New GST on Flight Tickets in India: Rates, HSN Codes & Fare Breakdown

Quick Summary

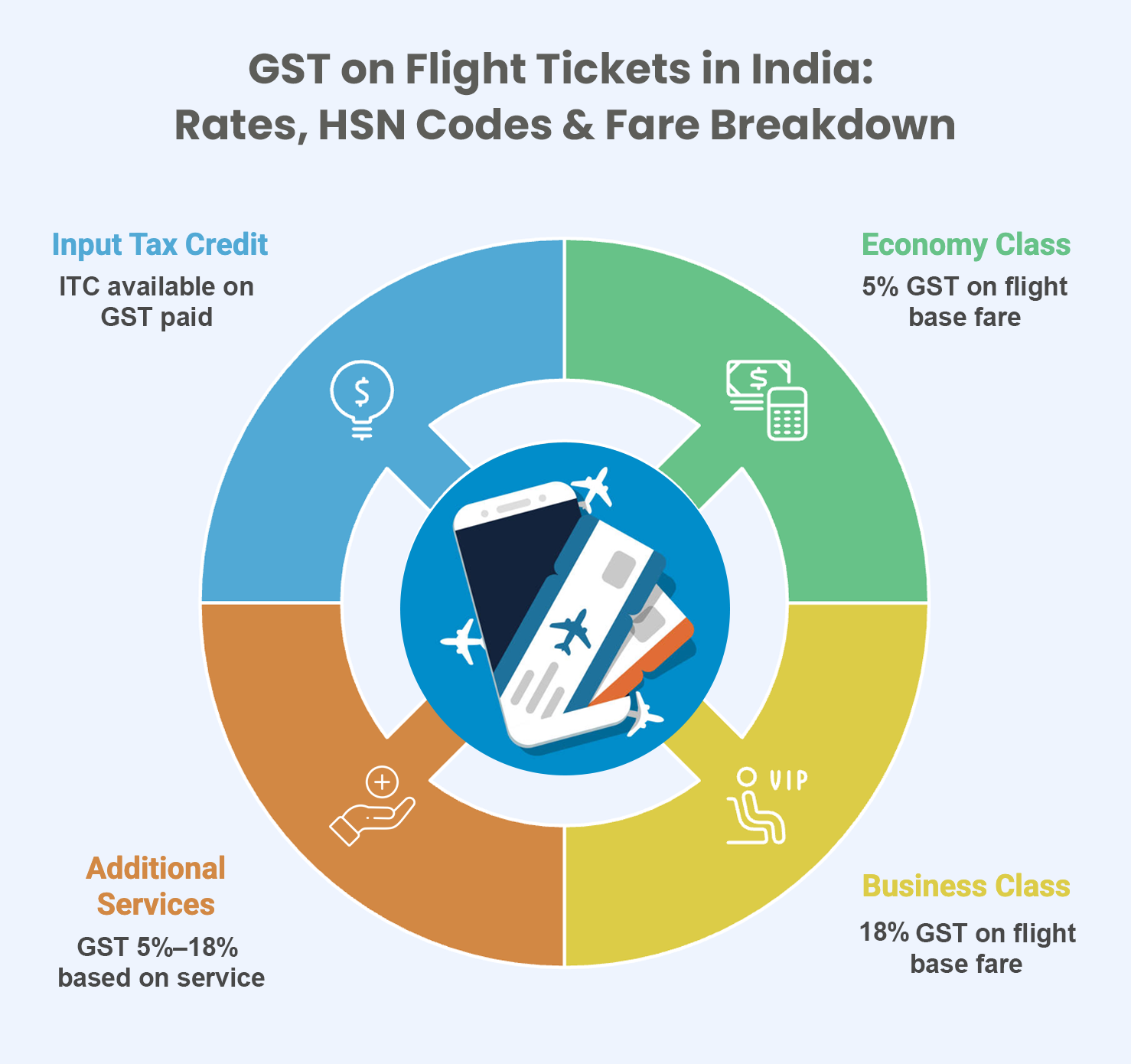

- The new GST rates for flight tickets in India are 5% for economy class and 18% for business class, effective after September 22, 2025.

- GST is charged on both domestic and international flights originating from India, and airlines include it in the ticket price.

- Businesses can claim Input Tax Credit (ITC) on business class tickets if booked under a company name and used for business purposes.

- GST applies to additional services like extra baggage (18%), seat selection (5%/12%), and lounge access (18%).

- International flights from India incur GST only if the flight originates in India, with 5% for economy and 12% for business class.

Whether you’re flying for business or leisure, your airline ticket includes more than just the base fare. One major component is Goods and Services Tax (GST), which varies based on travel class and flight type. In this blog, we’ll break down the gst on flight tickets, explain how rates differ between economy and business class, and what travelers and businesses need to know about claiming Input Tax Credit (ITC) .

Book A Demo

New GST Rate on Air Travel in India

The Government of India is updating GST rates effective after 22 Sep 2025. Below are the expected new GST rates by travel class (no compensation cess).

| Travel Class | New GST Rate |

|---|---|

| Economy Class | 5% |

| Business Class | 18% |

This rate applies to both domestic and international flights departing from India. Airlines charge the GST as part of your ticket price and deposit it with the government.

Old GST Rate on Flight Tickets

(Old GST Rates – Applicable Until 21st September)

GST on air travel in India is based on the class of travel:

| Travel Class | Levied By |

|---|---|

| Economy Class | 5% |

| Business Class | 12% |

This rate applies to both domestic and international flights departing from India. Airlines charge the GST as part of your ticket price and deposit it with the government.

Get a Free Trial – Best Accounting Software For Small Business

HSN Code for Air Travel Services?

Air travel services fall under HSN Code 9964 , specifically:

| Service Type | HSN Code | GST Rate |

|---|---|---|

| Air transport of passengers | 996422 | 5% (economy) / 12% (business) |

| Charter flights or helicopter services | 996423 | 18% |

These codes help categorize the type of service for invoicing and GST filing .

GST Calculation Example on Flight Tickets

Let’s say you book a one-way economy ticket for ₹4,000:

- GST @5% = ₹200

- Total Ticket Price = ₹4,200

Now let’s consider a business class ticket worth ₹15,000:

- GST @12% = ₹1,800

- Total Ticket Price = ₹16,800

So, the gst on flight ticket significantly affects higher-class fares.

Input Tax Credit (ITC) on Air Tickets

For Businesses:

- ITC is not available on economy class tickets

- ITC is allowed on business class tickets, provided:

- The booking is in the company’s name

- The airline issues a tax invoice with GSTIN

- The trip is for business purposes

This allows businesses to reduce their net GST liability.

Get a Free Trial – Best Accounting Software For Small Business

GST on International Flights

For international travel, GST is applicable only if:

- The flight originates in India

- The airline is registered under GST

In such cases:

- Economy class – 5% GST

- Business class – 12% GST

If the flight originates from outside India, no GST applies under the Indian tax laws.

GST on Ancillary Charges

Airlines also levy GST on additional services such as:

| Service | GST Rate |

|---|---|

| Extra baggage fees | 18% |

| Seat selection charges | 5% / 12% (based on class) |

| Lounge access | 18% |

| On-board food (pre-booked) | 5% |

So even your seat upgrade or extra luggage can attract GST.

Explore a Free Demo of – Best Inventory Management Software For Small Business

Final Thoughts

Understanding the gst on flight tickets helps travelers decode their fare breakdown. While the 5% GST for economy class is relatively modest, business class travelers and companies should take note of the 12% rate and potential for ITC. Whether you’re flying within India or heading overseas, knowing how GST (Goods and Services Tax) works can help you optimize costs and stay compliant.