Versa Drives Private Limited vs. N/A

(AAR (Authority For Advance Ruling), Tamil Nadu)

VERSA DRIVES PRIVATE LIMITED, 38B, VADAKKU THOTTAM PART, IDIKARAI, COIMBATORE-641022 (hereinafter called the Applicant) are registered under GST with GSTIN 33AADCV2259E1ZK. The applicant has sought Advance Ruling on the following questions:

1. Tax rate for HSN code 85 04 40 90

2. HSN code for solar pump controller

The Applicant has submitted the copy of application in Form GST ARA - 01 and also submitted a copy of Challan evidencing payment of application fees of ₹ 5,000/- each under sub-rule (1) of Rule 104 of CGST rules 2017 and SGST Rules 2017.

2.1 The applicant has stated that they have developed a Solar Pump Controller for Solar Submersible Pump Application and have classified the controller under HSN code 85044090 and assesses @18% GST. They have stated that when they submitted the quote to the customer, the customer is of the view that it should be charged at 5%. The applicant is seeking clarification on what is the rate for HSN 85 04 40 90 to enable them to start billing the products.

2.2 The applicant has stated that the solar powered devices tax rate is 5%, but there is no clarity on what kind of a solar powered devices are at 5% tax and in some places that raises concern to the buyer. There is no clarity in GST rate index where 8 digit HSN codes are not there for most of the products. They have stated in general solar powered devices tax rate is 5% but there is no clarity on what kind of a solar powered devices are at 5%. They have further stated that tax rate index has to be with 8-digit HSN code and more information should be there so that these issues will not be faced by a designer and manufacturer like them.

3.1 Due to the prevailing PANDEMIC situation and in order not to delay the proceedings, the applicant was addressed through the Email Address mentioned in the application to seek their willingness to participate in a virtual Personal Hearing in Digital media. The applicant consented and the hearing was held on 03.02.2022. The Authorised Representative (AR), Ms. K. Maheswari, Vice President Operations appeared for the hearing virtually and reiterated the submissions. The AR stated that the pumps are used for agricultural purposes which will run only on solar power and not on electricity. The controllers are standalones, independent of the pump/solar panel. These are being designed and manufactured by them. The Member asked whether this product can be used in conjunction with DC mode/battery. The AR replied that this will be operated only on solar power and operating via DC mode is not feasible. When asked by the Member to submit invoices issued and PO's obtained the AR replied that they have not issued any invoices so far and before obtaining PO they wanted to clarify on the HSN code and tax rate applicable. They were asked to submit the following documents:-

(i) Detailed write up on the product, components, its functions along with photographs;

(ii) contention of their buyers for claiming the rate at 5%;

(iii) method of manufacture, whether indigenous or assembled;

(iv) if the pumps are only supplier or any other allied services rendered;

(v) any certification obtained about the product being solar energy based.

3.2 The applicant vide their email dated 05.02.2022 and letter dated 16.02.2022, submitted the following details/ documents:

- write up on the product, components, its functions along with photographs:

The product uses around 300 components, wherever they source its only in component form. Components used are electronic components like Microcontroller, IGHT Modules, Chip Resistors, Capacitors and Semiconductor components, these components were purchased from Electronic Component Traders / Distributors / Dealers across India. Some of the components were not dealt by them those are ONLY imported only component level. Bare PCBs were manufactured in India. These components were assembled, tested and manufactured as product in house. Multiple PCBs were connected through connectors and wires which are bought in India. Heatsink is manufactured for their need in India (They have made a customized tool for the same). The plastic enclosure was done through injection moulding in Coimbatore itself. The product was designed (Hardware and firmware) inhouse by their R&D engineers and the firmware was written by their R&D engineers. They have stated that their product is an indigenous product designed and manufactured by them. As this is an electronic product, India doesn't have the facility to manufacture those tiny powerful Integrated circuits which needs to be imported as components / bought through the authorised distributors I dealers / traders in India. They had enclosed Leaflet, user manual and photographs which are as follows:

The applicant has also submitted the user guide of Versa Solar Pump Drive, which includes the product overview, installation & wiring, Startup & operation, Diagnostic & troubleshooting details.

- Contention of their buyers for claiming the rate as 5% - when the customers asked for a 5% GST it was not clear, that was why the applicant has sought for clarification. They wanted to know clearly the Tax rate for HSN Code 85 04 40 90.

- Method of manufacture, whether indigenous or assembled - The product is indigenous by design and manufacturing.

- If the pumps are only supplied or any allied services rendered They are not supplying the pumps - they supply only the electronic controller which takes the power from Solar Panel and drives the motor of the submersible pumps. They only manufacture electronic controller. These controllers will be bought by submersible pump manufactures, solar panel manufacturers & Dealers and System Integrators. System Integrators will integrate Solar Panel, Solar Pump Controller and Submersible pumps.

- Any certification obtained about the product being solar energy based: There is no certification obtained, they are not aware on where to get this one. But they can self-declare.

- Their product cannot work with grid supply from Electricity board (the voltage from Electricity board is AC but the voltage from Solar panel is DC). If someone connects the battery it won't work simply, the battery should deliver large amount of current. Just like, how in home the UPS cannot run a mixer grinder / Wet Grinder / Iron Box / electric Water heater.

3.3 Further, vide their e-mail dated 21st March 2022, they have stated that in common man's language, the product they have developed will be connected between solar submersible pump which is submerged into the borewell and the Solar panels.; that this controller will provide the maximum output based on the solar profile.

4.1 The Centre Jurisdictional authority who has administrative control over the applicant has submitted that as on date there are no pending proceedings on the issue raised by the applicant. They have furnished the following comments:

- It is observed from the HSN classification that solar pump controller can be classified under HSN 85437092 under the description 'ELECTRICAL MACHINES AND APPARATUS HAVING INDIVIDUAL FUNCTIONS, NOT SPECIFIED OR INCLUDED ELSEWHERE IN THIS CHAPTER OTHER MACHINES AND APPARATUS OTHER EQUIPMENT GADGETS BASED ON SOLAR ENERGY" since solar pump controller is a equipment having individual function based on solar energy.

- Irrespective of the 8 digit classification under chapter 84 or 85, solar power based devices falling under chapter 84 or 85 is mentioned in Sl.No.234 of the fist of goods @5% GST under schedule I of Rate of GST on goods booklet given in www.cbic gst gov.in.

- hence, the tax rate for 'Solar Pump controller for solar submersible pump application 'falling under chapter 84 or 85 is 5%

5. The State Jurisdictional Authority has stated that there are no pending proceedings in the applicant's case.

6.1 We have carefully examined the statement of facts, supporting documents filed by the Applicant along with application, oral submissions made at the time of Virtual hearing, submissions made after hearing and the comments of the Jurisdictional Authority. The applicant has stated to have developed the solar pump controller which has applications in Agricultural pump sets, Domestic use, Solar Pools and Solar-powered fountains. They have sought ruling on following questions:

1. Tax rate for HSN code 85 04 40 90

2. HSN code for solar pump controller

The questions raised is on the Classification of the goods and the applicable rate of tax on such goods proposed/being supplied by the applicant. Therefore, the questions are covered under the ambit of this authority under Section 95(a)/97(2) of the CGST Act 2017 and are taken up for consideration on merits.

7.1 The applicant has sought the correct HSN Code (8 digit level) and the applicable Tax rate in respect of the Versa Vane Solar Pump Controller indigenously designed and manufactured by them using components locally sourced and in case of non-availability, after importing the same in the component level. From the submissions it is seen that

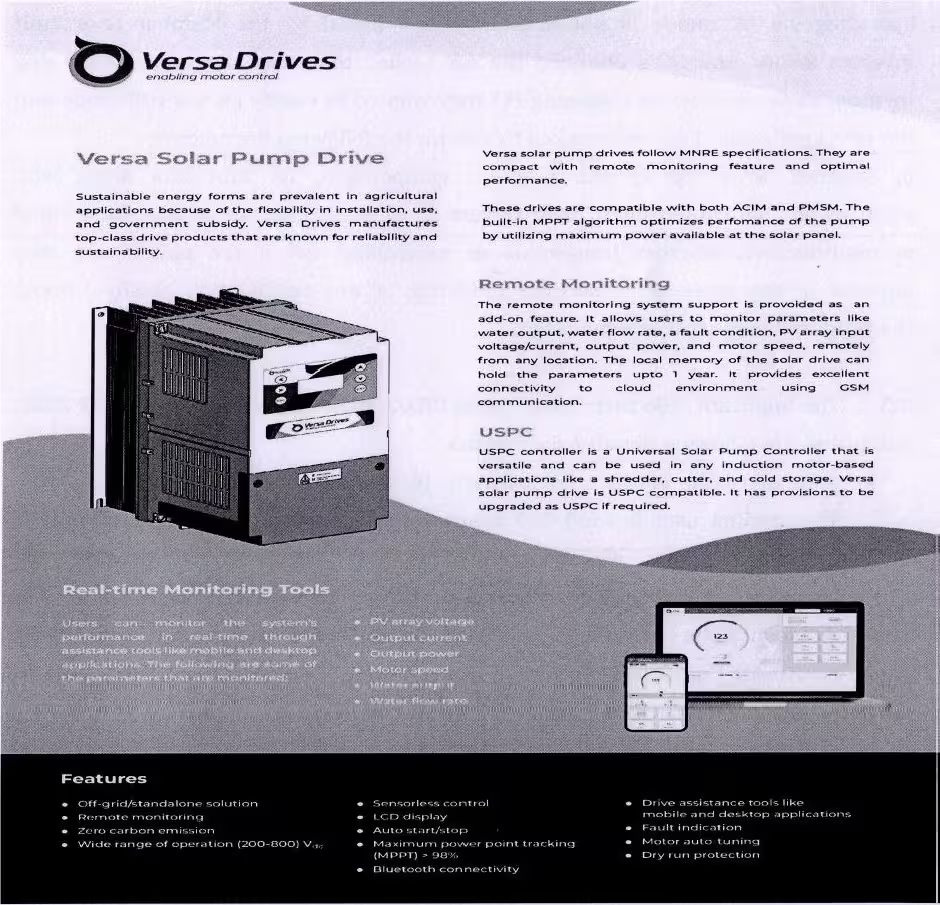

- Versa Solar Pump Drive follows MNRE specifications, and it is built using VDC800-XX-SP drives.

- They are compact controllers with remote monitoring and optimal performance.

- These drives are compatible with both AC Induction Motor (ACIM) and Permanent Magnet Synchronous Motor (PMSM). It has highly efficient Maximum Power Point Tracking (MPPT).

- Versa Vane allows users to monitor the parameters remotely, from any location, like water output, water flow rate, a fault condition, PV array input voltage/current, output power, and motor speed. The local memory of the solar drive can hold the parameters for up to 1 year. It provides excellent connectivity to the cloud environment using GSM communication.

- USPC is a Universal Solar Pump Controller that is versatile and can run any induction motor-based applications like a shredder, cutter, and cold storage. Versa Vane is USPC compatible. It has provisions to be upgraded as USPC if required.

On the Features of the product, the following are stated:

- Off-grid/ standalone solution

- Remote monitoring

- Zero carbon emission

- IP65 protection

- Wide range of operation (200-800) Vdc

- Sensor-less control

- LCD display

- Auto start/stop

- Maximum power point tracking (MPPT) is > 98%

- Bluetooth connectivity

- Drive assistance tools like mobile and desktop applications

- Fault indication

- Motor auto-tuning

- Dry run protection

- A Reverse polarity protection

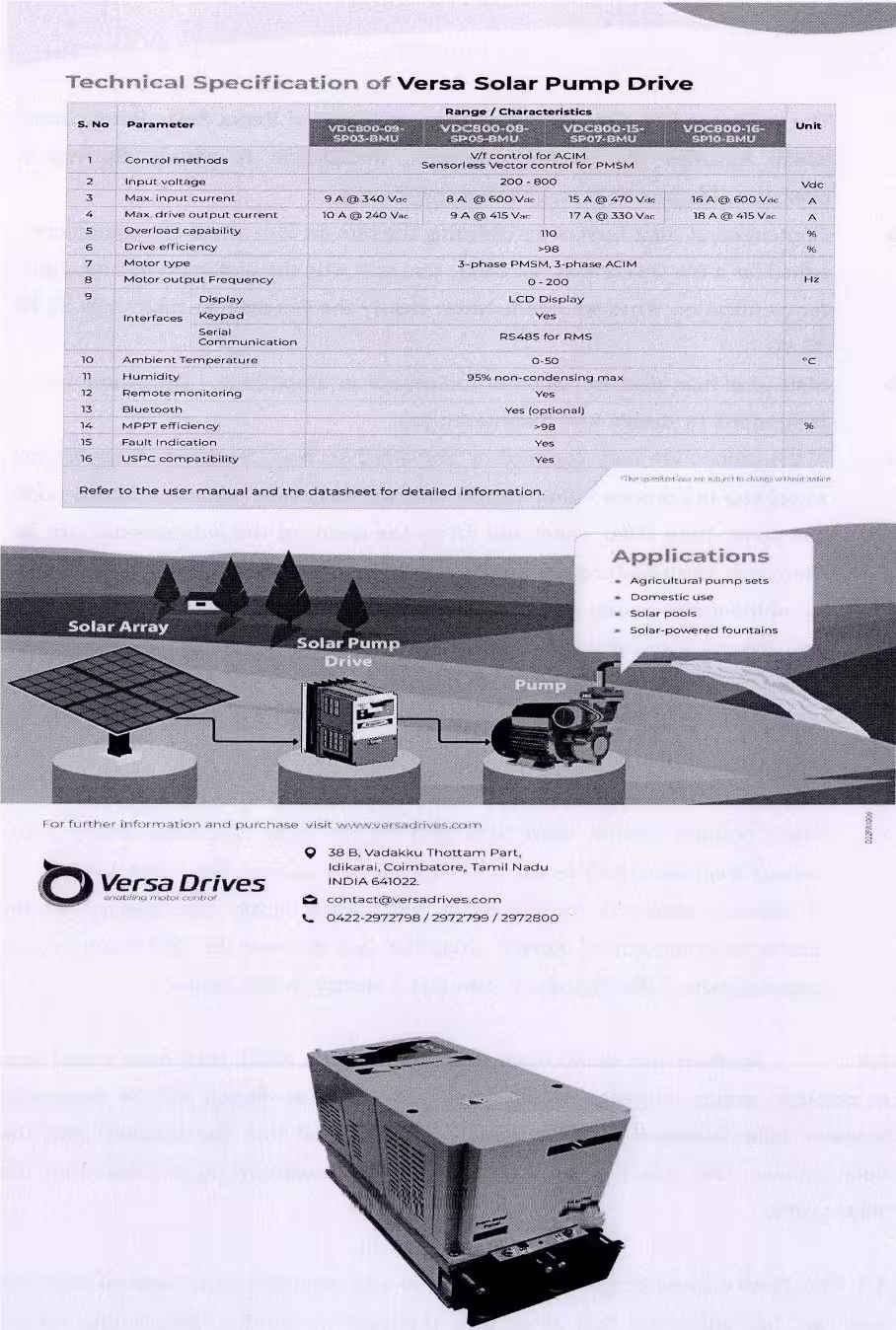

From the 'Technical Specification' furnished, it is seen that MPPT efficiency of the product is greater than 98%. From the user manual furnished for VDC 800-XX-SPYY-BMU it is seen that the drive is available in 5 models , i.e., without BMU/With B only/with M only/With U only/ with BMU and the configuration is as follows:

VDC-Versa DC Series; 800-Maximum input voltage; XX-Maximum input current; SP-Solar Pump application YY-Pump rating in HP; BMU-B-Bluetooth, M-Memory, U-UPSC.

It is further self-declared by the applicant that the input of the product being DC, the product cannot work with grid supply from Electricity Board and if a battery is connected, the product will not work as the battery should deliver large amount of current.

7.2 It is seen from the above various submissions that the product is a controller which provides the maximum output based on the solar profile. The controller takes the power from Solar Panel and drives the motor of the submersible pumps. The applicant has stated that these products are sold as 'stand-alone' products and will be bought by submersible pump manufacturers, solar panel manufacturers& dealers and System Integrators who will integrate Solar Panel, Solar pump controller and Submersible pumps. They are classifying the product under CTH 85044090.

7.3 Prima facie, the classification of the product is taken up. Under GST, as per the Explanation to Notification No. 01/2017-C.T. (Rate) dated 28.06.2017, the Customs Tariff which is based on HSN is made applicable. Therefore, the relevant entries in customs Tariff and the related Explanatory notes (HSN) are examined as under:

CHAPTER 85

Electrical machinery and equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such articles

NOTES:

2. Headings 8501 to 8504 do not apply to goods described in headings 8511. 8512. 8540. 8541 or 8542. However. metal tank mercury arc rectifiers remain classified in heading 8504.

| 8504 |

|

ELECTRICAL TRANSFORMERS, STATIC CONVERTERS (FOR EXAMPLE, RECTIFIERS) AND INDUCTORS |

| ……………… |

|

|

| 8504 40 |

- |

Static converters: |

| 8504 40 10 |

--- |

Electric inverter |

|

|

--- |

Rectifier : |

| 8504 40 21 |

---- |

Dip bridge rectifier |

| 8504 40 29 |

---- |

Other |

| 8504 40 30 |

--- |

Battery chargers |

| 8504 40 40 |

--- |

Voltage regulator and stabilizers (other than automatic) |

| 8504 40 90 |

--- |

Other |

| 8511 |

|

ELECTRICAL IGNITION OR STARTING EQUIPMENT OF A KIND USED FOR SPARK-IGNITION OR COMPRESSION-IGNITION INTERNAL COMBUSTION ENGINES FOR EXAMPLE, IGNITION MAGNETOS, MAGNETO-DYNAMOS, IGNITION COILS, SPARKING PLUGS AND GLOW PLUGS, STARTER MOTORS); GENERATORS (FOR EXAMPLE, DYNAMOS, ALTERNATORS) AND cur- OUTS OF A KIND USED LN CONJUNCTION WITH SUCH ENGINES |

| 8512 |

|

ELECTRIC-AL LIGHTING OR SIGNALLING EQUIPMENT (EXCLUDING ARTICLES OF HEADING 8539), WINDSCREEN WIPERS, DEFROSTERS AND DEMISTERS, OF A KEN'D USED FOR CYCLES OR MOTOR VEHICLES |

| 8540 |

|

THERMIONIC, COLD CATHODE OR PHOTO-CATHODE VALVES AND TUBES (FOR EXAMPLE, VACULTM OR VAPOUR OR GAS FILLED VALVES AND TUBES, MERCURY |

|

|

|

ARC RECTIFYLNG VALVES AND TUBES, CATHODE-RAY TUBES, TELEVISION CAMERA TUBES) |

| 8541 |

|

SEMICONDUCTOR DEVICES (FOR EXAMPLE, DIODES. TRANSISTORS. SEMICONDUCTOR BASED TRANSDUCERS): PHOTOSENSITIVE SEMICONDUCTOR, DEVICES, INCLUDING PHOTOVOLTAIC CELLS WHETHER OR NOT ASSEMBLED LN MODULES OR MADE UP INTO PANELS: LIGHT-EMITTING DIODES (LED). WHETHER OR NOT ASSEMBLED WITH OTHER LIGHT-EMITTING DIODES (LED); MOUNTED PIEZO-ELECTRIC CRYSTALS |

| 8542 |

|

ELECTRONIC MIGRATED CIRCUITS |

Explanatory Notes of HSN relevant to the Heading 8504 are examined as under:

(II) ELECTRICAL STATIC CONVERTERS

The apparatus of this group are used to convert electrical energy in order to adapt it for further use. They incorporate converting elements (e.g., valves) of different types. They may also incorporate various auxiliary devices (e.g., transformers, induction coils, resistors, command regulators, etc.). Their operation is based on the principle that the converting elements act alternately as conductors and non-conductors.

The fact that these apparatus often incorporate auxiliary circuits to regulate the voltage of the, emerging current does not affect their classification in this group, nor does the fact that they are sometimes referred to as voltage of current regulators.

7.4 Thus, as per Chapter Note 2 to Chapter 85, Heading 8501 to 8504 do not apply to goods described in Headings 8511, 8512, 8540, 8541 or 8542. On perusal of the Headings 8511, 8512, 8540, 8541 and 8542, it is clear that the product in hand do not fall under these Headings and the product being a Convertor, is likely covered under CTH 8504 above, more specifically under CTH 8504 40 90. It is further seen from the Explanatory notes, that the apparatus of this group are those used to convert electrical energy in order to adopt it for further use.

7.5 Applying the above to the product at hand, it is seen form the product overview that the applicant's product is designed and manufactured exclusively for pumps (ACIM/PMSM). Their product is an electronic controller connected between the solar submersible pump which is submerged into the bore well and the solar panels. It takes power from the solar panel which is a DC power and drives the ACIM/PMSM pumps. The built in Maximum power point tracking (MPPT) algorithm optimizes the performance of the pump by utilizing the maximum power from the solar panel and also regulates the voltage and current coming from the solar panel. Thus, it is evident from the above facts and the explanatory notes to CTH 8504 that the applicant's product merits classification under Chapter 85 in CTH 8504 and more specifically under CTH 8504 40 90- as Static converters(others); in as much as the Explanatory notes has specifically stated that incorporation of auxiliary circuits to regulate the voltage of the emerging current does not affect their classification in this group.

8.1 Having decided the classification of the product as falling under CTH 8504, the next issue to be decided is the applicable rate of Tax. In the case at hand, it is seen that the product solar pump convertor drive is to be placed between the solar panel and the submersible pump and the power from the solar panels are converted by this device when connected between the panels and pump; maximise the power availability to the Load, i.e., the submersible pumps. Further, the drive provides for remote monitoring support and is compatible and may be upgraded as an USPC [Universal Solar Pump Controller]. On perusal of the MNRE website[https://mnre.gov.in], the page [https://mnre.gov.in/solar/standard-specs-cost], gives the specification of the Solar Photovoltaic Water Pumping Systems in Annexure-I of Circular No. F. No. 41/3/2018-SPV Division dated 17.7.2019, wherein Para 2.8 and 2.9 states as under:

2.8 SPV Controller - Pump Controller converts the DC voltage of the SPV array into a suitable DC or AC, single or multi-phase power and may also include equipment for MPPT, remote monitoring, and protection devices.

2.9 Maximum Power Point Tracker (MPPT) - MPPT is an algorithm that is included in the pump controller used for extracting maximum available power from SPV array under a given condition. The voltage at which SPV array can produce maximum power is called 'maximum power point' voltage (or peak power voltage).

and on construction of such Pump, under Para 3.6 it is stated as follows:

3.6 SPV Controller

3.6.1 Maximum Power Point Tracker (MPPT) shall be included to optimally use the power available from the SPV array and maximize the water discharge.

3.6.2 The SPV Controller must have IP (65) protection or shall be housed in a cabinet having at least IP (65) protection.

3.6.3 Adequate protections shall be provided in the SPV Controller to protect the solar powered pump set against the following:

a) Dry running;

b) Open circuit;

c) Accidental output short circuit;

d) Under voltage;

e) Reverse polarity;

f) SPD to arrest high current surge; and

g) Lightening arrestor.

3.6.4 A good reliable DC Circuit Breaker as per IS/IEC 60947-2 suitable for switching DC power ON and OFF shall be provided in the SPV Controller.

3.6.5 All cables used shall be as per IS 694. Suitable size of cable shall be used in sufficient length for inter-connection between the SPV array to SPV Controller and the SPV Controller to solar powered pump set. Selection of the cable shall be as per IS 14536.

3.6.6 Controller shall be integrated with GSM/GPRS Gateway with Geo tagging. GSM/ GPRS Charges to be included in the Costing till the end of Warranty period of the Pump set.

In the instant case, the product has MPPT, IP(65) protection, dry run protection and such other features as stipulated in the above specifications, which shows that the product is a stand-alone device and when connected to solar panel converts the solar power into AC, optimizes the power and delivers it to the load, i.e., the submersible pump making such pump as solar power driven pump.

8.2 We have found that the product is classifiable under CTH 8504 and when such convertor draws DC power from the Solar Panels, converts it into AC, optimizes and make it available for the submersible pump along with auxiliary functions such as Remote Monitoring, etc, the SPV convertor/solar pump Drive, it is `Solar Power based device'. Thus, in cases when the Drive is used for Solar power Integration to connect the solar panels and the AC submersible pumps, these products are 'solar Power based devices'.

8.3 We find that the applicable rate was specified under SI.No. 234 of Schedule to Notification No. 01/2017-C.T.(Rate) dated 28.06.2017 from 01.07.2017 to 30.09.2021. Effective 01.10.2021, the said entry is omitted and the applicable tax rate of the product is as per Sl.No. 201A of Schedule-II of Notification No. 01/2017-C.T.(Rate) dated 28.06.2017 as amended by Notification No. 08/2021 dated 30th September 2021. The relevant entries are extracted as under:

S.No. 234 of Schedule-I of Notification no. 01/2017-C.T.(Rate) dated 28.06.2017 effective upto 30.09.2017:

| S.No. |

Chapter / Heading /Sub-heading/ Tariff item |

Description of Goods |

| (1) |

(2) |

(3) |

| 234. |

84 or 85 |

Following renewable energy devices & parts for their manufacture (a) Bio-gas plant (b) Solar power based devices (c) Solar power generating system (d) Wind mills, Wind Operated Electricity Generator (WOEG) (e) Waste to energy plants / devices (f) Solar lantern / solar lamp (g) Ocean waves/tidal waves energy devices/plants |

Sl.No. 201A of Schedule-II of Notification no. 01/2017-C.T.(Rate) dated 28.06.2017, effective from 01.10.2021:

| S. No. |

Chapter / Heading Sub-beading/ Tariff item |

Description of Goods |

| (1) |

(2) |

(3) |

| “201A |

84, 85 or 94 |

Following renewable energy devices and parts for their manufacture:- (a) Bio-gas plant: (b) Solar power based devices; (c) Solar power generator: (d) Wind mills, Wind Operated Electricity Generator (WOEG): (e) Waste to energy plants / devices: (f) Solar lantern / solar lamp; (g) Ocean waves/tidal waves energy devices/plants; (h) Photo voltaic cells, whether or not assembled in modules or made up into panels. Explanation:- If the goods specified in this entry are supplied, by a supplier, along with supplies of other goods and services, one of which being a taxable service specified in the entry at S. No. 38 of the Table mentioned in the notification No. 11/2017-Central Tax (Rate), dated 28th June, 2017 [G.S.R. 690(E)], the value of supply of goods for the purposes of this entry shall be deemed as seventy per cent. of the gross consideration charged for all such supplies, and the remaining thirty per cent. of the gross consideration charged shall be deemed as value of the said taxable service. |

9. In view of the foregoing, we rule as under:

RULING

1. The applicant's product “Versa Solar Pump Drive” being a convertor is classifiable under CTH 8504, more precisely CTH 8504 4090.

2. The applicable rate of tax on the above said product, when supplied for integration with solar panels and AC submersible pumps, as discussed at para 8 above, as effective from 01.10.2021, is CGST @ 6% as per Si. No. 201 A of Schedule II of Notification 01/2017-CT (Rate) dated 28.06.2017 as amended vide Notification No.8/2021- Central Tax (Rate) dated: 30.09.2021 and SGST @ 6% as per Sl. No 201 A of Schedule-II of Notification No. II (2)/ CTR/532(d-4) (G.O. Ms. No 62, CTR dated: 29.06.2017) as amended vide Notification G.O.Ms. No 121(TN) dated: 04.10.2021 w.e.f. 01.10.2021.