X Net ITC / Total Turnover) – Tax Payable on the inverted rate on supply of goods and services.

Let’s consider the following example:

Supply of Product A (Output Value) = Rs 1400

GST on Product A = 1500 X 5% = Rs 70

Supply of Product B = Rs 1500

GST on Product B = 1600 X 5% = Rs 75

Purchase Value of Finished product = Rs 1000

GST on the above = 1000 X 5% = Rs 50

Purchase Value of Raw Materials = Rs 1000

GST on the above = 1000 X 12% = Rs 120

Turnover of Inverted Rate of Supply = Rs 1400

Maximum Refund = (1400 X 120 / 1400) – 75 = 45

Terms Used in Calculating the Maximum Amount of Refund

The following are the terms used in calculating the maximum amount of Refund:

Turnover of Inverted Rate of Supply of Goods and Services

The amount of any inverted supply of goods or services made during the applicable period without paying tax in compliance with a bond or letter of undertaking. Turnover of the inverted-rated supply of commodities in the above instance is Rs 1,400.

Net Input Tax Credit

Net ITC refers to input tax credits obtained on inputs during the applicable period that are not those for which a refund is requested in compliance with sub-rules (4A) or (4B) or both. In the previous example, 50+120-50 = Rs 120.

Adjusted Total Turnover

“Adjusted Total Turnover” refers to the value of all taxable and exempt supplies made within a State or Union territory by a taxable person, excluding exempt supplies other than zero-rated supplies and supplies for which a refund is claimed under sub-rules (4A) or (4B) of sub-section (112) of section 2. The final calculation is done by adding the taxable and exempt supplies and subtracting the value of exempt supplies and supplies for which a refund is claimed.

“Turnover in State” or “Turnover in Union Territory” refers to the total value of all taxable supplies, exempt supplies, exports of goods or services, and inter-State supplies of goods or services made within a State or Union Territory by a taxable person, but excluding the central tax, State tax, Union territory tax, integrated tax, and cess.

Tax Payable on a Such Inverted-rated Good Supply

The tax amount due under the same head (IGST, CGST, or SGST) on such an inverted rated supply of goods. As shown in the previous example: 5% of 1400 = Rs 70.

Relevant Period

The time frame for which the claim was made.

How to Claim a Refund for an Unutilised ITC?

The prerequisites for claiming a refund for unutilised ITC are:

- GSTR-1 and GSTR-3B must be filed for the applicable tax period to submit a refund application for the accrued ITC.

- Required Form: RFD-01

Note: RFD-01 is the application that can be submitted online and is used to claim refunds.

- RFD-01 must be submitted within two years of the end of the fiscal year when the claim for reimbursement arises.

Procedure to Claim a Refund for Unutilised ITC

Given below is the process to claim a refund for unutilised ITC:

- Login to GST Portal and file RFD-01. ARN will be generated.

- Print filed application and ARN receipt from the GST Portal.

- Submit printed documents and supporting documents to a relevant authority.

- Tax official processes the refund application, and the refund is disbursed manually.

- If jurisdictional authority is not allotted, contact the Nodal officer of the state/centre.

To track the application:

- Using the My Saved / Submitted Applications option under Refunds, you can download PDFs of the filed applications (ARNs).

- Use the Track Application Status option under Refunds to track the filed applications’ status.

Issues and Contentions

A manufacturing industry may face varying tax rates on multiple inputs. Some have lower rates than the output, some have equal rates, and others have an inverted duty structure. This makes it difficult to match the output to inputs, leading to inaccurate refund calculations.

The question is, is the refund for the inverted duty structure only available for inputs with a higher GST rate than the output or for all inputs?

As per the formula for refund calculation, “Net ITC” refers to input tax credit on inputs (excluding credits claimed under sub-rules 4A or 4B). This definition does not mention inputs having higher GST rates than output supplies.

Therefore, the entire input credit can be considered for inverted duty structure refund calculation.

Conclusion

The Inverted Duty Structure under GST can create challenges for businesses that purchase raw materials or inputs with a higher tax rate than the finished goods they produce. While the government has taken steps to address this issue by providing refunds or allowing for the transfer of credit, businesses must still navigate the complexities of the system. Proper management of input tax credit and accurate record-keeping can help businesses reduce the impact of the Inverted Duty Structure and improve their financial health. Overall, it is important for businesses to stay informed about changes in the GST framework and adapt their strategies accordingly.

To streamline your GST compliance and claim ITC correctly, consider using a powerful GST Accounting Software like BUSY.