New GST for Laptops in India: Updated Tax Rates, HSN Codes & Business Benefits

Quick Summary

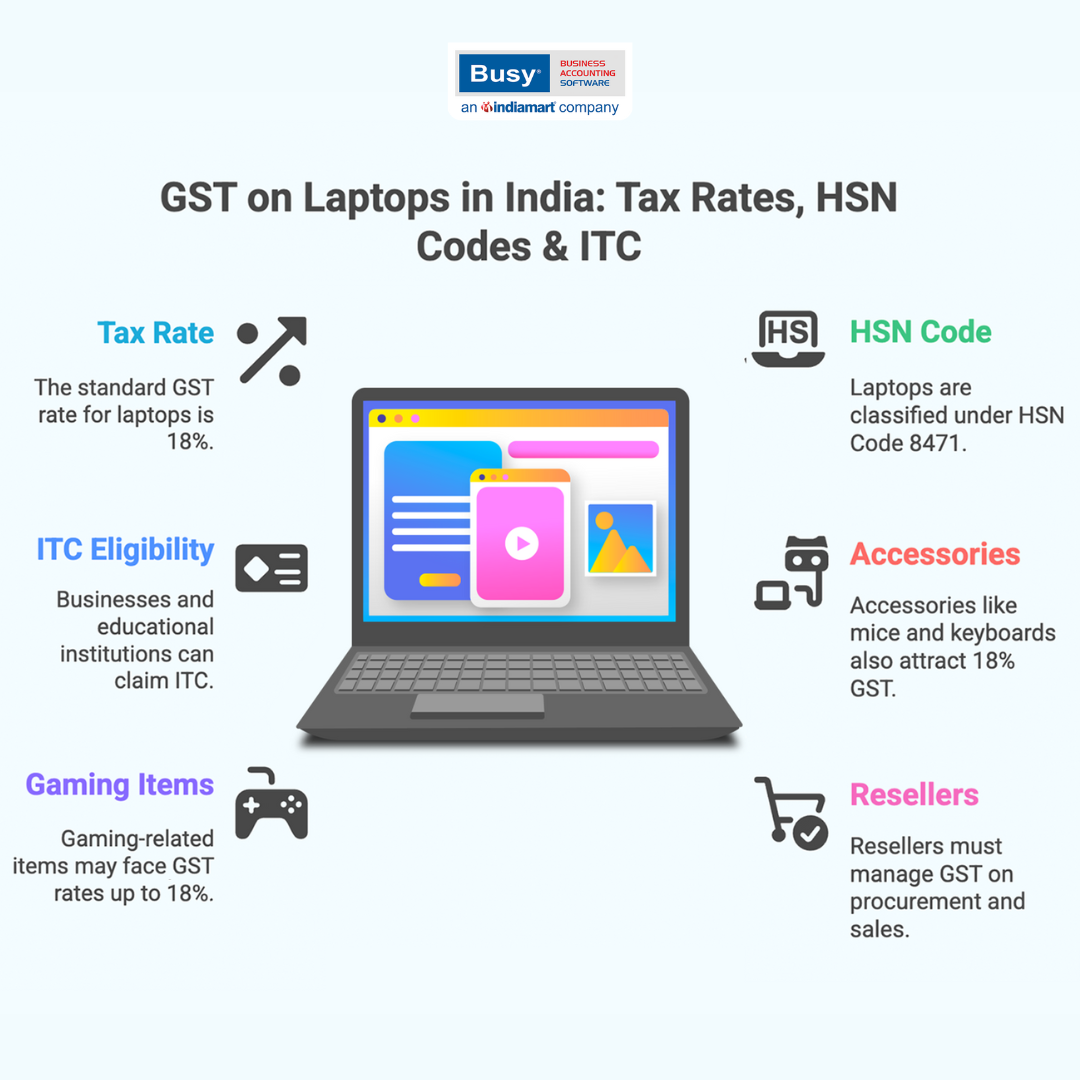

- Laptops, monitors, and accessories in India have a uniform GST rate of 18% starting from September 22, 2025.

- Laptops are classified under HSN Code 8471, which is important for tax invoices and GST returns.

- Businesses can claim Input Tax Credit (ITC) on GST paid for laptops if used for business purposes.

- Laptop accessories have varying GST rates, with most at 18%, but some gaming peripherals can be taxed up to 28%.

- Educational institutions can claim ITC on laptops if registered for GST, and some may benefit from state exemption schemes.

In the digital age, laptops have become essential for everyone—from students and professionals to business owners. But when buying a laptop, it’s not just the hardware cost that counts—there’s also GST (Goods and Services Tax) to factor in. In this blog, we’ll explain the GST rate on laptops in India, the relevant HSN code, how it affects pricing, and what businesses should know about claiming input tax credit (ITC).

Book A Demo

New GST Rate on Laptop & Accessories in India

The Government of India is updating GST rates effective after 22 Sep 2025. Below are the expected new GST rates for computers and accessories (no compensation cess).

| Product | GST Rate |

|---|---|

| Laptops (All types) | 18% |

| Computer monitors | 18% |

| Keyboards, mouse, accessories | 18% |

What is the Old GST Rate on Laptops?

(Old GST Rates – Applicable Until 21st September)

Laptops fall under the GST tax slab of 18%, which applies uniformly across brands, specifications, and configurations.

| Product | GST Rate |

|---|---|

| Laptops (All types) | 18% |

| Computer monitors | 18% |

| Keyboards, mouse, accessories | 18% or 28% depending on item |

Whether you’re buying from a physical store or online (e.g., Amazon, Flipkart), the 18% GST is included in the price.

Get a Free Trial – Best Accounting Software For Small Business

HSN Code for Laptops

Laptops are categorized under HSN Code 8471 , which covers automatic data processing machines and units like CPUs, monitors, and storage devices.

| Product Description | HSN Code | GST Rate |

|---|---|---|

| Laptops / Notebooks | 8471 | 18% |

| Printers and multifunction devices | 8443 | 18% |

| Computer accessories (mouse, keyboard) | 8471/8473 | 18% / 28% |

Manufacturers and retailers must include this code on tax invoices and GST returns .

GST Calculation Example

Let’s say you’re buying a laptop for ₹50,000 (base price).

- GST @18% = ₹9,000

- Total Invoice Amount = ₹59,000

If you’re a business buyer and eligible for ITC, you may reclaim this ₹9,000 later.

Get a Free Trial – Best GST Accounting Software For Small Business

Can You Claim Input Tax Credit (ITC) on Laptops?

Yes—if you’re a GST-registered business and the laptop is used for business operations, you can claim ITC on the GST paid at purchase.

To be eligible:

- The purchase must be in the company’s name

- A proper tax invoice with GSTIN must be available

- The seller must also file GST returns

Individuals buying laptops for personal use cannot claim ITC

GST on Laptop Accessories

Many accessories fall under different HSN codes and GST rates:

| Accessory | HSN Code | GST Rate |

|---|---|---|

| External keyboard | 8471 | 18% |

| Mouse | 8471 | 18% |

| Laptop bags | 4202 | 18% |

| External hard drive | 8471 | 18% |

| Gaming peripherals (headset, controller) | 8518/9504 | 18% – 28% |

GST for Laptop Resellers

If you’re in the business of selling laptops:

- Purchase laptops and pay 18% GST

- Sell laptops and collect 18% GST

- Use ITC to offset your output liability

This helps avoid tax cascading and keeps your pricing competitive.

GST on Laptops for Educational Institutes

Educational institutions buying laptops for official use (not to resell or give to students) can also claim ITC , provided they are GST registered and follow standard compliance.

Some state governments also run exemption schemes for students or public-funded institutions, but GST is typically levied and later reimbursed or subsidized.

Unique Features of BUSY Accounting Software For the Laptop Industry

- Serial number wise inventory management for different laptop models.

- Multi-location stock management across warehouses or branches.

- Warranty tracking for individual laptops sold.

- Customizable invoice formats with brand and model details.

- Easy management of combo offers and bundled accessories.

- Credit limit and outstanding alerts for dealers and retailers.

- Purchase planning and reorder levels for popular models.

- Sales and profit analysis by brand, model, or time period.

- User role-based security for billing and inventory control.

- Scheme and discount management during festive or clearance sales.

Final Thoughts

Understanding GST (Goods and Services Tax) on laptops can help you plan your purchase better—whether you’re a business aiming to reduce costs through ITC or an individual budgeting for a new device. At 18%, laptops fall in the mid-range tax bracket, and the system ensures a smooth credit chain for companies and retailers alike.