What is Credit Transfer Document (CTD) in GST?

BOOK A FREE DEMO

The Credit Transfer Document (CTD) is important in the Goods and Services Tax (GST) system. It enables the transfer of credit from one taxpayer to another. Under GST, taxpayers can transfer credit from the closing balance of one tax period to the next. This helps in avoiding double taxation and streamlining the taxation process. The CTD contains details of the tax credit being transferred, the name of the transferor, and the transferee. It is a crucial tool for companies to manage their tax credits and adhere to GST regulations effectively. Here we will provide an in-depth understanding of the CTD in GST and its significance for businesses.

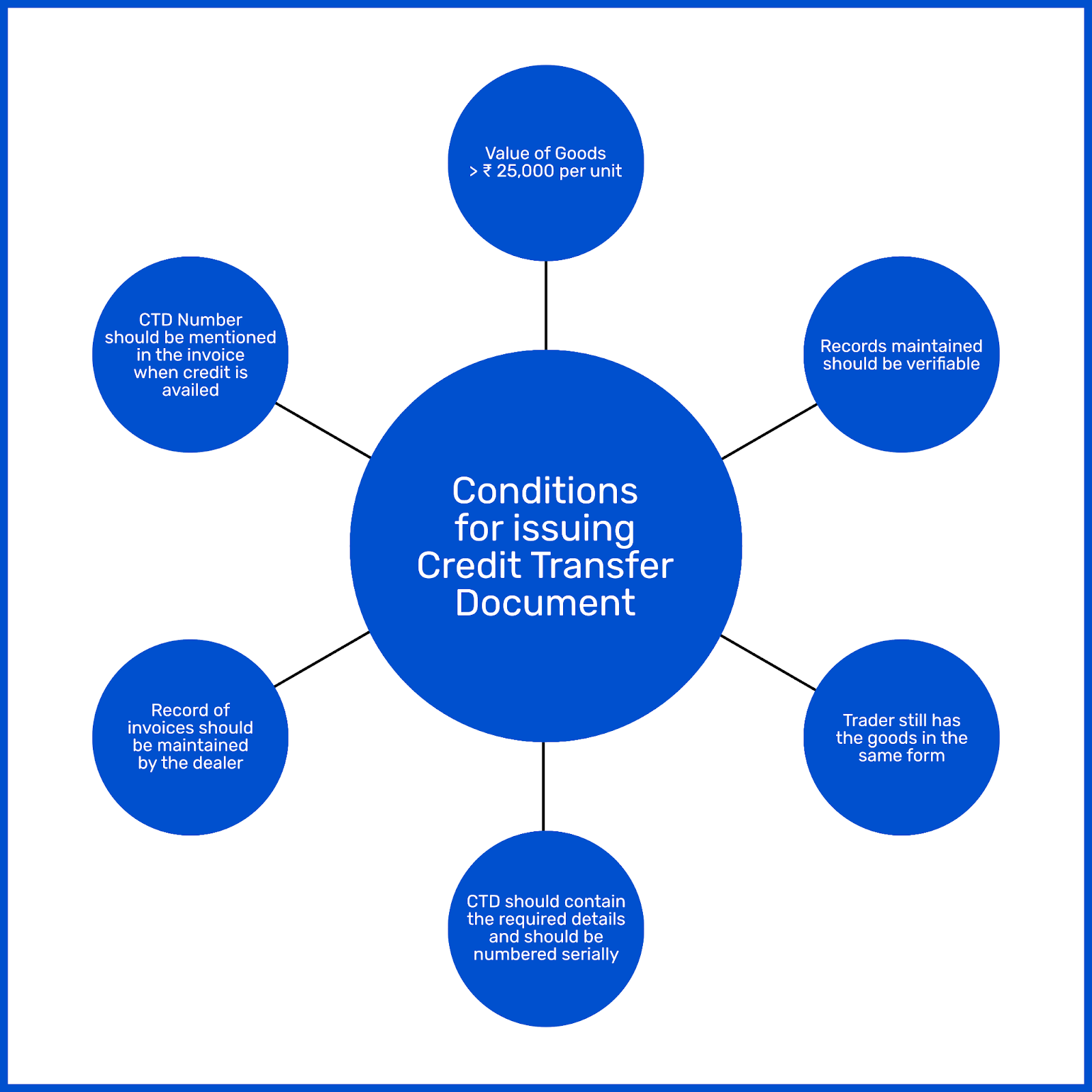

Conditions For Issuing a Credit Transfer Document

- The goods should have a unique identification like brand, chassis number, or engine number, and their value should be more than Rs. 25,000 per item or unit.

- The manufacturer should maintain records that contain details of the goods cleared and the duty paid on them. These records should be available for verification by a Central Excise Officer.

- The Credit Transfer Document (CTD) must contain certain mandatory details, including the Central Excise Registration Number and Division address, along with the recipient’s Name, Address, and GSTIN Number. Additionally, the document should include a Description and Classification of the goods, the Invoice Number, Date of Removal, Mode of Transport, Vehicle Registration Number, Rate of Duty, Quantity, Value, and Excise Duty Paid. The CTD should also be serially numbered to aid in record-keeping and compliance with GST regulations.

- To ensure compliance, the manufacturer is responsible for verifying that the trader who receives the Credit Transfer Document holds the goods in the same condition as when they were cleared by the manufacturer. This measure helps to prevent misuse of the CTD and ensures that the recipient is entitled to claim input tax credits. The manufacturer must take the necessary precautions to avoid any potential penalties for non-compliance.

- The dealer who avails credit through Credit Transfer Document should maintain invoices of buying and selling from the manufacturer.

- Credit Transfer Document should not be issued in favour of a dealer who has already issued an invoice for the same goods before 1st July 2017 to avoid double claiming of an input tax credit.

- To prevent claiming an input tax credit twice, a dealer who receives credit through a Credit Transfer Document is not permitted to receive credit under the Transition Rules of the CGST Act, 2017, on identical products made by the same manufacturer that is in the dealer’s stock.

- In the invoice he issues at the time of the supply of the goods, the dealer who is obtaining credit based on a Credit Transfer Document must include the relevant Credit Transfer Document number.

How to Issue a Credit Transfer Document (CTD)?

- The manufacturer must maintain detailed records of the goods cleared and the duty paid on them.

- The goods must be identifiable, and their value must exceed Rs. 25,000 per item or per unit.

- The CTD must be numbered serially and contain specific details like the Central Excise registration number, address of the Central Excise Division, and name and address of the person receiving it.

- The manufacturer must ensure that the trader receiving the CTD possesses the goods in the same form in which they were cleared.

- The dealer must keep records of invoices when buying and selling goods from the manufacturer.

- A CTD cannot be issued to a dealer who was already issued an invoice for the same goods before 1st July 2017.

- If a dealer uses a Credit Transfer Document (CTD) for a particular product. In that case, they cannot claim credit for the same goods under the Transition Rules of the CGST Act, 2017, even if the same manufacturer produced them. This provision is in place to prevent double claiming of input tax credits and promote compliance with GST regulations. Dealers must be aware of the limitations on credit availability when utilising CTDs to avoid any penalties for non-compliance.

- The dealer must mention the corresponding CTD number in the invoice issued by them at the time of the supply of goods.

What Happens When a Manufacturer Issues a CTD, and CENVAT Credit is Availed Twice on the Same Goods?

The manufacturer and the dealer will share joint and several liabilities for any excessive credit obtained by the dealer, as well as any interest and penalty incurred under the CENVAT Credit Rules 2004.

Documents Required To File CTD

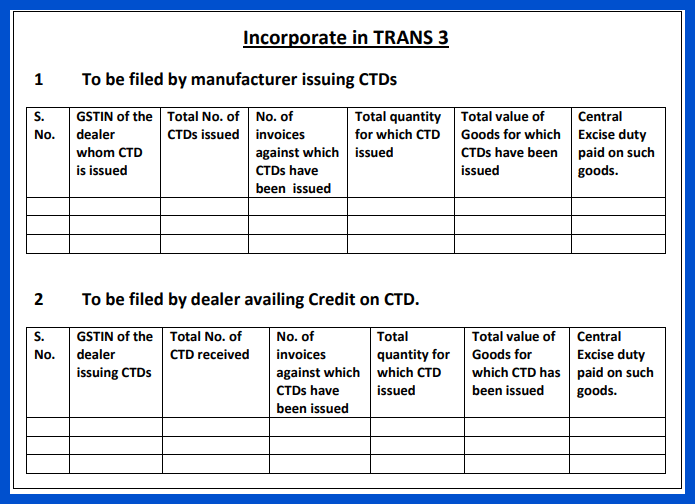

| Documents | Due Date For Filing | Who Should Issue The Document |

| Table 1 of TRANS 3 | 60 Days from 1st July 2017 | Manufacturer Issuing the CTD |

| Table 2 of TRANS 3 | 60 Days from 1st July 2017 | Dealers Availing the Credit Based On the CTD |

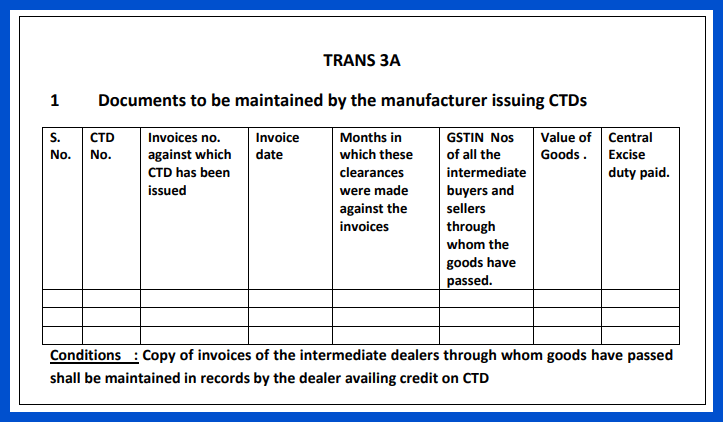

| TRANS 3A | No Due Date | The manufacturer is responsible for providing the Central Excise Officer with the necessary records upon request when issuing the CTD. |

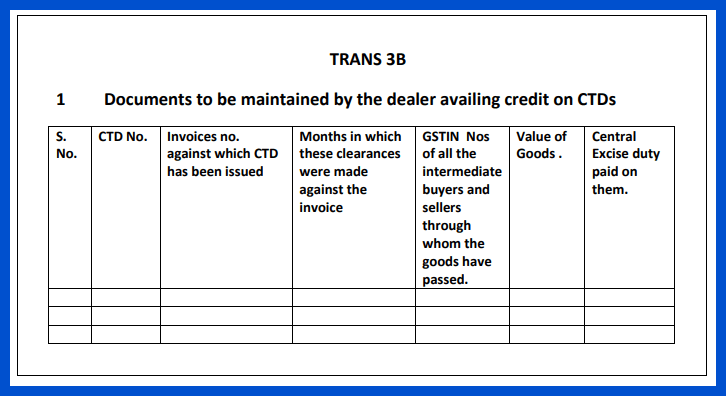

| TRANS 3B | No Due Date | The dealer who utilises the credit based on the CTD is required to provide the relevant records to the appropriate Central Excise Officer upon demand. |

The Formats for Forms TRANS 3, 3A, and 3B.

The formats of the various Trans forms 3, 3A, and 3B, which are important for both the manufacturer issuing a CTD and the dealer obtaining credit via CTD, are listed below:

Form for the manufacturer issuing CTD

Document to be maintained by the manufacturer issuing CTD

Conclusion

A credit Transfer Document (CTD) is an important instrument under the Goods and Services Tax (GST) regime that enables the transfer of input tax credit from one registered entity to another. It acts as proof of the credit transfer, allowing the recipient to claim the credit for input taxes paid by the transferor. The CTD serves as a mechanism for facilitating business transactions and promoting compliance with GST regulations. Understanding the requirements for issuing and utilising CTDs is crucial for businesses seeking to benefit from input tax credits and avoid penalties for non-compliance.