Nagarjuna Agro Chemicals Private Limited vs. Na

(AAAR (Appellate Authority For Advance Ruling), Telangana)

Preamble

In terms of Section 102 of the Telangana Goods & Services Tax Act, 2017 (“the Act”, in short), this Order may be amended by the Appellate authority so as to rectify any error apparent on the face of the record, if such error is noticed by the Appellate authority on its own accord, or is brought to its notice by the concerned officer, the jurisdictional officer or the applicant within a period of six months from the date of the order. Provided that no rectification which has the effect of enhancing the tax liability or reducing the amount of admissible input tax credit shall be made, unless the applicant or the appellant has been given an opportunity of being heard.

2. Under Section 103 (1) of the Act, this advance ruling pronounced by the Appellate Authority under Chapter XVII of the Act shall be binding only

(a) On the applicant who had sought it in respect of any matter referred to in sub-Section (2) of Section 97 for advance ruling;

(b) On the concerned officer or the jurisdictional officer in respect of the applicant.

3. Under Section 103 (2) of the Act, this advance ruling shall be binding unless the law, facts or circumstances supporting the original advance ruling have changed.

4. Under Section 104 (1) of the Act, where the Appellate Authority finds that advance ruling pronounced by it under sub-Section (l) of Section 101 has been obtained by the appellant by fraud or suppression of material facts or misrepresentation of facts, it may, by order, declare such ruling to be void ab-initio and thereupon all the provisions of this Act or the rules made thereunder shall apply to the appellant as if such advance ruling has never been made.

*******

1. The subject appeal has been filed under Section 100(1) of the Telangana Goods and Services Tax Act, 2017 (hereinafter referred to as “TGST Act, 2017” or “the Act”, in short) by M/s. Nagarjuna Agro Chemicals Pvt. Ltd., 6-3-1219/24, Flat No.302, 3rd Floor, Ujwal Bhavishya Complex, Kundanbagh, Hyderabad – 500 016 having GSTIN 36AABCN5531F1ZP (“M/S. NACPL” / “the appellant”). The appeal is directed against the TSAAR Order No.3/2018 dated 30-05-2018 passed by the Telangana State Authority for Advance Ruling (Goods and Services Tax) (“Adv. Ruling Authority” / “lower Authority”) in respect of an application for Advance Ruling filed by the appellant.

2.1. Vide the said application filed under Section 97(1) of the Act, the appellant had sought an Advance Ruling with regard to the following question:

“Classification / Rate of Tax i.e., Whether the Agricultural Soil testing Minilab and its Reagent Refills is classifiable under exempted goods as notified vide Notification No.2/2017 of Section 6, sub-Section (1) of the Act, the Entry No. 137 falling under Chapter Heading No. 8201 ?”

2.2. The Adv. Ruling Authority disposed of the application vide the impugned Order by pronouncing the Advance Ruling as follows:

“Agricultural Soil testing Minilab and its Reagent Refills are classifiable under Tariff heading 9027 of the GST Tariff and tax rate applicable is 9% CGST + 9% SGST”.

It is against the aforesaid ruling that the present appeal has been filed.

I. Whether the appeal is filed in time:

3. In terms of Section 100 (2) of the Act, an appeal against Advance Ruling has to be filed within thirty (30) days from the date of communication thereof to the applicant. The impugned Order dated 30-5-2018 was received by the appellant on 02.06.2018 as mentioned in their Appeal Form GST ARA-02and they have filed the appeal on 21-06-2018 i.e., within the prescribed time-limit.

II. Brief Facts:

4.1. The appellant had initially filed an application for Advance Ruling in the prescribed Form GST ARA-01 before the Adv. Ruling Authority on the question with regard to the classification, rate of tax and applicability of exemption Notification-entry, as cited above, in respect of the goods “Agricultural Soil Testing Minilab” (also referred to as “Mridaparikshak Minilab”) and its “Refilling Reagents” – hereinafter referred to colly. as “impugned goods”; and separately as “Mridaparikshak”/”Minilab” and “Refilling reagents” respectively. The appellants had stated that the impugned goods were used for determining / verifying soil health in terms of the parameters i.e., soil pH, Electrical Conductivity, Organic Carbon etc. The appellants claimed that the impugned goods were covered by the exemption entry at Sl.No.137 of Notification No. 2/2017 -Central Tax (Rate) dated 28-6-20171 which reads as follows:

| Sl. No. | Chapter/Heading/Subheading/Tariff item | Description of Goods | Rate |

| 137 Schedule- of Notification No.2/2017 Central Tax (Rate) | 8201 | Agricultural implements manually operated or animal driven i.e. Hand tools, such as spades, shovels, mattocks, picks, hoes, forks and rakes; axes, bill hooks and similar hewing tools; secateurs and pruners of any kind; scythes, sickles, hay knives, hedge shears, timber wedges and other tools of a kind used in agriculture, horticulture or forestry | Nil |

The appellants contended that the Minilab and Refill Reagents were exclusively used for Agriculture and hence fall for consideration as “Agricultural implements” of Heading 8201 as mentioned in the above entry.

4.2. The Adv. Ruling Authority, vide the impugned order, after considering the description, nature and usage etc. of the impugned goods and the applicable Chapter Notes / General rules for interpretation of the First Schedule to the Customs Tariff Act, 19752 (hereinafter referred to as “the Tariff”) and HSN (Harmonised System of Nomenclature) Notes; arrived at the conclusion that the impugned goods were classifiable under Heading 9027 of the Tariff and pronounced the Advance Ruling accordingly, as reproduced earlier. In essence, the Adv. Ruling Authority rejected the appellants’ claims for (i) classification of the impugned goods under Heading 8201 and (ii) exemption thereof under the Notification-entry cited above.

IV: Appeal filed by the Appellant :

5. Against the said Advance ruling Order, the appellant filed the present appeal, inter-alia, on the following grounds:

(i) The Authority failed to appreciate their submissions especially that the product is exclusively meant for Soil Testing which squarely falls under “Agricultural implements of kind used in Agriculture”. Hence, the same ought to have been considered under Heading 8201 on the ground that it is exclusively used for Agriculture.

(ii) The Authority treated it under Chapter Heading No.9027 (entry 417) as instruments for checking quantities of heat, sound or light; whereas the Soil Testing Minilab is exclusively meant for soil testing to ascertain Soil nutrients for the purpose of exclusively for Agriculture, it is neither a chemical or a measuring equipment.

(iii) They further relied on certain case laws in support of their contentions.

6.1. As required vide Section 101 (1) of the Act, the appellant as well as the jurisdictional officers were granted personal hearing before this Appellate Authority on 10-9-2018. Sri J.V. Rao, Advocate, Sri P.V. Krishnamohan, GM-Finance, appeared on behalf of the appellant-Company; while Sri Jay G. Waghmare, Assistant Commissioner, Ameerpet Division and Smt. G. Sarada Srinivas, Superintendent, the jurisdictional officers represented the Department (CGST / Central Tax). After hearing the Advocate explaining his case for some time, it appeared to this Appellate Authority that the nature, functioning etc., of the impugned goods can be better understood / appreciated on the basis of details / explanation given by a proper technical person of the company. The hearing was accordingly adjourned.

6.2. At the next hearing held on 17-9-2018, Sri T.S.R. Murthy, Senior Research Officer (Technical person) of the company appeared, apart from the representatives of the appellant and Department, mentioned above. Both the parties filed written submissions; the appellants also submitted copies of certain documents viz., a leaflet of the item “Mridaparikshak”, Operation manual/Working Protocol for “Mridaparikshak-Minilab”, Soil Health Card apart from a compilation of case-laws relied upon by them.

6.3. Sri T.S.R. Murthy, the technical person explained the various aspects pertaining to the impugned goods including the nature, composition, functionality, method & manner of usage, form of supply etc. in detail, as follows:

(a) He produced before the Bench the main equipment “Mridaparikshak” and explained that the product described as “Mridaparikshak – MiniLab for Agriculture Soil Testing” as per the tax invoice on page 29 of the appeal booklet is actually a set of things / instruments / items / reagents (which are as shown in the photograph / leaflet submitted by them), and that out of these various items they are now showing to the Bench only the main item or instrument which is called as “Mridaparikshak”. The list of these various items / accessories etc., is given on the last page of the Operations Manual filed by them today which gives a list of total 38 items under various sub-categories, overall titled as “Mridaparikshak Packing Slip”. Sri Murthy further explained that on first supply of the Minilab, the reagents are supplied along with it, and thereafter depending on the requirement, refills are supplied as per the invoices of the kind shown on page 30 of the appeal booklet. During discussions, he explained that the entire Minilab put together, is basically a system for soil analysis, which analyses / measures, and reports (by way of a printout called the Soil Health Card) various soil parameters which are listed on the main item itself. These are as under :

“Soil Parameters:

pH, EC, Organic Carbon Available Nitrogen

Available Phosphorus

Available Potassium

Available Zinc

Available Sulphur

Available Iron

Available Boron

Available Cu

Available Mn

Lime Requirement

Gypsum Requirement

Calcareous”

(b) On further query from the Bench regarding the exact methodology, Sri Murthy explained that usually there are some prior processes required to be completed before the soil sample is placed for analysis by this Minilab. These processes are called quartering, sieving, etc., which are essentially in the nature of filtering fine / finer particles of soil to bring it to a mesh-size which can be analysed by this Minilab. The soil sample so refined / arrived at is then converted into a suspension by using various reagents, which are essentially chemicals [the composition of which he claimed is a secret, but which are supplied along with the Minilab as a part thereof; labeled as Reagent Number 1 to Reagent Number 42]. Then the electrode of the “Mridaparikshak” is dipped into the soil suspension so prepared and the machine is turned on and thereafter as per the internal software in the machine / equipment, the concerned parameter (which could be pH or Nitrogen content or Sulphur content and so on) is displayed on the display panel of the main item Mridaparikshak. Similarly, by using different reagents on the soil sample, the different parameters are measured and the result is printed on the Soil Health Card. He further explained that depending on the values of the various parameters, the system gives recommendation in terms of fertilizers needed by the farmers.

(c) On further query from the Bench, he explained that some parameters such as pH, EC (Electrical Conductivity) and OC (Organic Carbon) are directly measured by the system whereas some others for example “Available Nitrogen” are thereafter internally calculated based on in-built logic/software. For example, the value of the parameter “Available nitrogen” is calculated on the basis of the measured “Organic Carbon”. He explained that the details in this regard are given in the manual filed by them. With this, the technical person concluded his deposition.

(d) The Counsel mentioned that though it is true that the item “Mridaparikshak” is measuring various parameters of the soil and in fact the name itself i.e, Mridaparikshak means ‘tester of soil’, but the fact remains that the item is working on soil, that the item is used for farmer, that the item is used for agriculture, and that therefore going by the end-use test it should be classified in Chapter 82 as ‘Agriculture tools’. He also referred to the case laws which he has filed as per which the benefit of doubt should go to the taxpayer.

(e) The Bench raised a query as to how the item does not fall under Heading 90.27 which inter-alia refers to ‘instruments for chemical analysis’. In response to this, the learned Counsel read out the text of the Heading 90.27 and said that that heading does not include the phrase “soil testing”. The Bench specifically wanted to know, especially in the light of the earlier explanation by their technical person, whether or not the impugned item does “chemical analysis” of the soil. In response to this, the Counsel mentioned that he is “not on that aspect”. His limited point is that the word ‘soil testing’ is not mentioned in Heading 90.27. The Bench then wanted to know whether the words “soil testing” are mentioned in the Heading 82.01 which is being claimed by them. In response, the Counsel referred to the entry 82.01 and agreed that the phrase “soil-testing” is not mentioned there either, but he referred to the phrase used therein namely “all other tools of a kind used for agricultural purpose”. He had nothing more to add.

(f) From Department side, Sri Jay G. Waghmare, Assistant Commissioner, stated that the system Minilab which is the subject of dispute here, admittedly carries out a process of chemical analysis, therefore is rightly classifiable in Heading 90.27. He further mentioned that the Heading 8201 which is claimed by the appellants applies only to hand tools of the kind mentioned therein whereas the system in question is not a hand tool inasmuch as it admittedly uses power and in fact also contains a Hot plate (the heating element in the photograph shown to us earlier by Sri Murthy). (At this point, Sri Murthy clarified that the system can be run either on power or on battery or by using solar power). He had nothing further to add.

VI. Discussion, Findings and Determination of the Appeal:

7. We have carefully considered the submissions on both sides as well as the material available on record, including the product literature, Manual, leaflet etc., and the applicable statutory provisions i.e, Tariff-entries, Chapter Notes etc.

8. The issues arising for determination in the subject appeal are as follows:

(i) Whether the goods viz., “Mridaparikshak – Minilab for Agriculture Soil Testing” merit classification under Heading 8201 of the Tariff as claimed by the appellant; or they are classifiable under Heading 9027 ibid as held by the Adv. Ruling Authority ?

(ii) Whether the goods viz., Refill Reagents merit classification under Heading 8201 of the Tariff as claimed by the appellant; or they are classifiable under Heading 9027 ibid as held by the Adv. Ruling Authority ?

(iii) Whether the goods i.e, Mridaparikshak-Minilab as also the Refill Reagents are covered by the entry at Sl.No. 137 of Notification No. 2/201 7-Central Tax (Rate) dated 28-6-2017 with ‘NIL’ rate of tax as claimed by the appellant; or they are chargeable to 9 % CGST + 9 % SGST as per the impugned Order?

9. In order to determine the aforesaid questions, first the nature, usage etc. of the goods involved (hereinafter also referred to as “impugned goods”) are to be considered, followed by the relevant Tariff entries and statutory provisions etc.; and thereafter, the applicability or otherwise of the exemption-Notification entry to the impugned goods. [Applicability/otherwise of the case-laws cited by appellant is dealt at appropriate places in the course of our discussion & findings].

10. Details regarding the description, nature, functionality, usage etc. of the impugned goods are as available in the detailed record of personal hearing reproduced above [read with the Operation Manual / Working Protocol submitted by the appellants] and hence not reiterated again. From the same, we find as under:

(i) Mridaparikshak is an electronic instrument used for determining various soil parameters i.e. soil pH (roughly termed as power of hydrogen ions)3, EC (Electrical Conductivity), OC (Organic Carbon), Available Nitrogen, Phosphorus, Potassium, Sulphur and micronutrients like Zinc, Boron and Iron etc. The phrase “Mridaparikshak-Minilab for Agriculture soil testing” is the reference to the set of things / instruments / items consisting of the said main instrument Mridaparikshak plus totally 38 no.s of specified items (as per the Mridaparikshak Packing Slip submitted during the hearing). The said specified items (many of them mentioned under the caption “Accessories” in the Packing Slip) include a Meter, Shaker, Hot Plate, Sieves, Funnel, Beaker, Test tubes, Weighing Balance etc., and a Reagent box containing bottles of different Reagents (No.l to 42).

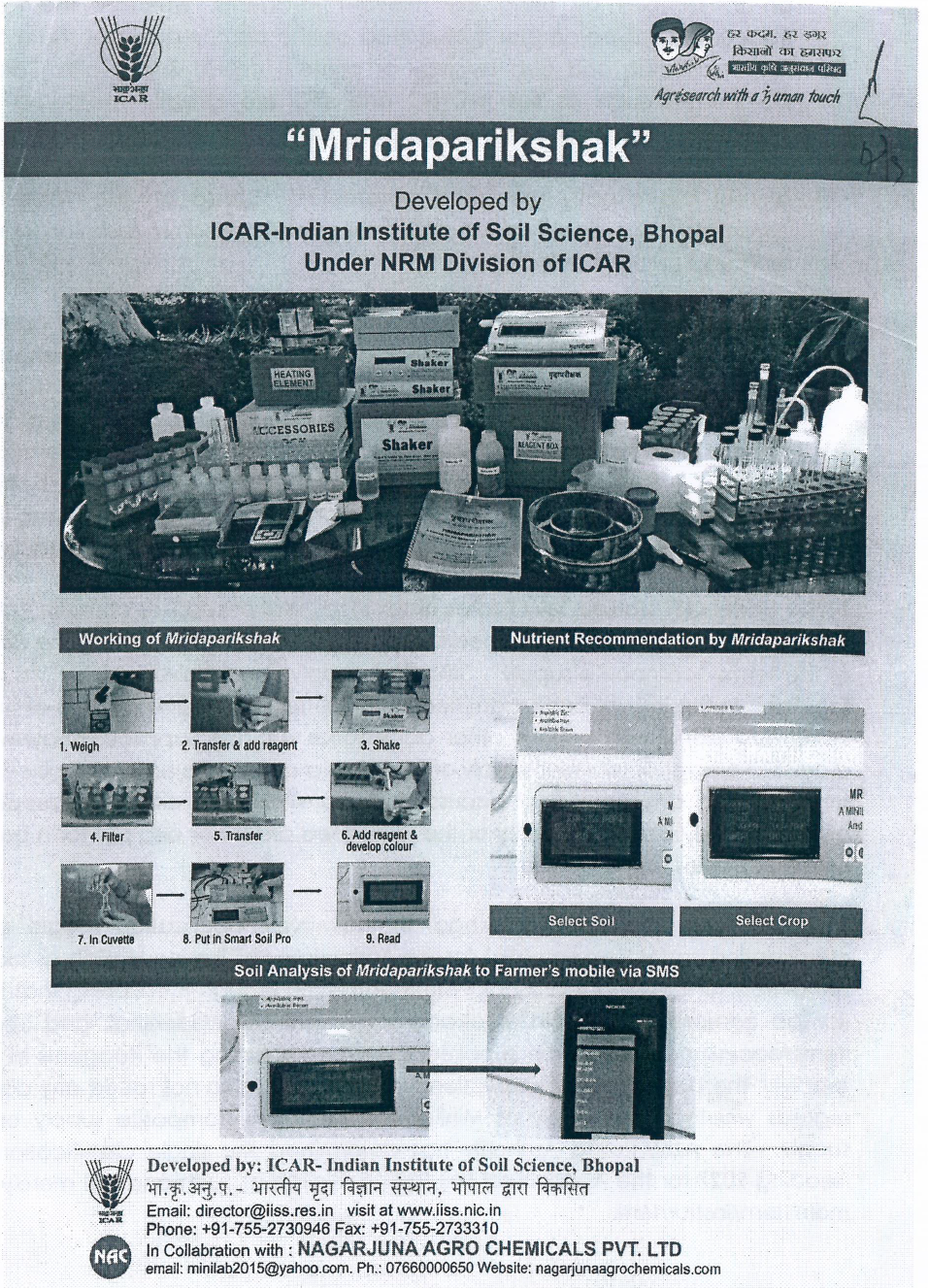

Thus, Mridaparikshak Soil Testing Minilab is a system / kit for soil analysis. The leaflet picture of the same, both sides, is as under:-

(ii) The Minilab is used to perform / undertake various steps / specified processes4 on soil-samples by using the relevant Reagents; whereby the result i.e, concerned soil parameter is displayed on the display panel of the main item Mridaparikshak and also by way of printout called Soil Health Card. The parameters such as soil pH, EC and OC are directly measured by the system/instrument whereas others such as Available Nitrogen are internally calculated by the instrument based on in-built logic/software, on the basis of any of the directly measured parameter. Based on the values of soil parameters, the system gives crop / soil specific recommendation in terms of fertilisers/nutrients needed.

(iii) The Reagents are chemicals/chemical substances supplied in bottles, but the nature i.e, chemical composition of these have not been furnished by the appellants either in their initial AR application or in the subsequent proceedings; during the personal hearing before us, it was claimed that the same is a secret, however, these are identified with assigned description as Reagent I to Reagent 42 on the labels affixed to the reagent bottles. As further explained during the said hearing, the first supply of the Minilab includes the Reagents, while subsequent refills are supplied depending on requirement.

11.1. Under GST statute, levy / rates of tax in respect of supplies consisting of two or more supplies of goods, is governed by Section 8 of the Act read with the definitions of the terms “composite supply”, “principal supply” and “mixed supply” as given in the Act. In the instant case, admittedly the Soil Testing Minilab consists of the main instrument along with various other accessories etc., as supplied. However, the aforesaid aspect of whether supply of Minilab is a composite supply or mixed supply, does not find any mention / discussion / examination in either the proceedings before the Adv. Ruling Authority or the impugned order nor also put forth before us, by either parties to the appeal.

11.2. As seen, the appellants had, in their initial application sought a single classification under Heading 8201 for the Agriculture Soil Testing Minilab as such (and not merely for the Mridaparikshak instrument) even though mentioning that the said Minilab comprises the main electronic instrument Mridaparikshak and also other items/accessories, which are supplied together (including the Reagents in the first supply). The Department / jurisdictional officers have also not raised any dispute as regards whether the supply of Minilab constitutes a composite supply or mixed supply. The Adv. Ruling Authority has determined the single classification under Heading 9027 for the Agricultural Soil testing Minilab as such and not merely for the main item/instrument.

11.3. Thus, we find that proceedings before the lower Authority were on the basis of an un-disputed and un-contradicted position (though not expressly mentioned/recorded so) that the supply of Minilab has been considered as a single supply for which classification was sought and determined on the basis of the nature/usage of the main instrument only and consequently treating the remaining items in the Minilab as secondary / ancillary. Thus, in the appeal as arisen before us read with statutory provision vide Section 8 ibid we find that the Minilab-supply has been treated a composite supply with principal supply therein being the Mridaparikshak main instrument as the predominant element to which the supply of other items/accessories was ancillary; and consequently the classification determined with regard to main instrument Mridaparikshak was applied as the classification of the Minilab. The parties to the appeal have not raised any dispute on this aspect.

11.4. In view of the above position, we are not required to go into the question of whether or not the supply of the impugned goods i.e, Agriculture Soil Testing Minilab actually constitutes a composite supply or mixed supply. We are required to only determine the correctness of the classification of the goods as determined by the lower Authority i.e, w.r.t. (1) the Minilab as initially supplied-which includes a set of Reagents and (2) the Refill Reagents subsequently supplied; in terms of the questions framed by us earlier.

12.1. As mentioned earlier, classification of goods for GST-purposes, is based upon the entries in the First Schedule to the Customs Tariff Act, 1975; including the Chapter / Section Notes therein, Rules for Interpretation thereof and General Explanatory Notes. The relevant entries pertaining to the two competing entries in the appeal i.e, Heading 8201 claimed by appellant and Heading 9027 as per the lower Authority’s ruling, merit a reference. The same read as follows:

“SECTION XV

BASE METALS AND ARTICLES OF BASE METAL

Notes :

1. This Section does not cover :

……………………

(i) instruments or apparatus of Section XVIII5, including clock or watch springs;

……………………

Chapter 82

Tools, implements, cutlery, spoons and forks, of base metal; parts thereof of base metal

Notes :

1. Apart from blow lamps, portable forges, grinding wheels with frameworks, manicure or pedicure sets, and goods of heading 8209, this Chapter covers only articles with a blade, working edge, working surface or other working part of:

(a) base metal;

(b) metal carbides or cermets;

(c) precious or semi-precious stones (natural, synthetic or reconstructed) on a support of base metal, metal carbide or cermet; or

(d) abrasive materials on a support of base metal, provided that the articles have cutting teeth, flutes, grooves, or the like, of base metal, which retain their identity and function after the application of the abrasive.

…………..

| Tariff Item | Description | Unit | |

| (1) | (2) | (3) | |

| 8201 | HAND TOOLS, THE FOLLOWING: SPADES, SHOVELS, MATTOCKS , PICKS, HOES, FORKS AND RAKES; AXES , BILL HOOKS AND SIMILAR HEWING TOOLS; SECATEURS AND PRUNERS OF ANY KIND ; SCYTHES, SICKLES, HAY KNIVES, HEDGE SHEARS, TIMBER WEDGES AND OTHER TOOLS OF A KIND USED IN AGRICULTURE, HORTICULTURE OR FORESTRY. | ||

| 8201 10 00 | – | Spades and shovels | kg. |

| 8201 30 00 | – | Mattocks, picks, hoes and rakes | kg. |

| 8201 40 00 | – | Axes, bill hooks and similar hewing tools | kg. |

| 8201 50 00 | – | Secateurs and similar one-handed pruners and shears (including poultry shears) | kg. |

| 8201 60 00 | – | Hedge shears, two-handed pruning shears and similar two-handed shears | kg. |

| 8201 90 00 | – | Other hand tools of a kind used in agriculture, horticulture or forestry | kg. |

SECTION XVIII

OPTICAL, PHOTOGRAPHIC, CINEMATOGRAPHIC, MEASURING, CHECKING, PRECISION,

MEDICAL OR SURGICAL INSTRUMENTS AND APPARATUS; CLOCKS AND WATCHES; MUSICAL INSTRUMENTS;

PARTS AND ACCESSORIES THEREOF

Chapter 90

Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; parts and accessories thereof

Notes :

1. This Chapter does not cover :

……………

2. Subject to Note 1 above, parts and accessories for machines, apparatus, instruments or articles of this Chapter are to be classified according to the following rules :

(a) parts and accessories which are goods included in any of the headings of this Chapter or of Chapter 84, 85 or 91 (other than heading 8487, 8548 or 9033) are in all cases to be classified in their respective headings;

(b) other parts and accessories, if suitable for use solely or principally with a particular kind of machine, instrument or apparatus, or with a number of machines, instruments or apparatus of the same heading (including a machine, instrument or apparatus of heading 9010, 9013 or 9031) are to be classified with the machines, instruments or apparatus of that kind;

(c) all other parts and accessories are to be classified in heading 9033.

| 9027 | Instruments and Apparatus for physical or chemical analysis (for example, polarimeters, refractometers, spectrometers, gas or smoke analysis apparatus); instruments and apparatus for measuring or checking viscosity, porosity, expansion, surface tension or the like; instruments and apparatus for measuring or checking quantities of heat, sound or light (including exposure meters); microtomes | ||

| 9027 10 00 | – | Gas or smoke analysis apparatus | u |

| 9027 20 00 | – | Chromatographs and electrophoresis instruments | u |

| 9027 30 | – | Spectrometers, spectrophotometers and spectrographs using optical radiations (UV, visible, IR) : | |

| 9027 30 10 | — | Spectrometers | u |

| 9027 30 20 | — | Spectrophotometers | u |

| 9027 30 90 | — | Other | u |

| 9027 50 | – | Other instruments and apparatus using optical radiations (UV, visible, IR) : | |

| 9027 50 10 | — | Photometers | u |

| 9027 50 20 | — | Refractometers | u |

| 9027 50 30 | — | Polarimeters | u |

| 9027 50 90 | — | Other | u |

| 9027 80 | – | Other instruments and apparatus: | |

| 9027 80 10 | — | Viscometers | u |

| 9027 80 20 | — | Calorimeters | u |

| 9027 80 30 | — | Instruments and apparatus for measuring the surface or interfocial tension of liquids | u |

| 9027 80 40 | — | Nuclear magnetic resonance instruments | u |

| 9027 80 90 | — | Other | u |

| 9027 90 | – | Microtomes; parts and accessories : | |

| 9027 90 10 | — | Microtomes, including parts and accessories thereof | kg. |

| 9027 90 20 | — | Printed circuit assemblies for the goods of sub-heading 9027 80 | kg. |

| 9027 90 90 | — | Other | kg. |

12.2. The Rules for Interpretation of the First Schedule to the Customs Tariff Act, 1975 (also referred in the Explanation to Notification No. 1 /2017- Central Tax (Rate) dated 28.06.2017), read as follows:

“GENERAL RULES FOR INTERPRETATION OF THE SCHEDULE

Classification of goods in this Schedule shall be governed by the following principles:

1. The titles of Sections, Chapters and sub-chapters are provided for ease of reference only; for legal purposes, classification shall be determined according to the terms of the headings and any relative Section or Chapter Notes and, provided such headings or Notes do not otherwise require, according to the following provisions:

2. (a) Any reference in a heading to an article shall be taken to include a reference to that article incomplete or unfinished, provided that, as presented, the incomplete or unfinished articles has the essential character of the complete or finished article. It shall also be taken to include a reference to that article complete or finished (or falling to be classified as complete or finished by viltue of this rule), presented unassembled or disassembled.

(b) Any reference in a heading to a material or substance shall be taken to include a reference to mixtures or combinations of that material or substance with other materials or substances. Any reference to goods of a given material or substance shall be taken to include a reference to goods consisting wholly or partly of such material or substance. The classification of goods consisting of more than one material or substance shall be according to principles of rule 3.

3. When by application of rule 2(b) or for any other reason, goods are, prima facie, classifiable under two or more headings, classification shall be effected as follows:

(a) The heading which provides the most specific description shall be preferred to headings providing a more general description. However, when two or more headings each refer to part only of the materials or substances contained in mixed or composite goods or to part only of the items in a set put up for retail sale, those headings are to be regarded as equally specific in relation to those goods, even if one of them gives a more complete or precise description of the goods.

(b) Mixtures, composite goods consisting of different materials or made up of different components, and goods put up in sets for retail sale, which cannot be classified by reference to (a), shall be classified as if they consisted of the material or component which gives them their essential character, in so far as this criterion is applicable.

(c) When goods cannot be classified by reference to (a) or (b), they shall be classified under the heading which occurs last in numerical order among those which equally merit consideration.

4. Goods which cannot be classified in accordance with the above rules shall be classified under the heading appropriate to the goods to which they are most akin”.

[Rules 5, 6, General Notes and Additional Notes are not reproduced since not relevant]

13.1. First, we deal with classification of the Mridaparikshak Minilab. On considering the nature, functions, usage etc. of the said Minilab vis-d-vis Heading 8201 claimed by appellant, the following position emerges:

(i) Heading 8201 covers goods which are Hand-tools, of the types specifically enumerated thereunder i.e, ‘Spades’ to ‘Timber-wedges’ and “other tools of a kind used in agriculture, horticulture or forestry”. Admittedly and undisputedly, the Minilab does not fall under any of the specific enumerated items ‘Spades’ to ‘Timber-wedges’.

(ii) The appellants’ claim is that they fall under the phrase “other tools of a kind used in agriculture”, appearing in the Heading.

13.2. We find the above claim to be untenable, for the following reasons:

(i) The construction of description in Heading 8201 is a typical one attracting application of the principle of ‘ejusdem generis’ for interpretation of the phrase “other tools of a kind used in agriculture,…. ‘. The said principle specifies that “general terms following particular expressions take their colour and meaning as that of the preceding expressions”. Application of the said principle is reflected / explained in the decisions of Hon’ble Supreme Court in Collector of C.Ex., Bombay vs Maharashtra Fur Fabrics Ltd. 2002 (145) E.L.T. 287 (S.C.)’, CCE, Chandigarh vs Shital International 2010 (259) E.L.T. 165 (S.C.) and Grasim Industries Ltd., vs Collector, Customs, Bombay 2002 (141) E.L.T. 593 (S.C.). Relevant extracts from the said decisions are reproduced, as follows:

Maharashtra Fur Fabrics Ltd.

“……6. A careful reading of the proviso to the notification would show that by resorting not only to the process of bleaching, dyeing, printing, shrink proofing, tentering, heat-setting, crease-resistant processing, but also to “any other process or any two or more of these processes”, the respondent would lose the benefit of the exemption. It is a well established principle that general terms following particular expressions take their colour and meaning as that of the preceding expressions, applying the principle of ejusdem generis rule, therefore, in construing the words “or any other process”, the import of the specific expressions will have to be kept in mind. It follows that the words “or any other process” would have to be understood in the same sense in which the process, including tentering, would be understood. Thus understood, a process akin to stentering/tentering would fall within the meaning of the proviso and, consequently, the benefit of the notification cannot be availed by the respondent.

Shital International

“…..14. There is no dispute that knitted pile fabrics are to be classified under heading No.60.01 of the Tariff Act. The issue is whether the processes of shearing and back-coating which do not figure in Chapter Note 4 to Chapter 60 of the Tariff Act, would fall within the ambit of “any other process” referred to in the said note. It is well settled that general terms following particular expressions take their colour and meaning as that of the preceding expressions, applying the principle of ejusdem generis rule, therefore, in construing the words “or any other process”, the import of the specific expressions will have to be kept in mind. (See: Collector of Central Excise, Bombay vs. Maharashtra Fur Fabrics Ltd. (2002) 7 SCC 444). Therefore, the processes, with which we are concerned in the present appeals must take their colour from the process of bleaching, dyeing, printing, shrink- proofing, tentering, heat-setting, crease-resistant processing, specifically mentioned in the note.

Grasim Industries Ltd.

“10.In the background of what has been urged by the assessee it has to be further seen whether the principles of ejusdem generis have application. The rule is applicable when particular words pertaining to a class, category or genus are followed by general words. In such a case the general words are construed as limited to things of the same kind as those specified. The rule reflects an attempt to reconcile incompatibility between the specific and general words in view of the other rules of interpretation that all words in a statute are given effect if possible, that a statute is to be construed as a whole and that no words in a statute are presumed to be superfluous. The rule applies only when (1) the statute enumerates the specific words, (2) the subjects of enumeration constitute a class or category, (3) that class or category is not exhausted by the enumeration, (4) the general terms follow the enumeration and (5) there is no indication of a different legislative intent….”

(ii) The guidelines in Grasim Industries supra, are found to be squarely fulfilled by the description against Heading 8201 . The opening phrase “Hand tools i.e,” primarily specifies the class/category/genus of goods falling therein as Hand Tools and none else. The items specifically enumerated thereafter i.e, ‘Spades..’ onwards to ‘timber-wedges’ all belong to the category of handtools. The said enumeration is not exhaustive in itself. The subsequent phrase “and other tools of a kind…” is a general expression following the specific enumeration. The Heading-description nowhere indicates a different legislative intent that goods other than hand tools, can fall under the said Heading. In fact though the Heading-description uses the words “other tools”, the description against the Tariff-item No. 8201 90 00 Uses the words “other hand tools…”. And the said Tariff Item is the last entry in the Heading; there being no further residual entry. Thus, it is clear that legislative intent is that only goods of the genus ‘hand tools’ are covered in the phrase “other tools of a kind…”, in particular and in the Heading 8201 in general.

(iii) In view of the above, the phrase “other tools of a kind…” appearing in Heading 8201 would not cover any goods other than hand tools. More pertinently, it would not cover the Mridaparikshak instrument / Minilab in question, which is admittedly an electronic instrument operated on electricity / battery /solar power, and is not even remotely in the nature of the various hand tools listed in the entry 8201.

14.1. The appellants had laid much emphasis on the aspect that the Minilab was used exclusively for agricultural purpose and hence to be classified under Heading 8201 as ‘tools of a kind used in agriculture’. This reason, can have no bearing nor relevance in the given context where the classification under Heading 8201 is to be governed only by the relevant Tariff-entries, Heading-description etc. Heading 8201 , as detailed above, does not provide any scope for nor in any manner envisages that all and every items used for agriculture would be covered therein.

14.2. Further, the Tariff specifically covers various items such as harvesting machinery, threshing machinery etc., which are also used exclusively in agriculture; under other headings; examples given below.

| 196. | 8432 | Agricultural, horticultural or forestry machinery for soil preparation or cultivation; lawn or sports-ground rollers |

| 197. | 8433 | Harvesting or threshing machinery, including straw or fodder balers; grass or hay mowers; machines for cleaning, sorting or grading eggs, fruit or other agricultural produce, other than machine of heading 8437 |

The appellants’ interpretation that any item exclusively used for agriculture has to fall under Heading 8201 under the category “other tools of kind used in agriculture” would render various other specific entries in the Tariff, such as those above, as redundant. Clearly, such interpretation is impermissible.

15. In view of the above, we hold that the goods i.,e the Mridaparikshak Instrument / the Minilab are not classifiable under Heading 8201 as claimed by the appellants.

16.1. Coming to the question of classification of the Minilab under Heading 9027 as held by the Adv. Ruling Authority, we find as follows:

(i) Description against Heading 9027 reads as follows:

“Instruments and apparatus for physical or chemical analysis (for example, polarimeters, refractometers, spectrometers, gas or smoke analysis apparatus); instruments and apparatus for measuring or checking viscosity, porosity, expansion, surface tension or the like; instruments and apparatus for measuring or checking quantities of heat, sound or light (including exposure meters); microtomes”.

(ii) The instruments / apparatus mentioned in the above description do not specifically include those used for either ‘soil testing’ or for determination of the parameters viz., soil pH, Electrical Conductivity, Organic Carbon or Available Nitrogen etc., which is the admitted function of the impugned Mridaparikshak instrument / Minilab. However, the said Heading-description is not exhaustive as seen from the words / phrases used therein i.e., “for example”, “or the like”.

(iii) In the Operation Manual / Working Protocol of the Mridaparikshak Minilab, submitted by the appellant during the personal hearing before us, we find the following description / explanation6 :

“Mridaparikshak lets you know quantitatively the status of soil pH, soil electrical conductivity (EC), and organic carbon, available N, available P, available K, available S, available Zn, B and Fe. The results as given by Mridaparikshak correspond to the results obtained by soil test laboratories. The results are comparable with the results obtained by Walkley and Black procedure for organic C, Subbaiah and Asija method for available N, Olsen and Bray methods for available P, neutral 1 N ammonium acetate method of available K, DTPA extraction method for available Fe and Zn, and hot water soluble method for available B”.

(iv) The Manual further provides a detailed description as to the method and manner of usage of the instrument as also the various accessories, Reagents etc., for the purposes of testing the soil-samples; along with specific parameter-wise description of the procedures to be undertaken etc., which are all in the nature of chemical analysis of the samples to discern / determine the desired parameters. In fact, at various places, the Manual-description refers to and mentions the processes / procedures undertaken as “analysis”; some excerpts being as under:

(i) “Most Important: It may be noted by the user that for the analysis of Organic C, Available P, K, S, Zn, Fe, Mn, Cu, and B, the instrument has to be set at zero level with distilled water… This has to be separately done before every analysts”7

(ii) “1) Please note that entire analysis of micronutrients has to be done in double layer distilled water”8,

(iii) “These filtrates will be used for the analysis of Fe, Mn and Cu as explained below”9,

(emphasis added).

(v) In fact, the meaning of the words “Reagents” as per standard dictionaries is “a substance that, because of the reactions it causes, is used in analysis and synthesis”10 A substance or mixture for use in chemical analysis or other reactions”11 Thus usage of Reagents in itself denotes that the Minilab is used for conducting chemical analysis.

16.2. From the aforesaid material on record and also considering the detailed explanation given by the appellant-company’s Technical person w.r.t. the method/manner of usage of the Mridaparikshak instrument / Minilab during the hearing before us, we conclude that the said goods are designed, intended and used for conducting “chemical analysis”. As such, the same would rightly fall within the description “Instruments for physical or chemical analysis” and hence rightly classifiable under Heading 9027.

17.1. The appellant’s contentions against the classification of the Minilab under Heading 9027 as stated in their grounds of appeal, are that ‘these are not instruments for checking quantities of heat, sound or light as treated by the Adv. Ruling authority’ and further that ‘it is neither a chemical or measuring equipment’. And during the hearing before us, it was contended that Heading 9027 is not applicable since it does not contain the phrase “soil-testing”.

17.2. We do not find merit in the above contentions. The mere non-appearance of phrase ‘soil testing’ in Heading 9027 is of no relevance. As per the clearly evident elements detailed above, the impugned Minilab is admittedly an instrument for scientific (physical / chemical) analysis of the soil. As such, it remains specifically covered in the Heading 9027, which applies to instruments or apparatus for physical / chemical analysis. In fact, during the hearing before us, in response to the specific query from the Bench as to “whether or not the impugned item does chemical analysis of the soil” the Counsel has only mentioned that “he is not on that aspect”. We thus find that a specific and direct answer to the said relevant query was parried, which answer could only be in the affirmative as per the details discussed above.

18.1. The Adv. Ruling Authority had held as to the classification of the Minilab under Heading 9027 by considering that its functions are similar to instruments / apparatus for physical or chemical analysis. Reference in this regard was made to the fact in the HSN (Harmonised System of Nomenclature) Explanatory Notes, the instruments viz., “Wet chemical analysers” [for determining inorganic/organic components of liquids] and pH meters [used to measure the factor expressing the acidity or alkalinity of a solution] are specifically mentioned under Heading 9027.

18.2. As detailed above, by the nature, functions and usage etc., the Mridaparikshak instrument / Minilab falls within the specific phrase “instruments for physical or chemical analysis” used in Heading 9027. Hence, we find that this classification would be applicable under the primary criterion ‘according to the terms of Headings’ vide Rule I of the Interpretative Rules, mentioned earlier.

18.3. Notwithstanding the above, we find that Heading 9027 in the Tariff mentions the names of only some such instruments for physical / chemical analysis illustratively, as referred earlier. As such, the Adv. Ruling Authority was right in referring to the HSN Notes and in arriving at the conclusion basing on the specific mention therein of pH meter, Wet Chemical Analyser; which are used for the similar functions of measuring / determining the pH factor, inorganic / organic components etc., as done by the impugned Mridaparikshak / Minilab. It is a well-settled legal proposition that where the Tariff-Schedule is based upon and structured on the same pattern as the HSN, the HSN Notes are relevant and a safe guide for deciding issues of classification. This principle has been enunciated in a catena of judgements, including those of Hon’ble Supreme Court in CCE, Shillong vs Wood Craft Products Ltd. 1995 (77) ELT 23 (SC), CCE, Hyderabad vs. Bakelite Hylam Ltd., 1997 (091) ELT 0013 (SC), Commissioner of C.Ex., Goa vs Phil Corporation Ltd. 2008 (223) ELT 9 (SC) etc. [Though these decisions are rendered in the context of Central Excise Tariff, it is the substantive principle of law laid down therein which is applicable to the instant case, since there can be no dispute that the Customs Tariff (which is made applicable by the GST-rate Notification) is based upon and aligned with HSN]. Hence, we find that reference to HSN Notes by the Adv. Ruling Authority for deciding the classification of the Mridaparikshak / Minilab, is legally correct and tenable.

19. Inasmuch as the Mridaparikshak / Minilab is found to be classifiable under Heading 9027, the plea of appellants for classifying them under Heading 8201 remains further negated by Note I (h) to Section XV which precludes instruments/apparatus of Section XVIII (under which Chapter 90 falls) from being classified under Section XV, which includes Chapter 82.

20. In view of the above discussion, the first question for our determination is answered by holding that the goods viz., Mridaparikshak-MiniIab is rightly classifiable under Heading 9027 of the Tariff as held by the Adv. Ruling Authority and not under Heading 8201 as claimed by the appellant.

21.1. The next issue is the classification of Refill Reagents, which are admittedly chemicals / chemical substances – the composition of which is not disclosed by the appellants claiming the same to be a secret – and which are described only as ‘Reagent 1’ onwards to ‘Reagent 42’. In the Operation Manual / Working Protocol of Mridaparikshak Minilab also, references to the Reagents (in the different processes/procedures prescribed for analysis) are available with mention of only such number i.e, Bottle No. 1, Bottle No. 1 6 etc.

21.2. The advance ruling for classification has been sought for in respect of Refill Reagents; which are subsequently supplied as per requirement as stated by the appellants; in the initial supply, they are supplied as part of the Minilab classification of which has been determined above.

22. For the reasons alike as detailed above, with regard to a classification under Heading 8201, we find that the Refill Reagents are not classifiable under the said Heading since these do not qualify to be considered as ‘Hand tools’ by any means. Appellants have also not put forth any separate grounds/contentions in support of their claim for classifying the Refill reagents under Heading 8201, other than those which we have already dealt earlier.

23.1. In so far as classification of Refill Reagents under Heading 9027 – as held by the lower Authority – is concerned, we find as follows. The lower Authority’s reasoning and findings are that Refilling Reagents are part of Soil Testing Minilab; hence, parts and accessories identifiable as being solely or principally for use with instruments / apparatus of Heading 9027 are also to be classified under Heading 9027. This is apparently by applying Note 2 (b) to Chapter 90 supra, though not expressly stated so in the impugned order.

23.2. The appellants have, either in the grounds of appeal or further submissions, not disputed either the finding of the lower Authority that the Refill Reagents are solely or principally for use with the Mridaparikshak Minilab falling under Heading 9027 nor as to the application of Note 2 (b) of Chapter 90, for determining the classification. As such and on this count alone, the decision in the impugned Order classifying the Refill Reagents under Heading 9027 merits to be upheld.

23.3. Notwithstanding the same, on our independent examination, we find ourselves in agreement with the decision of the lower Authority in this regard, in view of the following:

(i) The Refill Reagents, said to be chemicals/chemical substances, however, as supplied to the customers, have no identity whatsoever by any specific name, description or contents etc., so as to show their actual nature / composition. Their only identity is in terms of the Sl. No.s assigned i.e, Reagent No. I to Reagent No. 42; and as mentioned above, the Mridaparikshak Minilab Operations Manual specifies their usage by a reference to these assigned Sl.Nos. only.

(ii) Thus, the Refill Reagents have the only identity as items/accessories to be used with the Mridaparikshak instrument / Minilab and none else; for the customers/recipients who use them. Evidently, in the absence of the actual name/composition etc. , the Refill Reagents cannot be put to any other use.

(iii) Note 2 to Chapter 90 specifies criteria, under three clauses (a) to (c), for classification of parts and accessories of the instruments/apparatus falling under the Chapter. Clause (a) is not applicable to Refill reagents, since these are not goods which by description / nature etc., fall under Chapters 84, 85, 90 or 91. Clause (b) speaks of parts and accessories, suitable for use solely or principally with a particular kind of machine.

(iv) The Refill reagents cannot fall to be considered as ‘parts’ of the Mridaparikshak instrument. However, the term ‘accessory’ has the meaning as “a person or thing that aids subordinately; an adjunct; appurtenance; accompaniment ‘12; “an object or device that is not essential in itself but that adds to the beauty, convenience or effectiveness of something else’; supplementary or secondary to something of greater or primary importance’, ‘additional’ 13.

(v) The question arises whether the Refill Reagents being chemicals used / consumed in the procedures / tests conducted for soil-testing / analysis can be considered as ‘accessories’ to the Minilab. In State of Uttar Pradesh vs M/s. Kores (India) Ltd. 1977 AIR 132, 1977 SCR (1) 837, Hon’ble Supreme Court dealing with the question of whether ‘ribbon’ is accessory or part of typewriter; held as under:

“..Regarding ribbon also to which the abovementioned rule of construction equally applies, we have no manner of doubt that it is an accessory and not a part of the typewriter (unlike spool) though it may not be possible to use the latter without the former. Just as aviation petrol is not apart of the aero-plane nor diesel is a part of a bus in the same way, ribbon is not a part of the typewriter though it may not be possible to type out any matter without it.”

(vi) Similarly, in Annapurna Carbon Industries Co vs State of Andhra Pradesh 1976 AIR 1418, Hon’ble Supreme Court held that ‘Cinema Arc Carbons’ are accessories to Cinematographic equipment.

(vii) Ratio of the above decisions squarely applies in respect of the Refill Reagents in the instant case. The Refill Reagents, without which, as it appears in the given facts of the case, the Minilab cannot be used / put to function by the customers for conducting the required chemical analysis, falls to be considered as an accessory to the Minilab. Thus, it is evident in the facts of the case that the Refill Reagents are suitable for use solely and principally with the Mridaparikshak Minilab, rather it is the only use and none otherwise. Hence, classification of Refill Reagents would be squarely covered in terms of Note 2(b) to Chapter 90. The residuary clause (c) of Note 2 is therefore not relevant.

24. In view of the above, with regard to the second question for our determination, we hold that the Adv. Ruling Authority’s decision of classifying Refill Reagents under Heading 9027 is correct and merits to be upheld.

25.1. The next question for determination is whether the exemption entry Sl.No. 137 of Notification No. 2/2017-Central Tax (Rate) dated 28-6-201 7 is applicable to the impugned goods. The said entry contains the relevant Heading as “8201”; while corresponding description of goods is given with the phrase “Agricultural implements manually operated or animal driven i.e.” preceding the same wording as per the Tariff heading 8201 i.e, “Hand tools, such as … or forestry”.

25.2. By considering the Heading 8201 specified in the entry alone, the impugned goods would not get covered therein for exemption, in view of our discussion and findings above showing that these are not classifiable under Heading 8201. The phrase “Agricultural implements ..” as used in the Notification qualifies the Heading description in the Tariff. That is, while the Tariff-heading covers various hand-tools described therein i.e, Spades, shovels etc., apart from the ‘other tools of a kind used in agriculture..’, the exemption is provided to only those hand tools fulfilling the criterion mentioned i.e, “agricultural implements..”. In other words, the exemption is applicable to a sub-set from out of the broad category of “Hand tools…” covered in Heading 8201. Since the impugned goods do not fall in the Heading itself, the exemption given in respect of a part of the Heading would not be applicable to them.

25.3. The phrase “agricultural implements” is not defined in the Notification or the Act. However, in the given context of the Notification-entry mentioning a specific Tariff Heading against the description, the said phrase cannot have an extended / extrapolated meaning to cover any/all goods which do not fall under the said Heading itself, such as the impugned goods.

26. Accordingly, w.r.t. the third question for our determination we hold that the impugned goods are not covered by the entry SI.No. 137 in the exemption Notification as claimed by the appellant.

27.1. The appellant has cited various case laws in their grounds of appeal / further submissions; the broad details of which are as follows:

| Sl.No. | Case law cited | Forum | Issue involved & Relevant Statute / Notification etc. |

| 1. | Sun Export Corporation vs. Collector of Customs, Bombay 1997(93) ELT.641 (S.C.) Cited by appellant as STC 111 (page 69) | Hon’ble SC | Pre-mix of Vitamin AD-3 (feed) grade not for medicinal use, whether falls under “Animal feed supplement” and exempted under Notification 234/82-CE dated 01-11-1982 |

| 2. | D.H. Brothers Pvt Ltd vs. Commissioner of Sales Tax, UP Lucknow | Hon’ble SC | Whether a Sugarcane Crusher is an Agricultural Implement within the enumeration in UP Sales Tax exemption Notification dated 14 November, 1980. |

| 3. | Indo National Ltd vs. State of Andhra Pradesh – 1987 64 STC 382 AP | Hon’ble High Court of Andhra Pradesh | Classification of ‘Dry Cells’ under First Schedule to the Andhra Pradesh General Sales Tax Act. |

| 4. | State of Andhra Pradesh vs. Karnatakam Govindayya Setty And Sons | Hon’ble High Court of Andhra Pradesh | Whether “vermicelli” popularly called “shevaya” is “maida” falling within entry 60 of First Schedule to the Andhra Pradesh General Sales Tax Act, 1957. |

| 5. | Jaya Food Industries Pvt Ltd vs Commercial Tax Officer, Nampally Circle, Hyderabad | Hon‘ble High Court of Andhra Pradesh | Whether vermicelli manufactured and sold under the trade name “Bambino vermicelli” falls under entry 129A of the First Schedule to the Andhra Pradesh General Sales Tax Act, 1957. |

| 6. | Godrej Agrovet Ltd vs Addl. Commissioner of Commercial Taxes, Bangalore 2011 (39) VST 20 Karn. | Hon’ble Court Karnataka High of | Whether Di-calcium Phosphate is an Animal feed supplement and chargeable to Nil rate of tax under the First Schedule to the Act or liable to tax under Third Schedule. |

| 7. | Vijay Ganesh Mill Stores, Vijayawada vs State of Andhra Pradesh | Hon’ble Sales Tax Appellate Tribunal | Classification of Rice Polishers whether falling under Entry 80 of First Schedule or Entry-12 of Sixth Schedule to the APGST Act Act. |

27.2. On perusal of the above decisions / case laws, we find as follows:

(i) None of the said case laws deal with the issue of classification of either the impugned goods or any goods similar to or comparable to them. Nor do any of the cited case-laws pertain to interpretation of the Tariff Headings 8201 nor for that matter Heading 9027 as involved in this case.

(ii) Each of the said decisions were rendered in respect of entirely different goods/commodities, in the context of totally different statutes / Acts / Notifications and the texts / wording therein; and further in totally different facts and circumstances. Hence, the said decisions have no applicability with regard to the subject matter before us, in our view.

(iii) Appellant has placed reliance on the ratio of some of these decisions that ‘in cases of two views or doubt /ambiguity, the view favourable to the assessee is to be preferred’; ‘that among different applicable entries the lower rate of tax has to be applied’; ‘that the end-user test has to be considered for classification’. However, we find that the above principles were applied in the situations involving an ambiguity / doubt as to the classification / eligibility for exemption vis-d-vis the statutory provisions / entries. In the instant case, as per our discussions and findings detailed above, the coverage of the impugned goods under Heading 9027 and the non-applicability of Heading 8201 as per the Tariff-entry as also the non-eligibility to the exemption-entry, are clear, unambiguous and without any scope for doubt. Hence, in our view, the aforesaid principles are not applicable to the present case.

(iv) We may further mention that it is well-settled legal position that precedent decisions can have application / binding value only in respect of identical (and not merely similar) set of facts and circumstances. Hon’ble Supreme Court in Collector of C.Ex., Calcutta vs Alnoori Tobacco Products 2004 (170) ELT.135 (SC) had held as follows:

11. Courts should not place reliance on decisions without discussing as to how the factual situation fits in with the fact situation of the decision on which reliance is placed. Observations of Courts are neither to be read as Euclid’s theorems nor as provisions of the statute and that too taken out of their context. These observations must be read in the context in which they appear to have been stated. Judgments of Courts are not to be construed as statutes. To interpret words, phrases and provisions of a statute, it may become necessary for judges to embark into lengthy discussions but the discussion is meant to explain and not to define. Judges interpret statutes, they do not interpret judgments. They interpret words of statutes; their words are not to be interpreted as statutes. In London Graving Dock co. Ltd. v. Horton (1951 AC 737 at p. 761), Lord Mac Dermot observed :

“The matter cannot, of course, be settled merely by treating the ipsissima vertra of Willes, J as though they were part of an Act of Parliament and applying the rules of interpretation appropriate thereto. This is not to detract from the great weight to be given to the language actually used by that most distinguished judge.”

12. In Home Office v. Dorset Yacht co. [1970 (2) All ER 294] Lord Reid said, “Lord Atkin’s speech is not to be treated as if it was a statute definition. It will require qualification in new circumstances.” Megarry, J in (1971) 1 WLR 1062 observed:

“One must not, of course, construe even a reserved judgment of Russell L.J. as if it were an Act of Parliament.” And, in Herrington v. British Railways Board [1972 (2) WLR 537] Lord Morris said :

“There is always peril in treating the words of a speech or judgment as though they are words in a legislative enactment, and it is to be remembered that judicial utterances made in the setting of the facts of a particular case.”

13. Circumstantial flexibility, one additional or different fact may make a world of difference between conclusions in two cases. Disposal of cases by blindly placing reliance on a decision is not proper.

14. The following words of Lord Denning in the matter of applying precedents have become locus classicus :

“Each case depends on its own facts and a close similarity between one case and another is not enough because even a single significant detail may alter the entire aspect, in deciding such cases, one should avoid the temptation to decide cases (as said by Cordozo) by matching the colour of one case against the colour of another. To decide therefore, on which side of the line a case falls, the broad resemblance to another case is not at all decisive.”

“Precedent should be followed only so far as it marks the path of justice, but you must cut the dead wood and trim off the side branches else you will find yourself lost in thickets and branches. My plea is to keep the path to justice clear of obstructions which could impede it.”

28. In view of the above, we find that none of the case laws cited by the appellant are applicable to the matter on hand.

29. In sum and having regard to the above discussions and findings, we hold that the impugned goods are correctly classifiable under Heading 9027 of the Tariff; they are not classifiable under Heading 8201 ibid. Further the impugned goods are not eligible for the exemption vide entry Sl.No. 137 of the Notification No. 2/2017- Central Tax (Rate) dated 28-6-201 7. The appellants have not made out any case for interference with the Adv. Ruling Authority’s ruling as above, which therefore merits to be upheld.

30. Accordingly, we pass the following

ORDER

The Advance Ruling pronounced vide TSAAR Order No. 02/2018 dated 30-052018 passed by the Telangana State Authority for Advance Ruling in re: appellant M/s. Nagarjuna Agro Chemicals Pvt. Ltd., Hyderabad is confirmed. The subject appeal is disposed of accordingly.

———————-

Notes:

1. Under the scheme of GST-taxation, for every Central Tax (Rate) Notification issued, a corresponding Notification is issued by State under respective state GST Act. As such, for ease of reference and appreciation of the discussion, the references hereinafter are made by citing the relevant Central Tax Rate Notification(s)/entries therein; which would also constitute a reference to the corresponding Notification issued under TGST Act, 2017.

2. Levy of GST on supply of goods is at the rates prescribed in Notification No.1/2017-Central Tax (Rate) dated 28-6-2017, which specifies goods by description and falling under ‘Tariff item”, “sub-heading”, Heading” and “Chapter”; which terms, vide Explanation (iii) have the meaning respectively as per the First Schedule to the Customs Tariff Act, 1975. Explanation (iv) further provides for application of the relevant Section / Chapter Notes, Rules for Interpretation of the Schedule and General Explanatory Notes for interpretation of the Notification. The Notification No.2/2017-Central Tax (Rate) dated 28-6-2017 is an exemption Notification also containing similar references /Explanation for application of the Customs Tariff for interpreting the entries therein.

3. Soil pH is a measure of the acidity or basicity (alkalinity) of a soil. pH is defined as the negative longrithm (base 10) of the activity of hydronium ions (H+) or, more precisely, H3O+aq) in a solution. Source: en.wikipedia.org.

4. As detailed in the Operations Manual / Working Protocol submitted by the appellant.

5. Chapter 90 containing the competing entry Heading 9027, falls under Section XVIII.

6. Second para under “Introduction” on page 3 of the Manual.

7. Page 20 of the Manual under the heading “3. Organic Carbon”.

8. Page 33 of the Manual under the heading “Procedure for iron, manganese and copper”.

9. Page 33 of the Manual under the heading “Procedure for iron, manganese and copper” after point (7).

10. www.dictionary.com

11. en.oxforddictionaries.com

12. Webster Comprehensive Dictionary, International Edition meaning as referred by Hon’ble Supreme Court in para 11 of 1997 (94) ELT.28 (SC) – United Copies India Pvt Ltd vs Commissioner of Sales Tax.

13. Webster’s Third New International Dictionary meaning referred by Hon’ble Supreme Court in Annapurna Carbon Industries Co vs State of Andhra Pradesh 1976 AIR 1418.