M/S. Tirumala Milk Products Private Limited vs. Na

(AAR (Authority For Advance Ruling), Andhra Pradesh)

ORDER

(Under sub-section (4) of Section 98 of Central Goods and Services Tax Act, 2017 and sub- section (4) of Section 98 of Andhra Pradesh Goods and Services Tax Act, 2017)

1. The present application has been filed u/s. 97 of the Central Goods & Services Tax Act, 2017 and AP Goods & Services Tax Act, 2017, (hereinafter referred to CGST Act and APGST Act respectively) by M/s. Tirumala Milk Products Private Limited., D.No. 12-8-8, Prakash Nagar, Narasarao pet – 522601 (hereinafter referred to as applicant), registered under the Goods & Services Tax.

2. The provisions of the CGST Act and APGST Act are identical, except for certain provisions. Therefore, unless a specific mention of the dissimilar provision is made, a reference to the CGST Act would also mean a reference to the same provision under the APGST Act. Further, henceforth, for the purposes of this Advance Ruling, a reference to such a similar provision under the CGST or AP GST Act would be mentioned as being under the GST Act.

3. Brief Facts of the case:

The applicant is registered under GST vide GSTIN – 37AABCT7907M1ZU. The applicant engaged in manufacturing of milk and milk products including flavoured milk. The applicant seeks clarification regarding the HSN code, and rate of duty on their outward supply of “flavoured milk”.

4. Activities of the applicant:

The applicant informed that;

(i) Flavoured milk is a sweetened dairy drink made with milk, sugar, permissible colourings and artificial or natural flavourings;

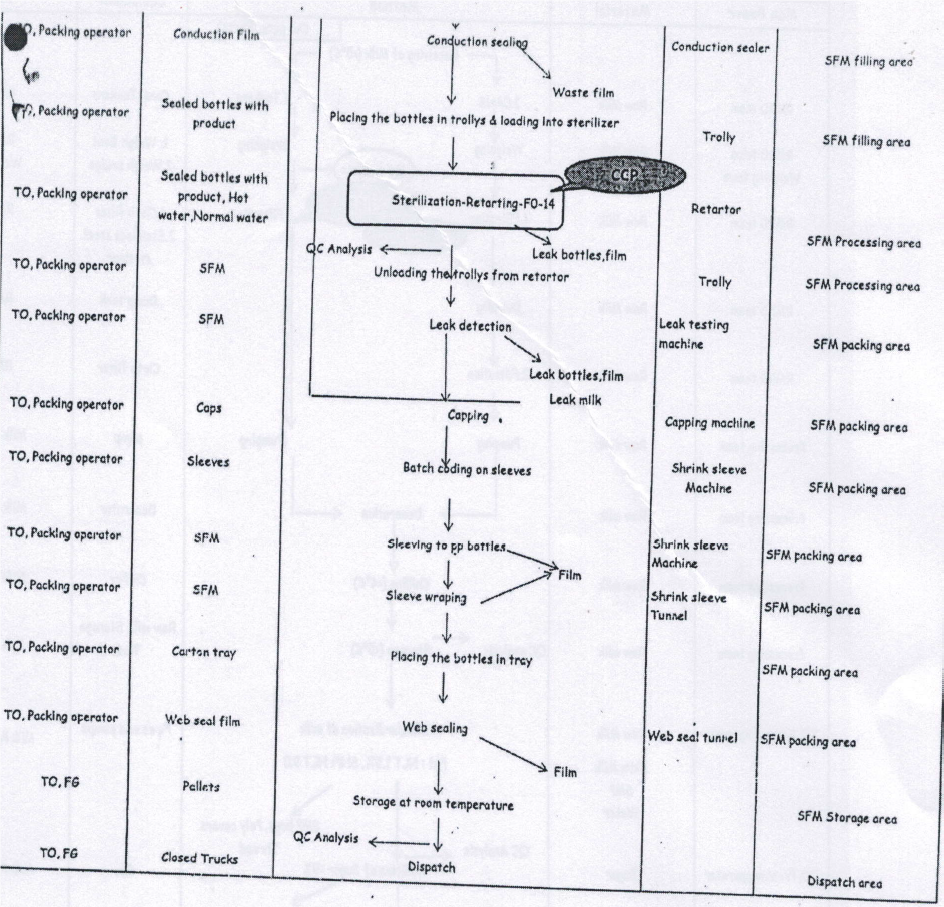

(ii) The brief manufacturing process of the flavoured milk is standardisation of fresh milk according to the fat contents and then heating at certain temperature followed by filtration, pasteurisation, and homogenisation and then mixing of sugar and flavours and finally bottling. The applicant provided process flow chart of flavoured milk.

5. Questions raised before the authority:

The applicant had filed an application in form GST ARA-01, dated 12.04.2019 by paying required amount of fee for seeking Advance Ruling on the following issue:

(a) What is the rate of GST applicable on outward supply of “Flavoured Milk”?

On Verification of basic information of the applicant, it is observed that the applicant falls under centre jurisdiction, Narasaraopet CGST Range, Guntur CGST Division.

Accordingly, the application has been forwarded to the jurisdictional officers with a copy marked to the State Tax authorities, Assistant Commissioner (State Tax), Narasarao peta Circle, to offer their remarks as per Section 98 (1) of CGST/APGST Act 2017. The jurisdictional officers concerned responded that there are no proceedings passed or pending relating to issue on which Advance Ruling is sought by the applicant.

6. Applicant’s Interpretation of Law And Facts:

The applicant is of the view that mere adding of sugar and different flavours to milk does not change essential character of milk; flavoured milk or milk shake is consumed as a substitute for milk; and it is a simple preparation of milk; no manufacturing process is involved nor does milk changes its composition in any way and classification of flavoured milk falls under Chapter 4 of the Customs Tariff Act, 1975 and sought clarification on the applicable HSN code under the said Chapter by providing extract of the same.

7. Record of Personal Hearing:

Sri. Phani Raja Kumar Boggaram, authorized representative of the Applicant appeared for personal hearing on 16.04.2019 and they reiterated the submission already made in the application.

8. Discussion and Findings:

8.1 We have examined the issue raised by the applicant regarding the HSN code and rate of duty on their outward supply of “flavoured milk”. The relevant legal provisions are discussed hereunder.

The Section 9 (1) of CGST Act, 2017 is as follows:

LEVY & COLLECTION

9 (1) Subject to the provisions of sub-section (2), there shall be levied a tax called central goods and service tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 and such rates, not exceeding twenty percent, as the case may be notified by the Government on the recommendations of the Council and collected in such a manner as may be prescribed and shall be paid by the taxable person.

Under Section 9 (1) of CGST Act, 2017, on the recommendations of the Council, the Central Government notified specifying schedule wise GST rates on goods vide Notification no.1/2017 – Central Tax (Rate) dated 28.06.2017 (hereinafter referred to as the “said notification” for brevity) as detailed below:

(i) 2.5 per cent. in respect of goods specified in Schedule I,

(ii) 6 per cent. in respect of goods specified in Schedule II,

(iii) 9 per cent. in respect of goods specified in Schedule III,

(iv) 14 per cent. in respect of goods specified in Schedule IV,

(v) 1.5 per cent. in respect of goods specified in Schedule V, and

(vi) 0.125 per cent. in respect of goods specified in Schedule VI

Under Schedule III, at entry number 453, it is mentioned that goods which are not specified in Schedules I, II, IV, V, VI of the said Notification attract Central Tax rate of 9%.

The Explanation to the said notification is as follows;

(i) …

(ii)(a) …

(ii)(b) …

(iii) “Tariff item”, “sub-heading” “heading” and “Chapter” shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975).

(iv) The rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.

From the above, it is evident that the applicable rate of GST is 18% (9% CGST and 9% SGST) on all goods except the goods specified in the schedules I, II, IV, V, VI of the said Notification. Further, for interpretation of the said notification, the rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as “FS to CTA, 1975”) are to be applied.

8.2 Before applying the said interpretation, we examine the detailed process chart furnished by the claimant in regard to the preparation of “flavoured milk”.

The applicant informed that the process of the flavoured milk is standardisation of fresh milk according to the fat contents and then heating at certain temperature followed by filtration, pasteurisation, and homogenisation and then mixing of sugar and various flavours and finally bottling. As per the flow chart, it involves various operations by RMRD team, weighing team, processing team, packing team and warehousing / despatch teams and thereby it is a preparation and no more it is fresh milk after adding flavours.

The applicant did not provide any details what are the flavours they are using in the preparations. As seen from their website [http://www.tirumalamilk.com/flavoured-milk.php] they are preparing flavoured milk of various flavours like strawberry, pista, mango, vanilla, badam, chocolate, rose, saffron, cardamom etc.,

8.3 The applicant stated that (i) adding flavours to milk does not change essential character of milk; (ii) flavoured milk is a substitute for milk (iii) it is a simple preparation of milk; (iv) no manufacturing process is involved nor does milk change its composition in any way and opined that the commodity milk and milk products are enumerated in Chapter 4 and they want clarification that under which tariff item / HSN code is applicable to the above said flavoured milk. Under the GST provisions the interpretation of the said Notification is to be under the rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975).

8.4 The applicant opines that flavoured milk is covered in Chapter 4 of FS to CTA, 1974. We examine this aspect. The Section I of FS to CTA, 1975 deals with Live Animals; Animal Products. The Chapter 4, deals goods of “DAIRY PRODUCE; BIRDS’ EGGS; NATURAL HONEY; EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED. Therefore, any items/goods are specified or included elsewhere in the Schedule; those items/goods do not fall under Chapter 4. The applicant stated that flavoured milk is a preparation. Section IV deals with goods of “Prepared food stuffs; beverages, spirits and vinegar; tobacco and manufactured tobacco substitutes” and the Chapter 22 deals with items/goods of “Beverages, Spirits and Vinegar”. The tariff item no. 2202 99 30 covers “Beverages containing milk”. Now, we discuss flavoured milk is classifiable under the said tariff item or otherwise.

8.5 The Hon’ble Madras High Court in the case of the State of Tamil Nadu vs Tvl. Ganesh Corporation, vide order dated 3 April, 2012, recorded that

“as per the Oxford Dictionary “beverage” means “a type of drink except water”. In Webster’s 3rd International Dictionary, “beverage” has been described as “liquid for drinking especially such liquid other than water (as tea, milk, fruit juice, beer) usually prepared (as by flavouring, heating, admixing) before being consumed”.

8.6 In the case of M/s Ernakulam Reg. Co-Op. Milk Products Union Ltd., Vs. CCE, Kochi [ 2009-236-ELT-329-TRIB- BANG], it is recorded that;

“4. We have carefully considered the submissions, it is an undisputed fact that the appellants were adding flavours to the milk and the Commissioner (A) after seeing the ingredients has considered the item to be beverage containing milk falling under Chapter 22 as against classification under Chapter 4 – ‘Milk and Milk Products’. The item cannot be used as milk per se in view of the addition of flavour added to it and it has to be considered as a beverage. This is our prima facie finding.”

The Hon’ble High Court of Gujarat, in the case of M/s. KAIRA DIST. CO-OP. MILK PRODUCERS’ UNION LTD Vs. UOI [2015-320-ELT-408-(Guj)] dealt the issue of classification of flavoured milk, which is as follows:

Quote

[Order per : M.S. Shah, J. (Oral)]. – What is challenged in this petition under Article 226 of the Constitution of India is the constitutional validity of the Central Government Notification No. 28/2007-Central Excise, dated 15-6-2007, particularly Serial No. 1 in the table in so far as in column No. 2, code 2202 90 30 is given to “Flavoured milk of animal origin” while giving the said item exemption from duty.

The dispute is about the flavoured milk being produced by the petitioners under the brand name Amul Kool/Amul Kool Cafe.

2. Mr. Paresh M. Dave for the petitioners has submitted as under :-

2.1 Earlier under the six digit code system prevailing till 27-02-2005, the flavoured milk made by the petitioners was falling under Entry 0401.11 which read as under :-

CHAPTER 4

DAIRY PRODUCE; EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED

Notes :-

1. The expression, ‘Milk’ means full cream milk or partially or completely skimmed milk.

2 ……………

| Heading No. | Sub-heading No. | Description of goods | Rate of duty |

| (1) | (2) | (3) | (4) |

| 04.01 | 0401.11 | Flavoured milk, whether sweetened or not, put up in unit containers and ordinarily intended for sale. | Nil. |

2.2 It is submitted that even under the 8 digit code introduced from 28-2-2005, flavoured milk could only fall under Chapter 4 Heading No. 0402, more particularly under sub-heading No. 0402 99 90 reading as under :-

CHAPTER 4

DAIRY PRODUCE; BIRD’S EGGS; NATURAL HONEY; EDIBLE PRODUCTS OF ANIMAL ORIGIN, NOT ELSEWHERE SPECIFIED OR INCLUDED

Notes :-

1. The expression ‘milk’ means full cream milk or partially or completely skimmed milk.

| Tariff Item | Description of goods | Unit | Rate of duty |

| (1) | (2) | (3) | (4) |

| 0401 | Milk and cream, not concentrated nor containing added sugar or other sweetening matter. | ||

| 0402 | Milk and cream, concentrated or containing added sugar or other sweetening matter. | ||

| 0402 91 | Not containing added sugar or other sweetening matter. | ||

| 0402 99 | Other | ||

| 0402 99 10 | Whole milk | kg. | Nil |

| 0402 99 20 | Condensed milk | kg. | 16% |

| 0402 99 90 | Other | kg. | Nil |

2.3 Simultaneously with bringing into operation the above Tariff Amendment Act, the Central Government has issued various Notifications thereby maintaining the effective rates as they stood for various products till 28-2-2005 once again signifying that the objective of the above Tariff Amendment Act was not to change scope of any Chapter or to change classification of the excisable goods, nor was the objective to change the rate structure of the excisable goods.

2.4 According to the department, as per the show cause notice dated 16-04-2007, the Flavoured milk falls in Chapter 22 under Tariff Item No. 2202 90 30.

CHAPTER 22

Beverages, spirits and vinegar

| Tariff Item | Description of goods | Unit | Rate of duty |

| (1) | (2) | (3) | (4) |

| 2202 | Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured, and other non-alcoholic beverages, not including fruit or vegetable juices of Heading 2009. |

|

|

| 2202 90 30 | Beverages containing milk | 1 | 16% |

Mr. Dave further states that only items like Milkis and Swerve (Vanana) being made by other foreign producers can be considered as beverages containing milk because over and above milk, they contain many other ingredients and milk is only one of the ingredients. On the other hand, Amul Kool and Amul Kool Kafe are only skimmed milk with sugar and flavour and therefore they fall only under Chapter 4 providing for dairy produce where note 1 specifically defines milk as including skimmed milk.

2.5 The Notification dated 15-06-2007 reads as under :-

“In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excise Act, 1944 (1 of 1944), the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby further amends the following notifications of the Government of India in the Ministry of Finance (Department of Revenue) specified in column (2) of the Table hereto annexed, in the manner and to the extent specified in the corresponding entry in column (3) of the said Table, namely :-

| Sr. No. | Notification No. and date | Amendments | |

| (1) | (2) | (3) | |

| 1.

| 3/2005-Central Excise dated the 24th February, 2005 [G.S.R. 95(E), dated the 24th February, 2005] | In the said notification, in the Table, after S. No. 11 and the entries relating thereto, the following S. No. and entries shall be inserted, namely :- | |

| (1) | (2) | (3) | (4) |

| “11A. | 2202 90 30 | Flavoured milk of animal origin | Nil” |

2.6 The basic Notification No. 3/2005-C.E. is a general exemption notification prescribing effective rate for various excisable goods, and it is under this general exemption notification that Sr. No. 11A has been inserted from 15-6-2007 thereby specifying nil rate of duty for flavoured milk of animal origin. As the product in question was classified as flavoured milk under SH No. 0401.11 of the Tariff as it stood till 28-2-2005 and since it is not disputed by the Revenue even at this stage that Amul Kool/Amul Kool Cafe is flavoured milk, the respondents would now treat the goods as chargeable to nil rate of duty from 15-6-2007. However, in the process, the petitioners’ right to establish classification of these goods under Chapter 4 of the Tariff as dairy produce has been defeated because the classification of this product is shown under this Notification as 2202 90 30.

2.7 The petitioners’ submission is that Section 5A of the Central Excise Act empowers the Central Government to exempt excisable goods of any specific description from the whole or any part of the duty of excise leviable thereon. The power is thus, to grant exemption of excisable goods of any specified description, but not to decide a classification of any excisable goods by way of a notification issued under this Section. The Central Government could have very well prescribed nil rate of duty for flavoured milk of animal origin without referring to its classification in the said Notification, but having prescribed these goods as falling under classification Code No. 2202 90 30 under this Notification, the Central Government has decided classification of the product by virtue of Notification under Section 5A of the Act, and therefore also, this action is also ultra vires the powers conferred upon the Government under Section 5A of the Act.

The petitioners’ submission is that if this Notification had been issued without indicating Tariff Item No. 2202 90 30, it would have been open to the petitioners to contend that the petitioners were entitled to exemption from excise duty for the entire period from 28-2-2005 to 14-6-2007 by contending that the flavoured milk is only milk with sugar and flavour and is not beverage containing milk as such. Hence, it would have been open to the petitioners to contend that the flavoured milk made by them only falls under Tariff Item No. 0402 99 90 for which Nil rate of duty is prescribed right from 28-2-2005 onwards.

2.8 However, the Central Government itself having given the classification of Tariff Item No. 2202 90 30 in the Notification dated 15-6-2007, apparently with prospective effect, no authority whether the Commissioner of Central Excise or the Appellate Tribunal could accept the petitioners’ contention that flavoured milk falls under Tariff Item No. 0402 99 90. The petitioners have, therefore, challenged the Notification dated 15-6-2007 only in so far as it purports to give classification of Tariff Item No. 2202 90 30 to “Flavoured milk of animal origin”.

2.9 In view of the above Notification, the authority which has issued the show-cause notice on 16-4-2007 would simply proceed on the basis of the said classification code given by the Central Government in the Notification dated 15-6-2007 to which the petitioners have already given reply on 10-7-2007.

3. Having heard learned counsel for the petitioners, we are of the view that looking to the subject matter of the controversy raised in the petition, this appears to be an eminently fit case where the petitioners should make a representation to the Central Government. Accordingly, if the petitioners make such a representation within one week from today, it is expected that the Central Government will decide the same as expeditiously as possible and preferably within one month from the date of receipt of the representation.

4. As regards pendency of the proceedings arising from the show-cause notice, it will be open to the petitioners to make a request before the Commissioner of Central Excise to adjourn the hearing suitably so as to await the decision of the Central Government on the representation. We are sure that such a request will be considered by the Commissioner in the proper perspective when the matter comes up for hearing before the Commissioner on 16-8-2007.

5. The petition stands disposed of in the above terms.

6. Liberty to apply in case of difficulty.

7. Direct service is permitted.

Unquote.

The above, decisions relate to the Central Excise regime. However, the interpretation and Ratio Decidendi is applicable to the very goods under GST also. In fact many dairy companies approached GST Council seeking clarification on the classification of flavoured milk. The matter recorded in the Agenda for 31st GST Council Meeting (Volume-2) dated 22.12.2018, in this regard is as follows:

| S. No. | Description | HSN | Present GST Rate (%) | Requested GST Rate (%) | Comments |

| 18 | Flavoured Milk | 2202 12 | 12 | Clarification on that it is classificable under chapter 4 | 1. The Explanatory Notes to HSN describe the goods classifiable under the heading 0402 as under: This heading covers milk (as defined in Note 1 to this Chapter) and cream, whether or not pasteurised, sterilised or otherwise preserved, homogenised or peptonised; but it excludes milk and cream which have been concentrated or which contain added sugar or other sweetening matter (heading 04.02) and curdled, fermented or acidified milk and cream (heading 04.03). The products of this heading may be frozen and may contain the additives referred to in the General Explanatory Note to this Chapter. The heading also covers reconstituted milk and cream having the same qualitative and quantitative composition as the natural products. 2. Flavoured milk is classifiable under HS code 2202. 3. Fitment Committee does not recommend issuance of such clarification. |

In view of the above, we arrive to the conclusion that ‘flavoured milk’ is classifiable under tariff item 2202 9930 of the First Schedule to the Customs Tariff Act,1975 as a “beverage containing milk” under HS code 2202. The rate of tax applicable for the said tariff item is 12% GST (6% CGST + 6% SGST) under entry no. 50 of Schedule II of Notification No.1/2017 – Central (Rate) dated 28.06.2017 as amended.

In the light of the facts and legal position the ruling is given as under.

RULING

(Under section 98 of Central Goods and Services Tax Act, 2017 and the Andhra Pradesh Goods and Services Tax Act, 2017)

The HS code for flavoured milk is 2202 9930 and the GST rate is 12% (6% CGST and 6% SGST) under entry No. 50 of Schedule II of Notification No.1/2017 – Central (Rate) dated 28.06.2017 as amended.