New GST on Batteries: Auto, Inverter, and More

Quick Summary

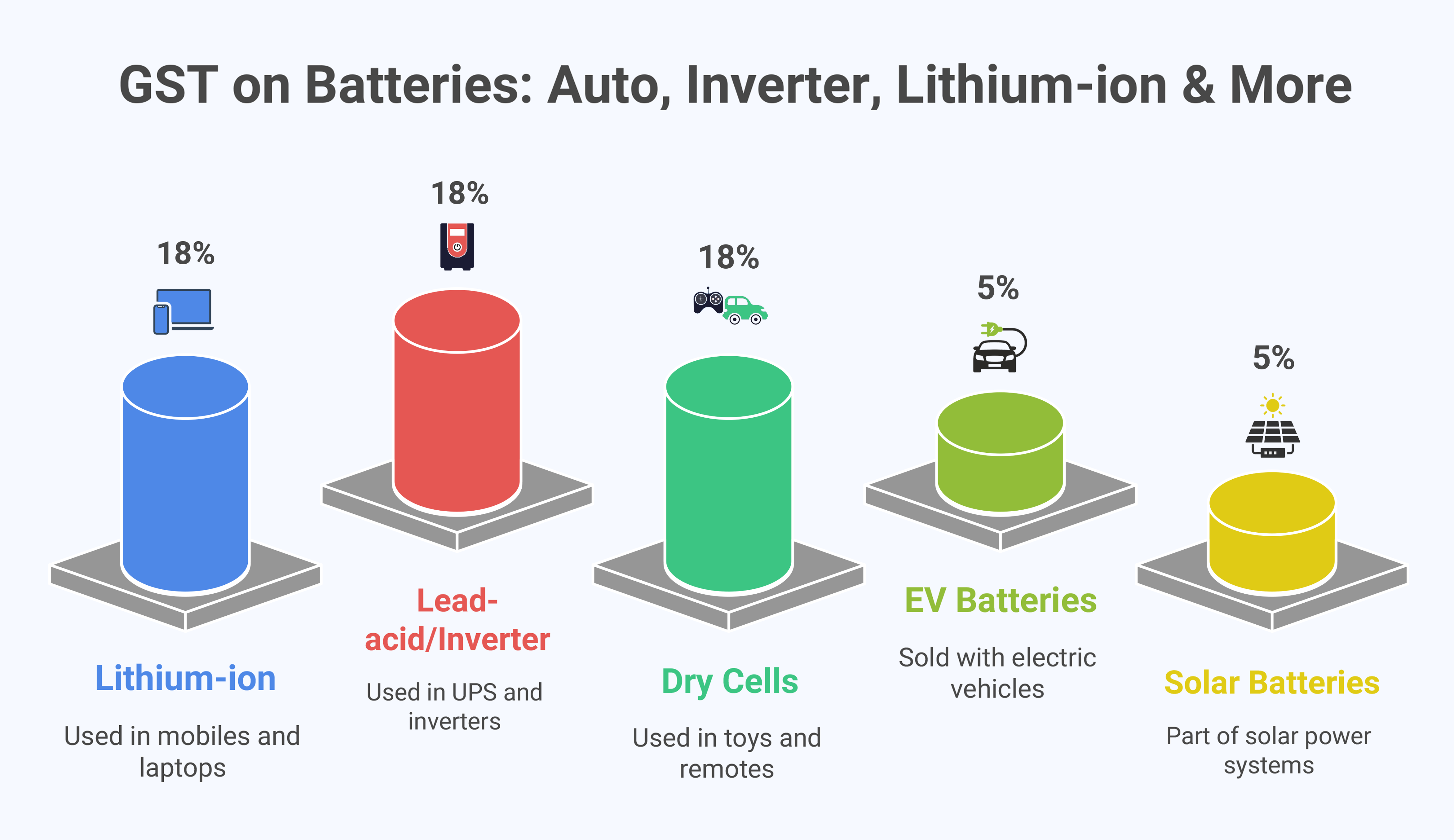

- The GST rate for automotive, inverter, lithium-ion, and UPS batteries in India is now 18%.

- Solar batteries have a lower GST rate of 5% when sold with a solar power system.

- Previously, lead-acid car and inverter batteries had a GST rate of 28%.

- Lithium-ion batteries are taxed at 18% due to their energy-efficient technology.

- Businesses can claim Input Tax Credit on batteries used for business operations if they are GST-registered.

Batteries are used in a wide range of applications — from cars and bikes to inverters and UPS systems. If you’re in the business of buying, selling, or using batteries, it’s important to understand how the Goods and Services Tax ( GST ) applies to them. In this blog, we’ll explain the gst on battery and break down the tax rates for different types of batteries used in homes, vehicles, and offices.

Book A Demo

New GST Rate on Batteries in India

The Government of India is updating GST rates effective after 22 Sep 2025. Below are the expected new GST rates for Batteries (no compensation cess).

New GST Rate on Batteries in India

The gst rate on battery varies depending on the type of battery and its usage. Here’s a breakdown of the common categories and their respective GST rates:

| Battery Type | New GST Rate | Notes |

|---|---|---|

| Automotive (lead-acid) battery | 18% | Used in cars, bikes, trucks, etc. |

| Inverter battery (lead-acid) | 18% | Typically used at homes/offices |

| Lithium-ion battery | 18% | Used in smartphones, EVs, laptops |

| UPS battery | 18% | Backup for computers or servers |

| Solar battery | 5% | Only with a solar power system |

Get a Free Trial – Best Accounting Software For Small Business

Old GST Rate on Batteries?

(Old GST Rates – Applicable Until 21st September)

The gst rate on battery varies depending on the type of battery and its usage. Here’s a breakdown of the common categories and their respective GST rates:

| Battery Type | Use Case | GST Rate |

|---|---|---|

| Lead-acid car battery | Automobiles | 28% |

| Lead-acid inverter battery | Home/office power backup | 28% |

| UPS battery | Computer/server backup | 18% |

| Lithium-ion battery | Smartphones, EVs, gadgets | 28% |

| Solar battery (with solar panel) | Renewable energy use | 5% |

Get a Free Trial – Best Accounting Software For Small Business

GST on Automotive Batteries

- Battery GST rate for car or bike batteries is 28%.

- Includes lead-acid batteries used in petrol or diesel vehicles.

- Same rate applies to batteries used in trucks, buses, or tractors.

GST on Inverter and UPS Batteries

- The gst on inverter battery is also 28%, whether for home or commercial use.

- UPS batteries also attract 28% GST as they fall under power backup devices.

Get a Free Trial – Best GST Accounting Software For Small Business

GST on Lithium-ion Batteries

Lithium-ion batteries, commonly used in smartphones, laptops, and electric vehicles, attract 18% GST.

These are considered energy-efficient and technologically advanced, hence taxed lower than traditional lead-acid batteries.

Explore a Free Demo of – Best Inventory Management Software For Small Business

GST on Solar Batteries

- If a battery is sold along with a solar panel system, the package may be taxed at 5%.

- If sold separately, it may attract 28% GST unless it qualifies as an essential solar component.

Summary Table: GST Rates for Battery Types

| Battery Type | Use Case | GST Rate |

|---|---|---|

| Lead-acid car battery | Automobiles | 18% |

| Lead-acid inverter battery | Home/office power backup | 18% |

| UPS battery | Computer/server backup | 18% |

| Lithium-ion battery | Smartphones, EVs, gadgets | 18% |

| Solar battery (with solar panel) | Renewable energy use | 5% |

Knowing the GST slab for your battery helps businesses claim Input Tax Credit and manage compliance efficiently.

Conclusion

The gst on battery depends on the type of battery and its intended use. While inverter and vehicle batteries fall under the higher 28% slab, lithium-ion and solar-integrated batteries are taxed at lower rates.

Whether you’re a business dealing in batteries or a household buying one for backup, knowing the right GST rate helps with budgeting and staying GST-compliant .