All About einvoice1-trial.nic.in – Trial Invoice Registration Portal

The e-invoicing system is being implemented in stages. The National Informatics Center was the first designated invoice registration portal (IRP) for this (NIC). A trial version of einvoice1-trial.nic.in was made available to taxpayers so they could get accustomed to using it. However, the government withdrew this website since many taxpayers were using it to create their actual e-invoices. In this piece, we will take a look at what einvoice1-trial.nic.in is and what the user can do by using this provision.

BOOK A FREE DEMO

What is the einvoice1-trial.nic.in?

- Generation Of unique Invoice Reference Number (IRN)

- Validation of IRN

- Cancel IRN

- Print e-invoice

- Generate MIS reports

- Authorise a Sub-user to generate IRN, Cancel IRN, or generate reports relating to IRN

Given below is what the user the user can access before and after logging in to the portal:

Before Logging In-

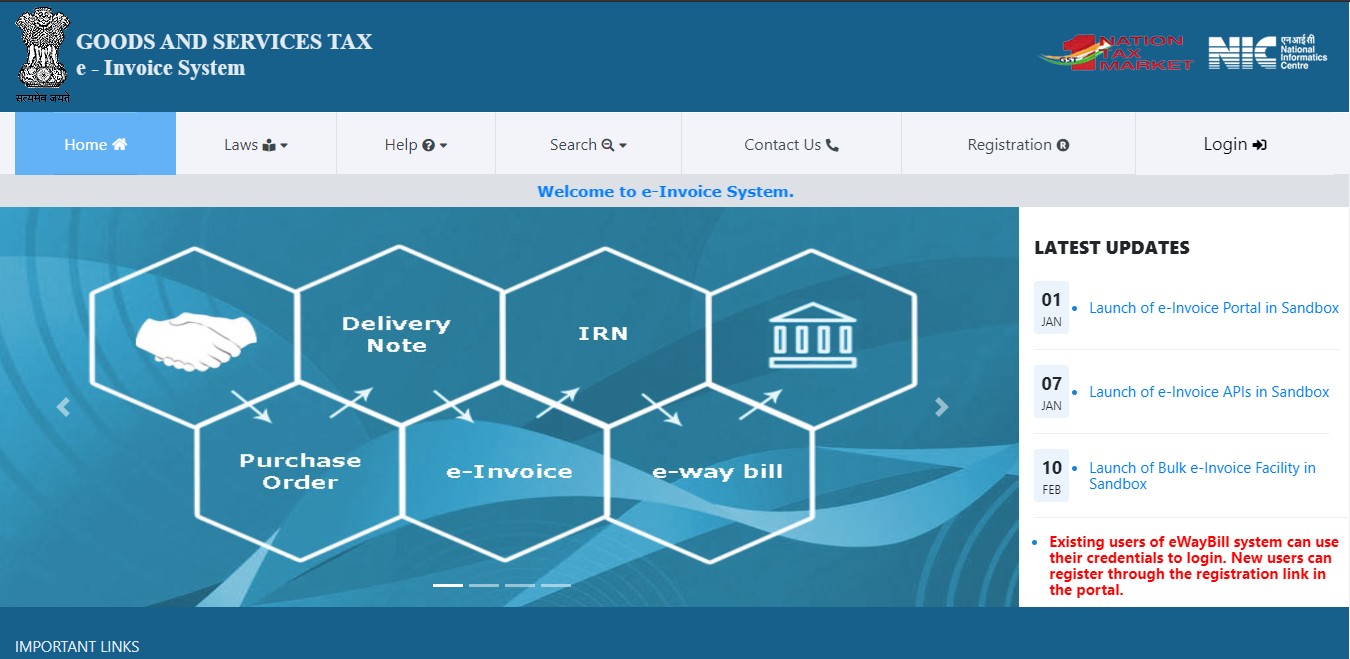

- Upon accessing the website’s homepage, a section containing updates relating to e-invoices could be found, where details regarding new features of the e-invoicing system are provided.

- The ‘Laws’ section contained various rules, forms, notifications and circulars related to e-invoicing.

- The ‘help’ section for the user manual, FAQs and tools like bulk generation tools can be found.

- The following information can be looked up in the “Search” section:

- Taxpayer details by entering their GSTIN.

- Product and service details by entering the HSN codes

- Verification of a signed invoice

- Status of e-invoice of the taxpayer

- There is a phone number and email address for support under the “Contact Us” section.

- The place where users register to utilise the e-invoicing system for the first time on the website. The registration facility is available for different types of users, such as SMS-based, mobile-based, GPS-based, API based, etc. Depending on the choice made during registration, an e-invoice generation mode is available.

- The ‘login’ section to enter credentials after registration is successful.

After Logging In-

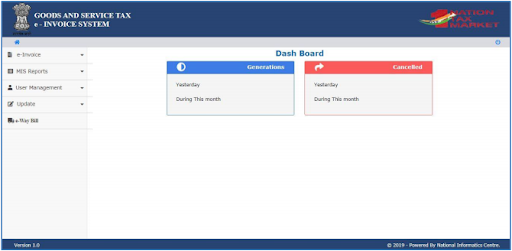

After a successful login, the main menu screen looks like this:

The information above shows that there are five main options.

- E-Invoice

- MIS Reports

- User Management

- Update

- E-Way Bill

E-Invoice

The e-invoice menu contains the following sub-menus-

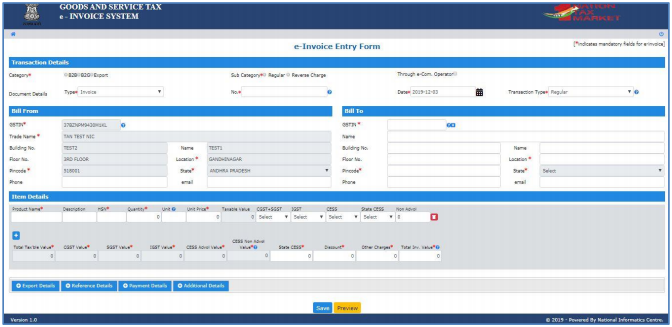

Generate IRN – This option lets the taxpayer generate the unique IRN by manually entering the invoice/debit note/credit note details.

Generate Bulk IRN – Rather than entering the data for each invoice one at a time, it is now possible to upload numerous invoices in a single JSON file. The website also provides a bulk converter tool that may be used to create JSON. Every invoice contained in the JSON will receive a different IRN.

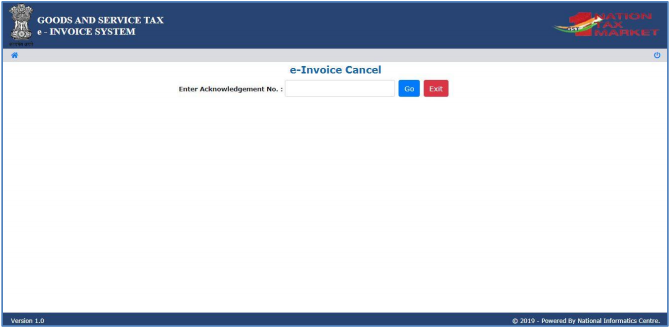

Cancel IRN – If the information for an invoice was uploaded incorrectly, the generated IRN might also be cancelled within 24 hours of developing it. Remember that the IRN cannot be removed; even a cancelled invoice still has a distinct IRN. You may find the invoice that has to be cancelled by entering the acknowledgement number.

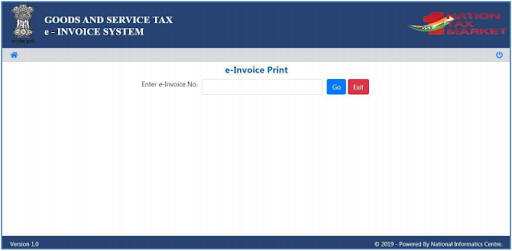

Print e-Invoice – It is necessary to enter the relevant invoice’s IRN/e-invoice number. A sample of the print can be seen below:

MIS Reports

An MIS report could be created using this option. A list of uploaded bills will be presented based on criteria and dates. Using the “Export To Spreadsheet Tab,” you may also export this list in excel format.

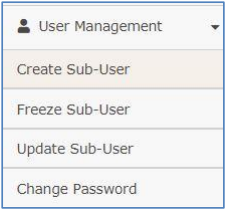

User Management

In a large firm, various individuals may play various responsibilities in the organisation’s handling of bills. Depending on their position, these users’ access could be managed through this site.

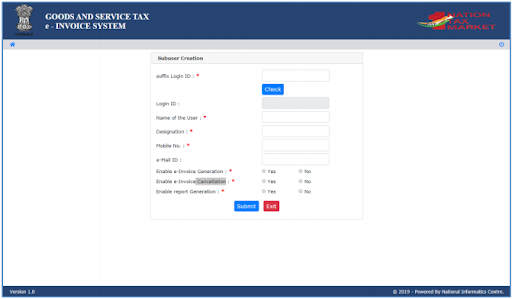

The options available are “Create Sub-User,” “Freeze Sub-User,” “Update Sub-User,” and “Change Password,” as seen in the above figure. Each of these sub-users received the ensuing kinds of permissions-

- Generate Invoice Reference Number

- Cancel Invoice reference Number

- Report Invoice Reference Number

The user IDs of the sub-users would be the same as those of the primary user, with the addition of a suffix, and they would each be given unique login credentials.

Update

The process of entering company information each time an e-invoice is created may be tedious. As a result, by using this option, you can use the information from the GST common site to automatically fill up some fields when creating an e-invoice.

E-Way Bill

Entering company information each time an e-invoice is created may be tedious. As a result, by using this option, you can use the information from the GST common site to automatically fill up some fields when creating an e-invoice.

Conclusion

With BUSY accounting software, you can generate IRN, cancel IRN, get GTIN details and complete system checks. It will eliminate the multiple visits to IRP, enabling you to generate and perform invoice operations within ERP itself. E-invoice has many benefits, such as auto-reporting invoices into GST returns and generation of the e-way bill, reducing the processing costs and improving business efficiency.

- GST Rates for ProductsGST Rates: GST for washing machine GST on paper GST on readymade clothes GST on alcohol GST for tours and travels toys GST rate GST on diamond GST rate for computer GST for mobile phones GST on taxi GST on paints GST for gym GST for rice GST on cab service GST for luxury items GST on dairy products GST on medical insurance tobacco GST rate agarbatti GST rate GST on fruits

Frequently Asked Questions

- Should I create e-invoices on the trial website or on https://einvoice1.gst.gov.in/?You should create e-invoices for live transactions on the official website, einvoice1.gst.gov.in. The trial website is for testing purposes only and should not be used for generating invoices that will be used in real business transactions.

- If I am already registered on the GST portal, do I need to register again on the e-invoice portal?No, if you’re already registered on the GST portal, you don’t need to register again on the e-invoice portal. Your GST credentials are used to access and generate e-invoices, as both portals are linked under the same GST system.

- Can I partially cancel an e-invoice?No, once an e-invoice is generated, it cannot be partially cancelled. It can only be fully cancelled if needed, provided it is done within 24 hours of generation. After this, you must issue a credit note for any changes or cancellations.

- What is the maximum number of sub-users I can create?You can create up to 5 sub-users for your GST e-invoice portal account. Each sub-user can have different roles and permissions depending on the tasks they need to perform, such as generating or cancelling invoices.

- Do I have to assign sub-users, or is it optional?Assigning sub-users is optional. If your business needs multiple people to manage different tasks, such as generating or cancelling invoices, you can assign sub-users. Otherwise, you can manage e-invoice tasks using your main account alone.

- Why can’t I generate reports for a specific time period, such as a start and end date?If you’re unable to generate reports for a specific time period, it might be due to system limitations or data unavailability. Ensure that all relevant data is uploaded correctly. In case of issues, check for any updates or consult the GST helpdesk.

- Can I make changes to an e-invoice after it has been generated?Once an e-invoice is generated and authenticated, it cannot be directly edited. However, if there are any errors, you must cancel the e-invoice and generate a new one with the corrected details. You can also issue a credit note or debit note as needed.