How to Opt-Out of the Composition Scheme?

To withdraw or opt out of the GST Composition Scheme, a taxpayer must file an application in the prescribed format of Form GST CMP-04. The application must also include details of stocks in finished and semi-finished goods, which must be provided in the form of GST ITC-01. After applying, the taxpayer has 30 days to intimate the stock details from the application date.

BOOK A FREE DEMO

What is the Composition Scheme under GST?

The Composition Scheme under GST is designed for small taxpayers to simplify their tax filings and reduce the compliance burden. Businesses with turnover up to ₹1.5 crore (₹75 lakh in certain states) can opt for the scheme and pay tax at a fixed rate on their turnover. It is available to manufacturers, traders, and certain service providers with limited revenue.

However, taxpayers may choose to exit the scheme if their business expands or they want to claim Input Tax Credit (ITC), which is not allowed under the Composition Scheme. Exiting the scheme allows them to switch to regular GST filing and unlock benefits like interstate trade and ITC claims.

Reasons for Opting Out of the Composition Scheme

There are several valid reasons why a business might want to opt out of the Composition Scheme, including:

- There is a need to claim an Input Tax Credit on purchases, which is not allowed under the scheme.

- A desire to expand business across state borders, as the scheme is limited to intra-state supplies.

- The requirement to supply through e-commerce platforms is not permitted for composition dealers.

- Business growth exceeding the turnover limit, making the scheme non-applicable.

Exiting the scheme gives businesses greater flexibility and the ability to grow, especially if their operations become more complex or interstate in nature.

Ineligibility Criteria for the Composition Scheme

The GST law clearly defines cases where businesses become ineligible for the Composition Scheme. These include:

- Making inter-state outward supplies of goods or services

- Supplying goods through e-commerce operators required to collect TCS

- Providing services beyond the prescribed limits (except for specified cases like restaurants)

- Dealing in non-taxable goods, such as alcohol or petroleum

- Acting as a casual taxable person or non-resident taxable person

If a taxpayer continues to operate under the scheme despite being ineligible, it can lead to demand notices, tax liability, interest, and penalties.

When Should You Exit the Composition Scheme?

You should consider exiting the Composition Scheme if:

- Your annual turnover exceeds the threshold (₹1.5 crore or ₹75 lakh)

- You plan to supply goods or services across states

- Your customers demand GST-compliant tax invoices and ITC claims

- You wish to scale up using online marketplaces or export channels

- You’re eligible and prefer to claim ITC on purchases and expenses

Timely action helps avoid non-compliance. You must file Form CMP-04 to formally opt out of the scheme and update your GST profile accordingly.

A Composition Dealer must submit GST CMP-04 under three situations:

- The taxpayer voluntarily chooses to opt out of the scheme.

- The taxpayer’s turnover exceeds the prescribed limit for the scheme.

- The taxpayer fails to fulfil any of the conditions required to avail of the scheme.

Also Know – Differences Between Regular And Composite Schemes

How to File CMP-04?

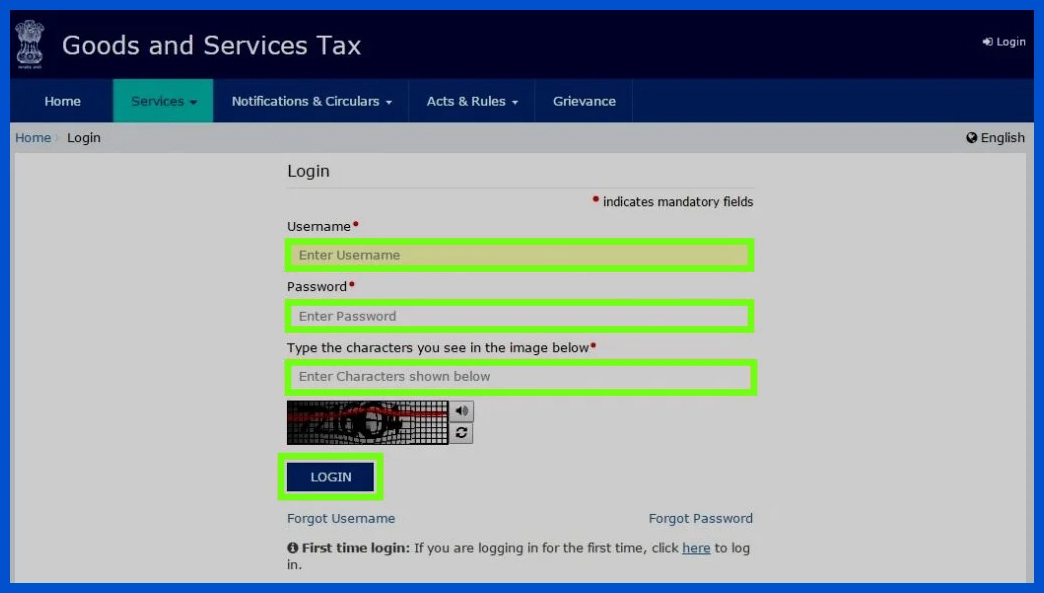

Step 1: Log in to the GST portal by adding your login credentials.

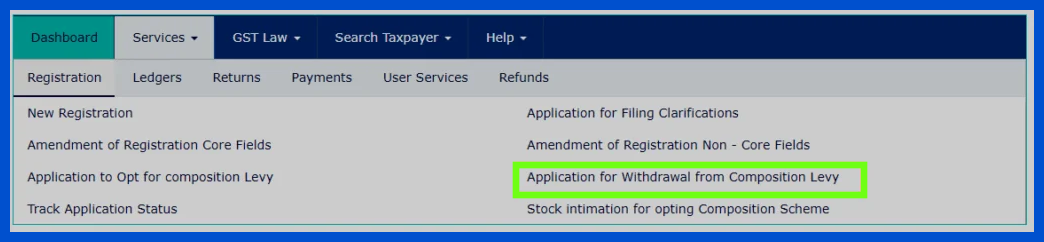

Step 2: Once logged into your account, you can access the “Services” section and select “Registration”. You can navigate to the “Application for Withdrawal from Composition Scheme” section from there.

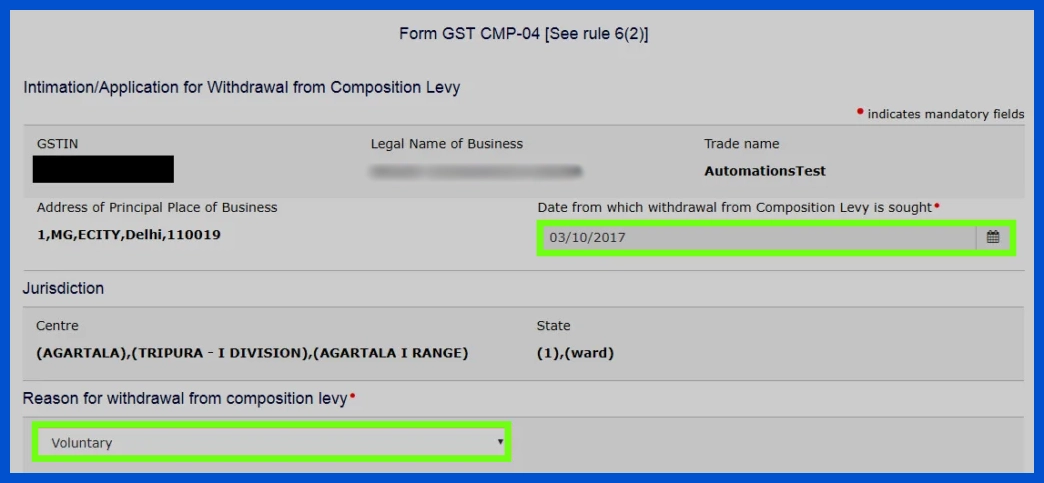

Step 3: When you click on the application page, you will be redirected to the “Intimation/Application for Withdrawal from Composition Levy” page. On this page, you will see a “Date” section where you can select the relevant date from the calendar. Note that the withdrawal date cannot be earlier than the date on which the Composition Levy opted. Additionally, there will be a “Reason” section where you need to select the reason for opting out from the dropdown list.

Step 4: Underneath the date and reason sections is a “Composition Declaration” declaration section. You must review and agree to the terms, conditions, and restrictions of the “Composition Levy”.

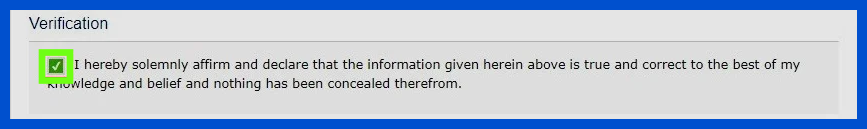

Step 5: Following the “Composition Declaration”, there is a section called “Verification”. This section implies that all the information provided is accurate and no relevant details have been concealed from the appropriate authority.

Step 6: To complete the process, click on the “Verification” and “Composition Declaration” boxes. Afterwards, select the name of the authorised signatory, enter the place of a signature, and click on the “Save” option.

Step 7: To sign or verify the form, you can use either the “EVC” or “DSC” options. Please note that using the DSC option requires EmSigner software for the GST portal. If you choose to proceed using DSC, click on the “Submit with DSC” option and then click “Proceed”.

Step 8: The emSigner page will then appear on the screen. Choose the desired signature and click on the “Sign” option.

Step 9: Signing using EVC is also an option. Click on the “Submit” button with EVC, and the system will send an OTP to the registered mobile number and email address via SMS and email. Enter the OTP to authenticate the submission. After the authentication is complete, a “Success” message will appear on your phone. An ARN (Application Reference Number) will be generated and sent to the registered mobile number and email address within 15 minutes of authentication completion.

Checking Status After Filing CMP-04

After submitting Form CMP-04 (intimation for withdrawal from the Composition Scheme), it is important to verify whether your GST registration status has been updated.

To check:

- Log in to the GST Portal

- Navigate to ‘Services > User Services > View Profile’

- Under the registration details, check if your taxpayer type has been updated to Regular

- You’ll also receive confirmation via email and SMS once the switch is processed.

BUSY Software reflects this change automatically in your profile, updating billing and return options to match your new regular taxpayer status.

What Happens After You Opt-Out of the Composition Scheme?

Once you exit the Composition Scheme:

- You must begin issuing tax invoices (instead of Bills of Supply)

- You are required to collect GST from customers at applicable rates

- You can now claim Input Tax Credit on eligible purchases

- You must start filing monthly/quarterly returns, including GSTR-1 and GSTR-3B

The change in compliance format requires robust software support. BUSY simplifies the transition by automatically switching your invoicing format, tax calculations, and return filing workflow.

Impact on Input Tax Credit

After opting out, you become eligible to claim Input Tax Credit (ITC) on:

- Inputs and input services held in stock

- Inputs in semi-finished or finished goods

- Capital goods (proportionate credit as per GST rules)

To avail ITC, you must file Form ITC-01 within 30 days of becoming a regular taxpayer. This form must include invoice-wise details of stock and taxes paid.

BUSY Software helps track your stock, generates ITC-eligible reports, and accurately prepares Form ITC-01 details, ensuring smooth ITC recovery during the transition.

Common Mistakes to Avoid While Exiting the Composition Scheme

Exiting the scheme improperly can result in compliance issues. Avoid these common mistakes:

- Missing the deadline to file CMP-04 when your turnover exceeds the threshold

- Continuing to issue Bill of Supply instead of switching to tax invoices

- Failing to file Form ITC-01 to claim Input Tax Credit

- Not updating your accounting software and processes to reflect regular taxpayer requirements

- Ignoring new return filing obligations like GSTR-1 and GSTR-3B

With BUSY, businesses receive alerts, updated invoice formats, and automated workflows that help them manage the transition without error.

Conclusion

The Composition Scheme is a great option for small, local businesses seeking simplified GST compliance. But as your business grows or becomes more complex, exiting the scheme may become necessary to claim ITC, expand operations, and meet customer expectations.

By using BUSY Accounting Software, the process of exiting the Composition Scheme is streamlined—from filing CMP-04 to switching invoice formats and return filing. It ensures that your transition is smooth, compliant, and aligned with your business growth.

- GST Rates for ProductsGST Rates: chalk GST rate GST on fertilizer GST for food business yarn GST rate GST on commercial rent GST on marble GST on builder rent GST rate GST rate for contractor GST for construction materials GST on cloud kitchen GST on pencil GST on cryptocurrency GST on freight charges GST on footwear GST on sugar GST on advocate services GST on e commerce operator GST for fmcg products GST on upi transaction