How to File GSTR-1 from BUSY

BOOK A FREE DEMO

Here is a GSTR 1 Filing Process Step By Step:

Step 1: Check the GSTR-1 screen report in BUSY and verify the data.

Step 2: Generate JSON file. You can generate a JSON file in the following ways:

- Generate JSON directly from BUSY

- Generate CSV/Excel from BUSY and convert it to JSON using the government offline tool.

Step 3: Upload the JSON file to GST online portal and Submit the return.

Now, Let Us Discuss The Above Mentioned Steps In Detail:

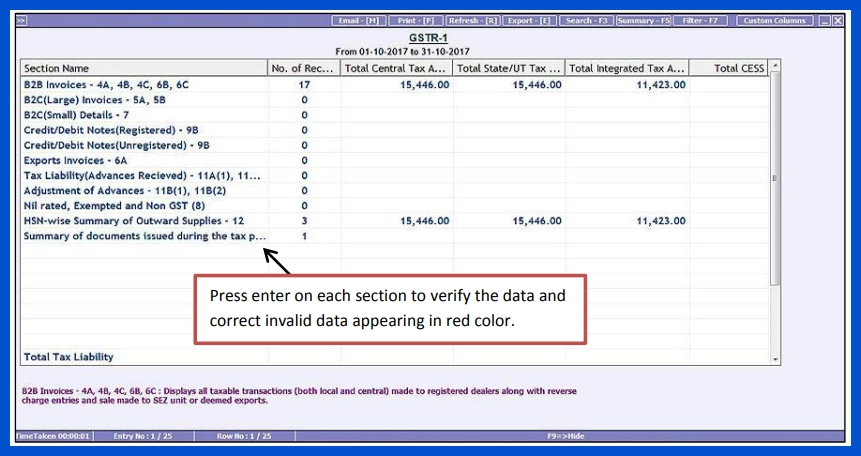

Step 1: Check the GSTR-1 screen report in BUSY and verify the data.

- First, ensure that the data in the GSTR-1 screen report is accurate by reviewing it. To access the GSTR-1 screen report, navigate to Display > GST Reports > GST Returns > GSTR-1.

- Select the desired month and click the “OK” button” to view the report. Press enter on each section to confirm the data displayed within it.

- The system considers any rows highlighted in red invalid and may generate an error during uploading. Please correct this data to prevent any discrepancies when filing your GSTR-1 return. Below is a screenshot of the GSTR-1 screen report.

Step 2: Generate JSON file. Various ways can generate JSON files directly from BUSY:

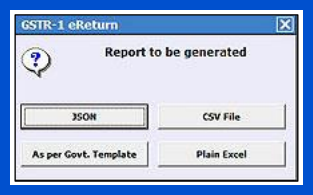

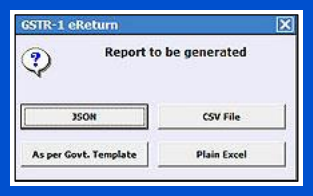

- To generate a JSON file directly from BUSY, follow these steps: Go to Display > GST Reports > GST Returns > GSTR-1 eReturn. Clicking on GSTR-1 eReturn will open a new window where you can select the type of report you wish to generate (JSON, CSV, As per govt. template, or Plain Excel).

- Please note that the direct JSON option is only available in BUSY’s Standard and Enterprise editions.

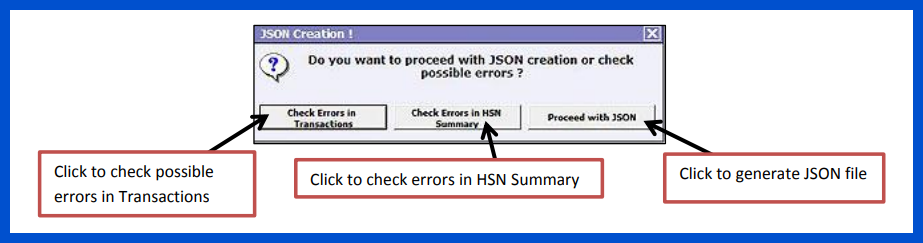

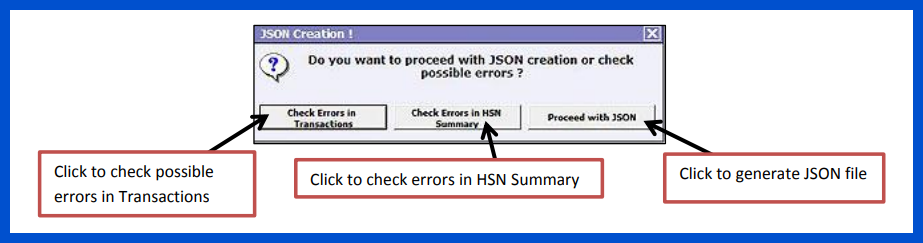

- Select the “JSON” option and specify the month for which you wish to generate the eReturn. Then, specify the path where you want the JSON file generated and click “OK”. After clicking “OK,” a JSON creation message box will appear.

- Select the “JSON” option and specify the month for which you wish to generate the eReturn. Then, specify the path where you want the JSON file generated and click “OK”. After clicking “OK,” a JSON creation message box will appears.

- It is recommended that you check for errors before generating the JSON file. If errors are not addressed, the JSON file generated from BUSY may be rejected at the GST portal. Once errors are corrected, you can proceed to generate the JSON file.

- Generate CSV/ Excel file from BUSY and convert it to JSON using an offline tool

- Alternatively, you can generate CSV or Excel files from BUSY and convert them to JSON. To generate CSV or Excel files from BUSY, navigate to Display > GST Reports > GST Returns > GSTR-1 eReturn. Clicking on “GSTR-1 eReturn” will open a new window with the following options:

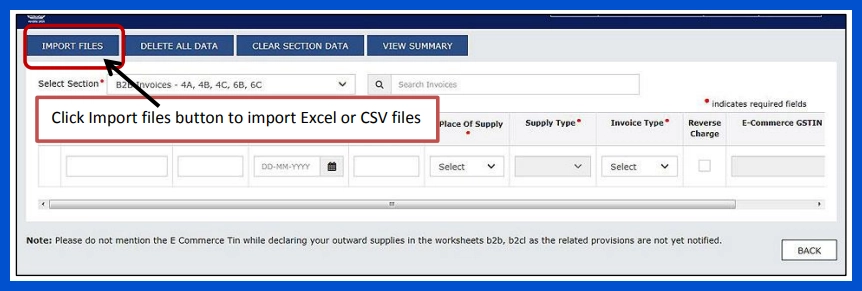

- CSV: Choose this option to generate CSV files directly from BUSY. A separate CSV file will be generated for each section of GSTR-1, regardless of whether data appears in that section or not. These section-wise CSV files should be imported individually into the GST offline tool to generate JSON files.

- As per govt. Template: Select this option to generate an Excel file based on the government template. When using this option, you will need to specify the path of the Excel template that comes with the offline tool. Please note that generating an Excel file using this option may take some time. Once you have generated an Excel file, you must import it into the GST offline tool and generate a JSON file from there.

- Plain Excel: Select this option to generate a plain Excel file without specifying a path for the Excel template. Please note that files generated from this option may not import properly into the offline tool. Alternatively, you can use the “As per govt. template” or “CSV” option.

- After generating the CSV or Excel file, import it into the GST offline tool and generate a JSON file from there.

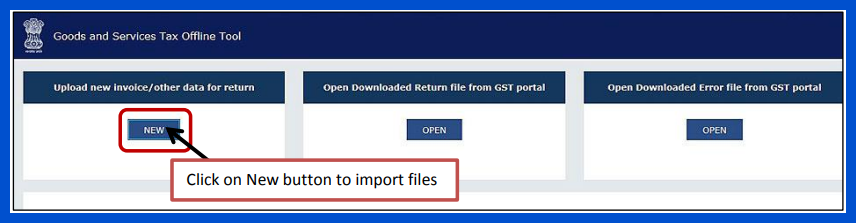

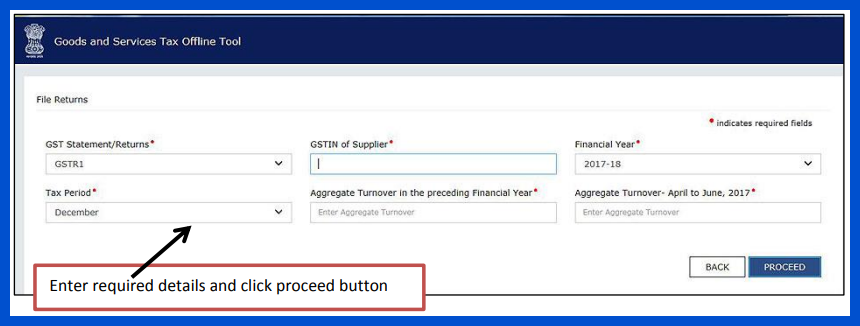

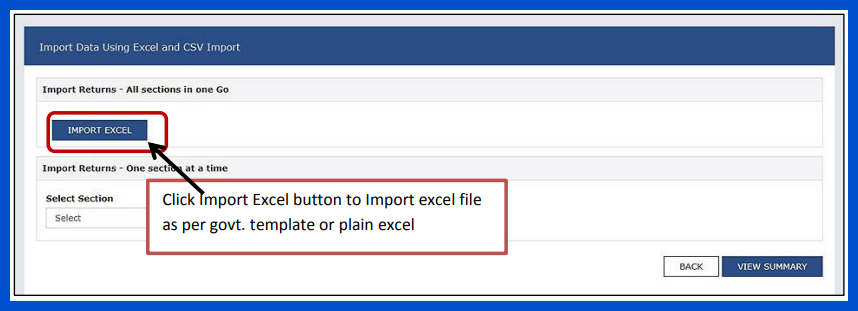

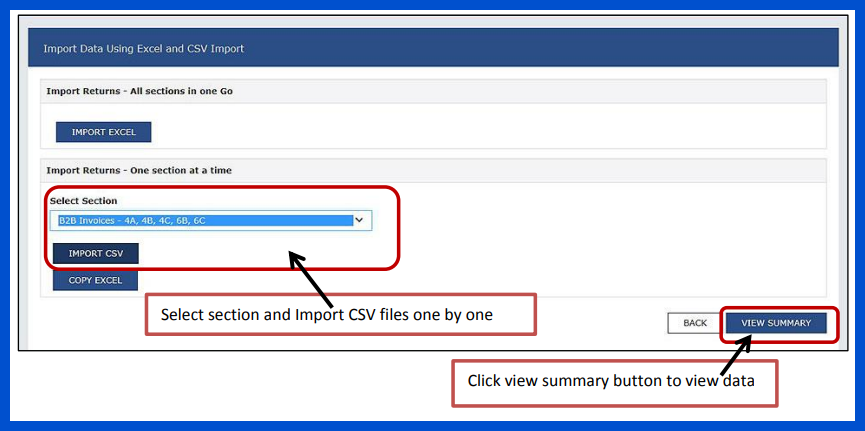

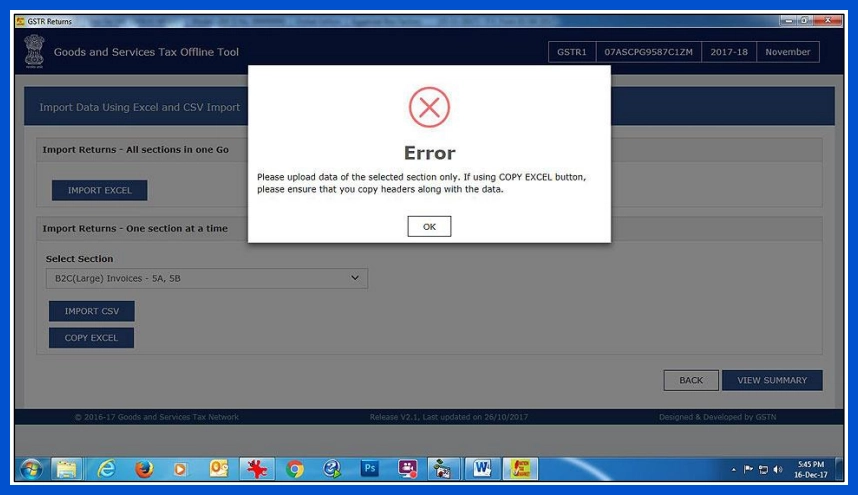

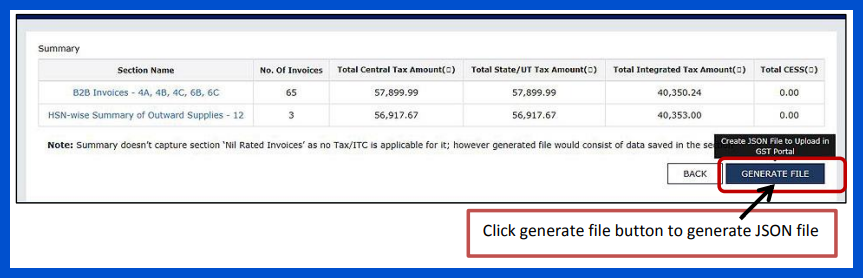

- First, download and run the GST offline tool. Below are screenshots illustrating importing and generating JSON files from the offline tool.

- Once you have imported the CSV or Excel file, use the options provided in the tool to generate the JSON file.

Also Know About GST Accounting Software

Step 3: Upload JSON file to GST online portal

- After generating the JSON file, the next step is to upload it to the GST online portal. Below are screenshots illustrating how to upload the JSON file to the GST online portal.

- Once the JSON file is uploaded to the GST portal, you can review the uploaded data and provide any additional details as required before finally submitting the return.

- This completes the process of filing GSTR-1 from BUSY.

Also Know About: BUSY 21

- GST Rates for ProductsGST Rates: GST on ac GST for laptops GST on iphone GST for hotel room GST on flight tickets GST on silver GST for tv wood GST rate GST on train tickets GST on water bottle GST for medicines GST on tyres GST in garments GST on milk GST on stationery GST on tractor GST for food GST rate on tiles GST on sweets GST on gold

Frequently Asked Questions

- How can I download my GST certificate?Log in to the GST portal using your credentials to download your certificate. Navigate to the ‘Services’ tab, select ‘User Services’, and then ‘View/Download Certificates’. Click on the ‘Download’ button ‘to get your ‘ST certificate.

- What is a ‘GST certificate?’A GST certificate is an official document issued by the GST authorities upon successful registration. It contains essential details about the registered entity, such as the GSTIN, legal name, trade name, and type of business.

- Why is it essential to download and keep a copy of your GST registration certificate?It’s essential to download and save your GST registration certificate as it’s a form of registration. It would be best if you had it for compliance and displayed it at your business location.

- What steps should I follow to download the GST registration certificate?To obtain your GST registration certificate, log in to the GST portal. Go to the ‘Services’ section and select ‘User Services’. Click on ‘View/Download Certificate” and then click the ‘Download’ button to save the certificate.

- Can I download GST certificate multiple times?You can download GST certificate multiple times from the GST portal. There is no restriction on how many times you can download your GST registration certificate.

- What are the benefits of GST registration for businesses?Registering for GST helps businesses by officially identifying them as providers of goods or services. It allows them to claim tax credits and collect GST from customers. It also enhances trust with customers and suppliers.

- Is there a fee for downloading the GST registration certificate?No, there is no fee for downloading the GST registration certificate from the GST portal. The process is entirely free of charge.

- What details are included in the GST certificate?The GST certificate contains information such as the GSTIN, business legal name, trade name, business type, main location, extra locations, and registration date.

- How does having a GST registration certificate benefit my business?Getting a GST registration certificate can help your business in many ways. Obtaining a GST registration certificate can benefit your business in various ways. It can enhance your credibility and allow you to claim input tax credit. Additionally, it enables you to expand your business operations across different states.

- What should I do if I face issues while downloading the GST registration certificate?If you can’t download your GST certificate, check your internet connection. You can also try clearing your browser cache. Another option is to use a different browser. If the problem persists, contact the GST helpdesk for assistance.

Please Wait