Gyankeer Products Private Limited vs. Na

(AAR (Authority For Advance Ruling), Rajasthan)

At the outset, we would like to make it clear that the provisions of both the CGST Act and the RGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the RGST Act. Further to the earlier, henceforth for the purposes of this Advance Ruling, a reference to such a similar provision under the CGST Act / RGST Act would be mentioned as being under the “GST Act”.

The issue raised by M/s Gyankeer Products Private Limited, NH 9 Upli Oden, Nathdwara, Rajsamand-313301 Rajasthan – (hereinafter the applicant) is fit to pronounce advance ruling as it falls under the ambit of the Section 97(2) (a) given as under:

(a) Classification of goods and/or services or both:

A. SUBMISSION OF THE APPLICANT (in brief)

1. That M/s. Gyankeer Products P. Ltd. (hereinafter referred to as the “applicant”) are registered under GST having GSTIN 08AAHCG3822A1Z1. Applicant wishes to manufacture and supply the product “Keer Kokil” which is ‘Tobacco pre-mixed with lime’. It is principally unmanufactured tobacco which has been pre-mixed with lime.

2. That the applicant wishes to manufacture “Keer Kokil” i.e. ‘Tobacco premixed with lime’ where the principal content is tobacco which is mixed with lime. Further, little aroma and menthol is used for freshness and to avoid bad smell.

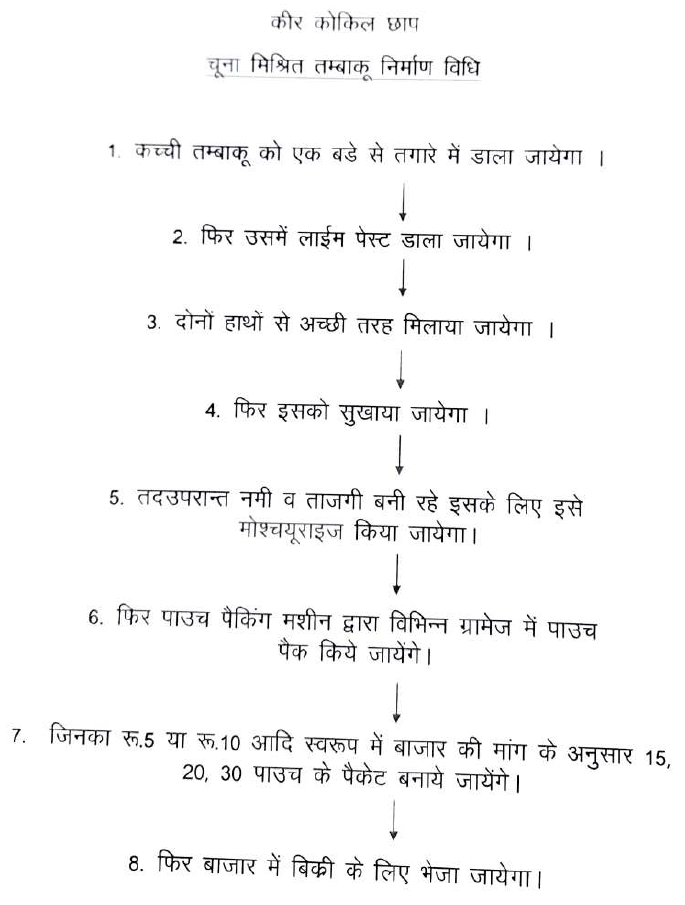

3. as per submission made by the applicant on 16.05.2022, this product involves following process.

Statement of Applicant’s Interpretation of Law/ Facts

1. Applicant understands that Tobacco and unmanufactured tobacco substitutes are classified under Chapter 24 of the GST Tariff wherein inter alia Unmanufactured tobacco is classified under Heading 2401 chargeable to 28% GST with following 2 categories :

| S. No. | Description |

| (1) | Unmanufactured Tobacco (without Lime tube |

| (2) | Unmanufactured Tobacco with Lime tube) |

Unmanufactured tobacco with lime tube signifies those pouches where a tube of lime is put inside the pouch containing unmanufactured tobacco. As against this, ‘unmanufactured tobacco without lime tube’ signifies those products where it is sold without any lime tube i.e. no tube of lime is put inside the pouch. The product “Keer Kokil” is more specifically falling under this category of Unmanufactured tobacco without lime tube’ because we will not be selling any tube of lime inside our pouches. Since, there are only two sub classification of unmanufactured tobacco, therefore, our product more appropriately falls under first category i.e. ‘unmanufactured tobacco without lime tube’. It is submitted that it is a residual category where all unmanufactured tobacco would fall which are not containing lime tube and accordingly, tobacco pre-mixed with lime would also fall under this category as it is not containing any lime tube.

It is relevant to mention here that the tobacco leaves are never chewed/ used directly but same are mixed with lime and then only consumed. Either consumer mixes lime while consuming the tobacco or it is supplied to consumer pre-mixed with lime, there is no material change in the product, quality, price bracket and category of end user because product principally remains same i.e. ‘unmanufactured tobacco’ which falls under Heading 2401. Our product “Keer Kokil” is principally the same i.e. tobacco leaves and instead of subsequent mixing of lime by consumer it is already mixed with lime. Further, a little aroma and menthol is used for freshness and to avoid bad smell. Despite this, the nature of the product is not altered and the consumer base remains the same i.e. farmer/ labour class. This tobacco is never used with Pan Masala and is never put in Pan.

2. On the other hand, there is another tobacco product in the market which is known and called as ‘Zarda scented tobacco’ which is a product used in Pan or Pan-Masala. Such tobacco product is classified under Heading 2403 under the category “Chewing Tobacco”. Normally it contains less than half gram of tobacco and priced at Rs. 10/- per pouch which means a cost of Rs. 20,000/- per kg on the basis of MRP. The quality of tobacco leaf is totally different and costly in this product which is e idem from the high selling price of the product. Further, it is highly scented and totally dry. Since, it is a costly product it is consumed by rich and elite class of people

3. It is submitted that the basic points of difference between the above two categories of Tobacco products i.e. Unmanufactured Tobacco (with or without lime tube) including “Keer Kokil” and Chewing Tobacco which is basically known as ‘Zarda Scented Tobacco’ are as follows:-

a) Contents and Composition: The quality of tobacco leaves used in the Unmanufactured Tobacco product is totally different with the tobacco leaves used in the Chewing Tobacco or Zarda Scented Tobacco. Further, Zarda Scented Tobacco is highly scented and totally dry.

b) Price: Where unmanufactured tobacco is priced at around Rs. 5 per pouch containing approximately 6 grams of tobacco, which means a cost o! Rs. 835/- per Kg on MRP basis. On the contrary, chewing tobacco is priced at Rs. 10/- per pouch containing approximately less than halt gram of tobacco which means a cost of Rs. 20,000/- per kg on the basis of MRP.

c) Usage: Unmanufactured tobacco which either comes with lime tube or without lime tube is consumed directly after mixing lime in it whereas the chewing tobacco i.e. Zarda Scented Tobacco is used in Pan/ Pan Masala. It is submitted that the unmanufactured tobacco is never used in Pam’ Pan Masala.

d) Customer Base: Since, unmanufactured tobacco is prices very cheap, the category of consumer of this product is the labour and farmer class or the Biri Sector whereas, chewing tobacco or Zarda Scented Tobacco is consumed by rich and elite class of people due to its high pricing.

4. It is submitted that in case of our product “Keer Kokil” i.e. ‘Tobacco premixed with lime’ principally the product is same as ‘unmanufactured tobacco’ with the only difference that instead of a separate tube of lime, lime will be already mixed in it and will be sold as “Keer Kokil”.

5. Further, the quality of tobacco leaves in our product “Keer Kokil” is similar to the quality of leaves used in unmanufactured tobacco which keeps it within the same price range of unmanufactured tobacco.

6. Further, it is submitted that the making process and ingredients of our product “Keer Kokil” is totally different from that of the chewing tobacco or the Zarda scented tobacco. Since, chewing tobacco is a costly product it is consumed by rich and elite class of people and therefore this product, as per classification, end use and class of consumer is totally different from that of our product “Keer Kokil” i.e. ‘tobacco pre-mixed with lime’.

7. It is submitted that presently “Keer Kokil” i.e. ‘tobacco pre-mixed with lime’ does not fall under any of the specified categories in the schedule of levy of GST Compensation Cess. It is further relevant to mention that there is no product like Chewing Tobacco (with lime tube or without lime tube). It is only unmanufactured tobacco, which is sold either as such or sold with additional lime tube or sold pre-mixed with lime. This aspect is missing in present Classification and therefore, our product most specifically falls under the category of unmanufactured tobacco without lime tube.

8. Considering the above facts and submissions, applicant submits that as per their understanding, the product “Keer Kokil” i.e. ‘Tobacco pre-mixed with lime’ is classifiable under Heading 2401 along with Unmanufactured Tobacco and not under Heading 2403 with Chewing Tobacco.

B. QUESTIONS ON WHICH THE ADVANCE RULING IS SOUGHT:-

Classification and applicable rate of GST and/ or Compensation Cess on our product “Keer Kokil” i.e.’Tobacco pre-mixed with lime’.?

C. PERSONAL HEARING

In the mailer personal hearing was granted to the applicant on 29.03.2022 and again on 11-05-2022. CA. Keshav Maloo, and Adv. M.L. Patodi, authorized representatives of applicant appeared for personal hearing. During the personal hearing, they reiterated the submissions already made. On being asked during personal hearing they further submitted that the decision of AAAR of Tamilnadu state in the case of Kavi Cut Tobacco in Order-in-Appeal No. AAAR/03/2020(AR) is not a good law as it is contradictory to various judgments of tribunals including that of Mumbai Tribunal in the case of Yogesh Associates reported at 2006 (195) EL T 196 (Tri-Mumbai) which has been affirmed by Hon’ble Supreme Court which has been reported 2006 (199) ELT A221(S.C.). Shri Maloo also submitted the process of manufacture of Kavi Cut tobacco and their product is different from their product Keer Kokil. They submitted a note on the same during personal hearing.

D. COMMENTS OF THE JURISDICTIONAL OFFICER

Comments received from the Dy. Commissioner, State Tax, Circle-B, Rajsamand vide letter dated 18.01.2022 and 10.05.2022, the gist of the same is as under: –

- The firm M/s GYANKEER PRODUCTS PVT LTD is registered under GST having GSTIN- 08AAHCG3822A1Z1 w.e.f 03.10.2018. The HSN Code and product detail as per registration certificate are as under –

- The firm is paying tax as normal taxpayee and filing returns regularly. The firm has shown sale of Pan Masala (AAV1SHKAR PAN MASALA), Food prepared items paying GST at the applicable rate and compensation cess on Pan Masala @ 60%.

- As per application of the applicant he wishes to manufacture “Keer Kokil” i.e ‘Tobacco pre-mixed with Lime’.

- Interpretation of facts regarding product of “Keer Kokil”:

| HSN Code | Product |

| A. | 2106 | – FOOD PREPARATIONS NOT ELSEWHERE SPECIFIED |

| B. | 2401 | -UNMANUFACTURED TOBACCO; TOBACCO REFUSE |

| C. | 240120 | – Tobacco, partly or wholly stemmed or stripped |

| D. | 24012090 | – UNMANUFACTURED TOBACCO; TOBACCO REFUSE – TOBACCO, PARTLY OR WHOLLY STEMMED OR STRIPPED: OTHER. |

A. Lime paste is mixed with raw cut Tobacco and dried in Auto plant to abolish water during drying process.

B. segregate uneven leaves and dust the lime mixed Tobacco is processed through vibrators.

C. It will be stored in Jute fabric covered steel Silos and then a little aroma and menthol, will be added to avoid bad smell.

- As per HSN Code Tobacco and unmanufactured Tobacco substitutes are classified under chapter 24 of the GST tariff and unmanufactured Tobacco is classified under heading 2401.

- There are two categories of unmanufactured Tobacco in HSN tariff plan code 2401 :-

| HSN Code | Description | Rate (%) | CESS (%) | Effective Date | Rate Revision |

| 2401 | Tobacco leaves | 5% |

| 01/07/2017 |

|

| 2401 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE .TOBACCO LEAVES AS SUCH OR BROKEN TOBACCO LEAVES OR LEAVES STEMS, UNMANUFACTURED TOBACCO (WITHOUT LIME TUBE) BEARING A BRAND NAME, UNMANUFACTURED TOBACCO (WITH LIME TUBE) BEARING A BRAND | 28% | 71%/ 65% | 01/07/2017 |

|

| 240110 | TOBACCO, NOT STEMMED OR STRIPPED | 28% | 71% | 01/07/2017 |

|

| 24011010 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO, NOT OR STRIPPED : FLUE CURED VIRGINIA TOBACCO STEMMED | 28% | 71% | 01/07/2017 |

|

| 24011020 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE – TOBACCO NOT STEMMED OR STRIPPED ; SUN CURED COUNTRY (NATU) TOBACCO | 28% |

| 01/07/2017 |

|

| 24011030 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO, NOT STEMMED OR STRIPPED : SUN CURED VIRGINIA TOBACCO | 28% |

| 01/07/2017 |

|

| 24011040 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE – TOBACCO, NOT STEMMED OR STRIPPED : BURLEY TOBACCO | 28% |

| 01/07/2017 |

|

| 24011050 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO, NOT STEMMED OR STRIPPED TOBACCO FOR MANUFACTURE OF BIRIS, NOT STEMMED | 28% |

| 01/07/2017 |

|

| 24011060 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE – TOBACCO, NOT STEMMED OR STRIPPED : TOBACCO FOR MANUFACTURE OF CHEWING TOBACCO | 28% |

| 01/07/2017 |

|

| 24011070 | UNMANUF ACTU RED TOBACCO; TOBACCO REFUSE -TOBACCO NOT STEMMED OR STRIPPED TOBACCO FOR MANUFACTURE OF CIGAR AND CHEROOT | 28% |

| 01/07/2017 |

|

| 24011 080 | UNMANUFACTURED TOBACCO; TOBACCO REEL SE – TOBACCO NOT STEMMED OR STRIPPED TOBACCO FOR MANUFACTURE OF HOOKAH TOBACCO | 28% |

| 01/07/2017 |

|

| 24011090 | UNMANUFACTURED TOBACCO: TOBACCO REFUSE – TOBACCO. NOT STEMMED OR STRIPPED : OTHER | 28% |

| 01/07/2017 |

|

| 240120 | TOBACCO PARTLY OR WHOLLY STEMMED OR STRIPPED | 28% |

| 01/07/2017 |

|

| 24012010 | UNMANUFACTURED TOBACCO: TOBACCO REFUSE -TOBACCO. PARTLY OR WHOLLY STEMMED OR STRIPPED : FLUE CURED VIRGINIA TOBACCO | 28% |

| 01/07/2017 |

|

| 24012020 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO PARTLY OR WHOLLY STEMMED OR STRIPPED ; SUN CURED COUNTRY (NATU) TOBACCO | 28% |

| 01/07/2017 |

|

| 24012030 | UNMANUFACTURED TOBACCO: TOBACCO REFUSE-TOBACCO. PARTLY OR WHOLLY STEMMED OR STRIPPED SUN CURED VIRGINIA TOBACCO | 28% |

| 01/07/2017 |

|

| 24012040 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO. PARTLY OR WHOLLY STEMMED OR STRIPPED : BURLEY TOBACCO | 28% |

| 01/07/2017 |

|

| 24012050 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO. PARTLY OR WHOLLY STEMMED OR STRIPPED : TOBACCO FOR MANUFACTURE OF BIRIS | 28% |

| 01/07/2017 |

|

| 24012060 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO, PARTLY OR WHOLLY STEMMED OR STRIPPED : TOBACCO FOR MANUFACTURE OF CHEWING TOBACCO | 28% |

| 01/07/2017 |

|

| 24012070 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO, PARTLY OR WHOLLY STEMMED OR STRIPPED TOBACCO FOR MANUFACTURE OF CIGAR AND CHEROOT | 28% |

| 01/07/2017 |

|

| 24012080 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO, PARTLY OR WHOLLY STEMMED OR STRIPPED TOBACCO FOR MANUFACTURE OF HOOKAH TOBACCO | 28% |

| 01/07/2017 |

|

| 24012090 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO, PARTLY OR WHOLLY STEMMED OR STRIPPED : OTHER | 28% |

| 01/07/2017 |

|

| 24013000 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE -TOBACCO REFUSE | 28% | 61% | 01/07/2017 |

|

i. Unmanufactured tobacco (without lime tube) bearing a brand name GST @ 28% and Compensation Cess @71%.

ii. Unmanufactured tobacco (with lime tube) bearing a brand name GST @ 28% and Compensation Cess @61%.

- The product “Keer Kokil” is falling under the category of unmanufactured tobacco without lime tube HSN Code 2401 (As interpretation and explained process of product of the applicant).

- “Keer Kokil” will be supplied to consumer pre-mixed with lime and there will be no material change of tobacco leaves in the product.

- The tobacco leaves used in “Keer Kokil” remains original after adding a little aroma and menthol to avoid bad smell. The nature of the product will not be changed.

E. FINDINGS, ANALYSIS & CONCLUSION:

1. We have perused the records on file and gone through the facts of the case and the submissions made by the applicant as well as the department. On the basis of submission made on 16.05.2022, we are of the view that the applicant i.e. M/s. Gyankeer Products P. Ltd. (GSTIN 08AAHCG3822A1Z1) wishes to manufacture and supply the product ‘Tobacco pre-mixed with lime having name “Keer Kokil” where the principal content is tobacco which is mixed with Lime.

2. The manufacturing process of the “Keer Kokil” i.e. ‘Tobacco pre-mixed with lime’ (as elaborated in their application and revised submission by the applicant) :

3. In the present case we have to decide the classification and applicable rate of GST and or Compensation Cess on the product “Keer Kokil i.e. tobacco pre-mixed with lime’.

4. Below we delve deep to decide the case, it would be proper in the fitment of justice to discuss the relevant provisions of the statute which are as under-

4.1 Linder GST. the applicable rates of CGST are notified by Notification No. 1/ 2017-C.T. (Rate), dated 28-6-2017 and in terms of explanation (iii) and (iv) to the said Notification.

(iii) “Tariff item”, “sub-heading” “heading’ and “Chapter shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act. 1975(51 of 1975).

(iv) The rules for the interpretation of the First Schedule to the Customs Tariff Act. 1975 (51 of 1975), including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be. apply to the interpretation of this notification.

Thus for the purposes of classification under GST, the First Schedule to Customs Tariff Act is only applicable. Further the first schedule to the Customs Tariff Act, 1975, and the Rules of interpretation therein are to be followed for classifying a product, in terms of Explanation 1 and 2 to Notification No. 1/2017-Compensation Cess (Rate), dated 28-6-2017.

4.2 Chapter 24 of Customs Tariff is as under:-

CHAPTER 24

Tobacco and manufactured tobacco substitutes; products, whether or not containing nicotine, intended for inhalation without combustion; other nicotine containing products intended for the intake of nicotine into the human body

Notes:

1. This Chapter does not cover medicinal cigarettes (Chapter 30);

2. Any products classifiable in heading 2404 and any other heading of the Chapter are to be classified in heading 2404.

3. For the purposes of heading 2404, the expression “inhalation without combustion” means inhalation through heated delivery or other means, without combustion.

SUB-HEADING Note:

For the purpossses of sub-heading 2403 11, the expression “water pipe tobacco” means tobacco intended for smoking in a water pipe and which consists of a mixture of tobacco and glycerol, whether or not containing aromatic oils and extracts, molasses or sugar, and whether or not flavoured with fruit. However, tobacco free products intended for smoking in a water pipe are excluded from this sub-heading.

SUPPLEMENTRY NOTES :

For the purposes of this Chapter:

(1) “tobacco” means any form of tobacco, whether cured or uncured and whether manufactured or not, and includes the leaf, stalks and stems of the tobacco plant, but does not include any part of a tobacco plant while still attached to the earth.

(2) “cut-tobacco” means the prepared or processed cut-to-size tobacco which is generally blended or moisturised to a desired extent for use in the manufacture of machine – rolled cigarettes.

(3) “smoking mixtures for pipes and cigarettes” of sub-heading 2403 10 does not cover “ Gudaku”

4.3 The Customs Tariff Classification in respect of Chapter 2401 are reproduced below for reference:

| 2401 | UNMANUFACTURED TOBACCO; TOBACCO REFUSE |

| 2401 10 | – Tobacco, not stemmed or stripped : |

| 2401 10 10 | — Flue cured virginia tobacco |

| 2401 10 20 | — Sun cured country (natu) tobacco |

| 2401 10 30 | — Sun cured virginia tobacco |

| 2401 10 40 | — Burley tobacco |

| 2401 10 50 | — Tobacco for manufacture of biris, not stemmed |

| 2401 10 60 | — Tobacco for manufacture of chewing tobacco |

| 2401 10 70 | — Tobacco for manufacture of cigar and cheroot |

| 2401 10 80 | — Tobacco for manufacture of hookah tobacco |

| 2401 10 90 | — Other |

| 2401 20 | – Tobacco, partly or wholly stemmed or stripped : |

| 2401 20 10 | — Flue cured virginia tobacco |

| 2401 20 20 | — Sun cured country (natu) tobacco |

| 2401 20 30 | — Sun cured virginia tobacco |

| 2401 20 40 | — Burley tobacco |

| 2401 20 50 | — Tobacco for manufacture of biris |

| 2401 20 60 | — Tobacco for manufacture of chewing tobacco |

| 2401 20 70 | — Tobacco for manufacture of cigar and cheroot |

| 2401 20 80 | — Tobacco for manufacture of hookah tobacco |

| 2401 20 90 | — Other |

| 2401 30 00 | – Tobacco refuse |

CTH 2403 covers “Other manufactured tobacco and Manufactured Tobacco substitutes; “Homogenised” or “Reconstituted” Tobacco; Tobacco Extracts and Essences”. CTH 2403 99 10 – covers ‘Chewing Tobacco’.

| 2403 | OTHER MANUFACTURED TOBACCO AND MANUFACTURED TOBACCO SUBSTITUTES; “HOMOGENISED” OR “RECONSTITUTED” TOBACCO; TOBACCO EXTRACTS AND ESSENCES |

| – Smoking tobacco, whether or not containing tobacco substitutes in any proportion : |

| 2403 11 | — Water pipe tobacco specified in Sub-heading Note to this Chapter: |

| 2403 11 10 | — Hookah or gudaku tobacco |

| 2403 11 90 | — Other |

| 2403 19 | — Other: |

| 2403 19 10 | — Smoking mixtures for pipes and cigarettes |

| — Biris: |

| 2403 19 21 | —- Other than paper rolled biris, manufactured without the aid of machine |

| 2403 19 29 | —- Other |

| 2403 19 90 | — Other |

| 0 | – Other : |

| 2403 91 00 | — “Homogenised” or “reconstituted” tobacco |

| 2403 99 | — Other : |

| 2403 99 10 | — Chewing tobacco |

| 2403 99 20 | — Preparations containing chewing tobacco |

| 2403 99 30 | — Jarda scented tobacco |

| 2403 99 40 | — Snuff |

| 2403 99 50 | — Preparations containing snuff |

| 2403 99 60 | — Tobacco extracts and essence |

| 2403 99 70 | — Cut-tobacco |

| 2403 99 90 | — Other |

4.4 The rates of GST in respect of Tobacco covered under the heads are as under [Notification No. 1/2017-CT(R) dated 28.06.2017]:

| Schedule | HSN | product Description | Rate of GST |

| Schedule I SI. No. 109 | 2401 | Tobacco Leaves | @ 5% (2.5% CGST+ 2.5% SGST) |

| Schedule IV SI. No. 13 | 2401 | Unmanufactured Tobacco; Tobacco refuse (other than tobacco leaves) | @ 28% (14% CGST+ 14% SGST) |

| Schedule IV SI. No. 14 | 2402 | Cigars, Cheroots, Cigarillos, Cigarettes; of tobacco or tobacco substitutes. | @ 28% (14% CGST+ 14% SGST) |

| Schedule IV SI. No. 15 | 2403 | Other manufactured tobacco and manufactured tobacco substitutes; “homogenised” or “reconstituted” tobacco; tobacco extracts and essences [including biris] | @ 28% (14% CGST+ 14% SGST) |

4.5 The relevant rates of GST Compensation Cess in respect of Tobacco covered under the heads are as under [Notification No. 1/2017- Compensation (R) dated 28.06.2017]:

| SI.No. | Chapter / Heading / Sub-heading / Tariff item | Description of Goods | Rate of Goods & Service Tax Compensation Cess |

| (1) | (2) | (3) | (4) |

| 5 | 2401 | Unmanufactured Tobacco (without Lime tube)-bearing a brand name | 71% |

| 6 | 2401 | Unmanufactured Tobacco (with Lime tube)-bearing a brand name | 65% |

| 7 | 2401 30 00 | Tobacco refuse, bearing brand name | 61% |

| 26 | 2403 99 10 | Chewing Tobacco (without Lime tube) | 160% |

| 27 | 2403 99 10 | Chewing Tobacco (with Lime tube) | 142% |

5. We have gone through the facts of the case and submissions made by the applicant including at the lime of hearing and as per revised submission made on 16.05.2022.

6. The applicant has submitted that their product is basically tobacco. Such raw tobacco leaves are not consumed without mixing it with lime and in their product the lime is in pre mixed condition.

7. As per applicant, they purchase dried and cut tobacco in which lime pest is mixed and thereafter it is dried, impurities and dust are removed and then it is stored in jute bags. Further while packing moisture is added so that it does not remain dried. It is finally packed in pouches for use by consumers.

8. We find that the AAAR of Tamilnadu in the case of M/s Kavicut tobacco held that raw dried tobacco leaves procured from market. After that, the first step undertakes the process of grading, drying, liquoring i.e. the dried tobacco leaves are cured using jeggary water for the purpose preventing it from moulding or further decaying, stalking, semi-drying, mincing. Secondly, it will be cut into small pieces in a cutting machine therefore, classifiable under 2403 and not 2401.The basic reasoning given in the order is that since, the raw material undergoes a set of processes and emerges as a distinct product which makes it marketable/consumable for the chewing needs and therefore, it is a manufactured tobacco product for chewing classifiable under CTH 2403.

9. On gone through to GST Tariff, the Tobacco and unmanufactured Tobacco substitutes are classified under Chapter 24 wherein inter alia Unmanufactured tobacco is classified under Heading 2401 chargeable to 28% GST with following 2 categories:

| S. No. | Description |

| (1) | Unmanufactured Tobacco (without Lime tube) |

| (2) | Unmanufactured Tobacco (with Lime tube) |

Unmanufactured tobacco with lime tube signifies those pouches where a tube of lime is put inside the pouch containing unmanufactured tobacco. As against, ‘unmanufactured tobacco without lime tube’ signifies those products where it is sold without any lime tube i.e. no tube of lime is put inside the pouch. In the instant case, product of the applicant is tobacco pre-mixed with lime which is not containing any lime tube.

The ‘unmanufactured tobacco’ is being discussed as under: –

As per the HSN notes under the heading ‘unmanufactured tobacco’, the scope of the coverage of ‘unmanufactured tobacco’ is in the form of whole plants or leaves in the natural state or as cured or fermented leaves, whole or steamed/stripped, trimmed or untrimmed, broken or cut (including pieces cut to shape, but not tobacco ready for smoking). Tobacco leaves, blended, stemmed/stripped and “cased” (“sauced” or liquored”) with a liquid of appropriate composition mainly in order to prevent mould and drying and also to preserve the flavour are also covered in this heading.

Further, the Central Board of Excise & Customs vide its Circular No. 37/90-CX. 3, dt. 17-7-90, in case of flavours/scents added in preparation of scented snuff held the view that Snuff Tobacco even after addition of “Perfumes, Scents and Menthol” remain Tobacco. Therefore, the explanatory notes of HSN bringing in the leaf treated with Tobacco Solution Quimam herein and thereafter with flavouring perfumes agents cannot transform Raw leaf tobacco unmanufactured to manufactured tobacco. The addition of their volatile flavours will not amount to rendering unmanufactured tobacco to manufactured tobacco following the settled position that process of treatment Raw of leaf of Tobacco by effecting various processes, e.g. sieing etc. would keep the tobacco as unmanufactured and classification under heading 2401 cannot be disturbed.

Apart from above, the Jurisdictional SGST Officer vide letter dated 18.01.2022 and 10.05.2022 also stated that the product of applicant i.e. ‘Keer Kokil” will be supplied to consumer pre-mixed with lime and there will be no material change of tobacco leaves in the product. The tobacco leaves used in “Keer Kokil” remains original after adding lime’ The nature of the Product will not be changed.

10. However we find that Hon’ble Supreme Court in the case of Damodar J. Malpani reported at 2002(146) E.L.T.483 (SC) while dealing with the classification of chewing tobacco that :

“2. It is not in dispute that the appellants product is chewing tobacco. Il is also not in dispute that chewing tobacco is not necessarily manufactured tobacco or classifiable under tariff heading 2404. The classification of chewing tobacco”: “ultimately depend on the process adopted for consumption of the chewing tobacco………”

Relying upon the above said judgement, Hon’ble Bench of CESTAT, Mumbai in the case of Yogesh Associates vs. CCE. Surat-II reported at 2006 (195) E.L.T.196 (Tri-Mum) held that the raw tobacco leaves treated with tobacco solution quimam and other flavours including saffron water is classifiable under tariff 2401 and not 2403.

This order of Hon’ble Mumbai Tribunal was challenged by Commissioner of C.Ex. Sural-II before Hon’ble Supreme Court and such appeal of revenue was dismissed, and the judgement was reported at 2006 (199) E.L.T. A221 (S.C.).

We observe that processing of tobacco leaves with certain mixtures in it does not make the product classifiable under CH 2403 and it is still classifiable under tariff 2401.

The AAAR in the case of Kavi Cut tobacco is directly distinguishable from above said order of Tribunal and Hon’ble Supreme Court. Similar issue was decided by Hon’ble Chennai Tribunal in the case of Muthuvelappa Gounder and Sons reported at 2010 (256) ELT 320 (Tri.-Chennai) wherein it was held that curing of tobacco leaves by treating the same with jiggery water is classifiable under heading 2401 and the revenue’s appeal seeking classification under heading 2404 as chewing tobacco was dismissed. Likewise, Hon’ble Mumbai Tribunal in the case of Suresh Enterprises Vs. CCE, Pune reported at 2006 (203) E. L. T. 432 (Tri.- Mumbai) held that raw tobacco treated with quimam and perfumes is classifiable under sub-heading 2401 and not in sub heading 2404.

11. In view of above, we find that mixing of lime in tobacco leaves does not alter the nature of the product. The addition of their volatile flavours will not amount to rendering unmanufactured tobacco to manufactured tobacco in view of judgment of Hon’ble Apex Court in case of M/s Yogesh Associates. The quality of tobacco leaves used in the product i.e. “Keer Kokil’ is different with the tobacco leaves used in the Chewing Tobacco or Zarda Scented Tobacco. Thus, the product is basically Unmanufactured Tobacco (without Lime tube) bearing a brand name. The HSN notes for heading 2401 specifically covers leaves in natural slate, cured tobacco and tobacco for manufacturing chewing Tobacco etc. Hence. ‘Tobacco pre-mixed with lime’ containing ingredients like lime is nothing but ‘unmanufactured tobacco’ and will be classified under heading 2401.

12. Once it is held that the product is ‘unmanufactured tobacco’, the classification of the product is under CTH 2401 which specifics under the sub head 2101 20 90 as ‘others’ and attracts GST @ 28% (i.e. 14% CGST + 14% SGST) as per S. No. 13 of Schedule IV of the Notification No. 01/2017-CT (Rale) dated 28.06.2017.

13. As far as the rate of Compensation Cess applicable to the product is concerned, the rate of Compensation Cess is provided vide Notification No. 1/2017-Compensation Cess (Rate), dated 28-6-2017 and SI. No. 5 provides the Compensation Cess Rate as 71% for the product “Unmanufactured Tobacco (without Lime tube)”.

14. In view of the extensive deliberations as hereinabove, we rule as follows: –

RULING

(Under Section 98 of the Central Goods and Services Tax Act, 2017 and the Rajasthan Goods and Services Tax Act, 2017)

For reasons as discussed in the body of the order, the questions are answered thus:

Question – Classification and applicable rate of GST and/ or Compensation Cess on our product “Keer Kokil” i.e.’Tobacco pre-mixed with lime’?

Answer– The product intended to be manufactured by the applicant and supplied with brand name ‘Keer Kokil’ is ‘unmanufactured tobacco’ and is classifiable under CTH 2401 20 90 – “others”. The product attracts GST @28% (i.e. 14%CGST+ 14%SGST) and Compensation Cess as mentioned at SI. No. 5 of the Notification No. 1/2017-Compensation Cess, dated 28-6-2017.