Almora Van Prabhag vs. N/A

(AAR (Authority For Advance Ruling), Uttarakhand)

1. This is an application under Sub-Section (1) of Section 97 of the Central Goods & Service Tax Act, 2017 and Uttarakhand State Goods & Service Tax Act, 2017 (hereinafter referred to as CGST/SGST Act) and the rules made there under filed by M/s Almora Van Prabhag (Divisional Forest Office, Almora) Forest Compound, Mall Road, Almora, Uttarakhand - 263601, (herein after referred to as the “applicant”), a body of the State Government of Uttarakhand and registered with GSTIN-05AAALA1356K1ZF under the CGST Act, 2017 read with the provisions of the UGGST Act, 2017 (hereinafter referred to as 'the applicant').

2. (i) The applicant is involved in the business of forest plantation, tapping, storage and sale /supply of Lisa/Resin etc.

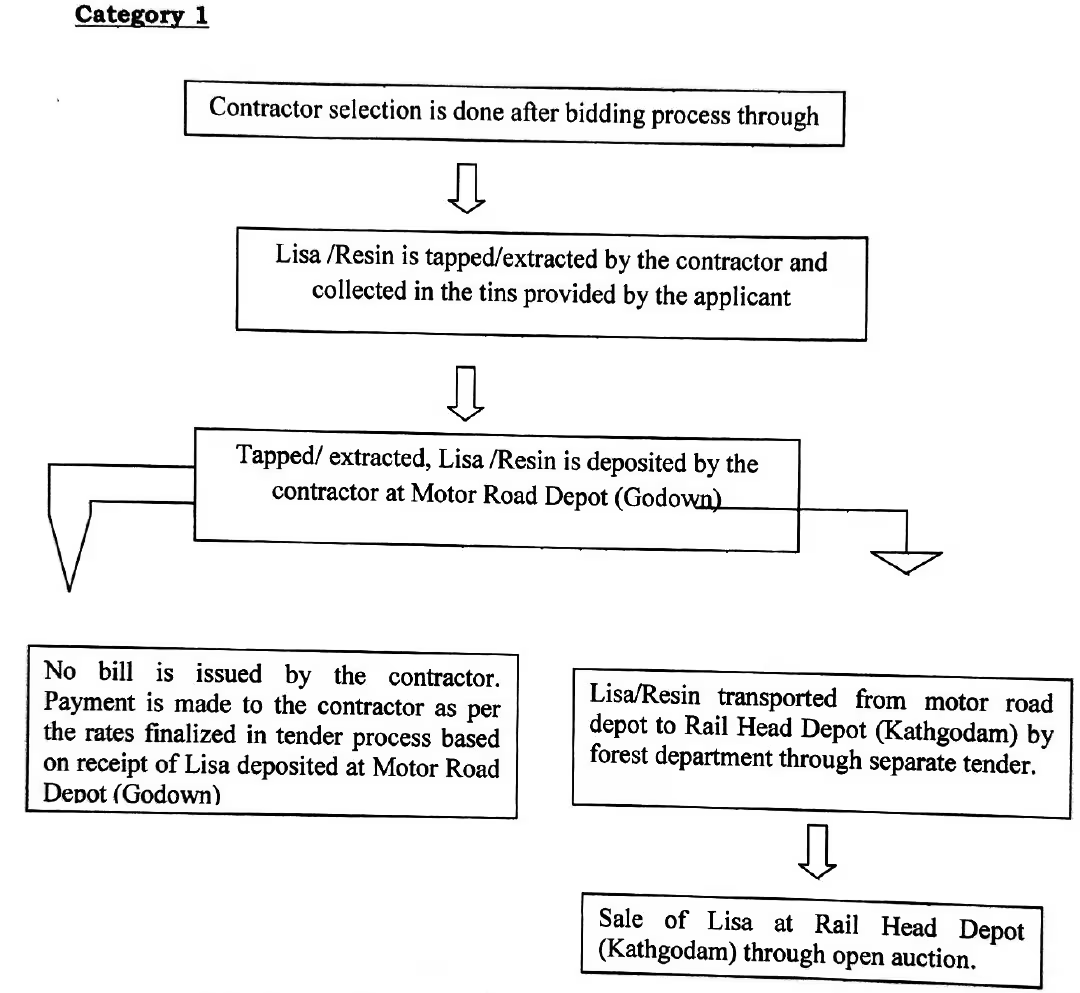

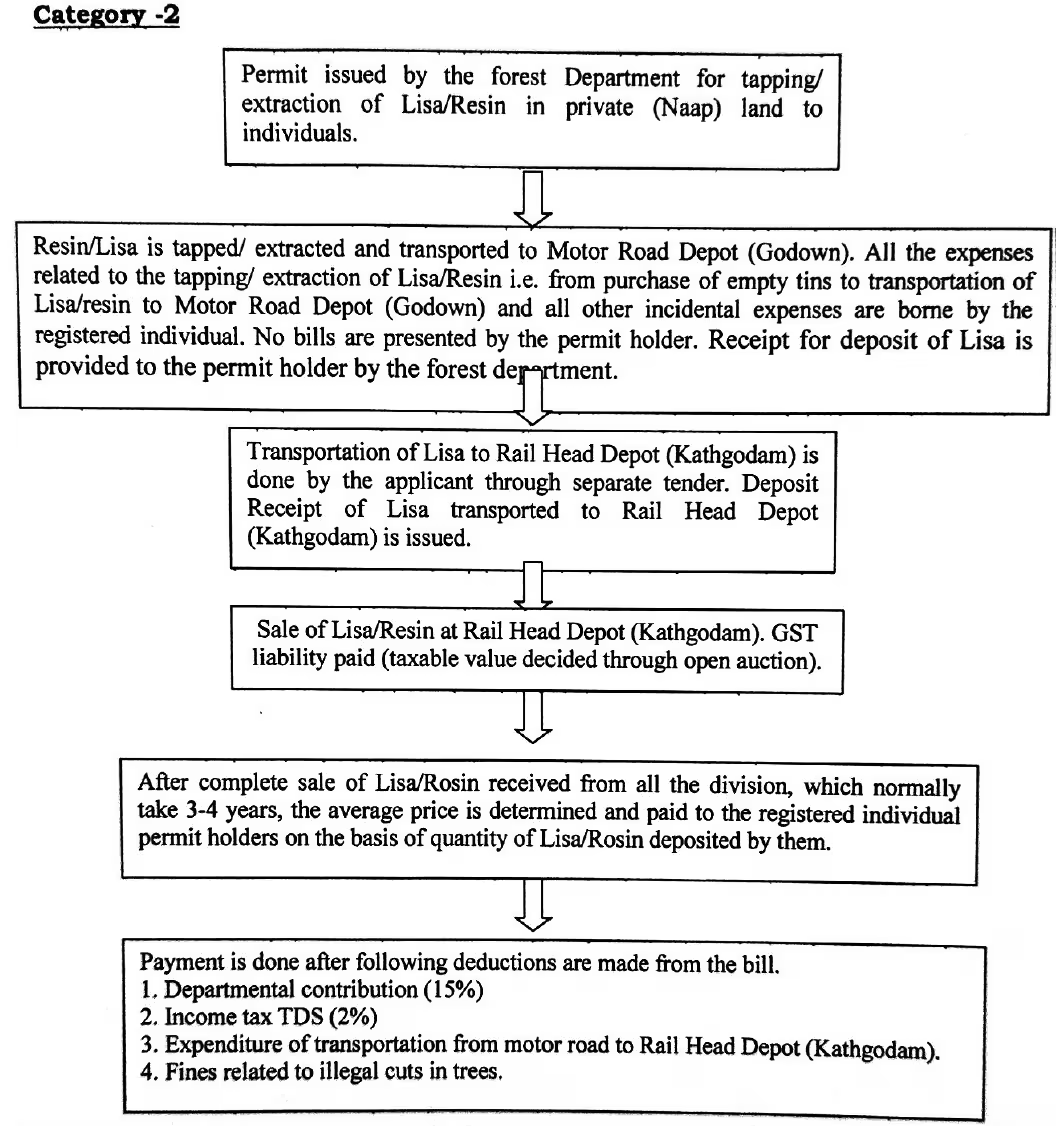

(ii) Lisa/Resin tapping are broadly divided into two categories: -

Category-1: - Tapping/ extraction of Lisa/Resin from reserved forest, van panchayat and civil forest by the selected bidder/contractor.

Category-2: - Tapping/ extraction of Lisa/Resin from private (Naap) land on the basis of permit issued by the applicant.

The processes for both the categories are as under:

Category-1: - For the purpose of tapping/ extraction of Lisa/Resin from reserved forest, van panchayat and civil forest and transporting it to the Motor Road Depot (Godown) various bonds/bids are issued by the applicant. The winning bidder/contractor undertakes the said work, at the prescribed rates, as per the terms & conditions of the bids. As per the terms & conditions of the bids, only empty tins are provided by the applicant for storage of Lisa/Resin and rest of the expenditure is borne by the selected bidder and the extracted Lisa/Resin collected by the bidder is transported and, thereafter stocked at Motor Road Depot (Godown) of the applicant. The applicant makes payment to the bidder, as per the rates finalized in the tender only after depositing total quantity of Lisa/Resin (pre-described in the bidding document) to the Motor Road Depot (Godown). For depositing, extracted Lisa/Resin by the bidder, no separate bills are raised by the bidder.

Category-2: - For the purpose of tapping/ extraction of Lisa/Resin from private (Naap) land and transporting it to the Motor Road Depot (Godown) permits are issued by the applicant to the registered individual for a year for an area called unit (for issuing permits no tender /bidding process is followed). The unit in this case is generally a village and Lisa extraction is done from Chir/Pine trees located on the private (Naap) land of various villagers. For this purpose, firstly, a file is prepared by the revenue department regarding the availability of Chir/Pine trees in a particular area called missal and thereafter, the forest department i.e. the applicant verifies these trees and thereafter permits are issued for tapping/ extraction of Lisa/Resin to the registered individual for a year. All the expenses related to the tapping/ extraction of Lisa/Resin i.e. from purchase of empty tins to transportation of Lisa/resin to Motor Road Depot (Godown) and all other incidental expenses are borne by the registered individual. At the time of deposit of extracted Lisa/Resin, at the Motor Road Depot (Godown), no bills are presented by the permit holder, only receipt for the same are issued by the applicant to the permit holder. After the receipt of extracted Lisa/Resin at the Motor Road Depot (Godown), total control and supervision is with the applicant. Payment to individual permit holder is done after full quantity of Lisa/Rosin received from all the divisions, are sold. Payment to individual permit holders is determined on the basis of average price of Lisa/ resin sold (through open auction) at the Rail Head Depot (Kathgodam). While making payments to individual permit holders, deductions of the applicant contribution @15%, Income tax TDS @ 2%, Expenditure of transportation from motor road to Rail Head Depot (Kathgodam) and Fines related to illegal cuts in trees (if any) are made.

Under both the categories after the receipt of extracted Lisa/Resin at the Motor Road Depot (Godown), total control and supervision is under the applicant and also the transportation of Lisa/Resin collected at Motor Road Depot to Rail Head Depot (Kathgodam) is done by the applicant through separate tender. At the time of Sale of Lisa/Resin (through open auction) at Rail Head Depot (Kathgodam), applicable GST is paid.

In view of the above facts the applicant has sought advance ruling on the following questions:-

1. Does the entire work is liable under GST?

2. Who is liable for GST, the department or the bidder?

3. What will be the applicable rate of GST for such activity?

4. What will be the classification of HSN/SAC code for such activity?

Services -

Sale -

5. At which point/time of supply, GST is liable to be paid?

6. On which amount GST should be paid? Whether the taxable amount will include all charges i.e. loading, unloading, tapping & transportation charges?

7. Whether GST TDS (@2% applicable) is liable to be deducted by the department from the payment made to bidder?

8. Does every contractor should be registered under GST working with the department for any types of activities?

9. What will be condition for deduction of GST TDS, if bidder has a contract less than 10 Lakh or unregistered person?

3. At the outset, we would like to state that the provisions of both the CGST Act and the SGST Act are the same except for certain provisions; therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provisions under the SGST Act.

4. The Advance Ruling under GST means a decision provided by the authority or the appellate authority to an applicant on matters or on questions specified in sub-section (2) of section 97 or sub section (1) of section 100 in relation to the supply of goods or services or both being undertaken or proposed to be undertaken by the applicant.

5. As per the said sub-section (2) of Section 97 of the Act advance ruling can be sought by an applicant in respect of:-

(a) Classification of any goods or services or both

(b) Applicability of a notification issued under the provisions of this Act,

(c) Determination of time and value of supply of goods or services or both,

(d) Admissibility of input tax credit of tax paid or deemed to have been paid

(e) Determination of the liability to pay tax on any goods or services or both

(f) Whether the applicant is required to be registered

(g) Whether any particular thing done by the applicant with respect to any goods or services or both amounts to or results in a supply of goods or services or both within the meaning of that term.

In the present case applicant has sought advance ruling on applicability of GST. Therefore, in terms of said section 97(2) the present application is hereby admitted.

6. Accordingly opportunity of personal hearing was granted to the applicant on 09.12.2021. Mr. Pankaj Chauhan, advocate and Shri Mahatim Yadav, DFO Almora, on behalf of the applicant department appeared for personal hearing on the said date and re-iterated the submission as filed with the application. Ms Preeti Manral, Deputy Commissioner, SGST-Dehradun, concerned officer from State Authority was also present during the hearing proceedings. She illustrated the relevant legal provisions and submitted that the case be decided as per law on merit.

7. We find that the applicant i.e. M/s Almora Van Prabhag (Divisional Forest Office, Almora) is a body of the State Government of Uttarakhand and registered with GSTIN-05AAALA1356K1ZF in Uttarakhand at Forest Compound, Mall Road, Almora, Uttarakhand - 263601 and in their application dated 23.11.2021, the applicant submitted graphical chart for both the categories.

8. We take up the issues involved one by one.

Category -1: The contractor i.e. the winner of the bidding process, after tapping/extracting, collects and store the Lisa /Resin in the tins provided by the applicant and transport it to the Motor Head Depot and in the process incur various expenditures. Upon deposit of the total quantity of Lisa /Resin mentioned in the bidding document, the applicant makes payment to the contractor at the rate mentioned in the bidding document.

Category -2: The Permit holder undertakes tapping/extraction of Lisa /Resin in the tins arranged by them and transports it to the Motor Head Depot. The applicant issues a receipt to the permit holder for the quantity of Lisa deposited. The Lisa/ Resin is then transported to Rail Head Depot (Kathgodam) and upon final sales through open auction) from there, payment is made to the permit holder after deducting applicant contribution @15%, Income tax TDS @ 2%, Expenditure of transportation from motor road to Rail Head Depot (Kathgodam) and Fines related to illegal cuts in trees (if any).

9. We observe that under both the categories, the extraction of Oleo Resin (Lisa) from pine trees involves human endeavour and an elaborate and well laid procedure has to be followed for such extraction/production. After such extraction, the Lisa/Resin is then transported to the Motor Road Depot (Godown) and in both the categories the cost of transportation and other incidental expenses are borne by the contractor/ individual permit holder. We further find that once the Lisa/Resin is deposited by the contractor/ individual permit holder, total control and supervision of Lisa/Resin is with the applicant. We also note that the transportation of Lisa/ Resin from the Motor Road Depot to Rail Head Depot (Kathgodam) is done by the designated transporter, which is appointed through a separate tendering process. We also observe that in the instant application, the applicant has declared that the applicable GST on Lisa/Resin is charged and collected by them at the time of Sale of Lisa/Resin (through open auction) at Rail Head Depot (Kathgodam) and deposited to the Govt, exchequer. We find that it is not disputed that the ownership of collected Lisa/Resin is with the applicant.

10. In view of the above facts, we proceed to decide the issues before us one by one.

10.2 a) We observe that the contractor is engaged in supply of goods i.e. Lisa/ Resin after extracting /tapping it from the Chir/Pine trees located on the reserved forest, van panchayat and civil forest. Thereafter, the contractor transports the extracted Lisa/ Resin to the Motor Road Depot (Godown), which is a supply of service. Tapping/ extraction of Lisa/Resin and its transportation to Motor Road Depot (Godown) is a composite supply and, hence applicable GST for composite supply is payable by the contractor. Tax rate of the principle supply will apply on the entire supply, since extracted goods i.e. Lisa/Resin is the principal supply and the transportation' of the same to the Motor Head Depot is another supply and the transportation cannot be done separately, if there are no goods. We further find that since the consideration to be paid to the contractor is decided before the performance of said supply of services it is assumed that all the expenses incidental to said supply of composite supply is part of such consideration.

b) Likewise we observe that an individual permit holder is engaged in supply of goods i.e. Lisa/ Resin after extracting / tapping it from the Chir/Pine trees located on the private (Naap) land. Thereafter, the individual permit holder transports the extracted Lisa/ Resin to the Motor Road Depot (Godown), which is a supply of service. Tapping/ extraction of Lisa/ Resin and its transportation to Motor Road Depot (Godown) is a composite supply and, hence, applicable GST for composite supply is payable by the contractor. Tax rate of the principle supply will apply on the entire supply, since extracted goods i.e. Lisa/ Resin is the principal supply and the transportation of the same to the Motor Head Depot is another supply and the transportation cannot be done separately, if there are no goods. We further find that once the Lisa/ Resin is deposited at the motor head depot (godown), total control and supervision is under the applicant i.e. the ownership of the goods is with the applicant, all the expenses incurred till such deposit, becomes part of taxable value of such composite supply.

In view of the above position, applicable GST is payable by the contractor / individual permit holder at the time of supply.

10.3 We further find that as per section 22 of the CGST Act, 2007, every supplier has to get registered in the State or Union territory, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds threshold exemption limit, as provided in the act and Section 23 of the Central Goods and Service Tax Act, 2017, list persons, which shall not be liable to registration. In view of the above provisions we observe that the contractors / individual permit holders, whose aggregate turnover (annual turnover) is within the threshold exemption limit, as provided in the Act, are not liable to get registered.

10.4 Further, we find that for transportation of Lisa/Resin (which is under total control and supervision of the applicant) from Motor Head Depot (Godown) to Rail Head Depot (Kathgodam), a service provider is selected through a separate tender process. We observe that this is another service provided by the transporter to the applicant and applicable GST has to be paid by the service provider.

10.5 We observe that Sections 12, 13 & 14 of the CGST Act, 2017, deals with the provisions related to time of supply and as per section 31 of the CGST Act, an invoice for supply of goods needs to be issued before or at the time of removal of goods for supply to the recipient, where the supply involves movement of goods. However, in other cases, an invoice needs to be issued before or at the time of delivery of goods or while making goods available to the recipient. Hence time of supply in case of goods, will be earliest of the following dates,

- Date of issue of invoice by the supplier, If the invoice is not issued, then the last date on which the supplier is legally bound to issue the invoice with respect to the supply

- Date on which the supplier receives the payment.

10.6 Further we find that as per section 51 of the CGST Act, 2017, a department or establishment of the Central Government or State Government, local authority, Governmental agencies and such persons or category of persons as may be notified by the Government on the recommendations of the Council, tax has to be deducted @ 2% of the payment made to the supplier of taxable goods or services or both, where the total value of such supply, under a contract, exceeds two lakh and fifty thousand rupees (excluding the amount of central tax, State tax, Union territory tax, integrated tax and cess indicated in the invoice), hence TDS as applicable under the provisions of law has to be deducted by the applicant being a Government body while making payments for the supply of goods as well as services.

10.7 The liability to pay applicable GST at the time of final sale (after open auction) of Lisa/Resin lies with the applicant and all the expenses incurred from tapping/extraction to final sale including all incidental expenses namely loading unloading, transportation etc. form the part of taxable value.

11. In view of the discussions held above, we rule as under:

RULING

1. Yes, all the activities are liable to GST.

2. a) The contractor, undertaking tapping /extraction and collection of Lisa/Resin, from the Chir/Pine trees located on the reserved forest, van panchayat and civil forest, is liable to payment of GST on composite supply.

b) An individual permit holder, undertaking tapping /extraction and collection of Lisa/Resin, from the Chir/Pine trees located on the private (Naap) land, is liable to payment of GST on composite supply.

3 The activity by contractor / individual permit holder is a composite supply and supply of goods i.e. Oleo Resin (Lisa) is the principal supply hence GST @ 5 % (2.5% + 2.5%) is payable.

4. Classification of HSN/SAC code is as under:

Services : Goods transport service - 9965

Sale : Oleo Resin (Lisa) - 13019049

5. The applicant is liable to pay applicable GST on Lisa/ Resin at the time of ' issue of invoice by them i.e. at the time of final sale through open auction.

6 The applicable GST on Lisa/Resin falling under HSN 13019049, is to be paid, ' on the value arrived at the time of final sale (after open auction) and all the expenses incurred from tapping /extraction to final sale including all incidental expenses incurred by the applicant, forms the part of taxable value and no deductions, of any type is available in the taxable value.

7. The TDS as applicable under the provisions of law has to be deducted by the applicant, being a Government body while making payments, for the supply of goods as well as services.

8. Yes, every contractor/individual permit holder is required to get registered as per section 22 of the CGST Act, 2007, however, the contractors / individual permit holders, whose aggregate turnover (annual turnover) is within the threshold exemption limit, they are not required to get registered in view of Section 23 of the Central Goods and Service Tax Act, 2017.

9. TDS @ 2% is required to be deducted, on payment made to the supplier of taxable goods or services or both, where the value of such supply under a contract exceeds ₹ 2.5 Lakhs.