Mohammed Hasabhai Karbalai vs. Na

(AAR (Authority For Advance Ruling), Gujrat)

Mr. Mohammed Hasanbhai Kabalai (hereinafter referred to as the applicant) submits that it intends to supply Thermally Processed Ready to Serve Fruit Beverage. The applicant cites entry 2.3.10 of the Food Safety and Standards (Food Products Standards and Food Additives) Regulation, 2011 for classification of goods. It shall be a ready to serve fruit beverage with different flavours. Presently, the applicant is not registered under GST.

2. The applicant initially intend to supply apple juice based drinks in the name of ‘Apple Cola Fizzy’ and ‘Malt Cola Fizzy ‘. Both the drinks will be apple juice based drinks having same ingredients and manufacturing process, the second one having an added flavour of malt.

3. The applicant has submitted the details of ingredient to be used in their product and manufacturing process of Apple Cola Fizzy and Malt Cola Fizzy.

Ingredients

- Water

- Sugar

- Apple Juice Concentrate (1.9%) [Equivalent to 12.7% Apple Juice Reconstituted]

- Carbon Dioxide (INS290)

- Acidity Regulators [INS296, INS 331 9iii), INS 330]

- Preservatives (INS211, INS224, INS202)

- Antioxidant (INS300)

- Natural Color (150d)

- Added Flavour

Manufacturing Process

a) Drawing of water from bore well or any other source & then collecting it in food graded Storage tank.

b) Then processes shall be undertaken for water treatment wherein water will be passed through pressure sand filter, activated carbon, micron cartridge filter (5 Micron), Reverse Osmosis system, chemical dozer System, ozonisation system & Ultra Violet sterilization system. Then the treated water will be collected in Stainless Steel storage tanks.

c) The treated water will be transferred to blending tank for further processing.

d) Double-refined sugar will be melted in the said tank with treated water. Melted sugar will be transferred through Stainless Steel pump for further processing.

e) Melted sugar shall be passed through sugar filter press, where the suspended impurities (if any) will be removed. The filtered sugar syrup will be then passed through Plate type Heat Exchanger (PHE), where the hot syrup shall be brought down to ambient temperature. Further it will be transferred through transfer pump for processing.

f) The final sugar syrup will be transferred to blending tank for further processing. Natural fruit juice concentrate, different flavours, colours & preservatives of food grade quality are mixed in requisite ratios.

g) The mixture shall be then transferred to blending tank for further processing and in the said mixture fruit juice, sugar syrup & different flavours/preservatives as mentioned above are mixed with agitator to make the final syrup.

h) The final syrup is then transferred through transfer pump for further processing. The same is then transferred to beverage processor, where it is mixed with treated water.

i) This ready beverage is transferred for thermal processing to pasteurizer where it is heated at a temperature of 940C ± 20C. The process is also known as pasteurization.

j) Then the product is cooled at 320C and further cooling is completed at 20C.

k) Then Food grade Co2 is added in this thermally processed beverage.

l) The chilled beverage is then filled in Pet Bottles, automatically on an automatic filling-capping machine. Then the brand labels are pasted on the bottles.

m) The bottles are printed with batch number, date of mfg., etc. These bottles are packed in either carton boxes or P.V.C. shrink film packs and are then stored for dispatch.

4. The applicant submits that it will commercially market the products as Apple Juice based drinks or Fruit Juice based drinks and labels affixed on the product will expressly indicate the same.

5. The applicant has stated that different rate of tax have been charged across the Industry for similar types of drinks with similar ingredients. It submits the names of few leading market makers with name of their drinks and rate of tax charged by them are as follows (illustrative list only, based on information available in public domain)

a. Fresca HazamJeera Soda – 12%

b. Appy Fizz- 12%

c. BisleriSpyci Masala Maar Ke Soft Drink – 40% (with cess)

d. XotikJeeruJeera Beverage- 40% (with cess)

6. The applicant submitted that the difference in rate of tax charged by various other manufactures is quite huge. Charging of 40% rate of tax when competitors are charging 12% makes the product unsellable and whole margin get eaten up subsequently. That in the above background, the applicant is confused and wishes to seeks the classification of the goods which it proposes to manufacture.

7. The applicant has submitted that to determine the classification of ‘Apple Cola Fizzy’ and ‘Malt Cola Fizzy, referred Chapter 22 “Beverages, spirits and vinegar” of the Customs Tariff and the Chapter heading which is relevant to the product is CTH 2202, reproduced as follows:

2202 WATERS, INCLUDING MINERAL WATERS AND AERATED WATERS, CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OR FLAVOURED, AND OTHER NON-ALCOHOLIC BEVERAGES, NOT INCLUDING FRUIT OR VEGETABLE JUICES OF HEADING 2009

2202 10 – Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured :

2202 10 10— Aerated waters

2202 10 20 — Lemonade

2202 10 90 — Other

– Other :

2202 91 00 — Non alcoholic beer

2202 99 — Other:

2202 99 10 — Soya milk drinks, whether or not sweetened or flavoured

2202 99 20 — Fruit pulp or fruit juice based drink

2202 99 30 — Beverages containing milk

2202 90 — Other

8. The applicant submits that Chapter Heading 2202 has been divided into two subheadings, viz. (i) Sub-heading 2202 10 which covers “Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured” and (ii) Sub-heading 2202 99 which covers “other non-alcoholic beverages”. Fruit pulp or fruit juice based drinks are specifically covered under Tariff Item No. 2202 99 20 under the sub-heading No. 2202 99 as ‘Other non-alcoholic beverages’. Chapter Sub-heading No. 2202 10 covers drinks which are predominantly made up of water, including mineral water and aerated water and are either sweetened or flavoured or both. The applicant submits that drink supplied by them is a “Beverage” but not “Water” and hence cannot be classified under 2202 10 which is for Waters.

9. The applicant has submitted that it intends to sell Ready to Serve Fruit Beverage and it will be clearly highlighted and pointed out on the labels affixed on the packing of the beverages ‘Apple Cola Fizzy’ and ‘Malt Cola Fizzy’. These are Ready to Serve Drink and is a Apple Juice based drink i.e. Fruit Juice based drink. Thus it is submitted that intent of the applicant in labelling the product in this manner depicts the fact that the product will be marketed as Ready to Serve a ‘fruit juice based beverages’ only. The products in question will be purchased by consumers considering it as a fruit juice-based drink which shall be in ready to serve state.

10. The applicant has submitted that The Food Safety and Standards (Licensing and Registration of Food Businesses) Regulations, 2011 (hereinafter referred to as the ‘Food Regulations’) have been framed under Section 92 read with Section 31 of the Food Safety and Standards Act, 2006 deals in Chapter II with Food Products Standards. Regulation 2.3 deals with ‘Fruit & Vegetable Products’ and in particular Regulation 2.3.10 deals with ‘Thermally Processed Fruit Beverages/Fruit Drinks/Ready to Serve Fruit Beverages’ while Regulation 2.3.30 deals with ‘Carbonated Fruit Beverages or Fruit Drinks’.

11. The relevant Regulations of FSSAI and the Food category under Appendix A are reproduced as follows:

2.3.10: Thermally Processed Fruit Beverages / Fruit Drink/ Ready to Serve Fruit Beverages

1. Thermally Processed Fruit Beverages / Fruit Drink/ Ready to Serve Fruit Beverages (Canned, Bottled, Flexible Pack And/ Or Aseptically Packed) means an unfermented but fermentable product which is prepared from juice or Pulp/Puree or concentrated juice or pulp of sound mature fruit. The substances that may be added to fruit juice or pulp are water, peel oil, fruit essences and flavours, salt, sugar, invert sugar, liquid glucose, milk and other ingredients appropriate to the product and processed by heat, in an appropriate manner, before or after being sealed in a container, so as to prevent spoilage.

2. The product may contain food additives permitted in these regulations including Appendix A. The product shall conform to the microbiological requirements given in Appendix B. The product shall meet the following requirements:-

| (i) Total Soluble solid (m/m) | Not less than 10.0 percent |

| (ii) Fruit juice content (m/m) |

|

| (a) Lime/Lemon ready to serve beverage | Not less than 5.0 percent |

| (b) All other beverage/drink | Not less than 10.0 percent |

3. The container shall be well filled with the product and shall occupy not less than 90.0 percent of the water capacity of the container, when packed in the rigid containers. The water capacity of the container is the volume of distilled water at 20ºC which the sealed container is capable of holding when completely filled.

2.3.30 Carbonated Fruit Beverages or Fruit Drinks:

1. Carbonated Fruit Beverages or Fruit Drink means any beverage or drink which is purported to be prepared from fruit juice and water or carbonated water and containing sugar, dextrose, invert sugar or liquid glucose either singly or in combination. It may contain peel oil and fruit essences. It may also contain any other ingredients appropriate to the products.

2. The product may contain food additives permitted in these regulations including Appendix A. The product shall conform to the microbiological requirements given in Appendix B. It shall meet the following requirements:-

| (i) Total Soluble solids (m/m) | Not less than 10.0 percent |

| (ii) Fruit content (m/m) |

|

| (a) Lime or Lemon juice | Not less than 5.0 percent |

| (b) Other fruits | Not less than 10.0 percent |

3. The product shall have the colour, taste & flavour characteristic of the product & shall be free from extraneous matter.

4. The container shall be well filled with the product and shall occupy not less than 90.0 percent of the water capacity of the container, when packed in the rigid containers. The water capacity of the container is the volume of distilled water at 20ºC which the sealed container is capable of holding when completely filled.

12. The applicant has submitted that from the above Food Regulations it is apparent that drink or beverage can either be said to be ‘Thermally Processed Fruit Beverages/Fruit Drinks/Ready to Serve Fruit Beverages’ or on the other hand they can be said to be ‘Carbonated Fruit Beverages or Fruit Drinks’.

13. The applicant submits that drinks prepared from juice concentrates and other ingredients including water, sugar, flavours etc. and processed by heat are classifiable under the category of ‘Thermally Processed Fruit Beverages/Fruit Drinks/Ready to Serve Fruit Beverages’. On the other hand, carbonated fruit beverages or fruit drinks may be prepared from carbonated water or by the process of carbonation, however thermal processing or processing by heat is not a trait of carbonated beverages.

14. The beverages of the applicant have the following characteristics:

i It is made from apple juice concentrate.

ii The fruit juice content and solids content percentage is more than 10%.

iii It is thermally processed beverage.

iv After the thermal processing, Carbon Dioxide is purged in the ready Fruit beverage for preservation to create an environment which will help to prevent spoilage during its shelf life.

iv It will be mentioned on the label that it contains Apple Juice Concentrate.

15. The applicant on the basis of above submits that their product is a thermally processed fruit beverages/ready to serve fruit beverage complying with category 2.3.10 as per FSSAI Regulations, 2011 having carbon dioxide as an ingredient which is used for preservation purpose only.

16. Food Safety and Standards (Food Products Standards and Food Additives) Regulation, 2011 was amended vide Notification dated 16th August, 2016 wherein the term ‘carbonated beverage with fruit juice’ has been defined as follows:

2. In the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011, in regulation 2.3, in sub-regulation 2.3.30, relating to ‘Carbonated Fruit Beverages or Fruit Drinks’, after clause 3, the following clause shall be inserted, namely:-

“3A. In case the quantity of fruit juice is below 10.0 per cent. but not less than 5.0 per cent. (2.5 per cent. in case of lime or lemon), the product shall be called ‘carbonated beverage with fruit juice’ and in such cases the requirement of TSS (Total Soluble Solids) shall not apply and the quantity of fruit juice shall be declared on the label”.

17. The applicant submits that Carbonated Fruit Beverages or Fruit Drinks having characteristics as explained above, having quantity of fruit juice below 10% but not less than 5% shall be called carbonated beverage with fruit juice. The applicant stated that since their product does not qualify to be a carbonated beverage/drink originally as per its other characteristics also, hence it cannot be classified as carbonated beverage with fruit juice.

18. The applicant submits that their said understanding is premised on the decision by Hon’ble Supreme Court in case of Commissioner of Central Excise, Bhopal v. Parle Agro Pvt. Ltd. reported in 2008 (226) E.L.T. 194 (Tri. – Del.). The issue that arose for consideration before the Tribunal and later upheld by Hon’ble Supreme Court was whether the product Appy Fizz could be classified under Tariff Item No. 2202 90 20 as a fruit juice based drink as contended by the assessee or as Aerated Water under Tariff Item No. 2202 10 10 as contended by the Revenue. The Tribunal held that the drinks based on fruit juice are specifically classifiable under Tariff Item No. 2202 90 20 and not under Tariff Item No. 2202 10. The relevant paragraphs 4 and 6 of the judgment are reproduced below:

“4. The contention of the respondent is that as per the certificate given by Ministry of Food and Processing Industries, New Delhi the product in question contains 23% of apple juice. As the product in question is juice based drink, therefore, rightly classifiable under sub-heading No. 2202 90 20 of the Tariff. The respondent also relied upon the chemical examiner’s report to submit that there are 13.7% by weight are soluble solids in the product. The respondent also relied upon the text to Prevention of Food Adulteration Rules, 1955 to submit that fruit beverage or fruit drink must contain total soluble solids not less than 10%.

6. The Revenue relied upon HSN Explanatory Notes of Chapter 22. We find that our tariff is not fully aligned with the HSN Explanatory Notes. In the HSN Explanatory [Notes] there are two sub-headings under Heading No. 2202 one is “water including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured” and second is in respect of others. Whereas Central Excise Tariff under sub-heading No. 2202 there are specific headings in respect of soya milk, drinks etc. As per the Central Excise Tariff, the waters; including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured are classifiable under subheading No. 2202.10. The drinks based on fruit juice are specifically classifiable under Item No. 2202 90 20 of the Tariff. In the present case, there is no dispute regarding the contents of the product. Revenue is not disputing the certificate given by the Ministry of Food and Processing Industries, New Delhi rather they are relying it in the ground of appeal, and as per the certificate, the product in question contains 23% of apple juice, therefore, we find no infirmity in the impugned order. The appeal is dismissed.”

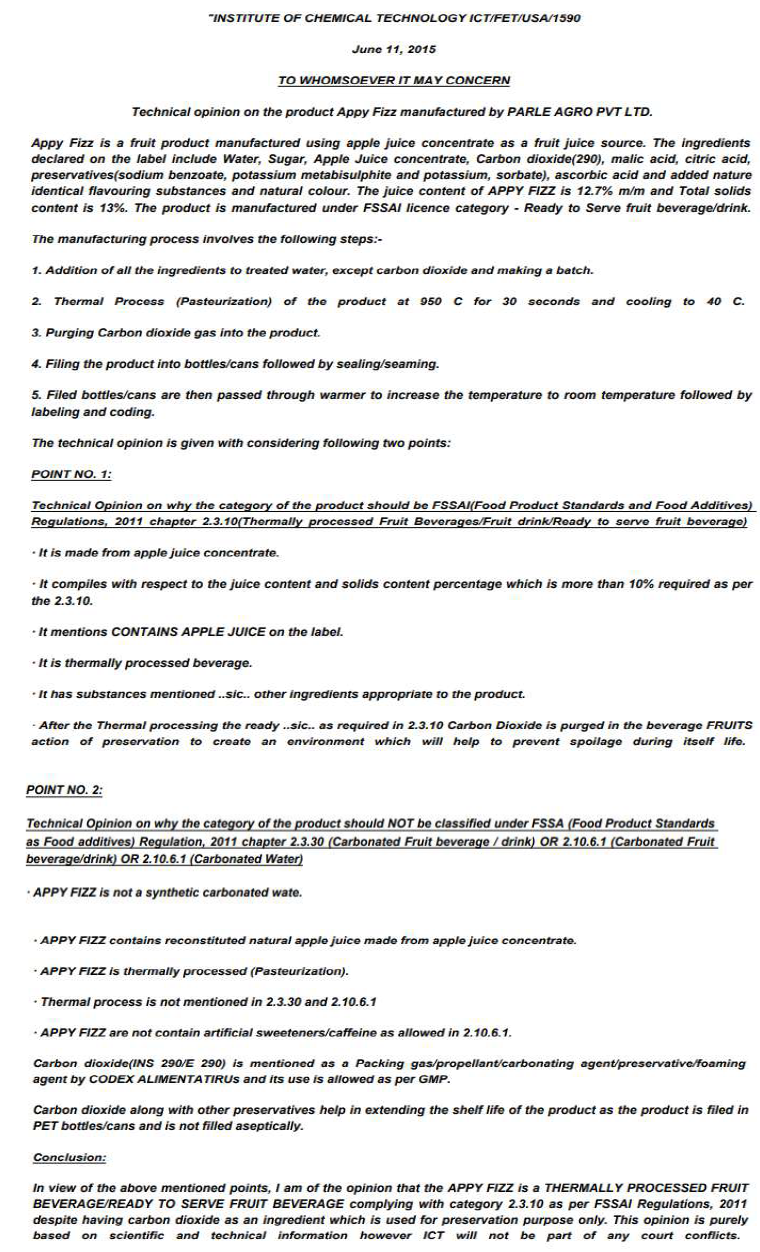

19. That in the above case petitioner filed a certificate of the Institute of Chemical Technology regarding the product and the finding of the court is significant for the case, held as follows:

The above technical opinion clearly mentioned that carbon dioxide is used for preservation purpose only. Before the Committee of Commissioners the entire process of manufacture of the product was explained along with all relevant orders and certificates of Food Safety Authorities. It was stated that the Experts in their opinions and certifications have mentioned that product is commercially and technically distinct from products which have classified as ‘aerated branded soft drinks’. The certifications which were relied by the appellant indicate that in the case of ‘Appy Fizz’ the product does not undergo aeration or carbonation; the product is thermally processed with CO2 which help in preserving the Apple Juice concentrate which is otherwise perishable in nature.

We, thus, conclude that orders of Food Safety Authority and expert opinion regarding process of manufacture relied by the appellant were relevant materials and Clarification Authority and High Court erred in law in discarding these materials.

20. The said technical opinion relied upon by the assessee as referred in the judgment is as follows:

21. The applicant submits that having similar ingredients and manufacturing process, as per their understanding the products ‘Apple Cola Fizzy’ and ‘Malt Cola Fizzy’ are Thermally Processed Fruit Beverages/Fruit Drinks/Ready to Serve Beverages and not Carbonated Fruit Beverage/Drink and relevant entries for GST rates in Tariff Notification No. 01/2017- Central Tax (Rate) for products falling under HSN 2202 is as follows:

| S.No. | Chapter / Heading /Sub-heading / Tariff item | Description of Goods | CGST Rate |

| 48. | 2202 99 20 | Fruit pulp or fruit juice based drink | 12% |

| 12. | 2202 10 | All goods including aerated waters, containing added sugar or other sweetening matter or flavoured | 28% |

22. Further there was an entry in Notification No. 1/2017-Compensation Cess (Rate), dated 28-6-2017 which is as follows:

| S.No. | Chapter/Heading/Sub-heading/Tariff Item | Description of Goods | Rate of Goods as Service tax compensation cess |

| (1) | (2) | (3) | (4) |

| 2. | 2202 10 10 | Aerated Waters | 12% |

23. With effect from 01.10.2021, a new entry has been added in the Goods Tariff Notification under Schedule V having rate of tax as 28% and Cess Rate Notification vide Notification No. 8/2021-Central Tax (Rate) dated 30thSeptember, 2021, read as follows:

| 12B. | 2202 | Carbonated Beverages of Fruit Drink or Carbonated Beverages with Fruit Juice | 28% |

SCHEDULE

| S.No. | Chapter/Heading/Sub-heading/Tariff Item | Description of Goods | Rate of Goods as Service tax compensation cess |

| (1) | (2) | (3) | (4) |

| 4B. | 2202 | Carbonated Beverages of Fruit Drink or Carbonated Beverages with Fruit Juice | 12% |

24. The applicant submits that on perusal of above it is evident that goods which merits classification under FSSAI Regulation No. 2.3.30 under point 1 or 3A i.e. Carbonated Fruit Beverage or Fruit Drink or Carbonated Beverage with fruit juice have been duly classified under entry 12B of the Notification No. 8/2021-Central Tax (Rate) dated the 30th September, 2021 with rate of tax at 28% and also under entry 4B of notification under Compensation Cess with rate at 12%.

25. The applicant submits that the Hon’ble Supreme Court has clearly classified the similar product (i.e. product similar in manufacturing process of the applicant) as fruit juice based drink in relevant entry of Central Excise Tariff. Thus the rationale for classification of the product under the Indirect Tax tariff is settled by the Court as far the entries with S.No. 48 in Schedule II and S.No. 12 in Schedule V of GST Tariff mentioned above are concerned.

26. Further, applicant submits that the Hon’ble Apex Court has already clearly laid with regard to a similar product that the product is not carbonated, it is thermally processed with CO2 for which help in preserving the Apple Juice concentrate. In case of applicant also, its product shall be a Ready to Serve Fruit Beverage and will be classified under FSSAI regulation no 2.3.10 instead of 2.3.30. Thus when its products are not ‘Carbonated Beverages of Fruit drink’ as per FSSAI but rather is a Ready to Serve Fruit Beverage which is thermally processed and being manufactured with CO2 being used only for preservation purposes, it cannot be classified under FSSAI Regulation 2.3.30

27. The applicant submits that ‘carbonated beverage with fruit juice’ are also carbonated fruit beverage/drink just with an exception regarding the quantity of fruit juice which can be below 10% but not less than 5% as defined in the FSSAI regulations. Since, the product of applicant does not qualify to be a carbonated beverage/drink primarily as per its other characteristics, hence applicant is of the view that it cannot be classified as ‘carbonated beverage with fruit juice’.

28. The applicant has submitted that on the contrary as ‘Fruit Juice Based Drinks’ classified under HSN 2202 99 20 have not been defined in the Tariff Schedule so they have to be understood in the sense in which the people conversant with the product and the people who deal in the product understand and buy and sell the product. Resort can also be taken to the provisions of the Regulations which governs its production, quality and consumption to understand whether the products are fruit based drinks. That whereas, the expression ‘fruit pulp or fruit juice based drinks’ falling under 2202 99 20 essentially means a drink based on fruit pulp or fruit juice which gives the overall/essential character to the drink.

29. The applicant submits that common parlance test can be applied to understand the classification of a product. In fact on principles for application of common and popular meaning of a product to determine the classification of a product, the Hon’ble Supreme Court in case of Commissioner v. Connaught Plaza Restaurant (P) Ltd. – 2012 (286) E.L.T. 321 (S.C.) has held that,

Classification – Common parlance test – It is extension of general principle of interpretation of statutes for deciphering mind of law maker – It is attempt to discover intention of legislature from language used by it, keeping in mind, that language is at best imperfect instrument for expression of actual human thoughts – In absence of statutory definition in precise terms, it is construction of words, entries and items in taxing statutes in terms of their commercial or trade understanding, or according to their popular meaning – It operates on standard of average reasonable person who is not expected to be aware of technical details of goods – It is construction in sense that people conversant with subject-matter of statute, attribute to it – Rigid interpretation in terms of scientific and technical meanings is to be avoided – However, when legislature has provided a statutory definition of particular entry, word or item in specific, scientific or technical terms, then, interpretation ought to be in accordance with that meaning and not according to common parlance. [paras 18, 31, 34]

30. The applicant submits that it has been laid down quite clearly that common parlance understanding of a product is an extension of general principle of interpretation of statue. Since no definition of fruit juice based drink has been given in the Tariff Schedule hence its popular meaning and the perception amongst the customers shall be relevant criteria for determination. Hence the products Apple Cola Fizzy and Malt Cola Fizzy are ‘fruit juice based drinks’ classifiable under HSN 2202 99 20.

31. The applicant has submitted that with recent amendment brought in GST Rate Schedule wherein GST Rate has been brought at entry 12B of the Notification No. 8/2021-Central Tax (Rate) dated the 30th September, 2021 with rate of tax at 28% and also under entry 4B of notification under Compensation Cess with rate at 12% under GST. The said rate has been brought at HSN 2202 with description as under:

| 4B. | 2202 | Carbonated Beverages of Fruit Drink or Carbonated Beverages with Fruit Juice | 12% |

32. The applicant further states that it clearly specifies that under HSN 2202 all beverages which are fruit juice based drinks or are Fruit Beverages are not covered under the given classification under GST Rate Schedule. Only those drinks which are Carbonated Beverages and are not classified as Carbonated Water are intended to be classified here. The given newly entry is verbatim replica of the FASSAI Regulation 2.3.30 under point 1 or 3A.

33. Further, submitted it is evident that entry 12B of the Notification No. 8/2021Central Tax (Rate) dated the 30th September, 2021 with rate of tax at 28% and also under entry 4B of notification under Compensation Cess with rate at 12% under GST has been aligned with FSSAI regulation No 2.3.30 (point 1 and 3A).

34. The applicant submits that it has already been explained in detail with support of judgement by Hon’ble Apex Court that product to be manufactured by them is not classifiable under FSSAI Regulation No 2.3.30 under point 1 or 3A. Rather the given product as already explained is technically and commercially known as “Ready to Serve Fruit Beverage”. It uses CO2 only for preservation purposes but does not includes the process of carbonation. Hence is classified under FASSAI Regulation No. 2.3.10 which includes Ready to Serve Fruit Beverage and does not include Carbonated Beverages.

35. The applicant has submitted that lastly it has already been held by the Hon’ble SC that beverages which merits classification under 2.3.10 under FSSAI regulations are classified under HSN Code 2202 99 20. Thus the product of the applicant which merits classification 2.3.10 and is not a carbonated beverage but rather is Fruit Juice based Drink and hence is taxable at Entry No 48 GST rates in Tariff Notification No. 01/2017- Central Tax (Rate) with rate of 12%.

Question on which Advance Ruling sought

36. What should be the classification and applicable tax rate on the supply of Ready to Serve Fruit Beverage named as ‘Apple Cola Fizzy’ and ‘Malt Cola Fizzy’ made by the applicant under Notification No. 1/2017 – CT (Rate) dated 28.06.2017 as amended up to date?

Personal Hearing

37. Personal hearing granted on 18-2-22 was attended by Ms. Shuchi Sethi, CA and she reiterated the submission.

Revenue’s submission

38. Revenue has neither submitted its comments nor appeared for hearing.

Findings

Part-1:

38. At the outset, we would like to state that the provisions of both the CGST Act and the GGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the GGST Act.

39. We have carefully considered all the submissions made by the applicant.

39. The applicant is before us for Classification of the following goods:

i. Apple Cola Fizzy

ii. Malt Cola Fizzy

40. The applicant cites Food Safety and Standard (Food products standards and food additives) Regulations, 2011 and refers to the meaning of Thermally processed fruit juices and carbonated fruit beverages or fruit drinks as referred in said Food safety and standards regulations, 2011.

41. We hold that the burden of Classification is on Revenue. However, Revenue has neither appeared for personal hearing nor submitted its comments on the applicant’s application.

42. Prior to proceeding with our discussion on the Classification of said goods, we find it prudent to place on record the position of law and thereby our thought process in subject matter:

i. We hold that Classification of goods under GST is based on Tariff aligned with the HSN. The General Interpretative Rules for GST Tariff Classification are to be sequentially followed as the way to classify the goods. We are to classify within the confines of law and procedure as laid down in GST scheme of law and procedure.

ii. The Customs Tariff is based on HSN. The Section Notes and Chapter Notes of Custom Tariff Act ( based on HSN) are part and parcel of the Custom Tariff Act, 1975 which is to say, part and parcel of law enacted by the Parliament and therefore, we are obliged to follow the classification based on Section Notes and Chapter Notes as per law.

iii. As per Rule 1 of the General Rules for the Interpretation, for legal purposes, classification shall be determined according to the terms of the headings and any Section or Chapter Notes. We shall follow the same in arriving at our pronouncement for Ruling in subject matter.

43. In the present case, we find that the applicant has cited classification of subject goods based on Food safety and standards regulations.

44. Now, the Legislature has empowered competent authority vide Section 168 CGST Act, 2017 with the power to issue Instruction or directions as per the GST scheme of law. As per CGST Act and rules framed thereunder, we do not find FSSAI empowered under GST scheme of law to issue directions/ instructions for GST Classification. We hold that the FSSAI has been created for laying down science based standards for articles of food and to regulate their manufacture, storage, distribution, sale and import to ensure availability of safe and wholesome food for human consumption (url: https://fssai.gov.in/cms/about-fssai.php#) ; and cannot be the factor for determination of the classification of goods under the GST scheme of law and procedure. The issue whether the regulation of other statute can be used for determination of the classification under the different statute, has been addressed by the H’ble Apex Court in the case of Commissioner of Central Excise, New Delhi v. Connaught Plaza Restaurant (P) Ltd. [2012 (286) E.L.T. 321 (S.C.) – para 43]. The H’ble Supreme Court has held that it is a settled principle in excise classification that the definition of one statute having a different object, purpose and scheme cannot be applied mechanically to another statute. The same view was held by Hon’ble High Court of Bombay in the case of Kaira Dist. Co. Op. Milk Producers’ Union Ltd. v. U.O.I. [1989 (41) E.L.T. 186 (Bom.) – Paras 7 and 8]

45. We note that the H’ble Delhi High Court in Greatship (India) Ltd. vs UOI- 2016 (338) ELT 545 (del) has held that in Interpretation of statutes, for Conflict of views between two Central Government Ministries -In such case, view taken by Ministry that is primarily responsible for policy in question, should prevail. By applying the same ratio, we find it in compliance to judicial discipline and in consonance to the laid ratio decidendi as cited, that in matters of GST Classification, we comply with the General Rules of Interpretation for GST Classification and GST Scheme of Law. Further we note that the reference to HSN explanatory Notes has persuasive value. What we intend to express is that GST Scheme of law shall be complied with for GST Classification.

Part 2:

46. The facts on record for the subject goods are as follows:

a. Both the goods are Apple Juice based beverages with apple juice concentrate 1.9% [Equivalent to 12.7% Apple Juice Reconstituted]

b. Both goods have carbon dioxide (INS 290)

c. Both goods have preservatives (INS211, INS224, INS202)

47. Further, in a common parlance sense, we note that the names of both the goods have the word ‘ fizzy’ which gives a reasonable impression in the market that these goods are carbonated with carbon dioxide, due to the very word ‘ fizzy’ appearing in their descriptions. We note that it is a fact that both the goods have been carbonated with carbon di oxide (INS 290). Further, both the goods have INS 211, INS 224, INS 202 as preservatives. We are of the opinion that carbon di oxide in subject beverages has given them the carbonated effect and the goods are thereby carbonated beverages.

48. We note that the Tariff Heading 2202 is divided into two sub-headings, viz. subheading 2202 10 which covers “waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured”, and sub-heading 2202 90 which covers “other”. The Tariff Heading 2202 in the Customs Tariff Act, 1975 is reproduced herein below :-

| Tariff Item | Description of goods | Unit |

| (1) | (2) | (3) |

| 2202 | Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured, and other nonalcoholic beverages, not including fruit or vegetable juices of Heading 2009 |

|

| 2202 10 – | Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured : |

|

| 220210 10 | — Aerated Waters | 1 |

| 220220 10 | — Lemonade | 1 |

| 220290 10 | — Other | 1 |

| – Other : |

|

| 2202 00 91 | — Non-alcoholic beer |

|

| 2202 99 | — Other : |

|

| 2202 10 99 | — Soya milk drinks, whether or not sweetened or flavoured | 1 |

| 2202 20 99 | — Fruit pulp or fruit juice based drinks | 1 |

| 2202 30 99 | — Beverages containing milk | 1 |

| 2202 90 99 | — Other | 1 |

49. Now We refer to the Explanatory Notes of Harmonised System of Nomenclature (HSN) for Tariff Heading 2202, reproduced as follows:

| “22.02 | WATERS, INCLUDING MINERAL WATERS AND AERATED WATERS, CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OR FLAVOURED, AND OTHER NON-ALCOHOLIC BEVERAGES, NOT INCLUDING FRUIT OR VEGETABLE JUICES OF HEADING 20.09. |

| 2202.10 | Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured |

| 2202.90 | Other |

This heading covers non-alcoholic beverages, as defined in Note 3 to this Chapter, not classified under other headings, particularly Heading 20.09 or 22.01.

(A) Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavored.

This group includes, inter alia :

(1) Sweetened or flavoured mineral waters(natural or artificial).

(2) Beverages such as lemonade, orangeade, cola, consisting of ordinary drinking water, sweetened or not, flavoured with fruit juices or essences, or compound extracts, to which citric acid or tartaric acid are sometimes added. They are often aerated with carbon dioxide gas, and are generally presented in bottles or other air tight containers.

(B) Other non-alcoholic beverages, not including fruit or vegetable juices of heading 20.09.

This group includes, inter alia :

(1) Tamarind nectar rendered ready for consumption as a beverage by the addition of water and sugar and straining.

(2) Certain other beverages ready for consumption, such as those with a basis of milk and cocoa.

50. On reading the Tariff 2202, along with the Explanatory Notes to HSN for sub-heading –220210, we note the following, as tabulated in the Table:

| Tariff 2202 read with its Explanatory Notes | Subject Goods Ingredients | Our Findings |

| 1. Waters including aerated waters containing added sugar/ sweetening matter or flavoured. | Water, Sugar | We find the Tariff 2202 satisfied. |

| 2. Flavoured with fruit juices or essences, or compound extracts. | Apple juice concentrate(1.9%) equivalent to 12.7% apple juice reconstituted. | We find the Explanatory Notes to HSN 220210 satisfied. |

| 3. Aerated with carbon dioxide gas | Carbon dioxide (INS 290) | We find the Explanatory Notes to HSN 220210 satisfied. |

| 4. Presented in bottles/ other airtight containers. | Goods filled in Pet Bottles | We find the Explanatory Notes to HSN 220210 satisfied. |

51.1 In pursuance to para 51, we are of the opinion that the subject goods which consist of water, sugar, sweetener, apple juice concentrate, flavours, aerated with carbon dioxide gas and presented in airtight containers fulfil the criteria to merit consideration for classification at HSN 220210.

52. We hold that subject goods, as evidenced from the Table-I at para 51, are carbonated beverages with fruit juice. Further, we, also, do notice there is a Tariff item at 22029920 with the description ‘fruit pulp or fruit juice based drinks’. Now we do observe that the subject goods having apple juice concentrate 1.9 % [Equivalent to 12.7% Apple Juice Reconstituted] appear to satisfy this description also and prima facie this heading 22029920 cannot be brushed aside as not applicable for subject goods.

53. We have considered the two competing Tariffs 220210 and 220299. We note that the issue of classification of Carbonated beverage with fruit juice and the applicable GST Rate has been dealt with by the Committee of Secretaries, Fitment Committee in the GST Regime. The observation of the Fitment Committee, which recommended for no change in the prevailing rates under Annexure-III of their recommendations placed for consideration by the GST Council during the 37th Council Meeting held on 20-9-19,is as follows:

Annexure III

Issues where no change has been proposed by the Fitment Committee in relation to goods

| S.No. | Description | HSN | Present GST Rate (%) | Requested GST rate (%) | Comments |

| 52. | Carbonated beverage with fruit juice | 2202 10 | 28% + cess | 12% as fruit juice | 1. Average pre-GST tax incidence on such goods was about 40%. |

| 2. Keeping in view the pre-GST tax rates, the Council has recommended 28% GST rate and 12% Compensation Cess on Aerated waters containing added sugar or other sweetening matter or flavoured (including lemonade) | |||||

| 3. Earlier, the Committee of Secretaries (CoS) in a meeting held on 29-8-2016 did not agree to the proposal of MoFPI to provide concessional rate of excise duty @ 6% for aerated drinks having fruit juice content of not less than 5% procured from domestic manufacturers | |||||

| 4. The issue regarding separate classification was earlier examined during the 28th GST Council meeting but the fitment Committee did not agree with the proposal keeping in mind the domestic fruit processing Industry | |||||

| 5. Fitment Committee does not recommend any reduction in present GST rate |

54. We note that the GST Council has agreed to the above recommendation as per the Minutes of the Meeting, the relevant para is reproduced as follows:

34.31 From item Nos. 43 to 57 of Annexure-III, the Council had no objection and approved the recommendation of Fitment Committee. The Hon’ble Minister from Uttar Pradesh raised the issue about item at Sl. No. 58 of Annexure III i.e. Extra Neutral Alcohol (ENA).

55. Further, GST council meeting held on 13th Sept. 2021, in the Press Release has issued following clarification:

‘5. Carbonated Fruit Beverages of Fruit Drink and Carbonated Beverages with Fruit Juice attract GST rate of 28% and Cess of 12%. This is being prescribed specifically in the GST rate schedule.’

56. From reading of Annexure III to the recommendation of the Fitment Committee, We note that the Fitment Committee has cited classification of Carbonated beverages with fruit juice at HSN 220210. We, further note that GST Council has approved the recommendation of Fitment Committee. Thus, with this, we infer that competing entries of HSN 220210 and 220299 for subject goods, is answered by the GST Council decision to be 220210 for carbonated beverages with fruit juice. Here we find it apt to reproduce the wordings of H’ble Delhi High Court, in the case of Manufacturers Traders Association vs UOI 2020 (43) G.S.T.L. 616 (Del.), at para 10:

‘GST Council – Status of – This is a Constitutional body brought into existence by 101st Amendment and is chaired by the Union Minister for Finance with Finance Minister of all States as members – Rates of GST are jointly decided and recommendations made to Central and State Governments – It is highest deliberative forum to resolve issues arising out of the implementation of the GST and the Council embodies the spirit of Co-operative Federalism’. The H’ble Court further ruled that it cannot sit in appeal and postulate that the decision of the Council is not what they have unwaveringly held it to be.

57. In conspectus of aforementioned discussions and findings, we pass the Ruling, based on the following:

i. The Explanatory Notes to HSN 220210

ii. The GST Council has approved the recommendation of said Fitment Committee, wherein carbonated beverages with fruit juice had been classified at HSN 220210.

iii. We abide by the decision of the GST Council, for it is legal and proper so to do, as also cited in the said H’ble Delhi High Court’s Decision at paragraph 57 of this Ruling

Ruling

1. Apple Cola Fizzy and Malt Cola Fizzy are Carbonated Beverages with fruit juice, classifiable at HSN 22021090.

2. GST is leviable at 28% on said goods.

3. GST Compensation Cess leviable at 12% on said Goods