How to File GSTR-2?

*Important Note: GSTR-2 and GSTR-3 Returns are currently suspended. Taxpayers are required to file GSTR-3B instead.>

After submitting GSTR-1 (details of outward supplies), taxpayers are required to submit GSTR-2. GSTR-2 is a return that includes information on all incoming supplies. A taxpayer can claim The Input Tax Credit that is established based on this return. The information about the inbound supplies is automatically filled out in GSTR-2A when your suppliers file GSTR-1. All your purchases listed on GSTR-2A are regarded as inbound supplies by you. Therefore, while filing GSTR-2, only information about purchases from unregistered dealers and purchases that do not appear in GSTR-2A must be provided.

BOOK A FREE DEMO

Step-by-Step Process to File GSTR-2

Below is a detailed guide on how to file GSTR-2:

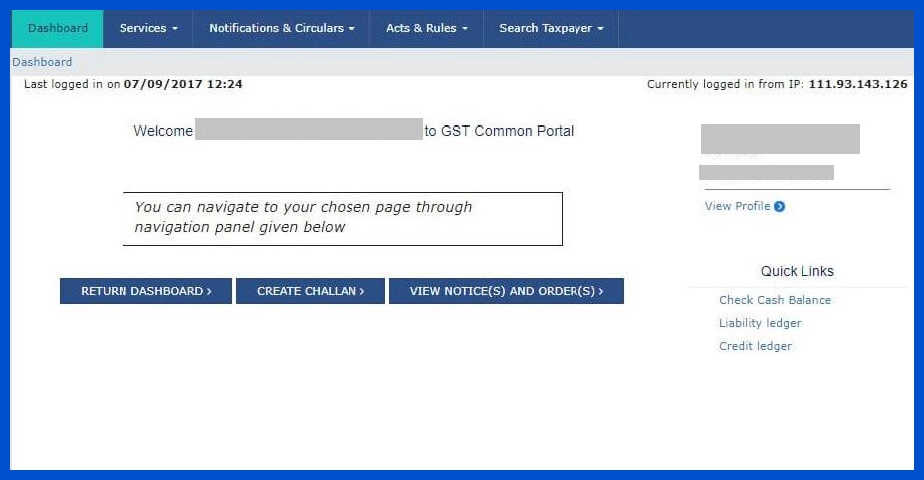

Step 1: Log on to GST Portal

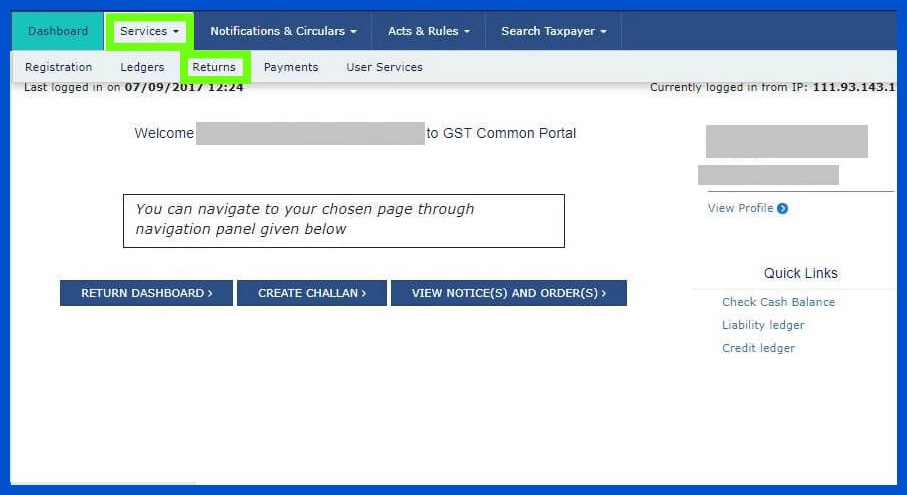

Step 2: Select the Returns option under Services

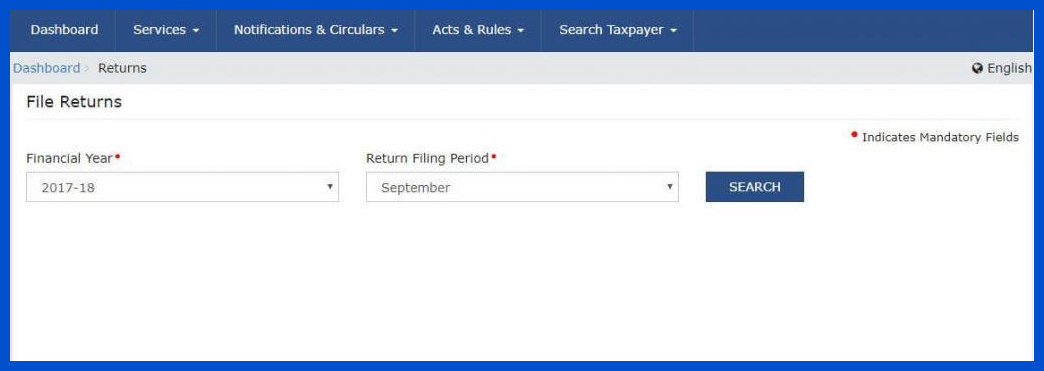

Step 3: Select the month for which GSTR-2 is being filed.

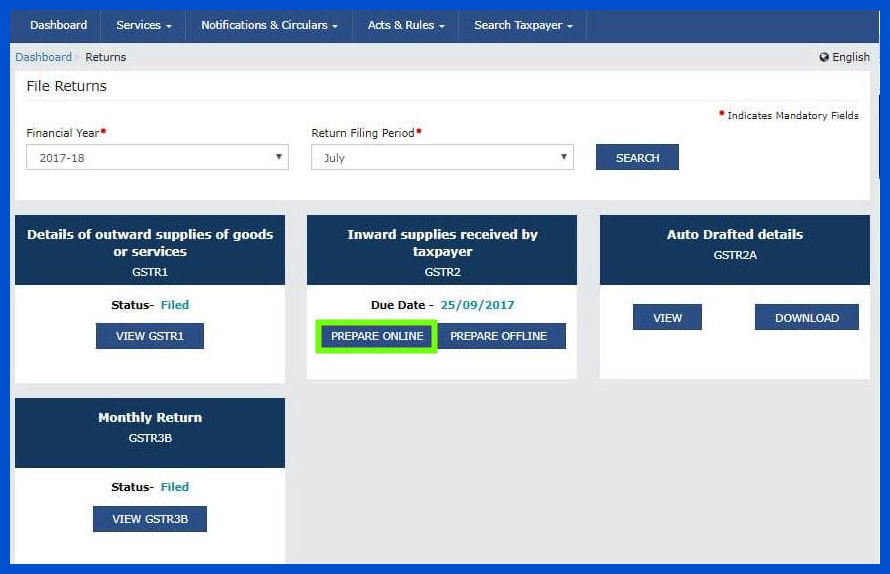

Step 4: Click the ‘Prepare Online’ button under GSTR-2

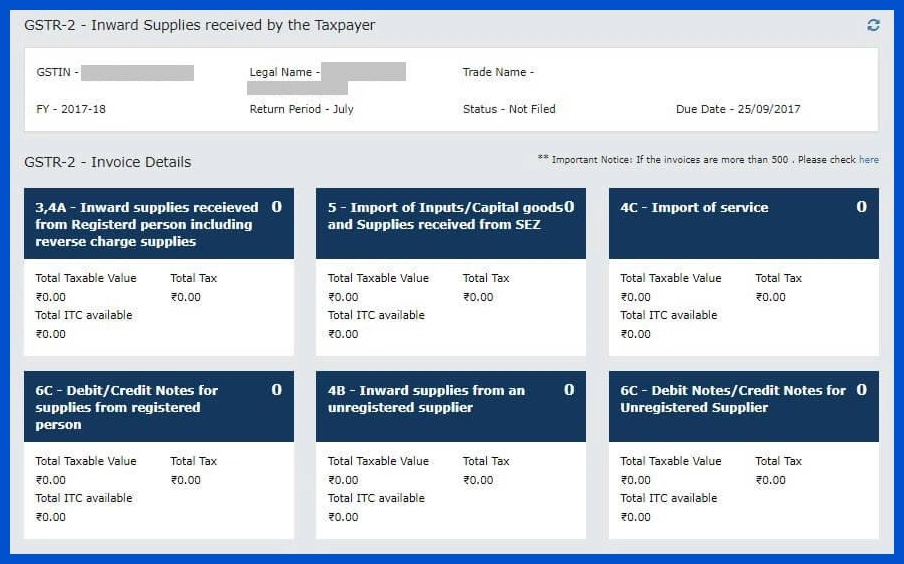

Step 5: You will find 11 sections that contain the necessary information. Only the information that needs to be modified or isn’t automatically filled out in your GSTR-2A should be entered in these tiles.

GSTR-2 Importance

GSTR-2 is a crucial return for taxpayers under the GST system. It captures detailed information about inward supplies, such as purchases and services availed during a tax period. This return helps taxpayers claim Input Tax Credit (ITC) by matching purchase details with the supplier’s GSTR-1. Accurate filing of GSTR-2 ensures that taxpayers receive the correct ITC, reducing tax liabilities.

Reconciliation of data between GSTR-2 and GSTR-2A (auto-populated from supplier filings) helps identify mismatches, such as missing or incorrect invoices. This process promotes transparency and minimizes errors in the GST system. Moreover, GSTR-2 helps the government monitor tax compliance and prevent tax evasion.

Timely filing of GSTR-2 ensures smooth credit flow and avoids penalties. Although GSTR-2 was suspended in 2017, it remains essential to understand its role as GST evolves, ensuring businesses stay prepared if it is reintroduced.

What is Buyer-Seller Reconciliation?

Buyer-seller reconciliation refers to the process of matching purchase records of a buyer with sales records filed by the seller under GST. This ensures that all invoices are reported accurately in both parties’ returns, avoiding mismatches and errors.

In GST, the buyer relies on the seller to upload correct invoice details in GSTR-1, which auto-populates GSTR-2A. The buyer compares this with their purchase records. If mismatches arise, such as missing or incorrect invoices, the buyer must communicate with the seller for corrections.

This reconciliation is crucial for claiming Input Tax Credit (ITC). Only matched invoices are eligible for ITC claims, making it essential for buyers to ensure accuracy. For sellers, accurate reporting avoids disputes and penalties.

Effective buyer-seller reconciliation promotes compliance, improves trust, and ensures smooth tax credit flow. It is an integral part of GST compliance to maintain accurate financial records and minimize disputes.

When Was GSTR-2 Due for a Month?

GSTR-2 was initially due on the 15th of the following month for a specific tax period. For example, the GSTR-2 for July was due by August 15. However, the government later suspended the filing of GSTR-2 due to its complexity and challenges faced by taxpayers.

The timeline for GSTR-2 filing was designed to allow buyers enough time to review and reconcile data with their suppliers’ filings in GSTR-1, which was due by the 10th of the following month. This sequential filing ensured that any mismatches in invoices or data could be identified and rectified before final submission.

Although GSTR-2 filing is currently suspended, taxpayers should remain familiar with its due dates and processes. This understanding helps ensure compliance if the government reintroduces the form in the future.

Get a Free Trial – Best E Way Bill Software

What Happened if GSTR-2 Was Not Filed?

If GSTR-2 was not filed, taxpayers risked losing their Input Tax Credit (ITC) for the relevant tax period. This is because ITC claims relied on the reconciliation of purchase details with suppliers’ GSTR-1 filings.

Non-filing could lead to mismatches in purchase and sales data, resulting in penalties and compliance issues. Tax authorities could initiate scrutiny or audits to investigate discrepancies, adding to the taxpayer’s burden.

Timely filing of GSTR-2 ensured compliance, smooth ITC claims, and avoidance of penalties.

Who Should File GSTR-2?

All registered taxpayers under GST were required to file GSTR-2, except for certain categories. Businesses engaged in the supply of goods or services, claiming Input Tax Credit (ITC), and registered under regular GST were eligible.

Exemptions included composition scheme taxpayers, Input Service Distributors (ISD), Non-Resident Taxable Persons, and those dealing in exempt supplies or exports under certain schemes. These entities had different compliance requirements.

The purpose of GSTR-2 was to capture details of inward supplies, such as purchases and services availed. This data was vital for reconciling with GSTR-2A and ensuring accurate ITC claims. Proper filing helped businesses maintain compliance and avoid penalties.

While GSTR-2 filing is currently suspended, understanding its requirements prepares taxpayers for potential reintroduction.

Explore a Free Demo of – Best Inventory Management Software For Small Business

How to Revise GSTR-2?

GSTR-2, once filed, could not be revised. Taxpayers were required to review and verify all details carefully before submission. To avoid errors, taxpayers reconciled purchase data with GSTR-2A, ensuring that all invoices matched accurately.

If discrepancies or mistakes were identified post-filing, they could be addressed in subsequent returns. For example, missed or incorrect invoices could be adjusted in the next month’s GSTR-2. Communication with suppliers was essential to ensure corrections in their GSTR-1 filings.

Thorough reconciliation before filing minimized the risk of errors. Taxpayers were encouraged to use tools like the GST Offline Utility for accurate data preparation and validation.

While GSTR-2 is currently suspended, taxpayers should focus on proper reconciliation and data verification practices to avoid filing errors in GST returns.

GSTR-2 Invoicing Details

3, 4A – Inward supplies, including reverse charge supplies, received from registered persons

If there is any missing supply that comes from authorised dealers, then the details of that supply should be mentioned here. This also applies to inbound supplies subject to a reverse charge.

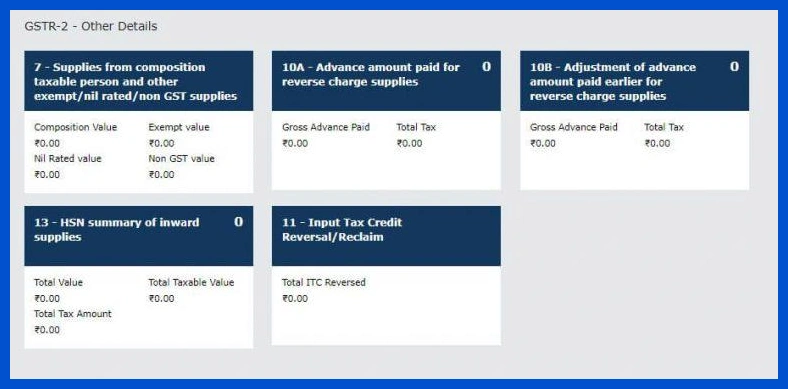

Step 1: To add information on any inward supplies from a registered person and reverse charge supplies missing from GSTR-2A, click on “ADD MISSING INVOICE DETAILS.”

Step 2: Enter the information below:

- GSTIN for the Supplier

- Date, number, and the total amount of the invoice

- Choose the state where the sale will take place

- Choose B2B, Deemed Exports, or SEZ Supplies with or without payment under Invoice Type.

Step 3: Click on Add Details

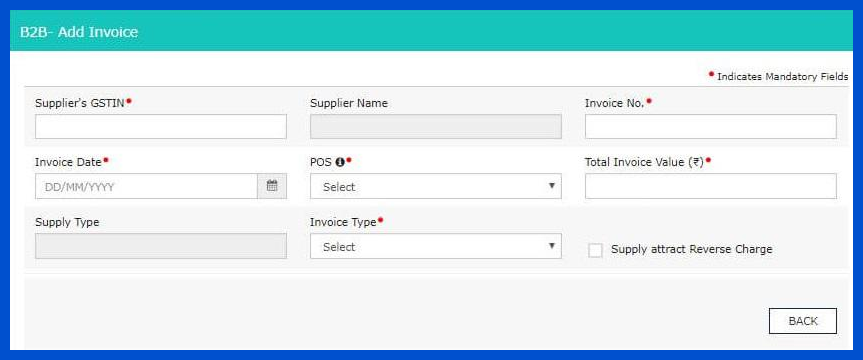

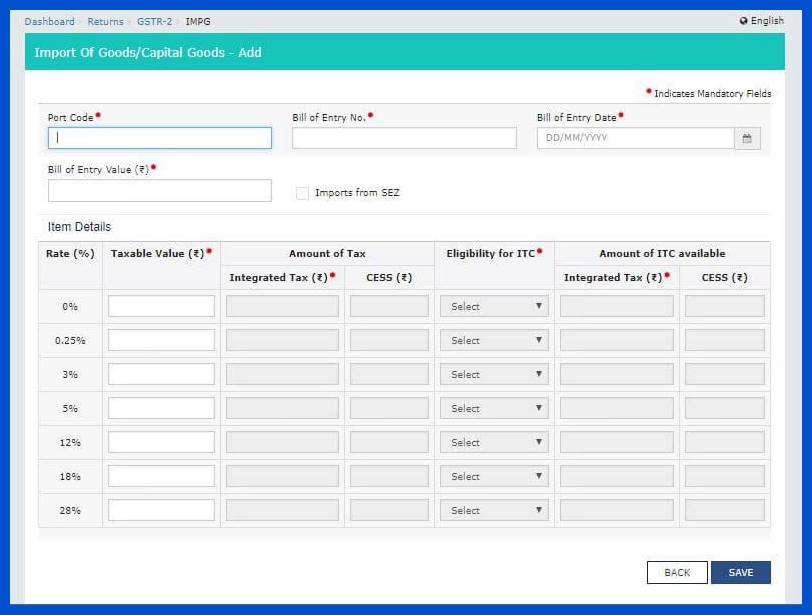

5 – Import of Inputs/ Capital Goods and Supplies received from SEZ

Goods received from SEZ, as well as inputs and capital products, should all be entered in this tile:

Step 1: Select “ADD BOE.”

Step 2: Enter the following information:

- The port code for the origin of the import

- Bill of Entry Number, Date, and Value

- Check the box to indicate whether the import is from a special economic zone.

- Enter the taxable amount based on the rate of tax that applies to the imported goods

- Select whether the tax qualifies for an ITC

Step 3: Click on Save

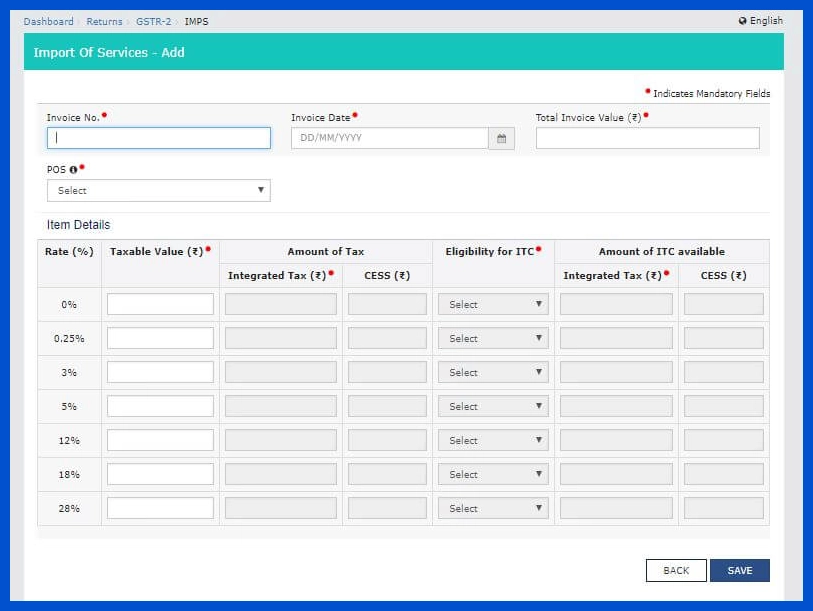

4C – Import of Service

Services that you imported are listed in this section.

Step 1: Select “ADD DETAILS.”

Step 2: Fill in the information below:

- Date, invoice number, and the total amount

- From the dropdown menu, choose a point of sale

- Enter the taxable amount based on the applicable tax rate

- Select whether the tax is eligible as ITC

Step 3: Click on Save

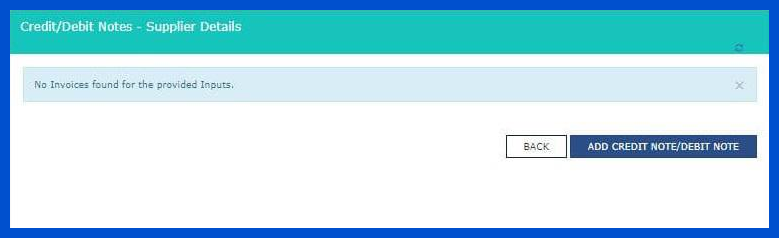

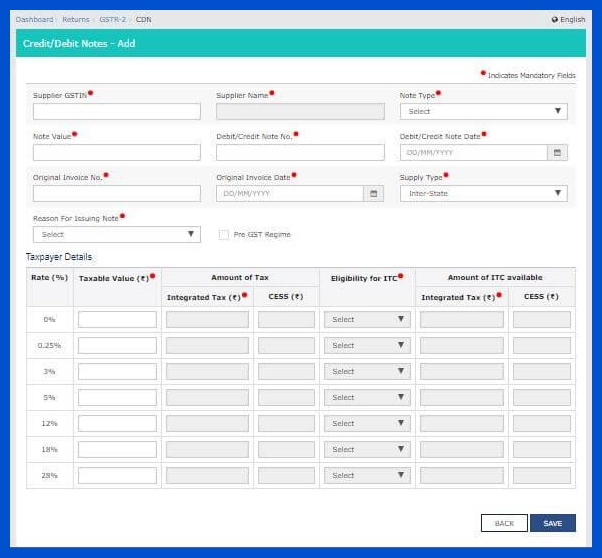

6C – Debit/Credit Notes for supplies from a registered person:

Any debit or credit note received from a registered dealer Click on ‘ADD CREDIT NOTE/DEBIT NOTE’but missing in GSTR-2A should be entered here.

Step 1: Click on ‘ADD CREDIT NOTE/DEBIT NOTE’

Step 2: Fill in the information below:

- GSTIN for the Supplier

- Type, value, number, and date of the note

- Date and original invoice number

- Interstate versus intrastate supply

- Reason for issuing note – sales return, post-sale discount, correction in the invoice, etc.

Step 3: Click on Save

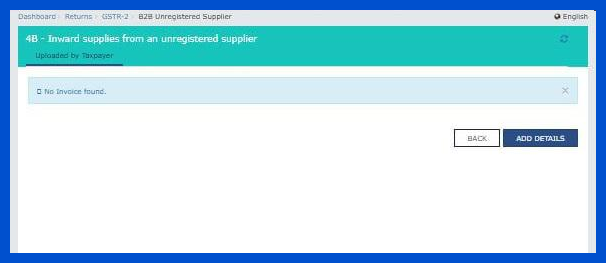

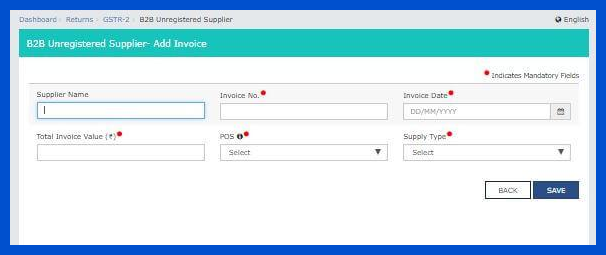

4b- Inward supplies from an unregistered supplier

This section must include information about all purchases of products and services from unregistered suppliers.

Step 1: Select “ADD DETAILS.”

Fill in the information below:

- Suppliers name

- Date, amount, and invoice number

- From the dropdown menu, choose the point of sale

- Interstate versus intrastate supply

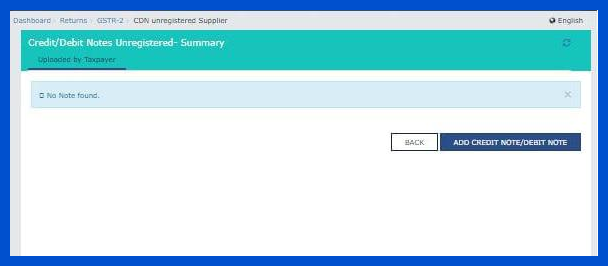

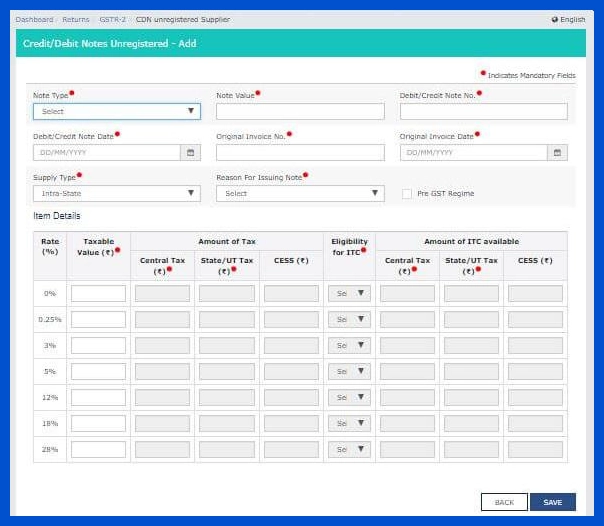

6C – Debit Notes/Credit Notes for Unregistered Suppliers

Any debit or credit note issued for incoming supplies from unregistered suppliers must be mentioned here.

Step 1: Select “ADD CREDIT NOTE/DEBIT NOTE.”

Step 2: Fill in the information below:

- Type, value, number, and date of the note

- Date and original invoice number

- Interstate versus intrastate supply

- Reason for the issue of note

- Based on the GST rate, the taxable value

Step 3: Click on Save

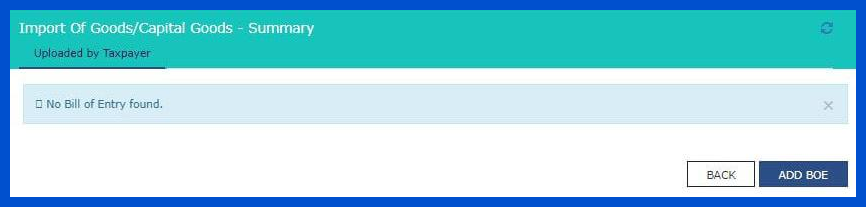

GSTR-2- Other Details

7 – Composition taxable person supplies and other exempt, nil-rated, and non-GST supplies

This field must be filled out with the total inbound supplies from composition dealers and all inbound goods that are exempt and nil rated.

Select “EDIT,” type the values, and select “SAVE.”

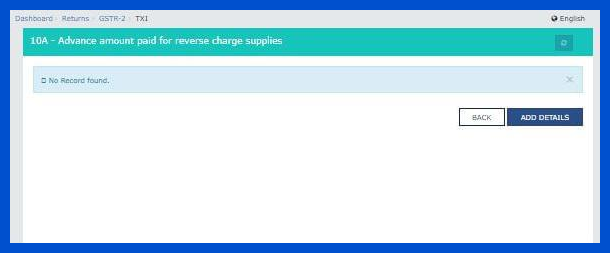

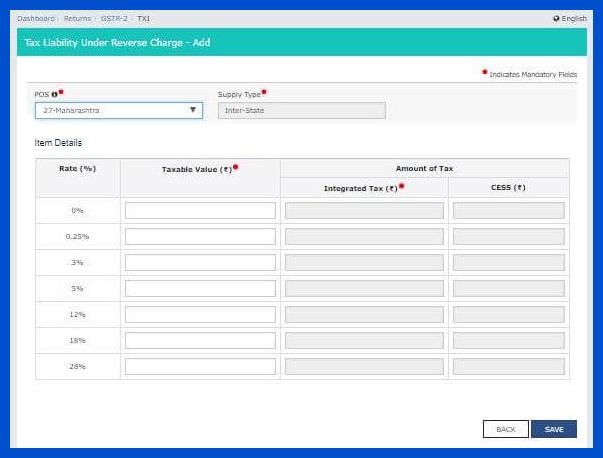

10A – Amount paid in advance for supplies with a reverse charge

You must enter any advances you’ve made for supplies subject to a reversal charge here. Due to the fact that you must pay tax based on RCM, this will increase your output tax obligation.

Step 1: Select “ADD DETAILS.”

Step 2: Enter the Point of Sale information and the Taxable Value calculated using the GST Rate. Select “SAVE”

10B – Adjustment of advance amount paid earlier for reverse charge supplies.

Any changes that need to be made to the information listed in tile 10A in earlier returns must be made here.

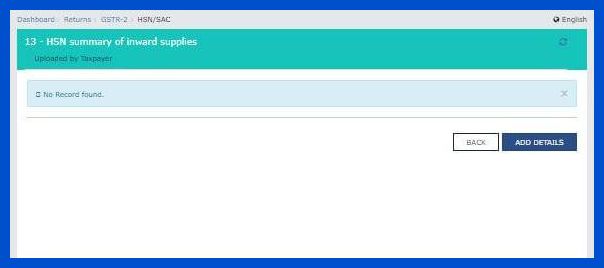

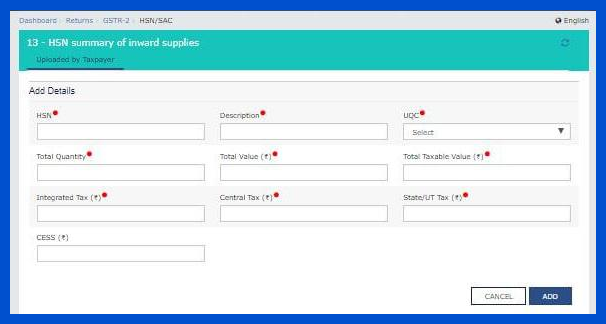

13 – HSN summary of inward supplies:

When submitting GSTR-2, information about incoming supply broken down by HSN code must be included.

Step 1: Select “ADD DETAILS.”

Step 2: Fill in the information below:

- The inward supplies’ HSN Code, Description, and Unique Quantity Code (UQC)

- The total amount, cost, and taxable value of all products and services

- The supplies were subject to IGST, CGST, SGST, and UTGST

Step 3: Click on Save

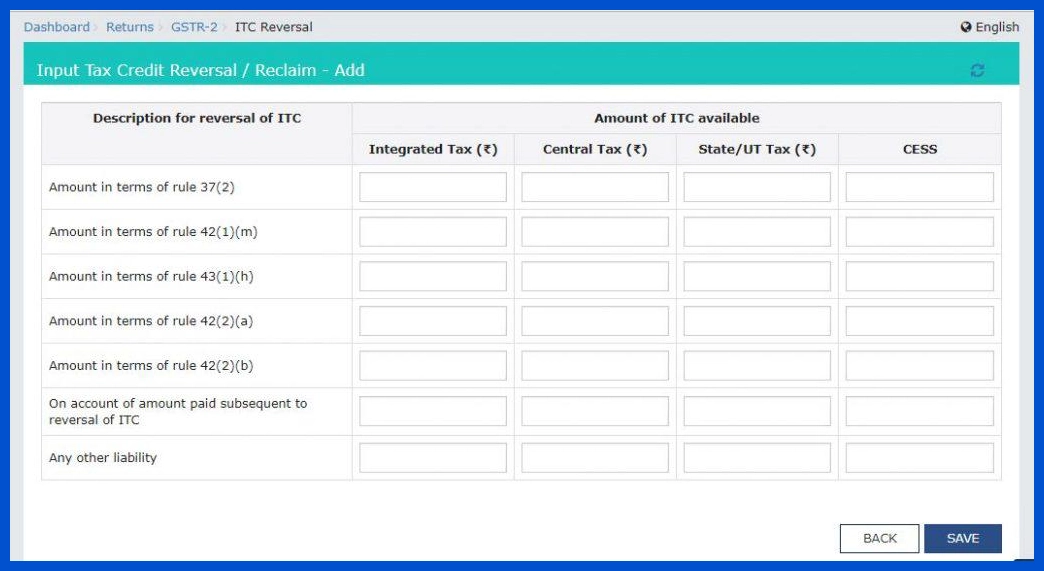

11 – Reversal or Reclaim of Input Tax Credit

ITC on inward supply can only be claimed under specific circumstances. The ITC must be reversed if the same is not met. ITC reversed information must be entered here. After adding the information, click on the “SAVE” button.

Finally, once all the information has been recorded, the return can be submitted online when a declaration has been made.

Conclusion

GSTR-2 Return has been suspended, hence it is not required to be filed.

Return filing can get complicated. Make it easy and simple with a robust GST Accounting Software like BUSY.

Frequently Asked Questions

- How can taxpayers download GSTR-2A data for filing GSTR-2?Taxpayers can download GSTR-2A data by logging into the GST portal, navigating to the ‘Returns Dashboard,’ and selecting GSTR-2A. The data can be downloaded in Excel or JSON format for reconciliation and filing purposes.

- What are the prerequisites for filing GSTR-2 on the GST portal?Taxpayers must have an active GSTIN, valid login credentials, and access to purchase invoices for the filing period. Ensure the supplier has uploaded the relevant details in their GSTR-1 to match with GSTR-2A.

- Can GSTR-2 be filed offline, and if so, how does the offline utility work?Yes, GSTR-2 can be filed offline using the GST Offline Tool. Taxpayers download the utility, import purchase data, make corrections if needed, generate the JSON file, and upload it on the GST portal.

- What is the process for reconciling purchase data with GSTR-2A before filing?Reconciliation involves comparing your purchase records with GSTR-2A details. Match invoice numbers, amounts, and GST amounts. Rectify mismatched entries with suppliers to ensure accurate filing of GSTR-2.

- How can mismatched invoices be corrected in GSTR-2?For mismatched invoices, communicate with suppliers to update or correct their GSTR-1 filings. Alternatively, use the “Add Missing Invoices” option in GSTR-2 to update unreported or incorrect invoices.

- What is the deadline for filing GSTR-2, and are there any late fees for delays?GSTR-2 deadlines are notified by the GST council periodically. Late fees may apply for delays, typically ₹50 per day (₹25 each for CGST and SGST) and ₹20 for nil returns.

- Are amendments allowed after filing GSTR-2, and how can they be made?Amendments are not allowed after filing GSTR-2. Ensure all details are correct before submission. Reconcile purchase data thoroughly and resolve discrepancies in advance.

- How does GSTR-2 affect the Input Tax Credit (ITC) claim process?GSTR-2 facilitates ITC claims by matching purchase details with GSTR-2A. Only matched and verified invoices are eligible for ITC, ensuring compliance and accurate tax credits.