New GST on Water Bottles: Plastic vs Reusable Containers

Quick Summary

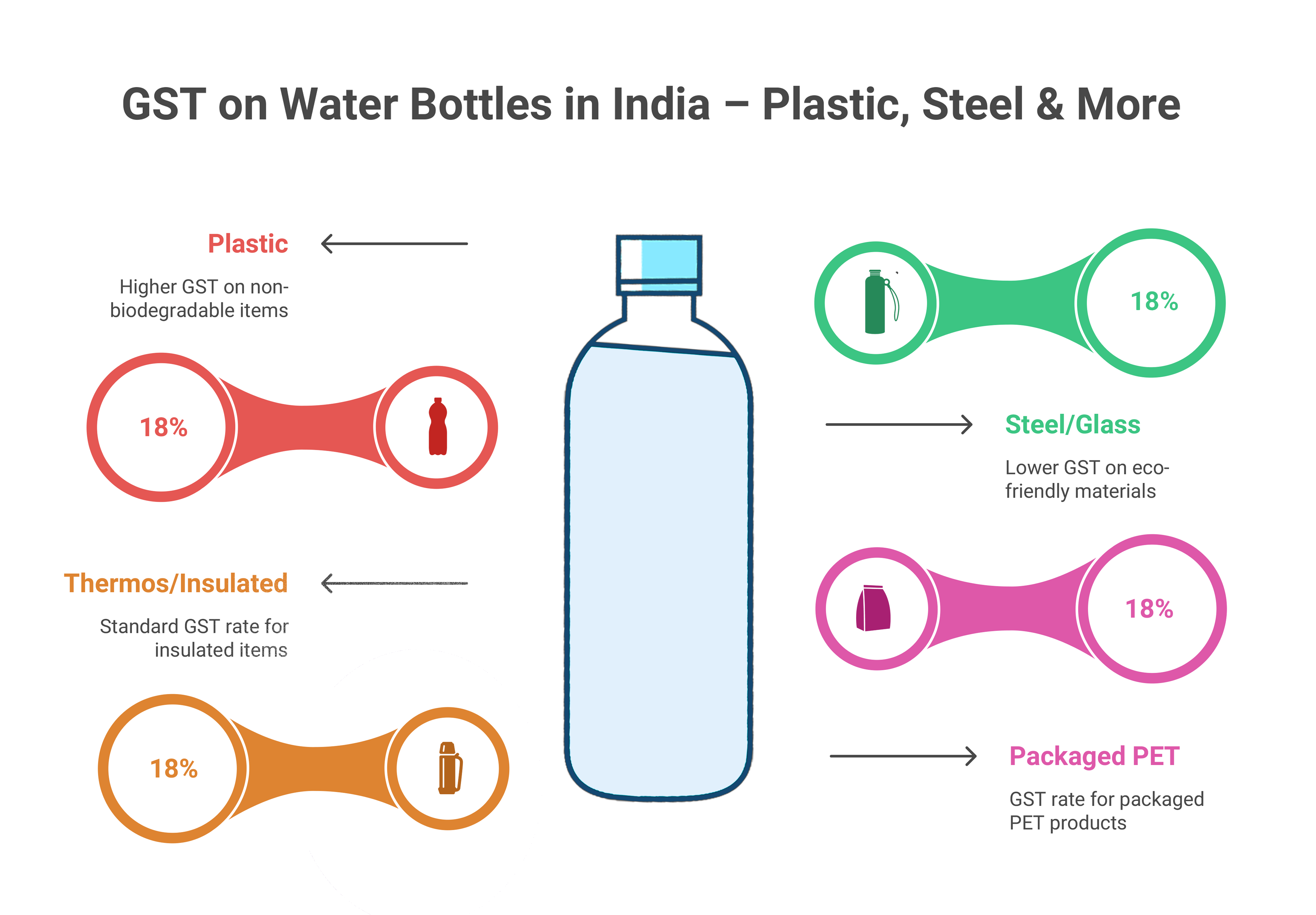

- Plastic water bottles and insulated bottles are taxed at 18% GST in India.

- Stainless steel and glass water bottles have a lower GST rate of 5%.

- Packaged drinking water in PET bottles is taxed at 18% GST.

- Sellers must apply the correct GST rate and include the HSN code on invoices.

- Businesses can claim Input Tax Credit (ITC) on raw materials under GST.

Water bottles are used by nearly everyone—students, office-goers, travelers, and homemakers. Whether you’re buying a single-use bottle or a durable stainless-steel one, it’s important to understand the gst on water bottle. This blog explains how water bottles are taxed under the GST system in India, based on their material and usage.

Book A Demo

New GST Rate on Water Bottles in India

The Government of India is updating GST rates effective after 22 Sep 2025. Below are the expected new GST rates for water bottles (no compensation cess).

New GST Rate on Water Bottles

Water bottles are taxed at different rates depending on the material they’re made from and how they’re sold (retail or commercial use).

| Type of Water Bottle | HSN Code | New GST Rate |

|---|---|---|

| Plastic water bottles | 3923 | 18% |

| Stainless steel/metal bottles | 7323 | 5% |

| Glass water bottles | 7013 | 5% |

| Insulated bottles (thermos/flask) | 9617 | 18% |

| Disposable PET water bottles (packaged water) | 2202 | 18% |

Old GST Rate on Water Bottles

(Old GST Rates – Applicable Until 21st September)

Water bottles are taxed at different rates depending on the material they’re made from and how they’re sold (retail or commercial use).

| Type of Water Bottle | HSN Code | GST Rate |

|---|---|---|

| Plastic water bottles | 3923 | 18% |

| Stainless steel/metal bottles | 7323 | 12% |

| Glass water bottles | 7013 | 12% |

| Insulated bottles (thermos/flask) | 9617 | 18% |

| Disposable PET water bottles (packaged water) | 2202 | 18% |

So, the water bottle gst rate usually ranges between 12% and 18%, depending on the material.

Get a Free Trial – Best Accounting Software For Small Business

GST on Plastic Water Bottles

Plastic is the most commonly used material for water bottles, especially for mass production. The gst on plastic water bottle is 18%, which is fairly high due to environmental concerns and the use of synthetic materials.

These bottles fall under HSN Code 3923, which covers plastic articles used for packing and storing liquids.

GST on Reusable and Insulated Bottles

- Reusable bottles made from stainless steel – 12% (HSN 7323)

- Glass water bottles – 12% (HSN 7013)

- Insulated flasks and thermos bottles – 18% (HSN 9617)

These eco-friendly options are generally taxed at a lower rate unless they are insulated, which increases the applicable GST rate.

Get a Free Trial – Best GST Accounting Software For Small Business

GST for Retailers and Manufacturers

- Apply the correct GST rate based on material

- Include the HSN code in your invoices

- File regular returns and claim Input Tax Credit (ITC) on raw materials

Proper GST compliance helps you avoid notices and ensures smooth business operations.

Explore a Free Demo of – Best Inventory Management Software For Small Business

GST on Packaged Drinking Water Bottles

Bottled mineral water and packaged drinking water are also taxed under GST. These are not classified as utensils but as beverages.

| Product | HSN Code | GST Rate |

|---|---|---|

| Packaged drinking water (PET bottles) | 2202 | 18% |

So, when you buy a bottle of mineral water, you’re paying 18% GST on it, included in the printed MRP.

Conclusion

Whether you’re buying plastic, stainless steel, or glass water bottles, knowing the applicable GST rates helps you make informed decisions. The gst on water bottle ranges from 12% to 18%, with PET packaged water bottles also taxed at 18%. For sellers and manufacturers, correct classification, invoicing, and ITC claims are essential for compliance and cost management.