Shv Energy Private Limited, vs. N/A

(AAAR (Appellate Authority For Advance Ruling), Tamil Nadu)

| 1. In terms of Section 102 of the Central Goods & Services Tax Act 2017/Tamilnadu Goods & Services Tax Act 2017 (“the Act”, in Short), this Order may be amended by the Appellate authority so as to rectify any error apparent on the face of the record, if such error is noticed by the Appellate authority on its own accord, or is brought to its notice by the concerned officer, the jurisdictional officer or the applicant within a period of six months from the date of the Order. Provided that no rectification which has the effect of enhancing the tax liability or reducing the amount of admissible input tax credit shall be made, unless the appellant has been given an opportunity of being heard. 2. Under Section 103(1) of the Act, this Advance ruling pronounced by the Appellate Authority under Chapter XVII of the Act shall be binding only (a). On the applicant who had sought it in respect of any matter referred to in subsection (2) of Section 97 for advance ruling; (b). On the concerned officer or the jurisdictional officer in respect of the applicant. 3. Under Section 103 (2) of the Act, this advance ruling shall be binding unless the law, facts or circumstances supporting the said advance ruling have changed. 4. Under Section 104(1) of the Act, where the Appellate Authority finds that advance ruling pronounced by it under sub-section (1) of Section 101 has been obtained by the appellant by fraud or suppression of material facts or misrepresentation of facts, it may, by order, declare such ruling to be void ab-initio and thereupon all the provisions of this Act or the rules made thereunder shall apply to the appellant as if such advance ruling has never been made. |

At the outset, we would like to make it clear that the provisions of both the Central Goods and Service Tax Act and the Tamil Nadu Goods and Service Tax Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the Central Goods and Service Tax Act would also mean a reference to the same provisions under the Tamil Nadu Goods and Service Tax Act.

The subject appeal is filed under Section 100 (1) of the Tamilnadu Goods & Services Tax Act, 2017/Central Goods & Services Tax Act 2017 by M/s. SHV Energy Private Limited (herein after referred as the Appellant), having their registered office at LPG Storage Terminal, (Near Red Gate), New Harbour, Tuticorin -628 004. They are registered in India and the primary business comprises of supply of Liquified Petroleum Gas (LPG) in Bulk and in cylinders to domestic/ other Business' segments under the brand name of “SUPER GAS”. SHV also supplies bulk LPG for Industrial and Auto LPG. SHV is the subsidiary of SHV Energy N.V., a Dutch Multinational Company in Netherlands. They are registered under GST with GSTIN. 33AACCS8676D1Z9. The appeal is filed against the Order No. 10/AAR/2021 dated 31.03.2021 passed by the Tamil Nadu State Authority for Advance ruling on the application for advance ruling filed by the appellant.

2.1 The appellant has stated that they import LPG from outside India and stores/ processes the same at various terminals located in India. The terminals are in Tuticorin (Tamil Nadu), Porbandar (Gujarat) and Mumbai (Maharashtra). They operate in 16 states in India through 3 terminals, 4 Regional offices, 24 filling plants and 6 depots in India. Their Tuticorin terminal is contemplating expansion to increase the LPG capacity from 3,50,000 Metric Tons Per Annum (MTPA) to 12,00,000 MTPA. The expansion will involve suitable augmentation of existing facilities including Utilities and Offsite systems. The following expenditure is proposed to be incurred by them in the process of expansion amongst others:-

1. Construction of transfer Pipeline

2. Construction of refrigerated atmospheric storage tank

3. Construction of water tank which is a part of firefighting system

4. Construction of foundation/ structural support through piling.

Transfer Pipeline: This is basically laid to connect the unloading point (jetty) to the storage tanks within factory premise. These are generally long distance pipelines covering various road, rail and river crossing sometimes also across the sea. The existing unloading arms and transfer Pipelines shall continue to be available for unloading LPG from ships. As part of proposed expansion, new Propane and Butane unloading arms (one each) shall be installed at the Jetty. The new loading arms shall be designed to handle 500 MT/hr each of refrigerated Propane and Butane. The approximate linear length of each new pipeline shall be 4.1 km and shall be installed adjacent to the existing piping corridor. The unloading line 16” size adequacy and hydraulics is based on ship pump head of 120 mlc (meter of liquid column). Two 16” pipelines and two 6” precooling lines with necessary insulation are considered. In order to reduce the ambient heat ingress and fire protection of the unloading, pipeline, 80mm thick Polyurethane foam (PDF) inner insulation and 50 mm thick Cellular glass outer insulation are recommended. For pre-cooling, the unloading lines, one insulated 6” pipeline is considered. Liquid propane and Butane are admitted into the respective unloading line to affect a slow cooling down of the unloading pipeline (approx. 3-5°C per hour). During the pre-cooling process, gas compressors will have to run continuously. Propane and Butane shall be received in refrigerated ship tankers with their own refrigerated system in parcel sizes of 22,500 MT at Port jetty of Tuticorin. The refrigerated liquid cargo shall be pumped by ship's pumps at a rate of 500 MT/h of Propane and Butane in each loading arm. This will be done through two marine unloading arms of 12” diameter and transferred to the storage tank via 16” diameter pipelines each having a total length of about 4.0 to 4.7 kms. The above mentioned is the process of transportation of Propane/ Butane from Jetty to the storage tank by using transfer pipeline, as transportation through tankers is cumbersome process.

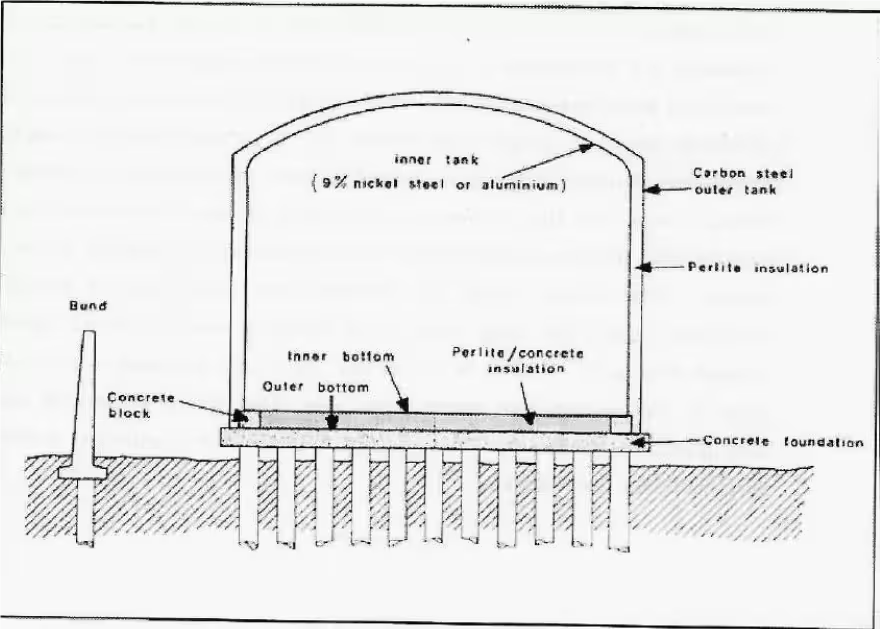

Storage Tank : Post expansion of the terminal, the Appellant envisages unloading of Propane and Butane from the ship using pipelines and storing in two refrigerated storage tanks of 15,000 MT capacity each. The tank normal operation pressure shall be 700 mm WC at a temperature of approximately (-) 450 C in case of propane and (-) 50 C in case of Butane. Propane and Butane pumps are submersible centrifugal type pumps kept inside tank. These pumps are provided for following functions:-

- Transfer of propane/ butane for heating and blending for production of LPG for tanker loading and;

- Pre cooling of unloading lines prior to ship unloading

Each pump is provided with automatic flow control valve meant for minimum flow return and these pumps are designed for the necessary flow to facilitate production of LPG of different ratios of Propane/ Butane. They are heated in separate heating trains to 150 C in two steps using dedicated air heaters followed by trim heaters. They are mixed in Static Blender (2000-FM-01) at a certain predetermined ratio in order to make LPG as per IS-4576. The ratio depends upon the composition of Propane and Butane stored in storage tank. Online blending control system is provided to make LPG as per IS specifications. The vapor pressure of the mixture is monitored by online measurement at the downstream of static blender with the help of online vapor pressure analyzer. The blended LPG is filled into road tanker via unloading arms for their customers. It is important to note that these tanks are constructed for specific usage of storage of Propane and Butane. These storage tankers cannot be used for any common storage.

Fire Water reservoir (tank) as part of Fire fighting system: The current expansion project is proposed to have firefighting system in compliance with Oil Industry Safety Directorate (OISD) standards 236. To meet the requirements, it is proposed to have provisions for fire tank, fire detection, fire alarm and fire extinguishing facilities to cover entire terminal and jetty. Water is stored to meet the requirement of firefighting for 4 hours duration, with pumps of adequate capacity. Hence two tanks of capacity 4oooKL each is proposed. Further, water stored in the tanks will be used for direct fire extinguishing, cooling down surrounding structures & equipment as water curtain to complete cut-off of fire zones. Thus, water reservoir (tank) is integral part of firefighting system which is connected with Hydrant lines sprinklers and water curtain. As part of existing safety system at Terminal, the system has a firewater system with tire following facilities:-

2 Nos of Firewater Pumps

2 Nos of Jockey Pumps

2 interconnected Firewater reservoirs with the total capacity of 2817m3.

Firewater ring main with single and double headed hydrants, monitors and deluge spray systems for Compressor, LPG Pumps, Heaters & Condensers, Tank Truck Gantry and Transformers are available. Due to proposed Terminal expansion and to meet the fire water demand new water tanks are to be constructed. The minimum fire protection measures envisaged and to be constructed for the terminal expansion are firewater pump house with firewater main pumps and jockey pumps, firewater storage tanks and firewater main ring. Firewater system shall be integrated with the existing facility. Firewater demand shall be calculated for a single largest fire scenario, considering composite plant of old and new terminals. The existing firewater and jockey pumps shall be replaced to suit the new fire water demand.

Foundation and structural support through Piling: Piling means a heavy stakes or posts installed to support the foundation of a structure. A pile foundation is defined as a series of columns constructed into the ground to transmit loads to a hard soil beneath. A pile is a long cylinder made up of a strong material, such as concrete. Piles act as a steady support for structures built on top of them. Piles transfer the loads from structures to hard strata, rocks, or soil with high load bearing capacity. As the Appellant's Project site is located close to the sea, the soil is filled up with clay with a very high ground water table (<1 m), this would mean that the load bearing capacity (weight per sqm the soil can withstand) is very low. Since the tanks are quite heavy, the Appellant needs to increase this load bearing capacity. Once the location of the piles has been identified, a hydraulic rig shall dig a hole up to the required depth, once the depth has been achieved a reinforcement cage(prefabricated) shall be placed inside the borehole and then filled up with concrete of required grade. These piles arc finished at ground level. While many methods are available for laying foundation, piling is one of the proven and affordable method to do so. Also, the storage tanks need a stable base, which can take the weight of entire tank with the product in it. Since their storage tanks need an elevated base, the piles are further extended to another 1.5m above the ground level upon which a pile cap/ concrete foundation is made joining all the piles together to form a load bearing plat form.

3. Appellant had sought Advance Ruling on the following questions:

1. Whether the appellant is eligible for availment of input tax credit of GST paid on goods and services for laying of transfer pipeline and the foundation and structural support for such pipeline which is intended for Unloading propane/Butane from the vessel/Jetty to the Terminal?

2. Whether the appellant is eligible for availment of input tax credit of GST paid on goods and services used for setting up refrigerated storage tank and input credit of goods and services used for foundation and structural support foundation tanks?

3. Whether the appellant is eligible for availment of input tax credit of GST paid on goods and services for setting up of Fire Water reservoir (tank and input credit on goods and services used for foundation and structural support for such reservoir?

4. AAR pronounced the following rulings:

1. The appellant is not eligible for availment of input tax credit of GST paid on goods and services for laying of transfer pipeline and the foundation and structural support for such pipeline which is intended for unloading propane/butane from the vessel/Jetty to the Terminal.

2. The appellant is eligible for availment of input tax credit of GST paid on goods and services used for setting up refrigerated storage tank including the structural support thereon as per the Purchase Order No.4500405026 dated 11.3.2020 subject to the condition that the tanks are capitalized in their books of accounts as plant and machinery and not as immovable property and the appellant are not eligible to avail input credit of goods and services used for pile foundation as per the purchase order no.4500401679 dated 10.02.2020

3. The appellant is eligible for availment of input tax credit of GST paid on goods and services for setting up of fire water reservoir (tank) including the structural support thereon as per the Purchase Order No.4500405071 dated 11.3.2020 subject to the condition that the tanks are capitalized in their books of accounts as plant and machinery and not as immovable property and the appellant are not eligible to avail input credit of goods and services used for pile foundation.

5. Aggrieved with the above ruling, the Appellant has filed the present appeal. The grounds of appeal are paraphrased as follows:

A. The Impugned Ruling has erred in not allowing the credit of taxes paid on construction of transfer pipelines

They have referred to Para 9.3 to 9.6 of the Impugned Ruling and submitted that the above observation of the Ld. Authority is completely incorrect for the following reasons:-

- Transfer pipelines should be considered as part of the factory premises. They had vide their application as well as the additional submissions, made detailed submissions on how the pipelines must be considered as a part of the factory.

- Ld. Authority has, without properly appreciating their contentions and merely on the ground that the definition of factory under the Factories Act is not applicable to the present case, has rejected their submissions.

- The term factory is not defined under the CGST Act. It is a settled principle of law that when a word is not defined under a statute, reliance can be placed on the definition in allied laws. It is also a settled principle of law that an interpretation of a particular statute should not ordinarily be in conflict with another statute unless and' until specifically provided so by the other statute. Normal rule of interpretation should be to harmoniously read different statutes to ensure there is no conflict in relation to same transaction. Reliance in this regard can be placed on Asst. Commr. Of I.T., Bharuch V. Narmada Chematur Petrochem. Ltd. 2012 (278) E.L.T. 178 (Guj.).

- Further, the Ld. Authority has held that the definition under Factories Act cannot be relied upon by merely referring to the Apex Court's judgment in the matter of M/s MSCO Pvt. Ltd, supra, without substantiating the applicability of the decision in the present facts. Merely relying on a judgment without providing its applicability to present matter cannot be held to be correct. Also, the Ld. Authority has not pointed to any conflict between the Factories Act and GST law. Thus, unless a conflicting intention is shown between the two legislations, meaning of factory can be understood from factories act. Having concluded that the Appellant's reliance of definition of factory from Factories Act is not tenable, the LA has failed to define what a factory would mean as per the Ld. Authority. The Ld. Authority has merely proceeded to reject the contention of the Appellant stating that the pipeline is outside the factory.

This is clearly erroneous and the Impugned Ruling therefore merits to be set aside on this ground.

- In any case, they would like to place reliance on the definition of 'factory' provided under Section 2(e) of the Central Excise Act, 1944. The definition is reproduced below for reference:-

“(e) “factory” means any premises, including the precincts there-of wherein or in any part of which excisable goods other than salt are manufactured, or wherein or in any part of which any manufacturing process connected with the production of these goods is being carried on or is ordinarily carried on;”

Central Excise law has been subsumed into GST and GST law is to much extent a production of Central Excise Act, 1944 only. Hence, it can be concluded that it is apt to place to reliance on the definition of factory provided in the Central Excise Act, 1944.

- With respect to the Ld. Authority's contention that the pipeline has not been added as additional place of business in the GST registration, it is hereby submitted that, even if assuming that it was required to be added in the registration, the same is merely a procedural lapse and the credit eligibility cannot be rejected merely on this ground as eligibility to avail credit is not based on registration as a place of business. From a perusal of the above definition, it is clear that the term factory includes any premises and precincts thereof. The term “precincts” has been defined under various dictionaries as below':-

Cambridge International Dictionary of English “area around building” Collins English Dictionary “the surrounding region or an area” Merriam webster “the region immediately surrounding a place?”

On perusal of aforesaid meanings, precinct would mean an area around building or a place. Therefore, a conjoint reading of the term “factory” and “precincts” makes it abundantly clear that the factory includes the surrounding areas which in the case of the Appellant is pipeline laid from Jetty to Terminal. Therefore, pipeline should be regarded as situated within the premise of the factory and hence eligible for input tax credit. In this regard, they that these pipelines qualify as precincts of the factory. It may be noted that these pipelines are just adjacent to the factory and spread upto 4 kms from factory to the Jetty. They have also received Right of Way approval from the V.O. Chidambaranar Port Trust. This means that this area is allotted to them for the pipelines and leads to an extension of the factory. Thus, making the pipelines within factory precincts.

- The transfer pipelines under consideration here are short distance pipes as against cross country pipelines which may stretch to over 100 of kms. In many businesses, it is required to lay down long distance pipelines which may pass through many cities or even beyond state boundaries. The pipes to be laid down by them are distinguished from such cross-country pipelines and should be considered more as pipes. As explained above, these pipes are used as unloading arms for unloading Propane/ Butane from ship tankers and transfer it to the storage tanks. Once such transfer is done, the other end of the pipelines at the jetty is disconnected. Thus, it lies disconnected once the transfer has been completed. This fact pattern clearly indicates that the transfer pipes work as a part of the factory itself. Consequently, the impugned ruling holding that the pipelines are laid outside the factory premises is erroneous and is liable to be set aside.

- They further rely on the interim relief granted by Chhattisgarh High Court in the matter of NMDC Limited Versus Union Of India [WPT No. 77 of 2021]. In this matter, the Hon’ble High Court has issued a stay order against the revenue order in a similar matter for allowance of input tax credit on goods and services used for laying of pipelines considering the provisions of Section 16 of the CGST Act.

- The transfer pipelines are an important part of the complete manufacturing process in their business. Thus, such pipelines should be considered as part of the plant and machinery. Reliance can also be placed on the judgment of the Hon'ble Supreme Court of India in the case of State of Bihar & Ors. Vs. Steel City Beverages Ltd. & Ors. [AIR 1998 SC 235/wherein a wide connotation has been given to the word 'plant' and the term 'plant' has been held to mean apparatus which is used by the industry for carrying on its industrial process of manufacture. It has been explained how these pipelines are used in the manufacturing process and are an important part thereof for the manufacture process. Thus, it should be considered as part of the plant and hence eligible for input tax credit. They place further reliance on the judgment of Bombay High Court in the matter of Reliance Industries [TS-226-HC-2017(BOM)-EXC], wherein MODVAT credit was allowed in respect of 'Single Point Mooring' system situated in the seabed, used for unloading of imported and coastal consignments and pumping of raw materials holding that this should be considered as an extension to the 'factory'.

- They in their Application had relied upon the meaning of factory from the Factories Act, 1948. Section 2(m) of the Factories Act, 1948. However, the Ld. Authority has held that adopting the definition of 'factory' from a different statute is not tenable. It is to be noted that the term 'factory' has not been defined under the GST law and the Ld. Authority in the Impugned Ruling has not suggested any alternate source for deriving the definition or meaning of the term 'factory'. They have now placed reliance on definition provided in Central Excise Act, 1944 also. It is a well settled legal principle that in case of absence of the definition of a term in the statue under litigation, the definition can be derived from other relevant statutes.

- Transfer Pipelines are used in the course or furtherance of business. The main objective and purpose of laying of pipeline is for unloading of Propane/ Butane. Propane/ Butane are the key raw material the process of manufacture of LPG. It is clear from the above that laying of pipeline constitutes an integral and inseparable part in the manufacturing process in as much as without the aforesaid activity of transportation of Propane/Butane for which pipelines are used, there cannot be manufacturing of LPG. Based on above, it is submitted that pipelines are used in course of or furtherance of business. The pipelines constitute an integral part of the manufacture carried out by them; credit of taxes paid by them should be eligible to them. Based on the decision in the case of Commissioner v. GSPL India Transco Ltd [2016 (43) S.T.R. J23 (Guj.)] by the Hon Hole High Court, it can be concluded that even in their case, transportation of Propane/Butane is not possible without laying of pipeline for transport. Therefore, laying of pipelines is an integral part of their business operations and hence used in course of furtherance of the business. Thus, it can be concluded that laying of pipeline for transport of Propane/ Butane from Jetty to Terminal is eligible for input tax credit under Section 16 of CGST Act and credit should not to be restricted under Section 17 of CGST Act. The Impugned Ruling has not disputed this ground, and this means that the Ld. Authority has accepted that the transfer pipelines are used in the course or furtherance of business. The exclusion from credit eligibility applies only to the pipelines laid outside the factory premise which is used for making outward supply of goods.

- Having considered the factual background, they wish to highlight specific provision in this regard. Section 17(5) of the CGST Act in its explanation has specifically described the expression plant and machinery. Decoding the above provision following inference can be drawn:-

- The provision restricts the input tax credit on immovable property other than plant and machinery;

- Plant and Machinery means any equipment fixed to earth by foundation or structural support; and

- The provision excludes the credit on pipeline laid outside the factory premise which is used for making outward supply of goods

In the current scenario, they receive Propane and Butane through refrigerated ship tankers with their own refrigerated systems. The refrigerated liquid cargo shall be pumped by ship's pumps at a rate of 500 MT/hr each of refrigerated Propane and Butane in each loading arm. This will be done through two marine unloading arms installed at Jetty and transfers the refrigerated Propane and Butane to their refrigerated storage tanks at Terminal via 16” diameter transfer pipelines each having a total length of about 4.3 kms from Jetty to the Terminal. The above referred process of procurement of Propane and Butane from Jetty to their terminal through transfer pipeline is the unique mode of transportation without which they cannot manufacture LPG which is their outward supply. Section 17 (5) restricts pipelines laid outside the factory premise which are used for making outward supply of goods or services not inward supply of goods or services. Hence, they believe that the transfer pipelines laid outside the factory premise for procurement of Propane and Butane is eligible for availing credit.

B. The impugned Ruling has erred in holding that credit is not eligible on input and input services used for laying Pile foundation. The Impugned Ruling at paragraph 10.5 and 11.3 has denied the credit of taxes paid on pile foundation. In this regard, they submit that the above ruling of the Ld. Authority is incorrect for the following reasons:-

- The Impugned Ruling has been passed without providing any proper reasoning and accordingly, the impugned Ruling vitiates the principles of natural justice and therefore, is bad in law. They had made detailed submissions to substantiate that pile foundation is essential for the storage tanks to bear the load. The Ld. Authority has, without providing any proper reasoning whatsoever has passed the impugned Ruling holding that pile foundation cannot be attributed as a foundation or structural support for an equipment/ apparatus. The Authority has not analysed or provided any observations for rejecting the submissions made by the Appellant that pile foundation is essential to bear the load of the tanks and therefore they form foundation of the storage tanks. This represents a flamboyant and prejudiced attempt of the Authority to frivolously deny the credit without any application of mind. Such order cannot be held to be sustainable in law. It is a settled principle of law that the order has to be passed by the Authority by providing a proper reasoning. Reliance in this regard can be placed on the following decisions:-

- Tata Engineering & Locomotive Co. Limited V. Collector of Central Excise, Pune reported in 2006 (203) E.L.T. 360 (SC)

- State of Punjab v. Bhag Singh reported in 2004 (164) E.L.T. 137 (SC)

The ratio of the above-mentioned judgments is fully applicable in the facts and circumstances of the present case. The Authority has however completely ignored the submissions made by them and has also not given any findings or reasoning for rejecting the submissions made by them. Accordingly, following the principles of natural justice and relying on the above judicial precedents, they submit, that the impugned Ruling in so far as not providing any proper reasoning is erroneous and liable be set aside on this ground alone.

- 'Pile foundation' essentially acts as a foundation to the storage tanks,-

- A pile foundation is defined as a series of columns constructed into the ground to transmit loads to a hard soil beneath.

- A pile is a long cylinder made up of a strong material, such as concrete. Piles act as a steady support for structures built on top of them.

- Piles transfer the loads from structures to hard strata, rocks, or soil with high load bearing capacity.

Their project site is located close to the sea, the soil is filled up with clay with a very high ground water table (<1 m), this would mean that the load bearing capacity (weight per sqm the soil can withstand) is very low. Since the storage tanks as well as water tanks are quite heavy, they need to increase this load bearing capacity. Therefore, the foundation byway of piling is must.

- As per Section 17(5) (c) and (d), the exclusion from credit eligibility for goods and/ or services used in the construction of immovable property is not applicable for plant and machinery. This means that input tax credit is allowed on goods, services and even works contract services received for construction of plant and machinery. As per the definition of 'Plant and Machinery', plant and machinery has been defined to include apparatus, equipment, and machinery fixed to earth and also includes the foundation and structural supports.

- The Impugned Ruling having concluded that the storage tank and water tank is plant and machinery, cannot deny the credit of taxes paid for the piling foundation, which in essence is the foundation of these tanks itself. They place reliance on Maharashtra Sales Tax Tribunal in the case of M/s Priyadarshini Polysacks Vs. The State of Maharashtra wherein it was observed that the foundation work for Wind Turbine would be classified as plant and machinery. In the above judgment also, foundation has been treated as part of the windmill (machinery) itself. Similarly, in the present case also, the pile foundation should be treated as part of the plant and machinery itself (storage and water tanks in this case) and thus, credit should be eligible.

- The definition of plant and machinery also specifically includes the foundation and structural support. Hence, the Impugned Ruling rejecting the credit of taxes paid on goods and services used for such pile foundation is erroneous and is liable to be set aside.

- 'Pile foundation' should be covered in the definition of plant and machinery and not in the exclusion part of such definition

The definition of “plant and-machinery” excludes:-

(i) Land, building or any other civil structures

(ii) Telecommunication towers; and

(iii) Pipelines laid outside the factory premises

It is clear that the foundation and structural support and construction of storage and water tank will not fall under the purview of clause (ii) or (iii) above. Therefore, clause (i) which provides for land, building or other civil structure is examined here. The exclusion is for land, building or any other civil structure. Since, pile foundation will not fall under land and building, the term 'any other civil structure' must be evaluated. In the absence of any specific definition of the term “civil structure” the meaning of the word must be understood in context of the two of the previous words used in that sentence by applying the principles of Ejusdem Generis. Hence the phrase “any other civil structures” has to be read in conjunction with land and building and therefore any civil structure in the nature of land and building should be understood as the civil structure of such land and building only and any other foundation or structural work, which is not part of land and building as such, should not be covered in the terms 'civil structure' in the current clause. Thus, it can be safely concluded that the pile foundation should not be covered in the exclusion list.

- They further submit that the 'foundation and structural support' of a 'plant and machinery' has been specifically included in the definition of plant and machinery. The pile foundation under consideration here is covered in such term 'foundation and structural support'. The Ld. Authority in para 10.5 and 11.3 of the Impugned Ruling has confused this pile foundation with the term 'any other civil structure' used in the exclusion list in the definition of plant and machinery. As discussed above, the term 'any other civil structure' has to be understood in conjunction with land and building', whereas the pile foundation is a part of the storage and water tanks i.e. plant and machinery. Such foundation is not separate from the plant and machinery. The Ld. Authority has allowed input tax credit on 'structural support' whereas denied it on 'foundation'. Though in the law these two terms have been used together.

- Specific rebuttal

The Ld. Authority vide paragraph 10.5 and 11.3 of the impugned ruling has observed that the pile foundation has been entrusted by them as a separate work and thus, do not form part of the foundation of storage and water tanks is without any basis and is not in consonance to the facts of the case. It is a fact that the pile foundation is intended to be constructed with the objective of providing support and stability to these tanks only. Merely the fact that a separate work order has been issued for such foundation work cannot be used as a valid argument to justify that this is not a foundation of the tanks. The definition of plant and machinery includes its foundation and structural support, irrespective of whether the same is undertaken under the same contact or separate contracts. Such an observation by the Ld. Authority is clearly without any foundation and the impugned Ruling therefore merits to be set aside on this ground alone. Ld. Authority has in Para 10.5 of the impugned Ruling has contended that Rile foundation is more aligned to 'land”, which stands excluded, than the 'structural support for an equipment” which is stated as 'plant and machinery' in the Explanation to Section 17 of the CSGT Act. In this regard, they submit that the Ld. Authority has grossly erred in understanding the meaning and purpose of the pile foundation by drawing this conclusion. Based on the discussions above, it has been clearly explained that this pile foundation is made solely for the purpose of providing support to the storage tanks and water reservoir tanks and works as a foundation for these. The pile foundation cannot be held to be akin to land' at all. In any case, such a conclusion is whimsical and without any basis and therefore such an observation of the Ld. Authority is erroneous and is liable to be set aside.

- Pile foundation is essential for the storage and water tanks. Reading all the above provisions together, it can also be interpreted that the essential elements for availing the credit of the input taxes paid in respect of the inward supplies of goods and services, the said supplies shall be used or intended to be used in the course or furtherance of the business. The equipment, plant and machinery and the tanks need a stable base, without proper foundation and structural support they cannot have a stable base which can take the weight of entire equipment, plant and machinery and the tanks with the product in it. Thus, the pile foundation is essential for the purpose of business of the Appellant.

- Impugned ruling has allowed the credit of taxes paid on storage tanks and water tanks and has disallowed the credit only on the pile foundation which is necessary for construction/ erection of the storage/water tanks. Storage tanks and water reservoir tanks (which are embedded on pile foundation) are extremely heavy in weight and cannot be constructed/erected without the foundation. Further, huge quantities of Propane and Butane are stored in the storage tanks and that of water in the water tanks. This makes the tanks even heavier. Hence, a very strong and load bearing foundation is needed to support these tanks. Since the product inside the tank is stored in a refrigerated state, the tank needs to be elevated to allow free air circulation beneath the tank. It is to be noted that such pile foundation is specifically used for the storage and water tanks and other heavy structures and not throughout in the factory. This clarifies that the pile foundation is essential specifically for these tanks.

- Piling means a heavy stakes or posts installed to support the foundation of a structure. A pile foundation is defined as a series of columns constructed into the ground to transmit loads to a hard soil beneath. A pile is a long cylinder made up of a strong material, such as concrete. Piles act as a steady support for structures built on top of them. Piles transfer the loads from structures to hard strata, rocks, or soil with high load bearing capacity. Foundation for the refrigerated tanks are planned with 700mm diameter piles which will be casted on site up to a depth of 10m (this is the depth where there is hard rock beneath). A total 600+ piles are envisaged for both the refrigerated tanks. Once the location of the piles has been identified, a hydraulic rig digs a hole upto the required depth, once the depth has been achieved a reinforcement cage is placed inside the borehole and then filled up with concrete. These piles are finished at ground level. Since the refrigerated tanks need an elevated base, the piles are further extended to another 1.5m above the ground level upon which a pile cap/ concrete foundation is made joining all the piles together to form a load bearing platform. The foundation of water reservoir tanks is also similar to that of the refrigerated storage tanks. The only difference being that the foundation is at ground level. Fire water tank being a smaller structure than the refrigerated storage tank, the diameter of the piles and the number of piles is lesser.

The above process depicts that pile foundation is built as per the specifications of the tanks and therefore the same is customised according the requirements. The number of piles, the depth of piles, the elevation of the piles etc are dependent on the requirement as per the tanks to be made above them. The tanks are embedded on such pile foundation. It is therefore clear that the pile foundation is an essential foundation for the tanks (plant and machinery).

- The Explanation to Section 17(5), while defining the term 'plant and machinery', specifically includes the foundation of such plant and machinery. The Explanation is produced below for ready reference:

“Explanation.- For the purposes of this Chapter and Chapter VI, the expression “plant and machinery” means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes,-

(i) land, building or any other civil structures;

(ii) Telecommunication towers; and

(iii) Pipelines laid outside the factory premises.”

It is clear from the above that where a machinery is fixed to earth by foundation, such foundation is included in the definition of 'plant and machinery'. Since the storage and water reservoir tanks have been held to be plant and machinery by the Ld. Authority and thus eligible for input tax credit, the pile foundation which is a foundation essential for the same plant and machinery should also be allowed in accordance with the provisions of the GST law.

In light of the above, they have submitted that the Ld. Authority has erred in observing that that these pile foundations are civil structures and not foundation for plant and machinery and the impugned ruling therefore merits to be set aside; they are eligible to avail credit of taxes paid for laying of transfer pipelines; they have already submitted in the appeal filed on 18 August 2021 that the transfer pipelines form part of the factory premises itself and therefore the credit of the taxes paid on laying of the pipelines is not restricted under Section 17 of the Central Goods and Services Tax Act, 2017 (CGST Act). In order to further substantiate the said submissions, one arm of the transfer pipeline is always connected to the storage tanks situated within the factory premises whereas the other arm is connected to the vessel (upon arrival). Once the loading/ unloading of Propane/Butane is completed from the vessel to the storage tanks, the transfer pipeline is then disconnected from the vessel. Thus, it is clear that the transfer pipelines are part of factory premises itself. In this background, the expression 'pipeline' in the exclusion from the definition of 'plant and machinery' connotes long distance pipelines and not pipes running for short distance. In their case, these transfer pipes are running for a short distance from the jetty to terminal. In light of the above, they are eligible to credit of the taxes paid on transfer pipeline and the impugned ruling therefore merits to be set aside.

Personal Hearing:

6. The Appellant was granted Virtual Personal Hearing as required under law before this Appellate Authority on 28.01.2022. The Authorized representatives of the Appellant Shri. K. Sivarajan and Ms. Khushboo Gupta reiterated their submissions made along with their appeal applications and their paper-book submitted earlier. They stated that the issue is on the eligibility of input tax credit on the pipeline laid from jetty to the factory premises and the pile foundation laid for storage tanks/water tanks. They further stated that the lease is for the factory area and they have obtained the 'Right of way leave' enabling the laying of pipeline and therefore the pipelines should not be considered as laid outside the factory. The pipelines are running through the port area and therefore no GST Registration can be obtained for the pipeline area which is only procedural and cannot be a ground to reject ITC. The piles are laid to support the refrigerated storage tank and are specially designed to support the load of the tanks and therefore they are foundation and structural supports and not in the nature of civil structure to be excluded for the purposes of ITC. He further stated that in the case of NMDC Ltd Vs Union of India the stay order status remains. To the query that requirement of pile foundation is soil specific and it is essentially to go with the land and do not depend on the load bearing, the authorised representative stated that in their case pile foundation is not laid in the entire area but the purpose in the case is to hold the load of the storage tanks.

Discussion and findings:

7.1 We have gone through the entire facts of the case, documents placed on record, Order of the Lower Authority & submissions made by the appellant before us. The appellant has raised three issues for advance ruling before this appellate forum praying setting aside the orders of the Advance ruling authority, Tamil Nadu:-

1. Whether the applicant is eligible for availment of input tax credit of GST paid on goods and services for laying of transfer pipeline and the foundation and structural support for such pipeline which is intended for Unloading propane/Butane from the vessel/Jetty to the Terminal?

2. Whether the applicant is eligible for availment of input tax credit of GST paid on goods and services used for foundation and structural support foundation tanks?

3. Whether the applicant is eligible for availment of input tax credit of GST paid on goods and services used for foundation and structural support for such reservoir?

7.2 Before proceeding into the issue of advance ruling, first we look into the date of filing of appeal before the forum. The appeal has been filed before this forum on 18th August 2021 against the order of the Authority for Advance Ruling, Tamil Nadu in order No. 10/AAR/2021, dated 31-3-2021 which was communicated on 22-4-2021. As per sub-section (1) of section 97 of the CGST Act 2017, appeal has to be filed within 30 days from the date of communication of the order and as per the proviso to above sub- section) 1) of section 97, a further period of 30 days with condonation of delay is granted to file such appeal. The appellant's authorized representative has stated that as per Honble Supreme Court in Suo Motu Writ Petition (Civil) No.3/2020 dated 23-03-2020 and 27-4-2021, wherein the period of limitation, as prescribed under any general or special laws in respect of judicial or quasi- judicial proceedings, whether condonable or not, shall stand extended till further orders. This has been examined and the Hon'ble Supreme Court in order No. Misc. Application No.21/2022 in Misc. Application No.665/2021 in Suo Motu Writ petition No.3 of 2020 dated 10-01-2022 has directed that the period from 15-3-2020 to 28-02-2022 shall be excluded for the purpose of limitation as may be prescribed under any general or special laws in respect of judicial or quasi- judicial proceedings. Accordingly, the appeal filed before this appellate forum is within the said extended period and the application is taken for advance ruling.

8.1 The first issue raised before us is,-

Whether the applicant is eligible for availment of input tax credit of GST paid on goods and services for laying of transfer pipeline and the foundation and structural support for such pipeline which is intended for Unloading propane/Butane from the vessel/Jetty to the Terminal?

The appellant submitted in the appeal that the transfer pipelines form part of the factory premises itself and therefore the credit of the taxes paid on laying of the pipelines is not restricted under Section 17 of the Central Goods and Services Tax Act, 2017. The Appellant added that one arm of the transfer pipeline is always connected to the storage tanks situated within the factory premises whereas the other arm is connected to the vessel (upon arrival); Once the loading/ unloading of Propane/Butane is completed from the vessel to the storage tanks, the transfer pipeline is then disconnected from the vessel and thus, it is clear that the transfer pipelines are part of factory premises itself. The appellant reiterated that the expression 'pipeline5 in the exclusion from the definition of 'plant and machinery' connotes long distance pipelines and not pipes running for short distance; in the case of the Appellant, these transfer pipes are running for a short distance from the jetty to terminal; Further, the expression 'factory' has not been defined under the GST law and therefore, the Appellant has placed reliance on the definition of 'factory' from the Central Excise Act, 1944 and Factories Act, 1948 ; both these laws have defined 'factory' to include 'precincts'. The appellant further stated that term “precincts” has been defined under various dictionaries as below:-

1.1 Cambridge International Dictionary of English “area around building

1.2 Collins English Dictionary “the surrounding region or an area”

1.3 Merriam webster “the region immediately surrounding a place?'

On perusal of aforesaid meanings, precinct would mean an area around building or a place. A conjoint reading of the term “factory” and “precincts” makes it abundantly clear that the factory includes the surrounding areas which in the case of the Appellant is the pipes laid from Jetty to Terminal. The appellant has also relied on the judgment of Bombay High Court in the matter of Reliance Industries [TS-226-HC-2017(BOM)EXC]. In this case, MODVAT credit was allowed in respect of 'Single Point Mooring' system situated in the seabed, used for unloading of imported and coastal consignments and pumping of raw materials holding that this should be considered as an extension to the 'factory' and in the case of NMDC Limited Versus Union Of India. [WPT No. 77 of 2021] also, the Chhattisgarh High Court, has issued a stay order against the revenue order in a similar, matter for allowance of input tax credit on goods and services used for laying of pipelines considering the provisions of Section 16 of the CGST Act. In their additional submission the appellant has also submitted copies of lease deed entered for Right of way for pipeline and relied on the orders of the Appellate authority for advance ruling, Chhattisgarh in the case of NMDC limited.

8.2 The averments made by the appellant are examined at length with reference to the provisions of the CGST Act and Rules made thereunder. The relevant provision of the CGST Act,2017 is extracted hereunder for the purpose of reference:-

17 (5) Notwithstanding anything contained in sub-section (1) of section 16 and sub section (1) of section 18, input tax credit shall not be available in respect of the following, namely:-

--------------

(c) works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service;

-----------------

Explanation.- For the purposes of this Chapter and Chapter VI, the expression -plant and machinery means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes,-

(i) land, building or any other civil structures;

(ii) telecommunication towers; and

(iii) pipelines laid outside the factory premises.

From the reading of the above provisions, it is crystal clear that the pipelines laid outside the factory premises is specifically excluded for the purpose of expression plant and machinery particularly for chapter V and Chapter VI. The intention of the Legislature in framing this expression, is to limit the vast definition of plant and machinery for the exclusive purpose of availability of Input Tax Credit on such plant and machinery and thereby the Parliament consciously prohibits the availability of the Input Tax Credit on pipelines laid outside the factory premises. The said exclusion applies to all such pipelines laid outside the factory be it small distance of 4 KM as contended by the Authorized Representative or long distance. When the exclusion has been explicitly provided in the Act, there is no need to borrow the definition from other acts including the subsumed Acts and accordingly the definition of factory as per Central. Excise Act or Factories Act, does not apply to this issue. The judgment of Bombay High Court in the case of Reliance Industries [TS-226-HC-2017(BOM)-EXC] relied on by the appellant relates to the MODVAT credit and therefore the provisions of the Central Excise Act and the CGST Act,2017 are not one and same and hence this judgment will not help the appellant, as the CGST Act,2017 specifically excludes the pipeline laid outside the factory premises for the purpose of determining the eligibility of Input Tax Credit. Further the appellant relied on the Appellate authority for advance ruling, Chhattisgarh, in the case NMDC Ltd. It is to be noted that under the provisions of sub-section (1) of section 103 of the CGST Act 2017, it is binding on the applicant only and not applicable to the appellant. Further even in such case, only stay order has been issued and final decision is still pending and this can be applied only in the identical circumstances which needs to be proved. Further the appellant relied on the judgment of Hon'ble High Court of Gujarat in the case of GSPL India Transco Ltd. (2016 [43] S.T.R.J23 (Guj). This judgment related to the capital goods under the Central Excise and the definition of capital goods under the Central Excise and GST is not pari-materia and hence the judgment relied on by the appellant would not be useful for the appellant.

8.3 It is pertinent to note that this pipeline is not used for making outward supply as found in the explanation to section 17(5) of the CGST Act,2017 as averred by the appellant. The contention that the transfer pipelines laid outside the factory premises for inward supply whereas the exclusion provided in the said explanation would be applicable for outward supply is not tenable. The exclusion provided therein reads as “pipelines laid outside the factory premises” and it would be applicable for both outward supply and inward supply. As the transfer pipelines would not fall under Plant and Machinery, the appellant is not eligible to avail input tax credit on the goods and services used for transfer pipelines, the foundations and structural support related to pipelines would also not eligible for ITC on the goods and services used for foundations and structural support related to pipelines. With regard to lease deed for Right of Way, the same is for the purpose of utilization of land that are required under the relevant Act which has nothing to do with this Act. In fact, the tax element if any involved for the said agreement also not eligible for input tax credit.

8.4 In view of the above, the Advance ruling authority of Tamil Nadu has rightly ruled that the input tax credit is not eligible for the pipeline laid outside the factory premises and the foundations and structural support for such pipelines.

9.1 In respect of the remaining two questions, the issues raised for advance lulling are common, both are taken up together for discussion and finding is as under:-

(i) Whether the applicant is eligible for availment of input tax credit of GST paid on goods and services used for foundation and structural support for the tanks?

(ii) Whether the applicant is eligible for availment of input tax credit of GST paid on goods and services used for foundation and structural support for such reservoir?

9.2 The Appellant stated that in the impugned ruling, the Advance Ruling authority has allowed the credit of tax paid on storage tanks and water tanks and has disallowed the credit only on the pile foundation which is necessary for construction/ erection of the storage/water tanks; that the storage tanks and water reservoir tanks (which are embedded on pile foundation) are extremely heavy in weight and cannot be constructed/erected without the foundation. Further they averred that huge quantities of Propane and Butane are stored in the storage tanks and that of water in the water tanks and this makes the tanks even heavier; Hence, a very strong and load bearing foundation is needed to support these tanks. The appellant .added that since the product inside the tank is stored in a refrigerated state, the tank needs to be elevated to allow free air circulation beneath the tank; It is to be noted that such pile foundation is specifically used for the storage and water tanks and other heavy structures and not throughout in the factory and this clarifies that the pile foundation is essential specifically for these tanks. The appellant stated further that explanation to Section 17(5), while defining the term 'plant and machinery', specifically includes the foundation of such plant and machinery. The Explanation is produced below for ready reference:-

“Explanation.- For the purposes of this Chapter and Chapter VI, the expression “plant and machinery” means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes,-

(i) land, building or any other civil structures;

(ii) Telecommunication towers; and.

(iii) Pipelines laid outside the factory premises.”

9.3 The appellant pleaded that it is clear from the above that where a machinery is fixed to earth by foundation, such foundation is included in the definition of 'plant and machinery; Since the storage and water reservoir tanks have been held to be plant and machinery by the Ld. Authority and thus eligible for input tax credit, the pile foundation which is a foundation essential for the same plant and machinery should also be allowed in accordance with the provisions of the GST law. In light of the above, the Appellant submits that the Ld. Authority has erred in observing that that these pile foundations are civil structures and not foundation for plant and machinery and the impugned ruling therefore merits to be set aside. The Authorised Representative stated further at the time of virtual hearing that in the case of wind mills also, foundation is laid to bear the load and hence in the case of storage tanks, pile foundation laid below the ground for load bearing of the tank.

Discussions of SGST Member:

10.1 The issue has been examined with reference to the grounds of the appeal and the Authorised Representative's contention put forth at the time of virtual personal hearing. The Authorised Representative's contention relied on the very explanation provided in section 17(5) of the CGST Act, 2017 and hence we need to examine the relevant provisions which is extracted above.

10.2 The appellant stated in the grounds of appeal that a pile foundation is defined as a series of columns constructed into ground to transmit load to a hard soil beneath; A pile is long cylinder made up of a strong material, such as concrete; Piles act as a steady support of structure built on top of them. Piles transfer the loads from structure to hard strata, rocks, or soil with high load bearing capacity. In the grounds of appeal the appellant stated that the piles are further extended to another 1.5m above the ground level upon which a pile cap /concrete foundation is made joining all the piles together to form a load bearing platform.

10.3 As per the National Building Code,2016, PART 6 STRUCTURAL DESIGN in Section 2, it has been stated that deep foundations like pile foundations; and other foundation systems to ensure safety and serviceability without exceeding the permissible stresses of the materials of foundations and the bearing capacity of the supporting soil/rock. and foundation has been defined as “That part of the structure which is in direct contact with and transmits loads to the ground (2.1.5)”. Further it has been stated in the said code (8.1 General) that “Piles find application in foundations to transfer loads from a structure to competent subsurface strata having adequate load-bearing capacity. The load transfer mechanism from a pile to the surrounding ground is complicated and is not yet fully understood, although application of piled foundations is in practice over many decades. Broadly, piles transfer axial loads either substantially by friction along its shaft and/or by end bearing. Piles are used where either of the above load transfer mechanism is possible depending upon the subsoil stratification at a particular site.

10.4 From the above, it is understood that the storage tanks require pile foundation based on soil condition as a part of structure to withstand the load. However, such pile foundation made of Cement, coarse aggregate, fine aggregate, lime, Surkhi, steel, timber and other materials and therefore it is basically a civil structure.. The lower advance ruling authority have ruled that storage tanks are falling under the definition of “ plant and machinery” for which the jurisdictional authority have not raised objection by way of filing of appeal, such ruling attained finality. The foundation has been defined in National building code, 2016 as “That part of the structure which is in direct contact with and transmits loads to the ground.”. Here in question is whether foundation is eligible for input tax credit on the goods and services used for such foundation as part and parcel of plant and machinery even though it would fall under civil structure.

10.5 As per the National Building Code, 2016, the foundation will transmit the load of the tanks to the ground. Thus the pile foundation on which plant and machinery i.e., storage tanks and water reservoir tanks are erected would transmit the load for the tanks to the ground and therefore the pile foundation would be eligible for the purpose of availing input tax credit on the goods and services used therein, as included in the definition of plant and machinery in the provisions of the section 17(5) of the CGST Act, 2017.

Discussions of CGST Member

11.1 I respectfully disagree with the above conclusion of my brother Member on the credit eligibility for the 'Pile foundation' considering the same as 'Plant and Machinery”. In the case at hand, the Input Tax Credit in respect of the Storage Tanks& Water tanks along with the foundation and structural support is held as admissible credit by the LA subject to certain conditions. The appellant currently claims the Input Tax Credit of the GST paid on the composite supply of Pile Foundation laid on the Sub-ground level to strengthen the load bearing capacity of the earth/ground, over which with further necessary foundation and structural support the Tanks are fabricated/installed and commissioned is denied by the LA. The appellant has not denied that the tanks are installed with foundation which is laid over the earth strengthened by the Piles. The appellant claim that as the Pile foundation strengthens the earth to bear the load of the tanks, this 'Pile foundation' should be considered as 'Plant and Machinery' and not to be excluded as to be in the genre of 'any other civil structure' excluded from the definition of 'plant and Machinery' for the purposes of ITC

11.2 The appellant has stated that “Their project site is located close to the sea, the soil is filled up with clay with a very high ground water table (<1 m), this would mean that the load bearing capacity (weight per sqm the soil can withstand) is very low. Since the storage tanks as well as water tanks are quite heavy, they need to increase this load bearing capacity. Therefore, the foundation by way of piling is must.”

11.3 The Explanation of 'Plant and Machinery' for the purposes of Input Tax Credit is defined as under:-

“Explanation.- For the purposes of this Chapter and Chapter VI, the expression “plant and machinery” means apparatus, equipment, and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services or both and includes such foundation and structural supports but excludes,-

(i) land, building or any other civil structures;

(ii) Telecommunication towers; and

(iii) Pipelines laid outside the factory premises.”

From the words of the explanation above, “Plant and Machinery” are apparatus, equipment, machinery fixed to earth by foundation or structural support and includes the foundation and such structural supports by which the machinery is fixed to earth.

11.4 In the case at hand, the 'Pile foundation' is the foundation made to strengthen the earth, upon which the tanks are installed, with necessary structural supports. The Pile foundation is made to strengthen the project site though the piling intervals may depend on the location of the Tanks. This docs not make the 'Pile Foundation' as the foundation by which the apparatus, equipment and machinery are fixed to earth. In the case at hand, it is clearly seen that the Storage tanks are placed on the elevated foundation made above ground and the water tanks are placed on the foundation on the ground level and the piles are throughout the project site(as can be seen in the Picture at Para 5 above). The 'Pile Foundation' is an added measure in view of the nature of the soil of the 'Project site' and in cannot be claimed as the 'foundation by which the tanks are fixed to earth', to be eligible as 'Plant and Machinery' as per the above explanation. Rather, it can be said that the piles support the earth to withstand the load of the Tanks and are to be considered as 'any other civil structure', excluded from the definition of 'plant and Machinery'. The reliance on the decision of the Third Bench of the Maharashtra Sales Tribunal in the case of Priyadarshini Polysacks do not help the case at hand as , 'Plant and Machinery' are not defined for the purposes of Rule54(g) of MVAT, under which the claim/ decision is arrived at in that case, whereas GST law defines 'Plant and Machinery' for the purposes of ITC.

11.5 Further, National Building code 2016 Part 6 STRUCTURAL DESIGN in Section 2 referred in Para 10.3 by the learned State Member speaks about 'Section 2 Soils and Foundations'. The code (Part6/Section 2) deals with the Structural design aspects of foundation to be laid in the earth and covers the design principles involved in different types of foundations to be made depending on the nature of soil, geo-location, terrain, wind, etc and the sustaining load to be put up on the earth. This do not help to substantiate that the 'Pile foundation' in the case at hand is to be considered as 'Plant and Machinery' for the purposes of 'Input Tax Credit' of GST Paid on the said works.

11.6 I differ with the view that since the credit extended to the 'Storage Tanks' holding them as 'Plant and Machinery' is not disputed, credit is to be allowed for the pile foundation, as these will transmit the load of tanks to the ground. I find that the LA has rightly extended the credit of GST paid on the works contract service availed by the appellant for Installation & commissioning of the Tanks', considering the Tanks' as 'Plant and Machinery' and the variance is only with respect of 'Pile foundation' which is a foundation laid primarily for the project site and not specifically contained to the Tanks'. Based on the above views, I hold that 'Pile foundation' laid to the 'Project site' are not the 'foundation' included as 'Plant and Machinery' and therefore credit of GST Paid on such works contract for 'Pile foundation' are restricted as per Section 17(5) of the GST Act and not available as ITC.

12. In view of the above facts, we rule as under:

RULING

1. For reasons discussed above, we do not find any reason to interfere with the order of the Advance Ruling Authority relating to question No. 1. The subject appeal is disposed of accordingly.

2. On Question No. 2 & 3, i.e., on the eligibility of ITC paid on the works contract service for 'Pile foundation to the project site' also claimed as foundation for the 'storage tanks' and “water tanks', as there is difference of opinion between the Members, no ruling is offered as per Section 101(3) of the CGST/TNGST Act 2017.