Daebu Automotive Seat India Private Limited vs. Na

(AAR (Authority For Advance Ruling), Tamilnadu)

Note: Any appeal against the Advance Ruling order shall be filed before Tamil Nadu State Appellate Authority for Advance Ruling, Chennai under section (1) Section 100 of CGST ACT/TNGST Act 2017 within 30 days from the date on which the ruling sought to be appealed against is communicated.

At the outset, we would like to make it clear that the provisions of both the Central Goods and Service Tax Act and the Tamil Nadu Goods and Service Tax Act are the same except for certain provisions, Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the Central Goods and Service Tax Act would also mean a reference to the same provisions under the Tamil Nadu Goods and Service Tax Act.

DAEBU AUTOMOTIVE SEAT INDIA LIMITED, 492, Mannur Village, Vallarpuram Post, Sriperumbudur Taluk, Kancheepuram-602105 (hereinafter called the Applicant) are registered under GST with GSTIN 33AACCD4599E1ZO. They are in engaged in the business of manufacture of seat components and accessories which is added to the manufacturing of full seat of four wheelers. The applicant has preferred an application seeking advance ruling on the following question:

i. What is the correct classification of goods manufactured by the applicant viz. “Automotive Seating System”?

ii. Will the goods manufactured fall under CH 87089900 attracting GST @28% or under CH 940199990 attracting GST @18%?

The Applicant has submitted the copy of application in Form GST ARA – 01 and also submitted a copy of Challan evidencing payment of application fees of ₹ 5,000/- each under sub-rule (1) of Rule 104 of CGST rules 2017 and SGST Rules 2017.

2.1 The applicant has stated that they are engaged in the manufacture of Seat Components and Accessories, which is added to the manufacturing of Full Seat of four wheelers. The parent company which is situated in Korea is called as DAS Corporation and they are engaged in the manufacture of automobile seats. The products manufactured by the applicant are Base Sub Assembly, Set Bracket, Floor Mounting Bracket, Track Sub Assembly, Base Plate, Pipe Assembly, Pipe Assembly height, Cushion Frame Assembly, Cushion Frame Sub Assembly, Recliner + Set Bracket Nut Assembly, Rail + Link Assembly, Spring + Track Lever Assembly etc. The major raw material is Mild Steel (CR) Coil of various category, thickness & size. The manufacturing process involves feeding the CR coils into Pressing Machine for Stamping Process. Stamped products are then sent for Nut Welding. Pipe squeeze Machine is used for Link Squeezing of piped parts. Then such piped parts are linked together as per requirements by link welding. The individual parts so manufactured are assembled to get Recliner + Set Bracket Nut Assembly, Rail + Link Assembly, spring + Track Lever Assembly etc. High end CNC machinery with robotic arms is used in the entire manufacturing process of stamping, welding, piping etc. The applicant has submitted the details of raw material suppliers, the description of goods and HSN, rate adopted by them. It is seen from the details that the goods supplied include covering wire, slider lever, plate base, cushion panel, side bracket, bas assembly. The HSN adopted is 87089999 and GST is levied at 28%. They have submitted that they are mainly supplying to M/s Hyundai Transys Lear Automotive Limited, Sriperumbudur, who in turn manufactures automotive car seats and supply to M/s Hyundai Motors India P Ltd., Irunkkattukottai. Their other customers are Harita Seating System Ltd., Hosur, M/s Adient India P Ltd., Singaperumalkoil, M/s Daechang India Seat Company P Ltd., Sriperumbudur etc. The applicant has also stated that they have been paying GST regularly and has been a regular filer of statutory returns etc. The goods manufactured by them are classified by them under HSN: 8708 99 00 and they are paying GST @28%.

2.2 On interpretation of law, the applicant has stated that divergent practices are being adopted among the manufacturers of similar goods and the automobile/automobile seat manufacturers many times, insist on classifying the goods under HSN 9401 99 00, which attracts lower rate of GST. Since HSN cannot be changed according to the needs of the customer and as they follow, HSN 8708 99 00, they are unable to cater to the demands of such customers and lose business on this account. They have submitted that the reasons for classifying the products manufactured by them under HSN 8708 99 00 are as follows:

i. Tariff Heading 9401 covers “Seats including seats of a kind used for motor vehicles”. 94019900 covers “Parts” of such seats. HSN explanatory notes states that:

PARTS – The heading also covers identifiable parts of chairs or other seats, such as backs, bottoms and arm rests (whether or not upholstered with straw or cone, stuffed or sprung) and spiral springs assembled for seat upholstery.

ii. Thus, it could be seen that HSN 9401 99 00 covers only those items which constitute as specific part of a seat like backs, bottoms, arm rests etc. They do not cover those items which are basically fitted under a seat on the floor of the motor vehicle. Seat could be complete without such items like Rail assembly, LH Rail assembly, etc., which are manufactured by the applicant.

iii. The goods manufactured by them are not essential parts of a seat. They are basically adjuncts affixed on the floor of the motor vehicle, on which seats are mounted. These goods/mechanisms enable the passengers and drivers of automobiles to adjust seat positions for their comfort and convenience.

iv. The goods manufactured by them are installed under the seat for varying the positions of seats basically intended to improve efficiency and to enhance travel comfort.

v. Therefore, the goods manufactured by them cannot become essential pieces/parts of the seats. The seats are complete by themselves without these mechanisms. In the products manufactured by the applicant, a person cannot directly sit and rest.

vi. Hence seat assembly mechanisms cannot be called as parts of seats falling under H5N 9401 99 00 & 94012000. Alternately, they can be termed as accessories of motor vehicle and classifiable under 8708 99 00.

2.3 The applicant has placed reliance on the ruling of the Hon’ble Supreme Court in the case of Commissioner of C.Ex., Delhi Vs. Insulation Electrical (P) Ltd., 2008 (224) ELT 0512 SC. In the appeal filed by the Department on the classification of similar goods under CETH: 8708 or 9401, the Apex court, has held that such goods are classifiable under CETH: 8708. They have submitted that the facts of the case dealt by the Hon’ble Apex Court are similar to the case on hand. They have also referred to the CBIC circular No.52/26/2018-GST dated 09/08/2018 wherein under Para 13.1 to 13.4, applicability of GST on “Disc Brake Pad for Automobiles” has been discussed and the same is applicable to the products manufactured by them also. Further, the applicant has submitted that Customs DGFT Departments have also classified the products manufactured by the applicant under HSN 8708 as parts and accessories of motor vehicles and not under HSN 9401 as “Parts of Seats”.

2.4 In view of the aforesaid facts, they have sought the authority to issue necessary ruling as to whether the products manufactured by them falls under HSN 8708 99 00 as “parts and accessories of motor vehicles” or under HSN 9401 99 00 as “Parts of Seats” and the applicable rate of tax under GST.

3.1 Due to the prevailing PANDEMIC situation and in order not to delay the proceedings, the applicant was addressed through the Email Address mentioned in the application to seek their willingness to participate in a virtual Personal Hearing in Digital media. The applicant consented and the hearing was held on 09.04.2021. The authorised representative appeared for the hearing. They stated that they are supplying as sub-assembly and fully assembled. They were asked to furnish the copy purchase orders and write up on the products regarding functionality of the sub-assembly and assembly for which the ruling is sought. They were asked to furnish the supreme court decision relied upon by them along with the gist on the applicability of the same to their case.

3.2 The applicant vide their letter dated 10.04.2021 has submitted for clarity that they have requested for determination of the classification of only the finished goods viz., Track assembly meant for front Left/right seat. The various sub-assemblies (which are also named in their typed set to their application) that go in to making their product viz., Track assembly are essentially parts of the track assembly. They had submitted the following documents:

- Purchase order PO NO 4200000917 of their client Hyundai Transys Lear Automative India Private Limited.

- Product description of the Track assembly

- copy of Hon’ble Supreme Court Case law Commissioner C.Ex., Delhi Vs Insulation Electrical (P) Ltd., reported in 2008 (224) ELT 0512 (SC).

3.3 On the write-up of the Functions of the product, they have stated that

(i) This Track Assembly is fitted on to the floor of the car,. Essentially, it enables the movement as forward and backward of the seat. When seats are fixed on this TRACK ASSY it can slide back and forth with the operation of a lever for varying the positions of the seats, which is basically intended to improve the comfort and efficiency of the persons sitting thereon. This mechanism enables the passengers and drivers of the automobile to adjust seat positions for their comfort and convenience. Thus the Track assembly manufactured and supplied by them is an adjunct to the car seat.

(Iii) They do not qualify to become parts of the seats as enunciated in the decision cited viz., AAR Ruling GUJ/GAARJR/42/2020 dated 30-07-2020 and the decision of the Hon’ble Supreme Court in the case of Commissioner C.Ex., Delhi Vs Insulation Electrical (P) Ltd., reported in 2008(224) ELT 0512 (SC)

(iii) Car seat could complete themselves without these mechanisms. Hence, Track assembly mechanisms independently could not be called as parts of seats falling under HSN 94019000 whereas, they could at best be identified as accessories to the seats and hence would appropriately classifiable under the Heading 87089900.

4.1 The central Jurisdictional authority who has administrative control over the applicant has stated that there are no proceedings pending in respect of the question raised by the applicant and further offered the following comments:

- Tariff heading 9401 covers “Seats including seats of a kind used for motor vehicles”. 94019900 covers “Parts” of such seats. Thus, it could be seen that HSN 94019900 covers only those items which constitute as specific part of a seat like backs, bottoms, arm rests etc. Contrarily they do not cover those items which are basically fitted under a seat on the floor of the motor vehicle. Hence, seat assembly mechanisms cannot be called as parts of seats falling under HSN 9401 9900 Alternatively they can be termed as accessories of motor vehicle and classifiable under HSN 8708 99 00 and not under HSN 9401 99 00.

5. The State jurisdictional authority has not furnished any comments and it is construed that there are no proceedings pending on the issue raised by the applicant.

6. We have carefully examined the statement of facts, supporting documents filed by the Applicant along with application, oral submissions made at the time of Virtual hearing, submissions made after hearing and the comments of the Jurisdictional Authority. This application is filed to ascertain the correct classification of the Track assembly meant for left/right seat which is fixed on to the floor of the car and enables the movement of the seat forward and backward. Applicant has contended that the said product deserves to be classified as part of motor vehicle under Chapter Heading 87089900 and not as part of the seats under CH 94019990. Hence the applicant has sought ruling for the following questions:

(i) What is the correct classification of goods manufactured by the applicant viz. “Automotive Seating System”?

(ii) Will the goods manufactured fall under CH 87089900 attracting GST @ 28% or under CH 940199990 attracting GST @ 18%.

The ruling is sought on the classification and the applicable rate for the goods manufactured and supplied and therefore the application is admissible under Section 97 of the GST Act, before this Authority.

7.1 From the submissions, we find that the applicant is engaged in the manufacture of Seat Components and Accessories, which is added to the manufacturing of Full Seat of four wheelers. The applicant are mainly supplying to M/s. Hundai Transys Lear Automotive Limited, Sriperumbudur who in turn manufacture automotive car seats and supply to M/s. Hyundai Motors India Pvt Ltd, Irungattukottai. They also supply to other customers namely Harita Seating System Ltd., Hosur, M/s.Adient India P Ltd., Singaperumalkoil, M/s Daechang India Seat Company P Ltd., Sriperumbudur. They have submitted that divergent practices are being adopted among the manufacturers of similar goods and the automobile/automobile seat manufacturers had been insisting on applicant to classify the goods under HSN 9401 99 00, which attracts lower rate of GST. Applicant has submitted that since HSN cannot be changed according to the needs of the customer and as they follow, HSN 8708 99 00, they are unable to cater to the demands of such customers and lose business on this account. Hence, they require an Advance Ruling in this regard.

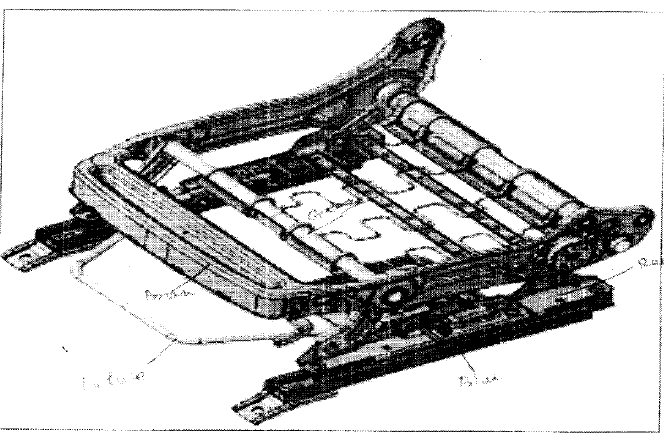

7.2 The product in question namely, Track Assembly is fitted on the floor of the car. Essentially, it enables forward and backward movement of the seat. When seats are fixed on this TRACK ASSY it can slide back and forth with the operation of a lever for varying the positions of the seats, which is basically intended to improve the comfort and efficiency of the persons sitting thereon. This mechanism enables the passengers and drivers of the automobile to adjust seat positions for their comfort and convenience. Thus they claim that the Track assembly manufactured and supplied by them is an adjunct to the car seat. The write up on the products manufactured by them submitted by the applicant is extracted below:

and the product description as furnished by the applicant is as under:

PRODUCT DESCRIPTION:- Track Assembly for front left or front right seat

7.3 Further, from the Purchase Orders and Invoice Copies furnished, the following are observed:

i) The applicant has supplied Track assembly front seat LH BA and RH BA, Track assembly Frt seat RH and LH Height BA, PNL assembly FRT CUSH LH STD HCI, RH STD HCI, Track assembly FRT CUSH LH STD HCI, RH STD HCI, Track assembly LH&RH OPT HCI, FRT CUSH LH&RH OPT H/ADJ, FRT SEAT OTR &INR LH&RH IB, FRT RH HEIGHT SMALL BRKT IB, FRT SEAT RH& LH HEIGHT IB, PNL ASSY FRT CUSH LH SBR HCKI, FRM ASSY FRT CUSH LH OPT (1-PT BRKT)HCI, TRACK ASSY SEAT CUSH etc classifying them under 8708.99.00 to M/s.Hyudai Transys Lear Automotive India Private Limited against Purchase order No.4200000917 dt. 26.02.2020.

ii) Applicant has adopted the classification under HSN code 8708.9900 for the items namely side BRKT &RECL assembly, side ARMS & RECL assembly supplied to M/s. Daechang India seat company Pvt Ltd , Kancheepuram under their Tax invoice no. DAS20G/ 14065 dt. 03.01.2021.

iii) Applicant has adopted the classification under HSN code 8708.9900 for the items namely Assembly FSC welded frame to M/s. Radiant India Pvt Ltd., Chengalpattu under their Tax invoice no. DAS20G/ 140599 dt. 03.01.2021.

iv) Applicant has adopted the classification under HSN code 8708.9900 for the items namely Assy slider active LH Bolt, Lever Return Spring-Plated and Spiral spring-plated to M/s. Harita Seating Systems Ltd, Sriperumbudur vide their Tax invoice no. DAS20G/ 14775 dt. 06.01.2021.

v) Applicant has adopted the classification under HSN code 8708.9900 for the items namely ASSY RSC Welded frame complete to M/s. SPACK Automotives Pvt Ltd under their Tax invoice no. 14854 dt. 07.01.2021.

7.4 In the case at hand, the goods for which the classification is sought before us is Track assembly’ that consists of Rail Assembly and Cushion panel assembly. Lower Rail assembly is fitted to the floor of the motor car. Upper rail assembly moves back and forth on the lower rail assembly. The lever of the lock assembly, connected to the Cushion Panel assembly, controls the movement of the upper rail assembly. The seat is fitted over this assembly, which provides spring action for allowing cushion action to the seat to be fitted over it. Thus, the Lower rail assembly of the Track assembly’ is fitted to the floor of the motor vehicle and the seat is fitted on the Cushion Panel assembly. The important aspect to arrive at for deciding the classification is

1. Whether the Track assembly’ is a ‘Part’ of Vehicle Seat classified under CTH 9401; or

2. Whether the Track assembly’ is an accessory of Motor vehicle meriting classification under CTH 8708

8.1 From the above, it is evident that the competing headings are CTH 8708 / CTH 9401. In order to determine the classification of the product ‘Track assembly’, both the Chapters heading 8708 as appearing in the First schedule to the Customs Tariff Act, 1975 are examined as follows: –

CTH 8708 falls under Section XVII. The relevant Section Note 2 863 are as under:

2. The expressions ‘parts” and “parts and accessories” do not apply to the following articles, whether or not they are identifiable as for the goods of this Section:

(a) joints, washers or the like of any material (classified according to their constituent material or in heading 8484) or other articles of vulcanised rubber other than hard rubber (heading 4016);

(b) parts of general use, as defined in Note 2 to Section XV, of base metal (Section XV), or similar goods of plastics (Chapter 39);

(c) articles of Chapter 82 (tools);

(d) articles of heading 8306;

(e) machines and apparatus of headings 8401 to 8479, or parts thereof, other than the radiators for the articles of this Section, articles of heading 8481 or 8482 or, provided they constitute integral parts of engines and motors, articles of heading 8483;

(f) electrical machinery or equipment (Chapter 85);

(g) articles of Chapter 90;

(h) articles of Chapter 91;

(Y) arms (Chapter 93);

(k) lamps or lighting fittings of heading 9405; or

(l) brushes of a kind used as parts of vehicles (heading 9603).

3. References in Chapters 86 to 88 to “parts” or “accessories” do not apply to parts or accessories which are not suitable for use solely or principally with the articles of those Chapters. A part or accessory which answers to a description in two or more of the headings of those Chapters is to be classified under that heading which corresponds to the principal use of that part of accessory.

CTH 8708 is as under:

8708 PARTS AND ACCESSORIES OF THE MOTOR VEHICLES OF HEADINGS 8701 TO 8705

8708 10 – Bumpers and parts thereof :

8708 10 10 — For tractors

8708 10 90 — Other

— Other parts and accessories of bodies (including cabs)

8708 21 00 — Safety seat belts

8708 29 00 — Other

8708 30 00 – Brakes and servo-brakes; parts thereof

8708 40 00 – Gear boxes and parts thereof

8708 50 00 -Drive-axles with differential, whether or not provided with other transmission components, non-driving axles; parts thereof

8708 70 00 – Road wheels and parts and accessories thereof

8708 80 00 – Suspension systems and parts thereof (including shock absorbers)

– Other parts and accessories:

8708 91 00 — Radiators and parts thereof-

8708 92 00 — Silencers (mufflers) and exhaust pipes; parts thereof

8708 93 00 — Clutches and parts thereof

8708 94 00 –Steering wheels, steering columns and steering boxes; parts thereof

8708 95 00 — Safety airbags with inflater system; parts thereof

8708 99 00 — Other

8.2 Heading 8708 of the First Schedule to the Customs Tariff Act covers “Parts and accessories of the motor vehicles of headings 8701 to 8705”. Motor vehicles covered under the headings 8701 to 8705 are described hereunder:

(i) 8701- Tractors (other than tractors of heading 8709).

(ii) 8702-Motor vehicles for the transport of ten or more persons, including the driver.

(iii) 8703-Motor cars and other motor vehicles principally designed for the transport of persons (other than those of headings 8702), including station wagons and racing cars.

(iv) 8704-Motor vehicles for the transport of goods.

(v) 8705-Special purpose motor vehicles, other than those principally designed for the transport of persons or goods (for example, breakdown lorries, crane lorries, fire fighting vehicles, concrete-mixers lorries, spraying lorries, mobile workshops, mobile radiological units)

8.3 The Explanatory Notes to HSN relevant to ‘Parts and Accessories’ falling under Section XVII and in specific under CTH 8708 are as under:

General Notes to Section XVII:

(III) PARTS AND ACCESSORIES

It should be noted that Chapter 89 makes no provision for parts (other than hulls) or accessories of ships, boats or floating structures. Such parts and accessories, even if identifiable as being for ships, etc., are therefore classified in other Chapters in their respective headings. The other Chapters of this Section each provide for the classification of parts and accessories of the vehicles. aircraft or equipment concerned.

It should, however, be noted that these headings apply only to those parts or accessories which comply with all three of the following conditions :

(a) They must not be excluded by the terms of Note 2 to this Section (see paragraph (A) below). and

(b) They must be suitable for use solely or principally with the articles of Chapters 86 to 88 (see paragraph (B) below). And

(c) They must not be more specifically included elsewhere in the Nomenclature (see paragraph (C) below).

(B) Criterion of sole or principal use.

(1) Parts and accessories classifiable both in Section XVII and in another Section.

Under Section Note 3, parts and accessories which are not suitable for use solely or principally with the articles of Chapters 86 to 88 are excluded from those Chapters.

The effect of Note 3 is therefore that when a part or accessory can fall in one or more other Sections as well as in Section XVII, its final classification is determined by its principal use. Thus the steering gear, braking, systems, road wheels, mudguards, etc., used on many of the mobile machines flailing in Chapter 84, are virtually identical with those used on the lorries of Chapter 87, and since their principal use is with lorries, such parts and accessories are classified m this Section.

(C) Parts and accessories covered more specifically elsewhere in the Nomenclature.

Pans and accessories, even if identifiable as for the articles of this Section, are excluded it they are covered more specifically by another heading elsewhere in the Nomenclature, e.g. :

(1) Profile shaps of vulcanised rubber other than hard rubber, whether or not cut to length (heading 40.08).

(2) Transmission belts of vulcanised rubber (heading 40.10).

……………………………………..

(11) Flexible shafts for speed indicators, revolution counters, etc. (heading 84.83).

(12) Vehicle seats of heading 94.01,

8.4 On a co-joint reading of the above, we find that

- CTH 8708 covers parts and accessories of Motor vehicles covered under CTH 8701 to 8705

- To be classified as a ‘Part and accessory’ under this Section, the said item

o Should not be excluded under Section Note 2 of Section XVII

o Should be for use solely or principally with the articles of Chapter 86 to chapter 88; and

o Should not be covered more specifically elsewhere in the Tariff

- Vehicle seats, being specifically mentioned at CTH 9401 are excluded

8.5 The competing CTH 9401 falls in Section XX and the entries of this heading are as follows:

9401 SEATS (OTHER THAN THOSE OF HEADING 9402), WHETHER OR NOT CONVERTIBLE INTO BEDS, AND PARTS THEREOF

9401 10 00 – Seats of a kind used for aircraft

9401 20 00 – Seats of a kind used for motor vehicle

9401 30 00 – Swivel seats and variable height adjustment

…………………………………….

9401 80 00 – Other seats

9401 90 00 – Parts

The notes of HSN relevant to the case at hand is as follows:

PARTS

The heading also covers identifiable parts of chairs or other seats, such as backs, bottoms and arm-rests (whether or not upholstered with straw or cane, stuffed or sprung), and spiral springs assembled for seat upholstery.

Separately presented cushions and mattresses, sprung, stuffed or internally fitted with any material or of cellular rubber or plastics whether or not covered, are excluded (heading 94.04) even it they are clearly specialised as parts of upholstered seats (e.g., settees, couches sofas). When these articles are combined with other parts of seats, however, they remain classified in this heading. They also remain in this heading when presented with the seats of which they form part.

From the above entries, it is seen that the chapter heading 9401 covers only seats and parts thereof. So only such items, which constitute as specific parts of a seat such as backs, bottoms, armrests etc can be termed as parts of seats.

8.6 CTH 8708 covers ‘Parts and accessories of Motor Vehicles’ and CTH 9401 covers ‘Parts of seats of Motor vehicles’. Now it is essential to find out the definitions of ‘parts’ and ‘accessories’. As per Oxford English Lexico, parts and accessories would be defined as under:

Parts: An amount or section which, when combined with others, makes up the whole of something.

Accessories: A thing which can be added to something else in order to make it more useful, versatile, or attractive.

From the above definitions, ‘parts’ are an amount or section which when combined with others makes up the whole of something. Hence part is an essential component of the whole without which the whole cannot be complete or cannot function. It is an integral component of the whole. As defined above, accessories are not an essential component without which the whole cannot be complete or function, but it is a component which when added improves the utility, efficiency or appearance of the whole thing.

8.7 In this case, it is stated that the Track Assembly is fitted to the floor of the car and it enables the forward and backward movement of the seat. The seat is manufactured and is complete before fixing it on the said assembly. The seat is fixed on this track assembly only to facilitate the movement of seat forward and backward. Thus it is clear that the seat and track assembly are two individual, independent products, manufactured separately and fixed together to make the seat movable for a comfortable position of the driver and the front co passenger. They are not parts of each other but are two products put together in a motor vehicle for aiding the front and backward movement of the seat. Seats are complete even without the said track assembly and so the said assembly cannot be termed as `Parts of seat’. Thus the track assembly which only improves the efficiency and convenience of the seat goes to prove that it is not in the nature of ‘Parts’ of Vehicle seats’ and would not merit classification under CH9401. When seats are fixed on the TRACK ASSY it can slide back and forth with the operation of a lever for varying the positions of the seats, which is basically intended to improve the comfort and efficiency of the persons sitting thereon. This mechanism enables the passengers and drivers of the automobile to adjust seat positions for their comfort and convenience. Thus the Track assembly manufactured and supplied by the applicant is an adjunct to the car seat. Therefore, it is clear that the ‘Track assembly’ is an accessory to the Motor vehicle and is covered under CTH 8708-‘Parts and accessories of Motor vehicles’ provided the three conditions listed therein in the HSN are satisfied, viz.,

(i) They must be identifiable as being suitable for use solely or principally with the above mentioned vehicles; –

(ii) They must not be excluded by the provisions of the Notes to Section XVII; and

(iii) They must not be specifically mentioned elsewhere in the nomenclature

It is stated that the track assembly are manufactured and supplied to seat manufacturers for further supply to the Motor Vehicle Manufacturers, the fact of which stands verified from the Purchase Orders/Invoices furnished before us and mentioned above. Thus the ‘Track assemblies’ are identified as being suitable for use solely or principally with the Motor Vehicles and the first condition is satisfied.

The said goods are not excluded under Section Note 2 to Section XVII, which is the second condition. Track assembly being an accessory which provides add-on-value, in terms of comfort for the driver/front passenger in terms of leg room, seating position, etc is not a ‘Part of vehicle seat’ as has been arrived at above, and is not specifically mentioned elsewhere in the nomenclature and thereby the third condition is also satisfied.

8.8 We further find that Hon’ble Supreme Court in the case of Commissioner of Central Excise, Delhi Vs. Insulation Electrical (P) Ltd in Civil-Appeal no.5943 of 2002 dt. 27.03.2008 has decided that Seat assembly cannot be held as ‘Parts’ meriting classification under Chapter heading 9401, rather they would be accessories to Motor vehicles and would merit classification under Chapter heading 8708 because they are fitted in the motor car for adjustment of the seats for convenience and comfort of the passengers. The case being similar, we find the Apex Court decision squarely applicable to the case at hand. Thus, the ‘Track assembly’ manufactured and supplied by the applicant, being accessory of the Motor vehicle, is aptly covered under the CTH 8708- “Parts and accessories of the motor vehicles” and we hold so.

9.1 Having decided the classification, we find that Chapter Heading 8708 is listed at Sl.No.170 in Schedule-IV of Notification No.1/2017-Central Tax(Rate) dt. 28.06.2017, and the applicable rate of GST is 28% (14% SGST + 14% CGST). The said entry reads as under:

| Sl.No. | Chapter/ Heading/sub-heading/ Tariff Item | Description of goods |

| 170 | 8708 | Parts and accessories of the motor vehicles of headings 8701 to 8705 [other than specified parts of tractors] |

10. In view of the above, we rule as under:

RULING

1. The product ‘Track Assembly’ manufactured and supplied by M/s. Daebu Automotive India Private Limited, is classifiable under CTH 8708 of the First Schedule to the Customs Tariff Act, 1975 as applicable to GST as per Explanation (iii) to Notification 1/2017-Central Tax (Rate) dt 28.06.2017 and G.O. Ms No. 59, Commercial Taxes and Registration (B1) dt 29th June 2017.

2. The applicable rate of tax is CGST @ 14% as per entry Sl.No.170 of Schedule-IV of the Notification no.1/2017-Central Tax (Rate) dt. 28.06.2017 as amended and SGST @14% as per entry sl. No. 170 of Schedule-IV of Notification No. II(2)/CTR/532(d-4)/2017 vide G.O. 29.06.2017 as amended.