Input Tax Credit on Job Work Under GST

Input Tax Credit (ITC) on job work in GST is an essential aspect of the Goods and Services Tax (GST) system that allows businesses to claim tax credit for inputs used in the manufacturing of goods or providing services. In the GST system, businesses can claim ITC on inputs sent for job work, subject to certain conditions. The business must maintain proper documentation and ensure that the job worker returns the processed goods within the specified time frame.

Additionally, the job worker must be registered under the GST system, and the goods must be returned to the business or supplied to another taxable person. In this article, we will examine the implications of GST and input tax credit on job work. The provisions for ITC on job work are defined in Form ITC 04 GST Job Work: Section 19 of the CGST Act, 2017.

BOOK A FREE DEMO

What is Job Work under GST?

When principal manufacturers send their semi-finished products to smaller manufacturers for finishing, it is known as job work according to Section 2(68) of the CGST Act. In such a scenario, the owner of the goods is known as the Principal, and the smaller company tasked with finishing up the goods is the Job Worker.

In simpler words, job work is any treatment or processing performed on goods belonging to another registered person. The job worker must carry out the process as advised by the Principal.

For example, ‘ABC Electronics’ produces electronic devices and contracts out the assembly process to a third-party company, ‘XYZ Manufacturing’.

ABC Electronics provides all the necessary components and instructions to XYZ Manufacturing to assemble the devices.

After the assembly is complete, the finished devices are returned to ABC Electronics for final testing and quality control.

Thus, according to the CGST Rules, 2017, the Principal is ABC Electronics, while XYZ Manufacturing is the Job Worker.

ABC Electronics is a registered business that has outsourced a specific process to XYZ Manufacturing, which is responsible for carrying out the assembly of the electronic devices.

This makes XYZ Manufacturing a Job Worker, as it has taken on the job from a registered business to complete a specific process in the production of electronic devices.

Time Constraints for Returning the Processed Goods to the Owner

Within a year, beginning on the date of receipt, the Principal must receive the inputs supplied for the job work under GST. When processing capital goods, there is a three-year time limit on returning the processed goods to the owner.

When goods are not received within the time frame specified above, they are considered to have been supplied as of the effective date. The principal will pay the tax on this deemed supply. The issued challan will be regarded as an invoice for that supply.

Responsibilities of the Principal

There are specific responsibilities that the Principal needs to undertake. These are:

- As in rule 10 of the invoices under GST, the Principal issues the challan to the job worker for the goods.

- The principal needs to maintain an account of inputs and capital goods.

- The principal needs to inform the relevant official of the expected input goods and the type of processing the job worker provides.

- In cases where goods are exported to a third party directly and the job worker is not registered for GST, the principal needs to declare the premise of the job worker as an additional place of business.

Input Tax Credit on Job Work Under GST

The Principal is the owner of the capital goods and inputs sent to the Job Worker. Hence, the Principal is allowed to claim input tax credit on those capital goods and inputs. This is true in both of the following cases:

- Goods are sent to the Job Worker from the principal’s place of business

- Goods are sent to the Job Worker directly from the Principal’s supplier

Conditions for Claiming ITC on Goods Supplied for Job Work

Some of the conditions required for claiming ITC on goods supplied for Job Work under GST are as follows:

- Sending out inputs, semi-finished goods, or capital for job work:

- Products shipped from the primary location of the business

- Direct shipment of goods from the supplier’s point of supply

- Sending out products along with a challan is required.

- The Challan should contain some specific points:

- Date and number of the delivery challan

- Name, address, and GSTIN of both the sender and the recipient

- Code, product description, and quantity for HSN

- Value subject to taxation, tax rate, and tax amount (CGST, SGST, IGST, and UTGST individually)

- Place of supply and signature

- In the GSTR-1 form, the details of the challan should be displayed.

- The ITC 04 in GST must be used to claim information regarding input and capital products sent to the job worker.

Transitional Provisions for Job Work under CGST

Transitional provisions determine whether or not the goods and services being processed or not processed before or on the designated day of GST are subject to GST coverage.

- According to Section 19 of the CGST Act, 2017[1], the person providing the job worker with taxable products for further processing can claim the input tax credits for the inputs used in the job work.

- Per the additional provision to the clause, as mentioned earlier, the principal is nevertheless permitted to claim a credit for input taxes paid even if the goods are delivered directly to the job worker for additional processing.

- Due to this, the principal can claim input credit without carrying the goods to his premises.

- Timeframe for Processed Goods Returns:

- Capital items delivered to the employee must return to the principal within three years of delivery.

- The inputs given to the job worker for additional processing must be returned within a year of being sent.

Get a Free Trial – Best Accounting Software For SMEs

ITC 4 Form

ITC-04 under GST is a form that includes information on the inputs or capital items sent to and received from such a job worker. The registered principal who sends inputs or capital goods on the job must submit this form quarterly.

It must contain the information from the challans for the following:

- Items sent to a job worker;

- Items received from a job worker;

- Items sent from one job worker to another.

From 1st October 2021, ITC-04 form is required on a semi-annual or an annual basis, depending on the following criteria:

- Annual turnover greater than ₹5 crore – Semi-annually (by 25th October for April – September and 25th April for October – March)

- Annual turnover up to ₹5 crore – Annually (by 25th April)

Get a Free Demo – Best Billing and Invoicing Software

Details Required in Form ITC-04

ITC-04 requires information in 2 parts:

- Details of capital goods or inputs sent to the Job Worker

- Details of Goods received back from the Job Worker

Details of Capital Goods or Inputs Sent to the Job Worker

Various details need to be mentioned here, including GSTIN, challan number, tax amount, and other pertinent information, which can be obtained from the challans.

Details of Goods Received Back from the Job Worker

This section will contain information regarding the goods that have been returned. The goods may either be received by the Principal or directly sent to another job worker from the initial job worker’s place of business. It is mandatory to mention all the relevant details of both the original and new challans.

Get a Free Trial – Best Accounting Software For SMEs

How to File ITC-04 Form

Given below are the steps to file the ITC- 04 form:

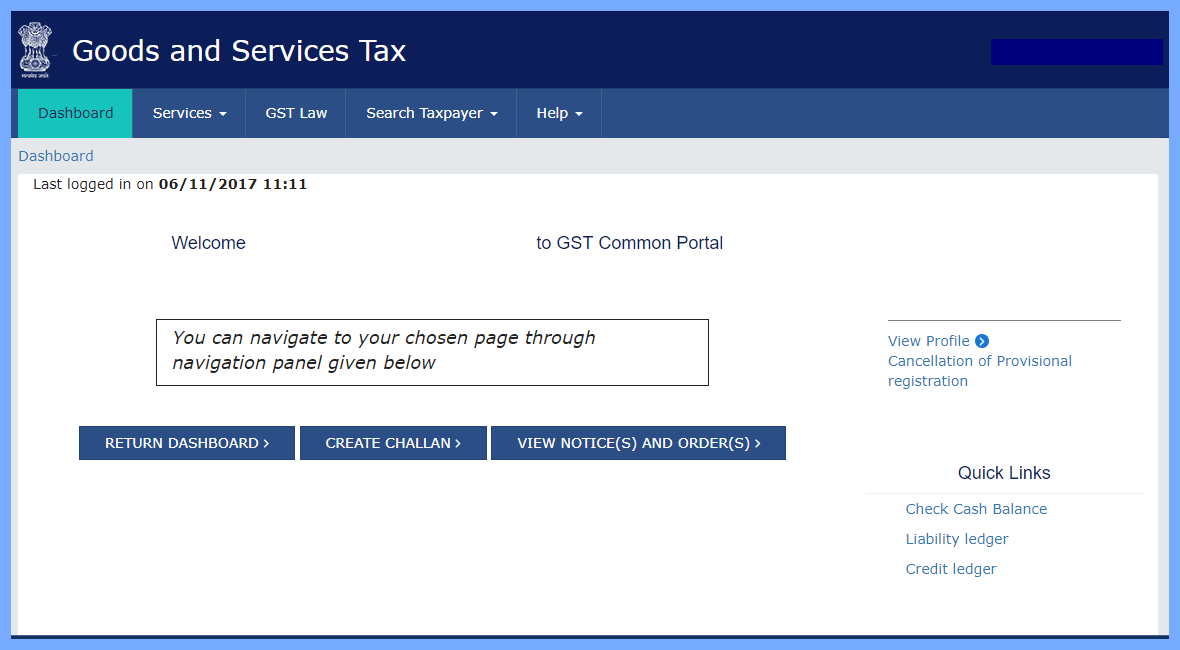

Step 1: Login to the GST Portal

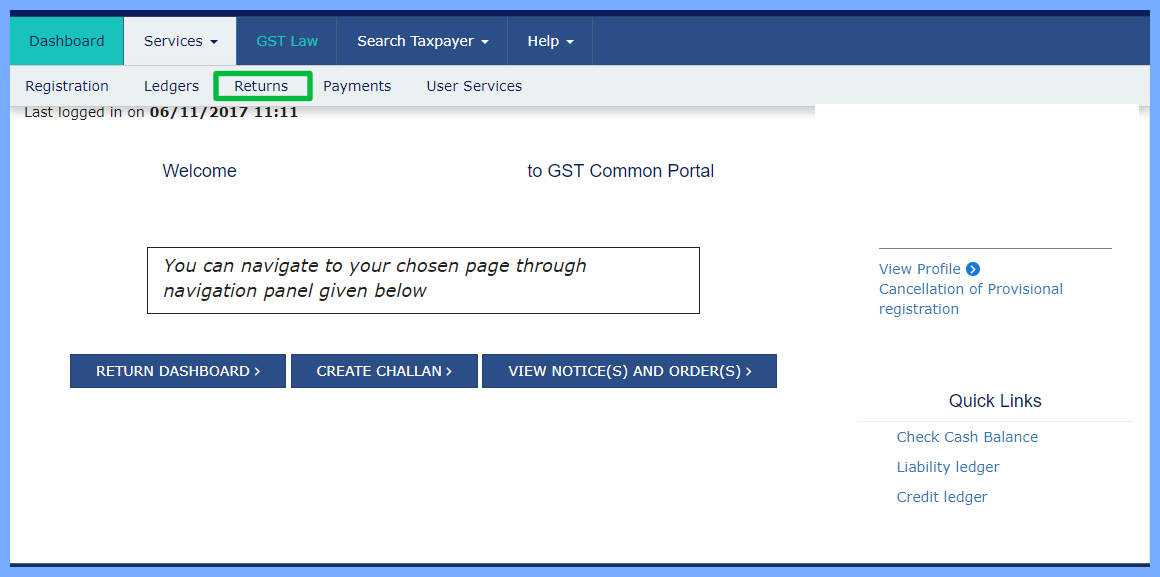

Step 2: Navigate to Services > Returns > ITC Forms

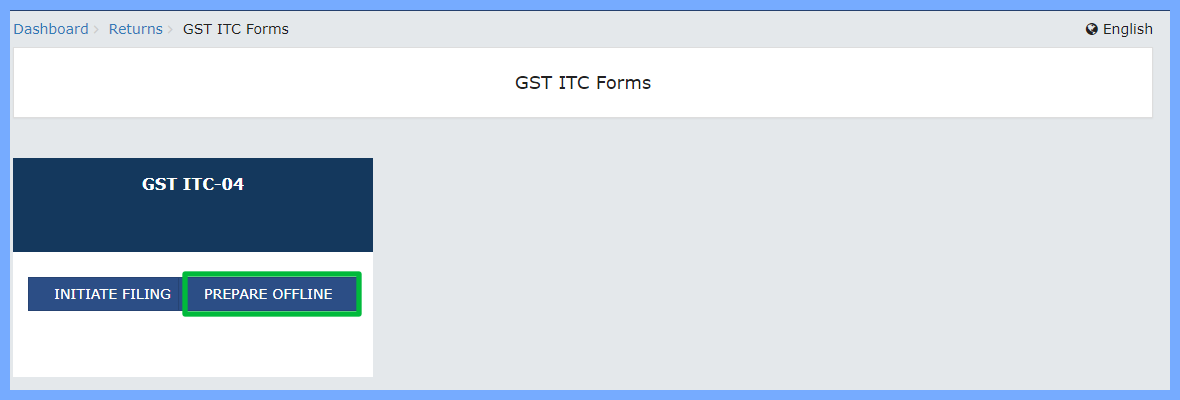

Step 3: Go to the “Prepare Offline” Section and Upload Your Invoices

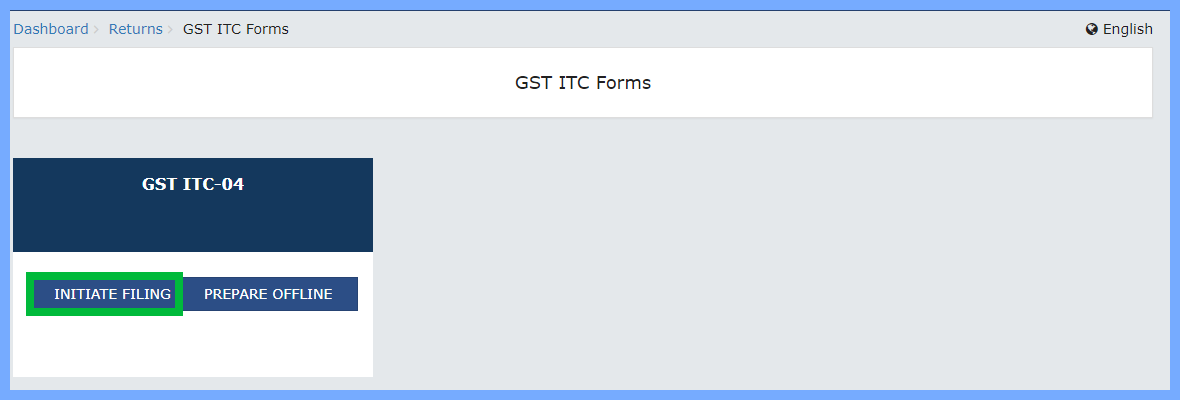

Step 4: After Uploading Invoices, Click on ‘Initiate Filing’

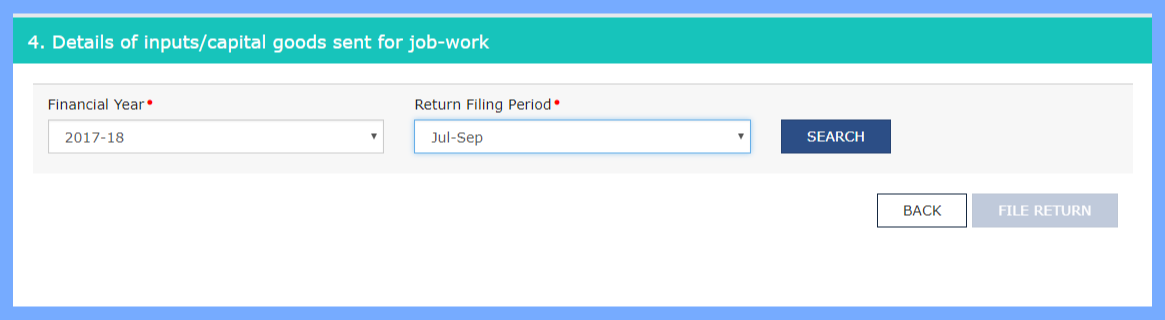

Step 5: Select the Tax Period

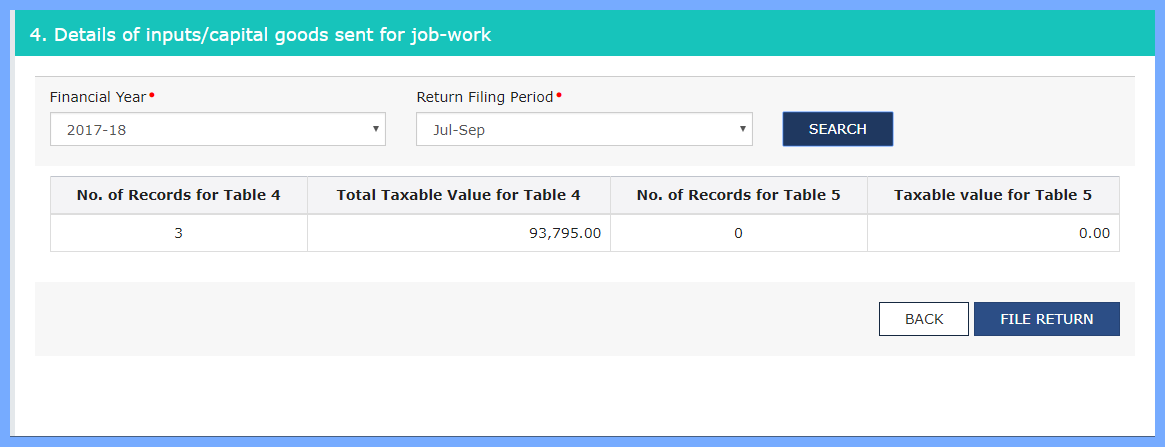

Step 6: Verify the Taxable Amount and Other Pertinent Details

Step 7: Submit the Return Using Either a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC)

Get a Free Demo – Best Billing and Invoicing Software

Return of Goods to the Principal

Returning goods to the principal is a crucial component of job labour. The principal expects to receive back any inputs or capital goods sent to a job worker within one year (in the case of inputs) and three years (in the case of capital goods) of the date the items were sent to the job worker.

Tools, jigs, and fixtures provided to the job worker by the principal are not subject to the provision for the return of goods. The principal would be responsible for paying GST on the sale of junk if the job worker did not have a GST registration, but the job worker would be responsible for paying GST when such moulds and dies, jigs and fixtures, or tools are disposed of as junk by the job worker. The failure to return input or capital items within the allotted period must be declared in Form GSTR-1. The principal is responsible for paying the tax due and any relevant interest.

What happens if the goods are not received within the specified time?

If goods sent to a job worker are not returned within the specified time (one year for inputs, three years for capital goods), they are considered a supply from the principal to the job worker under GST. This means the principal must treat the transfer as a taxable supply and pay GST on it. Timely tracking and adherence to deadlines help avoid tax implications on these goods.

Get a Free Demo – Best Billing and Invoicing Software

Can the principal directly sell from the job worker’s place?

Yes, the principal can sell goods directly from the job worker’s location if the goods are taxable and permission from GST authorities is obtained. The goods remain under the principal’s ownership and are taxed accordingly when sold. The principal must declare the job worker’s premises as an additional place of business, unless the job worker is registered under GST.

Various Machinery Sent to the Job Worker to Carry Out the Job Work

Also Know About – GST Composition Scheme

Machinery sent by the principal to the job worker for specific tasks remains under the principal’s ownership. This machinery is not considered a supply and hence does not attract GST. However, it should be returned to the principal’s premises within three years. The principal needs to maintain proper records of machinery movements and ensure it is used exclusively for the specified job work to avoid tax issues.

Conclusion

As a result, GST on job worker is given a sizable window of time to return the items to the principal, which promotes transparency when claiming an input tax credit.Claiming ITC correctly requires a lot of compliance work and accurate records to be maintained. It is advisable to use powerful GST Software to help you claim ITC correctly by ensuring that your business is GST compliant.

- GST Rates for ProductsGST Rates: GST for washing machine GST on paper GST on readymade clothes GST on alcohol GST for tours and travels toys GST rate GST on diamond GST rate for computer GST for mobile phones GST on taxi GST on paints GST for gym GST for rice GST on cab service GST for luxury items GST on dairy products GST on medical insurance tobacco GST rate agarbatti GST rate GST on fruits