Hp India Sales Private Limited vs. N/A

(AAR (Authority For Advance Ruling), Maharashtra)

PROCEEDINGS

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

The present application has been filed under section 97 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter referred to as "the CGST Act and MGST Act"] by HP India Sales Private Limited, the applicant, seeking an advance ruling in respect of the following questions:

i. Classification of ElectroInk supplied along with consumables under GST; and

ii. Determination of time and value of supply of ElectroInk with consumables under the indigo press Contract.

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the MGST Act. Further to the earlier, henceforth for the purposes of this Advance Ruling, a reference to such a similar provision under the CGST Act / MGST Act would be mentioned as being under the "GST Act".

02. FACTS AND CONTENTION - AS PER THE APPLICANT

The submissions, as reproduced verbatim, could be seen thus -

STATEMENT OF RELEVANT FACTS HAVING A BEARING ON THE OUESTION(S) ON WHICH ADVANCE RULING IS REQUIRED.

1. We, HP India Sales Private Limited (hereinafter referred to as "the Applicant" or "We"), being taxable person registered under Section 22 of the Maharashtra State Goods and Services Tax Act, 2017 (referred as "MSGST Act") read with Rule 24 of the Maharashtra Goods and Services tax Rules, 2017 (referred as "MSGST Rules"), having GSTIN 27AAACC9862F1ZI, are engaged inter alia in providing printing supplies to be used in HP's Indigo press machines supplied to customers.

2. The HP Indigo digital printing press (hereinafter referred as HP Indigo) is a printing press uniquely designed for ensuring best quality prints in the industry along with wide colour gamut, substrate versatility, speed, productivity and with the ability to vary every printed copy.

3. The HP Indigo machine is based on a unique digital offset colour technology specially designed to cater the printing requirements of large scale print service providers. The HP Indigo printers are significantly different from other office and industrial use printers due to the specialized liquid ink (hereinafter referred as ElectroInk) being used in its print process.

4. Additionally, ancillaries comprising of oil, binary ink developer, bib, blanket, print imaging plate and other machine products (hereinafter collectively referred as "consumables") are also consumed in the Indigo press machines in the course of effecting prints.

5. A write up on HP Indigo presses is enclosed as Annexure 1 - Background document on HP Indigo printing devices providing a details of the HP Indigo press technology, its characteristics and consumption.

6. In this regard, the ElectroInk along with the consumables are directly imported by the Applicant from its overseas suppliers at the customs port situated in Mumbai where from the said goods are cleared on payment of applicable customs duties including IGST. The goods are stored at the Applicant's warehouse in Maharashtra.

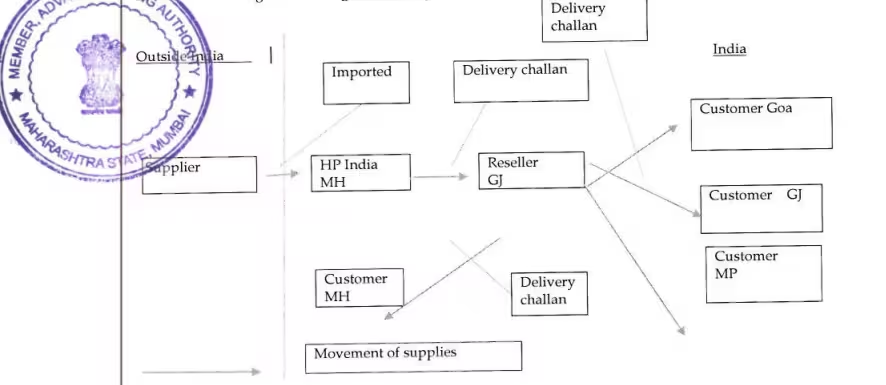

7. Further, the Applicant has contracted with a taxable person registered under GST to be its authorized reseller and distributor of such goods to various customers across India.

8. The terms of contract between the Applicant and the authorized reseller stipulates the conditions, prices, discount, mode of receiving orders, billing and payment terms in relation to supply of ElectroInk with consumables. Importantly, the contract stipulates that the supplies shall be the property of the Applicant till such time the supplies are utilized in the presses by the customer for effecting prints.

9. Further, the ElectroInk along with the consumables are moved by the Applicant to the authorised reseller locations in the States of Tamil Nadu, Gujarat and Punjab under a delivery challan along with the necessary road permit, where applicable.

10. Pursuant to the same, such goods are transported by the authorized reseller to the respective customer locations as segregated geographically across India.

The arrangement is diagrammatically explained below:

12. The Applicant has contracted with authorized resellers for making supplies of ElectroInk with consumables to be used in HP Indigo presses by the customers of HP Indigo presses on a back to back basis.

13. The agreement between the Applicant and the resellers is enclosed as Annexure 2 - HP Indigo Supplier Reseller Agreement, detailing the contractual obligations and other terms of agreement.

14. The resellers also have entered into agreements with the end customers for onward sales of such printing supplies. Sample agreement between the reseller and the end customer is enclosed as Annexure 3.

15. The billing for such arrangement shall be based on "per click basis" calculated on a monthly basis depending on the series of Indigo press machine pertaining to which the goods are supplied, number of clicks and the type of print performed.

16. To illustrate, assuming a customer uses the printer to take 100 prints in a month and each print costs ₹ 10/-, then the customer shall be billed ₹ 1,000 for the Electolnk along with the consumables used for the month.

17. Accordingly, when the running statement of accounts are collated for the respective end customers, the Applicant raises a consolidated invoice for the click charges on the reseller. Sample copy of the invoice raised by the Applicant on the reseller is enclosed as Annexure 4.

18. Also the reseller raises an invoice on each of the end customers based on the contractual arrangement between the reseller and the end customer. Sample copy of the invoice raised by the reseller on the end customer is enclosed as Annexure 5.

QUESTION ON WHICH ADVANCE RULING IS SOUGHT

19. In light of the above facts disclosed, the Applicant wishes to seek clarification on the following matters from the Authority for Advance Ruling established in the State of Maharashtra under the MSGST Act:

I. Classification of ElectroInk supplied along with consumables under GST, and

II. Determination of time and value of supply of ElectroInk with consumables under the indigo press contract

STATEMENT CONTAINING APPLICANT'S INTERPRETATION OF LAW AND/OR FACTS, AS THE CASE MAY BE, IN RESPECT OF OUESTION(S) ON WHICH ADVANCE RULING IS REQUIRED.

I. Classification of Electro Ink supplied along with consumables under GST

Supply of Electolnk along with consumables by the Applicant to the Reseller is a composite supply being supply consisting of supply of goods or services which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, where Ink is the principal supply. The ensuing paragraphs lay down the Applicant's contentions in this regard with relevant provisions from the Act, facts of the case and documentary submissions:

20. With respect to the matter put forth before the Authority for Advance Ruling in determination of the classification of Electolnk supplied along with consumables under GST, the Applicant makes the following submissions:

i. Section 2(30) of the MSGST Act provides that the term "composite supply" means:

"a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply".

ii. Further, Section 8 of the MSGST Act provides that the nature of a composite supply shall be treated as a supply of the principal supply contained therein.

iii. In this regard, Section 2(90) of the MSGST Act defines principal supply as "the supply of goods or services which constitutes predominant element of a composite supply and to which any other supply forming part of that composite supply is ancillary"

iv. Accordingly, the nature of the predominant element supplied in a composite supply shall be deemed as the nature of the entire value of supply and levying the rate of GST as applicable on the principal supply.

v. Drawing inference from the above legal provisions, a bundled supply of goods shall constitute a composite supply under the GST Act where the same is satisfying the following 4 tests:

- Such supply involves two or more taxable supplies of goods or services or both or any combination thereof;

- The supply of such goods or services is naturally bundled;

- The goods or services are supplied in conjunction with each other in the ordinary course of business; and

- One of such supply is the principal supply.

vi. In this regard, we wish to highlight the following relevant extracts from the HP Indigo Supplier Reseller Agreement (enclosed as Annexure 2) indicating compliance with each of the above conditions laid down for classifying a supply as a composite supply:

- Such supply involves two or more taxable supplies of goods or services or both or any combination thereof,

Point 17 of Section A - Definitions and appendices at page 2,

17. "Supplies" means Imaging Products and Operator Maintenance Parts required for the operation of the Indigo Press(es)".

Point 6 of Section A - Definitions and appendices at page 2

"6. Imaging Products" mean ElectroInk®, Photo Imaging plates, binary ink developer (BIDs), printing blankets, recycled agent, imaging agent and imaging oil.

Accordingly, the supplies involved in HP Indigo press arrangement comprises of supply of two or more taxable goods being made thereof. Further, the term used in the definition, "or any combination thereof indicates that any combination of supply of two or more goods as a bundle satisfies the requirement for being classified as a composite supply.

- The supply of such goods is naturally bundled

Point 1 of Section C-SUPPLIES at page 3

"3. The Indigo Presses require consistently superior quality Supplies which include Imaging Products, accessories and Operator Maintenance Parts.

Additionally, the document briefing on the Indigo Press Supply Technology as enclosed herewith as Annexure 1 details the printing cycle at page 2 which provides for the manner in which each product is interlinked with the other and required to ensure best quality prints.

We also wish to submit that in order to qualify as naturally bundled, the goods in the course of normality and as general expectation laid by the customer, should be supplied together.

As is evident from the printing cycle detailed in Annexure 1, ElectroInk and consumables are required to be consumed as a combination in order to complete the print activity. Shortage or absence of a single product in the required quantity shall not yield the expected output.

We also wish to bring to your attention Point 3 of Section C-SUPPLIES at page 3 of the ''HP Indigo Supplier Reseller Agreement'

"3. Purchase of Supplies by Reseller shall be subject to either the Tier or A-La-Carte programs set forth in Sections G and H below, and their respective terms and conditions. Reseller may elect to purchase Supplies for the different Indigo Press Product Lines under different programs, provided that Reseller shall purchase all of the Supplies required by it for each Indigo Press Product Line under the same Supplies purchase program."

Point "a" of Section G (1) - TIER PROGRAM FOR PURCHASE OF SUPPLIES BY RESELLER at page 4

a. "Click" means a chargeable unit for a Single Color Separation transferred onto substrate, except in the case of textured effect printing, where it is the action of texturing by applying pressure between the substrate and the mold. A Click unit may vary depending on the press model.

The Indigo press machine requires all the Supplies do be present in the device and collectively consumed. The invoicing for such supplies is also done on a per click basis, referring to the charges for a combined use of the ElectroInk and all the other consumables supplied. Therefore, the Electolnk along with the consumables are naturally bundled.

-The goods or services are supplied in conjunction with each other in the ordinary course of business

Point 1 of Section B - Appointment at page 3

"1. HP appoints Reseller as an authorized, non-exclusive Reseller for the purchase and resale of Supplies subject to the terms and conditions of this Agreement. HP reserves the right to sell Supplies to all HP end-user customers and resellers."

Point 3 of Section C-SUPPLIES at page 3

"3. Purchase of Supplies by Reseller shall be subject to either the Tier or A-La-Carte programs set forth in Sections G and H below, and their respective terms and conditions. Reseller may elect to purchase Supplies for the different Indigo Press Product Lines under different programs, provided that Reseller shall purchase all of the Supplies required by it for each Indigo Press Product Line under the same Supplies purchase program."

Point "a" of Section G (4) - TIER PROGRAM FOR PURCHASE OF SUPPLIES BY RESELLER at page 4

a. "Click" means a chargeable unit for a Single Color Separation transferred onto substrate, except in the case of textured effect printing, where it is the action of texturing by applying pressure between the substrate and the mold. A Click unit may vary depending on the press model.

Therefore, drawing reference from the above extracts of the contract, the Indigo press supplies are conisidered as being supplied in conjunction to each other based on the following facts:

- The Supplies are received by the authorised reseller from the Applicant as a

- bundle and are as-is supplied to the end customer;

- Further, the bundled supply of goods is made at the same point of time and is not split over different time periods;

- The billing for such supplies by the Applicant to the authorised reseller and by the authorised reseller to the end customer is also done on a consolidated basis for the entire bundled value of goods consumed and not on per category of goods supplied basis.

Further, the test of supplies being made in the ordinary course of business is satisfied depending on the frequency of the transaction in which the goods are supplied as a bundle. In this regard, re-iterating the above facts, the Indigo press machines require all the Supplies mentioned herein to be supplied in order to effectively produce a print. Such supplies are required to be consumed together in order to produce the desired output.

Therefore, the test of such goods being supplied in the conjunction to each other in the ordinary course of business also stands satisfied.

- One of such supply is the principal supply

The principal supply involved in a bundled supply of goods is the element which is most predominant in a composite supply and other supplies forming part of the bundle are only ancillary thereof.

In this regard, the Applicant wishes to submit that the ElectroInk supplied under the above arrangement is the predominant element contained in the bundled supply of goods made to authorised reseller. This can be inferred by the fact that the intention of the customer is to receive quality prints from the Indigo press which cannot be supplied without the "printing ink" being loaded therein. Additionally, other goods supplied in this regard are mere ancillary products to the ElectroInk in order to support the printing of the final image onto the paper.

The Applicant also submits that the HP indigo digital offset colour technology guarantees the best quality prints in the industry. Further, the liquid ink supplied in this regard is unique to indigo presses to ensure wide and accurate images matching the media. Accordingly, the printing ink supplied herein is the predominant element to ensure execution of entire supply contract by the Applicant

Additionally, every product supplied herein has a separate lifespan independent of each other. Accordingly, it can be inferred that consumables are necessary only to provide support function to the activity of printing and ensuring image processing is smoother and faster. Also, the mode of billing in relation to such supplies is based on the number of dicks generated during a specific period, which primarily requires printing ink to be loaded into the press machines.

The Applicant also wishes to submit the consumption pattern of Electolnk along with the consumables supplied to authorised reseller for your record as under. The same is also the pattern in which the undermentioned goods are consumed by end customers:

| SI. No. |

Nature of product |

HSN |

Consumption (%) |

| 1. |

Printing Ink (ElectroInk) |

32151190 |

41% |

| 2. |

Blanket |

59111000 |

16% |

| 3. |

PIP - Photo imaging plate |

59119090/ 84439100 |

13% |

| 4. |

OMP -Other machine products (miscellaneous) |

Multiple |

10% |

| 5. |

BID - Binary ink developer |

84439100 |

10% |

| 6. |

OIL |

27101980 |

7% |

| 7. |

Blanket Web |

59111000 |

2% |

| 8. |

Other Consumables |

Multiple |

1% |

Therefore, based on the above facts and submissions made herein, the Applicant submits before the Authority for Advance Ruling that the supply of Electolnk along with consumables should be classified as composite supply under GST and taxed at the rate applicable on supply of printing ink, being the principal supply therein.

II. Determination of time and value of ElectroInk supplied along with consumables under the Indigo press contract

21. With regards the determination of time and value of ElectroInk supplied along with consumables under GST, the Applicant makes the following submissions:

i. Considering the facts disclosed above in relation to ElectroInk supplied with consumables under GST, the Applicant understands that such goods qualify within the definition of "continuous supply of goods" as prescribed under Section 2(32) of the MSGST Act and reproduced hereunder:

" supply of goods which is provided, or agreed to be provided, continuously or on recurrent basis, under a contract, whether or not by means of a wire, cable, pipeline or other conduit, and for which the supplier invoices the recipient on a regular or periodic basis and includes supply of such goods as the Government may, subject to such conditions, as it may, by notification, specify".

ii. The Applicant supplies the ElectroInk and consumables in a recurrent manner to the reseller, when the end customer prints an image using the supplies. We wish to highlight Point 3 of Section G at page 5 in this regard:

"3. Supplies shall remain the property of HP until utilized in the Press(es). HP retains a security interest in all Supplies until HP receives payment for the same. In addition, upon first request by HP, Reseller will take all steps necessary to register a security interest or lien in favor of HP in the Supplies. Reseller acquires the ''Supplies for its Customers' own use only, and may not sell or otherwise transfer such Supplies to any other third party. Reseller shall further take reasonable efforts to advise its Customers in writing of HP's title to the Supplies as detailed in this Section, require that its Customers use the Supplies provided under the Tier Programme for their own use only and refrain from selling or otherwise transferring such Supplies to any other third party. However, in case of any non-compliance on the part of the Customer with regard to the above-mentioned the same shall be solely to the account of the Customer. If this Agreement or a relevant purchase order is cancelled or terminated, HP will require Reseller to inventory the Supplies and HP shall bill Reseller for Supplies on hand at the Site and not returned to HP within the time specified by HP..."

iii. The above clause suggests that the goods delivered by the Applicant to the Customer through the Reseller shall remain the property of the Applicant and shall be passed on to the Customer through the Reseller only upon invoicing for the same and receiving payment. Therefore the supply of goods is being made on a recurrent basis based on the invoicing by the Applicant.

iv. Since such supplies made by the Applicant are on a continuous basis being in accordance with the terms of the contract entered thereunder and requiring the Applicant to raise an invoice on a periodic basis (as per the number of clicks made in a month), such supply of ElectroInk along with the consumables shall be a "continuous supply of goods" under GST.

v. Accordingly, drawing reference to the time of supply provisions as prescribed under Section 12 of the MSGST Act, the time of supply shall be earlier of the following dates:

-

Date of issue of invoice by the supplier of goods or the last date on which such supplier is required to issue the invoice in accordance with Section 31(1) of the MSGST Act; or

-

Date of receipt of payment by the supplier in respect of such supplies.

vi. Further, Section 31 (4) of the MSGST Act provides that in case of continuous supply of goods, the supplier of such goods shall be required to issue a tax invoice before or at the time of raising successive statement of accounts or receipt of successive payments, as applicable in this regard.

vii. Drawing reference to the following extract from the HP Indigo Supplier Reseller Agreement (attached as Annexure-2), successive statement of account shall be raised within 15 days from the end of each calendar month with respect to supplies made in the preceding month. A sample copy of the successive statement of account is enclosed as Annexure 4.

Point 5 of Section G - at page number 5

"5 " Within 15 days from the end of each calendar month HP shall issue an invoice to Reseller for the supplies utilised under the Tier Program in the preceding month"

viii. Therefore, the Applicant understands that "supply" under GST law is not effected at the time of removal of goods from its registered location in Mumbai, but when the goods are used by the customer and correspondingly a statement of accounts is raised based on the number of clicks made by the customer in the preceding month.

ix. In this regard, the Applicant understands that the time of supply involved in respect of supply of ElectroInk with consumables to authorised reseller shall be based on the invoice raised basis the statement of accounts covering the number of clicks made by the customer.

22. We shall be glad to furnish such additional information and relevant documents as the Authority may require for passing its decision where the application is admitted.

Prayer

A. In view of the above factual and legal position, it is most humbly prayed that this Hon'ble Authority may clarify that:

i. Supply of printing supplies ink to be used in an Indigo press is a Composite supply, wherein the printing ink is the principal supply; and

ii. The time of supply of printing supplies is when the invoice is raised in respect to such supplies consumed in the process of generating prints by customer.

Background document on HP Indigo Printing devices

Introduction

The HP Indigo range of digital printing presses is based on Digital Offset Colour technology and process, offering a wide range of print based services to customers.

This document describes the HP Indigo Digital Offset Colour printing process and its unique features. Further, it details the principle characteristics of its predominant component consumed in the printing process, the HP Indigo's liquid ink - ElectroInk technology along with its uses.

Brief on Digital Offset Colour Technology

The HP Indigo process is fully digital from image creation to printing. The printed image is created directly from digital data, avoiding the use of any "analogue" intermediate media. Further, due to its fully digital process, every image can be a new one, enabling information to be varied as required.

A notable difference between conventional offset and HP Indigo digital offset printing technology is that HP Indigo's ink-ElectroInk, transfers from the blanket to the substrate with virtually no ink splitting that characterizes conventional offset printing systems. This enables the creation and transfer of a different image each printing cycle.

Further HP Indigo technology enables digital printing in full colour. The use of "on the fly colour switching" configuration enables HP Indigo presses print multiple colours for each single pass of the substrate through the press, The HP Indigo digital press transfers with each rotation of the press cylinders, on the single set of blanket and imaging plate, not only a different image but also a different ink.

In summary, HP Indigo's liquid ink - ElectroInk forms a core component of the HP Indigo Digital Offset Colour process.

HP Indigo's ElectroInk

All HP Indigo digital presses use ElectroInk, HP Indigo's unique liquid ink. ElectroInk contains electrically charged ink particles, dispersed in liquid. Similar to Digital Electrophotography, ElectroInk enables digital printing based on the application of strictly controlled electrical fields to move charged colour particles. This control enables accurate 'placement of the printing material. The ElectroInk enables the use of very small particle size, down to 1-2 microns. These small particles dispersed in the liquid carrier allow for higher resolution, uniform gloss, sharp image edges, and very thin image layers.

The thin image layer closely follows the surface topography of the paper. This gives a highly uniform finish, complementing the paper and resulting in a similar texture both on the image and on the non-image areas. The HP Indigo ElectroInk is available in an increasing range of colours.

ElectroInk is supplied in a concentrated form that is loaded into the press in cartridges in a "clean hands" operation. Inside the press it is fed into ink supply tanks, diluted with oil and combined with a charging control fluid, to form a fluid mixture of carrier liquid and colourant particles ready for printing. The mixing is done under accurate automated control, resulting in a stable ink with nearly constant physical traits, leading to consistent prints. Furthermore, ElectroInk incorporates pigments which are the same as offset; this supports both the price and the availability of the final ink product.

The Printing Cycle.

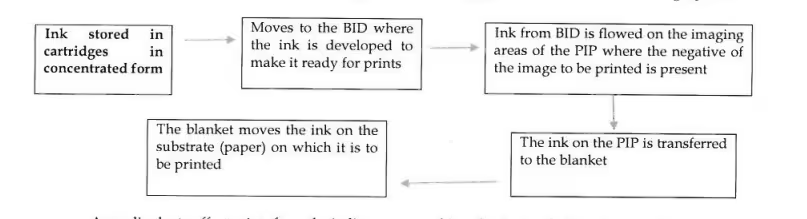

The HP Indigo printing engine performs the following operations sequentially :

1. Electrostatic charging of the electrophotographic Photo Imaging Plate (PIP) which is mounted on the imaging cylinder;

2. Exposure of the PIP by a scanned array of laser diodes. These lasers are controlled by the raster image processor which converts instructions from a digital file into "power" instructions for the lasers;

3. Image development performed by the Binary Ink Developer (BID) units;

4. Discharging the PIP in p-reparation for transfer;

5. Transfer of the inked image to the blanket cylinder;

6. Heating of the inked image carried by the blanket forming the final image in form of a thin tacky film;

7. Complete transfer of the final image film to the substrate held by the impression cylinder; and

8. Removal of any residual ink and electrical charge form the PIP cooling of the PIP after engagement with the hot blanket.

The entire printing cycle is designed in a manner to maximize productivity and versatility. The cycle revolves around the use and consumption of the HP Indigo's liquid ink - ElectroInk, to yield the best in the class prints. The ancillaries to the printing process consisting of products such as PIP, BID, blanket and other machining products complement and support the transfer of ink into the paper in the most optimum manner to produce quality prints.

Summary

The HP Indigo presses due to their unique technology lead to productivity, by its ability to change data, colour, and substrate at will and with no time penalty. The HP Indigo ElectroInk process is inherently faster than any DEP process by nearly an order of magnitude. The printing presses are robust and designed for 24/7 production. Critical process elements are automatically controlled by the press and reduce operator intervention.

While competing with offset printing for print quality, the digital technology offers important benefits, both economic and environmental. The HP Indigo's liquid ElectroInk uses oil to bind and distribute its pigment-carrying particles, which are about 1 micron in size, and consequently capable of creating much finer detail and thinner printed films. HP Indigo digital printing process offers a unique combination of quality, versatility, and productivity unmatched by any other existing digital technology.

****Additional submission in relation to the nature of supply made to our reseller for supplies to customers

HP India Sales Private Limited (hereinafter referred to as the "Applicant" or "Company" or "we") refer to the clarification sought in relation to the consumables supplied by the Company to Redington India Limited (reseller), to be further supplied to customers for the purpose of effecting print in the indigo press machines.

In this regard and further to the personal hearing attended on April 25, 2018, we wish to make the following additional submissions:

1. Latest copy of agreement entered between Applicant and Reseller for supply of indigo press consumables

The Applicant wishes to submit that the terms of reseller agreement (copy provided as Annexure 2 to the Statement of facts submitted along with the application for advance ruling) entered on July 19, 2013 stands valid as on date. Further, any rate revision required to the supply program are agreed mutually between the Applicant and the reseller from time-to-time. However, in this regard no amendment is made to the master agreement dated July 19, 2013.

2. Break-up of revenue earned by Applicant during the last financial year between tier and a-Ia-carte program

The Applicant wishes to submit break-up of revenue earned during the F.Y. 2017-18 for supply of consumables used in Indigo press machines, between tier (click) and a-la-carte model as under:

| Sl. No. |

Supply model |

Revenue earned (in mns.) |

% to total revenue |

| 1 |

Tier (click) Model |

1,179.35 |

99.14 |

| 2 |

A-la-carte |

10.28 |

0.86 |

|

|

Total |

1,189.63 |

100 |

While all customers in India who have purchased Indigo machines are required to enter into click model, there are certain customers who would like to purchase inks for enhanced print. These specialized inks are being billed seperately by HP and not as part of the click model which is being signed under tier (click) model.

Accordingly, as submitted the Indigo press consumables are predominantly supplied under the tier (click) model.

Further, the revenue share indicates that a minimal percentage of total revenue is contributed by the a-la-carte program.

The A-la-carte model consists of supply of specialized inks, attracting 12% GST. As there is no supply of other consumables like PIP, Blankets etc in such case, the question of composite vs mixed supply does not arise in case of supply of specialized inks.

3. Tax position adopted by similar suppliers in the industry

We understand that suppliers of other industrial printing machines also adopt the same click based billing model in relation to consumables supplied for undertaking print activity. However, the consumables supplied in relation to such printers vary differently from consumables supplied for effecting print from HP indigo machines.

Further, the Applicant wishes to submit that globally where the local regulations permit, the indigo press consumables supplied by HP are charged on a per click basis, based on the actual consumption of goods.

4. Nature of supply under the tier program

In addition to the submissions made in the statement of facts filed along with the application for advance ruling, the Applicant wishes to submit that the tier program of the indigo consumables supply model is a composite supply made under the GST Act. The supply satisfies all of the following conditions prescribed in this regard:

- Supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof:

The HP indigo machine consistently requires superior quality of imaging products for effecting a print. The imaging products as defined in SI. No. 6 of Section A of the HP reseller agreement (submitted as Annexure 2 to the statement of facts) consists primarily of ElectroInk, along with ancillaries such as photo imaging plate, binary ink developer, printing blankets, imaging oil.

Further, a single tax invoice is raised by the Applicant for all the goods supplied herein, based on the consumption report generated on a monthly basis (submitted as Annexure 4 to the statement of facts).

Accordingly, HP indigo tier program satisfies the requirement of supply being made by a taxable person to a recipient consisting of two or more taxable supply of goods.

- The supply of such goods is naturally bundled:

The term naturally bundled is not defined in the GST Act. However, in common parlance the term can be understood based on the intention of the parties to the contract. The intention plays a significant role in ascertaining whether such supplies qualify as being naturally bundled.

In this regard, the Applicant wishes to draw reference to the relevant extracts of the reseller agreement (submitted as Annexure 2 to the statement of facts) to prove the intention of the parties of the contract:

Section 1, Page 1

"Authorization to resell Indigo supplies........." - Redington shall not be the consumer of such goods and only an authorized representative of HP for making the supplies;

Section A, Point 79, Page 2

"Tier Program means the supplies purchase program defined in Section G below, which is subject to this Agreement, and whereby the amount the Reseller shall be charged for Supplies shall be a function of the number of print impressions counted, as defined in Section D below"

Section G, Point 3, Page 5

'Supplies shall remain the property of HP until utilized in the Press(es)."

Section A, Point 11, Page 2

"Maximum Usage Per Impression" means the maximum usage of Imaging Products (ElectroInk and other ancillaries) and/or Operator Maintenance Parts per impressions as published by HO from time to time at www.hp.com/go/supplies-usage."

Inference:

The above extracts imply that Redington shall be invoiced only where there is any print taken by the customer, in other words on a "per click basis". Till the time the consumables remain un-used, the same shall not be invoiced for, or in other words, the same may be treated as a ''supply without consideration" since the consideration is determinable only on the happening of a future event - being click. Further, the reseller shall be charged for all the supplies only on consumption, thereby indicating that the reseller also acknowledges the fact that all these goods will be consumed together. Where there was a separate point in time for consumption of each of these goods, the supplies agreement would have provided for different payment terms for the respective products.

Further, globally also the Applicant recognizes the supplies being made on a per impression basis (per click basis) which is the essence of the transaction. The quantity of consumables that should be used for an impression is pre-calculated by the Applicant and is constant for all Indigo presses of a particular series. As the print occurs, a particular quantity of each consumable is used and accordingly billed.

Additionally, drawing reference to the supplies agreement between the reseller and the customer, the intent of the parties prove that all the indigo press consumables shall be supplied and consumed together and invoiced based on such consumption. Highlighting, relevant extracts of the agreement as under:

Section 2 page 3

"The unused supplies under the terms of this agreement which are in the possession of the customer shall at all time remain the exclusive property of Redington"

Section 4 page 3

Invoice for the supplies will be raised based on the reading from the Print impression Counter noted..."

Accordingly, the intention of the applicant, reseller and customer is to supply and receive the consumables used in an indigo press machine as a single supply.

- Supplied in conjunction with each other in the ordinani course of business:

The term "in conjunction" in common parlance refers to "being used together". In this regard the Applicant wishes to submit the following the following chart explaining the flow of indigo press consumables in effecting a print:

Accordingly, to effect prints from the indigo press machine, the device shall require supplies of printing ink, binary ink developer, photo imaging plate, blanket and other ancillaries. The supplies are required to be used in conjunction with each other" to produce the desired output.

Further, such supplies are made by HP in its ordinary course of business. The same is evident from the revenue details provided earlier. HP markets and supplies such consumables as a bundle. Additionally, every consumer desirous of receiving such supplies shall be billed for all the goods, irrespective of the actual consumption of the respective products. The goods are supplied to the end customer generally once a month or for some customers twice a month. The goods are not capable of being used if the same any one of them is not used as required.

- One of such supply is the principal supply

As evident from the chart explaining the flow of consumables, the printing ink (referred as ElectroInk) is the most predominant supply in the bundle. The ink flows through the entire process to effectively generate a print and produce the desired output. It is the most essential and highest consumed product (in terms of volume) in a printing cycle, evident from the fact that 41% of the consumption in terms of value is of ink (refer Annexure -1). The ink determines the quality and resolution of the image being printed, in the manner required by the customer.

- Illustration provided in the definition of composite supply under Section 2(30) of the CCST Act (similar provision in the Maharashtra State GST Act):

Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply.

Accordingly, the concept of composite supply shall need to be analyzed only where there is a bundled supply of two or more goods or services.

Highlighting the above mentioned illustration as provided in the law, a taxable person may be capable of supplying goods only whereas the packing and transportation services are arranged for by the recipient. However, where such services are provided as a bundle along with the supply of goods, the supply shall be a composite supply, principal supply being the supply of goods. The fact that such goods or services may be capable of being supplied independently cannot be considered as a factor for determining the nature of bundled supply.

In HP's case, the items covered under the click program are not capable of being sold independently as all the items like Ink, Blanket, PIP etc. are essential for printing purpose and has no separate use for customer.

- Additional conditions for a composite supply

Drawing reference to the clarification issued by the Central Board of Indirect Taxes and Customs ("CBIC") on the concept of Composite supply via a flyer, whether a supply qualifies as a composite supply would depend upon the normal or frequent practices followed in the area of business to which services relate. Such normal and frequent practices adopted in a business can be ascertained from several indicators some of which are listed below:

a. The perception of the customer-

As explained above, the perception of the customer is to receive (consume) all such goods together in order to obtain the desired output. The same can further understood by the fact that the customer agrees to pay the consideration on click basis, i.e. the point in time when the supply of all the consumable actually occurs. Where these consumables were not naturally bundled, the consumer would have selected different payment terms for each of the product at the respective point of their consumption. These goods are provided as a package to all the customers of the Indigo press machine under the Tier program, evidencing the fact that such consumables are used together (to effect a print) and therefore the payment is also made for the clicks made and not the consumables held in the device,

b. majority of service providers in a particular area of business provide similar bundle of services.

Further to the submission made earlier, the HP indigo consumables are provided as a bundled and charged on click basis globally. Also other industrial printers competitors also supply consumables as a bundle and charge on click basis.

c. the nature of the various services in a bundle of services will also help in determining whether the services are bundled in the ordinary course of business. If the nature of services is such that one of the services is the main service and the other services combined with such service are in the nature of incidental or ancillary services which help in better enjoyment of a main service.

The HP Electrolnk is the principal supply as for the customers and suppliers the ElectroInk is the main component of the supply as is evident from the consumption. The ancillary supplies only help in transferring the ink from the cartridge to the paper.

d. There is a single price or the customer pays the same amount, no matter how much package they actually receive or use

The invoicing is done on a "per click basis" for all the supplies. Every customer is charged a single price for all the goods, irrespective of the fact that in achieving the final output of a print, there is different proportion of ElectroInk and other ancillaries consumed. Therefore, where a single price is charged in relation to bundled supply of goods or services, the said supply cannot be deemed as a "mixed supply" under GST. The definition of composite supply neither restricts nor lays down any condition on the manner of pricing to be adopted for such classification. Accordingly, bundled supplies having a single price can be classified as a composite supply, where other conditions are satisfied in this regard.

In this regard, the Applicant wishes to highlight the illustration provided in the flier issued by the CBIC wherein, activity of supply of hotel accommodation service along with supply of breakfast for a single price is considered as a composite supply.

e. The elements are normally advertised as a package and the different elements are not available separately

All customers enrolled under the tier program are supplied consumables as a bundle. Further, HP's agreement with Redington as indicated earlier provides that such goods shall be used only for commercial printing purpose ensure that these goods are not sold, and cannot be used individually.

f. The different elements are integral to one overall supply. If one or more is removed, the nature of the supply would be affected.

The desired print output can only be achieved where all these goods are used as a bundle. They are integral to ensure the final output by the customer is in the manner required.

Therefore, considering the above facts and explanations, the HP indigo consumables supplied under the tier program satisfies all the conditions of a composite supply.

03. CONTENTION - AS PER THE CONCERNED OFFICER-

The submission of Departments as reproduced verbatim, could be seen thus-

1) The applicant submitted that the supply of ink along with oil, plates, consumables, blanket, bib etc. to the reseller is composite supply consisting of supply of goods or services which are naturally bundled and supply with conjunction with each other in ordinary course of business, where ink is the principle supply.

2) To constitute the supply as a composite supply following 4 tests are required to be satisfy:

-

Such supply involves two or more taxable supplies of goods or services or both or any combination thereof.

-

The supply of such goods or services is naturally bundled.

-

The goods or services are supplied in conjunction with each other in ordinary course of business and one of such supplies is the principle supply.

3) The applicant has not provided order copy of customer and reseller to ascertain that the ink and other consumables are supplied together. Hence whether two or more taxable supplies are involved cannot be commented.

4) The applicant has submitted the consumption pattern of Electoink along with consumables supplied to authorised reseller. From this consumption pattern it is noticed that if the requisite quantity of ink and other consumables are supplied to the printing machine for first time, the other consumables are not required to be supplied compulsorily. Assuming that the ink is required to be replace after thousand clicks, the blanket or photo imaging plate is required to be replace after approximately 3000 and 3300 clicks respectively. This clears that the goods are not mandatorily required to supply in conjunction.

5) Naturally bundled" implies that the recipient of the supply has no option to decide whether he wishes to receive the various elements of the supply provided as a bundled supply. Whereas, if such an option to decide is possible, then the supply cannot be said to be "naturally bundled" and such a supply will not be treated as a "composite supply". From the number of clicks the user can very well order the quantity of ink and other consumables separately. The way the supplies are bundled must be examined. Mere conjoint supply of two or more goods or services does not constitute composite supply. In the instant case though the ink and other consumables are supplied conjointly, this supply can be made separately and there is no natural binding effect. The method of billing, assignment of separate prices etc. may not be relevant. The applicant has devised the billing on the basis of clicks does not alter the character of supply.

The classic example of Composite supply is supply of M seal. In which Resin and Hardener are supplied together and in conjunction to each other. The use of each goods is so naturally bundled that separate item could not be sold M-seal is a two-part epoxy system. The light coloured clay is Epoxy resin filled with silica powder and the dark colored clay is Polyamide Hardener filled with Silica powder. When these two are mixed together a chemical reaction called curing of Epoxy happens and the system hardens. Considering the above aspects it is respectfully submitted that the claim of applicant that it is a naturally bundled supply composite supply in which supply of ink is a principle supply should not be allowed. These goods are required to be taxed as per separate HSN provided by the applicant.

B) Departments submission regarding Time and Supply.

Submission on the issue of Continuous supply.-

In ordinary course of business the supplies are made available to actual user through the network of Distributor and Reseller. The transaction between importer / manufacturer and its distributor is recognized as independent and separate transaction. Further there are separate transactions of such distributor to reseller and reseller to actual user.

There is demand and supply of goods and services on regular basis. Most of times the supply is completed when the goods are removed from one entity/ location to another and tax liability has been discharged by the entity as per provisions. In this case there are two transactions, first between applicant and reseller and second between Reseller and actual user.

In GST law transfer of ownership in goods is not mandatory while effecting supply, e.g. In the case of Branch transfer, the goods are owned by a specific company, still the transfer between its two branches is treated as supply. The applicant has invited attention that the ownership / secured interest lies with applicant till the payment as per clicks basis is received and therefore supply takes place only after use of ink and consumables. Hence though the payment is received after use by customer, the supply by applicant to its reseller is completed. When the goods are removed from applicants warehouse. The transaction between applicants and its reseller is ordinary business transactions like between Importer and Reseller. The mode of billing will not alter the nature of supply. The purchase order and delivery challans are called from applicant. In absence of this document the very nature of supply between reseller and customer cannot be commented at this stage.

04. HEARING

The case was taken up for Preliminary hearing on dt. 04.04.2018 with respect to admission or rejection of present application when Sh. K. Sivrajan, C.A. along with Sh. Kunal Wadhwa, C.A., appeared and made contentions as per their ARA for admission of application. The Jurisdictional Officer, Sh. P. R. Nilewad, Deputy Commissioner of State Tax (E-618), Large Tax Unit - 2, Mumbai appeared and stated that they have made written submissions which may be considered.

The application was admitted and called for final hearing on 25.04.2018, Sh. K. Sivrajan, C.A. along with Sh. Kunal Wadhwa, C.A. appeared and made contentions as per their ARA application. Jurisdictional Officer, P. R. Nilewad, Deputy Commissioner of State Tax (E-618), Large Tax Unit - 2, Mumbai appeared and also made contentions as per his written submissions. The contention of both the parties were heard for this issue and matter was closed for order.

05. OBSERVATIONS

We have gone through the written and oral submission made by the applicant and jurisdictional officer in connection to the questions asked in Advance Ruling. As per the documentary evidences and written submissions produced on the record, it is observed that-

5.1 Applicant M/s. H.P. India Sales Pvt. Ltd. is a registered person and is providing to its authorised reseller and distributor printing supplies which mainly consist of ElectroInk (i.e. ink), ancillaries such oil, binary ink developer, bib blanket, print imaging plate and other machine products used in HP's Indigo press machine. Thus applicant is providing Electro Ink with consumables to its authorised reseller and distributors. The business model adopted by the applicant is of two type: Tier and A-La -Carte. As per of the terms of contract with the authorised reseller, applicant is making supplies of ElectroInk with consumables to be used in HP Indigo Presses by the customers of HP Indigo Presses on back to back basis. Further resellers also have entered into agreements with the end customers for outward sales of such printing Supplies. In this model the billing is based on 'Per Click basis' calculated on a monthly basis taking into account the number of clicks and the type of print performed.

Applicant has explained the billing method with an illustration as below:

Assuming a customer uses the printer to take 100 prints in a month and each print costs of ₹ 10/-, then the customer shall be billed ₹ 1000/- for the ElectroInk along with the consumables used for the month. Accordingly applicant raises monthly consolidated invoice for the click charges on the reseller and in turn the reseller raises an invoice on each of the end customers.

We find that on the above factual matrix we have been called upon to decide two questions namely classification of Elecrolnk supplied along with consumables supplied under GST and the time and value of supply of ElectroInk with consumables.

5.2. we shall now deal with each question separately as below :

Question 1- classification of ElectroInk supplied along with consumables under GST .

On perusal of statement containing applicant's interpretation of law and facts with respect to this question, it is revealed that applicant has laid much emphasis to impress upon us that the impugned transaction is 'Composite Supply' and supply of Electro Ink is the principle supply.

Under the GST Law the taxable event is supply of goods or services or both. The tax is payable on every supply unless otherwise exempted. The law notifies individual supply of goods and services with applicable rate of tax. Where supply consists individually of goods and services there is no confusion or problem. But with the advent of different models of business certain supplies consist of combination of goods or services or both. It is therefore required to be ascertained to apply the correct rate of tax. In order to give solution for such type of transaction GST identifies two types of supply namely Composite Supply and Mixed Supply which thereby imparts certainty in respect of tax treatment for such supplies.

5.3 It is therefore necessary first to understand the expression composite supply as defined in clause (30) of Section 2 of the GST Act.

[2 (30) ] "composite supply" means a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both, or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply;

Illustration: Where goods are packed and transported with insurance, the supply of goods, packing materials, transport and insurance is a composite supply and supply of goods is a principal supply.

Thus the essential ingredients that constitute Composite Supply are -

(i) the supply consists of two or more taxable supplies of goods or services or both or any combination thereof,

(ii) such supplies are naturally bundled

(iii) supplied in conjunction with each other and

(iv) such supplied are in the ordinary course of business, one of which is a principal supply.

Now let us examine whether the applicant satisfies the ingredient of composite supply.

In the light of facts discussed above, there is no doubt to conclude that the impugned transaction consists of two or more taxable supplies of goods and also the goods are supplied in conjunction. Thus the ingredients of the definition of composite supply at (i) and (iii) above are satisfied.

The next ingredient of the composite supply for our consideration is whether these supplies are naturally bundled. The concept of bundled service has been explained in the Education Guide issued by CBEC in the year 2012 even though it is with respect to erstwhile services, it is equally useful in case of supply of goods also:

'Bundled service' means a bundle of provision of various services wherein an element of provision of one service is combined with an element or elements of provision of any Other service or services. An example of bundled service 'would be air transport services provided by airlines wherein an element of transportation of passenger by air is combined with an element of provision of catering service on board. Each service involves differential treatment as a manner of determination of value of two services for the purpose of charging service tax is different. The ride is - 'If various elements of a bundled service are naturally bundled in the ordinary course of business, it shall be treated as provision of a single service which gives such bundle its essential character'.

In the present case we find that supply of ElectroInk with consumables by the applicant to the distributor/reseller constitute bundled supply which involves more than two taxable supplies of goods .

The next issue for our consideration in order to constitute impugned supply as composite supply is to find whether the supplies are naturally bundled .The word 'Naturally', is not defined under the ACT, we therefore refer to dictionary to under the meaning . The dictionary meaning is as below,

As per Merriam Webster

1 : by nature : by natural character or ability

- naturally timid

2 : according to the usual course of things : as might be expected

3 a : without artificial aid

4: with truth to nature : realistically

Without special intervention; in a natural manner.

As per English Oxford dictionary

In a normal manner; without exaggeration or effort.

'act naturally'

a naturally bright pupil'

The dictionary meaning of the word 'Naturally' with reference to supply implies that it should be in the natural manner or is happing or existing as a part of nature and not made or done by the people. In the present case and per the terms of the HP's agreement with reseller / customer which provides that "Reseller may elect to purchase Supplies for the different Indigo Press Product Lines under different programs, provided that Reseller shall purchase all of the Supplies required by it for each Indigo Press Product Line under the same Supplies purchase program." This clause of the purchase agreement assume significance of the factual background that there exists a notable difference between the conventional offset and HP Indigo Digital offset Printing Technology. The terms of the contract as mentioned above clearly indicate that the recipient of the supply has no option to select individual supply but to accept it as bundled supply. Thus the transaction of supply of ElectroInk with consumables cannot be considered as Naturally bundled Supply but a compulsory supply. Thus the transaction before us cannot be said to be naturally bundled supply.

5.4 Now we have to decide another aspect of composite supply i.e. whether the goods are supplied in the ordinary course of business.

In this regard useful reference can be made to GST Flyers issued by CBEC in which certain tests are laid down which are listed below to ascertain supply of goods or services or both in the ordinary course of business.

1) The perception of the consumer or the service receiver

2) Majority of service providers in a particular area of business provide similar bundle of services

3) The nature of the various services in a bundle of services.

4) There is a single price or the customer pays the same amount, no matter how much of the package they actually receive or use.

5) The elements are normally advertised as a package

6) The different elements are not available separately

7) The different elements are integral to one over all supply if one or more is removed, the nature of supply would be affected.

We may now apply these tests to the facts of the case to determine whether a particular supply constitute a composite supply under the GST though on the basis of this alone it would not be conclusive whether the supply is composite supply until it fulfils other requirements as well.

We find that the Applicant submits that 'Imaging Products' such as ElectroInk, imaging plates, binary ink developer, blanket etc. are supplied to reseller who elect to purchase supplies for the different Indigo Press Product Lines under different programs provided that the reseller shall purchase all of the supplies. All such supplies are required to be consumed together in order to produce desired output. He therefore submits that the goods are supplied in conjunction to each other in the ordinary course of business. However we find that this submission and argument is contrary to their own admission that every product supplied herein has a separate lifespan independent of each other.

The applicant has submitted the consumption pattern of Electro ink along with consumables supplied to authorised reseller. From this consumption pattern it is noticed that if the requisite quantity of ink and other consumables are supplied to the printing machine for first time, the other consumables are not required to be supplied compulsorily. Assuming that the ink is required to be replaced after thousand clicks, the blanket or photo imaging plate is required to be replaced after approximately 3000 and 3300 clicks respectively. Thus we find that the goods are mandatorily supplied in conjunction. Thus the consumption of supplies has its own pattern. Each of such supplies can be supplied separately as they are not dependent on each other and the identification of the principal supply therefore cannot be drawn from and among the supplies which gives one of the essential character of bundle supplies to the suppliers in the present case. As the impugned transaction fails to satisfy the tests mentioned above, the supply of Electro Ink along with consumable cannot be considered as a composite supply as defined under section 2(30) of the GST Act.

5.5 The next question as a corollary of the above finding is to decide whether the transaction is a mixed supply as defined under section 2 (74) of the GST Act which read as:

Section 2(74) "mixed supply" means two or more individual supplies of goods or services, or any combination thereof, made in conjunction with each other by a taxable person for a single price where such supply does not constitute a composite supply.

Illustration: A supply of a package consisting of canned foods, sweets, chocolates, cakes, dry fruits, aerated drinks and fruit juices when supplied for a single price is a mixed supply. Each of these items can be supplied separately and is not dependent on any other. It shall not be a mixed supply if these items are supplied separately;

There is no dispute that applicant's supplies consist of two or more than two supplies. It is also not in dispute that the supplies are made in conjunction with each other and made for a single price. We have already observed that each of the supplies can be supplied separately as they are not dependent on each other and one supply of goods does not occasion the supply of other goods. As the transaction put before us satisfies all the ingredient of 'mixed supply' we conclude the transaction would come and fall under 'mixed supply' as defined in clause 74 of section 2 of the GST Act.

Question 2: Determination of Time and Value of supply of ElectroInk with consumables under the Indigo press contract.

5.6. Before we decide the time of supply we shall first take into consideration the business model adopted by the applicant. Applicant has contracted with authorized reseller for making supplies of Electro Ink with consumable to be used in HP Indigo Presses by the customers of HP Presses on a back to back basis. The resellers also have entered into agreements with the end customers for onward sales of such printing supplies. The billing for such arrangement shall be based on 'per click basis' calculated on a monthly basis depending the Indigo machine press, number of clicks and type of print performed. The supplies as per the terms of the contract mentioned in applicant's submission suggest that the goods delivered by the applicant to the customer through the reseller remain the property of the applicant and it is passed on to the customer through reseller only upon invoicing and receiving of payment. Further applicant submits that supplies made by them are on continuous basis in accordance with the terms of the contract entered and the applicant is required to raise invoice on periodic basis We find that the supply of goods in the present case fulfil the basic tenets of 'continuous supply' and therefore we find from the above deliberation that the impugned supply is 'continuous supply of goods 'as defined in clause 32 of section 2 of the GST Act.

5.7 Time and Value of Supply -

The next issue for our consideration raised by the applicant is the time and value of supply of Electro Ink with consumables under the Indigo Press Contract. As per the provision of GST ACT, the liability to pay tax on goods arise at the time of supply as determined in accordance with the provisions of section 12 of the Act. As per section 12 the time of supply shall be:

Section 12(2) - Time of supply of goods.

(1) The liability to pay tax on goods shall arise at the time of supply, as determined in accordance with the provisions of this section.

(2) The time supply of goods shall be the earlier of the following dates, namely :-

(a) the date of issue of invoice by the supplier or the last date on which he is required, under sub-section (1) of section 31, to issue the invoice with respect to the supply; or

(b) the date on which the supplier receives the payment with respect to the supply:

Provided that where the supplier of taxable goods receives an amount up to one thousand rupees in excess of the amount indicated in the tax invoice, the time of supply to the extent of such excess amount shall, at the option of the said supplier, be the date of issue of invoice in respect of such excess amount.

Explanation 1.-For the purposes of clauses (a) and (b), "supply" shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment.

Explanation 2.-For the purposes of clause (b)," the date on which the supplier receives the payment" shall be the date on which the payment is entered in his books of account or the date on which the payment is credited to his bank account, whichever is earlier.

(3) ...............................

(4) ...............................

(5) Where it is not possible to determine the time of supply under the provisions of sub-section (2) or sub-section (3) or sub-section (4), the time of supply shall-

(a) in a case where a periodical return has to be filed, be the date on which such return is to be filed; or

(b) in any other case, be the date on which the tax is paid.

(6) The time of supply to the extent it relates to an addition in the value of supply by way of interest, late fee or penalty for delayed payment of any consideration shall be the date on which the supplier receives such addition in value.

As we have already concluded that the impugned supply is a continuous supply of goods as defined in the clause 32 of section 2 of GST ACT, and therefore the provisions pertaining to time of supply in case of "continuous supply of goods "are relevant.

Now we turn to time of supply in case of 'continuous supply of goods' as per section 12 of the GST Act. As per subsection 2 of section 12 the time of supply of goods shall be the earlier of the following dates, namely-

i) The date of issue of invoice by the supplier or the date on which he is required under sub section (1) of section 31, to issue the invoice

ii) The date on which the supplier received the payment with respect to the supply.

As discussed here in above the goods are supplied by the applicant on regular or periodic basis where successive statements of account are raised within 15 days from the end of each calendar month with respect to supplies made in the preceding month. Section 31 (4) is the relevant section where provisions are made for issue of invoice in case of continuous supply of goods. The section is reproduced herein below:

Section 31 (4) 'In case of continuous supply of goods, where successive statement of account or payments are made, the invoice shall be issued before or at the time of each statement is issued or as the case may be, such payments are received.'

Accordingly we find that applicant has to raise invoice on or before 15th day from the end of each calendar month with respect to supplies made in the preceding month. Thus the time of supply in the present case will be the earliest date between the date of invoice or the date of payments with respect to impugned supply as per the provisions of section 12(2) of the GST Act.

5.8. Value of Supply-

The next issue pertains to values of supply of ElectroInk with consumables under the Indigo Press Contract, the details of such supplies are as below:-

| SI. No. |

Nature of product |

HSN |

Consumption (%) |

| 1. |

Printing Ink (ElectroInk) |

32151190 |

41% |

| 2. |

Blanket |

59111000 |

16% |

| 3. |

PIP - Photo imaging plate |

59119090/ 84439100 |

13% |

| 4. |

OMP -Other machine products (miscellaneous) |

Multiple |

10% |

| 5. |

BID - Binary ink developer |

84439100 |

10% |

| 6. |

OIL |

27101980 |

7% |

| 7. |

Blanket Web |

59111000 |

2% |

| 8. |

Other Consumables |

Multiple |

1% |

As discussed above we have found that the impugned transaction is a mixed supply with nature of supply as continuous supply of goods for single price and therefore the Value of supply of goods as per section 15 of the GST Act shall be the transaction value as reflected in the invoice issue by the applicant.

06. In view of the deliberations held hereinabove, we pass the order as under:

ORDER

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

NO. GST-ARA-38/2017-18/B-45 Mumbai, dt.08/06/2018

For reasons as discussed in the body of the order, the question is answered thus -

Question :-1. Classification of Electro Ink supplied along with consumables under GST

Answer - The supply of Electro Ink supplied along with consumable is a mixed supply as defined u/s section 2 (74) of the GST Act and is also a continuous supply of goods as defined u/s 2 (32) of the GST Act.

Question 2. Determination of time and value of supply of Electro Ink with consumables under the indigo press contract

Answer: - The time of supply of Electro Ink supplied along with consumables under the indigo press contract would be the earliest date between the date of invoice or the date of receipt of payment. As regards the value of supply of Electro Ink supplied with consumables under the Indigo Press Contract would be the transactions value as reflected in the invoice issued u/s 31(4) of the GST Act.