Wabco India Limited vs. Na

(AAR (Authority For Advance Ruling), Tamilnadu)

Note : Any appeal against the advance ruling order shall be filed before the Tamilnadu State Appellate Authority for Advance Ruling, Chennai under Sub-section (1) of Section 100 of CGST ACT/TNGST Act 2017 within 30 days from the date on which the ruling sought to be appealed against is communicated.

At the outset, we would like to make it clear that the provisions of both the Central Goods and Service Tax Act and the Tamil Nadu Goods and Service Tax Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the Central Goods and Service Tax Act would also mean a reference to the same provisions under the Tamil Nadu Goods and Service Tax Act.

M/. WABCO India Limited, No.3 (SP) Third Main Road: Ambattur Industrial Estate, Chennai, Tamilnadu – 600 093 (hereinafter called as ‘WABCO’ or’ ‘AppIicant’) is a limited company engaged in the manufacture of brake systems and related parts for heavy vehicles. They are registered under Goods and Service Tax (GST) vide Registration no. 33AAFCA6421P1ZK. The applicant has submitted the copy of application in Form GST ARA – 01 and also submitted a copy of Challan evidencing payment of application fees of ₹ 5,000/-each under sub-rule (1) of Rule 104 of CGST rules 2017 and SGST Rules 2017. WABCO, manufacture inter-alia, a product named ‘Electrical Wiring Harness’. WABCO has sought advance ruling on the following:

1. Whether the Electrical Wiring Harness, primarily an electrical wire with connectors at both ends, manufactured by the Applicant falls under the HSN tariff item 8544 for which the rate prescribed vide Notification no 1/2017 -Central tax (Rate) dated 28 June 2017 read with 41/2017 -Central tax (Rate) dated 14th November 2017 is 9% ?

2.Whether the said rate of Central tax of 9 0/0 is applicable to the above product with effect from 1st July 2017?

2.0 WABCO has stated that they are engaged in manufacture of brake systems and related parts for heavy vehicles such as trucks, bus and other such commercial vehicles. The Electrical Wiring Harness is primarily an electrical wire with connectors at both ends and this product, manufactured by the applicant, is supplied to automobile manufacturers for applications in Anti-skid Braking Systems (ABS) in heavy vehicles. The Electrical Wiring Harness consists of Connectors & accessories, Wires & Cables, Tapes – Flame retardant (FR) grade for Wiring Harness applications, corrugated tubes – Flame retardant (FR) grade for Wiring Harness applications and are used to distribute the electrical energy from one point to another. The Applicant manufactures the wiring harness following the ISO standards prescribed for automobile industry.

2.1 They have further stated Electrical Wiring Harness for vehicle will be classified more specifically under tariff item 85443000 “Ignition wiring sets and other wiring sets of a kind used in vehicles, aircraft or ships” and 854442 “fitted with connectors” and not under tariff item 8708 as “parts and accessories of motor vehicles of heading 88701 to 8705”; that as per Note 2 to Section XVII in Explanatory Notes for Harmonized Commodity Description and Coding System , which covers Chapter 86 to 89, the expression “parts and accessories” do not apply to “electrical machinery or equipment (chapter 85);they are also excluded from “parts and accessories” as per General Explanatory Notes to Section XVII as Electrical Harness is specifically covered elsewhere.

2.2 They stated that they are supplying the Electrical Wiring Harness to their customers such as major automobile manufacturers and in the retail segment through their distributors.; The supply has been made under invoices with CGST of 14% as per Sl no 161 of Schedule IV of Notification No 1/2017 as “insulated (including enameled or anodized) wire, cable and other insulated electrical conductors whether or not fitted with connectors(other than winding wires, coaxial cables, optical fibers” and with the amendment of Notification noel effective from 14th November 2017, the customers have been demanding the Applicant to charge CGST on above product at the rate of 9% as per sl.no 395 of Schedule III of Notification No 1/2017 and insisting on credit note for the differential tax charged in the past transactions (From 1 July, 2017 to 13th November,2017).Out of abundant caution, the Applicant continued to charge CGST on such products at the rate of 14% and deposited the amount with the Government. The intention of legislature was to treat 8544 as single entry as is evident from amendment and hence Electrical Wiring Harness attracted 9% CGST under Notification No 1/2017 effective from 1 July 2017. The Applicant has thus preferred this ruling for a clarity on the rate to the applied.

3. The Authorized Representative of the Applicant was heard in the matter. They stated that the Electrical Wiring Harness are to be classified under 8544 as per Customs Tariff and HSN explanatory Notes. They had stated that Notification No. 01/2017 has tariff 8544 under Schedule Ill presently and under Schedule IV till its amendment in November 2017, when tariff 8544 figures only in Schedule III. They stated that their goods are wiring harness which will fit the description of 8544.30 as other wiring sets used in vehicles as this is used in brakes. They stated that the notification rate of 9% should be applicable from 01/07/2017 onwards. They submitted write up on the product, images, invoices pre-and post GST. They also submitted Circular 25/88 Cx dated 17.11.1988 issued by CBEC on classification of wiring harness as under 8544.

4. The documents submitted by the Applicant have been examined. It is seen that a wiring harness is a set of wires, terminals and connectors that run throughout entire vehicle and relay information and electric power used in starting engine, lights, meters, power windows, doors, brakes and other devices in the vehicle. The wiring harness are made up of connectors, wires, cables, flame retardant tapes and corrugated tubes. This product is specifically used in Anti-lock braking system. The major customers are Tata Motors Limited & Ashok Leyland Ltd along with after-market sales to wholesalers & retailers. Sample invoices provided indicate that the product is being sold under the description “Electrical Wiring Harness” under HSN 8708 and 8544.

5. The question raised before us is Whether the Electrical Wiring Harness, primarily an electrical wire with connectors at both ends, manufactured by the Applicant falls under HSN tariff item 8544 for which the rate prescribed vide Notification No. 01/2017 – Central Tax (Rate) dated 28th June 2017 read with 41/2017 – Central Tax (Rate) dated 14th November 2017 is 9% and whether the said rate of Central tax of 9% is applicable to the above product with effect from 1st July 2017.

5.1 From the various submissions of the Applicant, it is seen that the Applicant is engaged in the manufacture of Electrical Wiring Harness Assembles consisting of insulated wires and cables with connectors used in brake systems and related parts for heavy vehicles such as bus, trucks and other such commercial vehicles; They have been supplying the Electrical Wiring Harness to their customers such as major automobile manufacturers and in the retail segment through their distributors.

5.2 In terms of explanation (iii) and (iv) to Notification No. 1/2017 – Central Tax (Rate) dt. 28-06-2017, tariff heading, sub-heading, heading and chapter shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act, 1975 and the rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975, including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall be applied for the interpretation and classification of goods.

General Notes to HSN Explanatory Notes to chapter 85 states:

This Chapter covers:

(7) certain articles and materials which are used in electrical apparatus and equipment because of their conducting or insulating properties, such as insulated electric wire and assemblies, thereof (heading 85.44)

Chapter Heading 8544 of Customs Tariff is as follows:

Insulated (including enameled or anodized) wire, cable (including co-axial cable) and other insulated electric conductors, whether or not fitted with connectors; optical fibre cables, made up of individually sheathed fibres, whether or not assembled tvith electric conductors or fitted with connectors

And more specifically, 85443000, states as follows:

Ignition wiring sets and other wiring sets of a kind used in vehicles, aircraft or ships

HSN Explanatory Notes to chapter 8544 states:

Provided they are insulated, this heading covers electric wire, cable and other conductors(e.g. braids, strips, bars) used as conductors in electrical machinery, apparatus or installations. . …Wires, cable etc, remain classified in this heading if cut to length or fitted with connectors(e.g. plugs, sockets, lugs, jacks, sleeves or terminals) at one or both ends. The heading also includes wire etc. of the types described above made up in sets (e.g. multiple cables for connecting motor vehicle sparking plugs to the distributor).

The applicant manufactures Electrical Wiring Harness which are insulated wires and cables with connectors which is used in automobile Industry and therefore it is to be seen that they are to be classified under HSN 85443000.

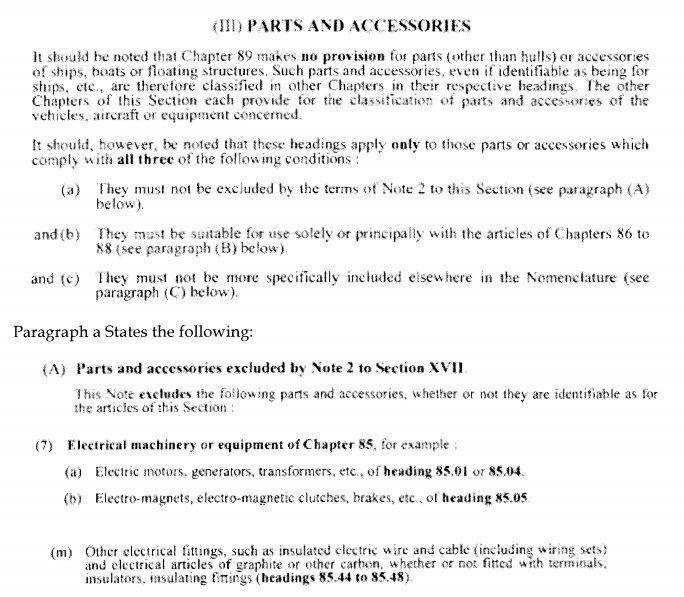

It is true that the items are parts of motor vehicles. Section note 2 to Section XVII covering chapter 87, is as follows:

2. The expressions “parts” and “parts and accessories” do not apply to the following articles, whether or not they are identifiable as for the goods of this Section:

(f) Electrical machinery or equipment (Chapter 85);

Further, as per the explanations to Section XVII in HSN, the parts and accessories of the vehicles falling under this chapter, will merit classification under this chapter only if the same satisfies the three conditions as below:

From the above, it is evident that insulated electrical wire and cable including wiring sets fitted with terminals or not of headings 8544 stands excluded as per Note 2 to Section XVII. Also, condition (c) is not satisfied in as much as wiring sets of a kind used in vehicles is specifically stated under 85443000. In view of the above, we find that the Electrical Wiring Harness manufactured by the applicant falls under the HSN tariff item 85443000. It is seen that Circular 25/88 Cx dated 17.11.1988 issued by CBEC has held that wiring harness are classifiable under 8544.

5.3 Having decided the classification, the next issue to be decided is the applicable rate. The description of goods falling under Tariff heading 8544 is mentioned at Sl. No. 395 of Schedule 111 and S.N0.161 of Schedule IV of Notification No. 1/2017-C.T.(Rate) dated 28.06.2()17, which are reproduced below:

| Sl. No. | Chapter/Heading /Sub-heading/ Tariff item | Description of Goods | Rate |

| 161 of Schedule IV | 8544 | Insulated (including enamelled or anodised) wire, cable and other insulated electric conductors, whether or not fitted with connectors [other than Winding Wires; Coaxial cables; Optical Fiber] | 14 |

| 395 of Schedule III | 8544 | Winding Wires; Coaxial cables; Optical Fiber | 9 |

The product in question is an Electrical Wiring Harness set falling under 85443000. Winding Wires, Coaxial cables and optical Fiber falls under Chapter Heading 854410, 854420 and 854470 respectively. Therefore, the product in question is covered under Sl.No. 161 of Schedule IV above of Notification No. 1/2017-C.T.(Rate) dated 28.06.2017 and G.O. (Ms) No. 62 dated 29.06.2017 No. Il(2)/CTR/532(d-4)/2017 and is subject to tax at the rate of 14% CGST and 14% SGST. The said Notification is amended as per Notification No. 41/2017- C.T.(Rate) dated 14th November 2017 and G.O. (Ms) No. 157, dated 14.11.2017 by which the Entry at SI.No. 161 of Schedule IV was omitted and the entry at SLNo. 395 of Schedule III was modified as follows:

“Insulated (including enameled or anodized) wire, cable (including co-axial cable) and other insulated electric conductors, whether or not fitted with connectors; optical fibre cables, made up of individually sheathed fibres, whether or not assembled with electric conductors or fitted with connectors”

These amendments were made effective from 15.11.2017.

From the above, it is clear that the ‘Electrical Wiring Harness manufactured by the Applicant, was subjected to tax @ 14% CGST and 14% SGST for the period from 01.07.2017 to 14.11.2017 and thereon, the tax rate is reduced to 9% CGST and 9% SGST.

6. In view of the foregoing, we rule as under:

RULING

1. The Electrical Wiring Harness manufactured by the Applicant falls under the HSN tariff item No. 85443000 for which the rate prescribed is 14% CGST under Sl.N0. 161 of Schedule IV of Notification No. 01/2017-C.T. (Rate) dated 28th June 2017 and SGST from Sl.No. 161 of Schedule IV of G.O. (Ms) No. 62 dated 29.06.2017 No. II(2)/CTR/532(d-4)/2017 for the period from 01.07.2017 to 14.11.2017 and from 15.11.2()17, the rate of tax is 9% CGST under Sl.No. 395 of Schedule III of Notification No. 01/2017-C.T. (Rate) dated 28th June 2017 and 9% SGST under Sl.No. 395 of Schedule 111 of G.O. (Ms) No. 62 dated 29.06.2017 No. II(2)/CTR/532(d-4)/2017

2. The rate of CGST and SGST at 9% each is applicable to the above product only with effect from 15.11.2017.