Malli Ramalingam Mothilal (Proprietor Of M/S. M.R. Mothilal) vs. Na

(AAR (Authority For Advance Ruling), Tamilnadu)

Mr. Malli Ramalingam Mothilal, Prop-of M/s. M.R.Mothilal (hereinafter called as M/s. M.R. Mothilal or Applicant) doing business at No.2/ 3-A, Saratha Illam, A.A. Road, CMR Road, Munichalai Road, Madurai-625 009 is engaged in the manufacture of Kalava Raksha Sutra (Sacred Thread) in different colours and are selling the same in Kilograms to the Intra-State buyers as well as Inter-State buyers. They are registered under GST vide Registration No. 33AATPM2415J1ZL.

The Applicant has sought advance ruling on the

“Classification of the Commodity ‘Kalava Raksha Sutra (Sacred Thread)’ manufactured and supplied by them”.

The Applicant had submitted the copy of application in Form GST ARA – 01 and also submitted a copy of Challan evidencing payment of application fees of ₹ 5,000/- each under Sub-rule (1) of Rule 104 of CGST Rules 2017 and SGST Rules 2017.

2. The Applicant has stated that they manufacture Kalava raksha sutra; the said commodity falls under S.No. 148 under item IX under the head puja samagiri in Notification No. 02/2017-C.T.(Rate); the said commodity is manufactured using the material like cotton yarn, PP Yarn, art silk yarn etc.; the manufactured product is just like a thread and commonly known as Kalava Raksha sutra. The Applicant has requested to classify the commodity.

3. The Applicant was heard in person. The Applicant stated that they are purchasing Viscose, Polyester, Poly-Propylene yarn & cotton yarn and make it into threads. They stated that they manufacture braided cords by using braiding machine. From dyed PP yarn, dyed cotton, dyed polyester where yarns of each material (8 or 12 or 16 yarns) are braided together. They are cut up to lengths equivalent to various weights 20 to 100 grams. They are then sold by weight to their buyers. They sell by weight to their buyers, who in turn cut it in different sizes and make into Kalava (Raksha Sutra). The Applicant had submitted Purchase invoices, Sales invoices relating to both Intra-State and Inter-State. The Applicant also submitted relevant photographs of the manufacturing process of Kalava (Raksha Sutra) of the product.

4. The submissions made by the Applicant were examined. In the case at hand, the Applicant purchases different types of yarn and make it into threads and sells by weight to the buyers, who cut and make into Kalava (Raksha Sutra) for individual sale. It is seen from the purchase invoices that the yarns purchased are cotton Yarn (HSN Code: 5205), Polyester Yarn (HSN Code: 5402); Viscose Filament Rayon Yarn (HSN 5403). The sale invoice under Product description has given as ‘KALAVA (Raksha sutra)- ‘400X20-1/2PPP Red’; No. % Black-49; Red-6; No.1/2 Lemon Yellow’ sold by Kgs weight. These dyed yarns are put on a braiding machine and multiple yarns (8 or 12 or 16) are twisted or braided together to form the braided yarns of the Applicant. They are cut up to lengths equivalent to various weights of 20 to 100 grams. These are braided yarns of either cotton or polyester, viscose or rayon or polypropylene thread made into skeins and sold as such without being further cut into specific sizes for individual use as Kalva raksha sutra. The items are not by themselves Kalva raksha sutra sold directly to consumers but long lengths of thread of various composition sold in loose rolls to he Applicant’s buyers who need to be further cut to individual sizes to make them Kalava Sutra.

5. From the above, it is seen that the items in question are skeins of thread of various composition i.e. cotton, polyester, viscose filament rayon, polypropylene. The Applicant has sought the classification of the same.

5.1 In terms of explanation (iii) and (iv) to Notification No. 1 /2017 – Central Tax (Rate) dt. 28-06-2017, tariff heading, sub-heading, heading and chapter shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act, 1975 and the rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975, including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall be applied for the interpretation and classification of goods.

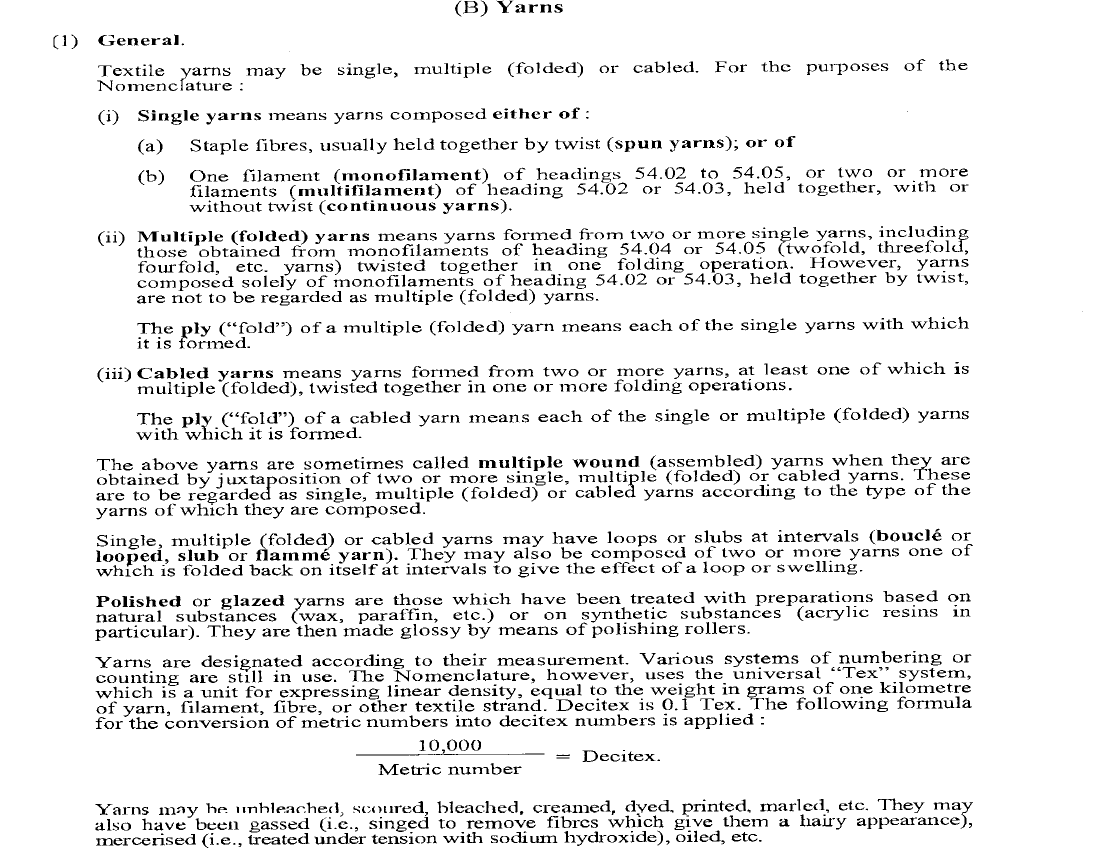

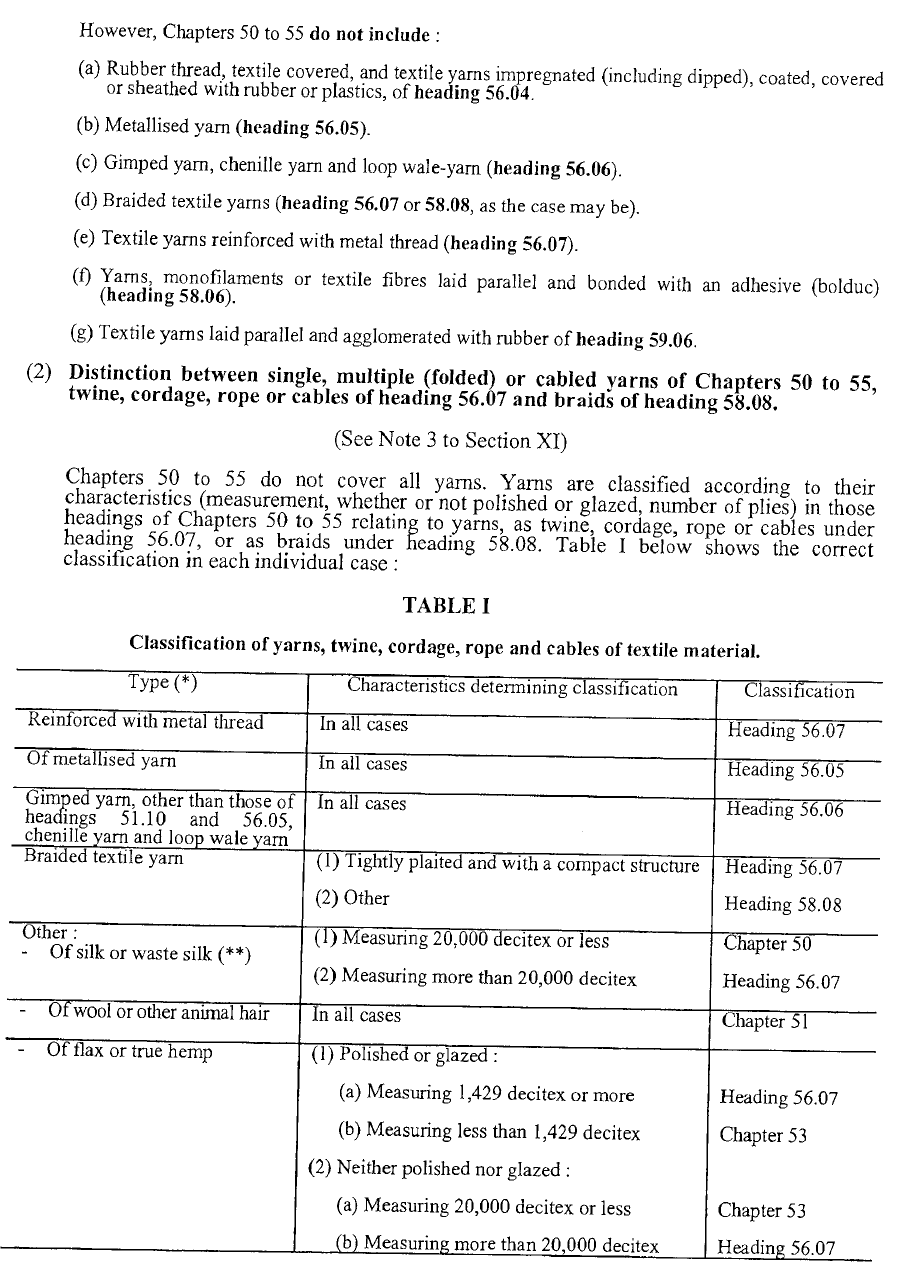

5.2 Section XI of Customs Tariff covers ‘Textile and Textile articles’ of chapter 50 to 63. Section Note (B)(1) and (2) to Section XI covers Yarns.

On a joint reading of the section notes referred to above and applying the same to the case in hand, it is evident that the commodity manufactured by the Applicant is a braided yarn made by a braiding machine which takes in dyed yarn of multiple numbers (8 or 12 or 16). The items are not by themselves Kalva raksha sutra sold directly to consumers but long lengths of thread of various composition sold in loose rolls to the Applicant’s buyers who need to be further cut to individual sizes to make them Kalava Sutra. As per Section Note (B)(1) and (2) to Section XI covering Chapter 50 to 63, braided textile yarn are not included in chapter 50 to 55, but in Chapter Heading 5607, if they are tightly plaited .

Explanatory notes to chapter 5607 states:

This heading covers twine, cordage, ropes and cables, produced by twisting or by plaiting or braiding.

(1) Twine, cordage, ropes and cables, not plaited or braided.

Pats (I) (B) (1) and (2) (particularly the Table) of the General Explanatory Note to Section Xl set out the circumstances in which single, multiple (folded) or cabled yarns are regarded as twine, cordage, ropes or cables of this heading.

Textile yarn reinforced with metal thread is always classified here and differs from metallised yarn of heading 56.05 in that the metal strand is usually thicker and acts as a reinforcing agent only and not for any ornamental purpose.

This group also includes twine, cordage, ropes and cables obtained from fibrillating strip which has been more or less completely split into filaments by twisting.

(2) Plaited or braided twine, cordage, ropes and cables.

These are in all cases classified here regardless of their weight per metre. They are usually tubular braids which are generally made of coarser materials than the braids of heading 58.08. However, the plaited goods of this heading differ from those of heading 58.08 less by the nature of the yarn used than by the fact that they are tightly plaited, with a compact structure, making them suitable for use as twine, cordage, ropes or cables. In addition, they are usually uncoloured.

The most important fibres used in the manufacture of twine, cordage, ropes or cables are hemp, jute, sisal, cotton, coir and synthetic fibres.

Chapter Heading 5607 states:

| 5607 | TWINE , CORDAGE , ROPES AND CABLES , WHETHER OR NOT PLAITED OR BRAIDED AND WHETHER OR NOT IMPREGNATED, COATED , COVERED OR SHEATHED WITH RUBBER OR PLASTICS | |

| – | Of sisal or other textile fibres of the genus Agave : | |

| 56072100 | — | Binder or baler twine |

| 56072900 | — | Other |

| – | Of polyethylene or polypropylene: | |

| 56074100 | — | Binder or baler twine |

| 56074900 | — | Other |

| 560750 | – | Of other synthetic fibres : |

| 56075010 | — | Nylon fish net twine |

| 56075020 | — | Nylon tyre cord |

| 56075030 | — | Viscose tyre cord |

| 56075040 | — | Nylon rope |

| 56075090 | — | Other |

| 560790 | – | Other : |

| 56079010 | — | Coir, cordage and ropes, other than of cotton |

| 56079020 | — | Cordage, cable, ropes and twine, of cotton |

| 56079090 | — | Other |

Accordingly, the commodity manufactured is liable to be classified based on the raw material as braided textile yarn under CTH 5607 i.e. made of polypropylene yarn under 56074900, made of other synthetic yarn under 56075090, made of cotton under 56079090.

6. In light of the above, we rule as under:

RULING

Braided textile yarns supplied by the Applicant made Polypropylene Yarn is classifiable under 56074900, made of Other Synthetic Yarn is classifiable under 56075090, made of Cotton is classifiable under 560790 90.