Sri Malai Mahadeshwara Swamy Kshethra Development vs. N/A

(AAR (Authority For Advance Ruling), Karnataka)

ORDER UNDER SECTION 98(4) OF THE CENTRAL GOODS & SERVICES TAX ACT, 2017 AND UNDER 98(4) OF THE KARNATAKA GOODS & SERVICES TAX ACT, 2017

1. M/s Sri Malai Mahadeshwara Swamy Kshethra Development Authority, MM Temple Building, MM Hills, Sankama Nilaya Road, MM Hills Road, Chamarajanagar-571490 (hereinafter called “the applicant”), having GSTIN number 29AABCI1411R1ZD, has filed an application for Advance Ruling under Section 97 of CGST Act, 2017 read with Rule 104 of CGST Rules 2017 86 Section 97 of KGST Act, 2017 read with Rule 104 of KGST Rules 2017, in FORM GST ARA-01 discharging the fee of ₹ 5,000-00 each under the CGST Act and the KGST Act.

2. The Applicant is registered under provisions of the Goods and Services Act, 2017. The applicant had sought advance ruling in respect of the following activities are liable to taxes or not narrated as under:

“1. The Authority has floated tenders for collection of vehicle entry fees, which is an access to temple premises. The highest bidding was at ₹ 56,08,077-00. The Authority wants to know whether KGST/ CGST has to be collected on the said amount.

2. The Authority sells laddoos, kallu sakkare, Thirtha Prasada, Cloth bags, and other articles beginning from ₹ 5/- up to ₹ 100/-. Whether KGST / CGST has to be collected on the same.

3. The Authority has approximately 100 shops which are given on lease through auction. Once in a year the Authority conducts public auction and the highest bidder is permitted to run the shop for a year. Whether KGST / CGST has to be collected on the same.

4. The Authority also conducts e-procurement auction for the service of tonsuring the heads of the devotees. The highest bidder is given the right to collect fees for tonsuring the head. Whether KGST / CGST has to be collected on the tendered amount.

5. The Authority has 16 Cottages/ rooms with 242 rooms which are given on rent and collects “vasathi nidhi kanike”. The Kanike ranges between ₹ 130 and ₹ 750. Whether KGST / CGST has to be collected on the same.

6. The Authority collects seva fees and Utsava Fees ranging from ₹ 50/- to ₹ 15,000-00 which are in the nature of religious activities. Whether KGST / CGST has to be collected on the same.

7. The Authority also collects “Special Darshan Fees” of ₹ 100, ₹ 150, and ₹ 300 for darshan of Malai Mahadeshwara Swamy. Whether KGST / CGST has to be collected on the same.

8. The Authority runs one Kalyana Mandapa at Kollegal, in Chamarajanagar District. The right to collect service charges is through tender cum auction. The highest bidder is permitted to collect service charges. Whether KGST / CGST has to be collected on the same.

9. The Authority also runs a Kalyana Mantapa at M.M.Hills and the rent charged per day is at ₹ 5000-00. Whether KGST / CGST has to be collected on the same.

10. The Authority floats tenders for collection of Vahana Pooja in front of the temple. The highest bidder is given the right to collect the charges. Whether KGST / CGST has to be collected on the same.

11. The Authority is collecting vehicle entry fees which is an access to temple premises. Whether such collection of entry fee is liable to KGST / CGST may be clarified.

12. The Authority wants to float tenders for similar such activities in future. Whether the rights given on tender or auction is liable to CGST/ KGST may be clarified.”

3. The applicant company furnishes some facts relevant to the stated activity:

a. The Applicant is constituted under the MM Hills Development Authority Act, 2014, headed by the Chief Minister of Karnataka. The said authority It is also registered as a religious and charitable institution under Section 12-AA of the Income Tax Act.

b. It is pertinent to note that the applicant has been rendering various Seva services and supplies Prasada items to the pilgrims in Sri Mahadeshwara Swamy Temple at Male Mahadeshwara Hills. It also rents out accommodations and other commercial places, either by itself or sells off the rights to provide such services and in lieu of this collects the money consideration.

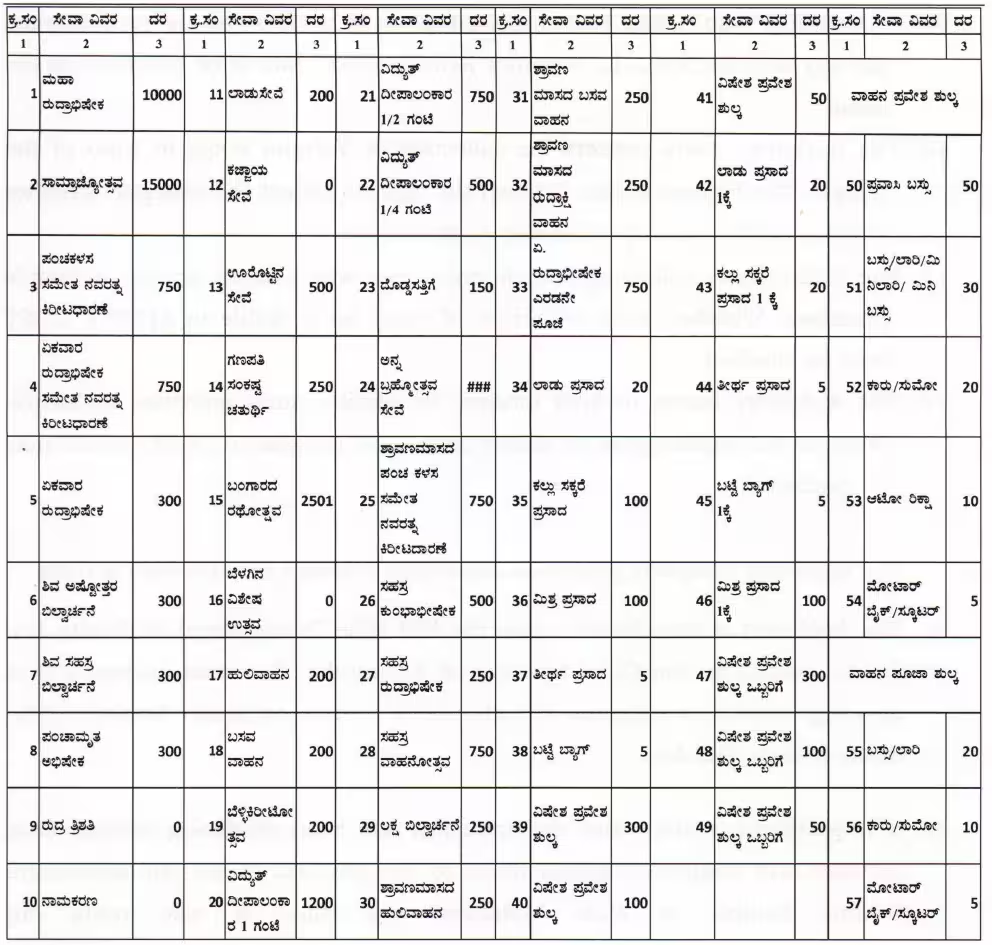

c. With regard to Seva Services, the Applicant states that the Authority is performing several Seva Services in the form of Pooja to the main deity, the Lord “MALAI MAHADESHWARA SWAMY” in the precincts of temple and charges the prescribed rates for the services offered to the devotees. The rates charged for different services are as under.

d. The Seva services provided by the applicant are as under:

e. Further, the applicant had 4 to 5 lodges where it is providing accommodation services to the pilgrims and devotes visiting the temple and for this it is collecting money consideration where the value of such supply of service does not exceed ₹ 1,000-00 per day per unit of accommodation and hence the applicant Authority is not collecting any GST on the same.

f. The applicant had two kalyanamatapas out of which one is located at Malai Mahadeshwara Hills and the other at Kollegal where it collects money consideration as rentals at ₹ 10,000-00 or more per day basis. Therefore the Authority is desirous to know the correctness of collection of GST?

g. Further the applicant is also rendering other services and is desirous to know the whether the said service which attracts GST or not. The details of such other services are as under.

(a) Transfer of the right to collect entry fee on vehicles,

(b) Leasing of commercial shops through auctioning,

(c) Transfer of the right to tonsure the heads of the devotees through auction/tendering, and

(d) Transfer of the right to collect entry fee for Darpana Mandira through auction/tendering.

In respect of these services, the Authority either conducts auction or calls for tenders and collects consideration.

h. The Applicant is presently collecting the money consideration from the devotees for rendering of the seva and accommodation services, auctioning and allotment of tenders, etc and remitting the same to the bank account of the Development Authority. The GST collected on different heads is also remitted to the different “Heads of Account” of the Government.

PERSONAL HEARING / PROCEEDINGS HELD ON 13.11.2019.

4. Sri Y.C.Shivakumar, Advocate, of the applicant appeared for personal hearing proceedings held on 13.11.2019 86 reiterated the facts narrated in their application.

4.1 The DAR argued that the Applicant is a Government Department falling under the Department of Religious and Endowments and the Revenue Secretariat. The majority of its services are in the nature of Religious ceremony and the same are being exempted from the payment of taxes as per Notification 2/2017 Central Tax (Rate) dated 28-06-2017. However, the applicant wants to know the whether these enumerated activities of the Authority is a supply or not and if the same are considered as supply, which of those are taxable under provisions of the GST Act. The details of services are mentioned as under:

a) Transfer of the right to collect entry fee on vehicles, i.e. vehicles coming to the precincts of the Malai Mahadeshwara Hills

b) Transfer of the right to tonsure the heads of the devotees, transfer of the right to collect entre fee for the Darpana Mandira

c) Leasing of commercial shops, either through auctioning or through issue of tenders.

d) The Advocate further stated that all the above activities were hitherto managed by the temple staff themselves. Since the Applicant wants to transfer these rights to third parties, it wants to know the rate of rate on each of the above.

4.2 At the time of hearing, the Advocate furnished a copy of Certificate No.F.No. D-471/12AA/CIT/MYS/09-10, dated 11-03-2010, issued under Section 12-AA of the Income Tax Act, 1961, by the Commissioner of Income Tax, Mysore. And also furnished a copy of Certificate No.F.No.S-471/80G/CIT/Mys/2010-11, dated 11-03-2010, issued under 80G of the Income Tax Act certifying that the donations made to the Sri Malai Mahadeshwara Swamy Temple Trust, Shri Malai Mahadeshwara Swamy Temple, MM Hills, Kollegal, are exempt under Section 80G (5) (vi) of the Income Tax Act, 1961, in the hands of the donor (s) subject to the limit prescribed therein.

5. FINDINGS 8s DISCUSSION:

5.1 We have considered the submissions made by the applicant in their application for advance ruling as well as the submissions made by Sri Y.C. Shivakumar, Advocate of the applicant during the personal hearing. We have also considered the issues involved, on which advance ruling is sought by the applicant, and relevant facts.

5.2 At the outset, we would like to make it clear that the provisions of both the Central Goods and Services Tax Act, 2017 and the Karnataka Goods and Services Tax Act, 2017 (hereinafter referred to as CGST Act, 2017 and KGST Act, 2017) are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the CGST Act would also mean a reference to the corresponding similar provisions under the KGST Act.

6. The questions posed before the Authority can be classified based on the nature of the activity done by the applicant into the following categories:-

a. Seva services which are in the form of worship and darshan of the diety for which charges are collected by the applicant from the devotees

b. Sales of prasadam which are sold to the devotees by the applicant

c. rental services of commercial premises

d. Leasing of the right to deliver services for consideration

e. rental services of accommodation

f. leasing services of commercial premises

g. services for providing access to the premises for vehicles

7. The question sought in the serial number 6 pertains to rendering of the seva services by the applicant in the form of religious ceremony to devotes who visits the temple and book the aforesaid pooja and seva services to deity by depositing money consideration in the name of the applicant such as Maha Rudrabhisheka, Samrojyotsava, Panchakalasa Sametha Navarathna Keerita Dharane, Ekavara Rudrabhisheka, Shiva Asthothara Bilvarchane, Shiva Sahasra Bilvarchane, Panchamruta Abhisheka, Rudra Tripati, Namakarana, Ladu Seve, Kajjaya Seve, Urottina Seve, Ganapathi Sankasta Chaturthi, Bangarada Rathotsava, Belagina Vishesha Utsava, Hulivahana, Basava Vahana, Belli Keeritotsava, Vidyuth Deepalankara, Dodda Sattige, Anna Brahmotsava Seve, Shravanamasada Pandha Kalasa Sametha Navarathna Keerita Dharane, Sahasra Kumbabhisheka, Sahasra Rudrabhisheka, Sahasra Vahanotsava, Laksha Bilvarchane, Sharavana Masada Hulivahana, Shravana Masada Basava Vahana, Shravana Masada Rudrakshi Vahana, Rudrabhisheka Second Pooja, Ladu Prasada, Kallu Sakkare Prasada, Mishra Prasada, Thirtha Prasada, which are in the form of religious ceremony. These are related to the question no. 6 of the applicant. Further, the applicant is also collecting charges for special darshan facilities to the devotees which is related to the issue no.7.

7.1 With reference to taxability or otherwise of the above seva transactions, it is seen that the services provided by the applicant under the category of seva services are for religious ceremonies and poojas. Sub-section (1) of Section 7 of the CGST Act, 2017 reads as under:

“7. Scope of Supply.- (1) For the purposes of this Act, the expression “supply” includes -

(a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, license, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business;

(b) . . . . .

(c) . . . . .

7.2 From the above it can be seen that the seva services are not in the course or furtherance of business and hence the same cannot be covered under the scope of supply, though there is money received by the applicant for the same. Further, even the definition of consideration also states that the money received should be in relation to the supply of goods or services or both and since the same does not fall under supply, the money received is not a consideration in relation to the supply of goods or services or both. Hence the seva services provided by the applicant is not a supply and hence is not a part of the turnover and hence cannot be taxed under the GST Act. Further, as per entry no. 13 of Notification No.12/2017- Central Tax (Rate) services by a person by way of conduct of any religious ceremony is also exempt from tax. Hence in lieu of both, the seva charges and the special darshan charges collected by the applicant is not liable to tax under the GST Act.

8. Regarding the accommodation services provided by the applicant to the pilgrims, which is related to the question 5, it is stated that the value of such service is less than ₹ 1000-00 per day per unit of accommodation. The following are also observed:

8.1 Since the accommodation services is provided by the applicant to the pilgrims and the consideration is used to maintain the precincts of the accommodation, and all the ingredients of business is present, the same is in the course of business and hence the same would be covered under the scope of supply as per sub-section (1) of section 7 of the CGST Act, 2017.

8.2 Entry No. 14 of Notification No. 12/2017 - Central Tax (Rate) dated 28.06.2017 states that “Services by a hotel, inn, guest house, club or campsite, by whatever name called, for residential or lodging purposes, having declared tariff of a unit of accommodation below one thousand rupees per day or equivalent” and covered by SAC Heading 9963 would be exempt from CGST. Even entry no. 13 of Notification No.12/2017- Central Tax (Rate) dated 28.06.2017 allows exemption of the services by way of renting of precincts of a religious place meant for general public, owned and managed by an entity registered as a charitable or religious trust under section 12AA of the Income Tax Act, 1961 and the proviso to that entry states that the exemption is not applicable to renting of rooms where charges are one thousand rupees or more per day. Hence both these exemption entries are applicable in case of the applicant if the rentals for rooms are less than ₹ 1,000-00 per day.

8.3 The applicant is running a lodging house where the accommodation services for lodging purpose is provided to the pilgrims and visitors and is charging the consideration based on a declared tariff. The applicant himself states that the declared tariff of a unit of accommodation is less than one thousand rupees per day and hence the same is squarely covered under the exemption entry stated above.

9. Regarding the sales of prasadam by the applicant, which is related to the question no. 2, it is seen that the entry no. 98 of the Notification No.2/2017 -Central Tax (Rate) dated 28.06.2017 exempts the goods falling under “Prasadam supplied by religious places like temples, mosques, churches, gurudwaras, dargahs, etc.”. It is very clear from the above, the items of prasadam sold by the applicant are exempt from GST. But if the applicant sells items other than edible items falling under HSN 2106, like cloth bags, and other articles, then such goods are liable to tax at the appropriate rates as they do not form part of prasadam.

10. Regarding the question no.1 related to the auctioning for collection of vehicle entry fees, question no.4 related to auctioning of service of tonsuring the heads of devotees, question no.8 related to the auctioning of right to collect service charges and question no.10 related to auctioning of the right to collect charges for vahana pooja, it is seen that in all of them, the applicant is transferring the right to provide certain services for a consideration and is not itself providing the services. These are supply of services falling under SAC 9997 and are covered under the entry no.35 of Notification No.11/2017- Central Tax (Rate) dated 28.06.2017 and are liable to CGST at the rate of 9%.

11. Regarding the question no.3 relating to leasing out of commercial shops, the same is examined and the entry no.13 of Notification No.12/2017- Central Tax (Rate) dated 28.06.2017 reads as under:

| 13. |

Heading 9963 or Heading 9972 or Heading 9995 or any other Heading of Section 9 |

Services by a person by way of - (a) conduct of any religious ceremony; (b) renting of precincts of a religious place meant for general public, owned and managed by an entity registered as a charitable or religious trust under section 12AA of the Income Tax Act, 1961 or a trust or an institution registered under sub-clause (v) of clause (23C) of section 10 of the Income Tax Act or a body or an authority covered under clause (23BBA) of section 10 of the said Income Tax Act: Provided that nothing contained in entry (b) of this exemption shall apply to,- (i) Renting of rooms where charges are one thousand rupees or more per day (ii) Renting of premises, community halls, kalyanamandapam or open area, and the like where charges are ten thousand rupees or more per day; (iii) Renting of shops or other spaces for business or commerce where charges are ten thousand rupees or more per month |

|

The same is examined and found that the applicant is charitable or religious trust under section 12-AA of the Income Tax Act and is providing shops for business and collecting rent by auctioning the same for a year. In case if the rent for such shops falls below ₹ 10,000-00 per month, then such rentals are covered under the entry no. 13 of the Notification No.12/2017- Central Tax (Rate) dated 28.06.2017 and therefore is exempted from the payment of GST on the same. In case, if the rent is more than ₹ 10,000-00 per month, the same would be liable to tax at 9% CGST under SAC 9972 under entry no.16 of Notification No.11/2017- Central Tax (Rate) dated 28.06.2017.

12. The question in No.9 related to the provision of services of Kalyanamantapam by the applicant, the entry no.13 of Notification No.12/2017 - Central Tax (Rate) dated 28.06.2017 is verified. The applicant being a charitable trust under section 12-AA of the Income Tax Act, 1961 is renting the Kalyanamandapam where the charges are less than ₹ 10,000-00 per day and hence the same is covered under this entry and hence is exempt from the levy of CGST.

13. Regarding the question in No.11, it is seen that the applicant is collecting vehicle entry fee which is an access to the temple premises, the same is verified and the entry no.23 of Notification No.12/2017- Central Tax (Rate) dated 28.06.2017 reads as under

| 23 |

Heading 9967 |

Service by way of access to a road or a bridge on payment of toll charges. |

Nil |

Nil |

The access as per the applicant, is provided to the temple premises and not to a road or a bridge and hence is not covered under this entry. Further, it is not even renting of precincts of a religious place meant for general public to be covered under entry no.13 of Notification No.12/2017 - Central Tax (Rate) dated 28.06.2017. Hence this is not covered under any exemption notification. Further SAC is verified and the same is covered under SAC 9967 and hence covered under entry 11 (H) of Notification No.11/2017- Central Tax (Rate) dated 28.06.2017 and liable to CGST at 9%.

14. Regarding the question in No.12, the applicant states that he is desirous to float tenders for similar such activity in future. In this regard, it is observed that the applicant himself is not providing any particular service but desires to transfer the right to provide services against a consideration to be received by the acceptor, for a consideration. The provision of a particular service and transfer of the right to perform a service are different and these transfers of rights to collect consideration for a particular service by the recipient of the contract given by the applicant would be supply of services falling under SAC 9997 and are covered under the entry no.35 of Notification No.11/2017- Central Tax (Rate) dated 28.06.2017 and are liable to CGST at the rate of 9%.

15. In view of the foregoing, we pass the following

RULING

1. Regarding question no.1 related to the auctioning for collection of vehicle entry fees, question no.4 related to auctioning of service of tonsuring the heads of devotees, question no.8 related to the auctioning of right to collect service charges and question no.10 related to auctioning of the right to collect charges for vahana pooja - are supply of services falling under SAC 9997 and are covered under the entry no.35 of Notification No.11/2017-Central Tax (Rate) dated 28.06.2017 and are liable to CGST at the rate of 9%. Similarly, they are also liable to tax at 9% under KGST under entry no.35 of Notification (11/2017) No. FD 48 CSL 2017 dated 29.06.2017.

2. Regarding question no.2, the sales of prasadam by the applicant, is exempt from tax as per entry no. 98 of the Notification No.2/2017 - Central Tax (Rate) dated 28.06.2017 and entry no.98 of Notification (02/2017) No. FD 48 CSL 2017 dated 29.06.2017. But if goods other than prasadam are sold, they would be liable to tax at appropriate rates applicable to those goods.

3. Regarding question no.3, relating to renting of commercial shops, the services are exempt if the rental value is less than ₹ 10,000-00 per month per shop as they are covered under the entry no. 13 of the Notification No.12 /2017- Central Tax (Rate) dated 28.06.2017 and entry no.13 of the Notification (12/2017) No. FD 48 CSL 2017 dated 29.06.2017. But if the rent per shop is more than ₹ 10,000-00 per month, the same would be liable to tax at 9% CGST under SAC 9972 under entry no.16 of Notification No.11/2017- Central Tax (Rate) dated 28.06.2017 and at 9% KGST under entry no.16 of Notification (11/2017) No. FD 48 CSL 2017 dated 29.06.2017.

4. Regarding question no.5 relating to providing of services of accommodation to pilgrims where the charges are less than ₹ 1000 per day per room, the same is exempt vide Notification No.12/2017 - Central Tax (Rate) dated 28.06.2017 and Notification (12/2017) No. FD 48 CSL 2017 dated 29.06.2017.

5. Regarding question no.6 relating to collection of seva charges and question no.7 relating to the collection of special darshan charges, the same is exempt from CGST and KGST as they are not covered under supply and also exempt as they are covered under entry no 13(a) of Notification No.12/2017- Central Tax (Rate) dated 28.06.2017 and Notification (12/2017) No.FD 48 CSL 2017 dated 29.06.2017 respectively.

6. Regarding question no.9, relating to renting out Kalyanamandapams, the same is exempt from CGST and KGST, if the rental is less than ₹ 10000-00 per day, as per entry no 13(b) of Notification No.12/2017- Central Tax (Rate) dated 28.06.2017 and Notification (12/2017) No.FD 48 CSL 2017 dated 29.06.2017 respectively.

7. Regarding question no.11, relating to collecting of entry fees providing access to the temple, the same is liable to tax at 9% under CGST Act and at 9% under KGST Act, as per entry 11(ii) of Notification No.11/2017- Central Tax (Rate) dated 28.06.2017 and Notification (11/2017) No. FD 48 CSL 2017 dated 29.06.2017.

8. Regarding question no.12, relating to future tendering of the right to collect charges and provide services, the same is liable to tax at 9% under CGST Act and at 9% under KGST Act as per entry no.35 of Notification No.11/2017-Central Tax (Rate) dated 28.06.2017 and Notification (11/2017) No. FD 48 CSL 2017 dated 29.06.2017.