New GST on Air Conditioners in India: Everything You Need to Know

Air conditioners (ACs) are no longer just luxury appliances—they’re becoming a necessity in India’s scorching summers. But when buying an AC, have you considered how much tax you’re paying? This blog breaks down the GST (Goods and Services Tax) applicable on air conditioners, explains the HSN code , and highlights how it impacts your final purchase price.

Book A Demo

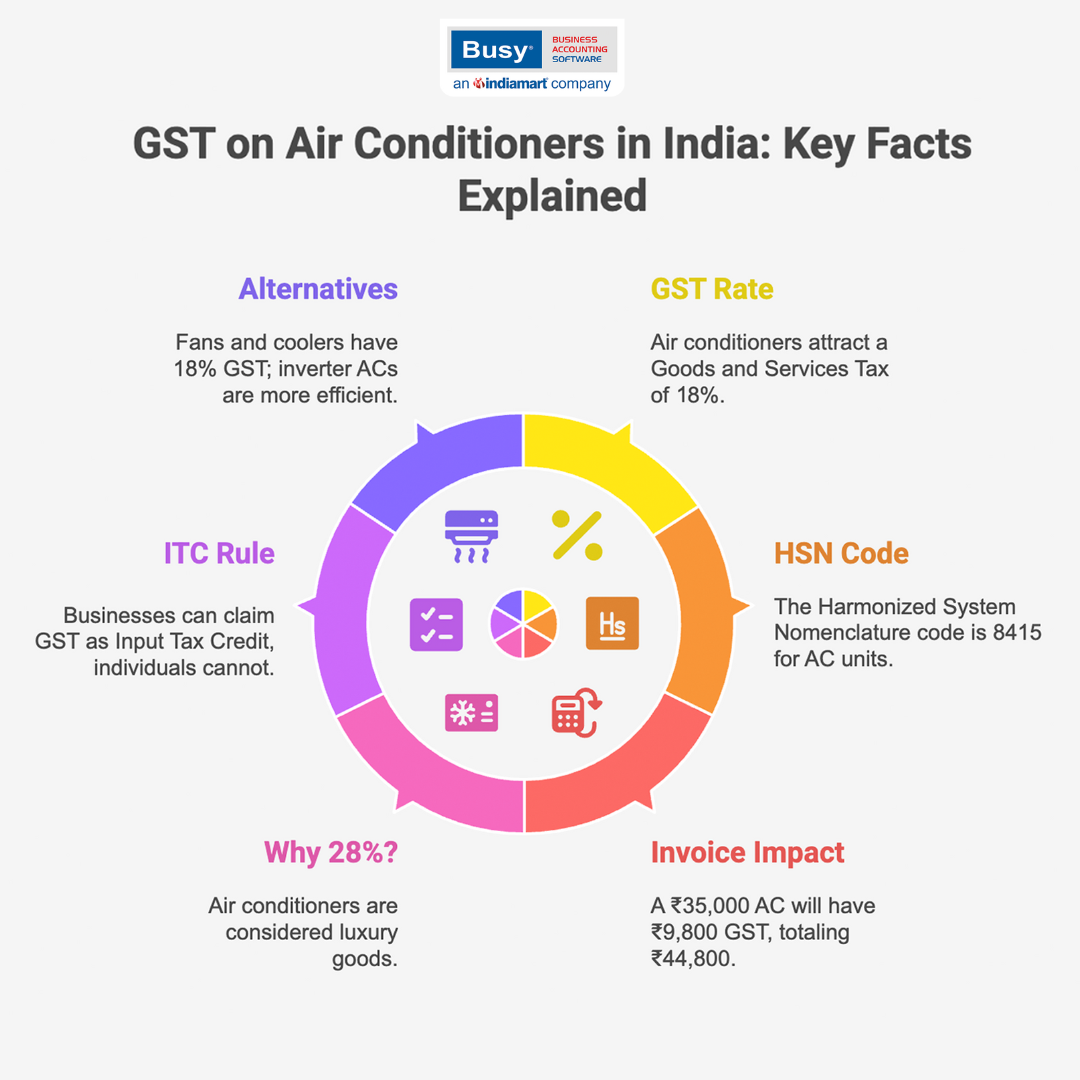

New GST Rate on Air Conditioners in India

The Government of India is updating GST rates effective after 22 Sep 2025. Below are the expected new GST rates for air conditioners and related cooling options (no compensation cess).

| Product | New GST Rate |

|---|---|

| Air Conditioner (all types: split, window, inverter) | 18% |

Alternatives with Lower Energy Use and Low New GST Rates

If you’re looking for efficient cooling options, consider:

| Product Type | New GST Rate |

|---|---|

| Ceiling fans | 18% |

| Air coolers | 18% |

| Inverter-based ACs | 18% (lower power use vs conventional) |

Although ACs are now at 18%, inverter-based models reduce energy bills and long-term operating cost.

Old GST Rate on Air Conditioners

Under GST, air conditioners fall under the highest tax slab of 28%. This rate categorizes ACs as “luxury or sin goods,” placing them in the same bracket as items like cars and high-end electronics.

| Product | GST Rate |

|---|---|

| Air Conditioner (all types: split, window, inverter) | 28% |

This rate is uniform across both residential and commercial buyers.

HSN Code for Air Conditioners

The HSN (Harmonized System of Nomenclature) code for air conditioners is 8415. This includes machines and appliances for treating air (whether or not they include a means for humidity control or temperature control).

| Product Type | HSN Code | Description |

|---|---|---|

| Air Conditioners | 8415 | Self-contained or split-system AC units |

Retailers and manufacturers must use this HSN code when invoicing under GST .

GST Calculation Example

Let’s assume you’re buying a split AC for ₹35,000 (base price).

- Base Price: ₹35,000

- GST @28%: ₹9,800

- Total Invoice Value: ₹35,000 + ₹9,800 = ₹44,800

So, your ₹35,000 AC actually costs ₹44,800 after GST is applied.

Why ACs Attract 28% GST

The government considers air conditioners a non-essential, luxury item. Unlike essentials such as food, books, or medicines which fall under lower tax brackets (0–12%), ACs are taxed at 28% to:

- Discourage excessive power usage

- Promote energy efficiency and sustainable alternatives

- Maintain a broader revenue base under GST

Input Tax Credit (ITC) on ACs

For Businesses:

If you’re a business buying ACs for commercial use (e.g., offices, stores, hotels), you can claim ITC on the GST paid.

Conditions to claim ITC:

- You are a GST-registered business

- The AC is used for business operations

- You have a proper tax invoice

For Individuals:

Home users cannot claim ITC, as personal consumption doesn’t qualify under GST rules .

Impact on Consumers

The 28% GST significantly increases the cost of buying an air conditioner. For middle-class families, this can be a big jump in expense, especially considering the base price already includes manufacturing, logistics, and dealer margin.

Many consumers delay purchases or opt for cheaper models to reduce tax liability. This also affects seasonal sales trends in the electronics market.

Alternatives with Lower GST

If you’re looking for energy-efficient cooling options with lower tax rates, consider:

| Product Type | GST Rate |

|---|---|

| Ceiling fans | 18% |

| Air coolers | 18% |

| Inverter-based ACs | 28% (still, lower power use) |

Although ACs are taxed at 28%, inverter-based models reduce energy bills and have a lower long-term operating cost.

Unique Features of BUSY Accounting Software For the Air Conditioner Industry

- Track AC models by brand, tonnage, star rating, and features with detailed inventory management.

- Manage each AC unit using serial numbers for warranty and service tracking.

- Create job cards for installations, servicing, and repairs with technician assignments.

- Configure seasonal discounts, brand schemes, and bundled offers with ease.

- Define customer-specific pricing and dealer-wise margins or incentives.

- Access actionable reports like model-wise sales.

Final Thoughts

While air conditioners offer comfort, the 28% GST adds a significant amount to the final price. Understanding how GST works on appliances like ACs can help you make better financial decisions—whether you’re a homeowner or a business. And if you’re running a commercial space, don’t forget to claim your input credit!