Arihant Enterprises vs. Na

(AAAR (Appellate Authority For Advance Ruling), Maharashtra)

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the MGST Act.

The present appeal has been filed under Section 100 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as “the CGST Act and MGST Act”] by the Asstt. Commr. of SGST(D-819), Pune Division (herein after referred to as the “Appellant” or “the Department” interchangeably) against the Advance Ruling No. GST-ARA-126/2018-19/B-29 dated 19.03.2019

Brief Facts of the case

A. M/s Arihant Enterprises is a partnership firm with GSTIN number 27AAUFA0033D1ZT and registered address at Flat No. 2, Ajit Building, Mahavir Park Society, Aundh, Pune Maharashtra-411007.They are inter-alia engaged in the business of reselling of Ice Cream from its Ice cream parlour situated in Aurangabad. They are supplied with the said goods from its sole manufacturer, M/s. Kamaths Ourtimes Icecreams Pvt Ltd (“The Franchisor”). They exclusively deal in the Naturals brand Ice cream manufactured by “the franchisor”. M/s Arihant Enterprises had made an application GST-ARA, Application No. 126 dated 25.02.2019 for advance ruling before the Maharashtra Authority for Advance Ruling, GST Bhavan, 8th floor, Fl-Wing, Mazgaon Mumbai-400010 on the issue of whether the supply of Ice Cream made by it from its retail outlet would be treated as supply of “goods” or supply of “service” or a “ composite supply”. In this context, after due consideration of various submissions made before it, The Hon’ble Maharashtra Authority For Advance Ruling issued an order of Advance Ruling No. GST-ARA-126/2018-19/B-29 dated 19.03.2019 wherein, it is inter-alia held that the supply of ice cream by the applicant from its retail outlets would be treated as supply of “goods”. Aggrieved by the said Order of the AAR, the present Appeal is being filed under Section 100 of the Act with the Appellate Authority for Advance Ruling seeking to quash the Advance Ruling Order ibid holding it void ab-initio in terms of Section 104 of the Act.

Grounds of Appeal

1. It has been brought to the notice of the Appellant by the Directorate General of Goods and Service Tax Intelligence (DGGI), Pune Zonal Unit, Pune vide its letter F.No. DGGI/PZU/Gr/C7AAR-Arihant/40/2019 dated 14th& 17th May,2019 that the Applicant appears to have suppressed certain vital facts in the application made before the AAR about the investigations that had been initiated by the DGGI against M/s Kamaths Ourtimes Ice Creams Pvt Ltd or KOTI (the franchisor) and its various franchisees who deals in Naturals brand Ice Cream under the terms and conditions of an identical franchise agreement entered with its each franchisees and therefore , the Advance Ruling thus obtained by keeping the AAR in dark appears to be not a legal and correct order and therefore it should be appealed against as the subject order of the AAR appears to be invalid ab initio.

2. It is stated by the DGGI that the Directorate General of Goods and Service Tax Intelligence (DGGI) is the apex intelligence organization working under the Central Board of Indirect Taxes & Customs, Department of Revenue, and Ministry of Finance is entrusted with detection and investigation of cases of Evasion of GST & it has jurisdiction all over India, that acting on a specific intelligence, the investigations of DGGI was initiated on 05.02.2019 by way of a simultaneous search operation at the premises of M/s KOTI and some of its franchisees located in Pune i.e. much before the date of application of the Applicant made on 25.02.2019 before the AAR, that the investigations were inter-alia involving the very same issue of classification of activities of franchisees for subjecting the same to the levy of GST, that during the course of search certain documents were seized from all the premises and the same are expected to be useful to establish GST evasion cases against each franchisee i.e. Natural Ice cream outlets, that one of the key persons from each premise was examined under Section 70 of the CGST Act, 2017 on the spot and his statement was recorded, that the investigations carried out so far appears to reveal that franchisees of M/s KOTI have evaded GST amounting more than ₹ 40.00 Crs on two aspects (a) by way of misclassifying their activity as supply of goods under HSN 2105 instead of its correct classification as supply of service under SAC 9963 (b) Suppression of supplies made and GST evaded thereon, that accordingly, investigations to detect cases of evasion of GST by franchisees of M/s KOTI located all over India, including M/s Arihant Enterprises, Aurangabad having its registered office in Pune were in progress covering one by one.

3. That in the meantime, based on an application dated 25.02.2019 for Advance Ruling, made by M/s Arihant Enterprises, the Hon’ble Maharashtra Authority For Advance Ruling issued an order of Advance Ruling No. GST-ARA-126/2018-19/B-29 dated 19.03.2019 wherein, it is inter-alia held that the supply of ice cream by the applicant from its retail outlets would be treated as supply of “goods”. That since, the Directorate General of GST Intelligence, Pune Zonal Unit, Pune was not a party to the application filed before the Authority for Advance Ruling, it had no knowledge of these proceedings and the order of advance ruling was also not endorsed to it. Thus, DGGI came to know about the subject Order of Advance Ruling only by routine searching on Maharashtra Authority for Advance Ruling website. Therefore, under these facts and circumstances, the DGGI requested the Appellant to file an appropriate Appeal against the subject Order of the AAR in the interest of justice so as to protect the interests of the revenue.

4. It appears that Under the terms and conditions of the franchise agreement and in the entire scheme of KOTI, the franchisor had the upper hand and final say in every aspects of business and the applicant had no reason to approach the Authority for Advance Ruling on the issue of classification of supply especially when there was not any dispute, which had cropped up either from the concerned State Tax Officer in this regard. It appears that M/s KOTI was in fact the brain behind the application made before the ARA, as investigations were already initiated against all the 11 number of franchisee outlets located in Mumbai, Delhi, Kolkata and Gurugram owned by M/s Kamaths Natural Retail Pvt Ltd which is a company under the same management and hence its Directors were interested in getting an advance ruling in their favour so that somehow they can escape from the clutches of the investigations of the DGGI.

5. During the course of ongoing investigations against franchisees of Naturals Ice cream, one Mr Virendra Nandkumar Mutha, one of the partners of M/s Ashirwad Enterprises, which is also a franchisee of KOTI, was summoned and his statement dated 10.05.2019 was recorded under Section 70 of the CGST Act,2017. Mr Virendra Mutha is admittedly a partner in the Applicant’s firm M/s Arihant Enterprises as well. In fact, the residential address of Mr Mutha at Aundh, Pune is admittedly the registered office of M/s Arihant Enterprises as declared in their GST registration documents in the said statement Mr Mutha, in response to queries raised, it is inter-alia categorically confirmed by him that he was aware of the ongoing DGGI investigations at KOTI and its franchisees and with due oral discussions with Directors of KOTI, it was taken decision to file an application before the ARA through a common consultant Mr Chirag Mehta but the relevant details of these investigations initiated by DGGI was not incorporated in their application before the ARA. The relevant para of the statement is reproduced herein under for ready reference.

A para from Statement dated 10.05.2019 of Mr Virendra Mehta;

“On being asked about the application dated 25.02.2019 made by M/s Arihant Enterprises before Advance Ruling Authority, I undertake to produce the same by 13.05.2019. In the light of franchisee agreement with KOTI and with due consideration to its terms and conditions, classification of the product and taxation thereon is decided by KOTI, the franchisor, by way of supplying the spectrum software for billing to your firm, which is mandatorily to be used by each franchisee, under these circumstances on being asked as to how M/s Arihant Enterprises had filed an application for advance ruling on its own, I state that with due oral discussion with directors of KOTI, it was taken decision to file an application before Advance Ruling Authority through a common legal consultant, Mr. Chirag Mehta for taking an advance ruling as to whether serving of ice cream at parlour end is a supply of service classifiable under SAC 9963 or resale of goods (ice cream) under HSN 2105, since this issue of classification was already taken up by DGGSTI, Pune Zonal Unit by initiating inquiry against KOTI and some of its franchisees during February 2019. On being specifically asked I state that involvement of KOTI and the relevant facts of investigations initiated by the DGGSTI and details thereof was not incorporated in our application and hence the Advance Ruling authority was not aware of the same”

6. Under the terms and conditions of the franchise agreement with KOTI, (a representative sample franchise agreement with M/s Ashirwad Enterprises, Pune is enclosed for ready reference) the applicant is under obligation to use the billing software supplied by KOTI which contained inter alia classification of ‘supply’ made by the applicant and tax liability thereon to be discharged mandatorily by the applicant and the applicant cannot change this practice without the consent /approval of the franchiser.! a statement dated 26.04.2019 recorded under Section 70 of the CGST Act,2017, of Shri Imran Kachhi a representative of M/s Creative IT India Pvt Ltd , Mumbai who had supplied Spectrum software to KOTI and its all franchisees is enclosed for ready reference)Therefore, it appears that the applicant -M/s Arihant Enterprises is hand in glove with the franchisor -M/s KOTI . It is further submitted that, the taxpayers are required to declare before Authority of Advance Ruling, in para 17 of form GST ARA-01 that whether question raised in the application is already pending or decided in any proceedings in applicant’s case under any provisions of the Act. The fact that the case has been booked against the taxpayer on this issue on 05.02.2019 i.e. well before making this application, which is under investigation, needs to be co-related with the declaration submitted by the taxpayer in form GST ARA-01. Whereas, the application filed by the applicant is not maintainable as per the provisions of Section 98 of the CGST Act, as proceedings are already initiated against them before the filing of their present application. Had it been known, the Authority for advance Ruling would have come to the conclusion that the applicant’s application is liable for rejection as per proviso to Section 98(2) of the CGST Act and accordingly, would have rejected application being non-maintainable. It therefore appears that the present Advance Ruling has been obtained by way of suppressing the material facts from the Advance Ruling Authority.

7. It is also submitted that some of the major competitors in the field such as ice cream brands under trade names “Gelato”, “Baskin Robbins”, “Cafe Chokolade” etc have rightly classified their activity of serving of Ice Cream at parlour ends as ‘supply of services’ under HSN Code 996331 of the GST tariff of India and they have paid [email protected]% and [email protected]% or IGST @5% as the case may be, w.e.f. 15.11.2017 by following the amending Notification No. 46/2017-Central Tax (Rate) dated 14.11.2017.

An explanation to Notification No. 46/2017-Central Tax (Rate) dated 14.11.2017 reads as under:

“For the removal of doubt, it is hereby clarified that, supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or drink, where such supply or service is for cash, deferred payment or other valuable consideration, provided by restaurant, eating joints including mess, canteen, whether for consumption on or away from the premises where such food or any other article for human consumption or drink is supplied, other than those located in the premises of hotels, inns, guest houses, clubs, campuses or other commercial places meant for residential or lodging purposes having declared tariff of any unit of accommodation of seven thousand five hundred rupees and above per unit per day or equivalent shall attract Central Tax @2.5% without any input tax credit under item (i) above and shall not be levied at the rate as specified under this entry”.

8. The view of the department is that as per Notification 11/2017 Central Tax Rate dated 28.06.2017 as amended by Notification No. 46/2017-Central Tax (Rate) dated 14.11.2017 supply by way of or as part of service or in any other manner whatsoever of goods, being food or any other article for human consumption shall attract Central Tax @ 2.5% without any Input Tax Credit. The view of the department is also supported by the fact that franchisees have put up the ice cream parlours as per approved design of franchisor and as approved and supervised by their architect with a view to attract customers by providing comfortable sitting, quality food. This is also *0 ensure unique and uniform consumer experience. They also cooked foods as ordered by customers in single scoop, double scoop in a cup or fresh waffle cone manufactured at the outlet, serving in the form of ice cream shakes’ prepared from ice cream received or even ice cream is served with fruits topping etc. They also provide ice cream in carry home packs or even deliver through online aggregators such as Swiggy, Uber eats, Zomato etc. The unique franchise agreement has no provision to recover any franchise fees from franchisees, agreement is conditional and is meant to exercise full control over franchisees in various ways i.e. Franchisees cannot sell any other patent or proprietary goods from their outlets. Non observance of conditions would result in cancellation of the franchise. Thus, franchisees are the mere arms of the franchisor and in the facts and circumstances they supply services to franchisor and get their service charges in the form of margin on sale proceeds of ice cream as fixed by the franchisor. Thus, the franchisor reaches out to the actual customers through franchisees and ensure successful advertisement and sales promotion/marketing of Natural ice cream effected thereby. Thus, franchisees including M/s Arihant Enterprises have charged and recovered money in the name of GST @ 18 % instead of 5% without ITC benefits from their customers. Thus, it is a case of recovery of tax in excess from the customers but not being deposited in to government account which is not legal and is liable to be recovered

9. In view of above legal position, it appears that the activity of ice cream parlours of the franchisees of M/s KOTI are covered under the explanation to the said notification which categorically classify the same as service under SAC 9963 and shall attract Central Tax @ 2.5% without any Input Tax Credit. Accordingly, the subject Order of Advance Ruling appears to be not just and proper as it can’t sustain on merits.

10. As per Longman Dictionary –what is ice cream parlour: ‘a restaurant that only sells ice cream’.

As per Wikipedia- Ice cream parlours are restaurants that sell ice cream.

11. The ratio of the Advance Ruling No. KAR ADRG 21/2018 dated 21st August, 2018 given in the case of M/s Coffee Day Global Limited, 23/2, 6th Floor, Vittal Mallya Road, Bangalore-560001 appears worth consideration in the facts and circumstances of the subject case.

12. The ratio of Advance Ruling by Authority of Advance Ruling under GST Madhya Pradesh in the case of JABALPUR ENTERTAINMENT COMPLEXES P. LTD also appears worth consideration in the facts and circumstances of the subject case. Its Para 7.3 is reproduced under for ready reference:-

“7.3 The first question reads, “Whether GST @ 5% can be charged on food, soft drinks and snacks sold in the Snack Bar & Food Court in terms of Notification No. 46/2017-Central Tax (Rate)?”. On a careful consideration of the legal position under the GST law, we find that the Notification No. 11/2017-Central Tax (Rate), dated 28-6-2017 further amended by Notification No. 46/2017-Central Tax (Rate) vide entry at Serial Number 7 and corresponding notifications issued under MPGST Act, 2017, squarely covers the services provided by the Applicant at item No. (i) which reads : ‘Supply, by way of or as part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or drink, where such supply or service is for cash, deferred payment or other valuable consideration, provided by a restaurant, eating joint including mess, canteen, whether for consumption on or away from the premises where such food or any other article for human consumption or drink is supplied, other than those located in the premises of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes having declared tariff at any unit of accommodation of seven thousand five hundred Rupees and above per unit per day or equivalent.’ and in respect of such services classifiable under SAC 9963, the rate of CGST and MPGST has been fixed @ 2.5% each subject to condition that no input tax charged on goods and services used in supplying the service has not been taken. As we gather from the submissions of the Applicant, they are not providing any accommodation facility for lodging and boarding and they are also not availing ITC of tax paid on goods & services used/utilized for providing services from the said Snack Bar. Further, on a different point of argument, we would also like to consider whether the impugned service would fall under the category of Outdoor Catering. The term ‘Outdoor Catering’ was defined under Section 65(76)(a) of the erstwhile Finance Act, 1994 as “Outdoor caterer means a caterer engaged in providing service in connection with catering at place other than his own but including a place provided by way of tenancy or otherwise by the person receiving such service”. On considering the common parlance meaning of ‘Outdoor Catering’ and its above definition for Service Tax, we come to the conclusion that the supply of food, soft drinks and snacks sold in the Food Court or Snack Bar of the Applicant cannot by any stretch of imagination, be treated as a part of outdoor catering. In view of the facts and circumstances, we are of the view that the services provided by the Applicant in Snack Bar would be classifiable under SAC 9963 and chargeable to GST @ 5% (CGST @ 2.5% + SGST @ 2.5%), provided they fulfil the conditions laid down under Notification No. 46/2017-Central Tax (Rate) and corresponding notifications issued under MGST Act, 2017.”

13. The subject case is not simply an act of resale of ice cream purchased from KOTI. The transactions between KOTI and M/s Arihant Enterprises are governed by the franchise agreement agreed between them. No franchise fees is charged separately. No sales promotion expenses, advertisement expenses, infra structure and business support etc provided to KOTI are reimbursed separately to Arihant Enterprises. Storage expenses, serving expenses etc are not reimbursed separately by KOTI. But all the activities of Arihant Enterprises including billing, classification of goods/services, taxation etc are under strict watch, control and guidance of KOTI. To cover all these aspects, KOTI offers more than 90% margin over and above the ex-factory cost price of ice cream supplied to M/s Arihant Enterprises, as can be seen from the facts demonstrated below;

Naturals ice cream is supplied in Bulk packaging of 1.50 kg from KOTI:

Ice cream price at KOTI-₹ 360/- per kg

There is a discount of 6% given and Transportation cost from Mumbai-Pune-₹ 6/-per kg which KOTI has included in Taxable value

Thus, Taxable value at factory end-₹ 344.4per Kg i.e. (360-21.6+6=344.4/-)

At franchisee ice cream parlour’s end, sale value as fixed by the franchisor-₹ 65/-per scoop of 80gm inclusive of GST @18% i.e. its taxable value is ₹ 55.08/-(65/118*100) 12 scoops per kg of 80 gm each is taken (as per one of the conditions of franchise agreement) then taxable value per kg comes to 660.88/- i.e. (12*55.08=660.88/-)

Therefore, gross margin offered to franchisees per kg is 660.88(-) 344.4/- = 317 or 92% of cost price at KOTI.

It is evident from the franchise agreement that the franchisor had not collected any franchise fees from the applicant franchisee which appears to reveal that it was not limited to trademark, but inclusive of bunch of services.

14. The term “Franchise” is defined under Finance Act,1994 vide Section 65(47), it reads as follows:-

“[(47) “franchise” means an agreement by which the franchisee is granted representational right to sell or manufacture goods or to provide service or undertake any process identified with franchisor, whether or not a trade mark, service mark, trade name or logo or any such symbol, as the case may be, is involved;…”

Thus, by definition, the franchise agreement grants only a representational right and not an exclusive right to sell/manufacture goods. Further, the provisions of the franchise agreements are only to the effect of giving the franchisee the non-exclusive right to use.

15. It therefore appears that the transaction between franchisor and applicant was actually not a real sale transaction but it is a transfer of Ice cream from factory of the franchisor to the retail ice cream parlours under the KOTI scheme of franchise agreement so as to sell/serve finally to unrelated buyers on behalf of KOTI. It is therefore pertinent to note that the various supply services offered by the franchisees to the franchisor and various fees payable by the franchisor to franchisee applicant thereon is adjusted along with the franchise fees not collected by the franchisor but hidden under the scheme of things, in the final sale price of Ice cream so fixed by the franchisor. The entire activities of franchisee applicant are therefore to be considered as supply of service. It therefore follows that the applicant’s contention that its activity is merely a resale of Ice Cream / supply of goods and not a supply of service is incorrect and not acceptable and accordingly the subject order of ARA upholding the views of the applicant is liable to be rejected as it is not tenable.

16. The Appellant places reliance in this context on the observations made by the Honourable High Court of Delhi in the case of MC DONALDS INDIA PVT. LTD. Versus COMMR. OF TRADE & TAXES, NEW DELHI [2017(5) G.S.T.L 120 DEL] with reference to the essence of franchise agreement is relevant in the facts and circumstances of the case and the relevant abstract reads as under;-

“Sale – Composite contract – Franchise agreement for non-exclusive transfer of composite system of services – Not limited to trademark, but inclusive of bunch of services – Cannot be treated as goods and be subject to Value Added Tax (VAT) – Article 366(29A) of Constitution of India – Section 23(6) of Delhi Sales Tax Act, 1975 – Section 9 of Delhi Sales Tax on Right to Use Goods Act, 2002. [para 35]

Franchise – Definition of – Franchise agreement grants only a representational right and not an exclusive right to sell/manufacture goods – Provisions of franchise agreements are only to the effect of giving franchisee non-exclusive right to use any name, mark or other intellectual property right granted or to be granted therein, etc. – Section 65(47) of Finance Act, 1994. [para 38]”

17. As regards the delay in filing of the instant appeal, the Appellant filed miscellaneous application for the condonation of delay, wherein they submitted as under:-

(i) that this condonation for delay application is before this Hon’ble Maharashtra Appellate Authority for Advance Ruling For Goods and Service Tax against the impugned Order No. GST-ARA-126/2018-19/B-29 dated 19.03.2019 passed by the Ld. Maharashtra Authority for Advance Ruling received on 16.04.2019 and with an appeal for the restoration and recall of the above-mentioned appeal;

(ii) that the crucial facts of this case were brought to the notice of the Appellant by the Dy. Director, DGGI, Pune Zonal Unit vide letter dated 14/05/2019, and it took considerable amount of time to come to conclude that an Appeal is required to be filed by the Appellant. Also, due to the nuances to the newly rolled out GST law, there has been this delay in filing of the present appeal.

(iii) that based upon the totality of the circumstances mentioned above this Hon’ble Maharashtra Appellate Authority for Advance Ruling For Goods and Service Tax, Air India Building, Nariman Point, Mumbai-400 021 may be pleased to consider the prayer of the applicant in granting the condonation for delay of only 25 days in filing before this Hon’ble Maharashtra Appellate Authority for Advance Ruling For Goods and Service Tax. Air India Building, Nariman Point, Mumbai-400 021 for justice and equity.

(iv) that the facts and circumstances elucidated in the present appeal involve the question of “substantial justice”, where gross delay of 25 days only, deserves to be condoned in the overall interest of justice. On the other hand, if condoning the delay being denied it would seriously undermine the cause of justice, resulting into miscarriage of justice for the appellant.

18. Thus, in view of the above grounds of appeal and the grounds mentioned in the application for the condonation of the delay in filing of the appeal under consideration, it was prayed by the Appellant:-

(i) that the delay in filing of appeal may be condoned;

(ii) that the appeal may be allowed and the order of advance ruling Order No. GST-ARA-126/2018-19/B-29 dated 19.03.2019 received by this office on 16.04.2019 may be set aside;

(iii) Any other order as deemed fit.

Respondent’s submissions

19. The Respondent submitted that the present appeal filed by the Department is not maintainable, void and bad in law. Accordingly, they stated and submitted as under:

20. The Respondent is a partnership firm duly incorporated under the provisions of Indian Partnership Act, 1932 and have registered office at Flat No. 2, Ajit Building, Mahavir Park, Aundh, Pune -411007.

21. The respondent is, inter alia, engaged in the business of reselling Ice-creams in wholesale as well as retail sale packages. Accordingly, the respondent is duly registered under the provisions of Central Goods and Service Tax Act, 2017, bearing GSTIN 27AAUFA0033DIZT.

22. The respondent purchases the said goods from its sole manufacturer, M/s.Kamaths Ourtimes Ice-creams Private Limited [“KOTI” / “The franchisor”]. The respondent exclusively deals in the ice-cream manufactured by the franchisor. The respondent sells the Ice-creams to their customers “as-it-is” without any further processing/alteration/structural or chemical change. ‘As-it-is’ means in its exact form as it is acquired from the franchisor. These facts are not in dispute. In fact, the same have been admitted by the appellant in their appeal memo itself. The relevant extract from the “brief facts of the case” reads thus:

“They inter alia engaged in the business of reselling of Ice cream from its ice cream parlour situated at Aurangabad. They are supplied with the said goods from its sole manufacturer, M/S Kamaths Ourtimes Icecreams Pvt Limited (“The Franchisor”)”

23. The Respondent made the supplies from its retail store situated in Aurangabad. The only source of revenue generation by the store is by way of selling ice-creams by means of namely, 1) retail packs; and 2) by way of Ice-cream scoops.

24. The Respondent has also enclosed copy of the Tax Audit report for the year 2017-18 (Assessment Year 2018-19) issued by a Chartered Accountant as required under section 44AB of the Income Tax Act, 1961, wherein they exhibited that the nature of business in the Tax Audit report is stated as “retail sale of Food, beverages and Tobacco in specialized stores” under code 09021 under the broad heading of Wholesale and Retail Trade.

25. In the subsequent paragraphs, each of the above revenue streams have been described in detail.

25.1 Sale of ice-creams in retail packs:

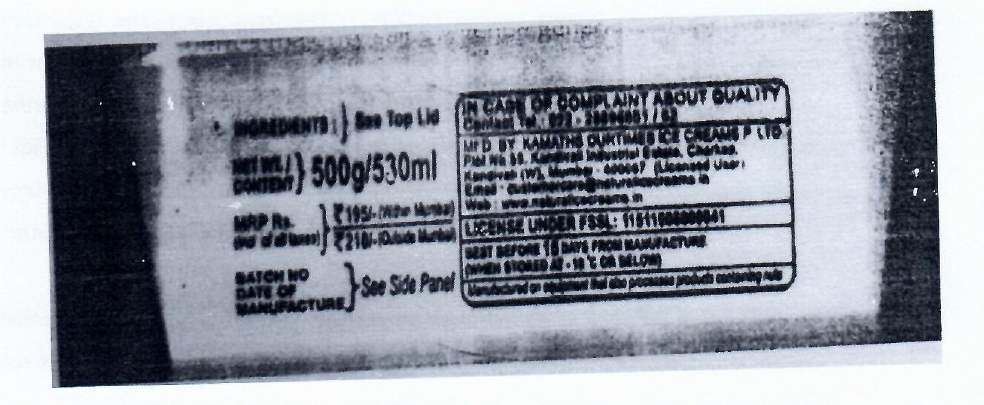

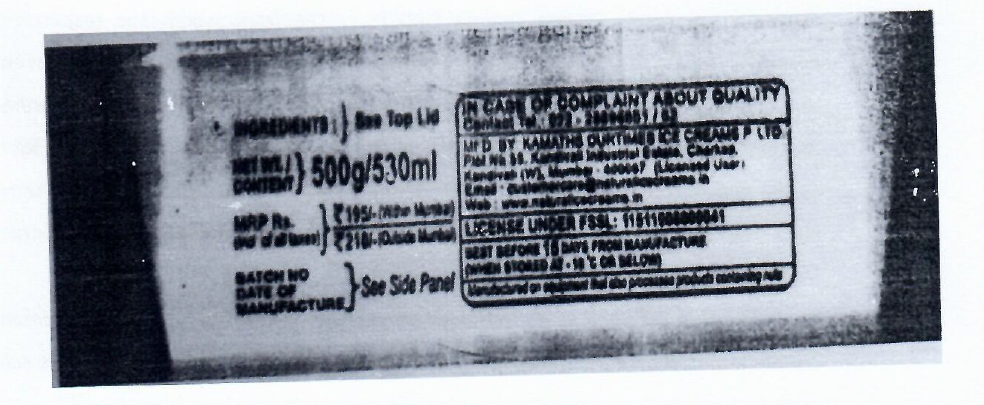

The respondent’s majority sales revenue generates from this mode of selling. The ice-cream is sold as 500 grams retail packs. The sales mainly consist of sale of party packs or popularly Known as “Tubs”. These are packed in plastic containers bearing the details of product including maximum retail price (MRP) of the product. The details of the product are printed on the packs in accordance with the provisions of the Legal Metrology Act, 2009. A pictorial representation of the pack is reproduced here under:

india

india

25.2 Sale of ice-cream by way-of-scoops:

Under this method, the ice-cream scoops are sold to the customers who wish to consume Ice-creams on a take-away basis. The franchisor supplies Ice-creams to the respondent in a wholesale pack to sell the same in scoops. These wholesale packs are emptied in steel containers at the outlet. Thereafter, the ice-creams are sold over the counter and supplied in scoops in paper cups, regular cones or waffle cones. Further, at times the customer prefers more than one flavour of ice cream in different combinations commonly known as “Double Scoop” or ‘(Triple Scoop”. Accordingly, the ice creams are supplied in large cones or cups. In some cases, the ice cream is melted (semi-liquid form) and sold in paper cups to the customer based on their demand. In such cases, only the form changes. Sometimes, the ice cream is topped with fruits, again based on demand from the customer. The Price is charged on per Scoop basis. These prices are fixed and consistent at all the outlets of the respondent as well as other franchisee owners of the franchisor.

26. In order to bring the clarity in the transaction, it is pertinent for us to explain the entire chain of events that takes place in the subject transaction:-

(i) The respondent purchases the ice- creams from the franchisor. The franchisor supplies the same in retail and the whole sale pack of ice creams under a Tax Invoice and collects GST [CGST + SGST or IGST depending on the place of supply]. It quotes HSN code 2105 and charges GST @ 18% in terms of Notification No. 01/2017 -CT (Rate), dated 28.06.2017, as amended.

(ii) Due to the inherent nature of the product, the packages received from the manufacturer/franchisor are stored in a refrigerator located inside the retail store.

(iii) In order to keep the quality of ice-cream intact, the respondent is supposed to maintain the temperature of the refrigerator at certain degree. Accordingly, the icecream outlets of the respondent are installed with the Air Conditioners. This is similar to how most of the departmental stores like food land, reliance fresh or big bazaar sell their products.

(iv) The customer walks to the counter, goes through the price list available, selects the flavour and places the order before the cashier.

(v) Once the order is placed, the customer pays the price for the order placed by him. The cashier prints two copies of the Tax Invoice and hands over the same to the customer.

(vi) The customer then moves to the delivery counter, hands over one copy of the Tax Invoice to the person at the counter. In case the customer has purchased a retail pack the same is handed over to him/ her against the copy of the Tax Invoice. On the other hand, if the customer has purchased a scoop of ice cream, the same is handed over to him in a cup or cone as per his desire.

(vii) Thereafter, the ice cream is handed over to the customer. He either waits within or outside the store or takes it away as the case may be. Within the store/shop, there are a few tables/chairs/benches for customers to sit, while waiting. It may be noted that the ice creams are sold by the respondent over the counter. There is no serving of ice cream by the respondent.

27. The respondent was not sure about the applicability of the rate of GST on the said sale in as much as the industry was divided on the said issue. In order to avoid any controversy and litigation in future, the respondent has filed an application before the Advance Ruling Authority, Mumbai vide Application No. 126 on 25.02.2019.

28. The said application was filed for seeking advance ruling in following questions:-

a) Whether supply of ice-cream by the respondent from its retail outlets would be treated as supply of “goods” or supply of “service” or a “composite supply” and subject to GST accordingly.

b) Whether the supply, not being a composite supply, would be treated as supply of service in terms of entry 6(b) of Schedule II, attached to the CGST Act, 2017 and leviable to CGST @ 2.5% in terms of Notification No.11/2017 as amended by Notification No.46/2017-Central Tax (Rate) (serial no.(i), entry no. 7) of the notification.

c) In case the supply is held to be “composite supply”, whether the taxability of the same should be treated as supply of service in terms of entry 6(b) of the Schedule II to the CGST act, 2017, or should be taxable on the basis of nature of principal supply in accordance with Section 8 of the Act.

d) In case the supply is held to be a supply of service in terms of entry 6(b) of Schedule II to the CGST Act, 2017, would it be mandatory for the respondent to collect and pay CGST @ 2.5% inspite of the fact that entry 7(i) of Notification No.11/2017 as amended by Notification No.46/2017-CentralTax is a conditional entry.

29. Vide Order No. GST-ARA-126/2018-19/B-29 dated 19.03.2019 the Advance Ruling Authority has held that the supply of ice-cream by the respondent from its retail outlets would be treated as supply of ‘goods’ and accordingly, would attract [email protected]%.

30. Being aggrieved by the AAR Order, the appellant i.e. department has filed the present appeal before the Appellate authority for Advance Ruling for GST.

31. The respondent submits that the above appeal is liable to be rejected on the following amongst other grounds which are urged herewith without prejudice to one another:

31.1 At the outset, the respondent submits that the impugned order, in so far as it is in favour of the respondent, is correct in law and hence, needs to be upheld. The Advance Ruling Authority (‘ARA’) has passed a detailed and cogent order. The said order does not suffer from any infirmity or illegality. Therefore, the present appeal, being devoid of any merit, is liable to be rejected.

32.1 The present appeal is time barred:

The impugned order is dated 19.03.2019. The appellant-department has stated that it has received the impugned order on 16.04.2019. However, no proof of the receipt of the said AAR Order has been enclosed by the appellant-department in its appeal. Further, the appellant-department has filed the present appeal along with application of condonation of delay for seeking condonation of twenty-five (25) days in filing the present appeal. The reason stated by the appellant-department for the said delay was that the crucial facts of this case were brought to the notice of the appellant-department by the Deputy Director, DGGI, Pune Zonal Unit vide letter dated 14.05.2019 and accordingly, the department has taken considerable time to decide whether the appeal is required to be filed or not. The appellant-department further stated that due to the nuances to the newly rolled out GST law also caused a delay in filing the present appeal.

32.2 The respondent submits that the above reasoning of the appellant-department is vague and absurd for the reasons stated infra.

(i) First, Section 100 of the CGST Act, 2017 speaks about the filing of appeal to Appellate Authority formed under section 99 of the CGST, 2017.-

“99. Appellate Authority for Advance Ruling –

Subject to the provisions of this Chapter, for the purposes of this Act, the Appellate Authority for Advance Ruling constituted under the provisions of a State Goods and Services Tax Act or a Union Territory Goods and Services Tax Act shall be deemed to be the Appellate Authority in respect of that State or Union territory.

100. Appeal to Appellate Authority-

The concerned officer, the jurisdictional officer or an applicant aggrieved by any advance ruling pronounced under sub-section (4) of section 98, may appeal to the Appellate Authority.

(1) Every appeal under this section shall be filed within a period of thirty days from the date on which the ruling sought to be appealed against is communicated to the concerned officer, the jurisdictional officer and the applicant:

Provided that the Appellate Authority may, if it is satisfied that the appellant was prevented by a sufficient cause from presenting the appeal within the said period of thirty days, allow it to be presented within a further period not exceeding thirty days.

(2) Every appeal under this section shall be in such form, accompanied by such fee and verified in such manner as may be prescribed.

(ii) On perusal of the above provisions, it is clear that an appeal against the advance ruling pronounced under section 98 of the Act shall lie before the appellate authority. The same should be filed within a period of thirty (30) days from the date of communication of the same to the concerned officer, jurisdictional officer and the applicant as the case may be. If the appellant has not filed the appeal within the said period of thirty (30) days, then on furnishing the ‘sufficient cause’ which has prevented him to file the appeal within the said prescribed period, allows the same to be filed within a further period of thirty (30) days.

(iii) From the above, it is clear that sufficient cause need to be shown to the court in order to persuade the court to exercise their judicial discretion. Liberal construction of the expression ‘sufficient cause’ is intended to advance substantial justice which itself presupposes no negligence or inaction on the part of the appellant-department, to whom want of bona fide is imputable. There can be instances where the Court should condone the delay; equally there would be cases where the Court must exercise its discretion against the applicant for want of any of these ingredients or where it does not reflect ‘sufficient cause’ as understood in law. The expression ‘sufficient cause’ implies the presence of legal and adequate reasons. The words ‘sufficient’ means adequate enough, as much as may be necessary to answer the purpose intended. It embraces no more than that which provides a plenitude which, when done, suffices to accomplish the purpose intended in the light of existing circumstances and when viewed from the reasonable standard of practical and cautious men. The sufficient cause should be such as it would persuade the Court, in exercise of its judicial discretion, to treat the delay as an excusable one. These provisions give the Courts enough power and discretion to apply a law in a meaningful manner, while assuring that the purpose of enacting such a law does not stand frustrated. The party should show that besides acting bona fide, it had taken all possible steps within its power and control and had approached the Court without any unnecessary delay. The test is whether or not a cause is sufficient to see whether it could have been avoided by the party by the exercise of due care and attention.

(iv) Delay is just one of the ingredients which has to be considered by the Court. In addition to this, the Court must also take into account the conduct of the parties, bona fide reasons for condonation of delay and whether such delay could easily be avoided by the appellant acting with normal care and caution. The statutory provisions mandate that applications for condonation of delay and applications belatedly filed beyond the prescribed period of limitation for bringing the legal representatives on record should be rejected unless sufficient cause is shown for condonation of delay. It is the requirement of law that these applications cannot be allowed as a matter of right and even in a routine manner.

(v) As regards the merits of the application in hand, except for a vague averment that the considerable amount of time has been taken to conclude or arrive at a decision that there is a need to file an appeal, there is no other justifiable reason stated in the one-page application. The application does not contain correct and true facts. Thus, want of bona fides is imputable to the appellant. There is no reason or sufficient cause shown as to what steps were taken during this period and why immediate steps were not taken by the appellant. The cumulative effect of all these circumstances is that the appellant-department has miserably failed in showing any ‘sufficient cause’ for condonation of delay.

(vi) Second, it is well settled that law of limitation undoubtedly binds everybody including the government. The respondent relied upon the decision of the apex court in the case of Office of the Chief Post Master General vs. Living Media India Pvt. Ltd., 2012 (277) ELT 289 wherein it is held that the claim on account of impersonal machinery and inherited bureaucratic methodology of making several notes cannot be accepted in view of the modern technologies being used and available. The relevant para is extracted hereunder:-

12. It is not in dispute that the person(s) concerned were well aware or conversant with the issues involved including the prescribed period of limitation for taking up the matter by way of filing a special leave petition in this Court. They cannot claim that they have a separate period of limitation when the Department was possessed with competent persons familiar with court proceedings. In the absence of plausible and acceptable explanation, we are posing a question why the delay is to be condoned mechanically merely because the Government or a wing of the Government is a party before us. Though we are conscious of the fact that in a matter of condonation of delay when there was no gross negligence or deliberate inaction or lack of bona fide, a liberal concession has to be adopted to advance substantial justice, we are of the view that in the facts and circumstances, the Department cannot take advantage of various earlier decisions. The claim on account of impersonal machinery and inherited bureaucratic methodology of making several notes cannot be accepted in view of the modern technologies being used and available. The law of limitation undoubtedly binds everybody including the Government.

13. In our view, it is the right time to inform oil the government bodies, their agencies and instrumentalities that unless they have reasonable and acceptable explanation for the delay and there was bona fide effort, there is no need to accept the usual explanation that the file was kept pending for several months/years due to considerable degree of procedural red-tape in the process. The government departments are under a special obligation to ensure that they perform their duties with diligence and commitment. Condonation of delay is an exception and should not be used as an anticipated benefit for government departments. The law shelters everyone under the same light and should not be swirled for the benefit of a few. Considering the fact that there was no proper explanation offered by the Department for the delay except mentioning of various dates, according to us, the Department has miserably failed to give any acceptable and cogent reasons sufficient to condone such a huge delay. Accordingly, the appeals are liable to be dismissed on the ground of delay.

(vii) Third, the Goods and Services Tax has been introduced with effect from01.07.2017. Now, we are standing in the year 2019 and still the department is learning the nuances of the newly rolled out GST law as stated in their application of condonation of delay. Such statements by the appellant-department are merely an eye wash. This clearly shows the appellant department lackadaisical and lethargic attitude towards the adherence of the laws even in the matters of their own interest. Such conduct should not be allowed to be precipitated and must be met with severe consequences.

(viii) Fourth, even otherwise, the reason stated for the delay that they were communicating with the DGCEI is also hard to believe. There is no explanation as to how and why DGCEI got involved in the present ruling. DGCEI is an investigating authority. It is not known as to how and why DGCEI is to communicate with the Authority for Advance Ruling or the department. It is also not known as to how and why DGCEI is interested in pursuing and directing the department to file an appeal. This is judicial intervention and must be taken note of by this Hon’ble Appellate Authority. The same cannot be ground or reason to condone the present delay. The very reason itself shows that the department was satisfied with the ruling and never intended to file any appeal. Thus, the present appeal is a motivated one, it lacks bonafide and hence, must be dismissed.

32.3 The present appeal is not maintainable

(i) At para A & B of the present appeal, wherein the appellant-department contends that the respondent has suppressed certain vital facts in the application made before the ARA about the Investigations that had been initiated by the DGGI against M/s. Kamath Our times Ice-creams (“the franchisor”) and its various franchisees, and that during the course of search, certain documents were seized from all the premises and the same are expected to be useful to establish GST evasion cases against each franchisee and hence being aggrieved by the impugned order they have filed the present appeal under section 100 of the act before the Appellate Authority for advance ruling seeking to quash the advance ruling order holding it void ab-initio in terms of section 104 of the act, the Respondent submits that the above mentioned contention of the appellant-department is without any logic, basis and reasoning. It is wholly perverse. It is malafide.

(ii) At the outset, the respondent submitted that the department referred to letter F. No.DGI/PZU/Gr’C’/AAR -Arihant/40/2019 dated 14.05.2019 and 17.05.2019 written by the DGGI to the appellant. Copies of the said letters have not been provided to the respondent, if the same have been referred to in the grounds of appeal, copies of the same should have been enclosed, failure to do so, vitiates the proceedings. It is not known what are the contents of the said letters and why and how the DGGI is directing the department to file the present appeal. What interest has the DGGI got in the present appeal? Under which provision of law and under which authority, the DGGI is communicating with the appellant. Under which capacity, the DGGI (being an investigating body) is influencing the decision-making process. The present appeal is motivated and lacks bonafide. Hence, on this count alone, the present appeal is liable to be rejected.

(iii) Apart from the above, it is pertinent to look into Section 104 of the act which reads as under:-

104. Advance ruling too be void in certain circumstances,-

(1) Where the Authority or the Appellate Authority finds that advance ruling pronounced by it under sub-section (4) of section 98 or under sub-section (1) of section 101 has been obtained by the applicant or the appellant by fraud or suppression of material facts or misrepresentation of facts, it may, by order, declare such ruling to be void ab-initio and thereupon all the provisions of this Act or the rules made thereunder shall apply to the applicant or the appellant as if such advance ruling had never been made:

Provided that no order shall be passed under this sub-section unless an opportunity of being heard has been given to the applicant or the appellant.

Explanation.- The period beginning with the date of such advance ruling and ending with the date of order under this subsection shall be excluded while computing the period specified in subsections (2) and (10) of section 73 or subsections (2) and (10) of section 74.

(2) A copy of the order made under sub-section (1) shall be sent to the applicant, the concerned officer and the jurisdictional officer.

On plain perusal of the above section, it can be seen that this provision empowers the respective authorities viz. Authority for Advance ruling who passed the order on the application for advance ruling and Appellate Authority who passes an appellate order on such ruling wherein an advance ruling has been challenged by way of appeal, to Suomoto recall the orders passed, if at any stage it is found that the same has been obtained by means of fraud, suppression of material facts or misrepresentation of facts.

(iv) In other words, the said provision is self contained. If the applicant in the application is guilty of fraud, suppression of material facts or misrepresentation of facts, the authority for Advance ruling can recall its own order. The same cannot be a ground of appeal. If the appellant was of the view that the ruling has been obtained by fraud, suppression of material facts or misrepresentation of facts, the Authority for Advance ruling could have itself recalled the said order, if the said facts were brought to its notice. The same cannot be a ground of appeal or ground of challenge in the appeal before the Appellate authority. Hence, the present appeal is totally misconceived and mis-directed. The appeal cannot be maintained on such a ground.

(v) If such appeals are allowed to be entertained on a ground that the applicant is guilty of fraud, suppression of material facts or misrepresentation of facts, then the provisions of section 104 would become redundant or otiose. There would be no meaning of section 104 as every such point can be raised in appeal. Such an interpretation would be absurd and hence, needs to be avoided.

(vi) The legislature is a perfect legislative body. It is presumed to know all the laws when it enacts any particular legislation. In Union of India VS.Hansoli Devi reported at (2002) 7 SCC 273 the Hon’ble Supreme Court has observed that the legislature never wastes it words or say anything in vain and a construction which attributes redundancy to legislation will not be accepted except for compelling reasons.

(vii) In Sultana Begum Vs. Prem Chand Jain reported at (1997) SCC 373 at page 381, the Hon’ble Apex Court has held as under:-

“……………………

15. On a conspectus of the case-low indicated above, the following principles are clearly discernible:

(1) lt is the duty of the courts to avoid the head-on clash between two sections of the act and to construe the provisions which appear to be in conflict with each other in such a manner as to harmonise them.

(2) The provisions of one section of a statute cannot be used to defeat the other provisions unless the court, in spite of its efforts, finds it impossible to effect reconciliation between them.

(3) lt has to be borne in mind by all the courts all the time that when there are two conflicting provisions in an Act, which cannot be reconciled with each other, they should be so interpreted that, if possible, effect should be given to both. This is the essence of the rule of “harmonious construction”.

(4) The courts have also to keep in mind that an interpretation which reduces one of the provisions as a “dead letter” or “useless lumber” is not harmonious-construction,

(5) To harmonise is not to destroy any statutory provisions or to render it otiose.

…. (underlining supplied)

(viii) Similarly, in CIT V/s Hindustan Bulk Carriers reported at (2003) 3 SCC 57, at page 73, the Hon’ble Supreme Court has held as under-

14. A construction which reduces the statute to a futility has to be avoided. A statute or any enacting provision therein must be so construed as to make it effective and operative on the principle expressed in the maxim ut res magisvaleatquam pereat i.e. a liberal construction should be put upon written instruments, so as to uphold them, if possible, and carry into effect the intention of the parties. [See Broom’s Legal Maxims (10th Edn.), p. 361, Craies on Statutes (7th Edn.), p. 95 and Maxwell on Statutes (11th Edn.),p. 221.]

16. The courts will have to reject the construction which will defeat the plain intention of the legislature even though there may be some in exactitude in the-language used. (See Salmon v. Duncombe 7 AC at p. 634, Curtis v. Stovin8 referred to in S. Teja Singh case 5.)

(ix) Thus, it is evident that section 100 of the Act has to be read together and in light of section 104 of the Act. It is well settled that every clause of the statute should be construed with reference to the context and other clauses of the Act, so as, as far as possible to make a consistent enactment of the whole of the statute. A bare mechanical interpretation of words and application of a legislative intent is devoid of concept and purpose will reduce the most of the remedial and beneficent legislation to futility. To be literal in meaning is to see the skin and miss the soul words, phrases and rules occurring in a statute are to be read together and not in an isolated manner. The legislation never intends to give one from one hand and take away from other hand. Hence, the present appeal is not maintainable and deserves to be dismissed, in lamina.

(x) There is yet another reason which supports the above submission of the respondent. The above provision section 104 would be applicable only in case where the applicant (assessee) is the appellant. The appellate authority would pass an order on the appeal of the appellant (assessee). Such an order can berecalled if the appellant (assessee) is guilty of fraud, suppression of material facts or misrepresentation of facts, It cannot be gainsaid that the revenue would be guilty of fraud, suppression of material facts or misrepresentation of facts.

(xi) If the DGGI was so convincing, they could have convinced the Authority for Advance ruling to recall its order and hold that the same is void, by moving an appropriate application before it, in terms of section 104 of the act ibid. Having failed to do so, the present appeal is a back door entry. It should not be permitted to be entertained. Hence, the present appeal is liable to be dismissed at the threshold.

32.4 Without prejudice, the respondent submits that there is no proceedings pending against the respondent, and hence, proviso to section 98(2) is not applicable.

(i) At Para C of the present appeal, wherein the appellant contends that since the DGGI was not a party to the application filed by the respondent (applicant) and came to know about the said order passed by the Authority for Advance Ruling on routine searching of the website of the Advance ruling. This submission is incorrect, false and wishful.

(ii) First, there is no evidence produced on record by the appellant in support of the above submission. It is a false claim. Second, in any case, there is no requirement, in law, of an investigating authority to be party to an application filed for advance ruling. The respondent is the state and not the investigating authority. If any such verification ought to have been carried out, it was for the state tax department. In fact, the facts stated in the application have been accepted by the appellant department.

(iii) At Para D of the present appeal, the appellant-department contends that the as per the conditions of the franchise agreement between the M/S Kamath Our Times Ice-creams (“the franchisor”) and the respondent, the franchisor has the upper hand and final say in every aspects of business. It is further alleged that the investigations were already initiated against all the 11 franchisee outlets located in Mumbai, Delhi, Kolkata and Gurugram owned by the franchisor. Hence, it is alleged that the management of the franchisor was interested in getting an advance ruling to escape the clutches of investigation by DGGI.

(iv) The above ground is nothing short of a movie story, far from reality. At the outset, it is an admitted factual position that no summons was issued to the present applicant. It is an admitted factual position that no search was carried out at the premises of the present applicant. It is an admitted factual position that no inquiry/investigation was conducted against the present applicant by the DGGI. Hence, it does not lie in the mouth of the appellant, at the behest of the DGGI, to submit that an inquiry was pending against the applicant.

(v) The proviso to Section 98 (2) of the said act can be applied only when any cases or proceedings are pending in the name of the applicant, in the present appeal, it is “the respondent”. The movie story that the investigations were initiated against the franchisor and hence, the respondent has no reason to approach the advance ruling authority for advance ruling, is without any basis. Such contention of the appellant-department is vague and absurd. It needs to be stated only to be rejected.

(vi) Even otherwise, it is immaterial, in law as well as in the facts and circumstances of the present case, whether there is any proceeding pending in the name of the franchisor or other franchisees. As per law, the provisions of Chapter XVII would be applicable only qua “the applicant”. The term “applicant” has been defined statutorily under section 95(c) of the Act as any person registered or desirous of obtaining registration under this Act. The ruling and other provisions would be applicable and enforceable only qua such an applicant. Hence, reference to investigation pending against the franchisor or other persons or the tax being paid by the competitors is wholly irrelevant to the issue at hand and clearly an attempt to mislead and misguide this Appellate authority. Hence, the appeal is liable to be rejected on this count alone.

(vii) Apart from the above, the respondent submits that:-

(a) First, there is no evidence produced on record that the franchisor intended to get an advance ruling in their favour. There is no basis of an allegation that the application was filed at the behest of the franchisor;

(b) Second, assuming whilst denying, how did the franchisor know that the ruling would be in their “favour”. The appellant department is casting illegal and unsubstantiated aspirations against the Authority itself. Were the outcome of the application been against the applicant, would the appellant department, at the behest of the DGGI, make such allegations;

(c) Third, the appellant department is so naive. The order passed by the authority for advance ruling only binds the applicant and the Revenue qua the applicant in terms of section 103 of the Act. It does not tie the hands of the DGGI to proceed with their investigations against the franchisors and other franchisees. It is evident that the present appeal is an outcome of personal vendetta of the DGGI against the franchisor.

(viii) At Para-E of the present appeal, the appellant-department relies upon the statement of one Mr.Virendra Nandkumar Mutha, one of the partners of M/S Ashirwad Enterprises, which is one of the franchisees of M/s. Kamath Our Times Ice creams. Mr.Virendra Nandkumar Mutha is a partner in the respondent’s firm as well. According to the appeal, it is categorically confirmed by him that he was aware of the ongoing DGGI investigations at KOTI and its franchisees and with due oral discussions with Directors of KOTI, it was taken a decision to file an application before the ARA through a common consultant Mr.Chirag Mehta. But the relevant details of these investigations were not incorporated in their application before the ARA. This submission is extreme and based on surmises. Here itself, at the outset, it may be pointed out that taking names of consultants is bad in taste. Consultants are advisors. They act on instructions of the client (assessee). The department should not stoop to such levels. In fact, it is only the department that is capable of making such frivolous allegations, without any basis, let alone evidence.

(ix) The statement of Shri. Virendra Nand Kumar has been recorded on 10.05.2019. The same has been recorded after the impugned order came to be passed. Hence, the said statement has been recorded, under duress, force, coercion and threat, in order to support the DGGI’s version. A copy of the said statement has not been provided to Shri Virendra Nand Kumar. No opportunity of allowing the maker thereof to retract the said statement has been granted. The said statement has not been tested on oath. No cross examination of shri Virendra Nand Kumar has been granted. Hence, as such, no reliance can be placed on the said statement.

(x) In Basudev Garg Vs. Commissioner of Customs – 2013 (294) ELT 353 (Del.), the Division Bench of Delhi High Court has held that the statement against the assessee cannot be used without giving them opportunity of cross examination. A statement needs to be tested on oath before being led in as evidence. In absence of the same, such statement cannot be relied upon.

(xi) To similar effect is judgment of the Hon’ble Punjab and Haryana High Court in the case of Jindal Drugs Private Limited v/s Union of India 2016 (340) ELT 67 (P&H)

(xii) Without prejudice to the above, reliance placed on the above statement is wholly irrelevant and out of context. The said statement does not prove that the proceedings were pending against the “applicant” – respondent. There is no legal or statutory bar against making an application for advance ruling if there is no proceeding pending against the assessee applicant. The said ruling would be binding on the applicant and not on Shri. Virendra Nand Kumar or even M/s. Ashirwad Enterprises. The Revenue is free to proceed, as per law, against the said Shri. Virendra Nand Kumar or even M/s Ashirwad Enterprises.

(xiii) The connection sought to be drawn by the DGCI, which is typical of them, between the applicant and the franchisor as well as the Partner of the applicant being a partner in another partnership firm is nothing short of a show cause notice investigation. The DGGI is free to undertake any such investigation, in law. However, with greatest respect, it cannot be a ground of appeal. The DCGI seems to be overlooking the fact that a person can be a partner in 20 firms, at the same time, as per the provisions of the Indian Partnership Act, 1932. To suggest that all such firms are connected and/or related is absurd. The contention of the appellant department is hinging on such extreme assumptions. There is no merit in such a contention. Hence, the present appeal is liable to be rejected.

(xiv) It is evident from the present appeal that the DGGI cannot digest the fact that their investigation was incorrect, in law and on merits, against the franchisor and/or other franchisees. Hence, the present appeal is to satisfy their fake ego and nothing else.

(xv) At Para-F of the present appeal, the appellant-department contends that had it been known to the ARA about the ongoing investigations at the premises of the franchisor or other 11 franchisees, the ARA would have come to the conclusion that the respondent application is liable for rejection as per proviso to Section 98(2) of the said act and accordingly, would rejected application being non maintainable.

(xvi) The above submission is purely presumptive in nature. Had the above been the case, the ARA would still have proceeded to decide the application, on merits, in as much as there was no proceeding pending against the applicant. The proviso to section 98(2) would not be applicable in the facts of the present case.

(xvii) At Para G of the present appeal, the appellant-department contends that some of the major competitors in the field such as ice-creams brands under trade names “Gelato”, “Baskin Robbins”, “Cafe Chokolade” etc. have rightly classified their activity of serving of Ice-cream at parlour end as’ supply of services’ under the HSN code 996331 of the GST tariff of India and they have paid CGST @2.5% and SGST @ 2.5% or the IGST @ 5%, as the case may be, w.e.f. 15.11.2017 by following amending Notification No. 46/2017-C.T. (Rate) dated 14.11.2017.

(xviii) The respondent submits that the above grounds taken by the appellant-department are absurd and incongruous. What is being done by other suppliers is not a basis to decide the present appeal. The present appeal needs to be decided on the facts of the present case. It is not known as to what is the activity being undertaken by the so called “competitors” and the tax treatment being undertaken by them. There is no evidence of the same produced on record by the department. No notice has been issued to the said competitors. Hence, a bald statement cannot be accepted. Therefore, the present appeal is liable to be rejected on this count alone.

(xix) Even assuming whilst denying, as contended by the appellant-department, there is no basis for the appellant to submit that the respondent should follow what their competitors are doing. If such be the case, then there is no need to constitute authorities like Advance Ruling Authority to seek for rulings where the assessee is in doubt. The entire chapter WII would be rendered futile and redundant.

(xx) Thus, the respondent submits that they have not suppressed any fact from the authority for advance ruling. In fact, the appellant-department is trying to mislead this Honourable Appellate Authority by drawing attention to issues which are totally alien to the case at hand. Instead of discharging the burden cast upon them, the appellant-department is making toothless and irrelevant allegations.

32.5 Without prejudice, the respondent submits that they have filed an application under Right to information Act, 2005 seeking information. To utter shock of the respondent, it has come to its knowledge that the Assistant Commissioner of State Tax has agreed with the correctness of the impugned order and concluded it as correct and lawful. However, inspite of follow up the application has not been disposed of by the Department. It has been informed to us that the response to the application should be expected by 19-08-2019. Hence, the present appeal is not maintainable on this count as well.

Submissions on merits

33. At Para-H and Para I of the present appeal, the appellant department contends that the franchisees (respondent) have set up ice cream parlours as per approved design of the franchisor. They also cooked foods as ordered by the customer in single scoop, double scoop, or waffle cone manufactured at their outlet, served in the form of ice cream shakes or even served with fruit toppings etc. They also provide ice cream in carry home packs or even deliver through online aggregators such as Swiggy, Uber Eats, Zomato etc. The appellant department refers to dictionary meanings of the term “ice cream parlour” to contend that ice cream parlours are ‘restaurants’.

34. Before adverting to the submissions made by the appellant department on merits and providing a response thereto, it is submitted that the above ground of appeal is frivolous and cannot be raised by the department. There is no dispute on facts. The facts as stated in the application are accepted by the department in their response/report filed before the Authority for Advance ruling. Hence, it is clear that the above factual position has been typed by the DGGI officials and provided to the appellant department. The appellant department never disputed facts. An appeal is not provided under Chapter XVII to dispute the factual position. If that be the case, the appellant department should have stated so in the report itself. The entire report of the department is in agreement with the facts stated in the application and the submissions of the applicant (respondent herein). It is a complete summersault, now, in the present appeal. The department needs to be reminded that it is not a case of assessment proceedings. It appears that the appellant department has donned the cap of an assessing officer while drafting the grounds of appeal, which is, part from being bad in law, not permissible. An appeal can be urged on the questions decided by the authority and not to argue on facts. This case is a classic case of abuse of the process of law. Hence, the present appeal must be rejected on this count alone.

35. In any event, the respondent submits that the factual position stated in the above paragraph 33 is incorrect. The factual position, which has been narrated above in the statement of facts, is true and correct. The appellant has also accepted the same in its own appeal the “brief facts of the case”. Hence, the above ground is self-contradictory. Therefore, the appeal needs to be rejected.

36. Without prejudice, the respondent does not “cook” anything. It appears that the appellant department does not know the meaning of cooking. It is the appellant department that it is “cooking” up stories. It is a figment of imagination of the DGGI, without any evidence. The respondent submits that the ice-creams so procured from the franchisor are directly being sold to the final consumers at the outlet. No processing is being done on the same. It is sold in the same manner. If Due to the inherent nature of the goods, the same have to be supplied in cups or cones. The cups or cones are mere carriers or containers. The predominant nature of the transaction is that of supply of goods. The form of delivery of the goods would not alter the nature of the transaction.

37. Similarly, if the goods are being delivered, either directly or through aggregators, to the customer’s premises, it would not be converted into a service. If this outlandish, rather childish, argument of the appellant department were to be accepted as correct, then delivery of chocolate by the local grocery store to the premises of the customer would also be a service. In other words, anything delivered, whether car or hair pin or aeroplane, to the premises of the customer would be a service. We need not discuss this argument any further.

38. Likewise, the reliance placed on the fact that the store of the franchisee is designed as per the design provided or under the supervision of the franchisor is wholly irrelevant to the issue at hand. Whether goods are being supplied or service is being supplied would depend on the activity undertaken and not the design of the store or place where it is supplied, The wildness of imagination of the appellant department, to get the advance ruling over turned by hook or by crook, amazes the respondent

39. The reliance placed on definitions of “ice cream parlour” is out of context. It is the activity which is question and not the place from where the activity is undertaken. In any case, it is submitted that above reliance is inaccurate inasmuch as the sources namely “Longman dictionary” and “Wikipedia” are not reliable one and can be modified, amended or changed at anybody’s end. Therefore, such resources cannot be relied upon and should not be even considered at first instance itself.

40. There could be no objection to this fact that the transaction under consideration involves transfer of property in movable goods. The respondent submits that, in the instant case, the customer approaches the respondent to buy Ice-cream. The customer accordingly, places the order from the price list and the same is delivered to them. In case of retail pack, the box is supplied as it is. However, in case of scoop, the flavour of choice is sold as per the customer preference i.e. in cup or cone. In either of the cases, the ice-cream received by the respondent from the franchisor is supplied as it is to the customer. No processing is done thereon, no customization is done. The respondent sells the said final products to the customer at agreed rates, as mentioned on price list. No extra money is charged from the customers. These facts have been admitted by the appellant department.

41. The intention of the parties and the understanding of the parties is that the same is a sale. The customer intends and accordingly, agrees to purchase the abovementioned final products from the respondent. There is no contract for provision of any service customers of the respondent are free to consume the ice-creams inside and outside the outlet. The customer could also carry the other desired location. There are no restrictions as regard to place of consumption.

42. This contention is supported by the fact that none of the outlet provides the facility of serving/dining to the customer. Every customer, irrespective of age or sex is required to collect the same from the delivery counter. Several outlets of respondent do not even offer seating facility. Several others offer a few, and those too are generally occupied by senior citizens and mothers who are accompanied by their toddlers. Few stores have two or three tables kept outside the store, which customers may occupy after they make their purchases. Accordingly, the respondent submits that the transaction is nothing but a supply i.e. ice-cream.

43. While dealing with the review petition in the matter of Northern India Caterers Vs. Lt. Governor of Delhi AIR 1980 SC 674, the apex court rejected the review petition and clarified their earlier decision in the aforesaid case by making the following observations:-

“Where food is supplied in an eating-house or restaurant, and it is established upon the facts the substance of the transaction, evidenced by its dominant object, is g sale of food and the rendering of services is merely incidental the transaction would undoubtedly be eligible to sales tax. In every case it will be for the taxing authority to ascertain the facts when making an assessment under the relevant sales lax law and to determine upon those facts whether a sale of the food supplied is intended.”

44. Here, it is also pertinent to note that in Northern India Caterers [1979] 1 SCR 557 while deciding as to whether the meals served to casual visitors in the restaurant of hotels would constitute a sale, the Apex court stresses on the fact that there is no transaction of sale as the property does not pass to the customer and the customer has no right to take away the goods. The supply of goods is only a part of the service contract. The Supreme Court observed that when meals were served to casual visitors in the restaurant the service must be regarded as providing for the satisfaction of a human need and could not be regarded as constituting a sale of food when all that the visitors were entitled to do was to eat the food served to them and were not entitled to remove or carry away uneaten food. Supporting consideration included the circumstance that the furniture and furnishing, linen, crockery and cutlery were provided, and there was also music, dancing and perhaps a floor show.

45. To similar effect is another decision of Apex court in the matter of State of Himachal Pradesh v. Associated Hotels of India [1972] 2 SCR 937 The ratio decidendi of the above judgment is that what is to be adjudged in each case is as to whether the dominant intention in a given transaction was of sale and purchase of eatables or drinks. Interpreting the above judgments Hon’ble high court of Andhra Pradesh in the matter of Durga Bhavan and Ors. [1981] 47 STC 104 (AP) have summarized the ratio decidendi of the judgments and observed:-

“13. To summarise the position at the end of the three decisions of the Supreme Court discussed earlier appears to be as follows:-

1. If there is no right to carry away the food there would be no sale in favour of the customer.

2. Even if there is a right to carry away if in essence the transaction is a transaction of service and not a transaction of sale it would not be eligible to tax.

3. If, however, where the customer has a right to take away the food if the dominant object is the sale of food and the rendering of service is merely incidental, then the transaction would be a transaction of sale and not a service contract.

4. The question whether the dominant object was the sale of food or rendering of service would depend upon the facts and circumstances of each case which has to be decided by the assessing authority in the light of the evidence before it.

46. Basis the above discussion the High court held that:-

“14. we may observe that sales across the counter will obviously be transactions of sale. It may be that in doing so some services are rendered by packing the foodstuffs, etc., but this part of the service is so infinitesimal and insignificant that the transaction would nevertheless be one of sale. Even in a case where a customer is asked to sit down in a chair or a more comfortable seat while the foodstuff is packed and handed over to him, still we consider that the transaction would be one of sale.”

47. The respondent submits that, in as far as sale of retail packs are concerned, the only activity involved therein is that of picking the plastic container from the shelf arid delivering the same to the customer. Here, it would be crucial to note that this is exactly the way goods, including Ice-creams, are sold at a typical banya shop, super market or a departmental store. Clearly, the activity is merely a transaction of supply of goods to the customers.

48. Further, the respondent submits that in respect of sale of ice-cream in scoops, the Icecream is supplied by the franchisor in wholesale containers. The same is then retailed in small scopes and cones over the counter-The respondent dos not serve the ice cream at its store. Thus, there is clearly transfer of title in goods i.e. ice-creams to the customers in cone and cup.

49. To substantiate the above interpretation, the respondent also place reliance on decision of the Rajasthan High Court in the matter of Govind Ram and Ors. Vs. State of Rajasthan and Ors. reported as AIR 1982 Raj 265 wherein the Hon’ble High Court has held that:-