Ktv Health Food Pvt. Ltd. vs. Na

(AAR (Authority For Advance Ruling), Tamilnadu)

PROCEEDINGS OF THE AUTHORITY FOR ADVANCE RULING U/s.98 OF THE GOODS AND SERVICES TAX ACT, 2017.

1. Any appeal against this Advance Ruling order shall be filed before the Tamil Nadu State Appellate Authority for Advance Rulings, Chennai under Sub-section (1) of Section 100 of Central Goods and Service Tax Act / Tamil Nadu Goods and Service Tax Act 2017 (“the Act” in short) within 30 days from the date on which the ruling sought to be appealed against is communicated.

2. In terms of Section 103(1) of the Act, this Advance ruling pronounced by the Authority under Chapter XVII of the Act shall be binding only-

(a) on the applicant who had sought it in respect of any matter referred to in subsection (2) of section 97 for advance ruling;

(b) on the concerned officer or the jurisdictional officer in respect of the applicant.

3. In terms of Section 103(2) of the Act, this advance ruling shall be binding unless the law, facts or circumstances supporting the original advance ruling have changed.

4. In terms of Section 104 of the Act, where the Authority finds that advance ruling pronounced by it under sub-section (4) of Section 98 or under sub-section (1) of section 101 has been obtained by the applicant by fraud or suppression of material facts or misrepresentation of facts, it may, by order, declare such ruling to be void ab initio and thereupon all the provisions of this Act or the rules made thereunder shall apply to the applicant as if such ruling had never been made.

5. At the outset, we would like to make it clear that the provisions of both the Central Goods and Service Tax Act and the Tamil Nadu Goods and Service Tax Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the Central Goods and Service Tax Act would also mean a reference to the same provisions under the Tamil Nadu Goods and Service Tax Act.

1. KTV HEALTH FOOD PVT LTD, No.7/3, ARUL NAGAR SALAI, KODUNGAIYUR, CHENNAI-600118 (hereinafter called the Applicant) are registered under GST with GSTIN33AABCK8863F1ZH. The Applicant has sought Advance Ruling on the following question:-

“Determination of correct classification of lamp oil.”

The Applicant has submitted the copy of application in Form GST ARA – 01 and also submitted a copy of Challan evidencing payment of application fees of Rs.5,000/- each under sub-rule (1) of Rule 104 of CGST rules 2017 and SGST Rules 2017.

2.0. The Applicant has stated that they are a registered Private Limited Company having its factory at Kodungaiyur and Gummidipoondi in Tamilnadu engaged in the process of refining, bleaching and de-odorising the Crude Palm oil and Sunflower oil falling under Chapter 15. The Applicant has stated that they are engaged in the processing and refining of healthy branded edible oils for more than three decades. Apart from manufacturing and marketing above edible oils, the Applicant makes a preparation which is mixture of edible oils viz Rice bran oil, Coconut oil. lllupai oil, castor oil and Gingelly oil with perfumery material and market the same as their new commercial premium product with trade name as ‘Deepa Jyothi Lamp Oil’ which carries a levy of tax at 12% in full under tariff heading 15.18.

2.1 The Applicant has stated that as part of their business, they have now proposed to introduce one of their manufactured product viz RBD Palmolein (Refined bleached deodorized palmolein) as ‘lamp oil’ which is of edible grade as such without being mixed with any other oils and perfumery material. It is used for lamp in the prayer hall of Hindu household as a matter of religious belief. The Applicant accordingly seeks a ruling as to the correct classification of RBD Palmolein used as ‘Lamp Oil’ in pooja room.

2.2 The Applicant has stated, inter alia, that they have proposed to market one of their product viz., RBD Palmolein which is of edible grade without changing its basic and essential character; the said edible oil intended to be introduced as lamp oil will be traded as edible grade in different pouches from 100 ml to 500ml clearly inscribing on one side with Applicant brand and market the product for trade understanding as ‘lamp oil’; the other side of the pouch will contain specification of RBD Palmolein the content of RBD Palmolein sold for retail consumption as edible oil; the applicant has stated that the manner in which a product is described for marketing cannot be sole guide for classification; they have stated that in south India, many vegetable oils are used for lighting lamp e.g., Gingelly oil (seasame oil). Coconut oil and Castrol oil; also coconut oil is used for cooking, hair and for lighting a lamp in Hindu prayer hall; Manufacturers who has manufactured different vegetable grade edible oils as per Indian Standard norms specifically sell to the public as edible grade but the purchasers makes some other use of it; that it will be anomalous if edible oil used for culinary purpose carry a rate of 5% and the same edible oil if used for lighting a lamp in Hindu prayer hall it becomes classified under Tariff Heading 15.18 read with Sl.No.27 of Schedule II of Notification No. 11/2017 Central Tax (Rate) dated 28.6.2017 and carry a rate of 12%.

2.3 On interpretation of law, the applicant has stated that as per customs tariff schedule, which is applicable to GST Tariff Schedule, RBD Palmolein as such without being mixed with any other oil is to be classified under heading 1511 (customs tariff entry 1511 90 20 is specific to RBD Palmolein). The heading covers ‘Palm oil and its fractions whether or not refined, but not chemically modified. Further, the tariff entry for each oil contain “edible grade”; “other”. They have also stated that the Rate of tax will be 5% in terms of Sl.No. 83 of Notification 01/2017 CT(RATE) dated 28.06.2017.

3.1 Personal Hearing was held on 29.04.2022. The Authorised Representative Shri. Hari Radhakrishnan. Advocate appeared for the hearing and reiterated the submissions made through email. They submitted that the lamp oil is also of edible nature and that for marketing purposes they have labelled it as lamp oil. Hence, they submitted that the rate of tax should be as applicable to edible oil only. The Member asked the AR to elaborate on the difference between lamp oil and edible oil. The AR replied that both are exactly the same and this can also be used for cooking. The Member questioned on the cost of products and the difference between the costs of both. The AR replied that the edible oil “ROOBINI” is priced at Rs 98.50/500ml and the lamp oil Rs.84/500 ml. While being asked about the reasons for difference in price, the AR replied that branding and intended use are the reasons. They were asked to furnish the following documents for both the products:-

(i) Process of manufacture of RBD Palmolien with pictures of various stages.

(ii) FSSAI Certification for the RBD Palmolien

(iii) Package details with the package pouch/covers

(iv) Substantiate the infrastructure available for manufacturing the RBD Palmolien.

(v) Invoices

3.2 The applicant vide their letter dated 09.05.2022 submitted the following documents:-

- Colour photographs of the package Roobini(palm oil) and Mahara Jyoti (palm Oil)

- Invoice copies for sale of Roobini(palm oil) and Mahara Jyoti (palm Oil)

- FSSAI Certification of both units at Kodungaiyur and at Gummidipoondi

- The applicant has stated that the products Roobini(palm oil) and Mahara Jyoti (palm Oil) are manufactured at the Gummidipoondi Factory of the applicant and is packed at No.7/3, Arul Nagar Salai, Kodungaiyur, Chennai-600118

- They have also reiterated that both ‘Roobini’ and ‘Mahara Jyoti’ arc packed with same RBD Palmolein Oil manufactured at the same unit of the applicant and both the products consist of same RBD Palmolein oil though their end use may differ.

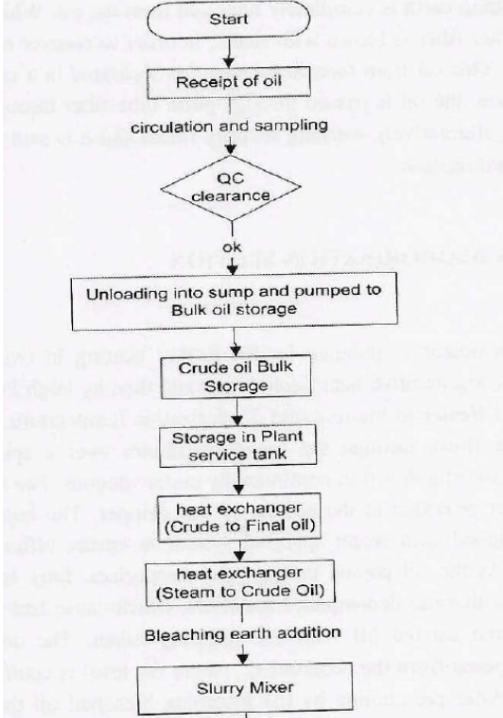

- The applicant has given the following as process of Manufacture of Palm oil:

PALM OIL PHYSICAL REFINING

ACID CONDITIONING:

The crude palm oil is filtered through Self Cleaning Filter and then heated to a required temperature for acid conditioning in Crude Economizer (Plate heat exchanger) by deodorized oil during steady state condition and subsequently by using steam in feed heater. After getting required temperature calculated phosphoric acid is dosed. The oil is allowed to mix throughly with phosphoric acid in the Dynamic mixer and then oil is sent to Retention tank where the precipitation of phosphatides and metal compounds takes place.

CONTINUOUS BLEACHING:

The treated oil is again heated to a temperature of 85 Deg.C using economizer with hot deodorized oil and sprayed into the Slurry mixing tank. The earth is automatically dosed by the Screw conveying System directly from the Earth feed hopper into the pipe located below the oilspray. The conveyor is sequenced by an equation to oil flow in the PLC programme. The slurry oil from is pumped to a bleacher vessel, through Viscoline to heat the oil up to bleaching temperature in case slurry is prepared at lower temperature (85 deg. C). In the Bleacher, which is equipped with steam agitation to ensure proper mixing and retention time, colour bodies, oxidizing material etc. in the oil, are generally adsorbed by the earth.

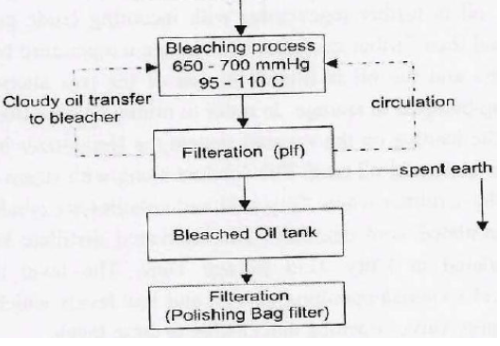

Filtration

The filtration takes place in two operating pressure leaf filters and 3 in standby where the bleaching earth is completely removed from the oil. While one filter is in operation the other filter is blown with steam, in order to recover residual oil in the bleaching earth. This oil from the exhaust steam is separated in a cyclone separator. After the filtration, the oil is passed through pulse tube filter through tank in series with one of two alternatively working security filters and it is sent to the BOT cum Dearetor for deodorization.

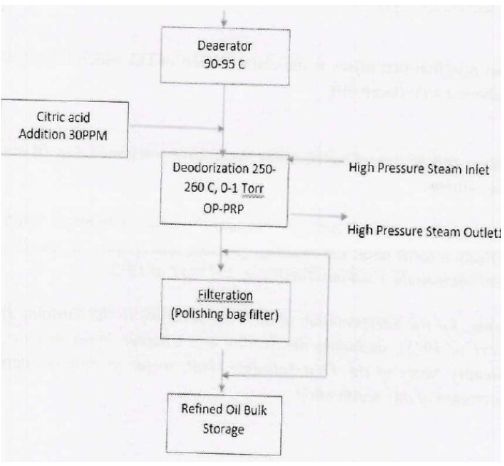

CONTINUOUS DEODORISATION SECTION

The oil from Deareator is pumped by for further heating in two steps, first by deodorized oil in regenerative heat Economizer and then by High Pressure steam in Vacuum final oil Heater to the required deodorization temperature. The hot oil fed into the Stripper flows through the liquid distributor over a specially designed packing in the form of a thin film continuously under vacuum. The separate holding vessel Deodoriser provided at the bottom of the stripper. The holding vessel and stripper are equipped with steam sparging system to ensure efficient stripping of volatile matter. As the oil passed through the Deodorizer, fatty acids, aldehydes, ketones and other thermal decomposed materials, which cause bad taste and smell, are vapourised and carried off with the stripping steam. The deodorized oil is discharged by a pump from the economizer, where the level is controlled by a level control system. After pre-cooling by the incoming bleached oil the vacuum Heat Economiser, this oil is further regenerates with incoming crude palm oil in plate heat exchanger and then further cooled to the storage temperature by cooling water in final oil coolers and the oil is filtered in one of the two alternative polishing filters, while being pumped to storage. In order to minimise pollution of the cooling water as well as the loading on the vacuum system, the Deodorizer is equipped with a Double scrubber cum acid oil tank. The vapours along with steam passed through a packed bed of the scrubber where fatty acid and volatiles are condensed by direct contact with recirculated cool distillate. The recovered distillate known as ‘fatty acids’ is accumulated in Fatty Acid storage Tank. The level in this tank is maintained by level switches operating at high and low levels which automatically controls the discharge valves opening and closing at these levels.

PALM OIL PROCESS PHYSICAL REFINING PROCESS

BLEACHING PROCESS FLOW CHART

DEOD PROCESS FLOW CHART

3.3. Another Personal Hearing was held on 08.12.2022, as there was a change in the constitution of Members. In this Personal Hearing which was conducted virtually, Shri. Hari Radhakrishnan, Authorised Representative of the Company (AR) briefly explained the process of manufacture of edible Palmolein with brand name Mahara Jyothi which is marketed as lamp oil. In response to the query whether any additives are added to make it lamp oil, the AR replied that no additives are added and the content is edible Palmolein and the packing is affixed with FSSAI license number used for Roobini Refined Palmolein as the manufacturing process is same for both the products. In response to query with regard to price of Roobini and Mahara Jyothi, the AR stated that Mahara Jyothi is lesser by Rs. 10/- as compared to Roobini, as the latter has brand value in the market.

4.0 We have carefully examined the statement of facts, supporting documents filed by the Applicant along with application, submissions/Additional submissions made during personal hearing. The Applicant has stated that they are engaged in the processing and refining of branded edible oils and they are before us seeking ruling on the following question:

“Determination of correct classification of lamp oil.”

As the question is to determine the nature of supply, which is within the ambit of the authority under section 97 (2) (g) of the CGST Act, the same is taken up for decision.

5.0 The short question that arises is the classification of Oil which is marketed by the applicant as Mahara Jyothi (lamp oil).

5.1 Explanation (iii) & (iv) of Notification No. 1/2017-Integrated Tax (Rate), dt. 28-6-2017 provides as follows:-

(iii) ‘‘Tariff item”, “sub-heading” “heading” and “Chapter” shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act, 1975 (51 of1975).

(iv) The rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.

5.2 Chapter 15 of the First Schedule to the Customs Tariff Act, 1975 deals with Animal or vegetable fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes. The relevant portions of the Act is as under:

Chapter 15

“Animal, vegetable or microbial fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes

| Tariff Item | Description of goods |

| 1511 | PALM OIL AND ITS FRACTIONS, WHETHER OR NOT REFINED, BUT NOT CHEMICALLY MODIFIED |

| 1511 10 00 | – Crude oil |

| 1511 90 | – Other : |

| 1511 90 10 | — Refined bleached deodorised palm oil |

| 1511 90 20 | — Refined bleached deodorised palmolein |

| 1511 90 30 | — Refined bleached deodorised palm stearin |

| 1511 90 90 | — Other |

| 1518 | ANIMAL, VEGETABLE OR MICROBIAL FATS AND OILS AND THEIR FRACTIONS, BOILED, OXIDISED, DEHYDRATED, SULPHURISED, BLOWN, POLYMERISED BY HEAT IN VACUUM OR IN INERT GAS OR OTHERWISE CHEMICALLY MODIFIED, EXCLUDING THOSE OF HEADING 1516; INEDIBLE MIXTURES OR PREPARATIONS OF ANIMAL, VEGETABLE OR MICROBIAL FATS OR OILS OR OF FRACTIONS OF DIFFERENT FATS OR OILS OF THIS CHAPTER, NOT ELSEWHERE SPECIFIED OR INCLUDED |

| 1518 00 | Omitted |

|

| — Lin seed oil: |

| 1518 00 11 | —- Edible grade |

| 1518 00 19 | —- Other |

|

| — Castor oil, dehydrated : |

| 1518 00 21 | —- Edible grade |

| 1518 00 29 | —- Other |

|

| — Other Vegetable oil and its fats: |

| 1518 00 31 | —- Edible grade |

| 1518 00 39 | —- Other |

| 1518 00 40 | — Other |

5.3 From the above provisions it is evident that RBD Palmolein Oil is covered under tariff heading 1511 90 20. Further, Chapter Heading 1518 provides for classification of ‘Inedible Mixtures or preparations of vegetable oils or of fractions’.

5.4 Refined Bleached Deodorised (RBD) Palmolein Oil is a fraction of Palm Oil obtained by a process called fractionation. The Applicant has stated that they have proposed to market one of their RBD Palmolein which is of edible grade without changing its basic and essential character as Mahara Jyothi, which is intended to be introduced as lamp oil. Applicant had further stated that the process of manufacture of Mahara Jyothi is the same as the process of manufacture of their edible RBD Palmolein which is branded as ‘‘Roobini”. No additives are added for Mahara Jyothi and the packing of Mahara Jyothi is affixed with FSSAI license number used for Roobini Refined Palmolein as the manufacturing process is same for both the products. Only difference is that Roobini edible RBD Palmolein is marketed as cooking oil while Mahara Jyothi edible RBD Palmolein is marketed as lamp oil. But, in Mahara Jyothi, no perfumes or other additives are added and Mahara Jyothi continues to be edible RBD Palmolein. From the photograph submitted by the applicant, it is observed that one side of pouch of Mahara Jyothi has the words ‘‘Refined Palmolein” and “Edible Vegetable Oil” with the description of contents and FSSAI license number. The other side contains the pictoral representation of Mahara Jyothi along with the package batch number, MRP amount and packed date etc. Hence, from the submissions of the applicant it is evident that Mahara Jyothi is nothing but edible RBD Palmolein. Though the Mahara Jyothi is marketed as lamp oil, classification can be done only as per the contents of the item and not as per the end use, unless it is specifically mentioned so. Therefore, as per the provisions of Chapter 15 of the CTA, RBD Palmolein Oil is covered under tariff heading 1511 90 20.

5.5 We find that in a AAR ruling in the case of M/s Sri Kanyakaparameshwari Oil Mills (AAR KAR ADRG 11/2019 dt. 25.06.2019) it was held that Deepam Oil which was an inedible mixture of Gingelly oil, Palmolein oil and rice bran oil intended to use as lighting lamp for God, was classifiable under Chapter Heading 1518. As indicated in Para 5.4, Chapter Heading 1518 provides for classification of ‘Inedible Mixtures or preparations of vegetable oils or of fractions’. But in the instant case, the Mahara Jyothi oil is neither a mixture of one or more oils nor is it inedible. It is an edible RBD Palmolein and hence, the ruling of AAR in the above cited case is distinguishable.

5.6 In as much as the said Mahara Jyothi oil, as per the submissions of the applicant, is edible and is RBD Palmolein without any additives or mixture of other oils, it is rightly classifiable under 1511 90 20.

6.0 In view of the above, we rule as under:

RULING

The Mahara Jyothi oil, which is an edible RBD Palmolein without any additives or mixture of other oils, is classifiable under 1511 90 20.