Raveendra Reddy, Director General Of Anti-profiteering Indirect Taxes & Customs vs. Myk Laticrete India Pvt Ltd

(Naa (National Anti Profiteering Authority), )

The present report dated 26.02.2021 has been received from the Applicant No. 2 i.e., the Director General of Anti-profiteering (DGAP) after a detailed investigation under Rule 129(6) of the CGST Rules, 2017. The brief facts of the present case are that the Applicant No. 1 had filed an application under Rule 128 of the CGST Rules, 2017 and alleged that the Respondent i.e. M/s MYK Laticrete India Pvt. Ltd, had resorted to profiteering in respect of supply of the products manufactured and sold by the Respondent, where the applicable GST rate was @ 18% w.e.f. 01.07.2017 compared to total pre-GST tax rate applicable i.e. Excise duty @12.5% and VAT @ 14.5%. The Applicant No. 1 also alleged that the Respondent had not passed on the benefit of reduction of rate of tax to the consumers by way of commensurate reduction in base price of the products manufactured and sold by him as stipulated in Section 171 of the CGST Act, 2017.

2. In the DGAPs Report dated 26.02.2021, it was inter-alia submitted that:-

(i) On receipt of the reference from the Standing Committee on Anti-profiteering, a Notice under Rule 129 of the Rules was issued by the Director General of Anti-profiteering on 01.07.2020, calling upon the Respondent to reply as to whether he admitted that the benefit of rate reduction and additional ITC available, had not been passed on to the recipient by way of commensurate reduction in price and if so, to suo-moto determine the quantum there of and indicate the same in his reply to the Notice as well as to furnish all documents in support of his reply. Vide the said Notice, the Respondent was also given an opportunity to inspect the non-confidential evidence/information which formed the basis of the said Notice, during the period 13.07.2020 to 15.07.2020. however, the Respondent did not avail of the said opportunity. The Authorised Representative of the Respondent requested to provide a copy of the complaint filed by the Applicant No. 1. However, the same was not provided to the Respondent as details sought were held confidential by the Applicant No. 1.

(ii) Vide letter dated 07.02.2021, the Respondent had submitted that the details being supplied by the Respondent must not be shared with any other party and kept confidential in terms of Rule 130 of the CGST Rules, 2017. The period covered by the current investigation was from b 01.07.2017 to 30.06.2020.

(iii) The statutory time limit to complete the investigation was 02.12.2020, which was extended up to 31.03.2021 by virtue of Notification No. 35/2020-Central Tax dated 03.04.2020, Notification No. 55/2020-Central Tax dated 27.06.2020, Notification No. 65/2020-Central Tax 01.09.2020 and Notification No. 91/2020-Central Tax dated 14.12.2020 issued by Central Government under Section 168A of the CGST Act, 2017, wherein, it was provided that “any time limit for completion or compliance of any action, by any authority, had been specified in, or prescribed or notified under section 171 of the said Act. Which falls during the period from the 20th day of March, 2020 to the 30th day of March, 2021, and where completion or compliance of such action had not been made within such time, then, the time-limit for completion or compliance of such action, shall be extended up to the 31st day of March, 2021.

(iv) In response to the Notice dated 01.07.2020 and various reminders and summons, the Respondent replied vide letters/e-mails dated 07.08.2020, 11.08.2020, 07.09.2020, 14.10.2020, 27.11.2020, 23.12.2020, 15.01.2021 and 16.02.202. The reply of the Respondent was summed up as follows:-

(a) That he was engaged in manufacturing of various products related to tile and stone installation and maintance industry, which included a vide range of adhesives, grouts, waterproofing, stone care products and wall putty, Manufacturing facilities of the Respondent were located in Telangana (2), Tamil Nadu (1) and Rajasthan (1). These products were sold by the Respondent through various channels including dealers and distributions. Additionally, the Respondent was also engaged in trading of some goods, the portion of which was very small as compared to manufacturing activity.

(b) That a list of products dealt by the Respondent pre-GST and post-GST as bifurcated into manufacturing and trading was tabulated in Table-1 below:

Table-1

| Particulars | Reference | Manufactured Goods | Traded Goods | Total | Remarks |

| Total no. of products dealt by the Respondent in pre-GST era | (A) | 582 | 18 | 600 |

|

| Products included in (A) but not sold in pre-GST era | (B) | 68 | 3 | 71 | Out of Anti-profiteering purview since these products were not sold during the period April-June 2017 |

| Products discontinued in GST i.e. w.e.f. 01 July 2017 | (C) | 11 | – | 11 | Out of Anti-profiteering purview since these products were sold in post-GST regime. |

| Products in GST era in which Respondent was dealing which existed in pre-GST era also | (D=A-B-C) | 503 | 15 | 518 | In SKUs terms, there were total 86 SKUs |

| Products launched after 01 July 2017 and dealt by Respondent in post-GST in addition to products listed in (D) | (E) | 119 | 5 | 124 | Out of Anti-profiteering purview since these products were not sold in pre-GST regime. |

(c) That on the manufactured goods, the ITC available to the Respondent primarily was of Excise Duty, VAT and Service Tax in the pre-GST era, and the same was available in the post-GST period also. However, on traded goods CENVAT credit of Excise Duty was not allowed in pre-GST era.

(d) That the details of tax rate applicable on 518 products was as tabulated in Table-2 below:

Table-2

| Particulars | Manufactured Goods | Traded Goods | Total |

| Products in GST era in which Respondent was dealing which existed in pre-GST era also | 503 | 15 | 518 |

| Products whose rate was 28% w.e.f. 01 July 2017 | 490 | 1 | 491 |

| Products whose rate was 18% w.e.f. 01 July 2017 | 13 | 14 | 27 |

(e) That the Respondent offered two type of discounts to his dealers/ distributors (1) Mutually agreed discount. Which was mentioned on the invoice itself and (2) Post sale discount by way of Credit Note.

(f) That in pre-GST era, on manufactured goods, Excise Duty @ 12.5% on a portion MRP Was levied VAT at applicable rate in the state (mostly 14.5%) was charged by the manufacturer. In the post-GST period, out of a total 503 products manufactured by the Respondent the applicable GST rate on 490 products was 28% w.e.f. 01.07.2017 and on remaining 13 products, GST rate was reduced to 18%.

(g) That during pre-GST period, the rate on trading goods, i.e., VAT @ 14.5% was levied, whereas in post-GST regime, the tax rate increased to 18%/ 28’%. Thus, the rate of tax applicable on traded goods increased w.e.f. 01.07.2017.

(h) That the Respondent requested to compute the profiteering on “rate price” rather than discounted price, as there were different discounts to the different distributors. which were offered by the Respondent and thus, these cannot be compared pre and post-GST for ascertaining profiteering. The Respondent relied upon the decision of this Authority itself in the matter Kerala State Screening Committee on Anti-profiteering Vs. Asian Paints Ltd.

(v) The DGAP has also informed that vide the aforementioned letters/e-mails, the Respondent submitted the following documents/information.

(a) List of GSTIN registrations in 15 States and ISD certificate.

(b) Invoice-wise details of outward supplies of the 490 manufactured products for the period 01.04.2017 to 30.09.2017, on which GST @ 28% was applicable from 01 July 2017 (on sample basis).

(c) Total Invoice-wise details of outward supplies of the 13 manufactured products for the period 01.04.2017 to 30.06.2020, on which GST @ 18% was applicable from 01 July 2017.

(d) Purchase details of traded goods on which excise duty cost for the period April, 2016 to June, 2017 and Invoice wise details of outward taxable supplies of such traded goods for the period from 01.07.2017 to 30.06.2020.

(e) Invoice-wise details of outward supplies of the traded goods for the period 01.06.2017 to 30.06.2017, on which GST @28%/18% was applicable from 01 July 2017 (on sample basis)

(f) Financial Statements for the period 2017-18 and 2018-19.

(g) Sample copies of invoices issued during the period

(h) Rate List of 86 SKUs’ (518 products) maintained by the Respondent (for Telangana manufacturing Plant) for the period pre and post 30.06.2017.

(vi) The DGAP has also stated that the Respondent had Submitted that the details being supplied by the Respondent i.e., rate list, invoice wise Sales data etc. must not be shared with any other party and kept confidential in terms of Rule 130 of the CGST Rules, 2017, since they were related to crucial information about the Respondent’s business operations and might affect his position/standing in the Market, if such data was shared with any other party/person.

3. The DGAP has further stated that:-

(i) The reference received from the Standing Committee on Anti-profiteering, various Replies of the Respondent/Applicant No. 1 and the document/evidence on record Were scrutinised by him. The main issues for determination were:

(a) Whether the rate of GST on the impacted products supplied by the Respondent was reduced w.e.f. 01.07.2017.

(b) Whether there was any additional benefit of ITC that was available to the Respondent on account of introduction of GST, and if so, whether Respondent passed on the benefit of such reduction in GST rate or availability of ITS to the recipients, in terms of Section 171 of the CGST Act, 2017.

(ii) As regards the issue of reduction in the rate of GST, the DGAP submitted that the Central Government, on the recommendation of the GST Council, had levied 28% tax on the HSN 32141000 vide S. No. 24 of Schedule-IV to Notification No. 01/2017-Central Tax (Rate) dated 28.06.2017 and 18% GST on the HSN 38244090 vide S.No. 97 of Schedule-III to Notification No. 01/2017-Central Tax (Rate) dated 28.06.2017. Further, for the goods traded by the Respondent under HSN 39259090 vide S.No. 110 of Schedule III to Notification No. 01/2017-Central Tax (Rate) dated 28.06.2017 GST applicable was 18%.

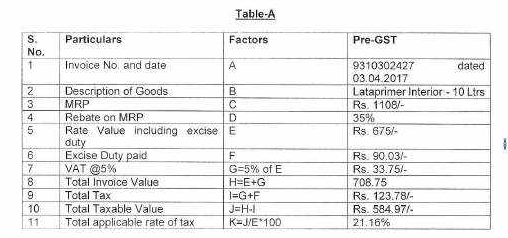

(iii) The Respondent was engaged in manufacturing as well as trading activities. In the pre-GST regime, on the sale of manufactured goods, Excise Duty @12.5% on a portion of MRP was levied and VAT at applicable rate in the States, was levied. The appliable tax rate was illustrated in Table-A below:

Thus, from the above table, the DGAP submitted that the rate of tax increased from 21.16% to 28% post GST. Thus, the products which fall under this category, where the rate of tax increased from 21.16% to 28% post-GST implementation, were out of the purview of investigation.

The Respondent had submitted, sales data of such 18 other products (on sample basis) to the DGAP, where the rate of tax applicable in pre-GST era ranged from 18% to 25% (depending on the VAT rate applicable and MRP of the products), that increased to 28% with introduction of GST. Thus, provisions of Section 171 were not applicable on sale of such goods.

From the outward supply of the goods, as submitted by the Respondent, the DGAP Submitted that there were 490 such products which were dealt by the Respondent in the post-GST era.

(iv) The Respondent’s reliance on the judgement of the Authority in the matter of Kerala State Screening Committee on Anti-profiteering vs. Asian Paints Ltd, to Consider rate price rather than transaction value for Computation of profiteering, Was not correct, as the transaction value was the base value (taxable value) upon which all the taxes was levied and paid to the Government. Therefore, to pass on the benefit of any rate reduction in terms of Section 171 of the CGST Act, 2017, the Supplier had to reduce the base value commensurately. It was also mentioned by the DGAP that the facts and circumstances of one case might be different from others, and were thus, incomparable.

(v) As regards the profiteering on account of reduction in rate, for the manufactured goods where cumulative tax rate was reduced to 18% on account of introduction of GST, the Respondent was simply required to keep the same base prices (excluding pre-GST taxes i.e. VAT and Central Excies) and charge the revised rate of tax i.e. GST. On going through the sales data submitted by the Respondent, the DGAP also noted that the Respondent had not maintained the same base price, and had thus indulged in profiteering. In order to compute the profiteering, DGAP had considered the average base price for the period from 01.04.2017 to 30.06.2017 and compared the same with actual base price for the post-GST period. The methodology adopted by the DGAP was explained with the help of an illustration. In the case of a particular products i.e., “L1776-Grout Admix Plus-5 Ltrs”, sold in Telangana State during the period 01.04.2017 to 30.06.2017 (pre-GST period) was taken and the average base price (after discount and before pre-GST taxes) was obtained on dividing the total taxable value (Excluding taxes) by total quantity of this item sold during this period. The average base price of this item was then compared to the actual selling price of the same item sold during post-GST period i.e., during 01.07.2017 to 30.06.2020, as illustrated in the Table-‘B’ below:

The DGAP claimed that from the above table, it was clear that the Respondent did not reduce the selling price commensurately of the “L1776- Grout Admix Plus – 5 Ltrs”. By keeping the same base price and charging the reduced rate of tax, when the GST rate was introduced vide Notification No. 1/2017 Central tax (Rate) dated 28.06.2017 w.e.f. 01.07.2017 and hence profiteering an amount of Rs.26,739/- on a particular invoice during the period 01.07.2017 to 30.06.2020 and thus the benefit of reduction in GST rate was not passed on to the recipient by way of commensurate reduction in the price, terms of Section 171 of the CSGT Act, 2017. On the basis of above calculation as illustrated in table-‘B’ above, profiteering in case of all impacted goods of the Respondent had also been arrived in similar way. The Respondent had also submitted that he sold the goods to his dealers located in each state who in turn sell goods to end consumers and the price for dealer in one state might differ from the price of another dealer in another state. Therefore, the profiteering had been computed by considering each state as a separated category. Following the similar methodology, the total profiteering amount on account of reduction in rate of tax, comes out of Rs.1,15,96,899/-.

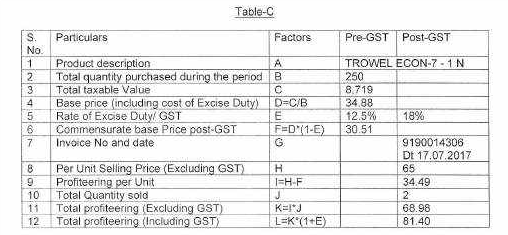

(vi) Apart from the manufacturing activity, the Respondent was also engaged in trading activity. It was pertinent to note that during the pre-GST period, the Respondent was not eligible to take the credit of the Central Excise Duty paid on the traded goods and the same was embedded in the cost. But, in the post-GST period, the Respondent was eligible to take credit of the GST paid on the traded goods. Thus, the Respondent received the benefit of the ITS in the post GST period. This additional benefit of ITC also needed to be passed on by the Respondent by way of commensurate reduction in prices. The Respondent had informed the DGAP that generally, he was engaed in the trading of 13 kinds of items. But, during the period April 2016 to June 2017, he dealt with one item, namely ‘TRAOWEL ECON-7-1 N’. From the data submitted by the Respondent, the DGAP claimed that he had not reduced the base price commensurately. Thus, the Respondent had not passed on the benefit of ITC to the recipient, in terms of Section 171 of the CGST Act, 2017. To arrive at the amount of profiteering, the average base price of this item during pre-GST period (from 0.4.2016 to 30.6.2017) was compared with the actual selling price of the same item sold during post-GST period (from 01.07.2017 to 30.06.2017) by the DGAP. The illustration was shown in the Table-‘C’ below:

Thus, the DGAP claimed that for this particular invoice, on account of additional benefit of ITC, the Respondent profiteering to the tune of Rs.81.40/-. Following this methodology, the DGAP calculated the total profiteering amount arrived at on account of benefit of additional ITC, that worked out to Rs.2,37,088/-.

(vii) The issue that remained was the determination and quantification of profiteering by the Respondent for failing to pass on the benefit of the additional ITC and reduction in the rate of GST on the goods supplied by the Respondent to his recipients, in terms of Section 171 of the CGST Act, 2017. The DGAP concluded that on the basis of aforesaid pre-GST and Post-GST rates and the invoice wise/item wise details of outward taxable supplied (other than zero rated, nil rated and exempted supplies) of the impacted products during the period 01.07.2017 to 30.06.2020 as furnished by the Respondent the amount of net higher sales realization due to increase in the base prices of the impacted goods, despite the reduction in the GST rate/availability of ITF the profiteered amount came to Rs. 1,18,33,987/- (Rs. 1,15,96,899/- for the manufactured goods and Rs. 2,37,088/- for the traded goods). The details of the computation are also submitted by the DGAP. The said profiteered amount had been arrived at by comparing the average of the base prices of the goods sold during the period 014.04.2047 to 30.06.2017 with the actual invoice-wise base prices of such goods sold during the period 01.07.2017 to 30.06.2020. The excess GST so collected from the recipients, was also included in the aforesaid profiteered amount as the excess price collected from the recipients also included the GST charged on the increased base prices.

(viii) As per the outward sales data submitted by the Respondent, the DGAP claimed that all the transactions of the Respondent were B2B customers. Therefore, each of the customers was identifiable. Therefore, the profiteered amount was required to be returned to all such recipients.

(ix) In this case, the allegation of profiteering against the Respondent that he had not passed on the benefit of reduction of rate of tax and additional ITC available, to the consumers by way of commensurate reduction in the prices of the products manufactured and sold by him was correct as the Respondent had increased the base prices (excluding tax) of the goods manufactured/traded and sold by him although there was a reduction in the rate of tax after the introduction of GST w.e.f. 01.07.2017 and benefit of additional ITC available to him. From the details furnished as mentioned above, the DGAP claimed that the base prices of the goods manufactured and sold/traded by the Respondent were increased after 01.07.2017. Thus, by increasing the base prices of goods consequent to the introduction of GST, the commensurate benefit of implementation of GST was not passed on to the recipients. The total amount of profiteering covering the period 01.07.2017 to 30.06.2020 was Rs. 1,18,33,987/- (Rs. 1,15,96,899/- for the manufactured goods and Rs. 2,37,086/- for the traded goods).

(x) The DGAP has reported that as aforementioned, the present investigation computed the profiteering covering the period 01.07.2017 to 30.03.2020. Profiteering, if any, for the period post 30.06.2020 had not been examined.

(xi) The DGAP in his report dated 26.02.2021 concluded that, in view of the aforementioned findings, Section 171(1) of the CGST Act, 2017, requiring that “any reduction in rate of tax on any supply of goods or services or the benefit of ITC shall be passed on to the recipient by way of commensurate reduction in prices had been contravened by the Respondent “M/s. MYK Laticrete” amounting to Rs. 1,18,33,987/- (Rs. One Crore Eighteen Lacs Thirty Three Thousand Nine Hundred and Eighty Sevgen only in the present case.

4. The above investigation Report was received by this Authority from the DGAP on 02.03.2021 and was considered in its sitting held on 04.03.2021 and Notice dated 09.03.2021 was issued to the Respondent and the Applicant No. 1 directing them to explain why the Report dated 26.02.2021 furnished by the DGAP should not be accepted and liability of the Respondent should not be fixed for violating the provisions of Section 171 of the CGST Act, 2017.

5. In response to the above said Notice, the Respondent has filed his submissions vide letter dated 24.03.2021, received on 25.03.2021, that is submitted as follows :-

(a) That as per the nature of commodity being dealt by the Respondent, prices/rates of the goods sold by the Respondent were driven highly by market forces and were majorly dependent upon demand-supply factor. Thus, cost of the product or tax rate applicable thereon was not a major factor while determining prices of his product which was highly market drive. However, the Respondent submitted that he did not accept the findings of the DGAP made vide this Report dated 26 February 2021, however, being an honest and responsible taxpayer & law compliant and also to avoid any litigation and to buy peace of mind, the Respondent proposed to return the amount alleged to be profiteered to recipients, as might be finally determined by this Authority vide its Final Order.

(b) That the findings of the DGAP vide his Report dated 26.02.2021 were not tenable. ‘Rate price’ must be considered wile computing profiteering instead of transaction value as alleged in DGAP’s report dated 26 February, 2021. The Respondent further submitted the DGAP, vide Para 13 of his Investigation & Findings in the Report dated 26.02.2021, had rejected Respondent’s submissions to adopt rate price as correct basis/comparison to compute profiteering of the Respondent. In this regard, he submitted that there were following rates of commodity sold by the Respondent :-

- MRP say Rs. 1,000/- which was maximum retail price of commodity, required to be declared as per the relevant Act and above which said commodity could not be sold.

- Rate price say Rs. 800/- which was the actual price on which goods were sold by the Respondent to his customers;

- “Transaction Value, after deducting Discount” given to recipient which was shown in the invoice itself, say Rs. Rs. 600 (Rs. 800 or Rate price less discount Rs. 200); and

- Net effective sale price, after deducting Discount given to the recipient post sale in the form of issuance of credit note(s), say Rs. 550 (Rs. 600 transaction value less Rs. 50 post sale discount by way of Credit note).

- The value of this discount given to dealer/distributor and mentioned in the invoice itself, varied from transaction to transaction and was a mutually agreed discount which was based on several factors, like quantity of product sold, distributor/dealer to whom product was sold area in which such product was sold, etc.

(c) That the DGAP had computed profiteering on Transaction Value, i.e. a value derived after deducting discount given to the recipient at the time of sale and mentioned in the invoice from the ‘rate price’. Whereas, the correct basis of comparison for base price pre-GST and post-GST should be ‘rate price’ rather than transaction value as adopted by the DGAP since rate price was a uniform price applicable to all the recipients as made applicable by the Respondent. Whereas; transaction value was the value which was highly variable since it was computed after deducting discount value which depends on various factors, like customer to whom goods were sold, quantity of goods sold, area in which goods were being sold, etc.

(d) That adopting ‘transaction value was not the correct basis of comparison since it was not a uniform price rater a variable price based on various factors and adopting such a price as rate for comparison would lead to computing profiteering based on discounts offered by the Respondent Pre-GST and post-GST regime. In this regard, the Respondent has placed reliance on this Authority’s decision in the matter of Kerala State Screening Committee on Anti-Profiteering v. Asian Paints Ltd. cited in MANU/NT/0027/2018 wherein this Authority adopted the ‘rate-price’ (before discount price) for comparison and computing profiteering, if any.

(e) That Profiteering had also been computed for excess GST charged by the Respondent and deposited with Government exchequer. The Respondent has claimed that the DGAP vide Para 16 of his Re.02.2021 had observed that “the excess GST so collected from the recipients, was also included in the aforesaid profiteering amount as the excess price collected from the recipient also included the GST charged on the increased base price”. Accordingly, whatever profiteering has been computed by the DGAP had been increased by the applicable GST rate to computer profiteering on account of excess GST charged by the Respondent from customers. In this regard, the Respondent submitted that whatever GST had been charged in excess by him from his customers, as alleged to be recovered as amount of profiteering, had been duly deposited by the Respondent with Government treasury on regular intervals and was not retained by the Respondent. Therefore, such amount, which represents GST portion should not be alleged to be profiteered by the Respondent and ordered to be recovered, as such amount was already deposited with Government treasury. The Respondent further stated that, even if, amount of excess GST charged by him and deposited with Government exchequer had to be regarded as amount of profiteering by the Respondent and recovered in pursuance thereof, the claimed that refund to that extent, which represents GST portion should be allowed to the Respondent by way of express mention in this Authority’s final order.

(f) That the penalty proposed to be levied under sub-section (3A) of Section 171 of the Act was introduced inserted by the Finance (No. 2) Act, 2019 w.e.f. 01 January, 2020 and reads as-

“(3A) Where the Authority referred to in sub-section (2) after holding examination as required under the said sub-section comes to the conclusion that any registered person had profiteered under sub-section (1), such person shall be liable to pay penalty equivalent to ten per cent of the amount so profiteered.

Provided that no penalty shall be leviable if the profiteered amount was deposited within thirty days of the date of passing of the order by the Authority.

Explanation For the purposes of this section, the expression “profiteered” shall mean the amount determined on account of not passing the benefit of reduction in rate of tax on supply of goods or services or both or the benefit of ITC to the recipient by way of commensurate reduction in the price of the goods or services or bothg.”

The Respondent further claimed that when a sub-section containing penalty clause had been inserted in the Act w.e.f. 01.01.2020 only, question of levy of penalty for the profiteering prior to such date, if any, does not arise. Thus, he submitted that no penalty must be levied on profiteering for the period 01 July 2017 to 31 December 2019.

(g) That to gain peace of mind and to avoid litigation, the Respondent had agree to make the payment of alleged profiteered amount as might be determined by this Authority vide its Final Order, the Respondent wished not to exercise his option of personal hearing

6. The Respondent’s submissions dated 24.03.2021 were forwarded to the DGAP to file his clarifications under Rule 133(2A) of the CGST Rules, 2017. The DGAP made his Clarifications dated 11.06.2021 which are summarized as follow :-

(a) That the transaction value was the base value (taxable value) upon which all the taxes were levied and paid to the Government. Therefore, to pass on the benefit of any rate reduction in terms of Section 171 of the CGST Act, 2017, the Supplier had to reduced the base value commensurately.

Also, the Respondent’s reliance on NAA’s decision in the matter of Kerala State Screening Committee on Anti-profiteering vs. Asian Paints Ltd. was not correct, as the facts and circumstances of this case were different from the case quoted by the Respondent and were thus, incorporable.

(b) That Profiteering had also been computed for excess GST charged by the Respondent and deposited with Government exchequer. The excess GST so collected from the recipients, was also included in the aforesaid profiteered amount as the excess price collected from the recipients also includes the GST charged on the increased base price.

Further, it was submitted that due to increase in base price, the customer had to bear not only the increased base price but also the GST levied on such increased base price. Hence, the same was incorporated by the DGAP for the purpose of calculation of profiteering amount. This methodology adopted by DGAP was consistent & uniform in all his reports involving allegation of profiteering in similar cases and had been upheld by the NAA. The Respondent had collected profiteered amount in the form of excess price and GST on it. As the additional GST amount was a part of profiteered amount, it could not be removed. Therefore, the contention of the Respondent that the GST portion should not be alleged to the profiteered by the Respondent was incorrect.

7. The above clarifications of the DGAP were supplied to the Respondent to file his rejoinder. Consequently, the Respondent filed his rejoinder dated 14.07.2021 which is summarized as follow :-

(a) That the Respondent, being honest tax payer and to avoid litigation and peace of mind, undertook to return the amount alleged to be profiteered to recipients, as may be finally determined by this Authority vide its Final Order. The Respondent had no further comment or clarification.

(b) That “Rate Price” must be considered for computing profiteering instead of “Transaction Value”. The Respondent further claimed that the Rate Price was same for transactions whereas Transaction value was different for each transaction and was mutually agreed discount which was based on several factors, like quantity of product sold dealer/distributor to whom product sold, etc. The Respondent has stated that in present matter, the DGAP had computed profiteering on Transaction value whereas correct basis of calculating profiteering was on price. The Respondent did not have any further comment or clarification on same issue.

(c) That Profiteering had also been computed for excess GST charged by Respondent and deposited with Government Exchequer. The Respondent submitted that the GST collected on alleged increased base price had already been deposited with Government Exchequer periodically. However, recovering the same from Respondent would be unfair as this would lead double payment of GST to the Government Exchequer as well as returning to the customer. He further claimed that even if amount of excess GST charged by Respondent had to be regarded as amount of profiteering and recovered pursuance thereof, he submitted that refund to the extent which represents GST portion should be allowed to the Respondent by way express mention in the Authority’s Final Order.

8. Further proceedings in the matter would not be completed by this Authority due to lack of required quorum of Members in the Authority during the period from 29.04.2021 till 23.02.2022, and the minimum quorum was restored only w.e.f. 23.02.2022 and hence, the matter was taken up for proceedings vide Order dated 23.03.2022 and the Respondent and the Applicant No. 1 were granted hearing through video conferencing on 23.03.2022.

9. The Personal Hearing in the matter was scheduled to be held on 23.03.2022. However, the Respondent vide his submissions dated 10.03.2022 had submitted that he did not wish to exercise the option of Personal Hearing since he had already made his submissions and further re-iterated his previous submissions. Consequently, hearing was closed vide Order dated 23.03.2022

10. We have carefully considered the Report filed by the DGAP, all the submissions and the documents placed on record and the arguments advanced by the Respondent. It is clear from the plain reading of Section 171(1) of the CGST Act, 2017, that it deals with two situations one related to the passing on the benefit of reduction in the rate of tax and the second pertaining to the passing on the benefit of ITC. As regards the issue of reduction in the rate of GST. It is pertinent to mention that the Central Government, on the recommendation of the GST Council, had levied 28% tax on the HSN 32141000 vide S. No. 24 of Schedule IV to the Notification No. 01/2017-Central Tax (Rate) dated 28-06-2017 and 18% GST on the HSN 38244090 vide S. No. 97 of the Schedule III to the above mentioned Notification. Further, for the goods traded by the Respondent, under HSN 39259090 vide S.No. 110 of the Schedule III to the same Notification. GST applicable was 18% Now, the issues to be decided by the Authority are as under :-

(a) Whether there was any violation of the provisions of Section 171 of the CGST Act, 1017 in this case?

(b) If yes, them what was the quantum of profiteering ?

11. Section 171 of the CGST Act provides as under :-

(1) “Any reduction in rate of tax on any supply of goods or services or the benefit of ITC shall be passed on to the recipient by way of commensurate reduction in prices.”

Section 171(1) of CGST Act, 2017 provides that any reduction in the rate of tax on any supply of goods or services or benefit of input tax credit should be passed on to the recipient by way of commensurate reduction in prices. This Authority constituted under Section 171(2) of the said Act is mandated to examine whether input tax credit availed by any registered person or the reduction in the tax rate have actually resulted in the commensurate reduction in the prices of goods or services or both supplied by him. Rule 127 of the CGST Rules, 2017 empowers the Authority to determine as to whether any reduction in the rate of tax on any supply of goods or services or benefit of input tax credit has been passed on to the recipient by way of commensurate reduction in prices; and to identify the registered person who as not passed on the benefit of reduction in the tax rate or the benefit of the input tax credit to the recipient and to order, inter-alia, reduction in the prices or return to the recipient of an amount equivalent to the amount not passed on by way of commensurate reduction in the prices along with interest.

12. From the Table-A on pre-page, it is gathered that the rate of tax had increased from 21.16% to 28% post-GST in respect of some goods. There were such 491 other products where the rate of tax applicable in pre-GST era ranged from 18% to 25% that increased to 28% with introduction of GST. In respect of 27 products manufactured or traded by the Respondent, the effective GST rate was 18%.

13. Further, the Authority finds that ass per the DGAP’s Report, in pre-GST era, there were 490 such manufactured products on which the rate of consolidated tax (i.e. CENVAT/Central Excise + VAT) applicable was 18% to 25% Ad-valorem i.e. less than 28% and the applicable rate of tax increased to 28% Ad-valorem with introduction of GST. Thus, the provisions of Section 171 of the CGST Act, 2017 are not applicable on supply of such goods. Further, there was reduction in the rate of tax applicable on only 13 manufactured goods and 14 traded goods in the GST-regime as per the DGAP’s Report and its Annexures (i.e. in comparison to the consolidated tax rate of tax i.e. CENVAT/Central Excise + VAT applicable in pre-GST regime). It is also noted that the Respondent had not dealt in 13 of such 14 traded goods on which the rate of tax was decreased in post-GST regime. Hence, the DGAP’s has calculated profiteering in respect of 13 manufactured goods and 01 traded goods (on which rate of tax was decreased with the introduction of GST) in which the Respondent has dealt post-GST.

14. The Authority finds that, the Respondent’s contention to consider rate price rather than transaction value for computation of profiteering is not sustainable as the transaction value is the base value (taxable value) upon which all the taxes are levied and paid to the Government. Therefore, to pass on the benefit of any rate reduction in terms of Section 171 of the CGST Act, 2017, the Supplier has to reduce the base value commensurately.

15. The Respondent has contended that profiteering has also been computed for excess GST charged by him and the same has been deposited with the Government Exchequer. In this regard. the Authority finds that, due to increase in base price, the customer had to bear not only the increased base price but also the GST levied on such excess valve Such amount needs to be included while determining the profiteered amount The Authority finds that, this methodology adopted by the DGAP has been consistent and uniform in all investigations in similar cases. The Respondent has collected the additional GST amount in the form of excess price and GST on it. As the additional GST amount is a part of the profiteered amount, the contention raised by the Respondent in this regard is not tenable.

16. The Respondent has also contended that sub-section containing penalty was inserted in the Act w.e.f. 01.01.2020, hence no penalty should be levied on the profiteering for the period from 01.07.2019 to 31.12.2019. The Authority finds that, the period of investigation is from 01.07.2017 to 30.06.2020 and the clause for penalty was already inserted well before the date of completion of the present investigation Hence, it is evident from the above narration of facts that Respondent has denied the benefit of tax reduction to the customers in contravention of the provisions of Section 171(1) of the CGST Act, 2017 and he has thus committed an offence under Section 171(3A) of the above Act and therefore, he is liable for imposition of penalty under the provisions of the above Section with effect from 01.01.2020 onwards for the amount profiteered. These provisions came into effect from 01.01 2020 i.e. penalty equivalent to ten per cent of the profiteered amount will be imposed upon him for the amount profiteered after 01.01.2020. However, no penalty shall be leviable if the profiteered amount is deposited within thirty days of the date of passing of the order by the Authority.

17. The Respondent has not raised any other objection to the quantification of profiteered amount of Rs. 1,18,33,987/- (including the goods traded) calculated in the DGAP Report dated 26.02.20020, a copy of which was provided to them. Further, the Respondent vide his submissions dated 14.07.2022 has agreed to return the profiteered amount to the recipients as finalized by the Authority in its Final Order.

18. For the reasons mentioned hereinabove and in the given facts and circumstances and also stated position of law, we find no reasons to differ from the Report of the DGAP and we therefore agree with the findings of the DGAP that the provisions of Section 171 of the CGST Act, 2017 have been contravened in this case and the Authority determine the profiteered amount at Rs. 1,18,33,987 (Rs. 1,15,96,899/- for the manufactured goods and Rs. 2,37,088/- for the traded goods) under the provision of Rule 133(1) of the CGST Rules.

19. Based on the above facts, the profiteered amount is determined as Rs. 1,18,33,987/-. Accordingly, the Respondent is directed to reduce his prices commensurately in terms of Rule 133(3)(a) of the CGST Rules, 2017. As per the outward sales data submitted by the Respondent, it is gathered that all the transactions of the Respondent are B2B customers. Therefore, each of the customer is identifiable. Hence, we order that the profiteered amount of Rs. 1,18,33,987/- shall be passed on/refunded along with interest @ 18% (from the date of receipt of the profiteered amount by the Respondent up till the date of passing on/refund of such profiteered amount to the recipients) by the Respondent as per Annexure-A and B to this Order within a period 3 months from the date of this order.

20. The concerned jurisdictional CGST/SGST Commissioner is directed to ensure compliance of this Order. It may be ensured that the benefit of rate reduction and ITC has been passed on to each recipient as per this Order along with interest @ 18% as prescribed under Rule 133(3)(b) of the CGST Rules, 2017. In this regard an advertisement of appropriate size to be visible to the public may also be published in minimum of two local Newspapers/vernacular press in Hindi/English/local language with the details i.e. Name of the Respondent-Ms. MYK Laticrete and amount of profiteering so that the concerned recipients can claim the benefit of ITC, if not passed on Recipients may also be informed that the detailed NAA Order is available on this Authority’s website www.naa.gov.in. Contract details of concerned Jurisdictional CGST/SGST Commissioner may also be advertised through the said advertisement.

21. The concerned jurisdictional CGST/SGST Commissioners shall submit a Report regarding compliance of this Order to the Authority and the DGAP within a period of 4 months from the date of receipt of this Order.

22. The Hon’ble Supreme Court in Miscellaneous Application No. 21 of 2022 in MA 665 of 2021 in Suo Motu Writ Petition (C) No. 03/2020 vide its Order dated 10.01.2022 has directed that :-

“I. The order dated 23.03.2020 is restored and in continuation of the subsequent order dated 08.03.2021, 27.04.2021 and 23.09.2021, it is directed that the period from 15.03.2020 till 28.02.2022 shall stand excluded for the purposes of limitation as may be prescribed under any general or special laws in respect of all judicial or quasi-judicial proceedings.

II. Consequently, the balance period of limitation remaining as on 03.10.2021, if any shall become available with effect from 01.03.2022.

III. In cases where the limitation would have expired during the period between 15.03.2020 till 28.02.2022, notwithstanding the actual balance period of limitation remaining, all persons shall have a limitation period of 90 days from 01.03.2022. In the event the actual balance period of limitation remaining, with effect from 01.03.2022 is greater than 90 days, the longer period shall apply.

IV. It is further clarified that the period from 15.03.2020 till 28.02.2022 shall also stand excluded in computing the periods prescribed under Section 23(4) and 29A of the Arbitration and Conciliation Act, 1996. Section 12A of the Commercial Courts Act, 2015 and provisos (b) and (c) of Section 138 of the Negotiable Instruments Act, 1881 and any other laws, which prescribe period(s) of limitation for instituting proceedings, outer limits (within which the court or tribunal can condone delay) and termination of proceedings.”

Hence, this Order passed today is within the limitation prescribed by Rule 133(1) of the CGST Rules, 2017.

23 A copy of this order be supplied. free of cost, to the Applicants, Respondent and CGST/SGST Commissioners Telangana for necessary action. File of the case be consigned after completion.

FULL FOR JUDGEMENT PLEASE CLICK ON PDF