Register for GST – A Complete Guide

Goods and service tax (GST) is a value-added tax that has replaced several indirect taxes in India. It is a comprehensive and destination-based tax levied when goods and services are supplied nationwide. Businesses must compulsorily register for GST if and when their turnover exceeds a specific threshold limit. Registering for GST can be confusing and overwhelming for many business owners. We have provided a complete guide to understanding the GST registration process in India.

BOOK A FREE DEMO

What is GST Registration?

GST registration means signing up your business under the Goods and Services Tax (GST) system in India. If your business earns more than ₹40 lakh (for goods) or ₹20 lakh (for services) in a year, it is mandatory to register for GST. After registration, you get a GSTIN—a unique number used to pay and collect GST. It’s also needed if you sell online or across different states. This number helps the government track your tax payments and lets you legally run your business under GST rules.

Benefits of GST Registration

- Gives your business legal recognition under GST

- Allows you to collect GST from customers

- Helps you claim Input Tax Credit (ITC) on purchases

- Builds trust and credibility with customers and partners

- Required for selling online or across different states

- Helps you save money by reducing your overall tax

- Makes it easier to file taxes and stay compliant

- Needed for participating in government tenders or big contracts

What are the Documents Required for the GST Registration Process?

You need the following documents for GST Registration:

- Owner’s PAN card

- Owner’s Aadhaar card

- Owner’s photograph

- Proof of address

- Bank account details

GST Registration Threshold Limits

| Category | Goods | Services |

|---|---|---|

| General states | ₹40 lakh | ₹20 lakh |

| Special category states* | ₹20 lakh | ₹10 lakh |

Note: Special category states include Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Uttarakhand, and the Union Territory of Ladakh.

Turnover Limits for GST Registration

| Business Type | Annual Turnover Limit | GST Registration Requirement |

|---|---|---|

| Supply of goods (normal states) | ₹40 lakh | Mandatory if above this limit |

| Supply of services (normal states) | ₹20 lakh | Mandatory if above this limit |

| Supply of goods (special states) | ₹20 lakh | Mandatory if above this limit |

| Supply of services (special states) | ₹10 lakh | Mandatory if above this limit |

| Interstate supply (goods or services) | No limit | GST registration is mandatory |

| E-commerce sellers (goods or services) | No limit | GST registration is compulsory |

| Casual taxable person / Non-resident | No limit | GST registration is required |

Steps to complete Part A of the GST process online

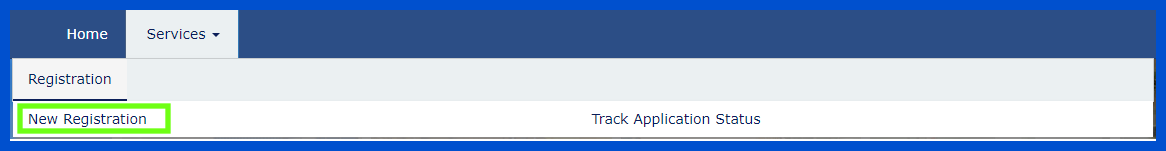

Step-1: Visit the GST portal. After clicking on services, choose the ‘Registration’ option and select ‘New registration.’

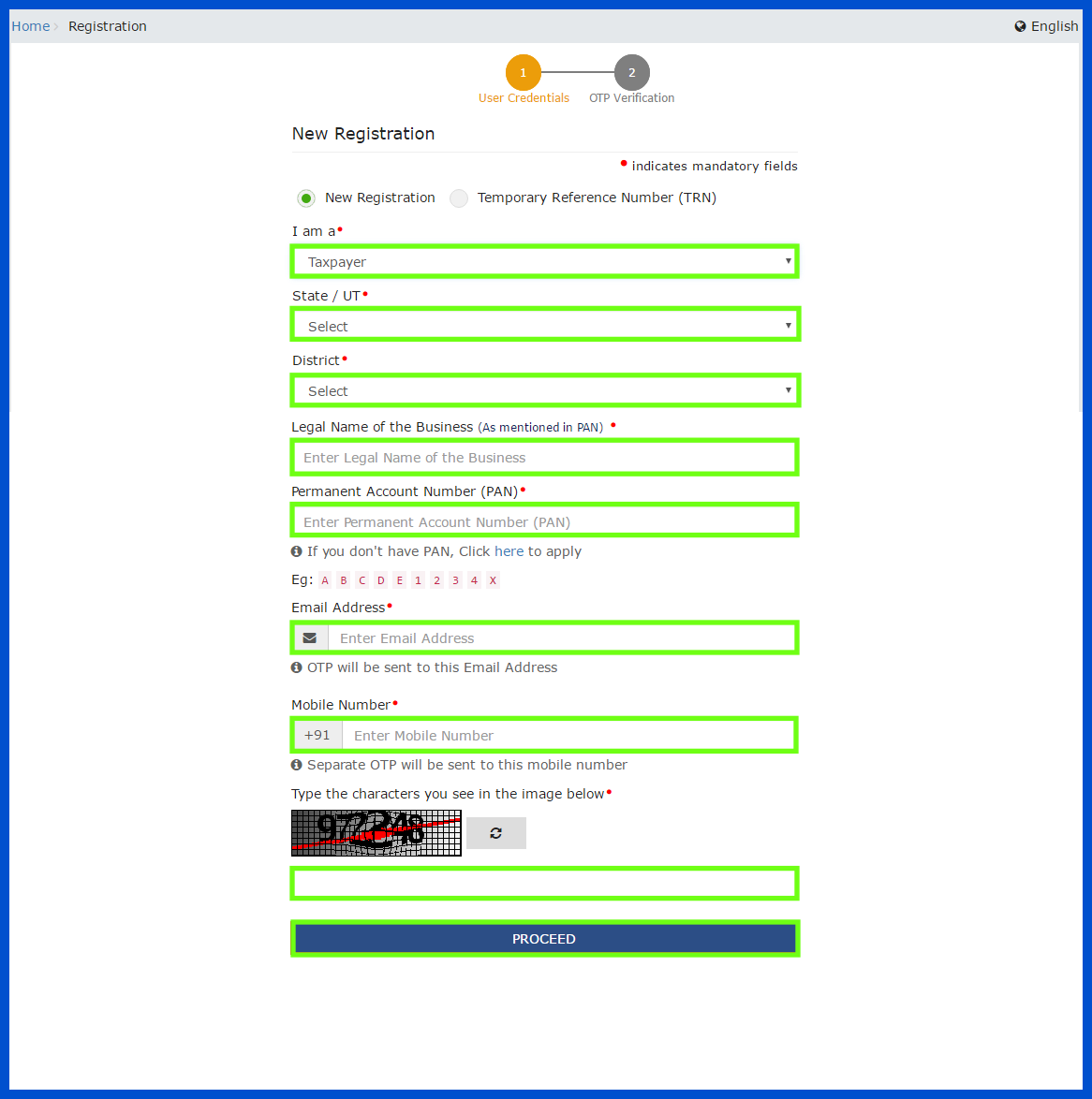

Step-2: Enter the following details in Part A:

- Select new registration

- In the next option of ‘I am a-’ select taxpayer

- Add state and district

- Mention the name and PAN of the business

- Enter a valid email address and mobile number where you intend to receive the OTPs.

- Click on ‘Proceed’

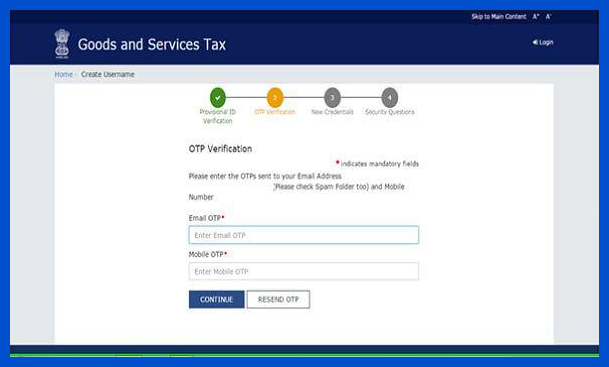

Step-3: Enter both the OTPs you have received; in case you did not receive both, then click on the ‘Resend OTP’ option.

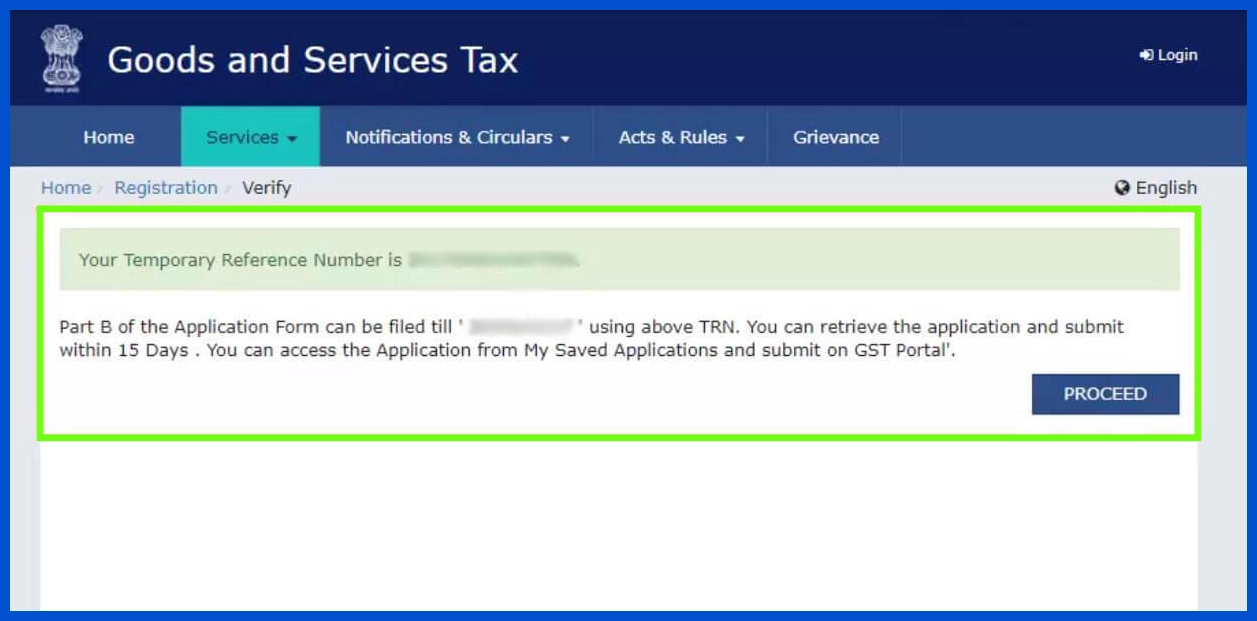

Step-4: Complete part B details within 15 days after receiving the TRN.

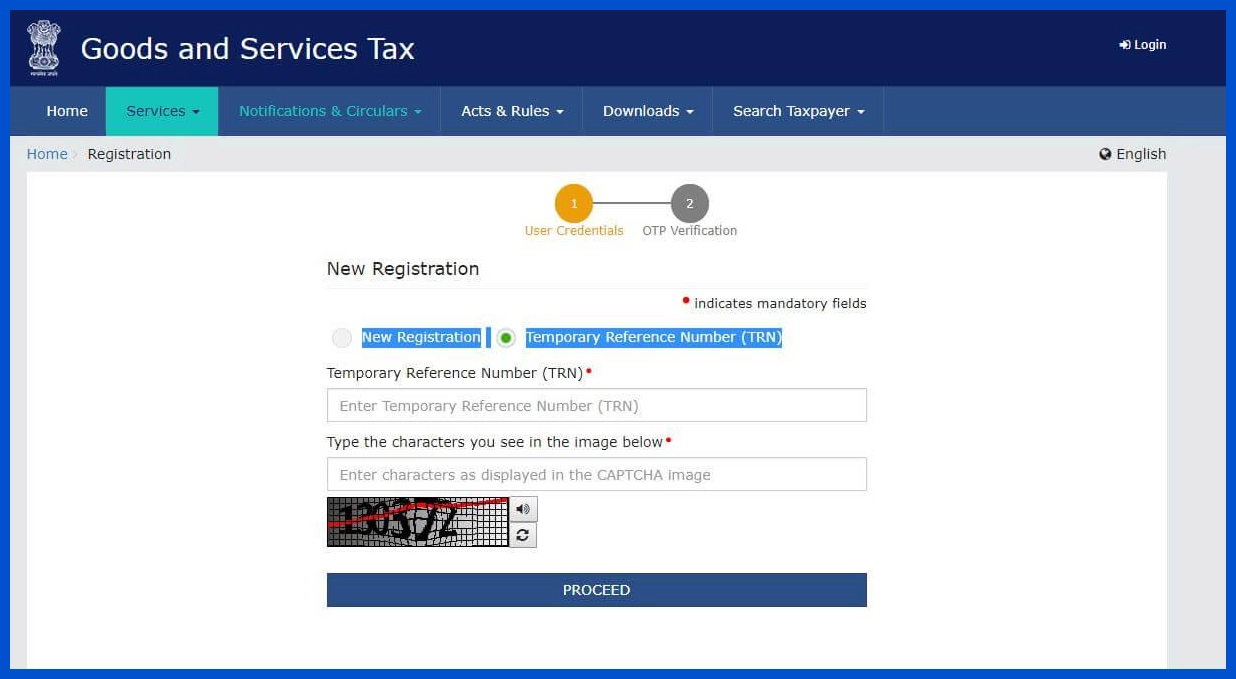

Step-5: Revisit the GST portal

Step-6: Select TRN, enter the captcha, and click proceed

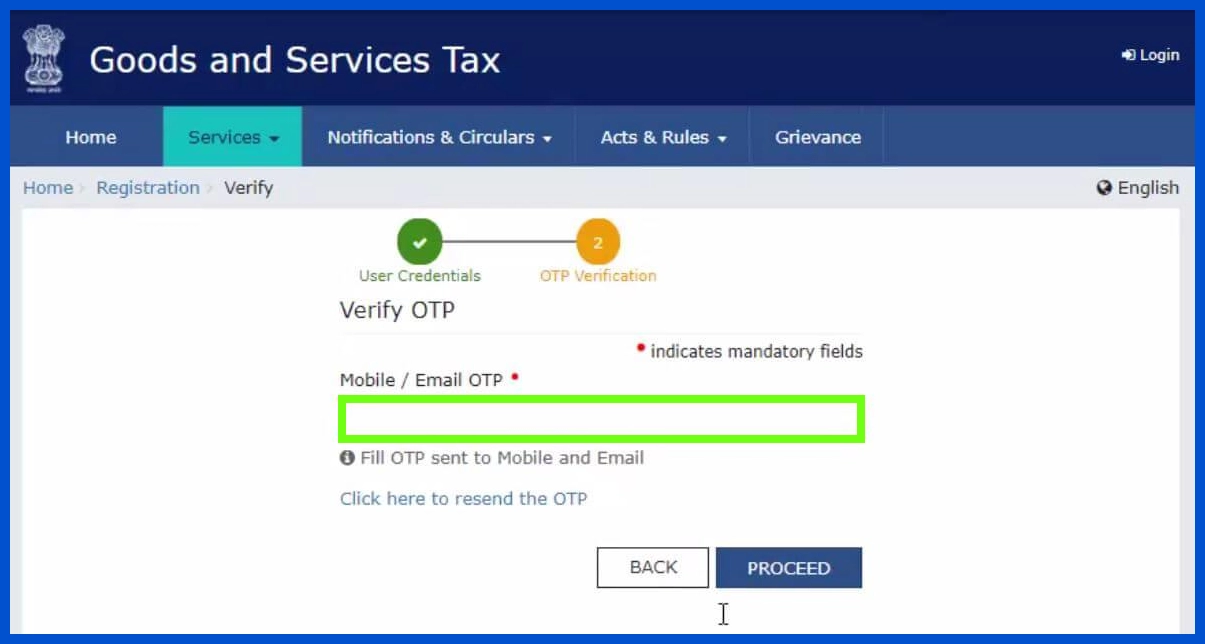

Step-7: Enter the received OTP and click on ‘Proceed’.

Step-8: Once confirming the status of the application as drafts, click on edit.

Steps to complete the Part B of the GST process online

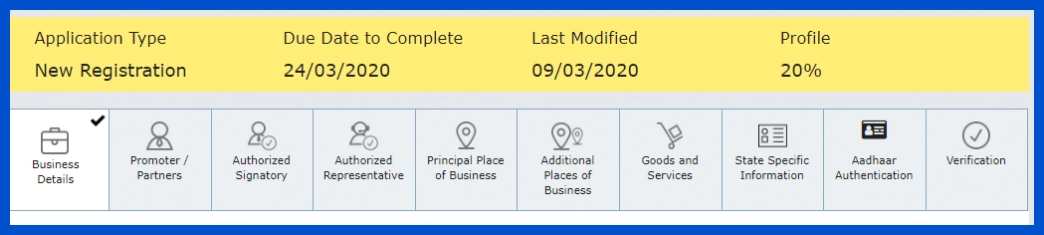

Step-9: Complete all ten sections of Part B with the necessary documents.

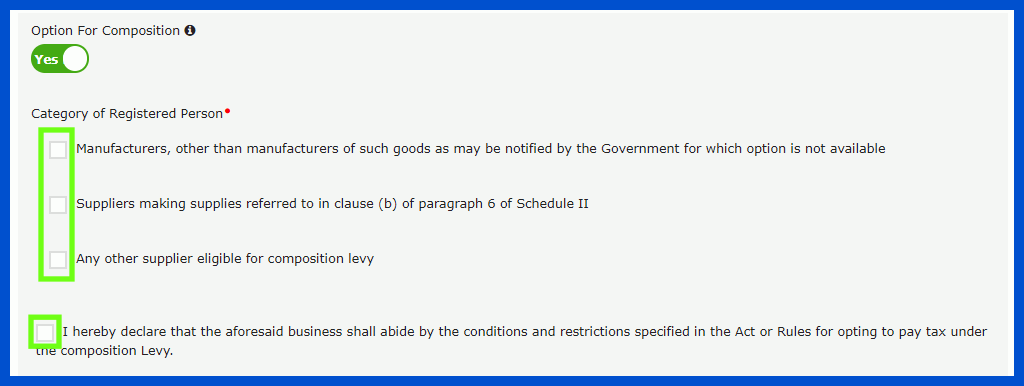

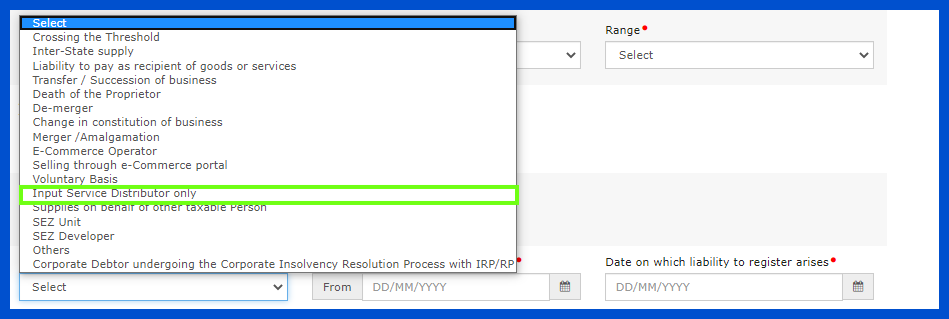

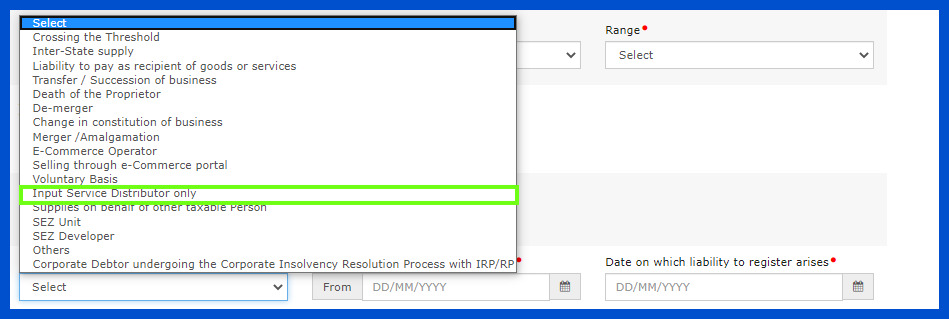

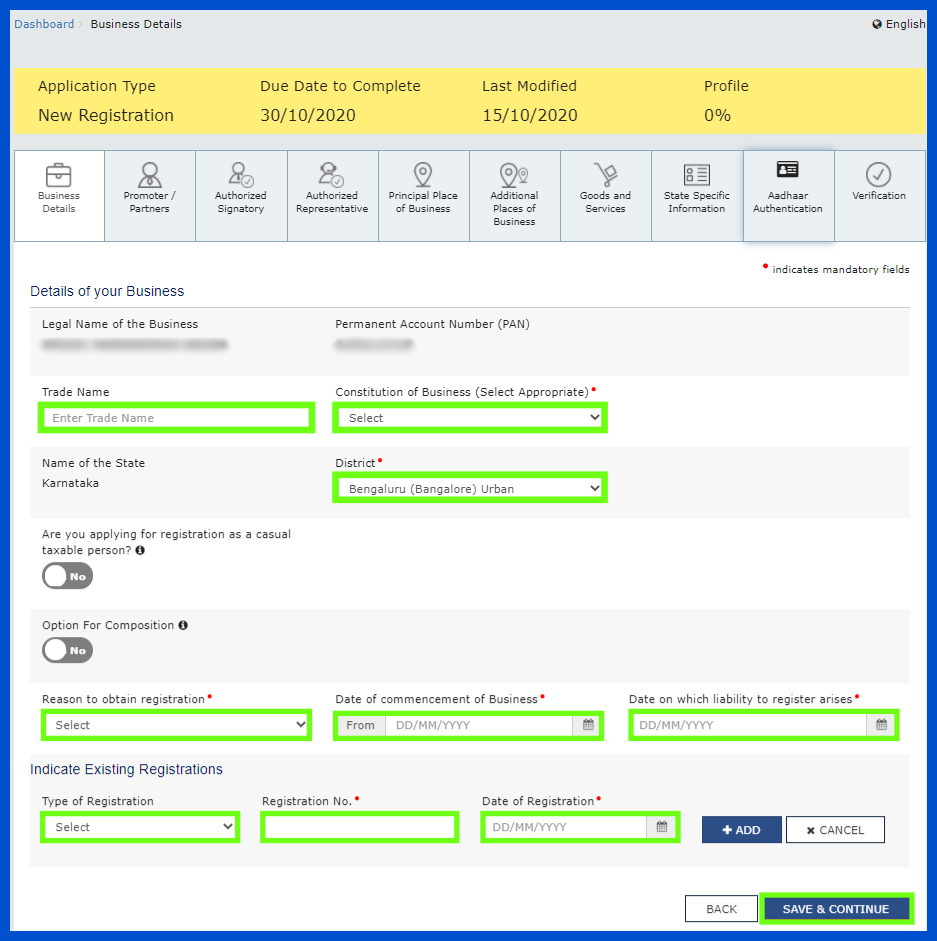

Step-10: Enter trade name, business constitution, and district in business details. Opt in or out of the composition system, and select the registered person type.

Enter the liability date and business commencement date. Choose yes/no for a casual taxable person registration type. Enter advanced tax payment details for generating challan.

Select ‘Input Service Distributor’ if applicable to obtain registration. Choose the appropriate options in the existing registrations section, such as excise or service tax, registration number and date, and click add.

Fill out relevant fields based on the decision made. For SEZ units, provide the name, authority’s designation, approval order number, and supporting documents.

Select existing registration types like CST, Excise or Service Tax, enter the registration number and date, and click ‘Add’.

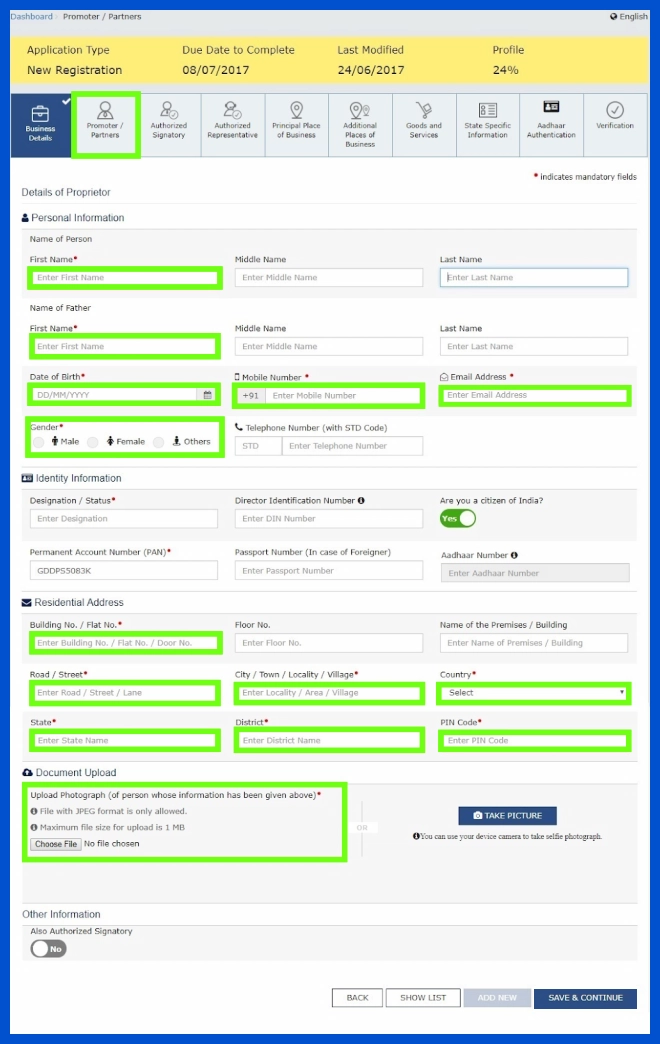

Step-11: Add up to ten partners/promoters with personal details like name, DOB, gender, phone, and email, for companies, including designation and director identification number. Enter Aadhar and PAN numbers, along with citizenship status.

Upload the stakeholder’s photo in PDF or JPEG format, with a maximum size of 1 MB. Choose the appropriate option if the promoter is the primary authorised signatory and click ‘Save and proceed’.

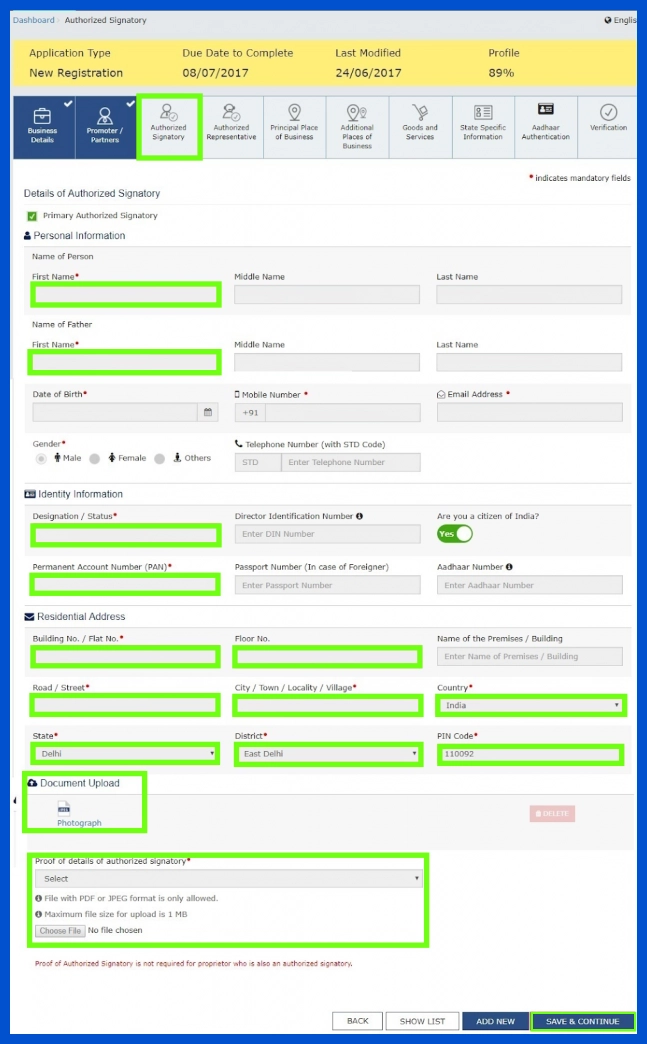

Step-12: Enter the details of the primary signatory authorities per Step 10.

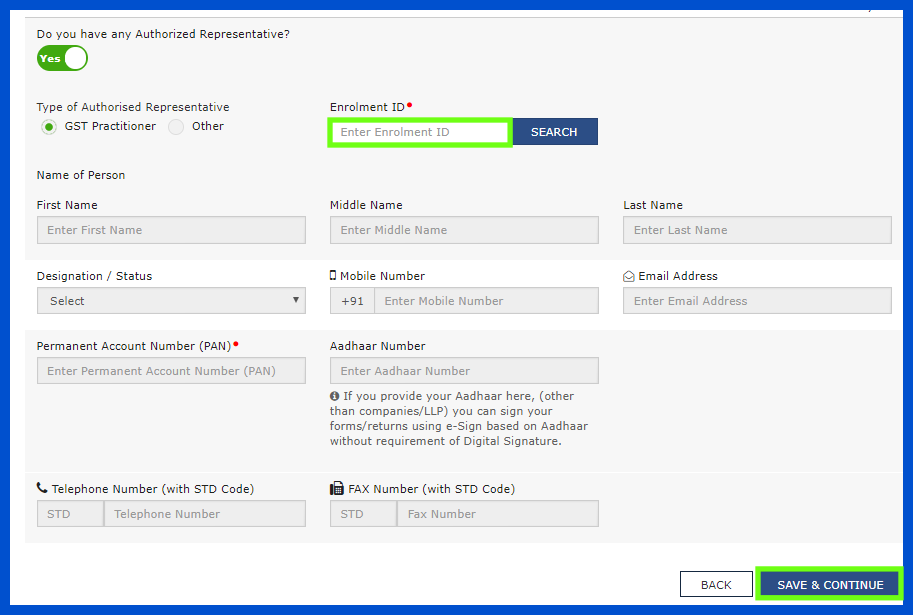

If the individual is a GST practitioner, they must provide an enrollment ID; if the individual is an authorised representative, you must present basic details.

Step-13: Provide Principal place of business details

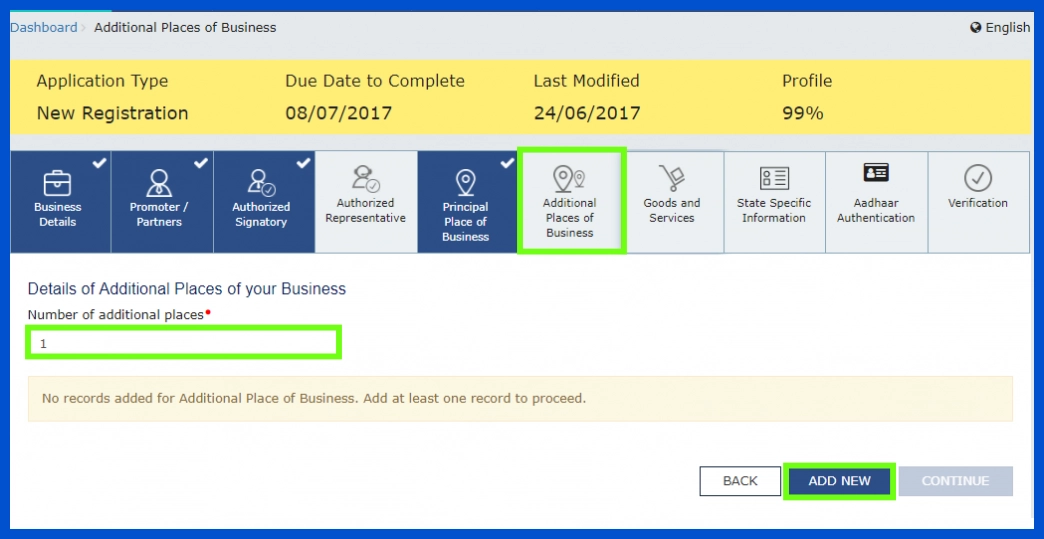

Enter details for the taxpayer’s principal place of business, including address, district, sector, circle, ward, charge, unit, commissioner, division, range codes, and an official phone number. Indicate property ownership status and submit necessary documents like NOC or SEZ approval. Add new commercial locations and click ‘SAVE AND CONTINUE’.

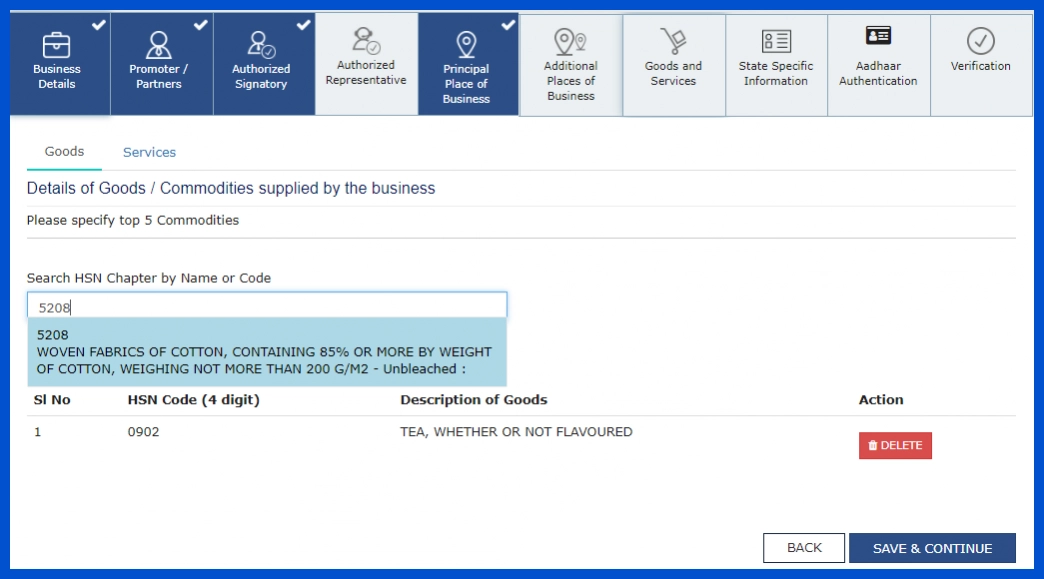

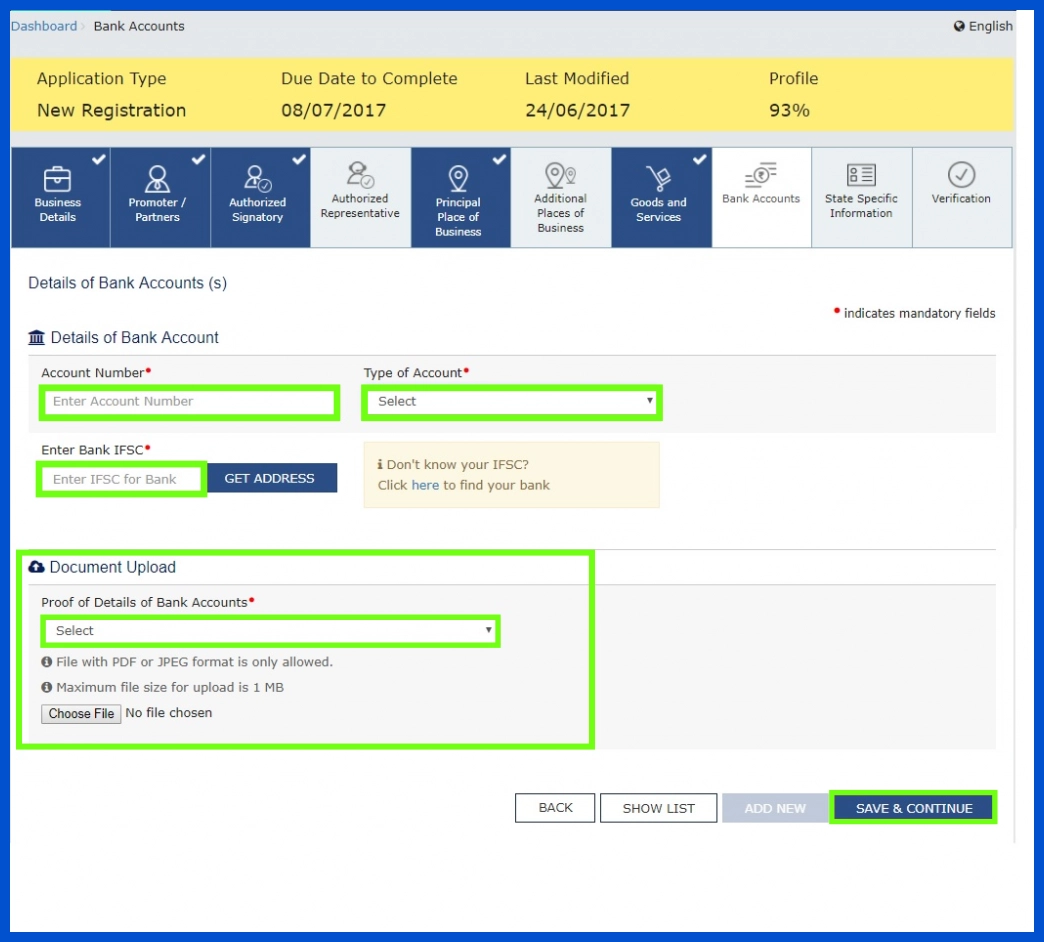

Step-14: List up to five products and services in the respective tab, along with their details and HSN codes or SAC.

Step-15: Enter the taxpayer’s information for up to ten bank accounts. Note that providing bank account information has been optional since December 27, 2018. If not provided during registration, a prompt to submit bank information will appear when logging into the GST portal after receiving the GSTIN.Include supporting documents in the upload section along with providing the information.

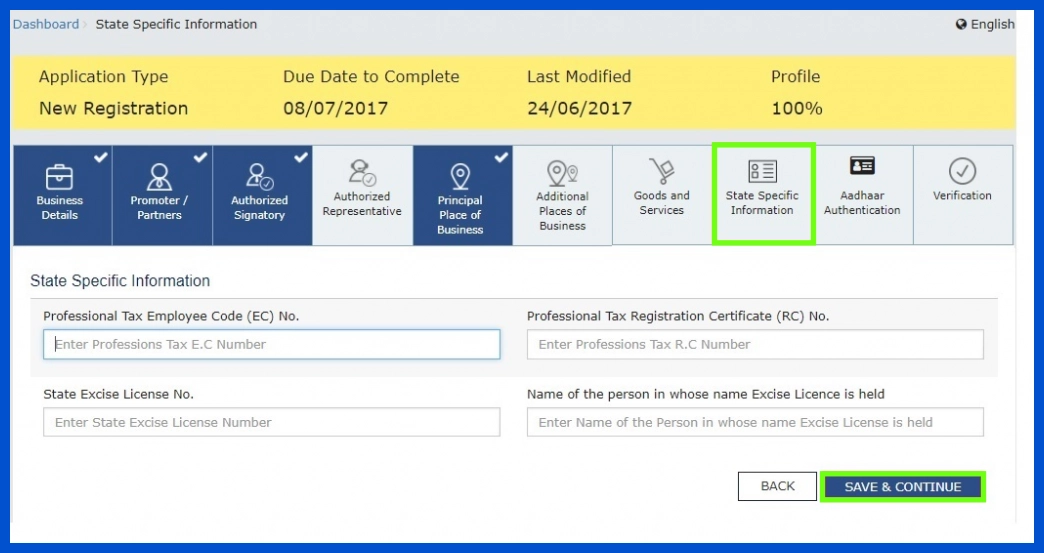

Step-16: Under the tab labelled ‘State Specific Information’, you need to provide the following information:

- Professional tax employee code number

- PT registration certificate number

- State Excise License number

- licence holder’s name

After entering the above details, select ‘SAVE & CONTINUE.’

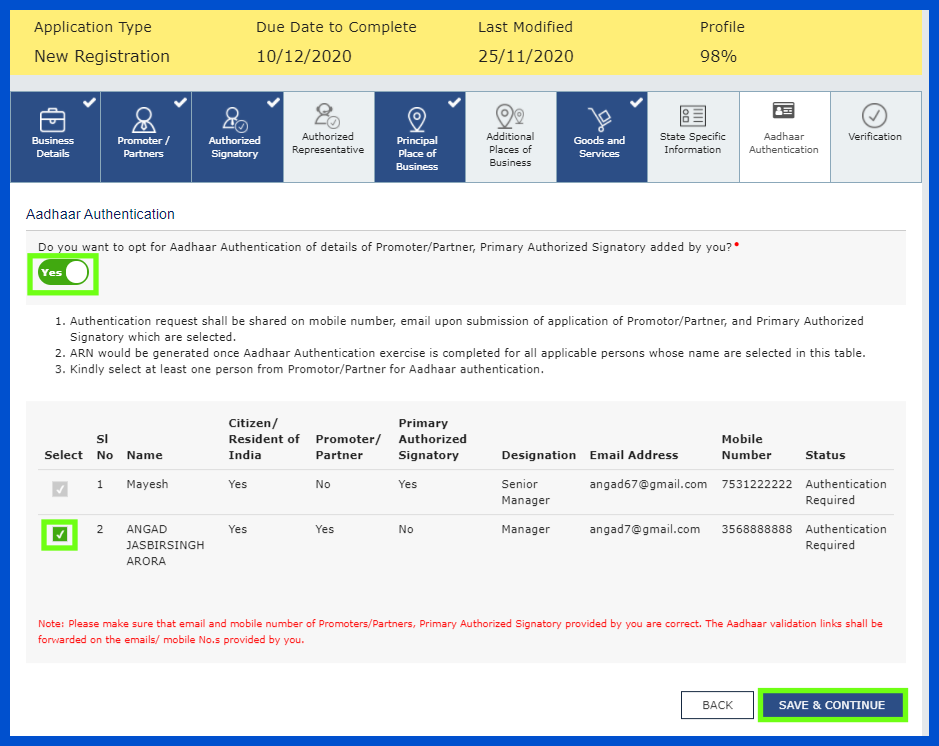

Step-17: Decide your willingness to submit to Aadhaar authentication next.

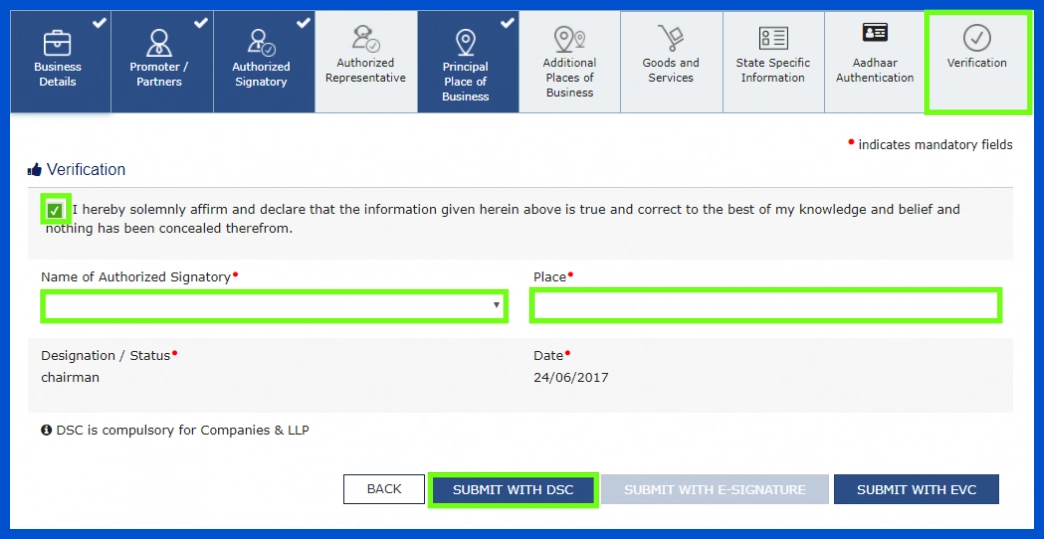

Step-18: Go to the Verification page after filling out all the details. Checkmark the declaration, then apply for one of the ways listed below:

- Companies and LLPs must compulsorily use their Digital Signature Certificates to submit applications.

- OTP will be delivered to the Aadhaar registered number using e-Sign.

- OTP will be received on the registered mobile device using the EVC

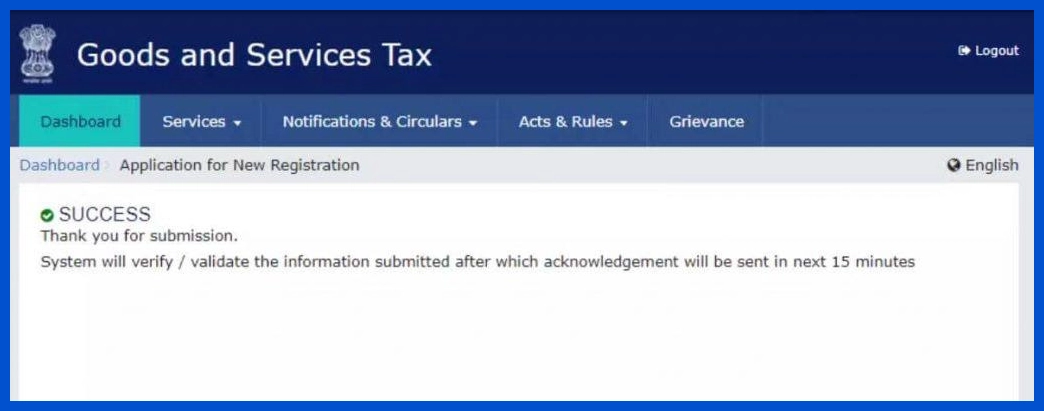

Step-19: A notice is displayed when an application is accepted, and the Application Reference Number (ARN) is issued to the registered email and mobile.

Below are the tax-paying entities that require GST registration and the necessary documents to be presented.

- GST Registration Documents for Partnerships and LLPs

- Partnership deed

- PAN cards of partners involved

- PAN cards of partners involved

- Aadhar card of any authorised signatory

- Appointment proof of the signatory

- Proof of LLP Registration

- Bank details

- Principal proof of address of the business

- GST Registration Documents for Hindu Undivided families (HUFs)

- PAN Card of the HUF

- PAN card of the patriarch of the family (known as Karta in an HUF)

- Photograph of the owner

- Bank details

- Principal address proof of the business

- GST Registration Documents for Companies

- Company PAN card

- The Ministry of Corporate Affairs incorporation certificate

- Memorandum/ Articles of Association

- Signatory’s appointment proof

- Signatory’s PAN card

- PAN card of all directors

- Bank details

- Business’ principal address proof

- GST Registration Documents for Society or Club

- A duplicate of the registration certificate for the group or society

- A duplicate of the PAN card of the club or organisation, as well as the PAN cards of any linked partners or promoters

- Photograph of partners or promoters

- A copy of the bank account statement/crossed cheque/passbook’s first page.

- Proof of registered office address, including utility bills and a copy of the society’s or club’s muPrincipal address proof of the businessnicipal khata for premises held by the society or club. A rent agreement and NOC from the premises’ owner are required in the event of rented premises.

- Letter of authorization signed by authorised signatory/signatories.

Also Know About – GST Composition Scheme

Steps to take after GST registration

Follow the steps below once you have completed the GST Registration Process:

- Display registration details in place of business.

- Identify the place of supply, which will determine whether you need to charge CGST and SGST or IGST.

- Start issuing the GST-compliant invoices.

- Charge and collect GST on taxable sales made.

- File Form ITC-01 to claim ITC on the goods kept in stock

- Begin to avail of an input tax credit on purchases.

- Maintain proper accounts and records under the GST laws.

- File GST returns: GSTR-1, GSTR-3B, GSTR-4.

- Understand that you may be subject to a reverse charge.

What are the Eligibility Criteria for the GST Registration process?

To be eligible for GST registration in India, a business must meet certain criteria. Any person or entity making taxable supplies with a turnover exceeding ₹20 lakhs (₹10 lakhs for special category states) must register. This includes sole proprietors, partnerships, and companies.

Additionally, businesses involved in interstate supplies, e-commerce operators, and those required to pay tax under reverse charge must also register. Specific categories, like non-resident taxable persons and agents of a supplier, are required to register regardless of turnover. Before applying, it’s essential to gather necessary documents, such as PAN, Aadhaar, and proof of business address.

GST Registration Fees

Government Fees

GST registration through the official GST portal is completely free. There are no government charges for getting a GST Identification Number (GSTIN), whether you’re a sole proprietor, company, or partnership firm.

Professional Fees

While there’s no fee to register directly on the portal, many businesses choose to hire professionals like Chartered Accountants or GST consultants. These experts may charge a fee for filing and documentation help. Here’s an approximate fee structure:

| Business Type | Estimated Professional Fees |

|---|---|

| Sole Proprietorship | ₹1,000 – ₹3,000 |

| Partnership Firm / LLP | ₹2,000 – ₹5,000 |

| Private Limited Company | ₹5,000 – ₹10,000 |

| E-commerce Sellers | ₹3,000 – ₹7,000 |

| Casual Taxable Person | ₹3,000 – ₹6,000 |

| Non-Resident Taxable Person | ₹5,000 – ₹15,000 |

Additional Costs

There may be a few extra costs depending on your business setup:

- Digital Signature Certificate (DSC): ₹500 to ₹2,000 (needed for companies and LLPs)

- PAN Application Fee: Around ₹100 (if PAN isn’t already available)

Penalties for Not Registering

If you are required to register under GST but fail to do so:

- Late Registration Penalty: 10% of the tax amount or ₹10,000, whichever is higher

- Tax Evasion Penalty: 100% of the tax amount due

Types of GST Registration

There are several types of GST registrations available in India. The most common include regular registration for businesses with a taxable turnover above the threshold limits. There’s also the gst composition scheme for small businesses, allowing them to pay tax at a fixed rate on turnover. Non-resident taxable persons, e-commerce operators, and suppliers’ agents must also register under different categories. Each registration type has specific compliance requirements and benefits, helping businesses manage their GST obligations effectively.

Must Know About – GST Invoicing

GST Registration Certificate

Once your GST application is approved, you will receive a GST Registration Certificate from the GST portal. This certificate contains your GSTIN (GST Identification Number) along with details like your business name, type, address, and date of registration. It serves as proof that your business is registered under GST and is legally allowed to collect GST and file returns.

You can download the certificate online from the GST portal after logging in. It must be displayed at your business premises as per GST rules. The certificate does not expire unless cancelled or surrendered.

Mistakes to Avoid During GST Registration

Here are some common mistakes that businesses should avoid while registering for GST:

- Using incorrect PAN details – Make sure the PAN matches your business name and type.

- Selecting the wrong business type – Choose the correct type (proprietor, partnership, company, etc.).

- Entering the wrong state or jurisdiction – This affects where you file returns and pay taxes.

- Uploading unclear documents – Ensure all proofs (address, identity, etc.) are readable and correct.

- Wrong email or phone number – These are used for OTP verification and login credentials.

- Not registering when required – If you cross the threshold limit, registration becomes mandatory.

Conclusion

Registering for GST is crucial for businesses operating in India as it enables them to comply with the country’s tax laws. GST registration is a simple process which you can complete online via the GST portal. By following the above GST registration process step-by-step guide provided in this article, you should be able to complete your GST registration process without a hitch.

Registering for GST is crucial for businesses operating in India as it enables them to comply with the country’s tax laws. GST registration is a simple process which you can complete online via the GST portal. By following the above step-by-step guide provided in this article, you should be able to complete your GST registration without a hitch. GST Registration provides you many privileges but also comes with a lot of responsibilities as a registered taxpayer. Your GST compliance needs to be flawless at all times, for which you need to maintain accurate records and invoices of all your transactions. Otherwise there is a high chance of attracting penalties and fines. For a hassle free experience with GST compliance, consider using BUSY GST Accounting Software.

- GST Rates for ProductsGST Rates: steel GST rate GST for cement GST for electronic items GST rate for bricks GST on petrol GST on bikes GST on ghee GST for restaurant GST for purchase of flat GST for scrap GST on battery GST rate for fridge GST on dry fruits GST on pen GST rate for broadband GST on soap cold drinks gst rate GST on watches GST on cosmetics GST on advocates

Frequently Asked Questions

- What are the benefits of registering for GST in India?Registering for GST allows businesses to claim input tax credit, improve credibility, and participate in interstate trade. It also simplifies tax compliance and enhances business visibility.

- Is GST registration mandatory for all businesses?No, GST registration is not mandatory for all businesses. It’s required for those exceeding the turnover limits or involved in specific activities like interstate supplies or e-commerce.

- What are the turnover limits for mandatory GST registration?The turnover limit for mandatory GST registration is ₹20 lakhs for most states and ₹10 lakhs for special category states. Businesses exceeding these thresholds must register for GST.