How To Generate E-invoices In Bulk

Invoicing is a crucial aspect of any business, and with the implementation of GST (Goods and Services Tax), it has become even more critical. Under the GST regime, an invoice is a document that provides the details of the goods or services provided by a registered supplier to their customer. It is an essential document for maintaining proper records of transactions and claiming input tax credit. An invoice under GST has specific features to be kept in mind while raising one. There are eligibility criteria a business has to fulfill for them to raise an invoice under GST.

BOOK A FREE DEMO

What is a GST invoice?

A GST invoice is a document issued by GST registered businesses to their customers at the time of supplying goods and services to them. It is a critical document that serves as a proof of the transaction. It is also required by the purchasers (in case they are a GST registered business) to claim the correct Input Tax Credit they are eligible to claim.

Issuing GST invoices for each transaction is a key step in ensuring GST Compliance. Using Busy’s GST Billing Solution will make the entire process simple for your business.

Who is eligible to raise a GST invoice?

Any business in India that is registered under GST is required by law to provide GST compliant invoices whenever they supply taxable goods and services to their customers. This law is applicable to both B2B (Business to Business) as well as B2C (Business to Consumer) businesses.

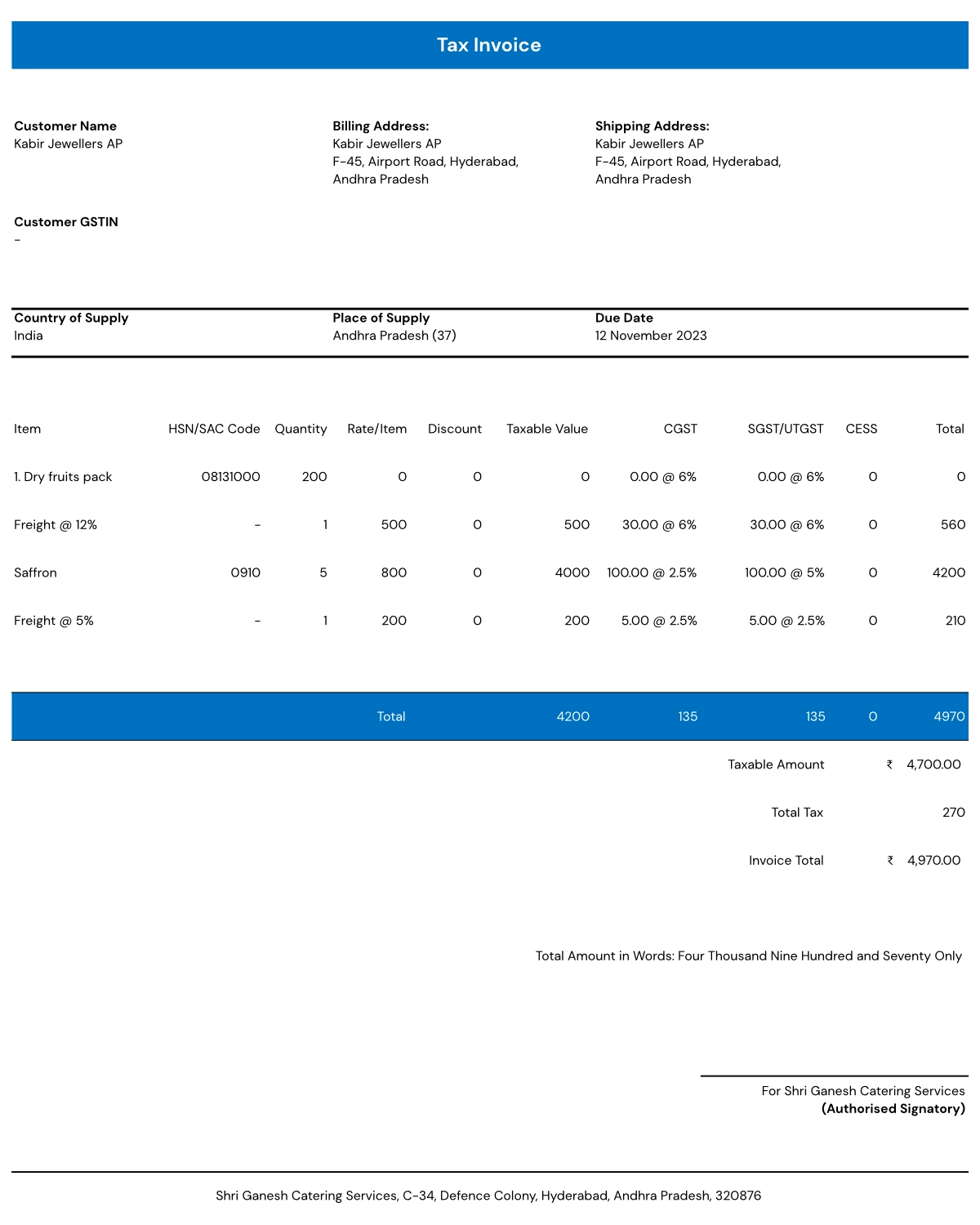

Mandatory fields in a GST invoice

Below is all the essential information that should be included in the GST invoice.

- The primary function of a tax invoice is to charge the tax and provide an input tax credit. The following fields are mandatory in an invoice to qualify as GST-compliant:

- Invoice number and date

- The name of the customer

- The addresses used for both shipping and billing purposes

- If the customer and taxpayer are both registered, then both their GSTINs should be mentioned

- Place of supply

- HSN/SAC code

- Details about the item’s quantity, unit, total value etc.

- Taxable deals and discounts should also be mentioned

- Both the rate and amount of taxes, such as CGST/IGST/SGST

- Whether a reverse charge is applicable on the GST paid or not

- Signature of the supplier

In the case of the supplier not being a registered GST business and the invoice being at the value of more than 50,000, then the contents of an invoice would include:

- Name and address of the recipient

- Address of delivery

- State name and code

A sample for your reference is attached below:

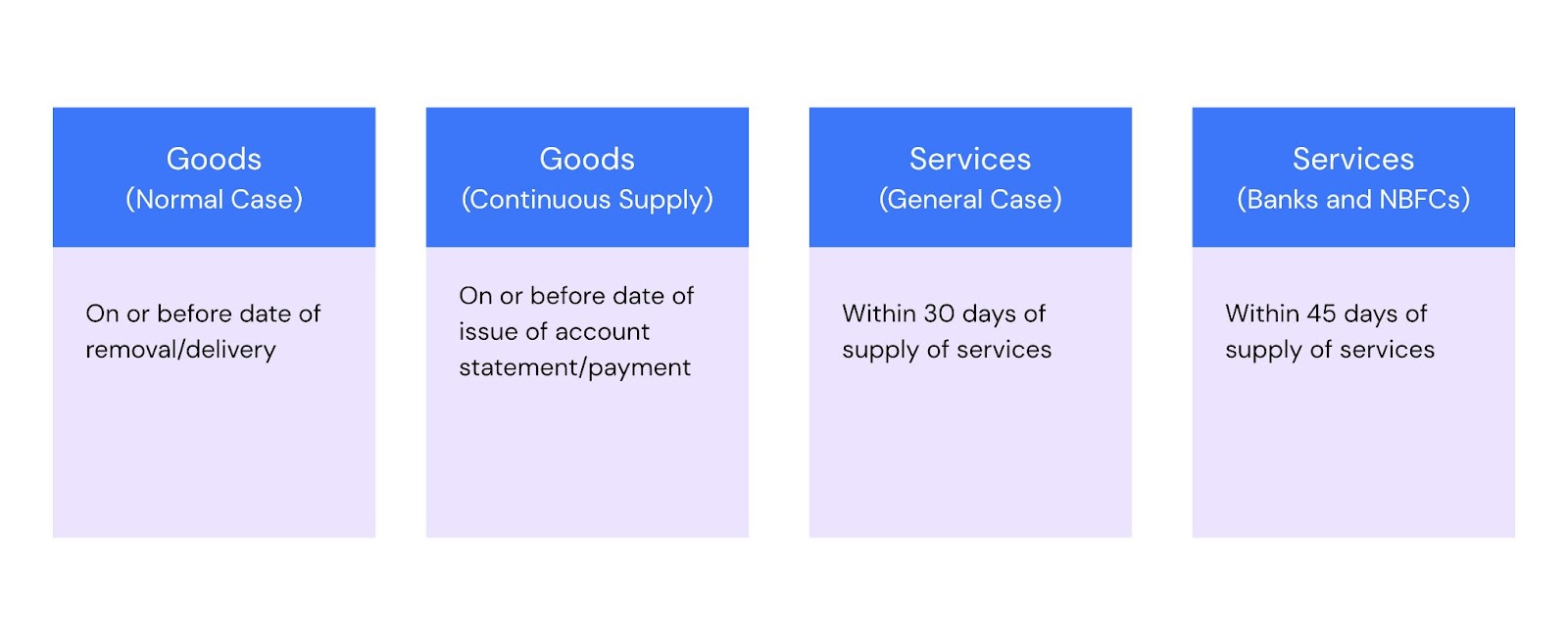

The time to issue invoices in different cases

- In case of goods it should be issued on or before the date of removal/ delivery

- In case of goods which qualify for continuous supply it should be raised on or date of issue of account statement/ payment

- In case of services it should be raised within 30 days of supply services

- In the case of services provided by banks and NBFCs an invoice should be raised within 45 days of supply of services

Types of Invoices

GST Invoices are of a few different types, and each has a specific use case depending on the nature of the transaction that has occurred. The types of GST invoices are:

- GST Tax Invoice: This is the most common type of GST Invoice. It is issued for B2B as well as B2C transactions.

- Bill of supply: This type of invoice is issued in cases where either the supplier is not registered under GST, or where the goods and services supplied are not of a taxable nature under GST. Businesses registered under the composite scheme are also required to issue a bill of supply to their customers, since they cannot claim any Input Tax Credit against the GST received under the scheme.

- Invoice-cum-Bill of Supply: In cases where both taxable as well as non-taxable or exempted goods are being supplied to a purchaser who is not registered under GST, a single Invoice-cum-Bill of Supply can be issued.

- Debit Note: Debit Notes are used as a corrective measure. In cases where a GST Invoice has already been issued, but it has later been discovered that the GST charged was less than what it should have been, a debit note can be issued by the supplier to the purchaser.

- Credit Note: Credit notes are also used as a corrective measure. In cases where a GST Invoice has already been issued, but it has later been discovered that the GST charged was more than what it should have been, or in the case where the purchaser has returned some or all of the goods mentioned in the original GST invoice, a credit note can be issued by the supplier to the purchaser.

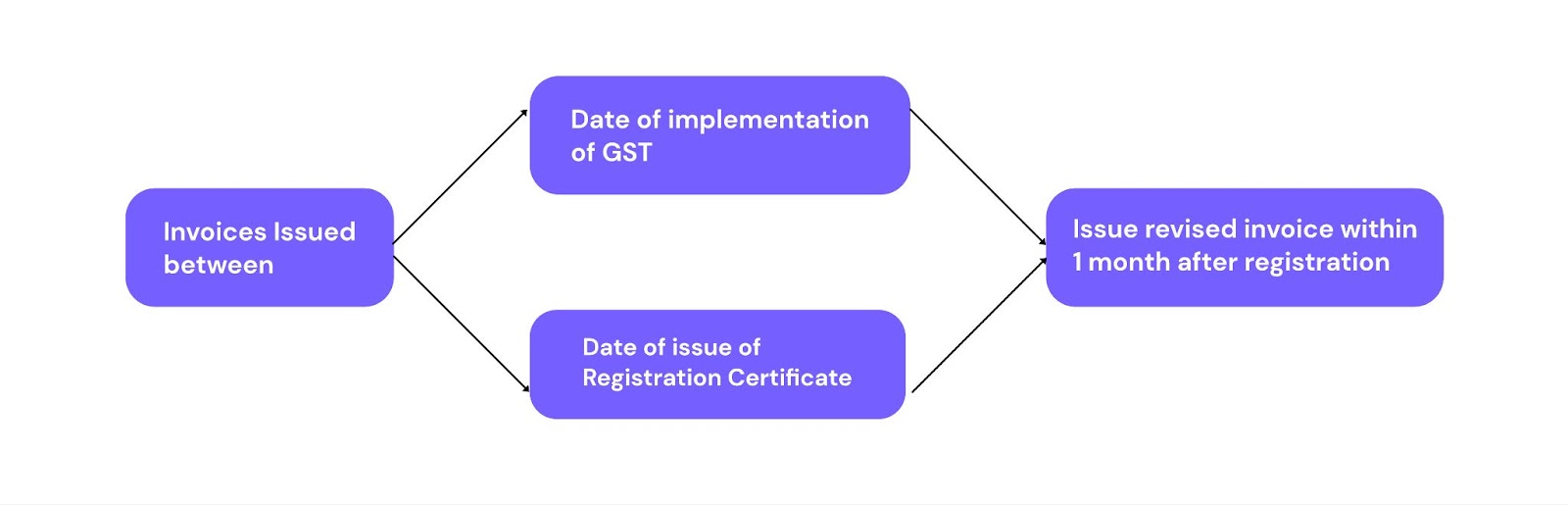

Are GST Invoices revisable?

GST invoices are often revisable. All dealers are required to apply for provisional registration before getting the permanent registration certificate.

An image is attached for your reference:

It is applicable to all the invoices issued between the date of implementation of GST and the date a registration is issued. It is mandatory for a dealer to issue a revised invoice against all the already issued invoices. A revised invoice is required to be issued within one month of the issue date of a registration certificate.

GST invoices under special cases

Every law and provision has exceptions and in the issuing of invoices those special cases include banking, passenger transport. There is a relaxation on the format of the invoices to be issued by the supplier.

Number of invoices to be issued

In case of goods three copies of invoices are to be issued and in the case of services two copies are to be issued.

Conclusion

Issuing GST Invoices are an important part of ensuring your business is GST compliant. They serve as a record of your business transactions, and failure to issue GST compliant invoices can lead to problems for your business. GST Invoices are applicable in both B2B as well as B2C transactions. Using a robust GST Invoicing Software like BUSY will make it easy for you to issue and track your GST Invoices. This will help your business reputation over time, as your business will be able to maintain a healthy GST Compliance Rating.

- GST Rates for ProductsGST Rates: GST for washing machine GST on paper GST on readymade clothes GST on alcohol GST for tours and travels toys GST rate GST on diamond GST rate for computer GST for mobile phones GST on taxi GST on paints GST for gym GST for rice GST on cab service GST for luxury items GST on dairy products GST on medical insurance tobacco GST rate agarbatti GST rate GST on fruits